Join me today for Episode 1085 of Bitcoin And . . .

Topics for today:

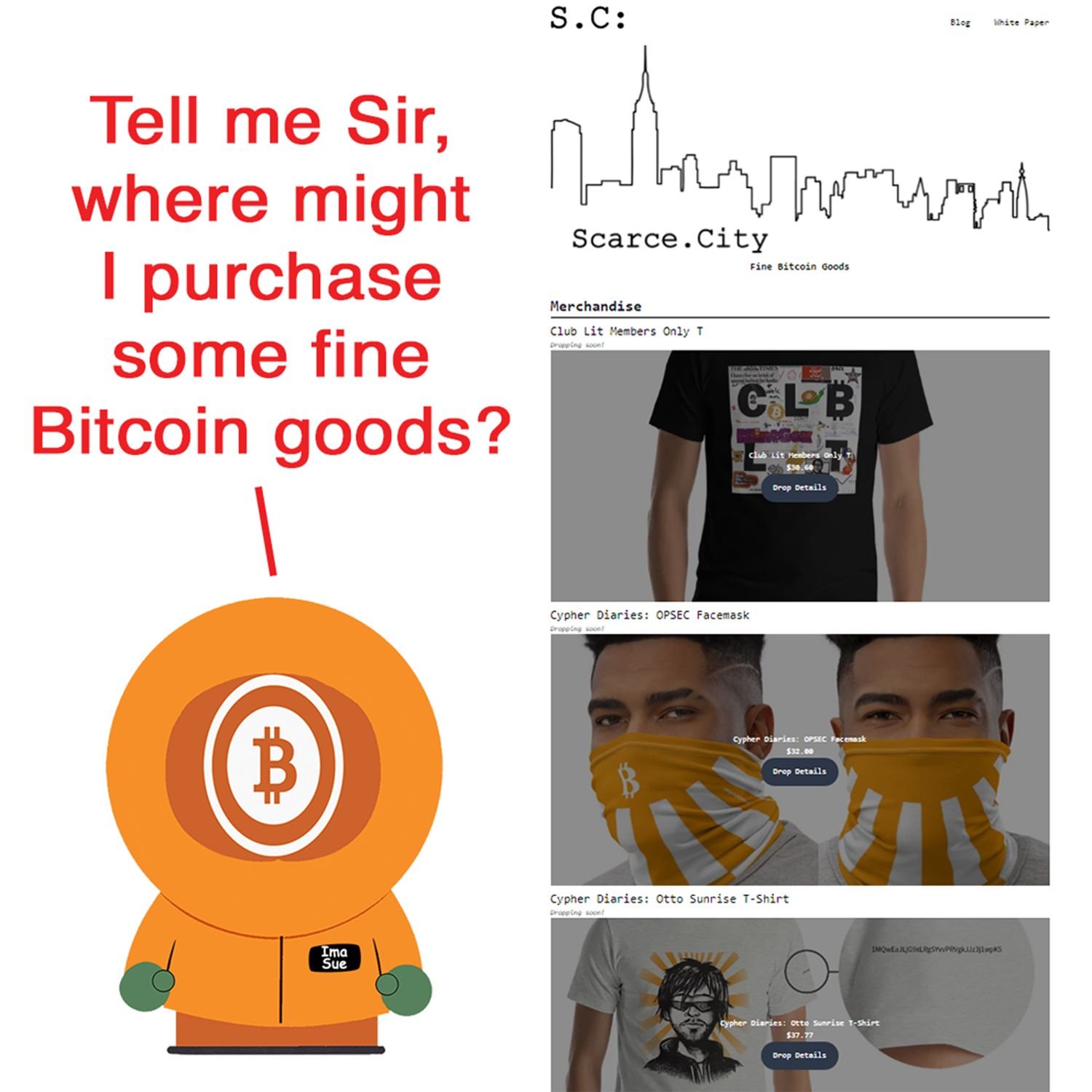

- Scarce.city and its use of the Lightning Network for art auctions

- The potential to create a new renaissance in art and culture

- The parallels between the punk rock movement and the Bitcoin community

Circle P:

SoapMinerProduct: Tallow Soap

Website: https://soapminer.com/

nostr Profile: https://nostrudel.ninja/#/u/npub1zzmxvr9sw49lhzfx236aweurt8h5tmzjw7x3gfsazlgd8j64ql0sexw5wy

Twitter Profile: https://x.com/soapminer1

Discount code: Use "BITCOINAND" in the Cart's Coupon Code box for 10% off total purchase

Find the Bitcoin And Podcast on every podcast app here

https://episodes.fm/1438789088

Find the Bitcoin And Podcast on every podcast app here:

https://episodes.fm/1438789088

Find me on nostr

npub1vwymuey3u7mf860ndrkw3r7dz30s0srg6tqmhtjzg7umtm6rn5eq2qzugd (npub)

6389be6491e7b693e9f368ece88fcd145f07c068d2c1bbae4247b9b5ef439d32 (Hex)

Twitter:

https://twitter.com/DavidB84567

StackerNews:

stacker.news/NunyaBidness

Podcasting 2.0:

fountain.fm/show/eK5XaSb3UaLRavU3lYrI

Apple Podcasts:

tinyurl.com/unm35bjh

Mastodon:

https://noauthority.social/@NunyaBidness

Support Bitcoin And . . . on Patreon:

patreon.com/BitcoinAndPodcast

Find Lightning Network Channel partners here:

https://t.me/+bj-7w_ePsANlOGEx (Nodestrich)

https://t.me/plebnet (Plebnet)

Music by:

Flutey Funk Kevin MacLeod (incompetech.com)

Licensed under Creative Commons: By Attribution 3.0 License

creativecommons.org/licenses/by/3.0/

It is 10:41AM Pacific Daylight Time. It is the last day of the fourth month of twenty twenty five already. And this is episode good lord. What is it? It's gonna be October. However, I'm going to bring you an older interview that I did with a gentleman from Scarce.city. His name is Chris Trammout. And Scarce..city is still going on. And if you've never heard of it, go to scarce.city. You can it's auctions. It's sorta like eBay. But it it it always captured my imagination. And this is this is actually pre Nostr, and I do not know if scarce.city has taken up the Nostr mantle and given us, like, you know, insect logins and whatnot like that. But I still think that it's important to go back and revisit some of the people that have been working all this time towards, well, a circular Bitcoin economy.

Because scarce dot city, you can buy the the auction items for for Bitcoin. And they were you know, they've been doing this for, like, a long time. I have the circle p. We're all trying to to do this circular Bitcoin economy, and it's proving to be difficult. So I think it's important to go back and listen to the words of Chris Trammout as he talks about scarce dot city. Back in the day, guys, this was like this was when I was still living in Canyon, Texas. This is like well over three years ago. We've been ever forging ahead on the Bitcoin circular economy.

So let's go back in time and let's talk to my friend, Chris Trammelt one more time. Chris, welcome to Bitcoin and how are you doing today, man? David, doing well, man. It's good to be here. What is your last name, unless you don't want to say it? Oh, no. I'm fully doxed already.

[00:02:07] Chris Trammout:

Chris Trammelt.

[00:02:09] David Bennett:

Okay. How do you spell that anyway?

