Join me today for Episode 936 of Bitcoin And . . .

Topics for today:

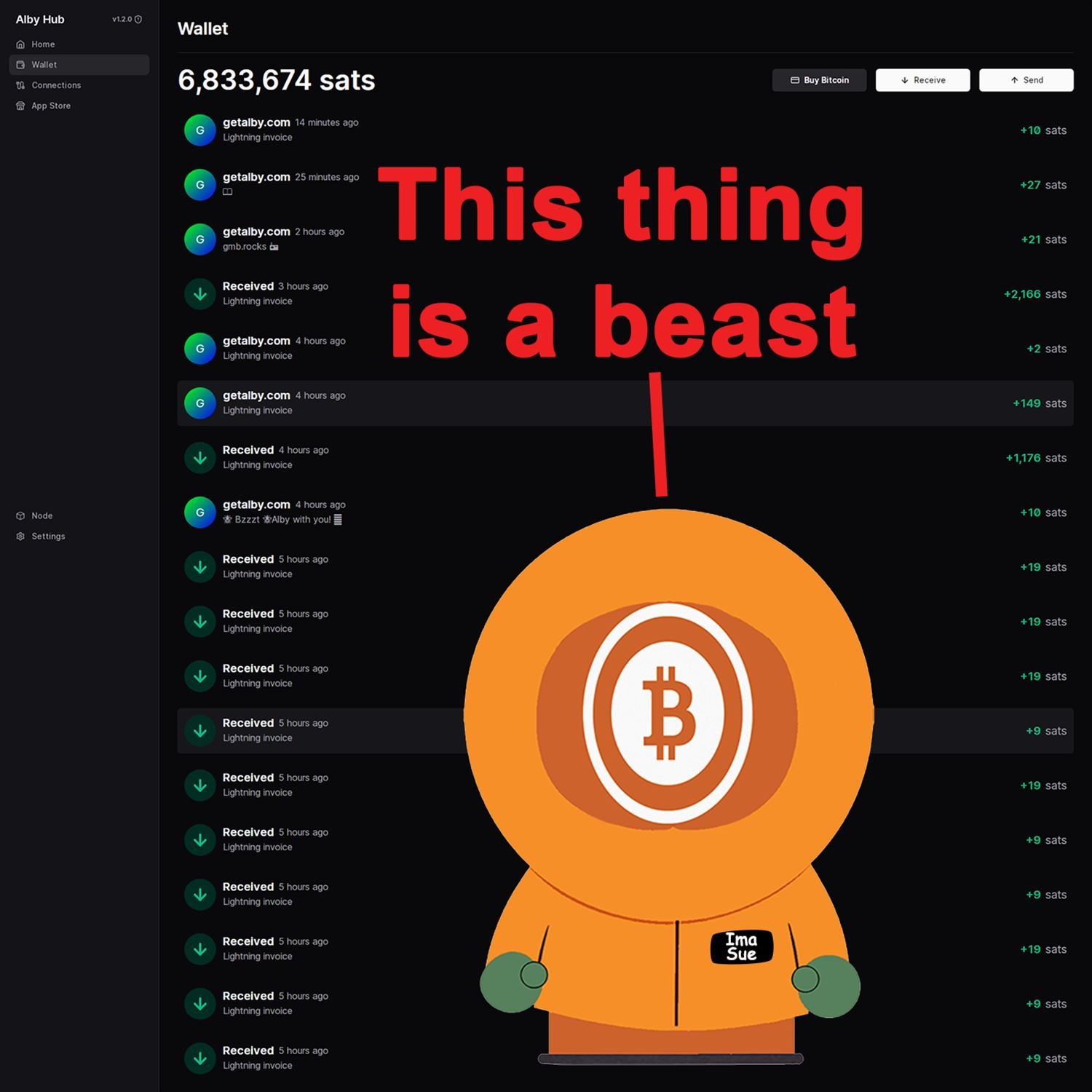

- Adventures With Alby Hub

- Riot Advances on Bitfarms

- Aussie Regulator Eats its Own

- Hacks Galore!

- SimpleX Gets $1.3 Million Seed

#Bitcoin #BitcoinAnd

Alby Hub/Start 9 Install Guide

-> https://getalby.com/nwc/umbrel_start9 <-

The King Ranch Donation Page:

https://www.givesendgo.com/Kingranch

Articles:

https://bitcoinmagazine.com/business/goldman-sachs-holds-over-400m-in-spot-bitcoin-etfs

https://cointelegraph.com/news/riot-platforms-boosts-bitfarms-stake-with-2-28-m-share-acquisition

https://decrypt.co/244572/australia-securities-regulator-sues-asx-for-misleading-statements-on-failed-blockchain-project

- https://www.cnbc.com/futures-and-commodities/

- https://www.cnbc.com/bonds/

- https://dashboard.clarkmoody.com/

- https://mempool.space/

- https://fountain.fm/show/eK5XaSb3UaLRavU3lYrI

https://www.nobsbitcoin.com/up-to-2-9-billion-records-stolen-in-a-hack-of-a-us-background-check-company/

https://www.bleepingcomputer.com/news/security/3am-ransomware-stole-data-of-464-000-kootenai-health-patients/

https://www.nobsbitcoin.com/introducing-bankify/

https://www.nobsbitcoin.com/simplex-chat-v6-0/

Find the Bitcoin And Podcast on every podcast app here:

https://episodes.fm/1438789088

Find me on nostr

npub1vwymuey3u7mf860ndrkw3r7dz30s0srg6tqmhtjzg7umtm6rn5eq2qzugd (npub)

