Join me today for Episode 1035 of Bitcoin And . . .

Topics for today:

- North Carolina Makes 28 States

- KULR Buys 100 BTC

- Japan's Gumi To Buy BTC

- Zeus, Alby Go, and Primal Updates

#Bitcoin #BitcoinAnd

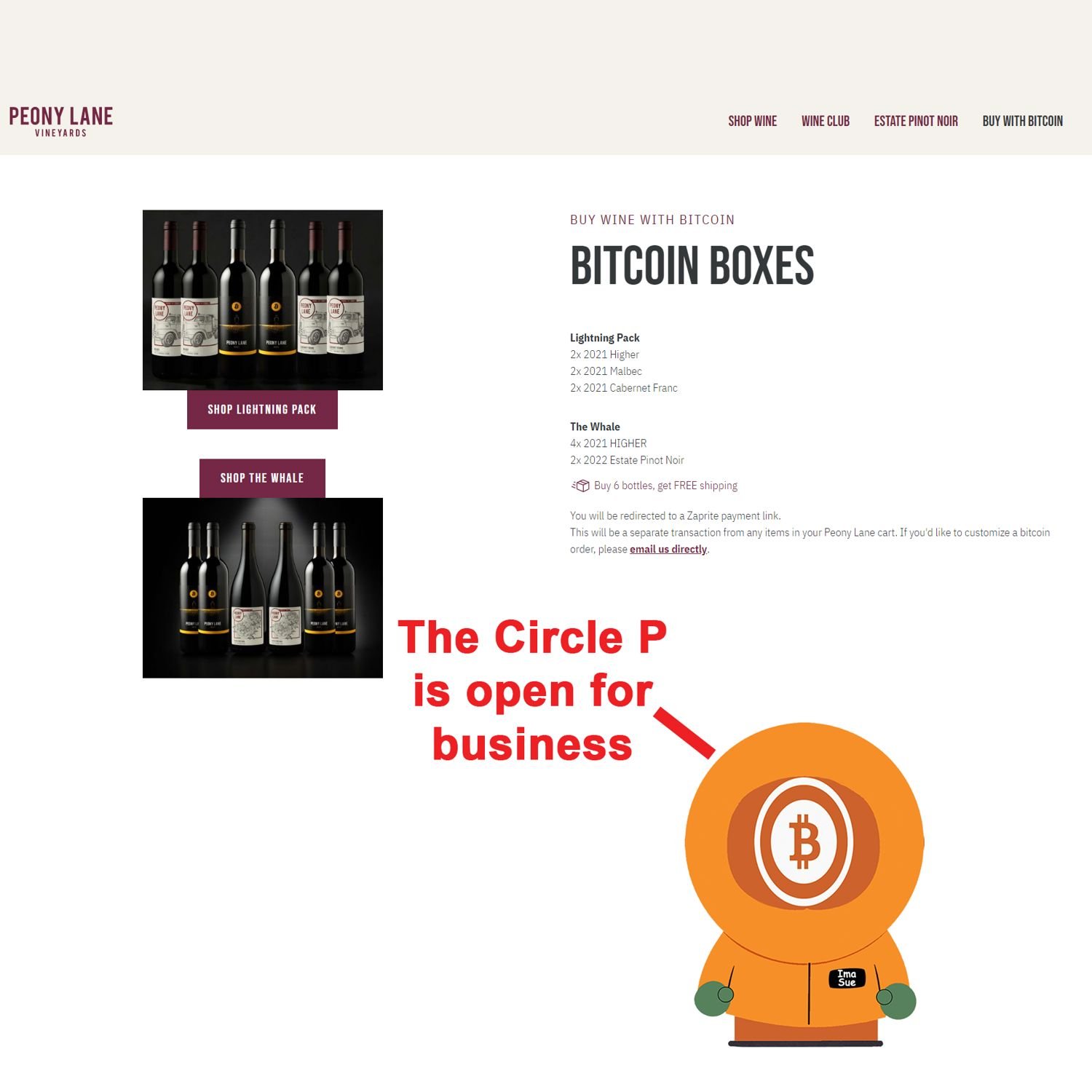

Circle P:

