Join me today for Episode 1052 of Bitcoin And . . .

Topics for today:

- Retracement Talk Explained

- Saylor to Step in with $21 Billion

- River Shows 3% Bitcoin Adoption Globally

- Craig Wright Fined For Using AI

#Bitcoin #BitcoinAnd

Circle P:

The King Ranch Donation Pages:

https://www.ruralamericainaction.com/fundraising/save-king-ranch-and-agriculture-in-washington

https://www.givesendgo.com/Kingranch

Articles:

https://bitcoinmagazine.com/news/white-house-draws-line-between-bitcoin-and-digital-assets-at-its-first-crypto-summit-in-eo

https://cointelegraph.com/news/michael-saylor-strategy-raise-21-billion-purchase-bitcoin

https://cointelegraph.com/news/bitcoin-70k-retracement-bull-market-analysts

https://atlas21.com/river-report-less-than-4-of-the-global-population-holds-bitcoin/

- https://www.cnbc.com/futures-and-commodities/

- https://dashboard.clarkmoody.com/

- https://mempool.space/

- https://value4value.info/

- https://fountain.fm/show/eK5XaSb3UaLRavU3lYrI

- https://geyser.fund/project/thebitcoinandpodcast

https://bitcoinnews.com/legal/craig-wright-fined-225k-ai-appeal-bid/

https://www.coindesk.com/markets/2025/03/11/bitwise-launches-bitcoin-standard-corporations-etf-strategy-takes-a-20-weighting

https://atlas21.com/texas-new-bill-introduced-for-a-strategic-digital-asset-reserve/

https://decrypt.co/309284/utah-legislature-passes-blockchain-bill-drops-bitcoin-reserve-provision

https://www.theblock.co/post/345689/sen-lummis-reintroduces-bill-to-create-trumps-planned-strategic-bitcoin-reserve

Find the Bitcoin And Podcast on every podcast app here:

https://episodes.fm/1438789088

Find the Bitcoin And Podcast on every podcast app here:

https://episodes.fm/1438789088

Find me on nostr

npub1vwymuey3u7mf860ndrkw3r7dz30s0srg6tqmhtjzg7umtm6rn5eq2qzugd (npub)

6389be6491e7b693e9f368ece88fcd145f07c068d2c1bbae4247b9b5ef439d32 (Hex)

Twitter:

https://twitter.com/DavidB84567

StackerNews:

stacker.news/NunyaBidness

Podcasting 2.0:

fountain.fm/show/eK5XaSb3UaLRavU3lYrI

Apple Podcasts:

tinyurl.com/unm35bjh

Mastodon:

https://noauthority.social/@NunyaBidness

Support Bitcoin And . . . on Patreon:

patreon.com/BitcoinAndPodcast

Find Lightning Network Channel partners here:

https://t.me/+bj-7w_ePsANlOGEx (Nodestrich)

https://t.me/plebnet (Plebnet)

Music by:

Flutey Funk Kevin MacLeod (incompetech.com)

Licensed under Creative Commons: By Attribution 3.0 License

creativecommons.org/licenses/by/3.0/

It is 08:56AM Pacific Daylight Time. Yes. It's happened. We've we've had the change. We we've done it again. We've decided to be stupid yet one more time and cause all manner of people to be late for work or too early for work depending, I guess. I can't remember how this works. Heart attacks have a tendency to spike around this time. Car accidents have a tendency to spike around this time. It happens It happens twice a year. We're always screwing around with the time, and I've come to the conclusion that it had nothing at all to do with saving electricity for war efforts, which is, apparently, one of the reasons why we got this daylight savings time thing going on in the first damn place.

No. No. I think it was more about keeping the population confused at I mean, majorly temporarily. Not temporarily, temporally, like temporal. Time time related keep you just confused as all get out because once you start messing around with time, dude, it's it's psychologically, it's really powerful. In fact, time deprivation is one of the tools used to completely mentally break somebody who you are torturing. If you want to get information out, like, they don't know how long that they've spent in the cell because you don't allow them to see the day and night cycles. You don't have regular meals.

You know, you you don't let them have thing that that makes them understand what the hell's going on in the real world, and it really does it messes your mind up. And while that's not clearly the case of what's going on here, we need to get rid of daylight savings time, ladies and gentlemen. And I thought we had a real good shot a couple of years ago. They were talking about it and then nothing. It doesn't really matter though, but this is episode ten fifty two of Bitcoin, and we've got some stuff on the plate today. I I didn't come to you yesterday for various reasons that I won't get into. But I'm here today with the White House Digital Asset Summit.

I'm also going to talk about Michael Saylor's strategy and yet raising more money to buy Bitcoin. We are going to talk about the price retracement. It cannot be denied. We're going to have to actually pull that apart. I've got something here by Zoltan Vardai that talks about retracement as being part of macroeconomic corrections and bull markets. It's I'm I'm not bringing that to you for a price prediction. It has nothing to do with that. You cannot have runs like this without something pulling back and the whole you know, the whole market's pulling back. And for all those people who said, hey. We finally decoupled from the S and P. No. We didn't. All everything is tanking. And a lot of it while a lot of it does have to do with the tariffs and tariff talk and potential trade wars and whatever, you know, what what whatever it is that's going on, it's taking markets left and right, and Bitcoin also has its own specific set of problems. And it's not really a problem, it's just that it you know, the thing gets a little too hot and it's gonna blow off, and it's just the way it is.

I mean, I I I wish I had better news for you, but I actually I do have better news for you. Craig Wright has been fined a lot of money for lying in a particular way. It's the guy's reaping what he sows. And if it wasn't for the fact that, you know, if I was, like, a purely karmic, you know, not bound by the the the terrestrial confines of being in a human body. I might just let it go and go, you know, make the the sound of the universe and go ohm a few times and forget about it, but I'm not, dude. I'm a dirty, filthy, hairless ape that fell out of a tree not too terribly long ago, and I am relishing every single thing Craig Wright is getting.

Texas has a third Bitcoin bill on the books, and Utah is doing stuff with their Bitcoin bill, and then we're going to talk lastly about senator Lummis who's going to, well, reintroduce a bill. But first, we're gonna start with this White House drawing the line between Bitcoin and digital assets at its first crypto summit. In the executive order, Bitcoin Magazine's Frank Korva has some thoughts. Quote, from this day on, America will follow the rule that everyone in Bitcoin knows very well, never sell your Bitcoin, president Donald Trump, on the seventh day of the third month of twenty twenty five at the inaugural White House crypto summit.