6389be6491e7b693e9f368ece88fcd145f07c068d2c1bbae4247b9b5ef439d32 (Hex)

Twitter:

https://twitter.com/DavidB84567

StackerNews:

stacker.news/NunyaBidness

Podcasting 2.0:

fountain.fm/show/eK5XaSb3UaLRavU3lYrI

Apple Podcasts:

tinyurl.com/unm35bjh

Mastodon:

https://noauthority.social/@NunyaBidness

Support Bitcoin And . . . on Patreon:

patreon.com/BitcoinAndPodcast

Find Lightning Network Channel partners here:

https://t.me/+bj-7w_ePsANlOGEx (Nodestrich)

https://t.me/plebnet (Plebnet)

Music by:

Flutey Funk Kevin MacLeod (incompetech.com)

Licensed under Creative Commons: By Attribution 3.0 License

creativecommons.org/licenses/by/3.0/

Good morning. This is David Bennett, and this is Bitcoin and, a podcast where I try to find the edge effect between the worlds of Bitcoin, gaming, permaculture, podcasting, and education to gain a better understanding of all. Edge effect is a concept from ecology describing a greater diversity of life where the edges of 2 systems overlap. While species from either system can be found at the edge, it is important to note there are species in the overlap that exist in neither system, and that is what I seek to uncover. Uncover. So join me in discovering the variety of things being created as Bitcoin rubs up against other systems. It is 9:0:9 am Pacific Daylight Time. It is the 14th day of August 2024.

And this is episode 936 of Bitcoin. And it's gonna be a shorter one today even though I've been doing shorter ones anyway. You know, like I went from an hour and a half. And I'm trying to like pair those down for like these kinds of just news shows to like 40 minutes or below. This is probably gonna be below that one. We've got some Goldman Sachs news, some riot platforms issues going on. Australia eats its own, which is probably not a surprise, but we'll get to that one. A couple of pretty big hacks happened. And then we've got some Simplex news and Bankofy news. We'll get into all that. Let's start with Goldman Sachs, who now holds over $400,000,000 worth in guess what, Spot Bitcoin ETFs.

That's right. Yes. They announced that. And they've disclosed a $418,000,000 holding in spot Bitcoin exchange traded funds, that's plural, signaling a growing institutional appetite for Bitcoin exposure. In a quarterly filing, the Wall Street titan titan, it's a titan, oh my god, it's a titan revealed investments in 7 different Bitcoin ETFs available in the US market. It's largest position, of course, was in BlackRock's Ishares Bitcoin Trust, or Ibit, which was worth nearly $240,000,000 Goldman also held shares of the $79,500,000 Fidelity Bitcoin ETF $35,100,000 in Grayscale's BTC $56,100,000 in Invesco bitcoin, 8,300,000 in bitwise bitcoin ETF, and then smaller stakes in funds from Wisdom Tree as well as Ark Invest.

The disclosure highlights a surging institutional demand for Bitcoin products as bitcoin gains mainstream adoption with its sizable and diverse bitcoin ETF holdings Goldman aims to benefit from Bitcoin's upside potential without direct ownership because they're spineless and sackless, whatever, earlier this year. Goldman Sachs, get it, head of digital assets called Bitcoin ETFs an astonishing success. Signaling a pivot after years of the Wall Street Giant's skepticism about Bitcoin. As legacy finance gradually embraces Bitcoin, Bitcoin ETFs have become a prime gateway for institutional participation.

ETFs offer familiarity and liquidity while muting Bitcoin's volatility swings. I don't think that that's actually as true as you think it is. Eventually, most major financial institutions will likely hold significant Bitcoin exposure, not Bitcoin itself, but Bitcoin exposure to meet client demand. Goldman's Bitcoin ETF bet signals an understanding that Bitcoin is here to stay. What it signals to me, that's the end of the article, but this was Bitcoin Magazine's Vivek Sin is was writing this one. What it signals to me is that nobody really understands this asset. We keep trying to package this asset in legacy Christmas paper and cardboard boxes and like the little cheap ass gift bags because everybody forgot how to actually wrap a fucking Christmas present.

So we we take this this incredible asset that you can own you can buy you can sell and you can custody it all on your own without any third parties whatsoever and what do we do we can't understand no third party so when I look at giant financial institutions that have been around for centuries at least decades, but in many cases at least a 100 years. And in some cases, well over a 100 years. We're talking getting into the centuries kind of thing. Like, Norge's Bank bought a whole bunch of MicroStrategy. Norge's Bank has been around for a long time. Like, Swiss banks have been around for a very, very long time. There's all manner of these institutions that are around that are either, you know, 50, 70 years old or like 200, 300 years old. And they're all doing the same thing. They're all they all have the same playbook.