[00:02:11] Chris Trammout:

T r a m o u n t.

[00:02:16] David Bennett:

Okay. Just wanted to make sure because I have this tendency. I have not only do I mispronounce people's names, I also misspell them often. I'm a terrible speller. Anyway, so, you so you are the founder, I am guessing, of this new thing called a scarcity. Is that correct?

[00:02:35] Chris Trammout:

That's right. One of two founders. I have a, technical cofounder, Arjan Jabari.

[00:02:40] David Bennett:

Okay. Alright. So, before we get into scarcity, let's let's set some tone and get some context of who you are and kinda where you come from. So take yourself back to high school. What did you wanna do when you grew up?

[00:02:56] Chris Trammout:

Oh, man. That's a great question. You know, it's funny. Like, I think back about on it, and I grew up in Charleston, South Carolina. And, you know, I just wasn't exposed to a lot of, like, the really interesting careers, at that time. So, you know, for me, like, I was good at math. So I was like, you know, I guess I'll just be an engineer because that's what math people did as far as my environment goes. Mhmm. You know, of course, there was, like, the business route, but I was like, I I don't really see myself as a business type of guy, at least the way I I thought of it then, which was, like, you know, in Charleston, it was like the bankers. Right?

Right. So, you know, I had no no concept of tech startups, not that anyone really did back then or anything, like, you know, related to technology. I will say that I did go through, I did go through a small phase where I wanted to be a fashion designer Nice. Which which has, like, become almost relevant now.

[00:04:04] David Bennett:

So Well, yeah, we we will we will see that a little bit later on in the interview. That's awesome, though, man. Not Not many people wanna do that. I have this weird thing about high I just got this weird thing about high fashion when I'm looking at, like, you know, I don't know, Dior, you know, releases the spring line or whatever, and I'm looking at the the models on the cat on the catwalk, and I'm looking at the stuff going, nobody's gonna wear that. I don't understand.

[00:04:29] Chris Trammout:

Yeah. No. And to be fair, like, I was always interested more in, like, the streetwear stuff, and I don't even know, like, you know, high end.

[00:04:37] David Bennett:

Gotcha. Gotcha. So fashion designer. Nice. So okay. So you're you're you're bumping along in high school thinking about either fashion or possibly engineering. And, woah, where did you run up against you know, When did you run into Bitcoin, or did it run over you? Some people have that.

[00:04:57] Chris Trammout:

Oh, man. You know, I think I first heard about it back in 02/2012, '2 thousand '13. Totally wrote it off from the beginning. And it's, you know, it's everybody has a similar story, but it's always kind of embarrassing. Yep. And for me, like, I'm I'm most embarrassed because, like, I understood the supply cap, and that's why I wrote it off because I had this, you know, idea that a deflationary currency will never be used. Right? People are disincentivized from spending it, so it'll just you know, it'll it'll never work. And I just I didn't have the the understanding of the different functions of money. It didn't occur to me that, you know, money could be a pure stored value or, you know, unit of account. I just wasn't thinking like that. And, of course, I just I I never gave Bitcoin my full attention to really understand it.

Right. Up until, you know, I came in, the flip switched for me in 02/2017. So, you know, still consider my myself a a freshman in the space.

[00:06:04] David Bennett:

Uh-huh.

[00:06:05] Chris Trammout:

But, you know, I think what really did it for me was I came to the realization that, you know, the Fed was just never gonna stop printing. And I started thinking about, you know, where's the money gonna go? Like, only so much can go into gold. Like and, you know, it's it's just a rock. Like, there's only so much we can do with that, so there's gotta be another place for it to go. And that's when I gave Bitcoin a second look. I had also been really into just studying technology and software at that time and had seen the progression play out over and over where, you know, you see some initial technology. It looks really clunky.

It's really hard to use. But then, sure enough, over time, it gets better and better, and all of a sudden, it becomes somewhat ubiquitous. So kind of being trained through that lens Yeah. Looking looking into the future of how the current systems were gonna play out, I finally wisened up to what was going on.

[00:07:11] David Bennett:

Well, you know, to be fair, none of us were taught what money was. I mean, you know, even back in in my high school days, which was quite a while ago, you know, it it it was it was almost as if it was a theme. You go to economics class and you do other homework or you snooze or you just space, you know, space totally out. And I start like hell, I mean you could even watch movies where they had like you know, there's a a Ferris Bueller's Day Off. One of the most famous scenes in that movie is the snooze fest in economics class because it was just this droning on of this guy who actually the actor that did that was a speechwriter for Nixon.

[00:07:54] Chris Trammout:

Right.

[00:07:55] David Bennett:

Yeah. And I always I always found that, like, just really, really odd. But, you know, it's almost as if it was almost as if it was on purpose because none of us know what money is. So, you you know,

[00:08:06] Chris Trammout:

you certainly can't be blamed, man. Right. That was the assumption. It's like, okay. We have money. Don't question that. And I will tell you every how it works. Like, everything to do everything you can do with that money. But, like, we're not gonna talk about what's really at the foundation of this thing.

[00:08:23] David Bennett:

Yeah. And I think a lot of us start you know, when when we got into Bitcoin, the very first you know, one of the very first things that we started doing was started asking ourselves questions about the one thing that we always took for granted and that everybody knew about, and that was money. And then once that door opened, it was like you just start seeing just how messed up everything else is, because half of all transactions in human existence is value transfer with money. You know, it's so yeah. So okay. So now you're you're you're firmly kind of planted into Bitcoin. You're you're you're chugging along. You've been slapped in the face a couple of times. You get into '20, you know, 2017. You start really freaking out about the bull run, and then scarcity happens.

Where where did that where did that come from?

[00:09:15] Chris Trammout:

Well, there was, like, a whole bear market in between there, which Of course. Hard to hard to just brush over. But, yeah, you know, it it, I I think, my path is not too dissimilar from many Bitcoiners where you get into Bitcoin, it just takes up all of your attention. Got it. It becomes hard to focus on anything else. And, I realized as I'm, like, in my regular job that I just can't I can't focus on anything that's not related to Bitcoin. And, like, as a professional, I'm just not gonna be using, this my skills to the best of my ability or my time the best that I can if I'm not doing something related to Bitcoin. So I was looking for a way into the space.

And, you know, my background before then, a lot of it had been centered around retail ecommerce. So it's it's an area that I have a decent understanding for.

[00:10:18] David Bennett:

Mhmm.

[00:10:19] Chris Trammout:

And I was in touch with, a Bitcoin artist, and we were just chatting. And they wanted to sell some clothing that fit with some of the properties of Bitcoin such as verifiable authenticity and supply.

[00:10:35] David Bennett:

Mhmm.

[00:10:36] Chris Trammout:

And just kinda, like, you know, being a total pleb at the time, I I assumed that was a solved problem. Yeah. And it was only after looking into it some more that I realized that's actually a pretty hard problem Yep. And, far from solved. So I started looking into it, and, you know, we came up with a rudimentary solution that we tested out with some face mask sales. And, you know, from there, we've been able to build a little bit of the community, and, that's helped us come up with, I think, some better ideas. Yep. And, it's kind of brought us to where we are right now. You know, we've just been testing a few things out, and we have some big ideas for the future.