The president of The United States is now reciting popular Bitcoin maxims as they pertain to America's Bitcoin stack. Wild. It's clear that he's gotten the message that Bitcoin is something altogether different than all other digital assets. He's proven this not only by what he said at today's crypto summit, but also by signing an executive order last night that established a strategic Bitcoin reserve independently of the digital asset stockpile. Yes. This article is a couple of days old. Bear with me. Regarding the SBR, the president said that The United States plans to hold on to its Bitcoin it has in its possession, unlike previous administrations who sold massive sums of it.

That said, the president also shared that members of his administration will pursue avenues to accumulate Bitcoin at no expense to the American public, quote, the treasury and commerce departments will explore new pathways to accumulate additional Bitcoin holdings for the reserve provided that it's done at no cost to the taxpayers. We don't want any cost to the taxpayers, he reiterated, highlighting the notion that the United States government plans to amass Bitcoin in a budget neutral manner. So who was there? Treasury secretary Scott Besant and commerce secretary Howard Lutnick were present alongside approximately 30 members of the, quote, unquote, Bitcoin and crypto industry, including Michael Saylor, Brian Armstrong, Cameron and Tyler Winklevoss, and BTC Incorporated CEO David Bailey.

Other members of the white of the Trump administration, including head of Small Business Administration, Kelly Loeffler, and White House crypto czar David Sachs, were also in attendance. Both Sachs and Loeffler praised the pace at which Trump is making progress with Bitcoin and crypto. Quote, your administration is moving at tech speed, said Sachs. Man, that's just kind of embarrassing. Quote, it's actually faster than any startup I've been a part of, added the venture capitalist, well known for investing in many tech startups over the course of his career. Secretary Lutnick vouched for president Trump's newfound Bitcoin and crypto knowledge, adding that the president has truly come to embrace the technology, quote, blockchain and Bitcoin technology are a key part of the president's thinking.

We're using blockchain. We're using Bitcoin. We're going to use digital assets to push forward, and Donald Trump is leading the way, end quote. Yeah. I know. It it's a little embarrassing. Let hold on hold on to your hats. Now before you get too excited about secretary Lutnick talking about, quote, using Bitcoin, please know that with all the bullish Bitcoin talk at the event, not a word of Bitcoin being used as money was uttered. Instead, it was solely referred to as a savings technology. As far as digital assets that the administration views as money, stablecoins stands alone.

And secretary of dissent reinforced the message, most recently pushed at both the first US press conference on digital assets and the first subcommittee on digital assets hearing at the summit. Quote, we are going to put a lot of thought into the stablecoin regime. And as president Trump has directed, we are going to keep the US dollar the dominant reserve currency in the world, and we will use stablecoins to do that. I'm pausing to remind you what I talked about several times over the past year or at least the past few months. I'll I'll I'll be conservative and say at least the past six months. I've been talking about essentially exporting United States debt to the rest of the world using stablecoins to do it. How does that work?

We print money in the form of treasuries. Tether buys those treasuries. Tether prints more tether. That tether goes out into the world essentially exporting the newly created debt instrument that is the United States Treasury bills that were printed, I e printing money. That's how this shit works. So with that in mind, I wanna read the sentence again. And as president Trump has directed, we are going to keep the US dollar, the dominant reserve currency in the world, and we will use stablecoins to do that. I told you this shit was coming.

That's why they love stablecoins. It is the it's it's their last at bat for fiat currency. This is the last at bat. This will be the I swear to God, I'm gonna go ahead and say it. This is the last time, a last ditch effort, the hail Mary, the last dying breath of something that should have died seventy five years ago. Fiat currency systems. And if you think it's going to be like a short pass to the infield, no. No. No. No. No, sir. I very well may be dead by the time the rest of the idiots in the world finally figure out that they've been had yet one more time. Just because it's a digital asset does not mean it's Bitcoin.

Anyway, so what what wasn't discussed? What is more, on a summit preview call with senior White House officials this morning, one of the officials dispelled the rumor that the administration would remove the capital gains tax from crypto sales. Something else that was not discussed at the summit was whether or not the United States Marshals service have provided the Trump administration with a proper audit of all the Bitcoin and other digital assets in custody. The last was reported. They apparently had very little idea of what they were actually holding.

Also unmentioned was how the government plans to secure the private keys to the Bitcoin it keeps in the SBR. But let's not get lost in some of the minor details here because it was a good day. Instead, let's take a cue from Brian Armstrong and acknowledge that today was, by many standards, a good day. Quote, it was pretty historic moment for the crypto industry, Armstrong told Bitcoin magazine after the summit concluded. President Trump really breathed life back into this industry. Oh, you know what? I gotta pause. Bullshit, Brian.

It looks to me like this industry had nothing but breath. Lots of breath. Lots of hot air floating around to lung like sacks that just were breathing fire everywhere, especially meme coins and shit coins and alt coins and stable coins, and it just goes on and on and on. I have no idea what Brian Armstrong's talking about. Trump breathed new life into not a damn thing. It doesn't mean that I'm I'm saying that it's, you know, that he's worthless or whatever or that I completely hate him. I don't. I really don't. You all have to try I'm trying to be neutral on the orange guy. But statements like that is pure fucking hubris. This is how I don't understand why people listen to people like Brian Armstrong.

It's like he's just talking. So, no, he did not breathe life back into the industry. I'll continue. A few years ago, it felt like we were under attack and some folks have tried to unlawfully kill the whole industry. What a sea change to be involved invited into the White House and to have the most pro crypto president ever he added. Armstrong also noted that next, he wants to see legislation passed to help make concrete some of the positive Bitcoin and crypto initiatives set in motion under the Trump admin, quote, congress is making good progress on this with stable coin and market structure legislation and hopefully hopefully codifying the strategic Bitcoin reserve eventually as well. Yeah. That's gonna be up to senator Lummis.