None of them are willing to actually hold the Bitcoin asset itself directly. They want exposure to the price, and somehow they think, or at least I think that they're thinking, that that gives them some kind of modicum of protection. Like they were saying, oh, it it it squelches volatility. I don't know. Have you seen the Ibit, chart lately it doesn't look like it squelched very much volatility to me it seems like it tracks pretty much right with right with whether or not you hold the asset yourself. Like, if I were to look and and I do because I have both of the I I on my trading view I have both MicroStrategy as well as I Ibit the BlackRock I shares Bitcoin ETF I have both of those charts on in my watch list so when I look at both of them MicroStrategy did not use to look like a Bitcoin chart.

Now it looks like a Bitcoin chart. Ibit has always looked like a Bitcoin chart because the entire thing is based around owning Bitcoin. So somebody, please, tell me how the hell shoving this crap into a Christmas present automatically somehow squelches volatility. I don't think it does. I think it is a fool's game that these people with 1,000,000,000,000 of dollars to play with are playing. I I don't think that they understand this trade. I don't think that they understand this asset. And that's that's a mouthful coming from somebody who doesn't have a degree in finance, never worked a risk management desk. I get it, but it doesn't I don't think it takes as much of a rocket scientist as we are led to believe to be able to understand these things.

So, as far as Goldman Sachs owning a shit ton at this point. $418,000,000 worth. Is that what it is? Yeah. Let's see. $418,000,000 worth of holdings, which is not an appreciable slice of their particular bankroll, but it is a lot of potential money depending on what Bitcoin decides to do. In either event, I cannot help but think that these people cannot understand an asset that is not a derivative. Like in this case the ETF is a derivative on price you don't actually hold the asset itself the you when you buy shares of I bitcoin like at this point BlackRock owns actual bitcoin Goldman Sachs owns shares of the BlackRock ETF.

They do not hold direct Bitcoin. So they are taking a bet on a derivative of the asset that is Bitcoin and that derivative, that first derivative, is price action. It is a gamble. There is nothing about this that is outside of a casino. The second that you don't hold the actual underlying asset all you're doing is flying your happy ass to Vegas, chilling out, thinking you're gonna get laid because you're gonna get a win at the craps table. And neither one of those things is going to occur. You're going to leave broke and without your kid's college fund. That's what's going to happen. So don't play that game. Now, getting into mining. Amaka Nwachaka is writing this one for Cointelegraph.

Riot Platform's Boost Bit farm stake with $2,280,000 share acquisition. If you thought the fight between bitfarms and Riot was over, no it's not. It's just heating up. Riot Platforms Incorporated, the 3rd largest Bitcoin miner on Wall Street, has significantly, significantly increased its stake in rival Bitfarms Ltd. In a regulatory filing yesterday, August 13th, Riot disclosed acquiring an additional 1,000,000 Bitfarms common shares through open market purchases. This transaction, which is valued at approximately $2,280,000 raises Riot's total holdings in Bitfarms to 85,300,000 shares, which is up from 84,300,000 shares. And with this purchase, Riot now owns 18.9 percent of Bitfarms, intensifying its influence over the Canadian mining firm.

The acquisition marks the latest development in the ongoing tensions between the cryptocurrency mining companies. In May, Riot made an unsolicited $950,000,000 offer to acquire Bitfarms, which Bitfarms promptly rejected, labeling the proposal as undervaluing the company. In response, Bitfarms adopted a poison pill defense to deter Wright's potential hostile takeover attempts, but the Canadian regulators fought this move. Despite withdrawing its initial acquisition offer, Riot has continued to exert pressure on Bitfarms leadership. And in June, Riot requisitioned a special shareholder meeting to remove certain Bitfarms directors and replace them with independent candidates.

Yeah. I'll I'll bet they're independent. Whatever. However, the boardroom battle appears to be yielding results. Earlier yesterday, August 13th, Bitfarms announced the immediate departure of co founder and chair Nicholas Bonta, one of the 3 board members Riot targeted for replacement. Riot indicated that it would continue to review its investment in Bitfarms and may consider further actions including adjusting its position or proposing additional changes to the board composition. In addition to its ongoing maneuvering with Bitfarms, Riot has succeeded in acquisitions elsewhere.

On July 24th, Riot completed the purchase of Kentucky based Block Mining for $92,500,000 and this acquisition significantly boosts Riot's Hash Rate. The block mining transaction finalized on July 23rd included an $18,500,000 cash payment and $74,000,000 in Ryman, Ryman, Riot common stock. Additionally, a potential earn out of up to $32,500,000 is available until 2025, contingent on block mining securing further power purchase agreements. So, Riot is going to end up with Bitfarms at one point or another. Either by proxy, considering that they'll pretty much control the company after this is all over, Or they'll just finally end up in an agreement with Bitfarms to buy the company outright. I'm not sure how much longer Bitfarms is actually going to last under this kind of pressure because after a while, shit just gets boring. And there's only so many, you know, so much tensions you that you wanna deal with as a human being in this kind of environment. But be that as it may.

Riot Platforms is going to end up with BITFarms no matter what anybody says. Right? My problem here is that I'm seeing yet again, like I was saying with Goldman Sachs, this attitude. And where was it that where where was it that it completed the purchase? No, no, no. Oh, yes. The boardroom battle that ended up resulting in the immediate departure of a co founder and the chairman, Nicholas Bonta, which was one of the 3 board members. This is legacy games. What I'm seeing is an almost impossible maneuver for modern humans that have anything to do at all with the business life or suit speak or all of the legacy finance bullshit, being able to break out of a particular line of thought.

