Join me today for Episode 885 of Bitcoin And . . .

Topics for today:

- A 500 Million Year Old Market

- Hong Kong Approves Spot BTC ETFs?

- Paraguay Embraces BTC Mining

- Fiji and Norway Hell Bent on Economic Destruction

- Deaton Outraises Warren In Senate Bid

#Bitcoin #BitcoinAnd

Circle P:

https://primal.net/p/npub172mu27r5yny0nnmvgjqwhx055dmsesrrx7j0p5d3pxagfx6xgxfsv75p3q

nostr handle: @beisnerds

Twitter: @beisnerds

Product: Maple Syrup and Soaps

Articles:

Fungus Figured out markets 500 million years ago

https://bitcoinmagazine.com/business/hong-kong-approves-the-first-batch-of-spot-bitcoin-etfs-issuer-says

https://cointelegraph.com/news/fiji-central-bank-warns-against-crypto-use-disappointing-bitcoin-hopes

https://decrypt.co/226493/bitcoin-miners-forced-out-norway-data-center-law

- https://www.cnbc.com/futures-and-commodities/

- https://www.cnbc.com/bonds/

- https://dashboard.clarkmoody.com/

- https://mempool.space/

- https://fountain.fm/show/eK5XaSb3UaLRavU3lYrI

https://cointelegraph.com/news/john-deaton-senate-bid-q1-donors-outraise-elizabeth-warren

https://www.nobsbitcoin.com/satoshi-7b-open-sourced/

https://www.nobsbitcoin.com/paraguay-reconsiders-bitcoin-mining-ban/

Find the Bitcoin And Podcast on every podcast app here:

https://episodes.fm/1438789088

Find me on nostr

npub1vwymuey3u7mf860ndrkw3r7dz30s0srg6tqmhtjzg7umtm6rn5eq2qzugd (npub)

6389be6491e7b693e9f368ece88fcd145f07c068d2c1bbae4247b9b5ef439d32 (Hex)

Twitter:

https://twitter.com/DavidB84567

StackerNews:

stacker.news/NunyaBidness

Podcasting 2.0:

fountain.fm/show/eK5XaSb3UaLRavU3lYrI

Apple Podcasts:

tinyurl.com/unm35bjh

Mastodon:

https://noauthority.social/@NunyaBidness

Support Bitcoin And . . . on Patreon:

patreon.com/BitcoinAndPodcast

Find Lightning Network Channel partners here:

https://t.me/+bj-7w_ePsANlOGEx (Nodestrich)

https://t.me/plebnet (Plebnet)

Music by:

Flutey Funk Kevin MacLeod (incompetech.com)

Licensed under Creative Commons: By Attribution 3.0 License

creativecommons.org/licenses/by/3.0/

Good morning. This is David Bennett, and this is Bitcoin Ant, a podcast where I try to find the edge effect between the worlds of Bitcoin, gaming, permaculture, casting, and education to gain a better understanding of all. Edge effect is a concept from ecology describing a greater diversity of life where the edges of two systems overlap. While species from either system can be found at the edge, it is important to note there are species in the overlap that exist in neither system. And that is what I seek to uncover. So join me in discovering the variety of things being created as Bitcoin rubs up against other systems. It is 11:30 AM Pacific Daylight Time. It is the 15th day of April. It's tax day in the United States. And this is episode 885 of Bitcoin.

And the circle p is open for business. The circle p is where I bring plebs like you to plebs like you with their goods and services for Bitcoin. Because if they're not selling it for Bitcoin, they're not in the circle p. Today, maple syrup from my friend, Bysnerds, at b e I s n e r d s, both on Twitter as well as on Noster. And he sells maple syrup and his sister Sarah's beef tallow soaps. Maple syrup is made by hand. He taps his own trees. He boils his own sap. He bottles his own maple syrup when it's finished, and he will sell it to you for Bitcoin.

That's right. And when you do, tell him that you heard about his maple syrup and his sister Sarah Soaps on the Bitcoin and podcast circle b, he will cut me in on some of those sweet sweet satoshis. There you go. You know what's really interesting about maple trees and pretty much all trees in general? This is the way that we're gonna start the show this morning. Trees have a fascinating relationship with something called ectomycorrhizal fungi, which is a fungus. It's very much a fungus. In fact, ectomycorrhizal fungi is one of the reasons you get truffles.

That's the fruiting body of this particular fungus. So, that said, I read something pretty fascinating last night and I want to bring it to you today. I just want to make sure that I've got it up here. There we go. Okay. The way this works is that trees and grasses and all all manner of plants that grow in the have most of them. Some do not but it's very very few plants that do not have a relationship with this mycorrhizal fungi in the ground. I know you're going how the hell is this about Bitcoin? Hold up. Hold up. I'll get to it here in a second.

