Join me today for Episode 870 of Bitcoin And . . .

Topics for today:

- Trump on Corn

- ETN's a Financial Weapon?

- Silver Falls to the King

- Porta Hardware Wallet

- Wu Wu! A 4nm Mining Chip

#Bitcoin #BitcoinAnd

Circle P:

MAPLE SYRUP!:

npub: npub172mu27r5yny0nnmvgjqwhx055dmsesrrx7j0p5d3pxagfx6xgxfsv75p3q

nostr handle: @beisnerds

Twitter: @beisnerds

Product: Maple Syrup and Soaps

Articles:

https://www.coindesk.com/business/2024/03/11/donald-trump-sounds-more-constructive-on-bitcoin/

https://cointelegraph.com/news/london-stock-exchange-bitcoin-ethereum-etn

https://decrypt.co/221151/microstrategy-205000-bitcoin-treasury

https://www.coindesk.com/markets/2024/03/11/bitcoins-market-cap-jumps-to-14t-surpassing-silver/

- https://www.cnbc.com/futures-and-commodities/

- https://www.cnbc.com/bonds/

- https://dashboard.clarkmoody.com/

- https://mempool.space/

- https://fountain.fm/show/eK5XaSb3UaLRavU3lYrI

https://decrypt.co/220918/coinbase-backed-85-million-crypto-super-pac-senate

https://www.nobsbitcoin.com/bitdeer-4nm-bitcoin-mining-chip-seal0/

https://www.nobsbitcoin.com/portal-by-twentytwo-devices/

Find me on nostr

npub1vwymuey3u7mf860ndrkw3r7dz30s0srg6tqmhtjzg7umtm6rn5eq2qzugd (npub)

6389be6491e7b693e9f368ece88fcd145f07c068d2c1bbae4247b9b5ef439d32 (Hex)

Twitter:

https://twitter.com/DavidB84567

StackerNews:

stacker.news/NunyaBidness

Podcasting 2.0:

fountain.fm/show/eK5XaSb3UaLRavU3lYrI

Apple Podcasts:

tinyurl.com/unm35bjh

Mastodon:

https://noauthority.social/@NunyaBidness

Support Bitcoin And . . . on Patreon:

patreon.com/BitcoinAndPodcast

Find Lightning Network Channel partners here:

https://t.me/+bj-7w_ePsANlOGEx (Nodestrich)

https://t.me/plebnet (Plebnet)

Music by:

Flutey Funk Kevin MacLeod (incompetech.com)

Licensed under Creative Commons: By Attribution 3.0 License

creativecommons.org/licenses/by/3.0/

[00:00:00]

Unknown:

Good morning. This is David Bennett, and this is Bitcoin Ant, a podcast where I try to find the edge effect between the worlds of Bitcoin, gaming, permaculture, podcasting, and education to gain a better understanding of all. Edge effect is a concept from ecology describing a greater diversity of life where the edges of two systems overlap. While species from either system can be found at the edge, it is important to note there are species in the overlap that exist in neither system, and that is what I seek to uncover. So join me in discovering the variety of things being created as Bitcoin rubs up against other systems. It is 9:31 AM Pacific Daylight Time. That's yes. We we did it. We we did it again here in the United States and other countries around the world.

We decided that it's still an absolutely excellent idea. Beyond all other ideas, it's that it's a good idea to not once, but twice a year change the time by a full hour so that, you know, we can I I don't know why we're doing this anymore? I I'm not even certain why it occurred in the first place. All I know is that daylight savings time and changing back again is physiologically bad for you. It's not good. It confuses people. It actually spikes heart attacks every single time that it's done. I don't get it. I think it's foolish. I think we're playing with fire. And the entire time change thing needs to end. In fact, I'm wondering if it's not applicable at this point to just for just Bitcoiners themselves just say we're done.

And we pick a time and that's the time that like we literally we pick a time and say this is now the time whether it pick daylight standard or daylight saving or whatever it is and we all agree and we say this is now the Bitcoin time, aside from the block time, but this is the Bitcoin time of day, right? This is the Bitcoin time of day. And then when the time changes and you show up an hour late for work, you just look at your boss and say, I'm sorry. I don't put up with bullshit. I just don't put up with bullshit and I don't have to put up with bullshit. Why? Because I have some Bitcoin. We're at an all time high again. An all time high again. Another all time high, ladies and gentlemen. Looks like, I don't know, 72,500 something like that.

It's insane. It's Monday. It's the start of a new week. Let's get into it with the circle p. Dive into the wildly pure, outrageously rich flavors of nature. With our funky artisanal handmade maple syrup whipped up from the grooviest of maple trees, each bottle pops with a sweet vibe of tradition and top notch quality. Pancakes, waffles, or that secret recipe begging for a twist of sweet funkiness? Well, we've got you covered. Jazz it up. Jazz up your eats. Jazz everything up with a splash of our amber magic. Hit us now. Hit us up. Just give us a call.

Throw me a note and groove to the best of true craftsmanship. Taste the difference? Ladies and gentlemen, taste the fun. That'd be maple trade. That's maple trade, aka beisnards@beisners. Yeah. There's no website. You're gonna have to get a hold of this guy through a direct message either on Twitter or on Noster because it's at b e I s n e r d s on both the dead bird site and the future of communications, which is Noster. He makes maple syrup. He makes them by hand, his own trees. He taps them by hand. He lugs the sap over to a boiler. He boils it down with hardwood. That's right. He lights up an actual God on his fire underneath this thing and boils it outside in the pleasure of the early early early spring.

And he boils it down and puts it into bottles and he'll sell it to you. And if you tell him if you tell Maple Trade, AKA Bisonerds, that you heard it here on the Circle P from the Bitcoin and podcast, He will cut me in on some of those sweet, sweet profits. Psyduck, just saw you join the livestream. How you doing there, brother? You can get a quart for $27. You can get 3 for $68. You can get half a gallon for $45 or 2 half gallons, also known as a full gallon, for $80. You can get 4 pints for $50. Again, hit up at b e I s n e r d s over on Twitter. Well, or dead birdsite. And the new site, the new stuff, the new funkiness, the new coms, the new everything because it stitches all of our worlds together. That would be noster at b e I s n e r d s. Make sure that you tell them you heard it here on the circle p. Now Donald Trump has entered the fray again.

This time, he's got a slightly different message when it comes to Bitcoin. Let's find out more from CoinDesk. Oliver Knight is writing it. Former United States president Donald Trump has continued to come around on Bitcoin, calling it an additional form of currency in a CNBC appearance. Quote, there has been a lot of use of that, you know, that Bitcoin, and I'm not sure that I would want to take it away at this point. Like you could, little orange man. The comments represent a stark change in stance from his 2021 stance when Trump labeled Bitcoin as a scam that threatened the United States dollar as the world reserve currency.

Trump's comments this morning follow remarks he made last month when he said bitcoin had, quote, taken on a life of its own and that it will probably need some regulation. To be sure, the GOP standard bearer for the 2024 presidential election is a long way from becoming a Bitcoin maxi or showing anything other than a passing interest in the cryptocurrency, quote, I want one currency. I want the dollar. I don't want people leaving the dollar. Good God. Please don't love the dollar. He continued before moving on talking about the great interest shown in some of his NFT offerings. Quote, people were going crazy for these things, these NFTs.

And so many of these were bought with this new cryptocurrency. And I couldn't believe the amount, he said. Trump added that he would not allow countries to go off of the dollar because when the United States loses that standard, it will be like losing a revolutionary war. But we have a lot of Bitcoin at the US Marshals office. You should just say that take the win and wear the crown, go home brother. Trump has regularly been posting screenshots of his bullish odds on Poly Market, a crypto based shitcoin prediction market. So here we go. Yay. Oh, thank you last ask for the 2,100 satoshis. That's a lot of money nowadays.

And sidetuck21, also a lot of money nowadays. What do you guys think about not Trump in general, because I know most for whatever reason most people hate Trump. I honestly don't understand why everybody's pissed off at him. I don't like him simply because I never kinda have liked him. You know, but I mean that I I was watching this guy when Oprah Winfrey kept bringing him up in the eighties when she was just getting her show, the Oprah Winfrey Show off of the ground, because guess what? She hasn't always been around. She regularly had Donald Trump on her show.

Regularly. She regularly had Donald Trump on his on her show. She loved Donald Trump. Of course, then again, at the time, Donald Trump was a staunch Democrat. He was a staunch New York Democrat. Now she hates him. Of course, because if you like Donald Trump, you're a pariah. Right? But all that aside, what does anybody think about Donald Trump now starting to say not terribly not hold on for a sec. The USDA has just issued a warning over lack of snowfall in Washington state. We're all gonna die from climate change. What so is he is he doing what I think that the man is doing? Where he's just he's just singing the praises while it's popular so that he can get the vote? See, that's what I think.