Peony Lane

Wine

nostr: https://primal.net/BenJustman

Twitter: https://x.com/BenJustman

Website: https://www.peonylanewine.com/bitcoin

The King Ranch Donation Pages:

https://www.ruralamericainaction.com/fundraising/save-king-ranch-and-agriculture-in-washington

https://www.givesendgo.com/Kingranch

Articles:

https://cointelegraph.com/news/north-carolina-files-bill-allow-state-treasurer-to-invest-bitcoin

https://decrypt.co/305304/poland-central-bank-not-buy-bitcoin

https://www.theblock.co/post/339957/kulr-100-bitcoin

https://www.theblock.co/post/339867/japanese-game-maker-gumi-announces-6-6-million-bitcoin-purchase

- https://www.cnbc.com/futures-and-commodities/

- https://dashboard.clarkmoody.com/

- https://mempool.space/

- https://value4value.info/

- https://fountain.fm/show/eK5XaSb3UaLRavU3lYrI

- https://geyser.fund/project/thebitcoinandpodcast

https://cointelegraph.com/news/crypto-broker-escapes-kidnappers-breaks-ankles-while-fleeing-spain-report

https://decrypt.co/305298/alabama-man-pleads-guilty-hijacking-sec-bitcoin

https://www.nobsbitcoin.com/zeus-v0-10-0-alpha1/

https://www.nobsbitcoin.com/alby-go-v1-9-0/

https://www.nobsbitcoin.com/primal-v2-1/

Find the Bitcoin And Podcast on every podcast app here:

https://episodes.fm/1438789088

Find the Bitcoin And Podcast on every podcast app here:

https://episodes.fm/1438789088

Find me on nostr

npub1vwymuey3u7mf860ndrkw3r7dz30s0srg6tqmhtjzg7umtm6rn5eq2qzugd (npub)

6389be6491e7b693e9f368ece88fcd145f07c068d2c1bbae4247b9b5ef439d32 (Hex)

Twitter:

https://twitter.com/DavidB84567

StackerNews:

stacker.news/NunyaBidness

Podcasting 2.0:

fountain.fm/show/eK5XaSb3UaLRavU3lYrI

Apple Podcasts:

tinyurl.com/unm35bjh

Mastodon:

https://noauthority.social/@NunyaBidness

Support Bitcoin And . . . on Patreon:

patreon.com/BitcoinAndPodcast

Find Lightning Network Channel partners here:

https://t.me/+bj-7w_ePsANlOGEx (Nodestrich)

https://t.me/plebnet (Plebnet)

Music by:

Flutey Funk Kevin MacLeod (incompetech.com)

Licensed under Creative Commons: By Attribution 3.0 License

creativecommons.org/licenses/by/3.0/

Man, it is cold. It is 11 degrees outside and snowy on this, the February 2025 at 08:51AM Pacific Standard Time. This is episode ten thirty five of Bitcoin and Poland is gonna have fun staying poor. I'll tell you about it. North Carolina does not wanna have fun staying poor and neither does Kuler or KULR FM. No. It's not really a radio station. I'll I'll I'll tell you all about it. And then we got some, Japanese stuff going on in the news as well as I'm going to bring you yet another story about why you don't wear bitcoin swag or tell people that you have lots of bitcoin or tell people that you're in crypto. Just honestly, just don't, man. I mean, not in meat space anyway, but, you know, Alabama, we're well, Alabama is not, as far as I know, one of the states is getting into Bitcoin.

They're doing something else. They got a guy, in their state that has done some really really nasty stuff. And then we've got a few software updates. But let's begin with Poland And, you know, I just Simon Chandler is gonna bring us a very, very sad story from decryp.co. The Poland Central Bank will not buy Bitcoin, quote, under any circumstances because we wanna have fun staying bored. National Bank of Poland will not consider holding Bitcoin reserves under any circumstances according to Central Bank president Adam Glapenitsky or however you pronounce it. Speaking at a press conference, said that a given asset, quote, must be absolutely secure for the National Bank of Poland to consider adding it to its reserves.

He compared Bitcoin unfavorably to gold, which he says helped the bank's reserves increase its value by 22% last year. Woo. 22%. Man. Wow. Can I get in on that? 22%. Whatever, dude. However, the NBP's president didn't completely dismiss the cryptocurrency noting that there's a lot to be said about Bitcoin even if his bank doesn't believe it can serve as a permanent safe element in its holdings. You can buy a lot and gain a lot as well as lose a lot. However, we prefer something certain. Just pausing to interject, this is not risk management.

