Join me today for Episode 925 of Bitcoin And . . .

Topics for today:

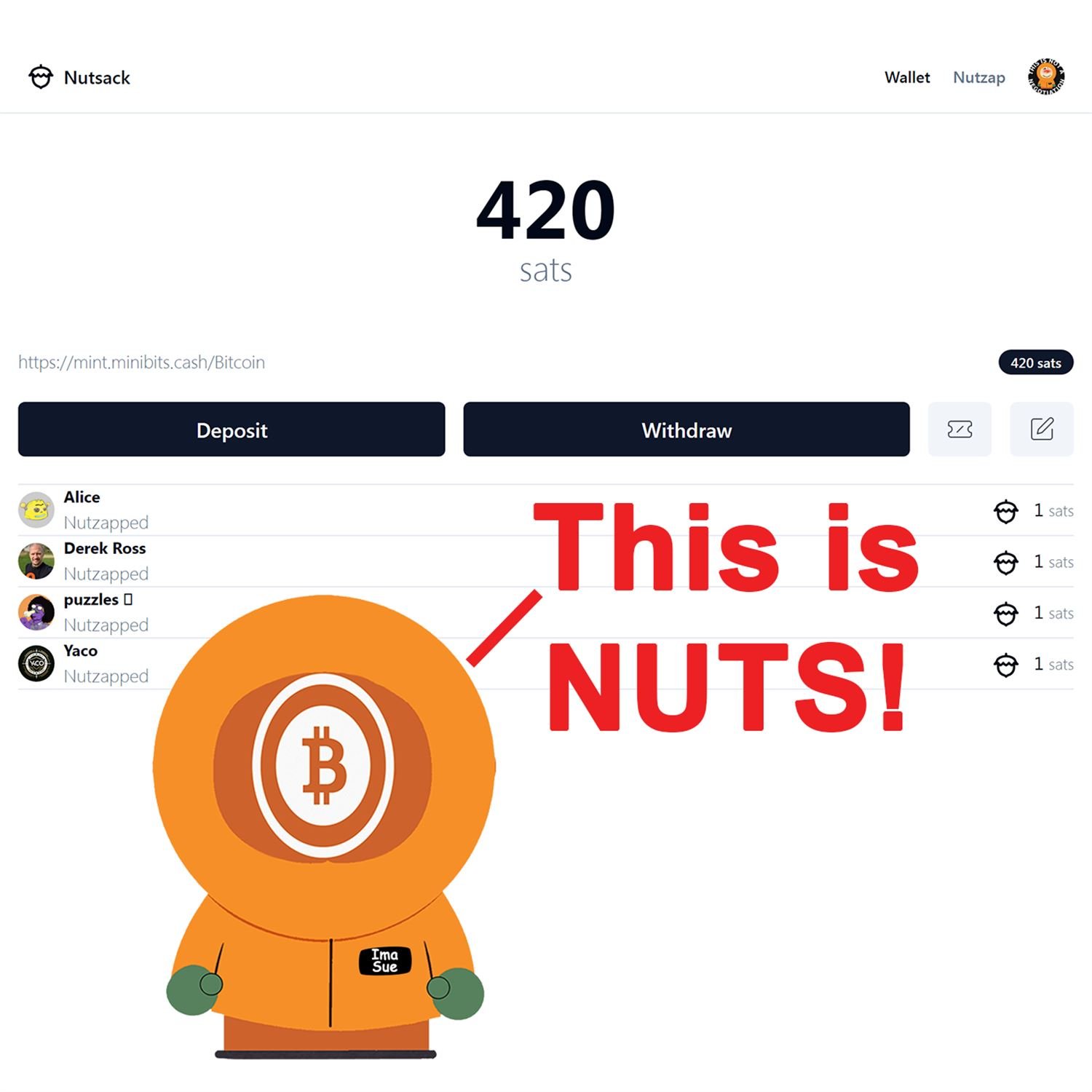

- Nutzaps are LIVE!

- Germany's "Reasoning" for BTC Sale

- MtGox Login Attacks Underway?

- Craig Wright Ordered Fess-Up on own Website/Twitter

#Bitcoin #BitcoinAnd

Circle P:

### Ink Blot Farm

If you (pleb) want to own some cows, have them rotationally grazed, be able to pick them up if you get your own farm, get a portion of their offspring, and get a prime spot to fish and camp near Kansas City and a several wineries, hit me up.

Buying a herd of bred heifers in June. $3-4k in bitcoin per head and no ongoing maintenance cost. 8 accounted for so far, 17 head left.

https://primal.net/p/npub16ux4qzg4qjue95vr3q327fzata4n594c9kgh4jmeyn80v8k54nhqg6lra7

The King Ranch Donation Page:

https://www.givesendgo.com/Kingranch

Articles:

https://www.coindesk.com/news-analysis/2024/07/18/germany-dumping-28b-bitcoin-is-market-intervention-despite-murky-legal-justifications/

https://primal.net/e/note1fexg7y3rru89vl5g2k97c6uukgqzskqsvqpuyjt7yuv6hhr5ukpqcnaccd

https://www.coindesk.com/tech/2024/07/18/mt-gox-creditors-reportedly-hit-by-failed-login-attempts-amid-repayments/

https://decrypt.co/240439/us-bitcoin-etfs-extend-9-day-winning-streak-amid-surging-demand

https://decrypt.co/240500/defi-technologies-doubles-bitcoin-treasury-solana-core

- https://www.cnbc.com/futures-and-commodities/

- https://www.cnbc.com/bonds/

- https://dashboard.clarkmoody.com/

- https://mempool.space/

- https://fountain.fm/show/eK5XaSb3UaLRavU3lYrI

https://primal.net/e/note1u3qvwqcdtf0fwv0lxt3rd6tfkjlye8rkl3gdw3zrevlhmqa378sqhex7ht

https://nutsack.me/

https://primal.net/e/note188sg2dgde2r68fvp8q0v6vtlj9grhjpd89a3sgd4kg0mfzzw6rxsm5jsvc

https://www.coindesk.com/policy/2024/07/16/after-court-order-craig-wright-updates-website-with-admission-he-is-not-satoshi-nakamoto/

https://www.nobsbitcoin.com/arthur-hayes-maelstrom-fund-launches-bitcoin-developer-grant-program/