[00:11:19] David Bennett:

So how long has this baby of yours been crying? I mean, when did you you know, when was opening day, so to speak?

[00:11:27] Chris Trammout:

You know, opening day was, I think, in March. Actually, no. It probably wasn't because it we we started building in March. I my cofounder, he and I were working together at the same startup before we got laid off of COVID. And, I I kinda talked him into trying this out with me. So I think we were building for maybe two ish months before we launched anything. So it's probably May. It's probably May. Late May, I think. But, you know, the idea had been cooking for at least six months before then.

[00:12:01] David Bennett:

Okay. So now now that we've talked about your you know, the the birthing of that which is scarcity, it's time for us to talk about what scarcity is. So can let let's start out with a nutshell description like your five minute elevator pitch. What what is scarcity?

[00:12:18] Chris Trammout:

Sure. So, you know, I'll start out with the the twenty second elevator pitches. Okay. Scarcity scarcity is a marketplace that uses Bitcoin, lightning, hopefully future layer three protocols to support Bitcoin culture and adoption.

[00:12:37] David Bennett:

Okay. Alright. So now, this is based seems to be based around the Lightning Network and Lightning Auctions, and I'm I'm looking at the, your, scarcity you know, or scarce.city website right now. And this seems to be you know, what I'm seeing is, like, hey. Look. You know, I read your white paper, so it's looks like, you know, it's like, hey. Look. I'm gonna sell you this T shirt, and we're gonna take a lightning payment for it. But there's much more to it than that because, a, it's auctions. It involves the lightning network and third parties shipping and stuff. So what's let's start with a lightning auction. So you got, you know, you got some artists.

They wanna sell t shirts. They come to you and say, I wanna sell my shirt at at auction. How let's kinda dive in or put our toes in the water right around there. Can you kinda start detailing this out a little bit?

[00:13:39] Chris Trammout:

Yeah. Absolutely. So, you know, the clothing we did in the past, that wasn't auction based. That was just Okay. Fixed fixed price. And because we did have a mechanism for, verifiable supply, we were, like, increasing supply with each item sold and doing some full stuff there. But our newest, what I would call product, is lightning auctions, and we're gonna be focused on original art and specifically Bitcoin art, at least in the beginning here. Okay. And, you know, we're still a few weeks away from putting this out into the wild, but, we have it in our test notes working great. The idea here is that we're using we're running auctions that use lightning payments to keep bidders accountable for their bids, while requiring minimal fees and minimal personal information from bidders.

So the the way this works step by step is, you know, we're trying to keep this as simple and clean-cut as possible. You go into the auction site. You check out the product. You check out the bids that have already been placed. You see how much time is left in the auction. You decide you wanna place a bid. You input your bid amount and put it into sats. You know, we're keeping that as the standard, but we do the auto calculation for you to US dollars. And you put in an email address. And, you know, we really don't want people to be putting in their, like, personal email address. It can be Right. Any email address. We just need it to, verify that the winning bidder placed, you know, the winning bid, and also to refund your collateral back to you.

And if it's your first time placing a bid with that email address, you input a display name, which you only input once when you make subsequent bids with that email address that auto populates. And once you submit that information, you're you're brought to, pay a lightning invoice, which can range anywhere from 5 to, you you know, on the very high end, $50, which is a percentage. It's a it's a small percentage of the amount you actually bid, and it acts as your collateral for that bid. So Okay. At the end of the auction, once it's all said and done, everybody gets their collateral back except in the case where the auction winner does not pay the amount they said they would pay.

And in that case, they lose their collateral. And the the next highest bidder would be become the winner of the auction.

[00:16:25] David Bennett:

Okay. So I've got like, let's say that I've got I don't know. I've got something like a piece of bitcoin bitcoin art. I put it up for auction, and I get notified that somebody has bid on it. And then I continuously get notifications that somebody's bid higher, bid higher until time runs out and the the winning bidder, does one of two things, pays all of the rest aside from the collateral that he already put up. Like, I think what what did you say was, like, 5% of the total price?

[00:16:56] Chris Trammout:

We're still playing with the percentages, but on Okay. At at a very minimum, it would be $5. If it's a very expensive bid, we're willing to push it up to, like, $50, but that's about as high as we wanna go. Okay. Yeah. I I I get it. So now

[00:17:11] David Bennett:

if the now does the bidder the winning bidder that chooses to pay and be honorable and all that, do they go ahead and complete with another Lightning transaction? Or at one point or another, do they have to break away and go to the main chain and do a full Bitcoin main chain transaction?

[00:17:28] Chris Trammout:

Yeah. So the items we're gonna be auctioning off here, we expect to be in the hundreds, if not thousands, of dollars in in total value. So these would be on chain transactions once you're actually paying the full amount.

[00:17:39] David Bennett:

So at that point, only the Lightning Network is only leveraged to make sure that people play fair. Right? That's exactly right. Okay. That's I just wanna I just wanna make sure that that I'm clear on that because I sometimes I'm not clear with myself on on certain things. So now are you so are you guys running your own lightning node to do this, or are you leveraging someone else?

[00:18:11] Chris Trammout:

We are using BTC pay server, which makes it easy for us, but, yes, we are running our own. No.

[00:18:17] David Bennett:

Now is have you guys done a, you know, any kind of simulation as to let let's say this thing just really takes off and you've got multiple auctions going on. I'm talking, like, let's say let's pie in the sky. Let's say you've got, like, 100 auctions that are live at the exact same time. Have you guys simulated at what point you might need to actually start, you know, either leveraging, an outside source? Somebody's like, you know, I can't remember who it was, just announced that was it oh, I almost I almost had the name, but they're, spinning up lightning lightning nodes in the cloud that you can rent.

Have you figured out at what point? Yeah. That's it. Thank thank you. Yeah. They're fantastic. Yeah. Would there be a point at which, you know, running it, you know, shake and bake on your desktop is just not gonna cut it anymore? Do you know when that point is or if that point even exists?

[00:19:13] Chris Trammout:

You know, it's not a near term problem for us. So I should clarify that we are taking a curated approach to this. Okay. So it's not gonna be, like, self serve. Anybody can start an auction, at least not anytime soon. Okay. We want to, very carefully control what is being put up for auction. And it's not just us. We have a community that helps us make these decisions. Right. But, yeah, I mean, we're gonna be taking this baby steps from the beginning. It would be fantastic if in, like, sometime within the next few months, we get to one auction a week. But, you know, part of this is we want to get as much attention around each individual auction auction as possible.

Okay. So there is a certain limitation there. And, you know, as far as, like, growing the business, we think there's, like, interesting ways to bundle other sales from most likely the same artist into the auction.

[00:20:12] David Bennett:

Right. Now I'm looking at this, and I'm, you know, I'm I'm I used to run a guy's I was helping a buddy of mine out at his business a couple of different times, and he actually had he was he was modifying Dish Network units and then reselling them on eBay, mostly to Canada. And I won't get into the parameters of the modification because, you know, it's probably not a good thing to talk about. But, you know, but we moved into, you know, auctioning all kinds of solid goods. I mean, things that that are, you know, fairly meaty. Is this gonna like, is I know that I would imagine that your answer in the near term is it's just gonna be art, but do you have any further thoughts of, like like, I got I got a Fender twin amplifier.