We keep coming back to play the same fiat games. We'll buy more shares. We'll get more control. We'll replace board members. How is this not just like, I don't know, Dunder Mifflin Paper Company? That that's what this looks like. I see a great guts and feathers of the people that quote unquote are the big players in Bitcoin defaulting to the bullshit that Bitcoin was designed to replace in the first place. I don't like it. There's nothing I can do about it. I'm not generally worried about it because again, it doesn't matter who controls what as far as the amount of Bitcoin. You can't change the code. All you can do is propose a change of the code, have a whole bunch of people rah rah your ass, and then maybe you'll sit around a round table and sign a letter somewhere in New York saying that you're gonna change the code. And all you're going to do is in effect is effect a fork. And I will never run the fork on my node. And I will always run a full node.

I will teach my children to run a full node, and the importance of making sure that the software that they run is in fact their vote on what protocol wins. And, honestly, I don't even think there could be a situation one of these days where a fork comes up and people are just too stupid to figure it out. And the only only thing that happens is that there's either some kind of tie. We've never seen this. I mean, Bitcoin Cash was was said that it was going that that's what Roger Ver said about book Bitcoin Cash is that, well, we're gonna do it this way and we're gonna end up being the dominant chain. And, at this point, I'm not sure if quote unquote dominant chain actually makes a flying fuck. So, what did happen with these forks is that the only way to make a credible fork at all is that you have to take a snapshot of the blockchain that you're forking from.

And then after your wallets and your chain is live and hopefully it actually, you know, makes a block for you unlike, what was it, Bitcoin Lite or whatever split off from from that whole New York agreement thing. It never actually mined its first block. But let's say that it does, and this new chain actually does something. It will simply just add to your ability to buy more Bitcoin because you'll have this shit chain. And they did that a lot. In 2017, we saw that. There are so many unclaimed coins that I have that I could go claim but I'm just uninterested in doing that because it's not worth the time because their value is so low so freaking low that it's just not even worth the time. But I do not dismiss the fact that this might not occur again. Right? So, as long as we're playing fiat games or these people are playing fiat games then what I suggest is that you do not trust these people.

That you do not trust Bitfarms. That you do not trust Riot. Because they're playing the same games that put us here in the first place. Now, on to Australia who are also playing the same Fiat games except now they're eating their own. The Australian Securities Regulator is suing the Australian Exchange for misleading statements on failed blockchain project. So this is out of decrypt. Mertusa Merchant is writing, the Australian Securities and Commission has sued the Australian Securities Exchange or ASX, the country's largest exchange, alleging misleading statements regarding its blockchain based clearinghouse electronic sub register system or CHES replacement project. Now, I'm pausing just to to say that this is like the SEC suing the New York Stock Exchange.

That that's what this is, except it's over in Australia. That's why I say they're eating their own. The ASIC or the Securities Investment Commission claims that ASX announcement on February 10th back in 2022 stating that the project was on track for go live in April of 2023 and was progressing well were misleading and deceptive. The regulator argues that these statements implied that the project was following ASX's announced plan and was on course to meet future milestones. The CHEST replacement project, which aimed to modernize the Exchange's 25 year old clearing and settlement system using block chain technology was a significant undertaking for the Exchange. As we can see here, the Exchange had been working on this initiative for guess what?

7 years. They've been working on rolling out a bullshit blockchain project for 7 years, intending to enhance its electronic securities trading processing capabilities. However, the project faced unforeseen challenges and was ultimately shelved following an independent audit by Accenture and highlighted various issues. In a statement issued on Wednesday, ASIC chair Joe Longo said companies and market participants rely on what the ASX says about its operations to make their own decisions and investments. Quote, we expect the ASX to be a place to list and invest with confidence, he said.

The regulator alleges that the true state of affairs on February 10, 2022 contradicted ASX's announcement that the project was, quote, progressing well. The subsequent delay and pause of the project in November of 2022 reportedly caused significant cost to ASX and market participants who had relied on the Exchange's assurances. And the financial impact of the failed blockchain project has been substantial, with ASX reporting a pretax loss of approximately $170,000,000 and that would be US dollars, which the company has written off. This setback has raised concerns about Australia's attractiveness as an investment market and the management of critical national infrastructural infrastructional no. No. Not infrastructure projects.

ASIC has yet to determine the specific penalty it will seek for ASX's alleged contraventions. This legal action follows a recent penalty of $1,050,000 paid by ASX in March of 2024 for compliance issues with market integrity rules. Who the hell is running the show at Australia's largest exchange? That's kinda what I'm what I'm wondering, because it it just it just seems a little incredulous that something like the equivalent of the New York Stock Exchange in Australia, which is not a small country. They have a lot of people. There's a lot of money in Australia. There's a lot of business. There's a lot of finance in Australia. And yet, they're acting like I don't know they're acting like one of the early like they're acting like Mt. Gox where they just really don't know what the hell they're doing They had 7 years 7 years to simply clone any blockchain project that you wanted to clone. You didn't even have to build this shit from scratch And just select one that comes close to doing what you want to do. Make your modifications.