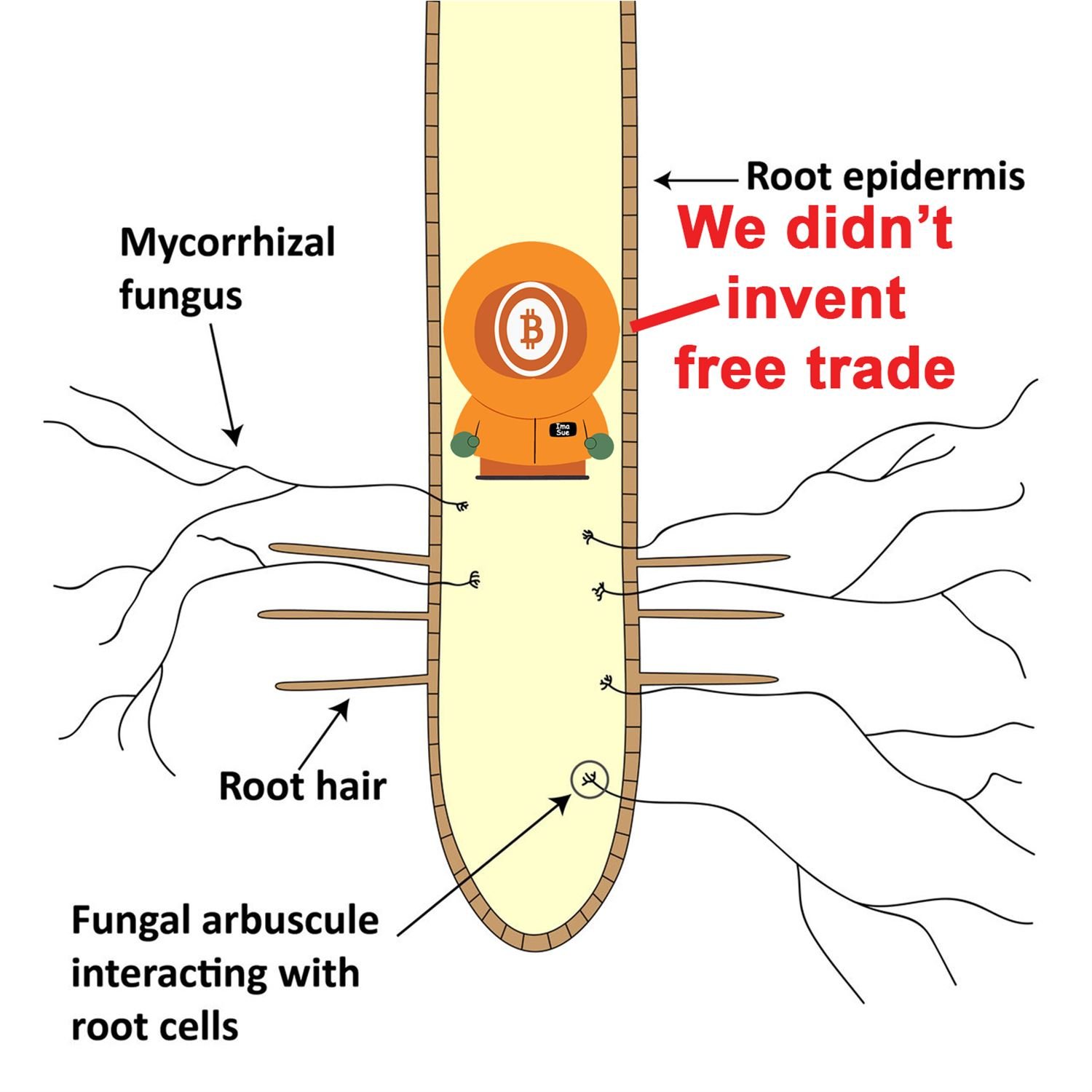

The way this works is that trees, plants, their roots have an association, a physical association, with the little itty bitty mycelial strands of mycorrhizal fungi. Whether it's ectomycorrhizal fungi, which is basically a sheath on the outside of the root, or it's endomycorrhizal fungi, which means that the threads penetrate into the root and then a few layers down into the cellular network of that root and then penetrates into a cell and they set it sets up a oh, how to say it? Like a farmers market. Because the ecto or the the end the mycorrhizal fungi can go scavenge minerals out of rocks and it uses organic acids to bust down those rocks and pull things like phosphorus. We'll use that for our example because that's coming up here in a few seconds.

It will pull phosphorus out of these phosphate rocks which are everywhere. It's in all the soil. It's just that the plants can't use the phosphorus in that particular form. Well, lo and behold, the plant has this fungus And the mycorrhizal fungus uses organic acids to break down these rocks and pull phosphorus in a format that the plant can actually use and then transports it to the plant. But it doesn't do it for free. It expects something in return. So phosphorus is a good that the plant needs not only does it want the phosphorus it needs the phosphorus to grow.