Now, again, I can't really just hate on Brian Armstrong totally. He's right there. If we don't get something passed in congress and the next president is not JD Vance, then the strategic Bitcoin reserve probably will immediately get liquidated as retaliation Because it'll be the democrats will be in power because if JD Vance doesn't win, if if he runs, and generally speaking, the vice president of the sitting president generally runs with that president's blessing and all that. So most likely is gonna be JD Vance that that is running for president. If he does not win, that means he got his ass handed to him by a democrat, and the democrats right now are really, really, really angry, and they are vengeful, vengeful people. They will liquefy that reserve.

And the only reason that they would not do that is if and only if the Bitcoin reserve becomes part of United States code law. Well, house bill go passes. It goes to the senate. It passes. It goes to the president's desk and boom, stamped. Now it's law. You can't sell it. You can add to it. You but you certainly can't just liquefy it when the new president comes in under an executive order. Alright. So I got to agree I got to agree with him on that one. So moving on, Michael Saylor's strategy is going to raise up to $21,000,000,000 to purchase more Bitcoin, Helen Parks, Cointelegraph, on March, strategy announced that it had entered into a new sales agreement that would allow the firm to issue and sell shares of its 8% coupon series a perpetual strike preferred stock to raise funds for general corporate purposes including potential Bitcoin acquisitions.

As part of the agreement deal, dubbed the ATM program, strategy expects to make sales in a disciplined manner over an extended period taking into account the trading price and volumes of the perpetual strike preferred stock at the time of sale. Quote, strategy intends to use the net proceeds from the ATM program for general purposes, including the acquisition of Bitcoin and for working capital, the firm said in the filing with the Securities and Exchange Commission. The announcement comes amid strategy holding just shy of 500,000 Bitcoin worth $41,200,000,000 at the time of writing, which it acquired for an aggregate amount of $33,300,000,000 at an average price of 66,423 per coin.

The company previously disclosed plans to issue and sell shares of its class a common stock to raise up to 21,000,000,000 in equity and 21,000,000,000 in fixed income securities over the next three years in order to accumulate more Bitcoin under its 2121 plan. So far, in 2025, strategy has publicly announced six Bitcoin acquisitions buying a total of 52,696 Bitcoin since January 13. The company's current BTC yield amounts to 6.9% year to date with Bitcoin trading at 82,972. Excuse me. Strategies BTC yield, which is an indicator representing the percentage change of the ratio between its Bitcoin holdings and assumed diluted shares amounted to 74% in 2024.

In 2025, the company expects to reach a Bitcoin yield target of 15%. So there you go. They're gonna they're gonna buy more Bitcoin as part of their 2121 plan. But by at the at the rate that that he's going, I don't think it's gonna take three years to get there. I think he he could very well be done by the end of this year, so we'll have to watch what happened. But I do remember something that happened when I was at Texas Tech in Lubbock, Texas when I was at school. We had a chancellor. His name was chancellor John Montford. Now if you don't know who Montford is, he's kinda famous. He actually ended up being external vice president for AT and T after he did what he did at Texas Tech. And what did he do? Well, he started this thing called the Horizon Fund for the university.

And he was so good at it because they had a target of I wanna say it was, like, $250,000,000 that he was gonna raise in, like, you know, hey. Give us your money. You know? Not grants, not loans, but, like, you know, donors and old alumni and stuff like that basically saying we want we wanna put Texas Tech on a better financial footing for the future. And this is back in the nineties, man. I mean, this is, like, late nineties or, like, early two thousands. So he hit that mark in six months. So he had, like, a couple of years to do it, a year or two years to do it. So they they said, screw it. We'll raise it. We'll raise it to 500,000,000. And they hit that in, like, another six months, and they're like, well, shit.

Well, let's do 750,000,000. Now remember, this is this is kinda before the whole QE thing. So we're talking about a lot of money back then. It not so much money, you know, right now. But he raised, like, 1.5 it was either 1.5 or $1,750,000,000 in the exact same time frame that he had actually set out to do $250,000,000. He they just kept raising the bar over and over and over and over again. I kind of imagine that we we can that we will see, Michael Saylor do the same thing. Okay. So the Bitcoin 70 k retracement as being part of the macro correction in bull markets according to analysts. Again, this is what I was telling you about, Zolton Vardai from Cointelegraph.

This this is not to suggest price floors, price tops, bottoms, sideway. I that's not what this is. It's just like if you're if you're kinda wondering, jeez, what why are y'all being stupid? Well, maybe Zoltan's got some some, you know, good words for us to read. Bitcoin's potential retracement to $70,000 may be part of an organic, part of the current bull market despite crypto investor concerns of an early arrival of a bear cycle. Bitcoin fell more than 14% during the last week to close at around $80,708 after investors were disappointed with the lack of direct federal Bitcoin investments in president Donald Trump's March seventh executive order that outlined a Bitcoin reserve.

Despite the drop in investor sentiment, cryptocurrencies and global markets remained in a macro correction as part of the bull market according to Aurelie Bartharrie, I can't pronounce his name. Sorry. Principal research analyst at the Nansen Crypto Intelligence Platform. Most cryptocurrencies have broken key support levels making it hard to estimate the next key price levels. Quote, this is a macro correction. United States technology will be down by 3% in the future as discussed, so we have to monitor BTC. Next level will be 71,000 to 72,000 top of the pre election trading range. Quote, we are still in a correction within the bull market. Stocks and crypto have realized and are pricing. A period of tariff, uncertainty, and fiscal cuts, no fed puts, recession fears are popping up, added the analyst.

Other analysts have also warned that Bitcoin may experience a deeper retracement towards the low $70,000 range, which Ilya Kalkchev, dispatch analyst at digital asset investment platform, Nexo, told Cointelegraph could provide a foundation for a more sustainable recovery. Bitcoin's potential retracement to the $70,000 psychological mark would still fall within a regular price movement of a normal bull market according to Arthur Hayes, cofounder of BitMex and chief investment officer at Maelstrom. Hayes wrote in a March 11 Twitter post, quote, be fucking patient. Bitcoin likely bottoms around 70 k, a 36% correction from the 110,000 all time high versus normal for a bull market.

And then here's a full quote, the plan from Arthur Hayes. Be fucking patient, and we read that. And then we need stocks, SPX and MDX to enter free fall. Then we need TradFi Muppet to go under. Then we get fed PBOC, ECB, and BOJ all easing to make their country great again. Then you load up the truck. Traders will then dot try to buy the dip. If you are more risk averse, wait for the central banks to ease and then deploy more capital. You might not catch the bottom, but you won't have to mentally suffer through a long period of sideways and potential unrealized losses. Wow.