There I mean, some people think that he oh, well, he's just applying risk management principles. No. He's not. This is straight up fear. This is I mean, what you do in a risk management situation is you go, okay. Here is an asset that is doing well, doing well over 22 per year, I might add, but well enough for me to say, what's the risk? And I could say, well, yeah, you can gain a lot or you could lose a lot. That's part of a risk management profile. And, you know, maybe you want to, you know, you don't understand the securities. That's why you say stupid sentences like it needs to be more secure. It's already secured. He's talking about volatility. Right? Okay. Okay. That's fine.

That's fine. But this is not risk management. This is just straight up fear. This is not the guy you want as an economist at a central bank or any kind of institution for that matter. This is the guy who's saying, look. I don't like Bitcoin. However, we cannot escape the fact that Bitcoin does x percent year over year. So, therefore, we're going to examine a half of 1% allocation as an experiment for the next six months, and we might sell off if we even if we find ourselves in profit. And we will certainly sell off if we find ourselves in the red.

That's risk management. This this is something else. This, in my opinion, is him telegraphing to the European Central Bank and old leatherface, Christine Lagarde, that he's gonna be a good little boy. That's what this is telling me. This is not risk management. This is him telling Christine that he's going to he's going to do right by her. He's gonna be her good little man. It's disgusting. But continuing such caution isn't particularly surprising to advocacy groups promoting the idea of BTC reserves with Matthew Pines, a national security fellow at the Bitcoin Policy Institute, telling Decrypt that central banks are usually conservative institutions by design, quote, their legal mandate is usually very narrow, stable prices, full employment, financial stability.

They also view currencies as inherently a sovereign prerogative and closely husband the legal monopoly granted to them by the state to issue state backed money, end quote. Yet despite current resistance, Golimsky's remarks come a week after the Czech central bank approved a proposal to study the possibility of investing in BTC. Golinski's remarks came a week after the Czech central bank approved a proposal to study the possibility. They said it twice. Oh, come on. Editing, guys. Editing. The study could publish by be published by August or September, yet it has met with some degree of resistance within Chechnya, with finance minister Zbyszczyzure saying that he would not recommend a national Bitcoin reserve and that sometimes he tells his colleagues not to think out loud on the microphone.

Wow. Such criticism forced the central bank's deputy governor, Eva Zamarazilyev, to come out with public clarification stating on Czech TV that the study would consider other investments in addition to bitcoin. She also seemingly retreated on previous suggestions that the Czech central bank could put as much as 5% of its reserves into bitcoin, quote, such a proposal has never been discussed by the bank board, she clarified, adding that the study is more of an exploration than an indication of any policy. The possibility of Bitcoin reserves also invited criticism from, guess who, ECB president Christine Lagarde, who recently criticized BTC along much of the same lines as Adam Galinsky.

Quote, there is a view around the table of the governing council that reserves have to be liquid, that reserves have to be secure, and they have to be safe, she said at a press conference. Yet the mere fact that central banks have begun talking about Bitcoin in this context may signal a pivotal shift in climate with noises in Europe following from the more concrete possibility of a strategic Bitcoin reserve in The United States. Within days of taking office, president Donald Trump created a working group to study creating a BTC reserve, while more recently he has called for the creation of a sovereign wealth fund. And nearly a third of US states are reviewing legislation.

No. That is no longer a third as I told you yesterday. Ladies and gentlemen, it is now 27 states are considering some type of strategic Bitcoin reserve, shitcoin reserve, or a combination thereof. Anyway, Matthew Pines has a view that such progress won't be at all impacted by disapproval in Poland and the wider European region with The US potentially more interested in keeping pace with, you know, more Bitcoin friendly jurisdictions, quote, The United States is closely watching as other nations, especially in The Gulf and in Asia, consider Bitcoin as a national asset.

So when I told you about this last week or possibly the week before, especially with Christine Lagarde coming out and making the statement that she did hot off the heels of the head guy at the Czech Republic National Bank saying that they were gonna examine looking at putting 5% of their reserves in Bitcoin, she immediately came out and said, no. She's talked to the guy, and that's never going to happen. And now we have internal Czech Republic central bank personnel lambasting the guy in the press. We never discussed that. They're making him look like a complete idiot. So now what here's what I'm seeing. There are all manner of good little boys and girls at the Czech Republic National Bank, and they are firmly in the pocket of Christine Lagarde and the European Central Bank.