Cannot grow without phosphorus cannot it certainly can't make seeds and propagate itself without phosphorus but it needs phosphorus. Well, the fungus doesn't do this shit for free. It expects to be paid. What does it get paid in? Carbon. Carbon, it turns out, is the monetary unit of the universe. Now I'm sure many people might laugh and say you're not smart enough to actually be able to say that. I'm going to go ahead and say I don't care. Carbon, the atom that is a carbon or a carbon atom is the dollar bill of the universe. Most trade is done that is done with carbon in the universe.

We won't get into all the facets of it. But in this particular case, how is that carbon given over to plants? It's done by the sugars because sugar is a carbohydrate. So there's carbon, hydrogen, and oxygen involved in the molecule of a sugar. There's many different kinds of sugars. Plants, when they go through photosynthesis, pull carbon dioxide out of the atmosphere, they combine it with the energy from sunlight and they build sugar molecules. And when that happens, they strip off oxygen molecules out of the co2 and that's where the oxygen comes from that plants produce for us. Alright? But now that this carbon has been sequestered in the plant it's done in a form of sugar.

But only, I don't know, between 40 60% of that mass that's built from sunlight and co2 remains in the tree as wood or leaves or whatever. The majority or almost the majority let's just say 50% because it's anywhere from 60 to 40 percent of the products of a of the the photosynthetic products of a plant anywhere between 40 60 percent of it, let's say half goes to the roots and then is shot out of the roots into the soil but when there's mycorrhizal fungi present in the inside the cells or least sheathing the root that sugar is intercepted by the mycorrhizal fungi. And that's the trading mechanism. If the sugar or if the plant wants the phosphorus that the fungi can provide it must pay for that phosphorus with sugar.

Okay, that's the setup. Now this isn't just trees bushes and shrubs and grasses and all manner of stuff tomatoes even even tomatoes form these mycorrhizal fungi relationships. They have to have them. So I'm re reading a book called Entangled Life by Martin Sheldrake and It's a fascinating read. It's very much well worth your time. Very much well worth your time. So, in it, there is a portion of the book that I found really fascinating and it really it it it expands this version this vision of a farmers market that is set up between the mycorrhizal fungi and plant roots.

Okay? So here it is. I'm gonna read this direct from the book. Intrigued by these questions and having read Thomas Pitecke's work on wealth inequality in human societies, Keers began thinking about the role of inequality within fungal networks. She and her team exposed a single mycorrhizal fungus to an unequal supply of phosphorus. One part of that mycelium had access to a great big patch of phosphorus. Another part had access to a very small patch. She was interested in how this would affect the fungus' trading decisions in different parts of the very same network.

Some recognizable patterns emerged. In parts of the mycelial network where phosphorus was scarce the plant paid a higher price, supplying more carbon to the fungus for every unit of phosphorus it received. Where phosphorus was more readily available, the fungus received a less favorable exchange rate. The price of phosphorus seemed to be governed by the familiar dynamics of supply and demand. Most surprising was the way the fungus coordinated its trading behavior across the network. Kears identified a strategy of buy low and sell high. The fungus actively transported phosphorus using its dynamic microtubule motors from areas of abundance where it fetched a low price when exchanged with a plant root to areas of scarcity where it was in higher demand and fetched a higher price.

By doing so, the fungus was able to transfer a greater portion of its phosphorus to the plant at a more favorable exchange rate, thus receiving larger quantities of carbon in return. Alright, so that's the passage. So now what are we looking at? What are we looking at now? We're looking at a single mycorrhizal fungus, just an organism, a single organism that spans, let's just say, I don't know, 5 meters in diameter. Right? It's all part of the it's all part of the same organism. It's not 2 different networks. It's the same network and there's a there's a part of that network that is able to get a hold of a shit ton of phosphorus and it's there's like let's say that there's a small tree that just happens to be right there in that same general area area where that high phosphorus is. And then there's another tree that's 5 meters away.

But it's in a part of the fungus where the fungus is not accessing a large part of phosphorus. So what does the fungus do? It senses: Hey, I'm getting more sugar for this low end, phosphorus side tree than I am getting from this tree that is really close to the phosphorus patch. And I don't know I honestly don't have to spend that much energy to be able to transport the phosphorus to this tree because it's a half a meter away. But this tree over here is giving me a lot more sugar for my phosphorus. So what happens if I transport that phosphorus from one side of my network to the other side of my network and get more carbon for the buck?