I don't think he gives a shit one way or another. But I'll tell you one thing, this entire quip about him saying that he doesn't let's see, where was it that he said this? He said that he would not allow countries, plural, like more than 1 country, to go off of the dollar. I I'm sorry, but I I don't think you really have to say in any country outside of the United States, at least not legally. Now, of course, you can send the USS Ronald Reagan over there to wipe the floor with their ass if they, you know, do something that you don't like, which is what we normally do. But when you tell other countries what they can and cannot do and you're not even president yet, you know, you had the election hasn't even been held yet. I I just think that the the amount of hubris that this man shows is one of the reasons why I actually don't like the guy.

But he's I mean, it doesn't really matter though, because I I don't like any of these people. And neither should you because you shouldn't trust these guys. They're too old. And hell, I'm old, and even I'm looking at these guys so saying, you're too old. You don't have a a hope in hell of understanding the new world. You can't see it. And even if you did, you wouldn't really understand it. All they really see are ghosts in the machine, and they're scared of them. So where's another ghost in the machine popping up? London?

Yep. London. The London Stock Exchange is going to accept Bitcoin and shitcoin number 1 exchange traded notes. Notes like notes on muster, except a little different. We'll get into it. Cointelegraph, Ezra Raguera writing, this London Stock Exchange has announced that it will start accepting applications for bitcoin and shitcoin number 1 crypto exchange traded notes in the Q2 of 2024. On March 11th, the exchange confirmed that it would accept applications following the guidelines specified in its crypto ETN admission fact sheet. Oh, it's a fact sheet. However, the exchange did not provide the exact date that it will start accepting applications in the fact sheet.

The exchange said that crypto ETNs should be physically backed and non leveraged. Oh, that should be interesting. They should have a market price or value measure of the underlying asset that is publicly available and must be backed by Bitcoin or shitcoin number 1. The exchange also highlighted that the underlying crypto asset should be wholly or principally held in a cold wallet or something similar. In addition, the asset should be held by a custodian subject to anti money laundering laws in the United Kingdom, the European Union, Switzerland, or the United States.

The Exchange defines ETNs, otherwise known as exchange traded notes, as quote, debt securities which provide exposure to an underlying asset, Crypto ETNs allow investors to trade securities that track the performance of crypto assets during the exchange's trading hours. An ETN is widely considered a soft alternative to exchange traded funds. Unlike the ETFs, an e t n is a debt instrument backed by its issuers rather than a pool of assets. ETFs often focused on esoteric debt strategies that do not easily fit into funds. Meanwhile, the UK's Financial Conduct Authority also announced that it would not object to request from recognized investment exchanges or RIEs to exchange to create a market segment for crypto backed d tns. According to the FCA, exchanges can offer the products to professional markets. You can just read that as gatekeeping because they don't like you. They only want their buddies to be rich. We'll come back to it. The financial watchdog also urged exchanges to ensure sufficient controls are in place to protect investors adequately.

The FCA also said that crypto backed ETNs must meet requirements such as ongoing disclosures and prospectuses, which are part of the UK listing regime. While exchanges can offer ETNs to institutions, the FCA said that they are unsuitable for retail investors for retail investors because of their risks. Gatekeeping. Gatekeeping. They're unsuitable for you because you're a stupid pleb. And there's no possible way that you living over there in the UK would have any amount of education that would be required for you to understand how to, oh, I don't know, get up out of a chair and walk out of a fucking door. Because you're too stupid.

You're too you retail sons of bitches are just the lowliest, crappiest, saw digging bastards ever. I mean, it's just so sad when I read this kind of stuff. The regulator said that selling crypto backed DTNs to retail consumers will remain banned because you suck. Quote, the FCA continues to remind plebs that crypto assets are high risk and largely unregulated. Those who invest should be prepared to lose all of their money, the regulator wrote. It's just an advertisement for getting their friends rich, but it's also an advertisement for something else. Let me see if I can pick back up the thought that I just had. Alright. Hold on.

Debt instruments backed by issuers rather than a pool of assets. Oh, yes, I know. Okay, so here's the sentence. Unlike the ETFs, an exchange traded note is a debt instrument backed by its issuers rather than a pool of assets ETFs often focus on the esoteric debt strategies that do not easily fit into funds I had a thought when I was reading that and here's the thought I think Bitcoin is going to unmask instruments, financial instruments that were designed to destroy an asset. Let me say that again. I think Bitcoin's existence, especially now that we're seeing it kinda run up a little bit. Right? I think what we're gonna see is since it's a brand new asset class that nobody has seen in more than a couple of fistfuls of decades, that when we hear shit like, oh, well, they're not gonna give you a spot ETF. No. They're gonna give you an exchange traded note, and it's gonna be it's gonna be a debt backed instrument by the issuers and not really centered on a pool of the actual asset that underlies the thing that they're writing the note for. That tells me that that's not an investment vehicle. It is a vehicle of potential destruction that they've probably used to suppress or completely crush the ability for plebs like you and me to have anything at all. Because the serfdom out there, the the people that service the fiefdom, the people that dig around in the sod like that scene in Monty Python and the Holy Grail where he's like, I'm being repressed. Help me. Help me. You see him repressing me.

See, that's where they want us. I think when people say stuff I think what we're gonna see is we're going to start really realizing what actual investment vehicles look like and what the instruments of total financial weaponized destruction to make sure that only certain people make money. We're going to see what those actually look like. We're going to figure out the actual names. And then we're gonna be able to go back into history and find out every single time that predator parasitic class has destroyed the ability for any normal person to be actually happy.

Not because they're rich, but because they're not worried about dying all the time. They're not worrying about their children crying all the time. They're not worried about themselves crying all the time. That they can walk out of their door and be happy to be fucking alive. That they can look at the sun and bathe in it and say, this is good. The universe has provided a good. God is good. Whatever it is that you think has created this existence that we walk around in, that we can have the ability to be happy walking around in. Whatever makes you comfortable, I think what we're going to see is the instrumentation that has been used for 100 of years to make sure that you and me have never been able to experience true, honest to God, walking around this existence in a smile.

And I think an ETN is exactly one of those instrumentations. I don't think it's designed to build wealth for anybody other than a certain class of people that seek to build wealth off of destroying another class of people. I think it is a weapon against Bitcoin. I don't think it's good. I'm just saying, just don't get me wrong. Don't let me get out of this without telling you the God's honest truth of what I feel because when people say, oh, tell us how you really feel. When somebody says that to me, I take it as a fucking insult. Why wouldn't I tell you how I really feel? Under what existence would you have me live that I do not tell you how I actually really feel?

When people use that shit as an insult, it is one of the most annoying, most telling things that I've ever heard in my entire life. Why wouldn't you want me to tell you how I feel? Are you playing with Barbie dolls and you just want to hear what's in your own head paired it out by something else that's made of plastic. MicroStrategy is not gonna have any of it. No. No, sir. Michael Saylor said no. Because they have 205,000 in bitcoin. Not dollars, they have 205,000 Bitcoin. Bitcoin. MicroStrategy's 205 1,000 Bitcoin Treasury is bigger than all of the other BTC treasuries combined, decrypts Stacey Elliott with its latest purchase, which apparently went down sometime, I don't know, Friday. I'm not sure. I wish somebody would actually say exactly what time this shit was bought. But with its latest purchase of 12,000 Bitcoin, MicroStrategy has now amassed a 205,000 BTC Treasury.

The software company's treasury is now worth approximately $14,700,000,000 at the current Bitcoin price. The list of companies with publicly disclosed Bitcoin treasuries have been growing. But it's hard to overstate just how dominant MicroStrategy has been in the realm of corporate Bitcoin stashes. Its 205,000 BTC stockpile is more than it's currently held by all other 44 companies tracked on the Bitcoin Treasury's website, which you can get to at bitcointreasuries.net. That's bitcointreasuries.net. Keep in mind, that list includes every publicly traded Bitcoin miner like Marathon Digital, HUD 8, and Riot Platforms. It also includes electric vehicle manufacturer, Tesla, crypto exchange, Coinbase, and payments firm, Block Incorporated, which is helmed by Bitcoiner Jack Dorsey, quote, we're buying it to hold it for a 100 years.

That's 66,000 to a $16,000 crash that shook out the tourists, MicroStrategy founder and chairman, Michael Saylor, said during a CNBC interview on Monday morning, quote, that shook out the non believers. When it was 16 ks, we were all ready to ride it to 0. And that's what you'll find with the Bitcoin maximalists, end quote. MicroStrategy now has more Bitcoin than BlackRock's iShares Bitcoin Trust currently holding, or currently holds to back shares of its ETF. But MicroStrategy would have to keep buying Bitcoin at a blistering pace to hold on to that honorific. The company announced last week it was looking to raise $600,000,000 to buy even more Bitcoin.