I don't really use it anymore, and I'd like to be able to auction that off. Is that something that you might do in the future? Go past close, you know, light, you know, lightweight shippable goods, to where we get into some some heavier items, or is that just like, nope. We're not even gonna touch it?

[00:21:22] Chris Trammout:

I certainly wouldn't shut it down completely. I will say, like, you know, our mission that we do wanna stay as true as possible to is, like, everything we do, we want it to be for Bitcoin adoption and culture. Right. So if we find that there's a demand for something that aligns with that mission, we're totally open to it. Yeah. Now Oh, go ahead. Was just gonna say, yeah. You know? But the demand portion is really important. Right? Like and what is important to us is that all of our transactions are in Bitcoin. And, certainly, at this point in time, there there are only a few types of transactions that really make sense to be made in Bitcoin.

Mhmm. And where we're seeing that is in Bitcoin collectibles, Bitcoin art. It's absolutely fascinating to go into the Bitcoin talk forums and see auctions for some of these Bitcoin collectibles being done in, like, you know, a very rudimentary, web one point o forum. And it's because the people in these forums, like, they are purists. Like, they only want to sell and buy with Bitcoin when it comes to Bitcoin collectibles. So to us, that's the, you know, first sweet spot that we wanna go after. I think over time, the types of transactions happening over Bitcoin will expand, and, you know, those will become addressable for us. But, you know, we wanna make sure that that, you know, the the desire to transact in Bitcoin is already there before we move into that.

[00:23:12] David Bennett:

So I I'm assuming that you guys are reaching out to some of the, you know, more well known artists, directly and saying, hey. We got this thing. Will you kind of, you know, help help us out, like, you know, consider, you know, putting some stuff up like Lucio Paletti and some of those guys?

[00:23:28] Chris Trammout:

Yeah. We have, we have an all star cast of, Bitcoin artists, in our Telegram group. You know, we're battle testing all of our ideas and and, prototypes against them. They've been hugely helpful in just helping us understand what's important to them. And, yeah, we have a process for admitting new members. Everybody votes on it. I my vote is worth the same amount as any other person in the group. So, yeah, it's, you know, we wouldn't have a chance without having the acceptance of the Bitcoin artist community, and they've just been hugely helpful already.

[00:24:13] David Bennett:

Okay. So, let's see. Let's take a I was just marking stuff off my list here. Shipping and delivery. The white paper mentioned something about integrating with tracking the package. Is it did I read that wrong, or is that indeed what you guys are doing?

[00:24:31] Chris Trammout:

So the white paper probably could use an update. And Okay. We're kind of we're we're really focused on the auctions now. And depending on how that goes, you probably see a pretty significant update to the white paper. Okay. But the way we the way we are structuring the auctions is we act as an escrow service. So when the auction is complete, the winner of the auction, they pay us. And then we work with the artist to make sure that the artist is packed securely. And once it's put into the mail and and, you know, sent to the auction winner, We receive tracking for that, and that's kind of our verification that, you know, the artist has done their point their part at that point. Right. And we pay them. Now, of course, there's still plenty of risk in the process from there of of the art getting from point a to point b, and that's where we offer insurance service.

And because we are working with the artist to make sure that art is the art is packed securely, we're comfortable taking that risk. Of course, we are getting compensated for it. But the point here is we wanna give the buyer as much security as possible that, you know, they're not at risk of the item being damaged or lost in transit.

[00:25:54] David Bennett:

Right. Do you guys leverage, like, the postal service, insurance stuff, like, where, you know, you get the artist to say, hey. You know, this thing cost this, with the tracking number. We need you know, it'd be nice to have proof of insurance that in case it does get lost, that there's some kind of recompensation. Do y'all do any anything like that?

[00:26:15] Chris Trammout:

It's it's the same basic idea. But we're just we're taking it on ourselves.

[00:26:20] David Bennett:

Okay. Because we used to do that well, that was mandatory when we were shipping stuff around The United States. Everything was insured that way. Worst case scenario, we could ping the post office or, you know, whoever was doing our shipping that offered insurance. We all I think we only shipped with, USPS for that reason because they were the only ones that had a good insurance thing. But, so so the the let's say that, you know, it's not it's not a digital piece of art. It's a physical piece of art. Auction has been won.

The guy has acted, you know, in in an ethical manner, has gone ahead and paid the the full price for winning the auction. Now it's up to the artist to ship that thing and pack it well, and then you guys are taking on that, you know, the beat space risk. So when the package actually arrives to the person the the winning bidder, does the winning bidder, is it do they, you know, have a obligation to contact you and say, yes. It it arrived. Here's a, you know, screenshot of it. Or, yes. It arrived, but it's damaged, and here's where the damage is. Is that how you would assess that, you know, that those kind of issues on their end?

[00:27:32] Chris Trammout:

Yeah. It would be more of, like, we don't need to know anything unless something went wrong. Uh-huh. Okay. And and, of course, we would need proof of that in some form. And it's a it's a great question, and something that we're thinking through really closely right now and and the best way to do that. But if everything goes well, we don't need to hear from the buyer from them.

[00:27:54] David Bennett:

Okay. Okay. That well, that that does that actually does make sense. We we would never hear from our customers unless there was, you know, something wrong either. But, yeah, that that whole thing with, you know, the the the interconnection between, you know, Bitcoin, Lightning Network, you know, all this stuff, and MeetSpaces, I think is much trickier than we're giving it credit for. And, you know, as the problems continuously pop up, you know, it'll be like whack a mole, and we'll you know, eventually, we'll just crush them when they come down. But, you know, the minute that that that edge between Bitcoin and and actual space is just I think there's a whole lot of growth potential in in figuring out how to solve logistical problems there. And I don't see anybody actually doing it. I mean, you guys are, you know, are there at the edge because you have to do stuff in meat space. But I think there's going to be a lot of opportunity for Bitcoiners to go, you know, there's there's a, you know, million problems here that could be solved, and here's the solution. So,

[00:28:57] Chris Trammout:

yeah. We're thinking along the same lines. You know? The the challenge in solving the problem is our opportunity.

[00:29:03] David Bennett:

So when, when is are you guys gonna you I think you guys you're you're saying that you're pretty much in the still in the testing phase. Is there a beta coming up that people can look forward to? Is there some way for, you know, listeners to take part of this?

[00:29:19] Chris Trammout:

Yeah. We're, I wanna say two to three weeks out from launching our first lightning auction. Okay. We have, we have a, a a very special work of, fine Bitcoin art that's, just finishing up production. We're still kind of keeping that close to the vest, but there will be a big announcement once it's ready to show.

[00:29:43] David Bennett:

Okay. Well, do me a favor. You know, let me help out. When that when you're about ready to release, if you'll ping me on that, on that tweet or whatever social media that you're you know, all that stuff, I'll help, you know, relay that message because I know it's, you know, it's it's hard to get traction in in a space that's filled with so much noise. That's for sure. I appreciate that. I'll definitely keep that in mind. Thank you. Okay. So now we're gonna shift gears. There's some things that that you wanted to talk about. And one of the first ones because we're we have been talking about art, and sometimes they're a meat space, but often we're seeing this stuff the the these non fungible token art, and it's coming it's been kinda coming to Bitcoin more and more and more.