I love our I have to love Arthur because he just he just says what he likes with that whether or not somebody's gonna be mad at at him or not. Like it. Most people don't wanna see this. I don't wanna see it. I don't like it. I'm I'm not feeling good about it. But Arthur Hayes was talking about, man, y'all need to y'all need to be prepared for what's coming next, and and he's not lying. All of this shit is collapsing. I mean, oil collapsed to under $67 a barrel for West Texas Intermediate. I saw an 860 drop in the freaking Nasdaq. You know, you'd think I'd see that kind of number in in in the Dow. No. I saw 660 drop in the Dow. The Nasdaq got its brains blown out. It's like somebody walked up behind Nasdaq, put a big old Clint Eastwood style gun to the back of the head and just canoed that son of a bitch.

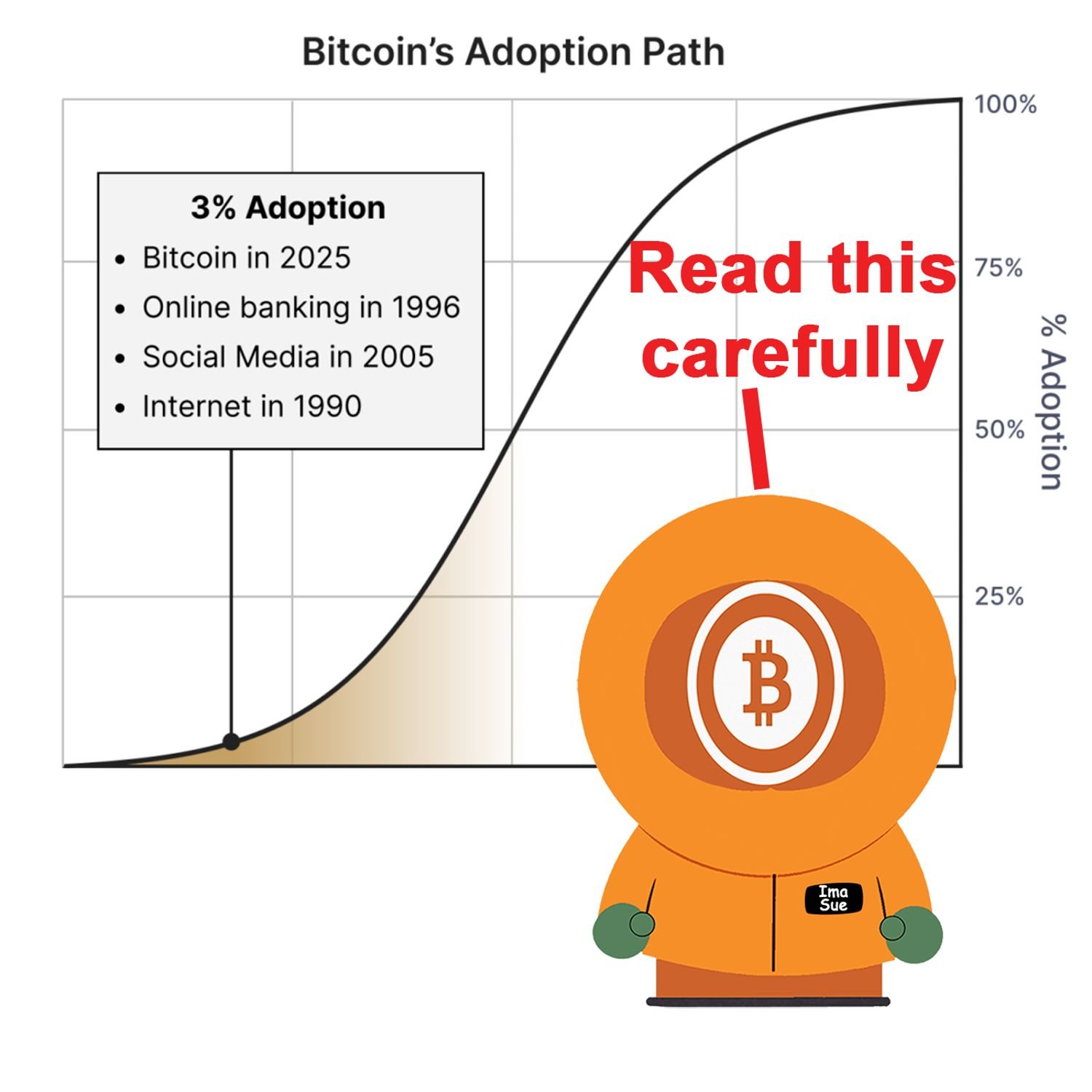

It's ugly out there, and it's not exactly all that pretty today either. It's not just Bitcoin, y'all. It really isn't. So just understand when we understand that when we get to this next one, this report from River as to what actually is going on. I mean, you don't I don't think any of us really truly understand where we are. Okay? So Atlas twenty one has republished this river report that says that less than 4% of the global population holds Bitcoin. Now you might go, David, I don't wanna hear this one either. I understand that.

But that's not what River is getting at. Okay? Let's let's see what's going on here. A new report published by River reveals that less than 4% of the world's population currently holds Bitcoin with the highest concentration in The United States, where approximately 14% of the population owns the cryptocurrency known as Bitcoin. North America leads in adoption rates at 10.7% among both individuals and institutions, while Africa records the lowest rate at just 1.6%. The report highlights that Bitcoin adoption tends to be higher in more developed regions compared to emerging markets. River estimates that Bitcoin has only reached 3% of its maximum adoption potential, indicating that the technology is still in its very, very early stages of global expansion.

Because Bitcoin's 2 point 1 trillion dollar market capitalization accounts for less than 1% of its total addressable markets, you know, governments, businesses, and institutions, estimated at 225,000,000,000,000, it's just 0.2% of global wealth, and that's at the $2,100,000,000,000 market capitalization. According to the report, Bitcoin adoption is expected to accelerate across four key areas, individuals, institutions, businesses, and then nation states. Medium term catalyst include g twenty nations announcing Bitcoin as a strategic reserve asset, increased use in international trade, and potentially favorable regulatory changes in The United States such as tax exemptions for small transactions.