We have arbitrage. This is arbitrage. That's all this is. Humans do it. Now, here's the fun thing to remember. Fungus and plants, well, they weren't plants. Okay? Essentially, what we have is this. Plants are farming fungus and fungus are farming plants. They're farming each other. Okay? But this relationship didn't happen after plants were born. This relationship most likely occurred about 500000000 years ago when fungus and algae that was floating in water kind of got together and started going, hey, hey, there's some mutually beneficial shit going on here. And then all of a sudden it gets washed up on land and all of a sudden maybe some of those algae that just happened to have be connected to some fungus. And that fungus was like, oh, rock. I know what to do with this. I'm gonna pump out organic acids. And I can make a shit ton of them because I'm connected to this plant and it's giving me carbon that I can manufacture the organic acids from. And then all of a sudden the plant's going, holy crap there's phosphorus.

And boom. 500000000 years later we've got Wall Street and it's just now in this breadth of a hair sliver of time that humans have been walking around and we're thinking that we figured it all out. That economics is something that we manufactured. It's that it's not part of nature. That it's something that a guy named Keynes and some Austrian economic guys started writing down, hey, this is how this shit works. This is what economies do. This is wealth of Nations and all that and I find it kind of laughable. Because all we're doing is what's called bio mimicry.

We learned everything that we know from nature because we grew up in it. Meanwhile, just to reiterate my point this entire arbitrage has been going on for 100 of 1000000 of years. And that just tells me that when somebody says that economics is just made up, that's not true. It might be the case that a couple of people got a hold of the ideas of economics but it was be it was ingrained in them in all of us in humans because we were here on the planet as part of this natural system or this grouping of natural systems and that they've engineered themselves into this tapestry that we call life But if we thought for an instant that economy is completely synthetic, That's not true.

This is proof. Economies have been here for at least 500000000 years when it comes to an interaction between at least 2 individuals trading with each other. Economy's been here for a long time. It's not going away anytime soon, which leads me to believe that the notion that Star Trek the TV show, you know, back in the day and all the way up till now they keep making them. The notion that we will not use money for trade is probably ludicrous because we've been doing it for half a 1000000000 years. I just I found that so interesting. I had to bring it to you. I hope you find it interesting as well. But we've got news. That's right, we do. The first up, Bitcoin Magazine. Hong Kong has approved the 1st batch of spot Bitcoin ETFs according to the issuers.

And this is Vivek Sin writing, Hong Kong has reportedly approved its 1st spot Bitcoin exchange traded funds or ETFs with multiple issuers announcing that they receive permission to launch the Bitcoin ETFs. And these are spot, by the way, and there's a couple of other differences. China Asset Management, Vocera Capital and other applicants posted on social media that they got clearance to list spot Bitcoin ETFs in Hong Kong. However, the Securities and Futures Commission has yet to release an official list of approved issuers. According to the posts, the Securities and Futures Commission greenlit China Asset Management to offer spot Bitcoin and shitcoin number 1 ETFs in partnership with OSL and BOCI International.

Other approved issuers include Harvest Global Investments, Hashkey Capital, and Vocera Asset Management. The news mirrors the success of spot Bitcoin ETFs in the United States, which launched in January and quickly attracted over $200,000,000,000 in trading volume. Hong Kong's approval marks a milestone as Asia's first jurisdiction to embrace spot Bitcoin ETFs. The ETFs provide exposure to actual Bitcoin rather than derivatives. Yes, we know that. But by approving the ETFs, Hong Kong cements its Bitcoin friendly stance amid ongoing efforts to become a finance hub. The accessibility traded funds or sorry. The excessively traded funds could stimulate significant retail and institutional demand. However, an official SFC announcement remains pending.

Some of the social media posts sharing the alleged approvals have since been deleted. The opacity around permissions could contribute to market uncertainty in the near term. Nonetheless, the report approves signal approvals signal a willingness at least by Hong Kong's regulators to meet surging investor appetite for Bitcoin. The ETFs launch will mark a major milestone for Bitcoin adoption and maturity in Asia. Okay. So again, I got I continues I feel that it's necessary to reiterate I do not buy the ETFs and I never will. Unless, of course, I get into a job or whatever that's got a 401 ks, then I will be actively asking HR, hey, find a fund that invests in the Bitcoin spot ETFs.

Outside of that, I don't care, right? But it's still like not unimportant. It's a thing that we have to deal with, and it's a big thing that we have to deal with because Hong Kong and I don't know why they're saying trying to be a finance hub. They are a finance hub. Hong Kong has been a finance hub for decades decades decades. But be that as it may, there's a there's a thing about these ETFs. These spot Bitcoin ETFs are indeed unlike the United States counterpart spot Bitcoin ETFs. Because in the United States, if I want to liquidate my position in a spot Bitcoin ETF fund, they actually have to sell the Bitcoin and give me United States dollars.