They had 7 years to do it. They couldn't pull it off. Now they've cost $170,000,000 to their customers in some way shape form fashion or another. And they've already been fined like, once for chicanery in their market actions by their very own country's regulator. So Australia just looks like it's in hell for all that matters. Let's run the numbers. CNBC Futures and Commodities Oil taking it on the chin down over a point to $77.57. Britain, North Sea down a half point to 80.33. Natural gas is up 4 and a half points to $2.46 per 1,000, and gasoline is down 1 and a half to $2.33.

Shiny metal rocks and are not doing well at all today. Gold is back below 25100 to 24.8190 cents after a one point drop. Silver is down 1 and a quarter draw point and platinum is down 1.66%. Copper is down a quarter of a point while palladium is down just over half. Ag is mostly in the green today. That's an that's interesting. Biggest loser is sugar, 2.18% of the downside and the biggest winner is coffee. 2.64 to the upside. Live cattle up 3 quarters of a point. Lean hogs up. Wow. 4.15 percent and feeder cattle are up just over one point. The Dow is up 2 thirds of a point. S and P is up 1 third of a point. Nasdaq moving sideways, as well as the S and P Mini. However, its color is just a bit red. Let's look at Clark Moody dashboard.

$59,060. Yes. We lost that little that sort of sub god candle that we had earlier. We are now down to $1,170,000,000,000,000 and we can only purchase 24.1 ounces of shiny metal rocks with our 1 bitcoin of which there are 19,739,689.87 of. Average fees per block are the same today as they were yesterday, 0.06btc average fees per block on a per block basis. And speaking of blocks, there are a 123 of them that are carrying 230 30,000. 230,000 unconfirmed transactions waiting to clear at high priorities of gee holy shit 3 satoshis per vByte.

Did you hear what I said? 3. Not 33, not 300, not 7, not 5, but 3. We are 2 satoshis away from a 1 satoshi clearing cost. It just flipped over to 4 for both high and low priorities, but wow, I haven't seen 3 in quite a while. Hash rate looks like it is where is it? Hello? Hello, hash rate. Come on. Come on. There you go. 628.1 exahashes per second, climbing back up a little bit. Now on to made in USA, episode 934 of of bitcoin and pies boosted 20,000 sats and says gas money. Pies with another 8,500 says gas money. Letter 6173 with 5,001 sat says great episode. Thank you. 02ZX with 5,000 says petrol, dog food, and for transacting with whomever you please. I appreciate that. Wartime with 3333 says, Ass Money.

Gas, grass, or ass brother. Nobody rides for free. Dubravco with 2210 says baller move. Signal. Also I'm on the job hunt and things are easier to do while chatting with friends. So, any long timers to this show, feel free to message and or call on Telegram. No scammers, please. Dobrovco with another 22100 sat says for freedom episode. Alright. So we joke about UK arresting people for speaking their mind, especially as subjects don't have free speech rights. The legislature only have free speech rights during their time actually debating and legislating, not when the shift is over.

That merely makes for less places we can flee that we can flee to when World War 3 pops off, especially for people that can get an Irish passport, which gives one EU residency, working, and medical rights. Imagine if Russia changed sides. Never happened. Dobrovka with another 2190 says, quote, the purpose of the system is what it does, not what it claims to do. Staffordbeer. And he gives an Instagram reel. And I went to it and it shows perpetual motion different kinds of perpetual motion machines. And here's my problem with perpetual motion machines. It's not that you can't have a perpetual motion machine, kind of, but you have to understand how much work could one actually produce We see all these wheels with different kinds of things going around and they seem to go around forever and it looks it looks great.

Except it's not actually doing any work. In fact, it's losing energy all the time to friction as it's rotating whatever it is wheel or whatever around the central pivot point. There's always friction. There's always a coefficient of friction. There's always loss of energy. I can see a situation where you can have a perpetual motion machine that for 10 years, a single wheel will that's That's my problem with perpetual motion. Okay. Now that said, Vague with 1200 says, really enjoyed the surprise performance by Bruce Springsteen at the end of this episode. Uh-oh. I don't know what that means.

I'm I'll have to go I'll have to go back and check that shit out. God's death with a 1,000 sat says, thank you, sir. It's all lies. Always has been. Fuck them. We're winning. Yeah. I agree. Alright. That's gonna do it for the weather report. Welcome to part 2 of the news. You can use up to 2.9000000000 records have been stolen in a hack of United States background check company, Jericho Pictures Incorporated, I think. A class action lawsuit claims that Jericho Pictures Incorporated or National Public Data was hacked earlier this year, exposing 2,900,000,000 billion with a b. 2,900,000,000 that's almost the entirety of the United States confidential records primarily of US citizens stolen by the hacker group USDOD.

On April 8th, the cyber criminal group USDOD posted a public data database on a dark web forum offering 2.9 individual well, 1,000,000,000 is they don't say 1,000,000,000. I think it's a typo. Offering 2,900,000,000 individual records for $3,500,000 according to a complaint filed Thursday in a US District Court for Southern District of Florida. The exposed data for potentially 100 of millions of people includes names, Social Security numbers, current and past addresses, and information about relatives including deceased family members according to the complaint. It's critical to clarify that each person has multiple records for each known address so the breach did not impact 3,000,000,000 individuals contrary to many inaccurate reports. Okay. I can deal with that.