While individuals currently hold 69.4% of the Bitcoin supply, ETFs account for 6.1% and businesses for a meager 4.4%. River predicts a steady rise in institutional and governmental holdings. River highlights that Bitcoin continues to demonstrate strong technical maturity sixteen years after its launch. In 2024, there were 115 active contributors to Bitcoin Core with an 8.5% increase in annual commits keeping the development ecosystem dynamic. The network now hosts 21,700 nodes, that's up 11% in 2024, and boasts a hash rate of 800 exahashes indicating increasing geographic decentralization.

Twenty twenty four marked a turning point in Bitcoin adoption with institutions surpassing individuals as the primary accumulators. US spot ETFs now manage nearly $100,000,000,000 in assets with 52% of top 25 hedge funds and registered investment advisers holding Bitcoin exposure. However, average allocations remain small. Point 24% for hedge funds, point 02% for RIAs, you know, the registered investment advisers, suggesting ample growth potential. Meanwhile, corporate adoption has surged with an 80% increase in publicly traded companies holding Bitcoin. Despite a decline in the number of transactions, the Lightning Network has seen a sharp rise in monthly volume growing from $12,100,000 in 2021 to 286,500,000.0 in 2024, primarily driven by exchange integrations.

On the custody front, security practices are evolving as well. Only 10% of total Bitcoin losses have occurred since 2015, and proof of reserves have become an industry standard increasing 580% since 2022. Okay. So that that's the report. But there is a graph in here that shows what's called what they're calling Bitcoin's adoption path from 0% adoption all the way to a % adoption. And we are on the way on the left hand side of this graph at 3% adoption. And that's that's Bitcoin in 2025. The same the 3% adoption number was the same for online banking in 1996.

Now ask yourself a question. In 1996, you probably were the other 97%. I'm never gonna do online banking. I'd rather go into the building. How many of you people when was the last time you actually walked into the bank building to go do something like transfer money from an account to an account? Yeah. Think about that. 3% adoption is also the same number for social media in 2,005. Are you the other 97% that never uses anything social media related? You don't use Nostr, you know, Twitter or LinkedIn or Facebook. You're you're one of those 97%. You still don't use it. Right? You still never touched it. You still never actually look at somebody else's, you know, maybe Twitter account just to get news.

Right? Yeah. That's yeah. Bullshit. That's what I'm getting at. And the Internet in 1990 also had 3% adoption. Are are you listening to me? Are you listening to this? Then you're using the Internet. So I'm kinda tired of the crying. Stop crying, and we'll run the numbers. Wow. Futures and commodities. Who would have guessed that we'd end up at war with Canada? Okay. It's a trade war. It's not a real it's not a hot war, but I had I would never, under any circumstances in the past, you know, decades of my life, ever thought that we would be having this kind of conversation with our Canadian, brother brethren and sister and up to the North.

Trump has raised the Canadian steel and aluminum tariffs to 50% in retaliation for Ontario energy duties. So Doug Ford Doug Ford up in Canada, he just wants to stop all electrons flowing to The United States altogether. But, apparently, we've been slapped with tariffs on electricity, which affects the Northeastern Part of The United States. This is a heavy population. Right? I mean, if you're in Texas, you don't give a shit. But we are talking about a very heavily populated region in The United States. But, yeah, we're we're in war. And the Dow apparently is extending its losses another 400 points to the downside because everybody's that twitchy.

This is the twitchiest market I've ever seen. Nobody know and here's the reason why. Nobody knows what anything actually costs. You know, there's there's a time when you're walking into Starbucks and you're like, an $8 cup of coffee? Are you kidding me? You know it's expensive. But then, you know, like, when with our, you know, Bitcoiners background, we're looking at that going, that may not be overpriced coffee. That there may be something else being signaled there and or or it may just be noise because the market doesn't know how to price anything. They've bought all the houses.

They can't stuff anymore. Well, they they could stuff a little bit more money, but not a whole whole lot more money into houses. Nobody knows what to do with their cash, and yet people are selling out everything. Equities, commodities, their Bitcoin, you name it, man. All of this shit is in the red, and they're going to United States dollars. Thank God we printed so many United States dollars so that people would be able to sell their shit. Right? So where are they putting that money? Well, they're just sitting on dollars as far as I can tell because I don't see a spike in housing or at least I don't see a spike in in, mortgage, receipts or or requests or granting or whatever. So I don't see a whole bunch of people buying houses.

I see a bunch of people selling out of their houses. Everything's twitchy. Nobody knows what anything is worth. And every time orange man opens his mouth, we we take a huge dive, which means that people are sitting on an ocean of cash in the form of United States dollars, and this is around the world, not just The United States. It's a very twitchy market. Be careful out there. West Texas Intermediate Oil is up point 89% back above $65 to $66.59. Brent Norsee is up point eight nine as well to 69 and 90¢. Natural gas is down a third of a point, but chilling out at at a comfortable $4.47 per thousand cubic feet. Gasoline up 1 and a quarter to $2.18 a gallon.

Gold is up point eight three, yet still still not above 3,000 again. $29.22 and 80¢. Silver is up 2%. Platinum is up one and a half. Copper is up 2.15. Palladium is up a third of a point. Ag is fully mixed today. Biggest winners appears to be coffee, 2.83% to the upside. Biggest loser today is wheat, 1.2% to the downside. Live cattle, getting pummeled point 5% to the downside. This is wow, man. That's, that's that's kinda, yeah, that's kinda ugly. Lean hogs down 1.61%. Feeder cattle down a quarter. Now here we go. The Dow is down not 400, but 526 points. That represents a percentage change of one and a quarter to the downside.

That is a huge number when you're looking at a, quote, unquote, price of Dow futures at 41,430. It's just it's these people don't know where to go. They like, they should just shove it all in Bitcoin, but, hey, you know, that's because I'm completely biased. The S and P is also down point 79%. Nasdaq is boning down point 29%, and the S and P Mini is down to complete our sea of blood, point 73% to the downside. We are down below well below a $1,700,000,000,000 market cap. $81,630, that is a $1,620,000,000,000 market cap. We can only purchase 27.9 ounces of shiny metal rocks with our one Bitcoin of which there are 19,835,204.1 of. An average fees per block are low, 0.04 BTC taken in fees on a per block basis. There are 20 blocks carrying a meager 27,000 unconfirmed transactions waiting to clear it. Wow. This is weird. High priorities of 10 Satoshis per vbyte.