Right? That is a cash and carry type of spot ETF. The ones that are coming in Hong Kong are in kind. Which means that I can place, as far as we know so far because the SFC has still yet to say yes or no, right? That's another thing about this. The SFC is still yet to actually say it. But as far as we know, I can take Bitcoin that I already own and put it into the ETF. Or if I decide to liquidate my position in an ETF, they don't have to liquidate the Bitcoin for, for, what is it, renminbi or whatever it's going to be. They can just give me the Bitcoin. This is in kind not cash and carry. It's a different beast altogether and it's going to be interesting to see if there's a huge difference in the way these two operate and secondly, it's going to be interesting to see if there's a huge difference in how they affect markets, but we will have to see because still the SFC has not said yay or nay, which completely mirrors the way that the whole thing was handled in the United States, Where the SEC made this tweet or whatever and said it's approved.

They're all approved. We're gonna be rich. Blah blah blah. And then the SEC was like, no, dude, take that down. We didn't say nothing. And then like a day later, which was the day that they were actually supposed to make the announcement, they finally made the announcement that, yes, indeed, that they have. Will the SFC is I mean, honestly, I I kinda wonder if this is a mechanism that they're employing. But be that as it may, I expect these things to actually be be approved in Hong Kong And remember that there's fundamental differences between the 2. To buy a Bitcoin ETF or liquidate a position in ETF in the United States means you're having to handle dollars.

In Hong Kong, it's just Bitcoin. You don't have to liquidate, you don't have to send cash. We'll have to see how that actually, you know, works out. But over there in Fiji, they're not having as good of a day. Because their central bank has warned against crypto use, which is disappointing Bitcoin hopes in Fiji. According to Derek Anderson for Cointelegraph, the Reserve Bank of Fiji has issued a warning to the public against using cryptocurrency for payment or investment. This is a reversal of the Fijian prime minister's perceived position on crypto.

Fijian residents may even face criminal charges for investing in cryptocurrency abroad using funds held in Fiji, the release added. Apparently, the warning was motivated by cryptocurrency promotion in the country. Quote, the governor of the RBF, mister Arif Ali, acknowledged that there are indicators of persons or entities promoting cryptocurrency investment schemes in Fiji. These investment schemes are increasingly being promoted through various platforms, including social media. The RBF has not licensed any person or entity to provide cryptocurrency investments or trade in virtual assets, end quote.

Hopes were high for the adoption of Bitcoin in Fiji after Stivani Rubuka, I guess, a longtime presence in Fiji's political scene, became prime minister in December of 20 pronounce this guy's name but it's Lord Fusiutu, I think is one of the ways that he's known, who labeled rebukas pro Bitcoin in a Twitter post shortly after rebukas election. Quote, let's go 2 for 2 BTC legal tender bills for the Pacific in 2023, Fusito's post, post read. Lord Fusito went on to explain that Rebuka asked me to meet with him a number of times and show him step by step how Fiji can do Bitcoin legal tender like Tonga. A comment on Fusetsu's post noted that Rebuka had not made any public statements on the use of Bitcoin, quote. I don't think he's been asked about it, he replied.

Lord Fusitus was a vocal proponent for the introduction of Bitcoin in 2022 to the extent of converting the national treasury to the cryptocurrency, and those measures have yet to be enacted in the country. The new statement from the RBF is in line with the advice of the International Monetary Fund, here we go, on cryptocurrency. The IMF released a paper on the use of digital money in Pacific Island Countries in February, in which it called cryptocurrencies poor substitutes for means of payment, and they carry additional macroeconomic risks. So the IMF is telling the Pacific Islanders what they can do.

And and and they're taking their advice. Why? Because they need the loans. That's how the IMF keeps the short you don't need bullets or bombs anymore. I think, honestly, we're, you know, we're this whole thing with Ukraine and Israel and Hamas and now Iran who whatever, did their thing over the weekend. It seems like old world stuff. What I'm like you really gotta do is make sure that your entire island nation will starve to death unless you do exactly what they say. Which is exactly why you need Bitcoin, which is exactly why you need to tell the IMF to go pound sand, that it's none of their business.

But let's move on to Norway, where they're also being stupid. Bitcoin miners could be forced out of Norway with a new data center law, Andrew Thorvallis from Decrypt. Norwegian lawmakers have passed a law placing data reporting requirements on Norway's data centers intended to regulate the use of energy devoted to crypto mining operations, the biggest of which revolves around, of course, Bitcoin. According to digitization minister Karianne Tung and energy minister Terje Aslund, the government aims to close the door on crypto mining in general.