Find the Bitcoin And Podcast on every podcast app here:

https://episodes.fm/1438789088

Find me on nostr

npub1vwymuey3u7mf860ndrkw3r7dz30s0srg6tqmhtjzg7umtm6rn5eq2qzugd (npub)

6389be6491e7b693e9f368ece88fcd145f07c068d2c1bbae4247b9b5ef439d32 (Hex)

Twitter:

https://twitter.com/DavidB84567

StackerNews:

stacker.news/NunyaBidness

Podcasting 2.0:

fountain.fm/show/eK5XaSb3UaLRavU3lYrI

Apple Podcasts:

tinyurl.com/unm35bjh

Mastodon:

https://noauthority.social/@NunyaBidness

Support Bitcoin And . . . on Patreon:

patreon.com/BitcoinAndPodcast

Find Lightning Network Channel partners here:

https://t.me/+bj-7w_ePsANlOGEx (Nodestrich)

https://t.me/plebnet (Plebnet)

Music by:

Flutey Funk Kevin MacLeod (incompetech.com)

Licensed under Creative Commons: By Attribution 3.0 License

creativecommons.org/licenses/by/3.0/

Good morning. This is David Bennett, and this is Bitcoin and, a podcast where I try to find the edge effect between the worlds of Bitcoin, gaming, permaculture, podcasting, and education to gain a better understanding of all. Edge effect is a concept from ecology describing a greater diversity of life where the edges of 2 systems overlap. While species from either system can be found at the edge, it is important to note there are species in the overlap that exist in neither system, and that is what I seek to uncover. Uncover. So join me in discovering the variety of things being created as Bitcoin rubs up against other systems. It is 9:45 AM Pacific Daylight Time. It is the 18th day of July 2024.

This is episode 925 of Bitcoin and might have a little bit of technical issues going on on the ZapStream. I'm actually not seeing the, my desktop is normal as it's streaming. So if there is anybody out there that's, when y'all join or if you're hearing me now and y'all, y'all could tell me whether or not you see my desktop because OBS, streaming software is showing my desktop, but ZapStream, even after refreshing, is not it's just showing the header so I'm not exactly sure what the what is going on but the show must go on so we're going to wing it and figure this all out on the fly. Alright so before we get started today, today is gonna be kind of a kind of a a big show. We've got a good we've got a good analysis on the Germany dump dumping Bitcoin on the market in the open rather than closed auctions and the reasoning behind that.

We'll get into that one. Let's see. What do we got? Mt. Gox creditors, we're gonna talk about that. There seems to be some weird login stuff going on. ETFs are dragging in a lot of Bitcoin over the last couple of days. We'll get into that. There's a yet another business that is stacking Nutsack. Yeah. Pablo's new, I don't know, his new paradigm shifting way of shuttling money around relays inside of Noster without the use of any kind of external wallet. We'll look at that, and I've got a I've I've got a audio clip of him kind of spelling it out, and I will put that, I will include that in the show. So we'll we'll get a chance to hear from Pablo directly.

What else do we got here? Oh, Craig Wright. Yeah. We'll we'll do the Craig Wright. But first, it is Inkblot Farms. If you've ever wanted to own some cows but you just can't put them anywhere, you can have them rotationally you can buy them and then have them rotationally grazed. And then later on if you want, you can pick them up. Do grazed. And then later on if you want, you can pick them up. Do whatever you want with them. You can take them to your own farm if you finally decide to get out of the city, as like I keep saying and get yourself enough land that you can put a couple of cows on and they'll help you. Inkblot farms I'm sure will will help you kind of figure out if you have enough land and if it's the right time. But these are bred heifers.

So they're pregnant. When you buy them and you're gonna buy them anywhere between $34,000 in Bitcoin, They're bread. They're they're they're already pregnant. So you you're sort of, like, gonna get some legacy out of this. There's no maintenance cost and that's really important. So he he's just basically gonna take care of these things, for you. Now he's got 8 of them have been sold so far. He's got 17 left. Again, anywhere between $304,000 worth of bitcoin. He takes directly in Bitcoin because if he did not, he wouldn't be in the circle p. If you're not in the circle if you're not taking Bitcoin for your goods and services, you're not in the circle p. That's just the way that works. Now, let's let's get in on to this Germany dumping thing and see if we can figure out what's going on here.

Germany dumping its $2,800,000,000 worth of Bitcoin is quote market intervention end quote despite murky legal justifications. CoinDesk Amitaj Singh, I believe is how you pronounce it, is writing. Germany may have finally come out with a legal reason why they offloaded nearly $3,000,000,000 worth of Bitcoin onto the open market. But industry experts aren't sold on the reasoning. Germany seized about 50,000 bitcoin back in January from movie2k.to, a website in the state of Saxony, or at least that the state of Saxony found guilty of money laundering and other illegal activities. The state, with the help of Frankfurt based German securities trading bank, Bankhaus, Schick, Wertzbergzazazelists AG, and the Federal Criminal Police sold about 50,000 Bitcoin between June 19 July 12th, securing €2,600,000,000 or 2,800,000,000 dollars according to his statement.

The move perplexed traders and put severe pressure on the price of bitcoin while the authorities stayed mum the reasons behind the selling spree. The sell off pressure was intensified at the time as the market was also cautious of mass selling by Mt. Gox creditors and faster liquidations by Bitcoin miners. Okay. Something's going on here. Hold on. Gonna have to do it this way. Alright. Now I gotta find my place again. Prices bottomed early this month at around $53,500 after Saxony completed its liquidation process, but not before wreaking havoc on the market as BTC fell over 7 percent in June.