That that makes sense. According to VX Underground, which verified that the data is real, the database does not contain information from individuals who use data opt out services. Every person who used some sort of data opt out service was not present. Since then, various threat actors have released partial copies of the data, each with a different record and content. On August 6th, a threat actor known as Fencey or Finice, f e n I c e, leaked the most complete version of the stolen national public data for free on the breached hacking forum.

The leaked data consists of 2 text files totaling 277 gigabytes containing almost 2,700,000,000 plaintext records slightly less than the 2,900,000,000 originally claimed by USDOD. Unlike previous leaks, this 2,700,000,000 record does not include phone numbers and email addresses and numerous people said that their data is incomplete or inaccurate, but many have confirmed that the data included their and other family members' legitimate information, including those who are deceased. Previously leaked samples also included email addresses as well as phone numbers. Quote, finally, this data may be outdated outdated as it does not contain the current address for any of the people that we checked, potentially indicating that the data was taken from an old backup. Oh, interesting. Those affected by the cyber attack may be unaware of their without individuals' knowledge or consent.

I smell a massive class action lawsuit coming. Quote, criminal records, background checks, and more. Our services are currently used by investigators, background check websites, data resellers, mobile apps, applications, and more, according to National Public Data website. According to the National Public Data's website, the incident is believed to have been involved with a third party bad actor that was trying to hack into data in late December of 2023 with potential leaks of certain data, in April of 2024 and summer summer of 2024. So there you go. That's just that's just great. A yet another hack.

But we're not done with hacks. Because 3 am ransomware has stolen the data of 464000 Kootenai Health Patients. Now, Kootenai I've seen Kootenai, health clinics and whatnot like that up here in the, inland northwest, and I'm sure that there are some in the Pacific Northwest. I do not know how far Kootenai goes, but I definitely know that they are they are where I'm at. I'm not a patient of Kootenai, but I know people that are Anyway, it looks like their, data has well been breached and impacted over 464 1,000 patients after their personal information was stolen and leaked by the 3 AM ransomware operation. Kootenai is a not for profit healthcare provider, oh, in Idaho, operating the largest hospital in the region, offering a wide range of medical services, including emergency care, surgery, cancer treatment, cardiac care, and orthopedics.

That's right. It's not in it's in the Inland Northwest, but not in Washington state. It's over there. The one that I am seeing is over there in a place called Coeur d'Alene, which if you just drive east from Spokane, you will hit a very pretty town called Coeur d'Alene with one of the most gorgeous lakes I've ever seen. Anyway, the organization is notifying patients who receives care at its facilities that it detected a cyber attack in early March, which disrupted certain IT systems. The examination of what data has been stolen as a result of this breach was concluded on August 1 confirming the following as exposed: Your full name, your date of birth, your social security number, your driver's license number, Your government ID number. Your medical record number. Medical treatment and medical condition information.

Your medical diagnoses. Health insurance information. Oh, man. This is bad. Kootenai Health states that it's unaware of any misuse of the stolen information. It was stolen. That's an automatic misuse. Wow. Just just tone deaf. Oh my god. It also enclosed or yeah. Enclosed instructions for impacted individuals to enroll in a 12 to 24 month of identity protection services depending on what data was exposed. That's all that I'm gonna read of this because we've got other we've got other fish to fry. But I'm gonna say this. If they're gonna offer 12 to 24 months of what I assume to be free identity protection services, Let me tell you how this is gonna roll out because this is this is sort of the attitude that I've seen in American service providers and these kinds of deals where they really don't give a shit. That everything is an opportunity to sell you something.

You're gonna sign up and you'll give them a credit card number. And if you don't cancel after your 12 to 24 month freebie, they're gonna start charging you for identity protection services and it's going to have been done because you got your shit stolen by somebody who has an IT department that is fucking incompetent. This is not the way to run a country. This is not the way to treat citizenry. This is not the way customer service should run. But I guarantee you that that's what's going to happen. Let's move on to Bankify. Let's turn cashew mints into lightning wallets with NWC.

This is, by the way, no bullshit Bitcoin. Bankify is a highly experimental tool for turning any cash you mint into a lightning wallet with Nostra Wallet Connect support. Bankify is a response to the frustration I've had. Not enough custodial Bitcoin wallets support Nostril WalletConnect, aka NWC. The only ones I'm aware of till I release this app are getalby.com, casu. Me and Mutiny Wallet if you configure it to use a federation first. But Mutiny Wallet is shutting down. And Alby Wallet stopped opening new accounts for their custodial service, so only Casu. Me will work in the near future.

Bankify to the rescue announced Supertestnet. Casu Mints offer a standardized API for melting and mint ecash tokens similar to receive and send functions in other custodial wallets. The melt option allows users to pay a mint with ecash, settling a lightning invoice on their behalf. The mint option lets users request a lightning invoice from the mint, which, once paid, provides an equivalent amount of ecash tokens. So, this is a quote. So I made a simple storage service that does those things automatically in the background, including managing e cache and just gives you nice and easy send and receive buttons explained at Supertestnet.