The purpose is to regulate the industry in such a way that we can close the door on projects that we do not want, said Tung, according to a local news report. The new law, first of its kind in Europe, requires data centers to register with the government, report who owns and manages it, and explain what services it offers. Aslan claimed that this will help the country direct its energy consumption towards socially useful services and infrastructure, among which crypto is not included, probably because the IMF told them to do that. Quote, it is associated with large greenhouse gas emissions and is an example of businesses that we do not want in Norway, he said with support from Tong.

Bitcoin mining is a globally a global industry in which individuals and businesses race to my new units of BTC. Yes. We understand that. Quote, they are not welcome in Norway, Aslan continued. We want serious actors who are important to society, and the society serving computer industry is important to us. The Norwegian officials have received harsh backlash from mining industry experts who say no part of Aslan's claims about mining are backed by any data whatsoever. Quote, Bitcoin mining has an ultra high 55% sustainable energy usage higher than any other global industry or major industrialized nation, wrote ch4 Capital cofounder Daniel Batten on Twitter on Monday. Furthermore, Bitcoin miners don't emit greenhouse gases themselves but have secondary emissions from an underlying power source.

Norway, specifically, is almost entirely powered by cheap, renewable hydroelectricity which is part of what makes it attractive to Bitcoin miners in the first place. Quote, the ability for the state to decide who has a right to use energy and who does not is by definition discriminatory, Batten added. Further quote, Asland doesn't have a problem with people using power for watching porn, a much higher energy usage, but he has a problem with people using energy for Bitcoin mining. Alright, so that's that's that. It's the same trope.

It's the same it's the same old b s, isn't it? And now Norway is basically pulling the revolver out of their holster, cocking the hammer, putting it to their head, and hopefully they don't actually pull the trigger. They haven't pulled the trigger yet, but but the language from this Aslan guy, I think that they very well may do it. And they're gonna screw up. They're gonna completely screw up. Because now those miners are gonna move where? They're gonna move to Texas. And they're gonna give the United States even more mining capacity and you don't want that.

Even as a United States citizen, I don't want all the mining here. I don't want a third of the mining here. I maybe 5%. But this shit needs to be distributed globally. That just helps with decentralization. But you already know that. So let's run the numbers. CNBC Futures and Commodities got West Texas Intermediate Oil down slightly just under I don't know, man. Just under a percent. $85.5 8¢. Brenton, North Sea is down, 0.19%. Let's see. $90.28. Natural gas, however, is down 4 and a quarter percent to $1.69 a 1000 cubic feet, and gasoline is down a third to $2.79 a gallon.

Gold doing well today, 0.61% to the upside. Silver is doing even better, 1.75% to the upside. Platinum is down 2%. Copper is up 2 and a third. Palladium is down 2 points. Most of your all the agricultural futures are mixed. Coffee is the biggest winner. No, rough rice is the biggest winner. 6.38 percent to the upside. Biggest loser today is sugar, 1.86 to the downside. Live cattle is up 1.4%. Feeder cattle is up 1.75. And I don't know what they did with live hogs, but they're not point 75. And I don't know what they did with live hogs, but they're not here in livestock futures anymore. The Dow is down 0.69%.

S and P is down 1.15%, Nasdaq is down 1.6%, and the S and P Mini is down 1.11%. Onto Clark Moody's dashboard, $63,000 Good god almighty. People are freaking stupid. That's gotten us down to 1 point $24,000,000,000,000 of market cap. There's 19,683,392,990 BTC in circulation as we speak. 625.9 x of hashes per second is the average hash rate over the last 20 2016 blocks. 0.42 BTC, average fees per block. Yes, fees are running high today. Halving estimate is still sticking at April 19, 2024, and the block space percentage for taking out the trash that is orbit ordinals has increased to 1.8%. Good Lord, you people are sick. Stop it. Stop it.

200 and 8 blocks, wow, carrying 179,000 unconfirmed transactions waiting to clear at prices of 97 satoshis per vbyte for high priorities. Low priority is gonna get in at 71, and anything under 5 0.92 satoshis per vbyte are being purged from mempools around the world. Now from, oh let's do this one first, from B from Brazil, Bitcoin and podcast, I think that was A episode 883, I've got the following boostograms from letter 6173 with 30,000 satoshi says, including this boost I have now sent Bitcoin and a total of 1,000,000 satoshis. And you earned every sat, and I implore others to contribute if they enjoy the content. Thank you, letter.

Dubravko with 16:30 gives his nostril pub or, gives a nostril pub, thank you for the shout out. I just got back from the short eclipse vacation and I'm going to check the stock in the morning. And he's Dubravco is Oak Grove. That's my guy with the, God, black soldier fly larvae. Get a hold of Oak Grove if you want some of them. Pies with 420 says, thank you sir, no thank you. God's death with 337 says, thank you sir, no thank you. Now on to Noster and hottlebod. This was the first episode that I or the first interview that I did that was sit down face to face and I'm addicted to it already.