But the offering went even better than the company anticipated, which is normal. That's completely normal. It's happened every single time he's done it. MicroStrategy, which trades under the micro MSTR ticker on the Nasdaq said in its Monday SEC filing that there was so much demand for the offering that it upsized to a total of $800,000,000 Ladies and gentlemen, boys and girls, that's $800,000,000 I told you on it was either Thursday or last Friday that he started at 6, and he had to raise it to 700,000,000, and he ended up having to raise it another 100,000,000.

So he went from $600,000,000 offering to an $800,000,000 offering and it all got bought. MSTR shareholders seem to like the news. At the time of writing, the stock the stock is trading for $154.42 a share, up from 6% from its previous close on Friday afternoon and a 110% higher than it was this time last month. MicroStrategy share price has no doubt been helped helped along by the recent Bitcoin price rallies. Just this morning, Bitcoin soared past 71,000 and then 72,000 a few hours later, Making it nearly impossible to decisively make a call on BTC's new all time high price.

So MicroStrategy making everybody look bad. Now when it when it says that he's gonna have to continue buying Bitcoin at a blistering pace, to be able to keep the honorific of having the most Bitcoin in a single treasury, it that's not gonna last. There's only I truly believe that there is only so much that Michael Saylor is going to be able to actually do up against something like BlackRock. I mean, MicroStrategy would actually have to convert and and don't put it past him. He's making MicroStrategy is making more money on this Bitcoin strategy than they probably ever made collectively on selling software over the last couple of decades.

I don't know if that's actually true, but it, you know, it's probably not terribly wrong if it is wrong. What would happen if MicroStrategy converted into an exchange traded fund? He could. He could. He could do it. There's no reason not to, but it would decouple. It would most likely decouple the Bitcoin from the share price and the share price would fall back down on its ass. So I kind of think that that might be what's keeping him from not doing it. And there's no reason that he has to unless for whatever reason he just wants to be competitive and have the honorific continuously have of having the most Bitcoin in the treasure.

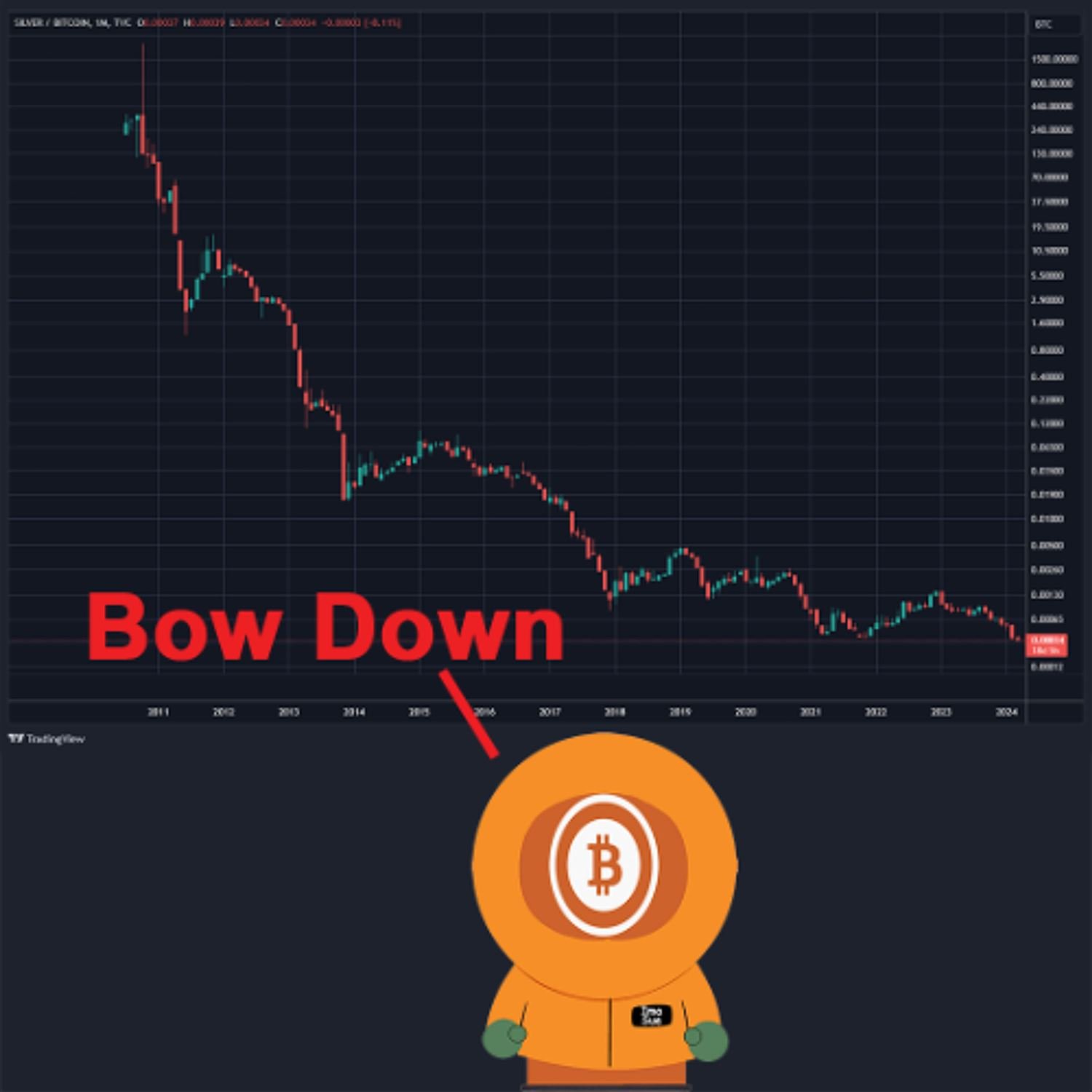

I honestly don't think it's worth it. I've just let BlackRock take the reins and say, fuck it, man. He's got enough. Well, we're gonna have to see what my, Michael, Sailor does in the coming months and next couple of years. But first of all, we've got silver falling, falling on its knees to the king. Bitcoin's market cap has jumped to $1,400,000,000,000 and has now officially surpassed silver's complete market cap. CoinDesk, Leelalizama. Bitcoin continues to rise in the ranks of top assets by market cap pushing past silver to become the world's 8th 8th 8th that's 1, 2, 3, 4, 5, 6, 7, 8th most valuable property with a 4% advance to an all time high pass to 72,000 in the morning hours of US trading, Bitcoin's valuation shot to $1,420,000,000,000 above that of silver holding at $1,387,000,000,000,000 according to companies market cap.

Earlier in this historic bull run, Bitcoin pushed ahead of the market cap of Meta, formerly known as Facebook, which now stands at a mere measly swamp sucking $1,200,000,000,000 Next up in Bitcoin's side is the globe's 7th most valuable asset, Google. Or, well, Alphabet, whose current valuation is just shy of 1.7 $1,000,000,000,000,000. And some Bitcoin bulls have their sights set on the world's most valuable property of all, gold, and it's $14,700,000,000,000 market cap. And to get there, Bitcoin would have to rise more than tenfold or well past $720,000 per Bitcoin quote.

The robust price action continues to be fueled by the positive momentum of BTC spot ETF, said Matteo Greco, research analyst at Faniqa, I guess is how you pronounce it, capital, in a morning note. To that point, the London Stock Exchange Monday decided to accept applications for Bitcoin and shitcoin number 1 exchange traded notes. And you already know what I think about all that bullshit. So let's not let's not belabor the point. In fact, let's run the numbers. CNBC Futures and Commodities. Hold on. Let me make sure I got my shit recording. Yep. I do. Alright. There we go. Futures commodities from CNBC. Oil is actually up today for some reason or another. 0.19 percent to $78.16 a barrel. Brent, North Sea, likewise, up 0.4 percent to 8242.

Natural gas, however, is down 2 and a quarter to $1.76, per 1,000 cubic feet. And gasoline is up almost 2 full points to $2.57. And if you did not understand what goes on as we go into spring and then we get into summer, it doesn't matter how much oil costs. It doesn't how much it doesn't matter how much oil is being pumped out of the ground. It has and there's absolutely no rhyme and reason to it because you're going to see higher gas prices. Why? Because that's when people start driving. They want to get out of their house. So all of a sudden magically as if by fairy godmothers throwing around a whole bunch of fucking glitter.

Every price at the pump increases even though oil didn't do dick. So just be prepared for it. Okay? All of your shiny metal rocks are doing well except for gold, which is still in the green, but it's only upscant, 0.0 5%. However, it still has a price tag of $2,186.90 per ounce, which isn't, I think, an all time high again. Silver is up a half a point, still not catching Bitcoin. Platinum is up 2.85%. Copper is up 0.87 percent. Palladium is up 1.5. Agricultural futures are mostly in the green. Biggest winner today is chocolate. Wow! 5.6 percent of the upside, followed by sugars 3.92 percent of the upside and the biggest loser today is gonna be soybeans, 0.38 percent of the downside. Live cattle, down negligible.