And you wanted to say how it's creating a new renaissance. I'm really interested in pulling those thoughts out of your head.

[00:30:38] Chris Trammout:

Yeah. So I figured if we're gonna talk for an hour, I have to have one point where I try to stir the pot up up a little bit and say something controversial.

[00:30:47] David Bennett:

Oh, no.

[00:30:48] Chris Trammout:

But, you know, when I first heard of NFT art, I thought it was totally crazy, but I felt a responsibility to do some due diligence here. Like, we're at least in a tangential space. I need to understand what this thing's all about. So got into it, bought a piece of, NFT art, And, you know, it certainly has many pitfalls, which I'm happy to go into. But the one thing that I realized really quickly is that the community of artists and collectors are just so unbelievably enthusiastic. And I I've learned the hard way to, not discount something that looks silly with a really, enthusiastic community.

Mhmm. And, you know, it's it's gotten it it's what's been proven for sure is that there's demand from real collectors for this type of art, and what that has incentivized is their creation of just incredible works of art. And now they are purely digital, but because they are digital, they're able to create entirely new experiences that just aren't aren't possible in the real world. Right. And, yeah, in my mind, the flywheel has already kind of taken shape, where the art is getting better, which is gonna attract different types of collectors.

And at the same time, you know, one of the biggest knocks on this thing is, you know, I can just copy and paste this and view it in my phone browser just the same. But you have this whole infrastructure layer that's being built around it because there is real demand here. And there's gonna be new ways to interact with this type of digital art that just wasn't possible before. So I think all of this is it's it's in motion. Now, like, the format of it, I have no idea. I think we're just scratching the surface of Yeah. What's possible here. And, you know, there's there's a ton of problems in the space. There's, you know, straight up fraud. There's plenty of wash trading.

And it's, you know, it's all at the foundation, it's on Ethereum, which, I think probably many of your listeners and, you know, I would share with you that that's that's shaky foundation. Yeah. So, you know, it's it's interesting going through the experience of buying one of these things because what it felt like to me is that I'm holding basically, ether, but in a more expressive way, which is kind of cool, but also comes with a whole lot of risk. Right? Like, you're not only betting on the work of art. You're betting on the artist. You're betting on, like, the NFT concept, and you're betting on the blockchain that it's all on.

Yeah. And, you know, like, the platform has already shifted. I don't know if you remember the the rare peeps or rare pepe's or I don't know how to pronounce it. Yes. I do. I remember the rare pepes very well. Yeah. So, like, you know, some of that art's really cool. Some of the artists are great, but I don't think those rare pepes are gonna be worth too much going forward because that platform is just kind of become you know, it's become less relevant. Right? So Right. My point here is that, I think there's a really interesting potential, but a whole lot of risk. And I think it becomes it can become much more interesting if it becomes if it comes to Bitcoin because then, you know, you're not just holding Bitcoin. You're you're you have ways to hold Bitcoin in more expressive ways, and you've been derisked somewhat by holding it on a blockchain that, in my mind, is much more secure.

[00:34:54] David Bennett:

Yeah. I agree. I was talking the first interview that I did, was with Samson Moe and, his art director, Wayne Won Chong, for from the, Infinite Fleet game. You familiar with that?

[00:35:07] Chris Trammout:

I'm not familiar with that one specifically.

[00:35:10] David Bennett:

Yeah. You know who Samson Moe is? Yeah. Yeah. Hey. A guy from Blockstream. Lizard lizard person apparently gonna kill us all, but, no, he's actually a really nice guy. But, you know, he's he's chief to chief strategy officer at Blockstream. But in, you know, in I guess in the you know, at night, he becomes video game developer. And if you haven't checked out Infinite Fleet, it's definitely worth take taking a look at. But they're using the the liquid side chain inside their their game, with the what's called the INF token, which is a token pegged to Bitcoin on, you know or it's it's pegged in a way to Bitcoin because it's through the Liquid Network.

Now they are actually doing NFTs in a way. And the way that they're, you know, the way that they're approaching it is as video game, you know, items like buying a new ship. But there's also the potential for art to come in there, too. One of the things that I think about a lot is, you know, some of the best art that I've ever seen in my entire life is in video games. And like my favorite game ever, and it took me years to to actually play it. I'd heard about it, but I by the time that I played it all the way through, it was already, like, seven years old. And that's Bioshock.

And some of the art inside that game, the the architecture, the way that they did things is was absolutely just brilliant. And I keep thinking about the fact that I can only experience that art either by firing up the game or, looking for screenshots or firing up the game and taking my own screenshots. That's the only way you're getting that art out of that game. Well, here comes NFTs. And what I think about that is that, you know, being able to play, you know, new games that come online, like maybe from Satoshi's games or Donner Lab, the guys that are, you know, really working with Bitcoin and other video games is to be able to pull art out and you buy that as an NFT and it's sort of kind of licensed to you. Not that you own it, but it's licensed to you. And then there's the other way that goes in.

And I'm thinking, you know, what you're talking about, and, you know, NFT artists creating one of these things and then being able to license their art and have it appear in a video game where their art is actually selected by one of the art developers or, art directors at a video game saying, you know, dude, Lucho's stuff would be perfect in this room because it has this kind of architecture. And they contact Lucho, and he says, yeah, dude. I'll I'll I'll either license you these that I've got on the shelf or I'll or I'll do you a custom piece. And then all of a sudden, the artist gets paid. Never had to do anything with you know, to fly to Amsterdam or wherever these companies are and, you know, hang out with them just and all of a sudden, you can crowdsource all the art that you need and have licensing potential on all of it. So I I don't think you're far from the truth that this is helping to create a new renaissance here, man.

[00:38:24] Chris Trammout:

Yeah. I agree. You know, at the end of the day, this is software. Right? So it's it's it's essentially just programmable art. And that's why I think we're just scratching the surface at at what's possible here. When you start getting into commercial rights and, you know, exclusive content that comes with that NFT, there's just a world of possibility. And already, what I think is so fascinating is already you have hundreds, if not thousands, of artists all around the world that now are able to make a living off of not just selling art, but, like, selling art that they really wanted to make. You know, I brought up I brought up the renaissance because I think about, like, you know, some of the great artists from the renaissance, like Leonardo da Vinci.

From my understanding, a lot of his money was made through commissioned work. Like, he wasn't even, you know, that wasn't even that wasn't coming straight from the heart, you know, some of these works. Right. Because we have this, you know, token model where there is ownership associated with the art now. And you can argue about, like, how legitimate that ownership is. But, you know, as a social construct, we've kind of agreed that, okay. Yes. You own this. I own that. We can trade them, whatever. And because we have these open marketplaces where we can reach an infinite number of people, buying and selling these digital art tokens, you know, now an artist, if they're talented, they can create the art that they want to create. And if it's good, they just need to find one buyer, and these marketplaces make it possible.

So to me, that's just that's a a beautiful thing, and it's going to do amazing things for creatives, and what's great for creatives is great for everyone.