Rather expensive right now, especially when there's only 20 blocks going on. Low priors low priority is gonna get you in at 7 Satoshis per vbyte. So what's going on with mining? Did we have a no. This is weird, man. Hash rate is well above 808 exahashes. 819.3 exahashes per second. It's one of the higher numbers you get, and yet we're paying 10 Satoshis per vbyte. Who knows what the hell is going on in mempools around the world? But I do know what's coming from pump, Trump, dump, which was Friday's show from Bitcoin and OB. 5,000 sats says absolutely nothing. Anonymous with three thousand three hundred and thirty three SAT says, buced.

Axelrod with one thousand and twenty one says, I accidentally listened to your show on another podcast app. I share your sustain for the current ad model and hope the value for value model grows into other digital media and beyond. Cheers. Thanks, Axelrod. I appreciate that, man. Anonymous with +1 says, oh, it's a it's a it's a copy. So Axelrod was the first one. Anonymous is the second one, but says the exact same thing. So we'll just let that go. Paul Surnai with five hundred says, thank you again, sir. Always a pleasure listening to your episodes. Greatly appreciated.

It remains to be seen how the SBR plays out, and I agree that it's quickly becoming a divisive topic among Bitcoiners. I salute you throwing a rope across the abyss. We need more of this level headedness in the Bitcoin space, and I feel more Bitcoiners need to get their boots on the ground again, understand where Bitcoin is coming from, what its intended purpose is, and actively promote and foster that purpose. Having said that, I'm still super bullish for the future. LFG. Thank you, Paul. I appreciate that. Psyduck with five sixty three says nothing. Yodle with 300 says nothing. Richard Dick Whitman with 250 says, twitchy markets. And I said it again.

God's death with 237 says, thank you, sir. No. Thank you. Pies, v four v, hashtag forty h p w. Thank you, sir. No. Thank you. And by the way, Pies, it's good to see you again. I remember you said that you were going to be taking a break. I'm glad to see you back. There you go. Okay. Where we at? Where we at? Hold on. Oh, yeah. That's it. That's it for the weather report. You're welcome to part two of the news you can use, and it's Craig Wright. And he's in trouble. Sorry. Craig Wright is fined £225,000 sterling over the use of artificial intelligence in his appeal bid. This is out of Bitcoin news.

Alex Larry is writing, Craig Wright, the Australian fraudster and computer scientist actually, I said fraudster. He didn't. So, Craig, if you wanna have at me, come on, brother. Let's roll, you fucking fraud. And computer scientist, and I put that in quotes because a guy can't program himself out of a wet paper bag with holes in it, and he claims to be the inventor of Bitcoin, has been ordered to pay around 290,000 United States dollars in legal costs after a judge found he had used artificial intelligence improperly in a failed appeal.

This is to be this is believed to be the very first time someone has been penalized for using AI in UK civil courts. Doctor Wright has always said he is Satoshi Nakamoto, the mysterious and pseudonymous creator of Bitcoin. But in May of twenty twenty four, the high court kicked his ass and said that he had lied extensively to support his claim. Despite this, he tried to appeal, but the case was dismissed in November of twenty twenty four. The Crypto Open Patent Alliance or COPPA, a group of digital asset firms and developers opposed rights appeal and later asked them to pay their legal cost. On March 2025, Lord Justice Arnold ordered Wright to pay a hundred thousand pounds to COPPA and a hundred and £25,000 to various Bitcoin developers.

1 of the key points in the ruling was Wright's misuse of AI in his appeal submissions. The Lord Justice Arnold said Wright's submissions were exceptional, wholly unnecessary, and wholly disproportionate. He added that rights AI generated legal documents risked significantly misleading the court by referring to non existent cases, laws, and false statements. So his his AI was hallucinating on him and saying shit like, in the case of, I don't know, Roger versus Pink Floyd or actually, that's a real case. Roger versus my car. Yeah. That they didn't even check what was written.

They didn't they didn't ground truth the results, and they just handed it to the court. Good god almighty. Legal experts say this is a warning to anyone using AI generated content in court. Phil Sherrill, a partner at Bird and Bird, said, quote, this is a stark warning to litigants, and in particular, litigants in person about the risks of using generative AI tools to create court documents, end quote. But this isn't the first time Wright's been in legal trouble. In December of twenty twenty four, he was sentenced to twelve months in prison, suspended for two years for contempt of court.

This was after he launched a brand new lawsuit suit worth over £900,000,000,000 sterling despite a court order stopping him from bringing any more cases related to Bitcoin. Copa also applied for a general civil restraint order against Wright stopping him from suing for three years. Jonathan Hu, KC, representing Copa said Wright had a history of bringing frivolous lawsuits that caused serious distress, inconvenience, and cost to individuals and companies in the Bitcoin space. He called Wright's actions legal terrorism and said his actions had used up significant court resources running to nearly one hundred court days in this jurisdiction.

Wright's legal woes are piling up. He claims to be the one who wrote the original Bitcoin white paper published in 02/2008 under the name Satoshi Nakamoto, but multiple court rulings have confirmed Wright is not the real creator of Bitcoin. Despite the legal setbacks, Wright still claims to be Satoshi Nakamoto, but with legal bills mounting, a suspended prison sentence, and now a ban on filing further lawsuits, his options are running out fast. Yeah. Well, they ain't running out fast enough. That son of a bitch needs to be put underneath a boat and keelhauled. Let's continue with this one. Bitwise launches ETFs of firms holding over 1,000 Bitcoin.

Strategy takes a 20% waiting. James Van Stratten is writing this one. Now why am I bringing this to you? Well, let's read through it because if you didn't get it from the, from the title, you'll you'll get it in the body. So Bitwise Invest has launched this thing called Bitwise Bitcoin Standard Corporation's ETF. Now the the ticker is OWNB. It's an exchange traded fund that's designed to track publicly traded companies that hold at least 1,000 Bitcoin. The index follows specific rules. Companies must hold a minimum of 1,000 BTC with holdings weighted based on the amount of Bitcoin owned.