They're corrupt. I guarantee it. Just saying. Peony Lane Vineyards. That's right. Peony Lane Vineyards is gonna bring you some wine, and you can buy that with Bitcoin, but only in the Circle p. The Circle p is now open for business, and it's where I bring plebs just like you with goods and services for sale to other plebs just like you so that you can buy with bitcoin because if you're not selling your goods and service in bitcoin, you ain't in the circle p. Alright. So you can go to peonylainewine.com. P e 0 n y. Peonylainewine Com / bitcoin.

And yes, it's powered what what is it? It's powered by BTC? No. It's powered by Zapprite. So you are going to be able to buy Ben Justman's wines, which are grown in the high country in Colorado, in the intense sunlight that has this tendency to not only produce high amounts of sugars, but concentrate those sugars in late in the season so that he can bring you extraordinary wines, and you're gonna be able to pay directly with Bitcoin. And I believe it's both on chain and lightning. So if you buy it, if you buy wine, there is a little place where when you're purchasing it that you can write a note. Make sure you tell Ben that you heard about Peony Lane Vineyards here on the Circle p at the Bitcoin and podcast, and he might consider cutting me some Satoshis of any sales that he knows that I made for him. Let's continue with the state that doesn't want to be poor.

North Carolina, well, the house speaker has filed a bill for the state to invest in Bitcoin exchange traded products, not Bitcoin itself, but the ETPs, which is also not the spot Bitcoin ETF, The investment or the the exchange traded products and Martin Young tells us more about the parameters in cointelegraph.com's piece. North Carolina has become the latest state in The United States to propose legislation permitting the state treasurer to invest public funds in, quote, qualified assets or digital assets. The NC Digital Assets Investment Act, house bill 92 introduced by North Carolina speaker of the house, Destin Hall, would diversify the state's investments by allowing the treasurer to include digital assets in its portfolio.

However, one of the requirements is that the digital asset must be an exchange traded product. Additionally, they must have an average market capitalization of at least $750,000,000,000 over the previous twelve months, meaning that at the moment, only Bitcoin exchange traded products are eligible. There is also a limit of 10% of any state funds balance at the time of the investment. Quote, investing in digital assets like Bitcoin not only has the potential to generate positive yields for our state investment fund, but also positions North Carolina as a leader in technological adoption and innovation, said Hall, who cosponsored the bill.

In a post on Twitter, he added that the move aligned with president Trump's vision of a national a national Bitcoin stockpile and ensuring that North Carolina leads at the state level. Legislators and bill sponsors said that there were several reasons to invest in crypto assets such as US dollar inflation and devaluation and potential returns from state funds, which include teachers and state employees' pensions, insurance funds, and veteran funds. Blockchain technology, decentralized finance, and other innovations in the crypto space will shape our future in many ways. North Carolina is poised to capitalize on these emerging opportunities, said Bill cosponsor Mike Schellzelt.

I cannot pronounce so many names. It's not I'm not doing it on purpose, ladies and gentlemen. It's just I can't pronounce some of these things. It's like too many z's and freaking consonants all in a row, and it's like, how the hell do you even say that shit? Anyway, the number of US states proposing crypto investment legislation is increasing almost daily. There are now 19 states with a bill proposed while Arizona and Utah advanced legislation beyond the house committee level. North Dakota, meanwhile, has rejected legislation regarding crypto investments. Well, that's just their own dumbass fault. But on February, Montana lawmakers introduced an act h b four twenty nine for creating a state special revenue account for investing in digital assets as well as precious metals. So, again, I I need to, you know, make sure that that everybody understands that when they say 19 states, what they really mean is 27 states.

Hell, even Oregon has something on the table right now. So just go well, we'll see. I think it's bitcoin laws. Hold on. Bitcoinlaws.io. Go over to bitcoin laws, l a w s, and there are oh, okay. Looks like they've they've updated a little bit, and now there are 21. No. There's 28. There are 28. I keep forgetting. There's a little switch that only talks about the state or, like, when you switch it on, it says SBR bills and there's twenty one twenty one states specifically say Bitcoin. If I turn that switch off, it now turns to 28.