[00:40:14] David Bennett:

Yeah. Absolutely. And and what you were talking about, the the commissioned works of people and the artist in the, you know, the the original renaissance, You know, those people were bounded by borders, distance. There was no telecommunications. Letters took, you know, god only knows how long it took a letter to get from Italy to, like, I don't know, you know, Germany or something like that. You know, now with commissions, you know, commissioned works at this point, there are no borders. Communication is instantaneous. It's gonna be real interesting to see how this one rolls out. I'll tell you that, man.

[00:40:51] Chris Trammout:

Yeah. I mean, we're super excited about it, and that's why we wanna be pioneers in bringing it to Bitcoin. We think it's a huge opportunity.

[00:40:58] David Bennett:

Yeah. Absolutely, man. So now we go from from NFTs. Let's talk about punk rock.

[00:41:05] Chris Trammout:

What what what you what you got bait what what's bacon in your brain about punk rock? Yeah. This one's been on my mind. You know, I, that's not for me. It's, I listened to, Peter McCormick, podcast he had on, this dude from The Clash. I think his name's, Keith Keith Levine. Did you listen to that? Oh, I listen I actually had to listen to that one twice because I was

[00:41:27] David Bennett:

had an emergency I had to make an emergency run from Panhandle Of Texas to Southwest Colorado because my sister had broken her foot. I started at 04:00 in the afternoon to basically embark on a ten hour drive that was gonna put me somewhere in Colorado around 02:00 in the morning. And, Yeah. Keith was Keith and Peter were my wingmen on that particular trip. That was a baller's interview, man, because that dude that dude got it. He just understood, and I'm like, man. Punk rockers. Check him out.

[00:42:03] Chris Trammout:

Absolutely. And he's just he's the type of guy too where he could just keep talking and you're like, yeah. Just keep talking. I'm listening. Whatever you got to say, like, I wanna hear. He's just such a fun guy to listen to. Yeah. But but, like, you know, it really resonated with me hearing him talk about it because he's talking about the pump movement and whatever. And I I wasn't around for that. But, you know, I I did kind of come of age in, like, the grunge period, which had a similar, like, stick to the man type of vibe. Right. And when I look back on that, what what was really interesting is, like, that whole movement was broadcasted to the public through MTV.

Mhmm. Right? Like, all, you know, all the music videos, all the live performances, Kurt Cobain, totally strong outlook flipping off the camera. Like, that was all. We saw all of that. Right. It was amazing. But then I don't know what happened first, but, you know, like, grunge kind of ended. And around the same time, MTV stopped playing music videos, and they started playing the real world, whatever. But it was almost it almost feels like it was like a form of censorship. And maybe this is just me how I remember it. And, you know, I can't think of a single counterculture movement.

Like, since then, that's been widely broadcasted through the mainstream media. And, you know, of course, mainstream media has become much less relevant since then. But even now in social media, we have cancel culture. So, like, anything that's controversial, it faces some type of censorship. So Right. Coming back to Bitcoin, like, Bitcoin is the ultimate counterculture movement. It's the ultimate stick to the man, but Bitcoin is not censorable. And, you know, of course, most directly in its transactions, but also in its its culture and its narratives. Like, we have what what does, what's Michael Saylor call it? The cyber hornets. Right? Like, we're the decentralized pack of cyber hornets.

You know Mhmm. If we're going to keep talking about Bitcoin Yeah. You know, we of course, we have Twitter, which is kind of a a central point of failure. Thankfully, we have Jack on our side there. But, you know, if Twitter gets shut down, like, we're gonna find a way to continue talking about Bitcoin. Yeah. So I feel like, you know, there's a lot of parallels there. And just like with, you know, punk rock and grunge, like, the cultural movement was was so important, and I feel like Bitcoin, along with being a financial revolution, is a cultural revolution.

And as part of that culture, there's, you know, there's, like, physical items. Like, I want T shirts. I want art so that I can, you know, represent my tribe here. I keep seeing the guy, you know, the guy on Twitter who, like, just goes in the middle of the street and starts yelling Bitcoin. I can't think of it. Dude. Yeah. But, like, I've been thinking about it recently. It's like, I get this guy. Like, if you're into Bitcoin, you just have this urge to start yelling Bitcoin. You know? Like, all of our normie friends are sick of hearing about it from us, but there's a strong need to express enthusiasm for Bitcoin.

Yeah. So, anyway, this is what we want to help support and promote.

[00:45:27] David Bennett:

Yeah. You know, I I think I get what you're saying. You know? Because you could you know, back in the punk rock days and even in the grunge days, if you had something to you know, if you if you were feeling particularly, you know, I don't know, salty or whatever and, you know, put on the clash and that sort of making a statement, It's playing that song loud is is in a way not only just because you wanna hear it in many other ways. It could be, you know, the old lady next door, you know, bitch me out for walking on the sidewalk even though that's not her property. So I'm gonna open my windows and play fuck you from whoever. You know? Sure. That's you can make that you can make that statement. And here, every time I make a Bitcoin transaction, I'm making a statement. Not only in my trans yeah. I'm not just transmitting value. I'm transmitting my absolute and utter disdain for all the stuff that I grew up with that was an actual lie, but was never told to me that it really was a lie because there was nobody around who believed anything, you know, anything different.

And they all believe the same lie. We've been lied to since before your grandmother was a baby. I we've been lied to a lot longer than that, probably. But, you know, definitely in my time when I grew up, I grew up thinking so much stuff. And now, you know, once you get into Bitcoin, like I said, once that first question pops about, well, what is money? It doesn't take you long to figure out what it was and how we screwed it up. So every transaction is like me playing a song very loud for the lady next door of The Clash.

[00:47:06] Chris Trammout:

Yeah. That's exactly it.

[00:47:08] David Bennett:

And we we need to, shift in to, something else that you put on the list, which was the psychology of buying with Bitcoin, and we kinda touched on that just a little bit. What what's your thoughts?

[00:47:22] Chris Trammout:

Yeah. So my experience was, you know, as I kinda mentioned, I I initially wrote off Bitcoin because I thought it would never be used for transactions. But, eventually, I wanted to buy some Bitcoin socks, right, from the, I think it's the the Mount Mount Sox guys. I probably got it wrong.

[00:47:39] David Bennett:

Mount Mount Sox.

[00:47:40] Chris Trammout:

Mount Socks. Yeah. And, you know, after I bought them, like, I've never been more excited to get socks or, like, maybe any piece of clothing for that matter. Uh-huh. And it just it it made me realize there there's a psychological impact of spending with Bitcoin, especially for something that can only be bought with Bitcoin. Right. Oh, it made me feel, like, nostalgic as a kid when my mom would take me to Toys R Us once a month, and I could spend $5 on a a toy. Like, when I got that toy, I really valued that toy because I used, like, my, like, scarcest resource to get it. And I kinda felt the same way with these socks. Like, I spent, like, the money that I really value to get these socks. So look. I mean, I think, as I kinda mentioned, I think we're a long way from using Bitcoin for everyday purchases.