This app also runs a Nostra WalletConnect server in the background so that NWC clients can connect to it and give it commands using that standardized API. So essentially, this app just translates between 2 custodial API standards. Huge warning. Quote, I made this app for testing purposes and I warn you, don't put any money in it unless you're happy to lose that money for the pursuit of science and the enrichment of someone who is not you. End quote. At least he's being upfront about it. This wallet stores private keys. Should I say that again? This wallet stores private keys and e cash notes unencrypted in local storage making them vulnerable to browser extension attacks and deletion during cookie clearing.

Additionally, e cash wallets carry custodial risks such as theft by the mint, loss if the mint is arrested, or hacking instance or incidents. The NWC connection only works while Bankify is open in a browser tab, so it's not currently recommended for Zaps on Nostr. So, this is really interesting. What he's doing is he's using a Cashumint to act as a lightning wallet. That's really all this means. And this is one of the things that I'm having problems with with, and I'm not having problems with GetAlBI. Don't get me wrong. I love the guys over at GetAlBI.

Yesterday I went through all the motions to install the AlBI hub on my start 9 and I had to side load it. Which what does that mean? Well, it means this. It means that I couldn't go through the start 9, store to get the app that would automatically install with a one button, click. I could not also find it, and this is remember, this is the get albie or the albie hub because albie is not doing custodial stuff any longer. They're they're deprecating their wallets yesterday or the day before they announced that they were going to start moving your the amount of, Satoshis you could keep on your custodial wallet if you're a legacy user. They're going to decrease the amount that you can keep on there. So I was like screw it. It is time to go to AlbiHub.

I could not find it on the community start 9 store either, which would have provided me a one button click. So I had to use the get Albie or the AlbieHub guide which is very easy to use. I will try to include it in the show note. In fact, let me just get it up right here. Okay. It will be the the, URL will be included in the show notes as to how to get this thing side loaded. And I highly recommend it if you are a Albie user and you have you're using the browser extension. And the browser extension will stay there. It's the wallet part that is basically being slowly deprecated over time so that, I guess, we don't send the, you know, 7th Atlantic Fleet out to, you know, hunt down and destroy everybody that had something to do with Get Albi because they were working with a United States citizen.

The extension stays the same. The wallet's being deprecated, and you're going to need to move over to to the hub, right? When you follow the guide, what you're going to end up doing is you're going to end up going to their GitHub. You're going to download a package. You're going to unzip that package. And you're going to place that package inside of your start 9. And if I go over to my start 9, right now it is under it's like at the very left hand side of your of your start 9 there's services, marketplace, updates, notifications, and system.

When you go to system and you go to the right hand side of its or the the right hand menu there is something called side load a service. And it's pretty easy. After I got my head around what was going on here, it took me about all of 15 well actually it only took me 5 minutes to do it the second time. The first time was another failure, but I think that was because my WiFi was being really weird, and I'm not I'm not directly patched in, through a LAN cable to my, router. So I think that's why it was. But once it did, it happened real fast, took 5 minutes, it auto configured itself, and then I had to attach my wallet and there's instructions in that same guide to be able to do all of this.

Once I did that, I got scared because I had almost a 1000000 sats in my existing get albie wallet that's in my browser. That was replaced immediately after I connected it to my LND node which is what you're doing when you when you side load this service all of that will be answered. You're going to end up connecting it to either yours or I guess somebody. If you don't have a lightning if you're not running a lightning node this is gonna be harder. This is for people that are like hardcore, you know, they got a Bitcoin Core node, they're running lightning, LND on it. It doesn't work with CLN or CLI or whatever it is. It only works with LND right now. So if you're not running LND, you're kind of SOL.

I'm just saying that when I connected my browser wallet to my Albi Hub, which was leveraging my pre existing lightning network node, it replaced my balance with my lightning network balance. It replaced my what my albie wallet brow my Alby Browser Wallet balance with what I already had on my lightning node. So I knew it was connected but where did my 1,000,000 sats go? You gotta kind of dig down. So if you here's what I here's what I recommend. Here's what I recommend, guys. If you're going to do Albie Hub, empty your Albie extension wallet your browser extension wallet Empty it. Put it somewhere else. Put it in your lightning node.

I don't know. Put it into you know a cashew something. I you know just just clear it out. And that way you won't get all freaked out because that was about like $524 you know when I did this yesterday that's not an easy pill to swallow But luckily, l b hub said here was your pre like when I went to a couple of places I finally found it. I had to go to something called node that was in the service, the alb hub service that was running on my start 9. I went to the service and then it said hey like here's some settings. Here's node. I went to node and boom there was my old balance and it had the option to transfer it. So I hit the transfer option and it transferred it directly to my lightning node And that's when I realized just how slick albihub is.

You guys are going if you're using git albih, you're gonna have to do this. Alright? And one either today, or tomorrow, or next week. It may not be right now, but it is going to be soon. So the quicker you get this shit fixed, the better off it's going to be. Now, back to this Bankofy thing. This turning Casu Mints into Lightning wallets with Nostra Wallet Connect. Do you do you kind of see how these things these networks that I keep talking about that are that are building themselves out in a sort of separate manner are starting to coalesce? This is what I keep talking about.