The largest holding is capped at 20%, while companies with less than 33% of their assets in Bitcoin are weighted at 1.5%. The index rebalances every quarter. According to Bitwise, publicly traded companies collectively held not 1,408,000 Bitcoin sorry. 591,817 Bitcoin as of the end of twenty twenty four. And the ETF, which will trade on the NYSE NYSE ARCA has an expense ratio of point 85%. So that's what you pay them. You pay them point 85% for all your shit when when you're when you hold this ETF. Bitwise has identified 70 public companies that currently hold Bitcoin on their balance sheets. 70.

70 public companies. This is one of the reasons why I wanted to bring this to you. If you wanted to know just how many public companies have Bitcoin on their balance sheet, the number is seven zero. 70. The fund's top three holdings of the ETF include strategy, Mara Holdings, and CleanSpark. Okay. That was one of the reasons I wanted to bring this to you. The other reason was to demonstrate how fucking stupid this goddamn casino has become. You're talking about an ETF that just essentially bets on companies that are betting on Bitcoin. How many derivatives away from Bitcoin can we get? Well, this is three.

They all hold the Bitcoin. They don't actually hold an ETF that holds the Bitcoin. They are betting now on companies that are holding Bitcoin. It's this is insane. You remember, like, if if you were a kid in the seventies or for whatever reason have a weird nostalgia streak running through you and you've seen the, old Tootsie Pop commercials with the owl in the tree, the kid brings him a Tootsie Pop, says, how many, licks does it take to get the center of the Tootsie Pop? And the, owl takes it and licks it three times and then crunches it with his beak and gets all the way to the center, and he says three. It takes three.

This is this is casino land. And, honestly, it's this kind of crap that causes the most noise in markets, which in turn create twitchy markets, which is why you're seeing the orange man cannot sneeze without sending the Dow down 560 points. Just saying. Let's go to Texas, where a new bill, a brand new bill, a third bill has been introduced for a strategic digital asset reserve. This is Atlas 21. Yesterday, March, Texas introduced its third bill regarding a potential digital asset reserve. The legislative proposal presented by Democratic representative Ron Reynolds and designated it as house bill forty two fifty eight seeks to allocate up to $250,000,000 from the state's economic stabilization fund for the purchase of Bitcoin and other digital assets.

This marks the third attempt by the state of Texas to establish a strategic digital asset reserve. The second bill, which we know as s b or senate bill 21, recently gained by bipartisan support in the senate and now awaits a decision in the Texas house of representatives, and that vote is expected by May. I don't know why they're taking so long. Anyway, unlike the initiative proposed by senator Charles Schwartner, house bill forty two fifty eight explicitly sets a cap on investments and broadens participation to municipalities and counties, allowing them to allocate up to $10,000,000 in digital assets.

If approved and enacted into law, the bill would take effect on September 2025. Commenting on the proposal, Texas Blockchain Council President Lee Bratcher highlighted the state's strategic position for Bitcoin adoption. He pointed to the Texas Triangle, Houston, Austin, and Dallas, which represents energy, technology, and capital markets, respective like Houston is energy, Austin is technology, and Dallas is capital markets. There's a word for what I was trying to get at, but my brain's firing on two neurons max. And as a convergence of industries, that would make Bitcoin integration particularly viable.

So we have a third bill. And s b 21 is sitting on the house floor waiting for a vote that should come on or before May. So we gotta get through all the way through March for the rest of this month. We gotta get all the way through April, and then we gotta get all the way through wait. Did it say March or May? I think it's yeah. May. May the '20 fourth. We gotta get damn near all the way through May before we find out if s b 21 is going to pass the freaking house of representatives. Why is it taking so long? Yes. I'm impatient. Yes. It suggests that I have a a short time preference. But in this particular case, this is this is what bugs me. When we first moved to Eastern Washington, we moved in the summer.

And that summer was when that dude killed those four students at the University of Idaho. He stabbed them in their house. That trial still has not taken place. We're and, yes, there's there's all kinds of legal maneuvering, but it's like, how long are you going to wait before you put this motherfucker on trial? Now over here in the house, what are we waiting on? We don't even have lawyers that are trying to block it. Otherwise, I would have news about it and I would bring it to you. It's just sitting there. Why not vote on it and get it done?

We may we may not even be able to beat freaking Utah because their legislature has passed a blockchain bill but drops the Bitcoin reserve provision. Ah, they're cheesing out. Spineless little bastards that they are. Sebastian Sinclair and Vismayevi team up for this one from decrypt. Utah lawmakers approved legislation late Friday aimed at providing regulatory clarity but but removed a pivotal provision that would have allowed the state to invest public funds directly into crypto. HB two thirty, the Blockchain and Digital Innovation Amendments passed Utah's senate by a 19 to seven vote after legislators amended it to eliminate language that would have authorized Utah's state treasurer to allocate state managed funds towards Bitcoin reserved.

Later that night, the house concurred with the Senate's revisions approving the bill 52 to 19 with four abstentions. Initially introduced by representative Jordan Tuscher and sponsored by the senate or in the senate by senator Kirk Kilmore, the amended legislation still contains significant blockchain friendly provisions. Oh, well, that's nice. The bill explicitly prohibits state and local governments from restricting the acceptance or the custody of digital assets. It protects individuals' rights to run blockchain nodes. It allows participation in staking and exempt such activities from state money transmitter licensing requirements. Actually, that's that's pretty good. That's not bad right there.

Additionally, the legislation limits local governments from imposing zoning and noise regulations that unfairly target digital asset mining businesses operating in industrial zones. The move comes shortly after President Trump's March sixth executive order establishing an SBR and a US digital asset stockpile at the federal level, reflecting broader governmental interest in crypto adoption. Governor Spencer Cox has not publicly indicated whether he intends to sign the bill into law or not. If it's approved, the the measure will officially take effect on May 2025.

While Utah is taking a step back, several other states are now accelerating their push to integrate Bitcoin into the public. Texas and Arizona remain the front runners of the same. Last Thursday well, we just got into that. Is there anything else? Not far behind is Arizona. It's advancing its own Bitcoin reserve proposal. Arizona's s b ten twenty five has already passed through the senate finance committee's third reading, proposes that the state invest up to 10% of public funds in Bitcoin and other digital assets. And following Arizona and Texas, Texas, we have Oklahoma's h b 12 o three, the strategic Bitcoin reserve act. It passed their house government oversight committee by a 12 to two vote.