When the authorities finally issued a statement this week, the process was called a market friendly sale, which was gentle on the market. The statement claimed that a fair market price was always achieved and continued to say that at this scale there is no direct influence on the Bitcoin price. However, some experts aren't convinced, and neither am I. Ramona Bugengert, adviser to Enzyme and ex CEO of Centrifuge, told CoinDesk, This is a perfect example of the kind of unintentional malicious activity based on a lack of competence that can come from governments and authorities, how they handled this sell off, moved the market, and is intervention in public markets?

So who will have an incentive now to hold this national authority accountable? Not the state. In an email to CoinDesk, Patrick Pintockski, prosecutor and press spokesman of the head of the Special Procedures Division, said, The legally regulated emergency sale means that we cannot wait to see whether and how the market value will change. The economic value of seized assets should be preserved as far as possible for later judicial confiscation. The German authority may have justified its decisions to sell, but market observers have questioned the timing of the sale and the benefit to taxpayers. Philip Hartmansgruber, a bitcoin expert who isn't convinced by the reasons laid out in Wednesday's statement said the sale earned around €600,000,000 more than what the BTC was worth when seized in January.

How much could the tax payer have made if bitcoin had been held for the long term? At the current bitcoin exchange rate of around €60,000 they would be worth about €390,000,000 more today. Hartzmanngruber, who regularly advises politicians and authorities as a board member of the blockchain Bundesband EV, or German Blockchain Association, specifically argued that the sale should not have been done during the announcement that up to 140,000 Bitcoin worth approximately 7,700,000,000 dollars from the Mt. Gox lawsuit will come to the market, even though he emphasized that perfect timing is never possible.

Hertzmanngruber also asked the authority to point to sources behind their claim that less than 1% of the market volume of Bitcoin was regularly traded over the counter and had no direct influence on the Bitcoin price. This may not be the case on July 8, 2024 when up to 16,309 BTC worth approximately €830,000,000 were sold. If 16,300 Bitcoin are sold in one day, this can have an enormous impact under certain circumstances. The statement argued that the authorities did not have the choice but to sell. However, some experts point to a gray area because the boundaries when you need to sell as an active emergency seems a bit less clear.

The court did not require selling the bitcoin because the statement said the proceedings were only provisionally secured as the concerned court has not yet made a decision on the confiscation becoming legally binding. Oh, my God. The decision, the statement said, was made because quote, the sale of valuable items before the conclusion of ongoing criminal proceedings is legally required whenever there is a risk of significant loss of value of around 10% or more. It further argued that given the volatility in the Bitcoin market, these conditions were always met. And indeed, Bitcoin drops 10% in the short term fairly often.

Lawyer and partner at GSK, Timo Bernau, indicated that authorities had banked on a general principle from a legal precedent to justify the sale: In German law, a general ban on speculation is assumed for public authorities. Such a ban on speculation with public funds is derived from the budgetary principle of economic efficiency and economy, Bernal said pointing to a 2017 ruling by the Federal Court of Justice. Bungeart noted that there was a legal gray line because the rules for this government agency on handling digital assets are not covered by the existing rule set. Hartzmanngruber argued the authority cited section 111P of the Code of Criminal Procedure to suggest they had no choice but to sell the bitcoin. However, the law states that after an object that has been seized may be sold if there is a risk of its spoilage or a significant loss of value.

The law therefore does not provide for an obligation, but merely an opportunity to sell. It is therefore questionable whether the disposal was legally required, Hartzmann Gruber said. Although there are legal reasons why the attorney general's office acted in this way, if it was not obliged to do so, the question arises as to why it nevertheless acted in this way and why it presented its actions as a supposed duty. Okay. So what they're basically say arguing here is that Germany or people around, I guess, connected with, the German government were saying that it wasn't our fault. Yes, it was. It certainly was. But they're saying that they were that Saxony is the one that did it. And Saxony, a state in Germany, was legally required to do it. And all these people are coming out of the woodwork saying, where are you reading that? That's not that is not what we're getting. So I think it's all bullshit. I think it's the same kind of double speak that you're gonna get from government agencies.

Sort of like what's going on with the Secret Service in the United States today. It's just nothing adds up. It's a bunch of crap. I wouldn't believe them. I don't trust these people as far as I can throw them and I never will. But the deed is done. Germany the only thing Germany has left is a bunch of trolling dust, in their wallet where people are just sending them, like, you know, 10,000 satoshis or 5000 satoshis with a note attached. And honestly, I think, you know, a trolling note attached. And honestly, I think if there was ever going to be reasoning behind the use of ordinals and inscriptions, it would be to inscribe the Bitcoin price chart on a single satoshi and send that one satoshi to Germany's wallet every single day. That I could almost approve of just because, you know, stupidity deserves to be trolled.

Breaking breaking breaking guys. New. From Bitcoin news over on Noster says Dennis Porter is reporting that Trump is going to announce a strategic Bitcoin Reserve at the Bitcoin Conference in Nashville. Hey, take it with a grain of salt. Is the man really gonna do that? And honestly, let's say let's say he actually says those words. He gets up on stage at Bitcoin Nashville at the conference and and looks at the crowd and says, I am announcing if I'm elected president that I'm going to start a strategic national reserve of Bitcoin. Okay, the crowd goes wild.

Noster goes wild. Bitcoin Twitter goes absolutely apeshit insane. And there's absolutely no legally binding thing that would force Trump to actually do that if he wins the presidency. He can basically say, I don't know what y'all are talking about. I never said that. And because nothing adds up when government officials talk, then this would probably just go away. It will be interesting to see if Trump actually does that. But again, we're gonna have to wait until the 25th through 27th in whatever date that Trump is scheduled to to speak to see what he does. But what we do know is happening is that Mt. Gox creditors are being hit by failed login attempts amid repayments. This is out of CoinDesk.