Lean hogs are down 0.1 or no. Up. Up. Lean hogs are up 0.12%. Feeder cattle, however, are down 0.41%. Legacy markets, looks like people are waiting on something. Dow is down 0.05%, S and P is down 0.2. NASDAQ is down a 3rd and the S and P mini is down almost a half a point at this time. Bonds, what are bond yields doing? Oh, well, most of them are have are yielding higher. Yay, I guess. No. It's toxic waste. For any of you that think that Treasury bonds are risk free assets that has not been true for 3 years minimum minimum minimum minimum. It's toxic debt and you don't want to have anything to do with this shit.

Sure, if you believe me and you get rid of all your bonds, I'm sure that you'll miss out on a $100 in profits, and you'll get all pissed off and tell me to go suck swamp water. I don't really care. I'm gonna be holding on to Bitcoin, which is the only only only asset that I can see that is not actually toxic at this time. In either event, let's move on to Clark Moody's dashboard where we are looking at a $72,450 price, $1,420,000,000,000 of market cap, 19,651,299 and a quarter BTC are in circulation at this time. Hash rates over the last 2,016 blocks coming in at an average of 594.6xahashes per second.

The average fees per block are standing at 0.39 BTC. The halving has been pushed up to April 18th so far, 2024. And the block space percentage for taking out the trash, which are ordinals and inscriptions, still at 2.5 percent. MIMPUs. What what are they doing? I don't know. Let's find out. 194 blocks carrying 130,000 unconfirmed transactions waiting to clear at high priority rates of 24 satoshis per vbyte. Low priority is 24 satoshis per vbyte. And anything under 5 is gonna get you kicked out of mempools from around the world. Mining, what's going on?

Flash holy shit. Flashing 698.3 exahashes per second. Holy smokes. So take the difference. We'll say, I don't know, 650 exahashes per second. Okay. So from JPM cries harder, episode 869 of Bitcoin and Bys nerds. That's at b e I s n e r d s with 15,000 satoshis. What was that for? Well, he comes back and replies to his own thing and he says, another set of orders out on the circle p. So I'm telling you, man, if you tell him, if you wanna support the show, then support the vendors that are on the show in the circle p, like Beisnerds and Maple Trade. If you want some really good maple maple syrup that's handmade and some of his sister Sarah's soaps, he's selling those too. You can get some good animal fat based soap from his sister Sarah.

Telling you, man, you're gonna support the show if you do it. Letter 6173 with 10,001 sats. Whoop dee doo. Thank you, brother. Jamie and JPM are notorious for manipulating gold markets. His butthurt tears stream from the draining liquidity in gold and derivatives markets. The golden goose is dead, and we are watching the man publicly grieve over future bonuses. Bisonerds with another 8,250 sat. Holy shit says more circle p. There is a soap order in this one. If you want to see what my sister has to offer, visit Sarah's Soaps Square site. And then contact Bysnerds on Nostr to pay in Bitcoin, also a few percentage points lower cost.

Also, some goes to the circle p if you mentioned this podcast or none you. That would be me, none you business over there on, well, on dead bird app, as well as the only real app that actually makes sense. But the only real protocol that makes sense anymore right now is is noster, and that's probably going to last for quite a while. Madnz. Is that mad New Zealand? M a d d n z? Let me know if that n z stands for New Zealand. And I will welcome my friend, the Kiwi and his 420 sats. Good morning. Yeah. Well, good morning to you, brother. Joey Delonge, by the way, that was over on zap.stream, which is Nostra based.

Joey Delonge with 3333. Satoshi says bitcoin. Rocks address data always deleted on a regular basis. Nothing is saved. Joey, thank you for letting us know that when anybody orders stickers from bitcoin.rocks, that's bitcoin.rocks, they give you free stickers. When they when you give them your home address, they're going to delete that information as soon as humanly possible. Wartime with 3333 gives me the fire emoji. Dubrovko with 1640 says, alright. I found a use case for ordinals. Oh, shit. And he gives me hold on. Let's see if I can get this up real quick. Let's see what he says.

Let's see let's see if he surprises us. Let's see what what's what's going on here. He's giving me a dead bird a dead bird, URL. Beat the screenshot. I'm getting this framed from James Ripian. And it says $69,420. 69,420 dot 69. What a price. But but but but it would have been better had it been 6942096. You know what? Screw it. I'm gonna take it. Alright. There's that. There's that. Okay. Thank you, brother. Jen and Indy with a1000. Thank you. No thank you. Axelroba 451 says, I use Evernote. I have I now have Obsidian 2, but have not invested the time to use it. Do you think I can migrate some of my Evernotes to Obsidian?

I don't know. I don't know. Here's like Axelrod, if you're listening to me, do this. Go to your favorite, search engine and type in Evernote to Obsidian. I guarantee you, somebody has an answer for you. Somebody somewhere has already figured it out. It may be as easy as getting a plug in because it's a plug in that allows me to grab all of my Kindle notes and take them and put them into Obsidian format. But I would imagine that the answer to your question is yes. I just don't know exactly how. But again, Google Evernote to obsidian.

2 o, the word. Go to. I need to take this and go to that, Right? So try that. Let me know if it works. Pies with 420, lfg. Thank you, sir. No. Thank you. Uncle Swim, 420. Thank you, sir. No. Thank you. Big gust 200. Boost. God's death, 137. Much better dad jokes, by the way. Daughters love them. God's death with 137. Thank you, sir. No. Thank you. And last up, madandybtc with a 100 says, thank you good sir, but I still think you don't quite understand UTXOs. Well, that's not entirely impossible. They're not something you can just run out of. You can create them at any point by sending yourself Bitcoin and you can combine them into 1 in the same way. The only real reason to combine them is to cut down on future fees. Yes, that is possible. And I understand everything that you just said.

And I'm not saying that we'll run out of UTXO's. That's not what we're saying. What we're saying is that there cannot be 8,000,000,000 UTXO's being actively run around, exchanged, consolidated, ripped apart, all at the same time on the on the Bitcoin network. We're talking about a hyper Bitcoinization scenario where the majority of money passing hands is passed in the form of a main chain transaction. Nobody there's no way. The the chain does not have that much bandwidth. I mean, it just it's just not going to work. That's what we're saying, but I do you are correct.

However, that's not what I'm saying. So anyway, that's that's all I got to say about that. Let's, oh shit. Gonna do for the weather report. Welcome to part 2 of the news that you can use. Alright, let's get off of here and get into this one. Coinbase backed $85,000,000 crypto super pack sets its sight on Senate races. But first, a thank you to madnzzzzappedme420 sats and orange mart with 2,100 sats over on zap.stream says survive and thrive with Bitcoin at the orangem.art otherwise known as orangemart. Orangem.art. Alright.

Sander Lutz is doing this one from decrypt. After spending over $10,000,000 in a successful effort to defeat a Democratic United States senate candidate in California earlier this week. A cash rich super PAC funded by the crypto establishment is setting its site on a handful of other key senate races that could determine the balance of power in Congress. The PAC or political action committee or whatever they're called, this one is called Fair Shake, and it will focus its efforts this election cycle on 4 United States senate races in Ohio, Montana, Maryland, and Michigan, apparently, according to Fair Shake spokesperson Josh Vlasto confirming would decrypt. Fair Shake, which has raised over $85,000,000, holy crap, to date, principally from major crypto players Coinbase, Ripple, and Andreessen Horowitz.

Oh my god. Horowitz. Sorry. Andreessen Horowitz, Ripple, And hold on. Make sure I'm not dying here. Alright. Yeah. These are the 3 names you don't wanna hear. This is not a good pack. They're gonna make you think it is, but this is not a good group of people. Coinbase, Ripple and Andreessen Horowitz, Some of the ugliest, nastiest, douchebaggery people in the Bitcoin space. Thank God, Ripple's not even in the Bitcoin space. But dude, this is this is we don't want these people. However, the enemy of my enemy is my friend. Let's see who our enemies are here. Fair shake, which has raised over 85,000,000 from these idiot 3 idiots will spend at spend this money on ads in Ohio and Montana, United States senate general elections and in the Maryland and Michigan US senate democratic primaries.

Ohio and Montana are both home to vulnerable Democratic senators up for reelection in states carried by Donald Trump in 2020. And both senators have previously made comments critical of crypto. Ohio senator Sherrod Brett who the hell is this? Oh Man created a clip brother orange mark created a clip inside of zap. Stream nice, dude Anyway, let's get back to it. I I got I see something shiny and I get I get all out of whack. Crucially, however, Fair Shake has not announced that it will be supporting campaigns against these two senators, which would be Montana's John, senator Jon Tester.