And some of those bills actually don't say Bitcoin. They say things like digital assets or cryptocurrencies, but they don't specifically call out Bitcoin. But there are still 28 states. Yesterday yesterday, it was 27. Nothing stops the train. Nothing stops the train, dude. So on well, let's go look at KULR FM where rock and roll reign supreme. No. It's not a it's not a radio station. But KULR acquires another 100 Bitcoin for $10,000,000 as its total holdings reached 610 BTC. Not bad. James Hunt from the block. KULR Technology Group has acquired another hundred Bitcoin for approximately 10,400,000.0 at an average price of a hundred and 3,905 per Bitcoin.

Woo. Inclusive of fees and expenses according to an eight k filing with the SEC. The company now holds 610.3 BTC worth nearly $60,000,000 at current prices, acquired at an average price of 98,312 per Bitcoin, and they are still underwater because we are Jerome Powell opened his dumbass mouth today, and now we're back down to 96,184. So currently, the, CEO, Michael Moe, of KULR is a little bit underwater. I'm just saying. Anyway, these latest acquisitions align with KULR's Bitcoin Treasury strategy, which they announced on December 2024, committing up to 90% of its surplus cash reserves to be held in Bitcoin.

KULR specializes in thermal management solutions designed to improve the safety and efficiency of energy storage systems, especially for lithium ion batteries. It is also among an increasing number of firms looking to emulate strategy, formerly MicroStrategy's Bitcoin acquisition playbook alongside similar scientific Meta Planet and the Japanese game maker, Gumi, among others. Like those firms, KULR uses a key performance indicator known as BTC yield to assess the effectiveness of its Bitcoin acquisition strategy in driving shareholder value. BTC yield represents the percentage change period to period of the ratio between KULR's Bitcoin holdings and its assumed diluted shares outstanding.

Year to date, KULR said that it has achieved a BTC yield of 167.3%, leveraging a combination of surplus cash and its at the market equity program to fund these purchases. KULR stock closed up more than 28% on Monday and is currently up point 4% in pre market trading on Tuesday. On Monday, strategy resumed its Bitcoin buying spree after a single week's pause announcing that it had acquired an additional 7,633 Bitcoin. So there you go. K u l r is, well, you know, running right ahead. So now in this piece, they mentioned similar scientific meta planet and the Japanese game maker, GUMI, g u m I. Just so happens, I've got that right here. From Danny Park, also writing for the block, Japanese game maker, Gumi, announces a $6,600,000 Bitcoin purchase.

Tokyo listed mobile game studio, Gumi Incorporated, intends to buy Bitcoin worth 1,000,000,000 Japanese yen, the company announced on Monday. Gumi plans to make the purchase in the period between February and May of this year according to the company's statement. Quote, through this initiative, we will further strengthen our node operation business and enhance our presence in the web three domain. The company stated that the decision to purchase Bitcoin was made to aid various efforts to strengthen the company's financial standing in pursuing blockchain and other businesses.

Such efforts include expanding its node operation business, Gumi said. According to the statement, Gumi became the first listed company in Japan to participate in Bitcoin staking protocol Babylon as a validator during the second quarter of the fiscal year ending April 2025. Gumi said that the company expects to earn secondary revenues from staking its surplus Bitcoin into Babylon and from validator rewards. You know, stop it. Just, honestly, just hold the damn Bitcoin. Anyway, continuing, regarding our cryptocurrency holdings, we will conduct a fair market value assessment quarterly, and the resulting gains or losses will be recorded on our income statement.

Founded in twenty o seven, Gumi was listed on the Tokyo Stock Exchange in 2014. The company has developed and launched a series of mobile games domestically and internationally, including Final Fantasy, Brave Exvius, and Brave Frontier. The company also owns Gumi Crypto Capital, a venture capital firm that invests in early stage blockchain and crypto companies. Gumi's stock price rose 3.65% on Monday to close the day at 454 yen according to MarketWatch. As of publication time, Bitcoin was trading at 97,608, up point 8% in the past twenty four hours.

Meanwhile, Japanese investment adviser, Meta Planet, has claimed that it is the first publicly traded company in Japan to establish a Bitcoin Treasury. So there you go. Gumi also in the news and buying Bitcoin. Let's run the numbers. Futures and commodities from CNBC. I got West Texas Intermediate oil up one and a quarter to $73.25. Brent, North Sea up almost one and a half to $76.94. Natural gas, two and a half percent to the upside. Gasoline is over 2% to the upside, chilling out at $2.14 per gallon. Gold and the rest of its little brethren are not having a good day. Gold is down a quarter of a point, but still at all time highs of $2,927 per ounce.