Sharra Malwa is writing it. Now, if you are one of the Mt. Gox creditors, you might wanna listen up because someone is apparently trying to log into creditors Mt. Gox accounts amid ongoing BTC repayments with several Reddit users reporting as many as 22 failed attempts as of Thursday. I just received 15 notifications for account login. Now I can't get into my own account. Is Mt. Gox under attack? Claimed Reddit user Ovkavok in a trending post on the rmountgoxinsolvencyforum. Quote, thank God at this point you can't do payee info change. Still getting login in emails and are at 22 so far.

End quote. More than 15 other users reported having received similar login notifications suggesting that an unknown individual was trying to log into a Mt. Gox account effectively to gain control of those accounts and likely withdraw any BTC received. The Mt. Gox claims portal is temporarily down for maintenance as of Asian morning hours Thursday, the site shows. One user, Johansen said that such attempts have been made on their Mt. Gox account previously and that accounts enabled with 2FA, a popular security authentication system, are presumably safe. Quote, I would guess some hacker has a record of all or a whole lot of Mt. Gox emails and are trying to brute force their way in. It's happened before.

As long as you have 2FA, you should hopefully be fine, the user said. In early July, the defunct crypto exchange began repaying creditors, of the 2014 attack. Be aware. This looks like this is a credible report. If you are a Mt. Gox creditor and you're listening to my voice, go you want you'll want to go check. Don't lose your shit. Don't freak out. Just go check your stuff and see if if you're seeing any of this and clearly if you are seeing any of this kind of activity, report it to, whoever it is that you need to report it to. But but take it to Noster. Take it to Twitter. Make sure other people know what's going on. Alright. Onto the United States Bitcoin ETFs have extended their 9 day winning streak amid surging demand.

Decrypt Sebastian Sinclair. US spot exchange traded funds for Bitcoin clocked a 9 day winning streak of inflows on Wednesday as several tailwinds continue to pop up renewed investor interest in the asset. Total daily net inflows from July 17th or I'm sorry, from July 5th to July 17th Discounting weekends amounted to roughly 1,970,000,000 dollars data from so so value shows. It's the longest streak in a month, when the 11 funds saw consistent inflows for 19 straight days from May 13th to June 7th. Inflows to U. S. Spot Bitcoin ETFs post having supply shortages and the launch of the Ethereum spot ETFs next week are likely driving demand, analysts say anyway.

US Federal Reserve rate cuts and a shifting political landscape in Washington DC may also help drive the asset to a 100,000 by the end of the year. Yeah. Just just stop that. Just I hate it when I hate it when people get into that shit. The world's largest crypto by market capitalization has clawed back significant losses incurred during the beginning of the month. Yadayada yadayada. They go they go into a bunch of other TA stuff. But it looks like the buying of bitcoin on the 11, US spot ETFs has resumed. And that was a good buying opportunity because they got basically a bunch of German coin is what was going on. They were buying they were buying that dip. When you go back and you look at what's going on with the ETFs when they were buying, yeah. They were buying all the German coin because Germany lost and the United States won.

Again, I I I just don't know what to say. I feel really bad for the German people though. Okay. Let's see. What else is going on? Oh, DeFi Technologies has doubled their Bitcoin Treasury Holdings and adds shitcoin number 3 and shitcoin number 4. I'm not even gonna say their names. But this is out of decrypt, Andrew Thorvallis writing. Canadian Fintech firm, DeFi Technologies, has added another 94.4 Bitcoin worth about $6,100,000 to its balance sheet building on its adoption of BTC as its, quote, primary treasury reserve asset last month. This marks the firm's 2nd publicly announced Bitcoin purchase, bringing its total holdings up to 204 and a third BTC, which is worth roughly $13,200,000 as of this writing.

And then they talk about buying some shitcoins. Quote, while Bitcoin remains the cornerstone of our treasury due to its established status as a store of value and hedge against inflation, other digital assets like Shitcoin 45 offer unique opportunities that complement our investment strategies, said Curtis Schoffelman, head shit coiner and VP of Communications at Defi Technologies to decrypt. Schoffman said that shit coin 4 let's get I'm gonna get past that because there's no reason to even talk about that. I think that they they that's what they do with the whole thing. Hold on.

No no no. Yeah. That's it. Okay. That's all we need. That's all we need to know on that one. Because they really just go hardcore into, why they bought this other crap. But again, last month, I brought DeFi Technologies to you with the first report of them putting Bitcoin on their balance sheet. And what was odd about their their press releases that they made sure to say several times, primary reserve asset. Not secondary. Not a reserve asset, but primary reserve asset. And it looks like they just doubled down. So it'll be interesting to see how they roll out because it's it's there's also a report that meta or whatever metaphor whatever it was over in Japan is also adding as of this week to their bitcoin stack which they are saying there is a primary reserve asset. So, the sailor the sailor playbook of shifting the way you think about having cash on your books versus having bitcoin on your books seems to have taken root.

He cast those seeds well over a year ago when he invited like a 1,000 people or something like that to a free webinar and opened exactly what their playbook was for for MicroStrategy and just gave it to the world for free. And nobody bid. Nobody bid at all. It it just it just died away. And then you start hearing these little it's like it's like waiting for popcorn in a microwave. You hear that first pop, and then pop pop and then pop pop pop. And then all of a sudden, son, it is off to the races. And that's exactly what I expect to CNBC Futures and Commodities. West Texas Intermediate is up half a point to $83.29.

Brent Norsee is up a third to 85.35. Natural gas up 4 and a half to 2.1 oh, sorry. $2.12 per 1,000. Gasoline is up a half to $2.51 a gallon. All your shiny metal rocks are having a bad day. Gold moving down only barely slightly. I mean, 0.02% down. Silver is down a half. Platinum is down over 2 points. Copper is down almost 3 points, and palladium is down 2 2 third points. Ag is getting hammered as well. The only 2 winners I see are lumber and chocolate. Chocolate's the winner, 4.64% to the upside. Everything else is in the red, and the biggest loser is sugar over 2 points to the downside. Live cattle down point no. 1. Sorry. 1 0.28%.