And anybody else? Oh, sure. Sherrod Brown. Yeah. Yeah. Yeah. Instead, the pack has merely said that it will have a presence one way or another in their general election races implying that Brown or Tester could still theoretically win the PAC support if they change tack quick enough to sufficiently pro crypto positions. Holding a gun to their head. Fish Fair Shake did not say by what date that it will decide which candidate to support in the in the Ohio and Montana races, only that the organization is viewing the elections holistically.

Holistically. Quote, among other considerations, we will evaluate a candidate's leadership on issues important to the crypto and blockchain communities. The viability of a candidate, the importance of the election, and our ability to impact the race, Blasto said in a statement shared with Decrypt. In Michigan, fair shake will wade into August Democratic senator primary, where Congresswoman Eliza Slotkin is leading the race. Slotkin, who has said little publicly about crypto except that politicians must disclose their own crypto trades, is facing off against multiple Democratic competitors, including the actor Hill Harper, who previously launched an app designed to encourage people of color to get involved with crypto.

In Maryland's May Democratic senate primary, David Trone, co founder of alcohol retail giant, Total Wine, will face off against Angela Ashbrooks, a local politician. Neither candidate mentions crypto on their campaign website or appears to have made public statements on the subject in the past. Fair shake has also not yet announced which candidate it will back in Michigan or Maryland, only that it will participate in those primaries. With Democrats currently holding onto a razor thin 5149 majority in the senate, any shakeups in those four races could easily tip the balance of power in Washington DC.

Flushed with crypto industry cash, Fair Shake's leadership appears confident that it can ensure that whoever wins come November, those politicians will advocate for the creation and adoption of long elusive crypto industry regulations. They want more than that and we'll get to it. Quote, we'll have the resources to affect ratios in the makeup of institutions at every level, Fair Shakes Flasto said, and we'll leverage those assets strategically to maximize their impact in order to build a sustainable bipartisan crypto and blockchain coalition.

Lying sack of shit. I'll get to it here in a second. Okay. So that's the end of the article. These people, Fair Shake, is not your friend. Not because of what they're doing, but because of who they represent. Coinbase, Ripple Labs and Andreessen Horowitz don't care about Bitcoin. They only care about their own wealth and they will they will plow their shit coins into the head of any retail Goomba they see fit, if that Goomba will open up their wallet and give them the money. That's all they care about, ladies and gentlemen. That's all they care about. They will wreck anybody in their path. And these these these senators that they think that they're gonna get into office, and if they do, they're I mean, it's possible. It's not outside the room possibility that they could they could shake up all 4 of those elections.

They don't want that senator talking about Bitcoin. They want them talking about Ripple. Andreessen Horowitz and Coinbase, they want them talking about NFTs. They don't care about Bitcoin. So don't think for a second that fair shake is anywhere close to a fair shake. They're all liars. They're all scum. They're all insiders. They're no different than the entire field of bullshit that we've been trying to fight against for years. Bitdeer bitdeer, bitdeer. It's a doe. It's a deer. It's female deer. Bitdeer announced a new 4 nanometer Bitcoin mining chip called seal01.

This is from nobsbitcoin.com. BitDeer Technologies Group announced the successful testing of its first bitcoin mining chip, the seal01, and is designed for integration into BitDeer's new seal miner A1 minuteing machines. Quote, the seal01 chip is created using an advanced 4 nanometer process technology in partnership with a world leading semiconductor foundry. Initial tests holy shit indicate an exceptional power efficiency of 18.1 joules per terahash, the company said in a press release. Y'all, that's good. If you don't understand the number, just just take it take my word for it.

That's a good number. That's an impressive number, in fact. Quote, with the successful testing of our new mining chip, I am very excited to formally announce the introduction of both the seal o one chip and the seal miner a one as core to our new mining machine business. These products showcase our technology excellence and positions us well for the future, said Xi Han Wu, founder, chairman and chief executive officer of Bit Dear. Why am I laughing? Because of Xi Han Wu. I I was not I did not know that he was behind Bit Deere. Who's Jian Wu? Man, that is a long story guys. If you don't know who Jian Wu is by now, wow.

He used to be he used to be a king in in the Bitcoin space and if he hadn't have got ahead of himself if he had gotten out of his own way, he'd be one of the richest men on the planet. But he decided to go all in or well close enough to all in on What was it? Oh, b cash. Otherwise known as Bitcoin cash. Him and Roger Ver were, I don't know if they still are, but they were pretty good friends. And Xi Han Wu got his ass talked into putting a whole bunch of money into Bitcoin Cash, which was a fork of the original Bitcoin. Because Roger Ver was so mad that nobody would listen to him about how we need the bigger blocks that he decided to fork Bitcoin, which caused an airdrop if you had if you had owned a Bitcoin address but be right before that that, that fork, then you got however many Bitcoin you had on the actual Bitcoin chain, you got in this airdrop bullshit.

And then after that, that got forked into bitcoin satoshi vision because Craig Wright decided to stab Roger Ver in the back and he hooked up with Calvin Air and then they started Bitcoin Satoshi Vision and we all know where that's going at this point. But Xi Han Wu, all he had to do was stay humble and stack miners, forge new technology. That's all he had to do. And he would have been one of the 10 richest men on the planet. That's what happens when you don't stay humble. That's exactly and it's not this won't be the last time. It won't be the last time that somebody fucks this up.

Don't let that be you. Moving on. Portal. Mobile native hardware wallet by 22 Devices. Again, no BS Bitcoin. Gonna finish this out this morning. Portal is a mobile native hardware wallet designed to keep your keys safe and seamlessly integrate into any mobile wallet app. It uses NFC technology to safely and effectively connect with any modern smartphone and doesn't need cables nor batteries. It's completely powered by the NFC. Oh, that's actually kinda cool. Here, let me put this one up. Let me get rid of you and I'm going to put you up over here. Alright.

That's a nice looking little thing right there. That's kind of cool. You may have seen our announcement at Bitcoin Atlantis or or rather our mission is to build hardware devices for Bitcoiners starting with new mobile native hardware wallet called Portal, announced Alekos Fellini. Quote, why yet another hardware wallet? Well, because we think none of the existing ones are both safe and easy to use with smartphones. So we made our own. Portal is built around NFC. Not n f t, NFC. Not only to talk to a phone, but also to power itself. No cables, no batteries, just wireless magic as if Tesla was still around.

We also spent a lot of effort simplifying the UX. There are no menus to navigate. As a user, you are just shown each transaction output and you can sign it by holding the button for a couple of seconds. Everything is open source. The firmware is completely written in Rust and based on Bitcoin DevKit. This allows us to support single sig, multi sig, and complex descriptors very easily although some functionalities are not yet exposed to the end user. The hardware has been designed from scratch or in KiCad. Sorry, KiCad, k I c a d, KiCad. And it's also available on GitHub.

We are also releasing a software development kit to help existing wallets integrate our device. We prefer to remain focused on the hardware and let other teams develop awesome software on the smartphone side. We have a few big names already starting the development. If you want to be the first to get your hands on a portal, you can preorder today at store. 20hyphen2.xyz. That's store.20hyphent2.xyz. And 22 is actually spelled out in letters, not numbers. Letterstoredot 20hyphentwo.xyz. We aim to start shipping the 1st batch of devices in the summer, Q3 at most. If you have any questions or you'd like to contribute to our repos, join the community on Telegram, and all this stuff will be in the show notes.

But that's gonna do it for the morning roundup, I suppose. Yeah. Yeah. That's gonna do it for the morning round. Dad says jokes. It's pretty much one of the only actual accounts that I look at with any regularity on, dead bird's side anymore. A bus station is where a bus stops. A train station, that's where a train stops. On my desk, I have a workstation. Alright, we'll figure it out from there. Okay, so I am reminded Jian Wu is also the person that came up with the ever loving meme, the meme that will never go away. What is it? Fork your mother if you want to fork. Well, he didn't make that meme. He actually said he actually said the actual f word, which was not good, but we turned it into as as Bitcoiners are want to do, we will turn it into, into memes. So we said fork your mother if you want to fork.

Guys, this London exchange business have been putting up the, oh, the exchange traded notes. I really believe that we're I really believe, and I want you to walk away with this in your head. It's not that you have to believe me. That's not what I'm saying. I'm just saying please think about it. Please think about the possibility that we now have our eyes completely uncovered. Now that we have our if you're a Bitcoiner for any amount of time whatsoever, chances are real good. All the veils that have been put up in front of you, all the filters that you've been provided by the powers that be to actually see the world as it not is have been stripped away.

Most likely they've been stripped away. Now that you have a set of eyeballs that can see the actual world, use those eyeballs to start disseminating what financial instruments are designed to destroy somebody or some other group's wealth and which ones are actually designed to improve anybody's well-being in the world. There's not I don't think that there's as many genuine articles of instrumentation for financial well being of humanity as a whole, then there are selective weaponry designed specifically to take out certain groups of people. I do not believe for a second that London, the London Stock Exchange allowing ETMs, I do not believe that that is a vehicle for wealth building for the majority of humanity.