You know, generally, like, fiat goods should be bought with fiat. But I think there's, there's plenty of special purchases specifically in Bitcoin culture that, you know, not only do people wanna sell them for Bitcoin, but people actually appreciate buying them with Bitcoin. So, yeah, that's what that's why I think that's the most interesting area for us to go after. Did you take part in the, Citadel 21 physical magazine,

[00:49:00] David Bennett:

when they launched that?

[00:49:01] Chris Trammout:

Yeah. Yeah. No. I I've got, I've got a issue one and issue two. Yeah. It's to say that it it ties back to, you know, kind of the crunch stuff too. Like, this is all these are the cultural elements of this revolution. And, getting these things, it just it just having it in your hands feels amazing.

[00:49:19] David Bennett:

Yeah. And it wasn't you know, for me, it was, you know, getting the magazine, and I don't want, you know, Huddl or not and and Katya to take this the wrong way, but getting the physical magazine was wasn't anywhere close to the rush that I had when I was sitting there with my finger on the button, and then the countdown stopped. And I, like, hit buy immediately. I logged it, you know, got it. I was already logged in, but I was like, I I got to the to the store page, and I'm just waiting for the auction to actually start. Starts up, go there, hit buy, and all their servers burnt to the ground.

Because every they had one server that they had from what I understand, they had one server that was handling the load, and we, like all the Bitcoiners, had spread the news so majestically for free that the response was way more than their, their little server could handle. So it burns to the ground. We start, you know, we're having a good time on Twitter talking about how this is, you know, it's amazing and look at what's happening and all that kind of stuff. And then they bring three more servers plus the original one online, and I felt no more I felt I've never felt so much joy in purchasing something, especially for $21 than I did at that moment. So because I'll go to, like, you know, not eBay, you know, Amazon to buy something.

I don't get charged up. I don't like, I'm just god. I gotta spend more money. Really? You know? And it's just a drag. And this from a psychological standpoint, I kind of like spending money or spending Bitcoin, but I only do that through the LNStrike so that I can convert dirty fiat immediately to, you know, Bitcoin that is then sent to the vendor. That I don't mind, but I I don't like spending out of my cold storage. So there's that. So, yeah, there's some some real intricacies here.

[00:51:21] Chris Trammout:

Yeah. And you bring up Ellen Strike. I haven't been I haven't been able to use it yet. It's, you know, not available in New York, but that takes it to the next level. You know? Not only are you spending money that you value, but you're burning that money that you told, in exchange for money that you value.

[00:51:37] David Bennett:

Again, yeah, that's a perfect way to put it. Not only are you buying something of value that you want with money that that you're excited about and at the same time, putting this lie into a brown paper bag, pouring diesel on it, and lighting it on fire. There's nothing there's a that's a that's a great that goes back to the whole punk rock thing, honestly. Exactly. Yeah. So now it's the now it's the future. So you, you got something about, you know, the the future of Bitcoin and LN for more than just payments. This seems like a good place to transition to that.

[00:52:12] Chris Trammout:

Sure. Yeah. So, you know, it was interesting when we did our first sale. We sold some face masks. And, like, going into that sale, we weren't even sure we were going to support Lightning, because, you know, we saw it as, like, MVP, minimum viable product. We wanted to keep it as bare bones as possible, but it just so happened to be during a time when, fees were spiking. Actually, I think it was just after the halving, so it was late May. So fees were up, and we're like, okay. We gotta support Lightning. Right? And we were we were blown away that over a third of our transactions were in Lightning.

Yep. And up to that point, I had just been a passive observer of Lightning. And from that moment, I was like, okay. I gotta try this thing out and see what this is about. So, you know, got set up on a lightning wallet, and it was the first payment that I made. I'm not even sure what it was for, but, like, that was it was just a total moment. Like, oh, well, this is definitely the future of at least Bitcoin payments, if not, you know, much more. So that kinda took me down the whole lightning rabbit hole and, like, saw all the use cases that were being tested with microtransactions and the whole primordial soup going on there. But then, you know, at some point in my research, I came across, it was actually Ryan Gentry's piece.

[00:53:41] David Bennett:

Yeah.

[00:53:43] Chris Trammout:

He wrote a piece for Multicoin when he was back there. And, I I can't remember the name of it exactly, but it was something like lightning as, you know, web three infrastructure. We actually wrote a blog post on it that, like, totally dumbed it down and made it, you know, memeified because it it is a pretty dense document. But it just Right. It totally opened the possibilities in my mind for, you know, what could be done with Lightning, and it goes way beyond payments. So it goes into, for example, decentralized IDs. So you can use your lightning node public key as basically a a digital identification and get all the benefits of a digital identification with that without, you know, all of the KYC and friction associated with it.

So, this is becoming very real right now. LN Markets has created a really great experience with their web app where, you know, you can log in either with your Jewel, Lightning browser wallet, if you're running your own node, or even with most other wallets at this point, you can use ln URL auth. And either way, you're just scanning a QR code and you're logged in. Boom. And not only are you logged in and, you know, you have access to all of your your history with that app, but by default, you're making lightning transactions, which is that just opens up so much possibility.

Yep. So so that's one thing we're really excited about implementing. I think we're gonna have it ready for v two of our auctions. And there are a bunch of other things too. You know? You know, I think the, DLCs is maybe something we can use to, you know, minimize the trust in returning our collateral payments, some kind of smart contract, on Bitcoin. There's there's these, like, TLV payments, which if you're familiar with, you know, anything really about Lightning, you know that payments can have a data payload attached to them. And, you know, in the most simple terms, that is text.

So you can actually there's this website, TLVshop.com, I think, and they did a test run of this where they sold sticker packs. And all you did was you made a TLV payment, which is just like any other lightning payment, and you're putting in your shipping address into the memo field of the payment. And what this enables is, like, you know, your shipping address is never touching a database, and it's only being sent from, you know, sender to receiver. And through the privacy of lightning, no one else is seeing that. Like, it's as private as it gets.

So that's something we wanna test out. We're super excited about. You know, there's a bunch of other stuff that I'm probably not thinking about. But the the point is, like, Lightning is so much more than payments, and I think a lot of the tools that it makes possible are really interesting for app developers, and I think we can bring a lot of it to life with, our ecommerce web marketplace.

[00:57:15] David Bennett:

Well, so, you know, speaking of that, you know, I guess the way to to approach this, you know, this this question is if the question is gonna be, how are you gonna deal with, oh, the changes that are gonna come in the future? Let me caveat that a little bit. We're seeing this I mean, the the rapidity of development and releases of different things. Lightning is not gonna be the last. So, you know, there's gonna be another second layer or or or it could end up being going above lightning and turn into a third layer that puts its hooks into the lightning layer. And then lightning puts its hooks into the Bitcoin main chain, as we know. So, you know, I'm not I'm going to try very hard not to say it this way, but, you know, what if something better comes along? And no, I'm not talking about a shit coin, guys. So give me, you know, give me a break if you're if you're, like, you know, killing me. No. But, I mean, like, new technologies are gonna be built on on on Bitcoin because this ain't stopping.