Lean hogs are up a quarter. Feeder cattle are up 0.8 or down 0.88%. All of the legacy indexes are down substantially this morning. Dow is down 3 quarters of a point. S and P is down over a half. Nasdaq is down almost a half, and the S and P Mini is down a third. On to Clark Moody's dashboard, price of Bitcoin, $63,720. That is a $1,260,000,000,000 market cap, and you can now purchase 26 point 1 ounces of shiny metal rocks with your 1 bitcoin of which there are 19,000,000,727,183.62 of, and fees remain low. Average fees per block, 0.09 BTC.

And how many blocks are there? We shall see. It is the number is 152. I wonder if the mempools will clear. And they might because 186,000 unconfirmed transactions are waiting to clear at high priority rates of, wait for it, 5 satoshis per v byte. Remember when it was 450 not too long ago? I do. I remember that shit. Low priorities are also 5. Anything under 2 is gonna be purged from mempools around the world which are operating at a hash rate of 496.7 exahashes per second, we have seen a substantial fall off from the 657 exahashes per second a couple of weeks ago. So I have no idea what's going on there. But over here at Mintats and Cumming, which was episode 924 of Bitcoin, and I got wartime with 20,000 satoshis, brother.

Attention plebs. Attention plebs. Attention. August is coming up fast. Do you wanna have a blast? Then come on over to Lake Satoshi for the annual Bitcoin retreat. August 9th, 10th, 11th for the low low price of $21. You you you can camp out and hang with the Michigan plebs, with others coming from as far as California and Canada, as well as El Salvador. Many people you'll know the names of in a laid back and relaxing setting. Visit lakesatoshi.com. That's lakesatoshi.com. One more time lakesatoshi dot com for more details. Or join the mid Michigan group on Telegram to talk directly to the organizers.

Be there. Yeah. Or be square. I hope you guys get the chance to go. DeBravco with 21:30 says, hold on. FKR Monday's episode regarding the clients. It nearly doesn't matter if they block you. I think of it as one of near infinite multi sig to access those notes. You only need 1. Yes. Absolutely. DeBravco with another 2120 says, thou shalt not make a machine in the likeness of a human mind. A verse from the Orange Catholic Bible. And if you don't know what that is, that is the Bible reference several times in Dune. And that's what I was talking about in Mentats.

If you want if if you if you wanted Mentats, then Project Alexandria looks like how you get Mentats. Now, Saints and SATS 500. Regarding Craig Wright, I have no evidence whatsoever, but intuition says Wright glows. Whether or not he is prosecuted will be an interesting tell. Apologies if you already commented on that in a previous episode. Saints and Sats, I did not. And, it wouldn't surprise me if if Craig Wright was some sort of glowy. But, I don't think he's a glowy for the United States. I could be a 100% wrong, and we could all be wrong, and he's just that much of a dick. And he's not somehow or another glowy at all. But it wouldn't surprise me at all. Oh, and I missed, Pies with a 1,000 says thank you, sir. No. Thank you. I also miss Perma Nerd with 737 says keep on keeping on.

Huddl solo with 500 says great show. I is it me with 420 says, keep going, legends. Great episode. Oh, thanks, brother. God's death with 237. My apologies, Lal. Thank you, sir. No. Thank you. God's death with 237. Thank you, sir. No. Thank you. User 3864-4922 boosted a 100 sats, said nothing, and that will do it for the weather report. Welcome to part 2 of the news you can use. Introducing nut sack 0.1. This is from Pablo f seven z. If you don't know what nutsack is, you're about to get educated. Nutsack. Me don't load too much money this is highly experimental a NIP60 a NIP 61 Noster client.

This is a wallet that lives in Noster. I'll repeat that. This is a wallet that lives in Nostr and it can be accessed from any Nostr client that chooses to implement it. And he's talking about the NIP 60 and NIP 61, types. Nutzaps are opt in. If you don't opt in to nutzaps, a NIP 6061 client that zaps, you would sorry. The zaps, you would just do a lnip57 payment. It would just be paying from e cash, but you would receive it on your lnwallet. With these 2 NIPS, NIP 60 and NIP 60 1, we will get a few cool things. 1, unified balances across your app.

2, pocket change that follows you around. 3, new users are immediately Oh, god. Well, I'm gonna pause on that here in a second. 4, verifiable nutzaps. 5 and finally faster zaps and zaps that can't go missing. And so much more cool stuff. Just watch the video and let your mind wander with the possibilities. Now before I hit I hit in get into the audio on this, I just want to say that number 3. We cannot sleep on this. New users are immediately zappable. Now that's only going to work, Pablo, if the new users, somehow or another are able to get a notification that they got a nutzap. If they don't know that they got something, if they aren't, I don't know, given a message or I don't know, mentioned in some kind of, Nostra bot that they got zapped, it it it won't be as effective. But we cannot sleep on the fact that if this works, what we're talking about here is as new users come over to Nasr, they don't have to sign up for a wallet. They don't have to load, like, their l n address into their bio. They don't have to do any of that shit.

It this is this this reduces the friction on new users to to understand what monetizable content actually looks like without them having to jump through 4, 5, 7, 8, 9 hoops. They're just immediately zappable. And the ramifications, the implications of that go far beyond making the user experience,

[00:31:09] Unknown:

you know, friction free. Oh, hello. I just published, NIP 60 and NIP 61, which is the, the Casio stuff that I've been working on. NIP 60 is, wallets, cash based wallets on NIP 60 1 is NAP subs. Okay. So let's say I'm a new person. I just heard about Nasr, and I'm here to create an account. So I gonna go here, and I'm gonna write, Paul. And start. Okay. So nothing special. I just created an account. If I go here, I see my my end sec. Oh, it starts with VADA. That's crazy. Okay. So I'm going to go. I see that I have zero sides, so I actually have a wallet already. Crazy. Okay.