What's going to end up happening is we're going to end up with some kind of supraorganism that we can't tell where Bitcoin ends, lightning begins where cashew ends and begins where nostr ends and begins it's gonna be this one super organism mass. And when that happens all hell is gonna break loose because nobody's gonna be able to stop it. There will be parallel networks that all of the other networks will be able to use. How that's going to happen, or when that is exactly going to happen, I can't tell you. All I know is all I gotta do is go out through a forest and see how the forest functions to know that the same type of functionality organically is going to come to us through Cashew, through Fediment, through Bitcoin, through Lightning Network, through Noster, and a whole host of other things that I can't even I don't even know about yet. Alright? So just be aware this shit's coming and it's probably gonna come to simplex as well.

Simplex, or what I call simplex, has raised $1,300,000 from Jack Dorsey and Asymmetric VC releases chat version 6.0. Simplex chat is a free and open source messaging platform that has no user identifiers and is private by design. Available on Android, iOS, Linux, Windows, and macOS. Quote, we are very happy to announce that we have funds to move faster. We raised a 1,300,000 precede round led by Jack Dorsey with participation of Asymmetric Capital Partners VC Fund announced Simplex. Jack Dorsey and ACP support will allow Simplex to make significant product advancements, expand its team, and secure medium term funding, excuse me, funding for the next stage of growth.

The investment comes without control or board seat provisions, ensuring Simplex remains committed to our privacy first communication network vision. Quote, we will also launch long form email like messaging over simplex network this year together with optional short public addresses that show profile, that you are connecting to before the connection. This is important for any public users and businesses out of the project. That's gonna be cool, man. The project also announced it had begun collaborating with legal experts to establish an open source governance model similar to that of Matrix.

In addition, Simplex chat version 6.0 stable the the stable version has been released with new user experience and private message routing enabled by default. Quote, v 6.0 is one of our biggest releases ever with a lot of focus on UX and stability improvements and the new features the users asked for. The private message routing we announced before is now enabled for all users by default. It protects users' IP addresses and sessions from the destination servers, end quote. So what's new? Messaging protocol improvements, new reachable interface, archive contacts to chat later option, new way to start a chat, new chat themes, improved moderation tools, increased font size, play media from the chat list, blur for better privacy, improved networking, and reduced battery usage. Yeah. Simplex used to eat through my battery, and I don't use it all that often. So let me let me be clear about that.

But here's what I'm I'm kind of thinking. Everybody is bitching about Nostra's direct messages, and I'm one of them. It's it's shitty. It just is. So why not sidecar simplex into Nostr as part of, like, instead of part of the protocol just as like you would treat like and so this would all be client side it wouldn't be protocol side But instead of leveraging the protocol part of Nostra for DMs, just don't use it in your client and then offer a way to sidecar simplex into something like damas or something like primal or something like coracle or something like that. I'd like to see at least at least one Nostr client just completely do away with Nostr protocol based direct messaging and replace it with simplex just to see what the hell would happen. And, of course, you're probably going, why don't you do it? Because I couldn't code my way out of a paper bag if the Germans were coming over the hill with a bunch of pans or tanks. It just wouldn't happen. I don't know how to do it. So, I actually have to say, here's an idea. I hope somebody goes, shit, that is a good idea. Maybe I'll just do that. And then if you make any money from it, just cut me 1%.

That's all I'm asking. Or boost the show with podcasting 2.0. Stream satoshis. Send me messages. Do all the things. But I need some gas money. Otherwise, I'm gonna go out and pound some baby seals. Oh, that didn't sound good. Maybe I'll just whack them upside the head with a lead filled snowshoe. And if you don't know where that comes from, I'm gonna be working on a sound effect for beating, baby seals. Alright. Is that it? Yeah. That is it. That's it for the day. So what have we learned? Your end pub remains unaffected from all these hacks. Unless you just decided to put your email and all your identifying information into a client that represents, your in pub and insect, you didn't you you you then you've got a problem. Right? You shouldn't you probably shouldn't do that.

What I'm saying here is that now that we were talking about Nostr the whole idea of digital identity that is not inherently private. Not inherently. Right? It depends on you. It depends on what you want to do with your inpub. It depends on whether or not and how much information you want to provide along with your insec and inpub key pair for Nostr. If you just have nothing on your profile and you've never connected anything at all to your end pub, like, you know, in your profile put in your email address or god forbid I don't know why you would do it but your home address or your phone number then it doesn't matter who scrapes your who scrapes a whole shit ton of in pubs You are unaffected.

So how does this type of digital identity become leveraged for stuff like medical records so that if you get hacked there's no real way to identify the actual person. All you have is: Hey, here's a medical record and here's the in pub. But since I own the insect, and that insect is kept safe by me, presumably then there's no way that anybody that has that information connected to this particular public inpub can do anything with the information at all except maybe collate how many people might have cancer or how many people went for a flu shot or whatever. I mean, there's there's data there that can be used and and I'm I'm actually kind of okay with that depending on what it's being used for, but it can't be connected to me.

And in scientific studies when we're dealing with human subjects what we call that is de identification. So here's what I'm kind of thinking is that maybe noster, nsec, and npub key pair is not digital identity. Maybe what it is is digital de identification. I'm gonna let you chew on that and I'll see you on the other side. This has been Bitcoin, and and I'm your host, David Bennett. I hope you enjoyed today's episode and hope to see you again real soon. Have a great day.

Digital Identity and De-Identification