Silver is down two thirds of a point. Platinum is up a quarter of a point. Copper is down 2.6, and palladium is down just over a full point. Over here in ag land, we've got the biggest winner, chocolate. 4.23% to the upside, biggest loser today is coffee, three and a quarter to the downside. While live cattle is also down 1.19%. Lean hogs, the other direction, point 5% to the upside. Feeder cattle is down one and a quarter point itself. Dow is essentially moving sideways, point 04% to the upside. S and P is point 2% down. Nasdaq is half a point down, and the S and P Mini is over half a point down. What did Jerome Powell say? I'd give real money if that dude would shut his hole. Because every time he opens his mouth, it's sell the news time. And it's just we're sitting at $96,132 right now. And it's ever since that boy was got up on the stand and started talking, we started seeing red candles.

It's the most amazing thing. I've never seen weaker bullshit in this market than I've been seeing over this last two years. It's just disgusting. Still, what did Jerome Powell say? There he's in no hurry to raise rates, that jobs and the employment sector look great. That we're fine. The economy's fine. That's what he told congress today at, the hearing. So, anyway, more bullshit. It's all a bunch of lies. I don't believe that guy for a second, and he's probably gonna come to blows with Trump at one point or another. Now, like I said, $96,150 per Bitcoin, that is a $1,910,000,000,000 market cap.

Man, we can only get 32.7 ounces of shiny metal rocks with the one Bitcoin, of which there are 19,822,676.18 of, and fees per block are low. 0.04. BTC taken in fees on average on a per block basis. And it looks to be like there are, what, 12. There are 12 blocks carrying 13,000 unconfirmed transactions. High priority is gonna get you in at five satoshis per v byte. Low priority is gonna go for four. And the hash rate is chilling at 801.2 exahashes per second. So still very very strong very strong security for the Bitcoin network. From United States Of Bitcoin, yesterday's episode of Bitcoin and I got pies with four twenty says thank you sir value for value no thank you.

X p l b z x says US of Bitcoin. Well, I gotta zap that. And anonymous gives me a hundred sats and says, oh, it's the exact same thing except this is says that it's anonymous. It says US Of Bitcoin. Well, I gotta zap that. So I'm not exactly sure what happened there, but I can tell you one thing. When I sent out the show, yesterday, something happened with podcast index, and it it just wasn't scraping, what it should be scraping. So it never it it didn't get to fountain, like, until, like, four hours later. It took that long. And and shit happens. I'm not blaming anybody. Things happen, dude. We're this is all brand new.

Podcasting two point o is, you know, it's it's in its infancy. You know, I asked Dave Jones over at Podcasting two point o to look at it, and he somehow immediately got he either was able to get it through or before he was able to touch a button, it actually went through all by itself. I'm not sure which. But when I sent out the show note or the show announcement, I had to put in the Apple podcast link because the fountain link didn't exist. And I can tell because I've only got, like, three zaps on this show. So if you would do me a favor and, like, I don't know, market that particular episode for me. I'd really appreciate it. I might even get you some sats back on the other side. That's the weather report.

Welcome to part two of the news you can use. Don't wear Bitcoin swag. Don't tell people that you got Bitcoin in meat space. Don't talk about it. Because a crypto broker breaks ankles while fleeing kidnappers in Spain. Stephen Kati, Cointelegraph. Jesus just gets worse and worse and worse. A UK Crypto Broker reportedly jumped 30 feet from a balcony to escape kidnappers who were threatening to torture and kill him for his crypto. According to a February 9 report from UK media outlet Metro, three British men have been arrested over the kidnapping. The broker reportedly accepted an invitation for drinks at the kidnapper's apartment in the nearby town of Estopona and upon arriving was told to hand over €30,000 from his customer's accounts or be tortured and or killed.

And or killed. The broker managed to call for help by phoning a friend in London, pretending he was phoning a customer to get his access codes. His friend then called the victim's mother, who called police. Local authorities were able to track down the apartment. Jesus. Metro reports that while the kidnappers were distracted by the police, the broker jumped 30 feet from the balcony, breaking both of his ankles. In a February 8 statement, Spanish police said that they arrived on the scene, they saw the victim attempting to climb down the apartment balcony before falling to the ground, and he was immediately taken to the hospital for treatment for his injuries.