So let's go here, and let's type hello there. I'm gonna type myself, and I'm gonna publish. Okay. Cool. So let's go here. Now this is my account. Logged in here with the same client. And, yeah, let's go to my notifications. And okay. I see here. I'm gonna send one set to this guy. So what this is doing is gonna check that this guy, whether he has a new 57, so regular subs, or NIP 61, not subs, and it's going to suck him in whatever way it can. So let's see here. I see one Nasdaq here, and let's actually go to Nasdaq dot me, and let's log in with this same guy.

So this key, and I'm gonna copy a key, And boom, the one side is there. So kind of crazy, that I already got here. Okay. So let's go back to this other account where I'm logged in as Pablo. Let's also go to that sector of me, And I see it's loading my balance. And here, I can go and see all the recent people that have, NIP 61 subs enabled. So I'm gonna say I'm gonna send in such to this guy and say, hello. Welcome to Noster. Okay. And send it over. Boom. 11¢ are there, and my wallet here has reflected that I have sent some money. And my wallet here has reflected that I have sent some money. These are 2 independent clients. It's just my balance.

My my my eCash is on Oster just like my contact list, just like my notes, just like this hello there. All of that is on on on relays, so is my money. So, oh, yeah. If we go here, I see that now here, I have 11¢. Pretty cool. And this even goes if I go to, to an application here. I'm also going to log in with my NSEC for this guy. I'm gonna lean. Boom. It has my my my balance. If I go here to withdraw, it's going to the hell is that oh, I don't know what that is. That's probably because of the simulator, but, it's trying to scan a QR code. But I guess it doesn't have permission to scan a QR code, but I can pay I can go and buy coffee with lightning by paying I mean, it's gonna be more than 11¢.

But, yeah, Sunday. What else? What else can I do? I'll I'm gonna send some money back to Pablo. Thanks for the well, cuff. Okay. And I'm gonna stop it. And oh, right. It removed. Oh, and it sat right here to my palo wallet, and it was subtracted from here. So, yeah, like, this means that I will have the same balance on any iPhone, on any on any phone, on any device, on any client, and I can pay with lightning. I could I could be using Zoos, and maybe I instead of using Huddl invoices that can lead to forest closures, like, light internal forest closures, maybe I get my my subs, on on a on a mint.

And the moment I'm online, boom, I read everything into my Zeus wallet. Yeah. There's so or or I could whenever I get to say 10,000 sats, it's too much. Maybe it will my wallet will automatically move it into, into a Federman or into a Lightning Wallet, into whatever you want to do.

[00:36:22] Unknown:

So, yeah, this is, pretty cool stuff. Okay. So that was Pablo's explanation of it. And, yeah, I know it it kinda doesn't, it's easier to actually watch the video itself, but if you don't if you can't find that video or or whatever, that's why I played the audio for you because we can't be sleeping on this. This is exactly what I thought it was. This is a a wallet that actually exists on relays, but are created by your essentially created for your public private key. It's almost as if there's nothing that actually has to be created other than the code that backs it, but there's no, like, something that you've got to do. There's no button you have to push. There's there's nothing you really gotta do. It's just that just because the way Pablo set this up if you have an insect n pub key and you're able to get into any of the nostril clients then you already have a wallet it it you just have it you don't have to use it but other people can zap you all right so again, I just think I just think it's important that we understand that this is a paradigm shifting event already in the 3 3 years of noster as a protocol, 3 and a half, more maybe.

I've been using it solid for well over 2 years. It's my Noster is pretty much the only thing that I want to see because it's the only thing that really makes sense. But this, this, if if you don't think that what just happened what you just heard is one of the most important advancements in the nostril ecosystem then I have failed at my job to impart just how important a thing is so if I failed that way then at this point just trust me. What you just saw is should be mind blowing. Okay. So I've got nutsack.me. That's nutsack.nutsack.me up and I logged in with my, GetAlby because their man, I let GetAlby manage my public private key pair.

I had, it brought up a wallet type looking, interface and I had 0 sats and I said, okay, well then I want to deposit some. I hit the deposit key and it asked me for an amount. I said, you know, put, I don't know, put 10 sats in there. And when I hit click, it goes and says, hey. Get Alby. We need 10 sats from the Get Alby wallet. And boom. I have ten sats sitting inside of nutsack. Me and I have like like just like what Pablo was saying. I went over to my contact list, looked for a couple of people that had, you know, if they're there in my contact list on nutsack. Me then that means they're enabled. I started zapping people, you know, like one sat just to test and sure enough I'm getting sat, sats zapped or or not zapped to me.

And this isn't through the the GetAlbI wallet any longer. The these are sats that live on the relay that will always be connected to my public private key pair no matter where I go. If those clients that I go to have NIP 6061 enabled, then my balance comes with me. Remember what I was saying about the the whole freedom of identity spiel that I went on? If I take my public and private key pair over to Wells Fargo and they say, you can't have your money for 90 days because we hate you. And then I take those keys over to Bank of America or, like, let's say, the Texas Tech Federal Credit Union, and I put those keys into that little safety deposit box and I turn them, then all of a sudden the teller there goes, oh, I see you have $10,000 sitting in this account. Would you like that?

And I say, yes. I would. Please. And they just give me my money even though wells fargo is telling me that I can't have my money that's what you're just witnessing right here you you just saw that occur So if if you want to go play with it, then the live version is nutsack.me. It is highly experimental. And I will tell you this: I have already lost 5 SATs from this. Somehow or another I started with 10. I zapped a person one sat. I zapped another person one sat. And then I zapped a third person one sat. Go back to my balance and I've only got one sat left out of 10. The math doesn't work.

I don't know what happened, but please expect there to be issues, rough spots, rough patches, failures, just you name it. This is so new, it's 0.1. So let that sink in. Okay. Here is a Noster note that I wrote and it is a I'm basically re noting liminal, liminal, who's one of the part project Alexandria developers who I've been talking to lately. And he wrote me and he he called me out directly. Well, he didn't call me out. He just put in at none your business. How would you like to see Nostra's development, development conversations, etcetera, all searchable and cut up, hyper focused and navigable.