[00:58:20] Chris Trammout:

Yeah. You know, it's totally possible. And we're, you know, we're totally unbiased as to what we're using as long as it is based on Bitcoin. Right. My my personal view is that Lightning has achieved kind of platform status. Yeah. Where where there's just so much development on it at this point, and even the l three protocols are depending on Lightning. So I have a hard time seeing Lightning going away. Yeah. And, you know, part of this is also I just believe so much in the community and the people that are working on it. I think it's here to stay. And, but, yeah, look. There's gonna be l three protocols. We're really excited about what's happening with RGB. That's gonna open up, hopefully, a world of possibilities for us.

And, you know, all of this is just so early. We can't even imagine what's gonna become possible.

[00:59:20] David Bennett:

Right. It just it's so difficult to keep track of all the developments that are going on in the space that that's where reason I was asking the question is it must you know, it's gonna be it's already at the point and will continue to be the point that if you are, you know, in retail and you're using you know, decided, you know, I just don't wanna take fiat payments anymore. You know, the amount of research that would have to be ongoing just as we enter this space, it's like, okay, you're gonna take part of this space. You're gonna take Bitcoin payments. You're gonna do lightning payments. Buckle up because you're gonna have to know almost everything that goes on, and it's impossible to know everything that goes on even if you're not, you know, doing you know, having to do the business part of it. So, yeah, know, that's one of the reasons I was trying to kind of gauge what, you know, where you were at on on on that because the just the sheer amount of research that I have to do every day and I feel like I'm falling further and further behind. It must be really scary thinking, what if something else comes out? How could we, you know, transition? How long would that take? And, of course, there's no way of knowing unless the technology actually presents itself. So

[01:00:26] Chris Trammout:

okay. Yeah. It's absolutely true. You know, it's we're living in the primordial soup, and you never know what's gonna really come to life here. So you gotta be ready for whatever. That that is really challenging for product builders like ourselves. Like, so much of this is out of our control, So we have to be really flexible and nimble, in the decisions we make and and the moves that we make. You know, I think that's that that nimbleness,

[01:00:53] David Bennett:

having to be nimble in the light of what we were just talking about is gonna really train some next generation business minds to be able to be way flexible, way more flexible than they are right now. So I think that that'll feed into second generation effects that Bitcoin has even if Bitcoin doesn't touch the business that is built by the people that had to actually wade through this. Although, I'll bet Bitcoin will probably be part of everyday life soon, but you get what I'm saying. It is Chris, it's time for ShillFest. You gotta shill your stuff, man. Is there any announcements that you wanna, that you've been holding back or anything you wanna say about scarcity?

[01:01:33] Chris Trammout:

You know, check us out on Twitter, scarce.city. You gotta spell out d o t. Check out our website, scarce.city. Sign up for our newsletter. We got some really big announcements on the way, the lightning auctions. It's gonna be wild. You know? You never know what's gonna happen until you throw something out there. And once we do, it's out of our hands. So, you know, stick around and watch. Whether you're into it or not, it's gonna be entertaining.

[01:02:03] David Bennett:

Nice. So how do they get, people get in touch directly with you? You gotta, surely, you know what what's your Twitter handle?

[01:02:10] Chris Trammout:

My Twitter handle is, c Tremont. DMs are open. DMs are also open on the scarcity Twitter. So, you know, I'm easy to find. Feel free to hit me up, however.

[01:02:21] David Bennett:

And that Telegram group, is there a do you wanna give that one out, or is that by invitation only to people that you want to come in?

[01:02:29] Chris Trammout:

Yeah. That one's invitation only at this point. But, hey, if you're a Bitcoin artist and you're doing cool things, let us know. We'll we'll take a look. And, you know, we vote as a group to see who we we let in. Alright. So we're always That's so excited to, check out new artists.

[01:02:45] David Bennett:

Sounds good, Chris. So if you are an artist out there and you wanna get into this, contact the guys over at Scare City, or see Tramont on Twitter, and maybe you can get entry into the super secret club.

[01:03:00] Chris Trammout:

Yeah. I hate to hate to make it sound exclusive like that. But yeah. We No. No. No. It's curation and and, quality control is is really important.

[01:03:09] David Bennett:

Well yeah. Yeah. And, it same same to be said for, like, you know, the auctions that you guys choose to do because, you know, if, you know, if you were to say, hey, man. Anybody can start their own auction, and we're the platform. Next thing you know, sex toys are being sold or, god, no. You know, god, something you don't wanna see is all over the screen. It is like, I don't wanna do it. So, yeah, curation. Yeah. There's a difference between curation and censorship, and I think we can we know that I think we know the difference there. So alright, Chris. It was, awesome. I enjoyed learning more about scarcity, yourself, your just the the punk rock stories. You know? But, it was it was a great discussion, and I really appreciate it. Thank you for your time, sir.

Likewise, David. This has been amazing. Thanks so much for having me on. Oh, absolutely. And if you ever need to announce something, hit me up. My DMs are always open.

[01:04:02] Chris Trammout:

I will. Thank you. Alright. See

[01:04:04] David Bennett:

you later, Chris. Alright. See you. I'd like to thank Chris again for giving me a long a long interview. He was very gracious with his time, and I very much appreciate that. So again, Chris Tremont, thank you, for telling us all about scarce. City. That I'm really I'm really excited about that. I, you know, especially if it goes into, you know, either them doing it or somebody else doing it. Somebody, you know, developing a full blown auction platform that uses, Lightning Auctions. You know, it was kind of tried, you know, Brian Hoffman was kind of doing a little bit like that.

Well, not really. Open Bazaar is, you know, different than just a full blown auction, I think. But, he kind of screwed up by going the side of Bitcoin Cash and I think then he started accepting bsv and you know that thing is almost dead. That's what you do when you tangle with you know, Bitcoin. And, I mean, I became very much not interested in using that platform at all the minute that that Brian started, talking about how some of these other things might be better than Bitcoin. Like, you know, you're you're not being a very good steward of this of the technology. You're you're in it for yourself. You're not in it for anybody else that, you know, and he I'm sure that Brian doesn't believe that. But I mean, everybody who's, you know, all these companies that have done that, are not doing well. Y'all's.

Well, not y'all's.org. Yours Org. I can't remember the guy's name because he's already slipping out of all of our collective memories. It's dead. I mean, I can't even go to, like, if I go to the website foryours.org, it's it's completely dead. It's a dead gateway. Doesn't go anywhere. And then he did money button, which is also on the rocks. And this is yet somebody else. Was it Charles or Charles x or I can't anyway, he did the exact same thing that Brian Hoffman did only way more vocal. And he also completely dropped any kind of support for Bitcoin and went completely b s v, that all those projects were almost dead too.

Yeah. Don't don't do that. It's just that you're playing with your life anyway. So, there's not much else going on. Again, I'm gonna bring you some more interviews this week, for the week of Thanksgiving, and I'll see you on the other side. This has been Bitcoin, and and I'm your host, David Bennett. I hope you enjoyed today's episode and hope to see you again real soon. Have a great day.

Introduction to Scarce.city and Chris Trammout

Chris Trammout's Background and Journey to Bitcoin

The Birth of Scarce.city

Understanding Scarce.city's Marketplace

Challenges and Opportunities in Bitcoin Auctions

NFTs and the New Renaissance

Punk Rock and Bitcoin's Counterculture Movement

Psychology of Buying with Bitcoin

Future of Bitcoin and Lightning Network

Closing Remarks and Contact Information