I'm addicted to sitting down with people face to face already. It it's just a superior format. Not Skype, not Zoom, not over the phone, sitting down, same room, 3 feet, 4 feet away from each other, just hashing it out. For Cas Peland boosted that episode 15,000 satoshis, and he says thank you. No, thank you. Wartime with 3,333 says, very much enjoyed the long format and discussion. Dabravco with 1640 says, great interview. Very interesting. Good news. Saw the Blue Angels with the kid. Bad news. I don't currently have enough BSBF larvae to split.

Okay, so he is low on his black soldier fly larvae, keep that in mind. Blogging Bitcoin with a 1000 satoshis sent me an interesting zap. He basically built a split zap note for both me and haldobod, 5050 on either side of that split. But you have to go to the particular note. Here, he gives the note ID, but it just it doesn't it doesn't resolve or it doesn't, it doesn't resolve inside a fountain. So I just I can't show it. Alejandro with a 1,000 says, nothing. Slow slow with a 1,000 says, great rip. Lucky mofo Fo with 500 says, David, Portuguese totally is a romance language, the most difficult to master for foreign speakers. In written form, Portuguese and Spanish are remarkably similar.

Spoken word is a different story. Thanks for the show. Oh, thanks for the information. That was interesting. Pies with 420 says, thank you, gentlemen. No, thank you. God's death with 337. Thank you, sirs. No, thank you. Big Gus with 200 says boost. Fountainhead with a 100 says nothing. Hold on. Magnus Nemo. Magnus Nemo? Magnus Nemo with a 100 says nothing. Stacy with a 100 says nothing. And I'll take this time to remind you guys, if you like what I'm doing, I need the support of the show. Your donations to this show are the only reason I keep doing this. Well, I really like doing the show. But eventually bills got to get paid.

I just I need the donations, right? And I've got to the point now where I'm taking Adam Curry's advice where I'm not gonna be shy about asking for the donations. I use the donations that I've gotten to this show and instead of you know, spending it on food, I well, I bought the rig that I used to record me and huddle bod together in a room and it's just like I said, I think it's a superior show. I think it's a superior product. If you want the show to become more superior, I need your help. So boostograms, zap me on Noster.

I've got a patreon. He's like the patreonforward/bitcoinandpodcast. I'll take fiat, it'll get converted into satoshis, but I'll take the fiat. Any like, but basically it's the boostograms that really do it. And I'm able to like now that I'm using my get Alby wallet to collect up the boostograms and streaming satoshis on this show, I have not yet run into any kind of problem whatsoever on getting large boostograms. So if you like what I do, if you think it's valuable then shave me off some satoshis and send me a boostogram. That's the weather report.

Welcome to part 2 of the news that you can use. John Deaton's crypto backers helped out raise, senator Warren in the senatorial race. Jesse Coughlin's got it from Cointelegraph. This is kind of interesting. Pro crypto lawyer John Deaton has outraised Senator Elizabeth Warren over the Q1 of this year for his bid to seize her senate spot, bankrolling $1,360,000 compared to Warren's 1.09 $1,000,000. A who's who of crypto backers make up Dean's top donors, including Ripple executive Chris Larsen and Brad Garlinghouse, Gemini co founders Cameron and Tyler Winklevoss, SkyBridge Capital founder Anthony Scaramucci, Cardano, and Ethereum cofounder Charles Hoskinson, and Kraken cofounder Jesse Powell. In total, Deaton's contributors have given him nearly 300 and $60,000 for the Q1 of 2,024, plus the $1,000,000 that he loaned to his campaign, preliminary filings to the United States Federal Electric Election Commission show.

In comparison, Warren reported raising just under $1,090,000 from all donors alone. Dayton rose to prominence defending Ripple. I know. Sickening, but it is what it is. And their interest in the Securities and Exchange Commission's legal fight against Ripple. He announced his bid for senator Warren's senate seat, representing Massachusetts in February running as a Republican against the 11 year Democratic Party incumbent. Warren has long campaigned against crypto. Yeah, we know. Among Deaton's largest individual contributors were Ripples, Larson and Garlinghouse, Scaramucci and the Winklevii.

This is not the guy that I want in Congress. I mean, honestly, at this point, I think I'd rather have senator Warren. She is dishonest as it comes, but she's so blatantly transparent about her hatred for crypto, at least I know where she stands. At least I know where she stands with this guy, this Deaton dude, the fact that he's being backed by Chris Larson and Brad Garlinghouse from Ripple by itself is a huge red flag. Huge red flag. I wouldn't want that this guy anywhere close to this crap. But it looks like he's out raising her. So if you're in Massachusetts, what are you gonna do?