I think it is a guided missile. Will it work? No. It's not gonna work. That's not what I'm saying. I'm saying that now that you have the ability to see now that we all have the ability to see a modicum of truth, we should start looking at what are these financial instruments? What are derivatives? What is an e t n? And and maybe see, the thing about it is is we've got this shit all wrong. Before Bitcoin, I guarantee you the only reason people wanted to find out the definition of an ETF is because they wanted to figure out how it would work for them. This time, maybe what we should be doing is looking for how these things are designed to destroy us.

You, me and all the rest of the serfdom out there that's toiling in the fields and pulling up sod and having the asshole King ride by with Excalibur and and the coward Robin Telling us that everything is gonna be fine. It's not gonna be fine unless we make it fine. We're serfs. That's okay. I don't mind. We won't be serfs for very much longer. And it won't be because of the price of Bitcoin, it will be because Bitcoin has given us another source of wealth. It's given us truth. It's given us the ability to see things that we never saw before, but also has given us the ability to not only see things that we never saw before, be able to immediately damn near understand that thing which we've never seen before. I've never even heard of a fucking exchange traded note, and I'm already looking at this thing going, I don't think that this is designed to help anybody except those at the very tippy top.

And that's not the last instrumentation that we're going to see. The last instrumentation that we've ever heard of. I guarantee you that over the next few months and the next couple of years, they are going to pull out everything that they have. That's a financial instrument because that's that's the only the only guidance system that they possess is it's only connected to these types of weaponry. It's not connect they are completely boxed in. They only have one guidance system and it only talks to one set of instruments. And none of them none of them are good. And none of them are on the same plane of existence as Bitcoin, which means like like an ethereal missile it will you can aim it at Bitcoin, but it won't hit it it'll pass right through it like a ghost.

That's what existing on 2 different planes of reality will get you. But that doesn't mean that we have the ability or well, it doesn't mean that we have the reason to sit back on our laurels and not identify these financial instruments that we've never heard of before and identify them as whether or not they're going to be good for humanity or not. And if you find one that's not good for humanity, call it out in public and continue to do that, and I will see you on the other side. This has been Bitcoin and and I'm your host, David Bennett. I hope you enjoyed today's episode and hope to see you again real soon. Have a great day.

Good morning. This is David Bennett, and this is Bitcoin Ant, a podcast where I try to find the edge effect between the worlds of Bitcoin, gaming, permaculture, podcasting, and education to gain a better understanding of all. Edge effect is a concept from ecology describing a greater diversity of life where the edges of two systems overlap. While species from either system can be found at the edge, it is important to note there are species in the overlap that exist in neither system, and that is what I seek to uncover. So join me in discovering the variety of things being created as Bitcoin rubs up against other systems. It is 9:31 AM Pacific Daylight Time. That's yes. We we did it. We we did it again here in the United States and other countries around the world.

We decided that it's still an absolutely excellent idea. Beyond all other ideas, it's that it's a good idea to not once, but twice a year change the time by a full hour so that, you know, we can I I don't know why we're doing this anymore? I I'm not even certain why it occurred in the first place. All I know is that daylight savings time and changing back again is physiologically bad for you. It's not good. It confuses people. It actually spikes heart attacks every single time that it's done. I don't get it. I think it's foolish. I think we're playing with fire. And the entire time change thing needs to end. In fact, I'm wondering if it's not applicable at this point to just for just Bitcoiners themselves just say we're done.

And we pick a time and that's the time that like we literally we pick a time and say this is now the time whether it pick daylight standard or daylight saving or whatever it is and we all agree and we say this is now the Bitcoin time, aside from the block time, but this is the Bitcoin time of day, right? This is the Bitcoin time of day. And then when the time changes and you show up an hour late for work, you just look at your boss and say, I'm sorry. I don't put up with bullshit. I just don't put up with bullshit and I don't have to put up with bullshit. Why? Because I have some Bitcoin. We're at an all time high again. An all time high again. Another all time high, ladies and gentlemen. Looks like, I don't know, 72,500 something like that.

It's insane. It's Monday. It's the start of a new week. Let's get into it with the circle p. Dive into the wildly pure, outrageously rich flavors of nature. With our funky artisanal handmade maple syrup whipped up from the grooviest of maple trees, each bottle pops with a sweet vibe of tradition and top notch quality. Pancakes, waffles, or that secret recipe begging for a twist of sweet funkiness? Well, we've got you covered. Jazz it up. Jazz up your eats. Jazz everything up with a splash of our amber magic. Hit us now. Hit us up. Just give us a call.

Throw me a note and groove to the best of true craftsmanship. Taste the difference? Ladies and gentlemen, taste the fun. That'd be maple trade. That's maple trade, aka beisnards@beisners. Yeah. There's no website. You're gonna have to get a hold of this guy through a direct message either on Twitter or on Noster because it's at b e I s n e r d s on both the dead bird site and the future of communications, which is Noster. He makes maple syrup. He makes them by hand, his own trees. He taps them by hand. He lugs the sap over to a boiler. He boils it down with hardwood. That's right. He lights up an actual God on his fire underneath this thing and boils it outside in the pleasure of the early early early spring.

And he boils it down and puts it into bottles and he'll sell it to you. And if you tell him if you tell Maple Trade, AKA Bisonerds, that you heard it here on the Circle P from the Bitcoin and podcast, He will cut me in on some of those sweet, sweet profits. Psyduck, just saw you join the livestream. How you doing there, brother? You can get a quart for $27. You can get 3 for $68. You can get half a gallon for $45 or 2 half gallons, also known as a full gallon, for $80. You can get 4 pints for $50. Again, hit up at b e I s n e r d s over on Twitter. Well, or dead birdsite. And the new site, the new stuff, the new funkiness, the new coms, the new everything because it stitches all of our worlds together. That would be noster at b e I s n e r d s. Make sure that you tell them you heard it here on the circle p. Now Donald Trump has entered the fray again.

This time, he's got a slightly different message when it comes to Bitcoin. Let's find out more from CoinDesk. Oliver Knight is writing it. Former United States president Donald Trump has continued to come around on Bitcoin, calling it an additional form of currency in a CNBC appearance. Quote, there has been a lot of use of that, you know, that Bitcoin, and I'm not sure that I would want to take it away at this point. Like you could, little orange man. The comments represent a stark change in stance from his 2021 stance when Trump labeled Bitcoin as a scam that threatened the United States dollar as the world reserve currency.

Trump's comments this morning follow remarks he made last month when he said bitcoin had, quote, taken on a life of its own and that it will probably need some regulation. To be sure, the GOP standard bearer for the 2024 presidential election is a long way from becoming a Bitcoin maxi or showing anything other than a passing interest in the cryptocurrency, quote, I want one currency. I want the dollar. I don't want people leaving the dollar. Good God. Please don't love the dollar. He continued before moving on talking about the great interest shown in some of his NFT offerings. Quote, people were going crazy for these things, these NFTs.

And so many of these were bought with this new cryptocurrency. And I couldn't believe the amount, he said. Trump added that he would not allow countries to go off of the dollar because when the United States loses that standard, it will be like losing a revolutionary war. But we have a lot of Bitcoin at the US Marshals office. You should just say that take the win and wear the crown, go home brother. Trump has regularly been posting screenshots of his bullish odds on Poly Market, a crypto based shitcoin prediction market. So here we go. Yay. Oh, thank you last ask for the 2,100 satoshis. That's a lot of money nowadays.

And sidetuck21, also a lot of money nowadays. What do you guys think about not Trump in general, because I know most for whatever reason most people hate Trump. I honestly don't understand why everybody's pissed off at him. I don't like him simply because I never kinda have liked him. You know, but I mean that I I was watching this guy when Oprah Winfrey kept bringing him up in the eighties when she was just getting her show, the Oprah Winfrey Show off of the ground, because guess what? She hasn't always been around. She regularly had Donald Trump on her show.

Regularly. She regularly had Donald Trump on his on her show. She loved Donald Trump. Of course, then again, at the time, Donald Trump was a staunch Democrat. He was a staunch New York Democrat. Now she hates him. Of course, because if you like Donald Trump, you're a pariah. Right? But all that aside, what does anybody think about Donald Trump now starting to say not terribly not hold on for a sec. The USDA has just issued a warning over lack of snowfall in Washington state. We're all gonna die from climate change. What so is he is he doing what I think that the man is doing? Where he's just he's just singing the praises while it's popular so that he can get the vote? See, that's what I think.