Even if you're not a developer, it still makes sense to learn. What he's talking about is this is sort of like a kind of an ongoing conversation that I've been having with LeSaren, which I think is also known as Stella, who's also a Project Alexandria developer, as well as Liminal, because I'm trying to figure out what it is. I wanna know more about what it is that Project Alexandria is from from their point of view. I have my notions about what I think it is. I'm close. I'm pretty sure I'm close and that seems to be borne out from discussions with Liminal and Stella, but if you've had that feeling that you're missing something, you're missing a big part of the picture.

I think I just got clued into a larger part of the picture because I re noted what I just read you from liminal out with this. The library, Nostor, is built. Now come the librarians. And I think that that is a good context to make a couple of additional notations to what I think about Project Alexandria and what I think it's doing. When I talk about notes and being able to connect people's thinking through Nostr, using things like tools like Obsidian, Zettelkasten, back linked notes. I'm thinking of a more of of a much smaller group of people interacting with each other that just kinda accidentally stumble across each other's notes. Next thing you know, you got this kind of the same ideas and you start trading notes. And and I wanna see that. And I think Project Alexandria will completely enable that. But the way these guys are thinking is whole libraries being disseminated and somehow made semantic, have standing connections.

And we got into it last night. I'm not going to get into the details because I have I have to really digest the discussion that we had last night, but the embeddable structures that they were have were talking about, embedding rich content into NostraNotes, that rabbit hole by itself is amazing. Now here's what I will say is that all of this is predicated upon the use of artificial intelligence. And many many people, me included, think that we're getting ahead of ourselves with what artificial intelligence can do or the ramifications thereof. Like, it's gonna take all our jobs. That's bullshit.

It will take jobs, but it will enable other jobs to be built. There's never going to be some kind of dearth of of human jobs. That's just not going to happen. Alright? We've we've we went through the the industrial revolutions. And guess what? People still act there are still job postings being made. Everybody thought that all all the jobs are gonna be taken at at, you know, at the at the at the pleb level. No. That never occurred. Jobs were taken, but not permanently because new jobs were actually built back up because of the industrial revolution. Same thing is going to happen with AI. AI is really shitty at making art.

Ai is really shitty at making music. Ai is almost shitty at everything except indexing and looking for patterns, and somehow or another cross linking things. That right now is where AI shines. And if you wanna think about it in a different way, think of AI as the best search engine we have right now. And the guys over at Project Alexandria are talking about taking not a whole book but whole libraries filled with information with tens of you know thousands if not hundreds of thousands of books like like tier 1 university research library like Texas Tech you're talking about over a 1000000 books and articles and journals and dissertations and thesis all collected in the central repository and they're talking about going and cutting it up into little bitty pieces and then refitting the entire library so that it's just more than easily searchable. Way more than that.

I can't really find good words to use to describe what what it is that I'm talking about because I my mind is still continuously being blown. But again, I want to read this note from liminal. How would you like to see Noster's development and all of the developer conversations all searchable and cut up hyper focused and navigable that means stitched together where they actually make sense they cluster together even if you're not a developer it still makes sense to learn again like what we were just talking about with Pablo F7 Z you're talking about paradigm shifting situations that are right here. They're right in front of us. You ever thought about what it would be like to live inside of a renaissance?

You're in one right now. And if you haven't recognized that, then understand that the people that were going through the Renaissance themselves, the actual real Renaissance, the Renaissance 1.0, they probably didn't see it either and look what came out of that look what came out what dropped on the other side of the renaissance And think about the people that were inside living in that time and not seeing what was going on around them. They just weren't aware. Some people were just like today. Some people are aware that we're in a renaissance. I'm one of them.

The guy like Pablo F7 Z. Will, you know, JB 55, Hogglebod, all so many good people that I know. We all recognize that we are smack dab. We're not at the front of Renaissance. We're not the tail end of the Renaissance. We are right in the middle of renaissance 2.0. If you can recognize that and embrace it and act accordingly, you're gonna be fine. But not like this guy after a court order Craig Wright updates his website with an admission that he is not Bitcoin creator Satoshi. How fucking embarrassing is that? Cheyenne Lignan, hopefully, will tell us all about it out of coin was it? No. CoinDesk. Out of Coin CoinDesk. Here we go. Australian computer scientist and one time Satoshi Nakamoto claimant Craig Wright has been forced to update the homepage of his personal, not business, his personal website with a legal notice declaring that he is not the inventor of Bitcoin. The notice, which must be displayed on Wright's website for 6 full months, declares that Wright lied, quote, extensively and repeatedly in court proceedings where he claimed to be Satoshi Nakamoto and attempted to create a false narrative by forging documents on a grand scale.

Wright's web of lies spun through multiple legal actions constitute a most serious abuse of the legal system in the UK, Norway and the United States, the declaration reads. It also links visitors to the full judgment against Wright and its appendix detailing various forged documents created by Doctor Wright. The notice is just part of a dissemination order granted by the UK Judge Justice James Miller overseeing the case brought against Wright by the Crypto Open Patent Alliance or COPPA, non profit organization representing Bitcoin developers. And here is the actual notice on Craig Wright's site.

There is I've been I've been to his site with this thing on it. I it there is non navigable. There's no other where to go. There's no other place to go in his website. This is all you get. And it reads legal notice, and this is all caps, by the way. Doctor. Craig Steven Wright is not Satoshi Nakamoto. And then he goes into regular case. Doctor Craig Stephen Wright was found by the High Court of England and Wales to have been dishonest in his claims to have been the person behind the pseudonym Satoshi Nakamoto. The court found that doctor Wright lied to the court extensively and repeatedly in his evidence and that he attempted to create a false narrative by forging documents on a grand scale. And it goes on, and then we get to the meat and potatoes.