And then when they talk about the idiots of Montana, South Dakota, Pennsylvania, North Dakota, and Wyoming who decided to pull out their gun, put one in the chamber, point it to the back of their head, and pull the trigger. You just you just can't stop stupid from happening. Let's move on. For the final story of the day, senator Lummis reintroduces a bill to create Trump's planned strategic Bitcoin reserve. Remember when I was saying, if they cannot get the Bitcoin strategic reserve into a law through legislative means, the very next change of the guard from Republican to Democrat will see the liquidation of the Bitcoin strategic reserve.

And in fact, you never know. Let's say that Vance does win. Maybe by the time that, you know, these last four years or by the time the four years are up, he really doesn't like Trump to the point that he himself liquidates the Bitcoin reserve. It's not impossible, but it would make it really hard to do if we had a bill that passed into law that created a strategic Bitcoin reserve, in which case the strategic Bitcoin reserve that was created by the executive order would be transferred, and it would be protected by this bill or this law if it becomes law. Sarah Wynne is writing it for the block.

Cynthia Lummis, a major proponent of Bitcoin, has reintroduced her bill to create a strategic Bitcoin reserve, taking a legislative path towards president Trump's plan for such a reserve. The bill's reintroduction last proposed in July of twenty twenty four would create the reserve to help bolster America's balance sheet according to a statement released on Tuesday. The bill, called the boosting innovation, technology, and competitiveness through optimized investment nationwide act or, god forbid, the Bitcoin act, has a few minor changes from the prior vision, a spokesperson for Lummis said.

Quote, by transforming the president's visionary executive action into an enduring law, we can ensure that our nation will harness the full potential of digital innovation to address our national debt while maintaining our competitive edge in the global economy. The creation of a strategic Bitcoin reserve has garnered considerable attention over the past few weeks with some calling it a huge moment and others criticizing Trump's Bitcoin reserve plan for lacking clear details. Bitcoin's value has been volatile over the past few days. Yes. We know. We're very aware. Lummis' bill would create a decentralized network of secure Bitcoin vaults operated by the United States Treasury Department with set requirements.

It would create a 1,000,000 unit Bitcoin purchase program over a set period of time to acquire a total stake of approximately 5% of the world's total Bitcoin supply, mirroring the size and scope of gold reserves held by The United States. According to the statement, the reserve would be paid for by diversifying funds that exist within the Federal Reserve and the Treasury Department. Republican senators Jim Justice, Tommy Tuberville oh my god. I don't like Tommy. He disrespected he disrespected Texas Tech Red Raiders as their head coach. I for the football team, Tommy Tuberville, go fuck yourself.

Roger Marshall, Marsha Blackburn, and Bernie Moreno as cosponsors of the bill, Republican, representative Nick I can't pronounce it. Has introduced a companion bill in the House of Representatives, according to the statement. Quote, creating a strategic Bitcoin reserve is an important step in making sure The United States remains the strongest economy in the world, Tuberville said. Oh, for god's sakes. Quote, there's no reason why we shouldn't use Bitcoin to pay down our national debt. I hate it that Tommy Tuberville is is is possibly an actual Bitcoiner. It would make more sense if he's just paying lip service, which is what I'm going to believe from now on. But this dude this dude okay. So just a just story of probably one of the greatest, if not the greatest, college football coach that has ever lived.

I mean, I'm talking about all of them put together, could not match this guy. Could not match Mike Leach. If you don't know who Mike Leach is, you might wanna look him up. This is a guy that played, like, junior high and possibly, like, a couple of years of high school football before he got injured. That's that was the maximum amount of football that he that he ever had. Yes. I know the sports ball talk, but this is this is important for me. So when I was going to school, the Red Raiders, the football team for Texas Tech was basically a backwater farm school football team. They sucked. It was terrible.

They were they were coached by the guy that coached the football team for Lee High School, which is where I went to high school in Midland, Texas, and he was coaching there while I was a student there. He did well at the high school level, but when he started coaching at the college level, it was just a mediocre team. But then then we got Mike Leach, and everything changed. We became world class. We were just we were just, I don't know, a couple of seasons away from a very possible national championship. He was that good. He turned that football program completely around, and we fucked him for it.

We did. If you don't know the story, I'm not gonna get into it. It had to do with one of his football players getting a concussion and complaining to his daddy that Mike Leach was mean to him and put a bag of ice on his head and put him in a and put him in a dark room because he had a concussion instead of sending him to the doctor. And this is essentially what the trainer is always going to do and check on you later, but no no no no. He complained to his daddy, and his daddy was somebody very very very important. And his daddy made he complained to the provost and the chancellor and the board of directors and god only knows who else, and him and his son cried together at Texas Tech until they finally ran Mike Leach off. And Mike Leach went to Washington State University where he did the exact same thing with their shitty ass football team. He turned them into national contenders and had him not and then and then he went down to, like I think it went to Orlando or something like that and he was about to do the same thing at wherever he was coaching down there, but he died of a heart attack like last year or the year before.

One of the greatest, if not the greatest football coaches ever, and he was replaced at Texas Tech by a guy named Tommy Tuberville. Tommy Tuberville ran that program back into the ground from whence it came. He was a terrible head coach. And in fact, his disrespect for Texas Tech came during a night where he had secretly been looking for other jobs to get out of Texas Tech. And he was at a banquet being held in his favor as the Red Raiders football coach. Tommy Tuberville, welcome. And they had a whole room full of people that were here just for him. And he got a phone call from somebody who wanted he who he was accepting a job as the head coach of another football team from another college at that dinner. He picked up the phone during the dinner. He walked out. He left. He never came back.

This is a man without any ethics at all, And it worries me that the word Bitcoin is falling out of his mouth so easily. Be very, very careful with Tommy Tuberville. He is not to be trusted. He has no ethical base. He's a terrible football coach, and he can go fuck himself. But, anyway, that's the end of the episode. I'm just gonna go ahead and cut it here, and I will see you on the other side. This has been Bitcoin and and I'm your host, David Bennett. I hope you enjoyed today's episode and hope to see you again real soon. Have a great day.

The Daylight Savings Time Dilemma

The Case Against Daylight Savings Time

Bitcoin and the White House Digital Asset Summit

Market Turbulence and Bitcoin's Challenges

Stablecoins and the Future of Fiat Currency

Strategic Bitcoin Reserve and Political Implications

Economic Tensions and Market Volatility