A subsequent search of the apartment uncovered two firearms, €10,000, a money counter, three knives, and 25 grams of pink cocaine. Pink? I don't think I've ever seen that. Pink cocaine? Well, is it flavored? Maybe it's strawberry. Oh, well. All three men were arrested and charged with kidnapping, wounding, belonging to a criminal organization, illegal possessions of weapons and drug trafficking. And after a court appearance, they were remanded to prison. Well, that was quick. There has been a growing number of incidents involving in person crypto robbery in recent years.

In October, blockchain investor, Zac ZBT, said that he'd received messages from victims of crypto home invasion thefts in Western Europe at a much higher rate than in other regions. Meanwhile, Jamieson Laupp, a cypherpunk and cofounder of self custodial firm Casa, has created a list on GitHub recording dozens of offline crypto robberies all over the world dating back to 2014 when someone allegedly tried to extort Hal Finney of 1,000 Bitcoin worth $400,000 at the time. In a more recent case, thieves broke into a home in Brazil and forced a husband and wife to transfer $16,000 in crypto to wallets controlled by criminals.

There have already been nine nine incidents of in person crypto related robbery this year. According to LOPS list, in 2024, there were 28, while there were 17 incidents in 2023 and thirty two in 2021. Guys, I'm serious. If you like, look. Here here's the scenario. You meet someone, you're kinda hammered, and you say, I own Bitcoin. And they go, you know, that's great. They kinda chat you up and then all of a sudden they invite you back to their hotel room or to their apartment for drinks. Yeah. Red flag. That's a that that that is a place that you have you are completely vulnerable.

Don't do that. In fact, start off by not just chatting up somebody at a bar and tell them about your Bitcoin. Alright. Just don't do that shit, man. It's just gonna get you into trouble. Like this guy, this Alabama dude who's pleading guilty to hijacking the Securities and Exchange Commission's Twitter account to pump the Bitcoin. Remember when that happened last year? Or the actually, like, at the was it yeah. It was January the eleventh of last year or January 10, right before we got the Bitcoin ETFs, I believe, is what Andrei Bogansky from decrypt C e CEO is talking about. An Alabama man has plead guilty on Monday to helping hack the SEC's Twitter account in January of twenty twenty four in an attempt to mislead the market about spot Bitcoin ETF approvals.

Eric Council, a 25 year old resident of Athens, Alabama, admitted he was guilty of a conspiracy to commit aggravated identity theft and access device fraud in the United States District Court for the District of Columbia, per Bloomberg. Council's attorney, Dwight Crowley, was unavailable for confirmation or comment. And a phone call with decrypt ended prematurely, and additional attempts to contact Crowley were directed to the attorney's voice mail. This article will be updated should decrypt hear back. That doesn't sound good. That doesn't sound good at all.

Council's guilty plea comes thirteen months after the SEC's approval of spot Bitcoin ETFs. The highly anticipated development which opened the door to billions of dollars of institutional cash was preempted preempted by a false statement one day earlier saying that a clutch of ETFs had already been approved. When arrested by the FBI in October, authorities alleged that counsel leveraged a SIM swapping technique. He gained control of a phone number belonging to an SEC employee which enabled him to gain unauthorized access to the SEC's social media account.

The alleged scheme involved crafting a fake ID using stolen personal information and then caused bitcoin's price to spike caused Bitcoin's price to spike. On January, Bitcoin's price jumped as high as 47,700 before plunging back to 45,600. Former SEC chair Gary Gensler quickly debunked the false statement which was echoed by the agency saying that its Twitter account had been compromised. Authorities claim that counsel made suspicious search inquiries following the incident. Quote, how can I know for sure if I am being investigated by the FBI? And what are the signs that you are under investigation by law enforcement or the FBI even if you have not been contacted by them?

Watch your Google searches, people. While a Washington judge will ultimately determine counsel sentence, the 25 year old may face fifteen years in prison for identity fraud and three years for impersonating a federal agency. The SEC did not respond to a request for comment. Okay. So there you go. Don't do that shit. It's just more trouble than it's worth. Alright. Zeus version 0.1 alpha one channel renewals, Nostril Wallet Connect, and developer tools. It's a mobile Bitcoin and lightning wallet and remote node manager for LND and core lightning. It's available on both android and iOS. Quote, Zeus version 0.1 open alpha test program has begun. Help us test the next major release of Zeus featuring channel renewals, Nostril Wallet Connect, client support, developer tools view, and Chan tools, sweep remote closed.