I don't think he gives a shit one way or another. But I'll tell you one thing, this entire quip about him saying that he doesn't let's see, where was it that he said this? He said that he would not allow countries, plural, like more than 1 country, to go off of the dollar. I I'm sorry, but I I don't think you really have to say in any country outside of the United States, at least not legally. Now, of course, you can send the USS Ronald Reagan over there to wipe the floor with their ass if they, you know, do something that you don't like, which is what we normally do. But when you tell other countries what they can and cannot do and you're not even president yet, you know, you had the election hasn't even been held yet. I I just think that the the amount of hubris that this man shows is one of the reasons why I actually don't like the guy.

But he's I mean, it doesn't really matter though, because I I don't like any of these people. And neither should you because you shouldn't trust these guys. They're too old. And hell, I'm old, and even I'm looking at these guys so saying, you're too old. You don't have a a hope in hell of understanding the new world. You can't see it. And even if you did, you wouldn't really understand it. All they really see are ghosts in the machine, and they're scared of them. So where's another ghost in the machine popping up? London?

Yep. London. The London Stock Exchange is going to accept Bitcoin and shitcoin number 1 exchange traded notes. Notes like notes on muster, except a little different. We'll get into it. Cointelegraph, Ezra Raguera writing, this London Stock Exchange has announced that it will start accepting applications for bitcoin and shitcoin number 1 crypto exchange traded notes in the Q2 of 2024. On March 11th, the exchange confirmed that it would accept applications following the guidelines specified in its crypto ETN admission fact sheet. Oh, it's a fact sheet. However, the exchange did not provide the exact date that it will start accepting applications in the fact sheet.

The exchange said that crypto ETNs should be physically backed and non leveraged. Oh, that should be interesting. They should have a market price or value measure of the underlying asset that is publicly available and must be backed by Bitcoin or shitcoin number 1. The exchange also highlighted that the underlying crypto asset should be wholly or principally held in a cold wallet or something similar. In addition, the asset should be held by a custodian subject to anti money laundering laws in the United Kingdom, the European Union, Switzerland, or the United States.

The Exchange defines ETNs, otherwise known as exchange traded notes, as quote, debt securities which provide exposure to an underlying asset, Crypto ETNs allow investors to trade securities that track the performance of crypto assets during the exchange's trading hours. An ETN is widely considered a soft alternative to exchange traded funds. Unlike the ETFs, an e t n is a debt instrument backed by its issuers rather than a pool of assets. ETFs often focused on esoteric debt strategies that do not easily fit into funds. Meanwhile, the UK's Financial Conduct Authority also announced that it would not object to request from recognized investment exchanges or RIEs to exchange to create a market segment for crypto backed d tns. According to the FCA, exchanges can offer the products to professional markets. You can just read that as gatekeeping because they don't like you. They only want their buddies to be rich. We'll come back to it. The financial watchdog also urged exchanges to ensure sufficient controls are in place to protect investors adequately.

The FCA also said that crypto backed ETNs must meet requirements such as ongoing disclosures and prospectuses, which are part of the UK listing regime. While exchanges can offer ETNs to institutions, the FCA said that they are unsuitable for retail investors for retail investors because of their risks. Gatekeeping. Gatekeeping. They're unsuitable for you because you're a stupid pleb. And there's no possible way that you living over there in the UK would have any amount of education that would be required for you to understand how to, oh, I don't know, get up out of a chair and walk out of a fucking door. Because you're too stupid.

You're too you retail sons of bitches are just the lowliest, crappiest, saw digging bastards ever. I mean, it's just so sad when I read this kind of stuff. The regulator said that selling crypto backed DTNs to retail consumers will remain banned because you suck. Quote, the FCA continues to remind plebs that crypto assets are high risk and largely unregulated. Those who invest should be prepared to lose all of their money, the regulator wrote. It's just an advertisement for getting their friends rich, but it's also an advertisement for something else. Let me see if I can pick back up the thought that I just had. Alright. Hold on.

Debt instruments backed by issuers rather than a pool of assets. Oh, yes, I know. Okay, so here's the sentence. Unlike the ETFs, an exchange traded note is a debt instrument backed by its issuers rather than a pool of assets ETFs often focus on the esoteric debt strategies that do not easily fit into funds I had a thought when I was reading that and here's the thought I think Bitcoin is going to unmask instruments, financial instruments that were designed to destroy an asset. Let me say that again. I think Bitcoin's existence, especially now that we're seeing it kinda run up a little bit. Right? I think what we're gonna see is since it's a brand new asset class that nobody has seen in more than a couple of fistfuls of decades, that when we hear shit like, oh, well, they're not gonna give you a spot ETF. No. They're gonna give you an exchange traded note, and it's gonna be it's gonna be a debt backed instrument by the issuers and not really centered on a pool of the actual asset that underlies the thing that they're writing the note for. That tells me that that's not an investment vehicle. It is a vehicle of potential destruction that they've probably used to suppress or completely crush the ability for plebs like you and me to have anything at all. Because the serfdom out there, the the people that service the fiefdom, the people that dig around in the sod like that scene in Monty Python and the Holy Grail where he's like, I'm being repressed. Help me. Help me. You see him repressing me.

See, that's where they want us. I think when people say stuff I think what we're gonna see is we're going to start really realizing what actual investment vehicles look like and what the instruments of total financial weaponized destruction to make sure that only certain people make money. We're going to see what those actually look like. We're going to figure out the actual names. And then we're gonna be able to go back into history and find out every single time that predator parasitic class has destroyed the ability for any normal person to be actually happy.

Not because they're rich, but because they're not worried about dying all the time. They're not worrying about their children crying all the time. They're not worried about themselves crying all the time. That they can walk out of their door and be happy to be fucking alive. That they can look at the sun and bathe in it and say, this is good. The universe has provided a good. God is good. Whatever it is that you think has created this existence that we walk around in, that we can have the ability to be happy walking around in. Whatever makes you comfortable, I think what we're going to see is the instrumentation that has been used for 100 of years to make sure that you and me have never been able to experience true, honest to God, walking around this existence in a smile.

And I think an ETN is exactly one of those instrumentations. I don't think it's designed to build wealth for anybody other than a certain class of people that seek to build wealth off of destroying another class of people. I think it is a weapon against Bitcoin. I don't think it's good. I'm just saying, just don't get me wrong. Don't let me get out of this without telling you the God's honest truth of what I feel because when people say, oh, tell us how you really feel. When somebody says that to me, I take it as a fucking insult. Why wouldn't I tell you how I really feel? Under what existence would you have me live that I do not tell you how I actually really feel?

When people use that shit as an insult, it is one of the most annoying, most telling things that I've ever heard in my entire life. Why wouldn't you want me to tell you how I feel? Are you playing with Barbie dolls and you just want to hear what's in your own head paired it out by something else that's made of plastic. MicroStrategy is not gonna have any of it. No. No, sir. Michael Saylor said no. Because they have 205,000 in bitcoin. Not dollars, they have 205,000 Bitcoin. Bitcoin. MicroStrategy's 205 1,000 Bitcoin Treasury is bigger than all of the other BTC treasuries combined, decrypts Stacey Elliott with its latest purchase, which apparently went down sometime, I don't know, Friday. I'm not sure. I wish somebody would actually say exactly what time this shit was bought. But with its latest purchase of 12,000 Bitcoin, MicroStrategy has now amassed a 205,000 BTC Treasury.

The software company's treasury is now worth approximately $14,700,000,000 at the current Bitcoin price. The list of companies with publicly disclosed Bitcoin treasuries have been growing. But it's hard to overstate just how dominant MicroStrategy has been in the realm of corporate Bitcoin stashes. Its 205,000 BTC stockpile is more than it's currently held by all other 44 companies tracked on the Bitcoin Treasury's website, which you can get to at bitcointreasuries.net. That's bitcointreasuries.net. Keep in mind, that list includes every publicly traded Bitcoin miner like Marathon Digital, HUD 8, and Riot Platforms. It also includes electric vehicle manufacturer, Tesla, crypto exchange, Coinbase, and payments firm, Block Incorporated, which is helmed by Bitcoiner Jack Dorsey, quote, we're buying it to hold it for a 100 years.

That's 66,000 to a $16,000 crash that shook out the tourists, MicroStrategy founder and chairman, Michael Saylor, said during a CNBC interview on Monday morning, quote, that shook out the non believers. When it was 16 ks, we were all ready to ride it to 0. And that's what you'll find with the Bitcoin maximalists, end quote. MicroStrategy now has more Bitcoin than BlackRock's iShares Bitcoin Trust currently holding, or currently holds to back shares of its ETF. But MicroStrategy would have to keep buying Bitcoin at a blistering pace to hold on to that honorific. The company announced last week it was looking to raise $600,000,000 to buy even more Bitcoin.

But the offering went even better than the company anticipated, which is normal. That's completely normal. It's happened every single time he's done it. MicroStrategy, which trades under the micro MSTR ticker on the Nasdaq said in its Monday SEC filing that there was so much demand for the offering that it upsized to a total of $800,000,000 Ladies and gentlemen, boys and girls, that's $800,000,000 I told you on it was either Thursday or last Friday that he started at 6, and he had to raise it to 700,000,000, and he ended up having to raise it another 100,000,000.