The high court formally declared as follows: first, that Doctor. Wright is not the author of the Bitcoin White Paper. 2nd, Doctor. Wright is not the owner of the copyright in the Bitcoin White Paper. 3rd, Doctor. Wright is not the person who adopted and operated under the pseudonym Satoshi Nakamoto in the period between 2,008 2011. 4th, Doctor Wright is not the person who created the Bitcoin system. 5th, Doctor Wright is not the author of the initial versions of the Bitcoin software. The full judgment and its appendix detailing various forged documents created by Doctor. Wright is accessible at the following URL and that is the only live link that will take you off the page to somewhere else. And it goes and shows you all of his forgeries.

Doctor Wright has been ordered not to commence in any legal proceedings based on his false claim, by claim or counterclaim, or procure any other person to do so. He has also been ordered not to threaten any such proceeding explicitly or implicitly, or procure any other person to do so. I've never heard of anything like this happening in the history of law. I'm sure it has, but I've never actually seen it. I mean, he can't sue anybody this way. He can't even imply that there might be a threat of lawsuit against something that would require him to pretend he's Satoshi Nakamoto.

I mean, he can I guess if somebody runs into his car, he can sue their insurance company, but that has nothing to do with Bitcoin or Satoshi Nakamoto or Bitcoin Development? So, therefore, he could probably do that. But he can't go sue Peter Todd. He can't go sue all these people for copyright infringement on the Bitcoin code. He's not allowed to. I mean, and as a libertarian, at least he claims he is, I'm sure he's just ripping his own teeth out. But I'm happy that this happened to Craig Wright. It couldn't have happened to a worse person.

Now, the dissemination order granted by Mueller was just part of his final judgment. Wright was also ordered to post a similar notice on his Twitter account and on the Slack channels where he communicates with his supporters. At the time of publication, Wright had, had not yet updated his, Twitter account to display the legal notice. His most recent post dated May 20th is a declaration of his intent to appeal Malore's decision that he was not Satoshi Nakamoto. Yeah. Well, it is updated. I saw it. His Twitter account has it. It is pinned. It's a pinned tweet and it's the last tweet that's up there as far as it was this morning or last night, last time I looked at it.

It's this it is this, that thing that I just read you. It's the exact same thing that's on his website. You want to talk about getting bitch slapped in public worldwide? I don't even know how embarrassing this is. I mean, we've all had embarrassing moments, but, you know, a handful of people saw it. Could you imagine being in his shoes right now, taking a full on shit on the stage and almost everybody in the world either knows about it, saw it happen, or heard about it, or can later on. Because this thing is forever. There is no erasing this from the internet at all.

Lastly, Arthur Hayes, one of my favorite people who got one of the best smiles in Bitcoin, Arthur Hayes Maelstrom Fund Launches Bitcoin Developer Grant Program. Arthur Hayes, co founder of BitMEX and CIO of Maelstrom, venture fund, managed by his family office announced a grant program to support open source Bitcoin developers. Quote, Malstrom is proud to announce the launch of the Bitcoin Grant Program. The objective of the program is to help with the technical development of Bitcoin and enhance its resilience, scalability, censorship resistance, and privacy characteristics, announced the fund.

According to the announcement, no strings attached grants can range from $50,000 to $150,000 per developer. Applications must be submitted prior to August 25th, 2024. Maelstrom, like other companies in the space, indirectly rely on the work of open source Bitcoin developers. We are therefore keen to give back and donate to the bitcoin technology on which the crypto ecosystem depends as was stated in the announcement. The first grants will be awarded in the 3rd Q4 of this year, and you can apply at maelstromdot fundforward/bitcoingrantprogram.

That's maelstrom.fundforward/bitcoingrantprogram. Program information deadline. Applications must be submitted prior to August 25th this year. That's coming up. If you if you are looking at this and going, oh shit, there's a whole other new set of grants available. If you've got an idea, you gotta get this shit in here by August 25th and just be aware. He's not saying anything about lightning and he's not saying anything about Noster. This looks to me like it is bitcoin only. Alright? So just understand that. Grants are issued for 12 months and payments will be made monthly in BTC, USDC, or USDT.

A grantee will be expected to contribute to Bitcoin's technical development, potentially in the form of pull requests or review work for the Bitcoin Core software project. Candidates should expect at least one interview with a member of the review committee prior to the issuance of the grant. Grant stacking is permitted with a cap of $250,000 per year. What does that mean? That means that one developer can get more than 2 grants at a time, and they but the cap is no more than grants totaling up to 250,000. So, if you you can get 5 $50,000 per year grants, that and then you'll hit the cap. Your application must contain at least one reference.

Review committee includes Arthur Hayes and Jonathan Beer, the grant program administrator. Grants are expected to be awarded again at the last two quarters of this year. So, a fantastic news because now that takes some of the pressure off of Jack Dorsey and it takes some of the pressure off of the OpenSats Foundation. I do wish that Maelstrom would consider Nostra Development, grants as well and Lightning Network development grants but it does not appear that that is being done. However, that now that Maelstrom is in the mix on just solid 100% Bitcoin Bitcoin development, maybe that means open sats or somebody else can start taking some of the money for Bitcoin development and refocus that back to Lightning Network and Noster Development.

And that way, we can sort of spread this around a little bit, sort of leverage Arthur Hayes' entry into the open grant development community and get some some more funds for Nostra Development and Lightning Network cash development because all of these things are really important, which is why I'm calling on OpenSats Foundation to reconsider the grant proposal that was submitted by a Liz Aaron AKA Stella, Liminal at all for project Alexandria. I I just I can't see a more worthy, not to say that there aren't other worthy, extremely worthy projects in the in the Noster space, but Project Alexandria deserves to be funded. So, Matt O'Dell, could you do me a favor even though I know you don't listen to the show? Early? Well, I mean, I I guess he doesn't listen to the show or maybe he does. But if you are listening, please reconsider, get a hold of Stella, get a hold of, liminal and have even, you know, even if you have to ask them to resubmit.

Because I I just can't see a better use of funds. Alright? So, that's that's it. Let's see. Is there anything else I got? No. That is it. So I will see you on the other side. This has been Bitcoin and and I'm your host, David Bennett. I hope you enjoyed today's episode and hope to see you again real soon. Have a great day.