Who are you gonna vote for? Yeah, I know man. That's kind of a sickening situation, isn't it? I don't know for me. I think it's better the devil, you know But whatever. Satoshi 7b, open source Bitcoin Centric Large Language Model. Quote, we are proud to announce that this model is open source and freely available for anyone to use, modify and enhance. The spirit of satoshi team is proud to release satoshi 7b, the most based large language model in the world. It is the culmination of almost 9 months of experimentation on a whole suite of open source models, and we're thrilled to share it with the world.

Satoshi 7 b is a large language model fine tuned on a q and a dataset related to Bitcoin principles, technology, culture, in addition to Austrian Austrian economics and non woke political perspectives. It is intended for use as a Bitcoin education, culture, and economics assistant. Quote, the Satoshi 7 b is ideal for anyone who's tired of using mainstream models, whether open or closed source, that avoid answering controversial topics, regurgitate Wikipedia esque answers, pre and post frame responses with apologetic excuses, or flat out tell you that the blue sky is green.

As a demonstration, we're providing a model specifically fine tuned for chat, which you can try out immediately here. And here is a link to app.spiritofsatoshi dotai. So you can go try it for yourself. You can download it yourself and run it all by yourself, and they give I think it's the huggingface.c0 link, is that's what they're given there. So you can actually use it anywhere, including locally with our reference implementation. You can even deploy it to any cloud. And you can use it, of course, on Hugging Face itself. Thank you for to the entire community and in particular our patrons.

Your support helped make this happen. Stay tuned for more. So if you want to use a non woke AI chat or large language model then consider satoshi 7b. However, be aware. 7b refers to 7,000,000,000 parameters. Sounds like a lot. But when you place a 7,000,000,000 parameter next to a 14, 21, 36,000,000,000 parameter model, You get what you pay for. But I I expect even better things from Alex Vetsky. He's the guy that's behind this Spirit of Satoshi project. I expect larger models to come out in the future. This I think this is just a trial run just to see what happens. I've used it. It's interesting and expect expect what you kind of already expect from large language models, except that this is non woke.

But, I mean you can't just rely on these things no matter who they're from to answer definitively a question that you have. I think it's good to use as a starting point much like I used to tell people, hey, there's no no reason not to use Wikipedia as long as you don't have it as a 100% source of information. Same is true for the large language models, even ones that are given, you know, that are built by our friends in the Bitcoin ecosphere. Alright, last up today, Paraguay reconsiders its mining ban in favor of selling excess energy to Bitcoin miners. So unlike the dudes over there in Norway, Paraguay seems to have their shit straight. Let's find out more.

A recently introduced bill proposed a sweeping ban on bitcoin mining. However, the senators have now halted progress on the ban and are considering selling the country's energy surplus to miners instead of selling it to Brazil and Argentina at low prices. Quote, today, we approved a declaration whereby the senate of Paraguay supports local and foreign investments in infrastructure and urges the Ministry of Industry to study the economic of selling surplus energy to the crypto mining industries. Senator Salz Bizzoque wrote on Twitter, a public hearing to debate the pros and cons of Bitcoin mining in Paraguay is said to be held on April 23rd.

Quote, banning Bitcoin mining could cost Paraguay more than $200,000,000 a year, assuming the country has 500 megawatts of legal miners paying 5 United States pennies per kilowatt hour in operating expenses, said HashLab's mining cofounder and chief mining strategist, Jarron Millerud. Some of the Bitcoin mining industry representatives have already held constructive meetings with the local government officials. So backtracking what Paraguay was going to do, which was a full scale mining ban on Bitcoin, apparently cooler heads immediately prevailed and that's a good sign.

That's a very good sign. That is in stark, almost mirror image contrast to the guys over in Norway that are saying that they want to ban mining and then are making actual statements about banning mining and using the FUD that we've been fighting for the past 5 years on its energy usage and it's co2 stuff and all that kind of crap. So Paraguay, from the 2 countries, Paraguay is actually the smarter country. They want to get something out of the stuff, the excess energy that they have. That's just market. That's being a fungus. If you wanna be smart, be more like a fungus.

Just I'm just saying man. It's it's it's it's literally is just that simple. Okay. I'm just gonna go ahead and end that here. We are 46 minutes minutes in. I kinda wanna keep the new shows definitely under an hour from now on. I will see you on the other side. This has been Bitcoin and and I'm your host, David Bennett. I hope you enjoyed today's episode and hope to see you again real soon. Have a great day.

The oldest free market in existence

Approval of spot Bitcoin ETFs in Hong Kong

Reserve Bank of Fiji is killing itself

Norwegian government to HFSP

Market update

Boostagrams and contributions from listeners to the Bitcoin And podcast

John Deaton's fundraising efforts for the senatorial race against Senator Elizabeth Warren

Satoshi 7b: the open-source Bitcoin-centric large language model

Paraguay reconsidering a mining ban