So he went from $600,000,000 offering to an $800,000,000 offering and it all got bought. MSTR shareholders seem to like the news. At the time of writing, the stock the stock is trading for $154.42 a share, up from 6% from its previous close on Friday afternoon and a 110% higher than it was this time last month. MicroStrategy share price has no doubt been helped helped along by the recent Bitcoin price rallies. Just this morning, Bitcoin soared past 71,000 and then 72,000 a few hours later, Making it nearly impossible to decisively make a call on BTC's new all time high price.

So MicroStrategy making everybody look bad. Now when it when it says that he's gonna have to continue buying Bitcoin at a blistering pace, to be able to keep the honorific of having the most Bitcoin in a single treasury, it that's not gonna last. There's only I truly believe that there is only so much that Michael Saylor is going to be able to actually do up against something like BlackRock. I mean, MicroStrategy would actually have to convert and and don't put it past him. He's making MicroStrategy is making more money on this Bitcoin strategy than they probably ever made collectively on selling software over the last couple of decades.

I don't know if that's actually true, but it, you know, it's probably not terribly wrong if it is wrong. What would happen if MicroStrategy converted into an exchange traded fund? He could. He could. He could do it. There's no reason not to, but it would decouple. It would most likely decouple the Bitcoin from the share price and the share price would fall back down on its ass. So I kind of think that that might be what's keeping him from not doing it. And there's no reason that he has to unless for whatever reason he just wants to be competitive and have the honorific continuously have of having the most Bitcoin in the treasure.

I honestly don't think it's worth it. I've just let BlackRock take the reins and say, fuck it, man. He's got enough. Well, we're gonna have to see what my, Michael, Sailor does in the coming months and next couple of years. But first of all, we've got silver falling, falling on its knees to the king. Bitcoin's market cap has jumped to $1,400,000,000,000 and has now officially surpassed silver's complete market cap. CoinDesk, Leelalizama. Bitcoin continues to rise in the ranks of top assets by market cap pushing past silver to become the world's 8th 8th 8th that's 1, 2, 3, 4, 5, 6, 7, 8th most valuable property with a 4% advance to an all time high pass to 72,000 in the morning hours of US trading, Bitcoin's valuation shot to $1,420,000,000,000 above that of silver holding at $1,387,000,000,000,000 according to companies market cap.

Earlier in this historic bull run, Bitcoin pushed ahead of the market cap of Meta, formerly known as Facebook, which now stands at a mere measly swamp sucking $1,200,000,000,000 Next up in Bitcoin's side is the globe's 7th most valuable asset, Google. Or, well, Alphabet, whose current valuation is just shy of 1.7 $1,000,000,000,000,000. And some Bitcoin bulls have their sights set on the world's most valuable property of all, gold, and it's $14,700,000,000,000 market cap. And to get there, Bitcoin would have to rise more than tenfold or well past $720,000 per Bitcoin quote.

The robust price action continues to be fueled by the positive momentum of BTC spot ETF, said Matteo Greco, research analyst at Faniqa, I guess is how you pronounce it, capital, in a morning note. To that point, the London Stock Exchange Monday decided to accept applications for Bitcoin and shitcoin number 1 exchange traded notes. And you already know what I think about all that bullshit. So let's not let's not belabor the point. In fact, let's run the numbers. CNBC Futures and Commodities. Hold on. Let me make sure I got my shit recording. Yep. I do. Alright. There we go. Futures commodities from CNBC. Oil is actually up today for some reason or another. 0.19 percent to $78.16 a barrel. Brent, North Sea, likewise, up 0.4 percent to 8242.

Natural gas, however, is down 2 and a quarter to $1.76, per 1,000 cubic feet. And gasoline is up almost 2 full points to $2.57. And if you did not understand what goes on as we go into spring and then we get into summer, it doesn't matter how much oil costs. It doesn't how much it doesn't matter how much oil is being pumped out of the ground. It has and there's absolutely no rhyme and reason to it because you're going to see higher gas prices. Why? Because that's when people start driving. They want to get out of their house. So all of a sudden magically as if by fairy godmothers throwing around a whole bunch of fucking glitter.

Every price at the pump increases even though oil didn't do dick. So just be prepared for it. Okay? All of your shiny metal rocks are doing well except for gold, which is still in the green, but it's only upscant, 0.0 5%. However, it still has a price tag of $2,186.90 per ounce, which isn't, I think, an all time high again. Silver is up a half a point, still not catching Bitcoin. Platinum is up 2.85%. Copper is up 0.87 percent. Palladium is up 1.5. Agricultural futures are mostly in the green. Biggest winner today is chocolate. Wow! 5.6 percent of the upside, followed by sugars 3.92 percent of the upside and the biggest loser today is gonna be soybeans, 0.38 percent of the downside. Live cattle, down negligible.

Lean hogs are down 0.1 or no. Up. Up. Lean hogs are up 0.12%. Feeder cattle, however, are down 0.41%. Legacy markets, looks like people are waiting on something. Dow is down 0.05%, S and P is down 0.2. NASDAQ is down a 3rd and the S and P mini is down almost a half a point at this time. Bonds, what are bond yields doing? Oh, well, most of them are have are yielding higher. Yay, I guess. No. It's toxic waste. For any of you that think that Treasury bonds are risk free assets that has not been true for 3 years minimum minimum minimum minimum. It's toxic debt and you don't want to have anything to do with this shit.

Sure, if you believe me and you get rid of all your bonds, I'm sure that you'll miss out on a $100 in profits, and you'll get all pissed off and tell me to go suck swamp water. I don't really care. I'm gonna be holding on to Bitcoin, which is the only only only asset that I can see that is not actually toxic at this time. In either event, let's move on to Clark Moody's dashboard where we are looking at a $72,450 price, $1,420,000,000,000 of market cap, 19,651,299 and a quarter BTC are in circulation at this time. Hash rates over the last 2,016 blocks coming in at an average of 594.6xahashes per second.

The average fees per block are standing at 0.39 BTC. The halving has been pushed up to April 18th so far, 2024. And the block space percentage for taking out the trash, which are ordinals and inscriptions, still at 2.5 percent. MIMPUs. What what are they doing? I don't know. Let's find out. 194 blocks carrying 130,000 unconfirmed transactions waiting to clear at high priority rates of 24 satoshis per vbyte. Low priority is 24 satoshis per vbyte. And anything under 5 is gonna get you kicked out of mempools from around the world. Mining, what's going on?

Flash holy shit. Flashing 698.3 exahashes per second. Holy smokes. So take the difference. We'll say, I don't know, 650 exahashes per second. Okay. So from JPM cries harder, episode 869 of Bitcoin and Bys nerds. That's at b e I s n e r d s with 15,000 satoshis. What was that for? Well, he comes back and replies to his own thing and he says, another set of orders out on the circle p. So I'm telling you, man, if you tell him, if you wanna support the show, then support the vendors that are on the show in the circle p, like Beisnerds and Maple Trade. If you want some really good maple maple syrup that's handmade and some of his sister Sarah's soaps, he's selling those too. You can get some good animal fat based soap from his sister Sarah.

Telling you, man, you're gonna support the show if you do it. Letter 6173 with 10,001 sats. Whoop dee doo. Thank you, brother. Jamie and JPM are notorious for manipulating gold markets. His butthurt tears stream from the draining liquidity in gold and derivatives markets. The golden goose is dead, and we are watching the man publicly grieve over future bonuses. Bisonerds with another 8,250 sat. Holy shit says more circle p. There is a soap order in this one. If you want to see what my sister has to offer, visit Sarah's Soaps Square site. And then contact Bysnerds on Nostr to pay in Bitcoin, also a few percentage points lower cost.

Also, some goes to the circle p if you mentioned this podcast or none you. That would be me, none you business over there on, well, on dead bird app, as well as the only real app that actually makes sense. But the only real protocol that makes sense anymore right now is is noster, and that's probably going to last for quite a while. Madnz. Is that mad New Zealand? M a d d n z? Let me know if that n z stands for New Zealand. And I will welcome my friend, the Kiwi and his 420 sats. Good morning. Yeah. Well, good morning to you, brother. Joey Delonge, by the way, that was over on zap.stream, which is Nostra based.

Joey Delonge with 3333. Satoshi says bitcoin. Rocks address data always deleted on a regular basis. Nothing is saved. Joey, thank you for letting us know that when anybody orders stickers from bitcoin.rocks, that's bitcoin.rocks, they give you free stickers. When they when you give them your home address, they're going to delete that information as soon as humanly possible. Wartime with 3333 gives me the fire emoji. Dubrovko with 1640 says, alright. I found a use case for ordinals. Oh, shit. And he gives me hold on. Let's see if I can get this up real quick. Let's see what he says.