I don't know what that means, but they announced it. Anyway, the alpha testing is open to everyone. Android users can download the release via GitHub or using tools like the Obtainium app, while iOS users must join the alpha test flight group. Note that Zeus iOS beta testers have to leave the beta testing group first to be able to test the alpha release. Is there anything else about this? So what's new? Okay. Channel renewals. Users can now renew and extend channel leases from both channel services. Channels open to Olympus LSP or Lightning Service Provider with user funds can be upgraded for guaranteed lifetime and fee savings. Renewal notifications are coming soon.

Nostra Wallet Connect now is supported by Zeus to external wallets like albihub and casu.me. Currently, it's for accessing NWC wallets in Zeus on the client side. Server side access to the built in Zeus wallet is planned for a future release. Developer tools, there is a new section for developers and is now available under the tools menu. And then there's Chantools. Chan Tools is a CLI tool for recovering lightning channel funds if channel state data is lost. Zeus version 0.1 delivers a sweep remote closed command for users with sync issues or lost channel backups.

More channel commands are expected to be added over time. So if you are a Zeus user and you want to go test this alpha, you just get a hold of him. And that's all the stories that I read to you today have their separate URLs in the show notes pretty much in the order that I read them. So just scroll down to the bottom and look for that. It is a no b s bitcoin.com story. As well as this one, AlbiGo version 1.9 has been released. Push notifications, pay zero amount invoices, and more. AlbiGo is a simple lightning mobile wallet interface for Bitcoin payments over the lightning network. It works well with AlbiHub or any other Nostra Wallet Connect wallets. It's available for both iOS and Android, and I have AlbiGo on my phone. Phone. I use it all the time.

Albi Go can now display notifications for payments sent and received via a connected Master Wallet connect wallet, and it can scan and pay zero amount invoices. This update also includes some minor fixes and improvements. So what's new? Real time push notifications of sent and received payments, support to pay zero amount invoices, updated lightning network address flow to avoid confusion, increased button touch area in header for ease of use, fixed alert titles being truncated, and updated transaction icon colors. I do not know what zero amount invoices are other than I can only assume that you can literally write a lightning invoice for no sats, for zero sats, and somehow or another that is payable.

I don't know why you'd want to do that. If you have an idea as to why that would be handy to have, please let me know because it's kinda interesting. But moving on to the last of the day, Primal version 2.1. Nostr wallet connect support for primal wallets and web app. Primal is a free and open source Nostr client focused on seamless user experience. It's available on web, iOS, and Android. It's introducing Nostra Wallet Connect support for both the Primal Wallet and the web app along with various feed improvements and legend cards.

So what's new is improved feeds. All feeds have been enhanced for a richer and smoother experience. Improved rendering and inline players are now available for Twitter, YouTube, Spotify, and Tidal with more platforms to follow. Primal Wallet NWC or Nostra Wallet Connect support. Primal Wallet users can now connect to any Nostra app allowing zapping within Nostra's ecosystem and you can manage connected apps in your primal wallet settings. Primal Web App MWC support enables zapping from the primal web app in settings, settings, connected wallets.

If you have an active Primal Wallet, just click connect to create an NWC connection to attach any NWC powered external wallet and legend cards. Implemented legend cards featuring primal shout outs for each legend. View these by clicking on the legend badge on the user profile screen. Okay. So a legend is somebody who has bought the lifetime support for primal's development. I am an OG. They gave me that. If I want to become a legend, I will like, I I can't remember how much it is. It's quite pricey. But if I wanna become a legend in in somebody's on Primal, they will actually see a gold legend badge on my name.

And, apparently, now there's, like, legend cards. So I don't know what those look like because I haven't seen it yet. But that is gonna do it for the show, and I understand that it is a shorter show today. But, honestly, there's just not that much going on today, guys. And I'm just not gonna force it on you, so I'll see you on the other side. This has been Bitcoin and and I'm your host, David Bennett. I hope you enjoyed today's episode and hope to see you again real soon. Have a great day.

Introduction and Episode Overview

Central Banks and Bitcoin: A European Perspective