Topics for today:

- The Nothing Burger Has Landed

- Tether's $20 Billion Raise - $500 Billion Valuation

- Morgan Stanley To Allow BTC on E-Trade

- FTX Trust Files 1.2 Billion Suit Against Genesis Digital

Circle P:

OshiArtisan pecan butter, date bars and chocolates

Website: https://www.oshigood.us/products

nostr Profile: https://primal.net/p/nprofile1qqswp94gnm4epqsgjkndl4lnd8krzdj5u4mzuppdtxksdymkty63g7gdurlfc

Today's Articles:

https://cointelegraph.com/news/ex-lawmaker-bitcoiner-ian-calderon-california-governor-racehttps://bitcoinmagazine.com/news/tether-in-talks-to-raise-20-billion-but-what-does-that-mean-for-bitcoin

https://decrypt.co/340910/morgan-stanley-bitcoin-ethereum-solana-trading-etrade

https://atlas21.com/trump-the-great-bluff-pro-bitcoin-proclamations-but-his-agenda-paves-the-way-for-stablecoins/

https://nostrhub.io/

https://bitcoinmagazine.com/news/ftx-trust-files-1-15-billion-lawsuit-against-bitcoin-miner-genesis-digital

https://decrypt.co/340917/shuttered-shapeshift-settles-sanctions-violations-750k

https://www.theblock.co/post/372101/b-hodl-buys-100-btc-for-bitcoin-treasury

https://bitcoinnews.com/press-release/dirty-coin-best-documentary-puerto-rico/

Get You're Free Comfrey Owner's Manual Here:

https://www.bitcoinandshow.com/the-comfrey-owners-manual-is-here/

Find the Bitcoin And Podcast on every podcast app here:

https://episodes.fm/1438789088

Find me on nostr

npub1vwymuey3u7mf860ndrkw3r7dz30s0srg6tqmhtjzg7umtm6rn5eq2qzugd (npub)

6389be6491e7b693e9f368ece88fcd145f07c068d2c1bbae4247b9b5ef439d32 (Hex)

Twitter:

https://twitter.com/DavidB84567

StackerNews:

stacker.news/NunyaBidness

Podcasting 2.0:

fountain.fm/show/eK5XaSb3UaLRavU3lYrI

Apple Podcasts:

tinyurl.com/unm35bjh

Mastodon:

https://noauthority.social/@NunyaBidness

Support Bitcoin And . . . on Patreon:

patreon.com/BitcoinAndPodcast

Find Lightning Network Channel partners here:

https://t.me/+bj-7w_ePsANlOGEx (Nodestrich)

https://t.me/plebnet (Plebnet)

Music by:

Flutey Funk Kevin MacLeod (incompetech.com)

Licensed under Creative Commons: By Attribution 3.0 License

creativecommons.org/licenses/by/3.0/

It is 10:11AM Pacific Daylight Time. It is the September 2025, and this is episode 11. What the hell is it? Is it 74? No, God $11.75 of Bitcoin and the nothing burger has well, it has presented itself to us and in all of its nothing glory. It's the halonic light of nothingness has shined down upon us poor unwashed masses and let us know that absolutely freaking nothing came of Dennis Porter's announcement. Just like everybody thought just like everybody thought would happen. It's the most embarrassing thing. And, well, actually, no. I've seen more embarrassing shit. But at least over the last week, I haven't seen anything as embarrassing as that. But here's the rub. Dentists don't care. And if you don't know what I'm talking about, you will by the time it's all said and done for the day. Now, Tether is in the news. They wanna raise a whole bunch of money and give only a little bit of themselves for it, which means the valuation of the company that is Tether would be extraordinarily high.

I mean, like, sky high. We'll get into the Tether news as well as some Morgan Stanley news. Yes. Morgan Stanley is in the news with Bitcoin. And then I've got a theory about oil prices right now and Russia. It may be half baked, but it's coming. So just, you know, be prepared. Derek Ross over on Noster has got some interesting things about to say about a a website called nostrhub.io. It will kick off the second part of the show. We've got FTX back in the news again. Yes. FTX is somehow or another. They're they're the bankruptcy is still reaching out trying to claw back yet more money. We'll get to that one. We've got ShapeShift, which has been closed down for, like, four years. That's in the news.

UK listed, BeHodl is in the news, and Dirtycoin, a movie, is in the news. Let's let's just start it all off with the nothing burger from Dennis Porter. Why do I keep saying his name? So that you will be able to avoid this individual for the rest of your natural born life. He used to actually be a fairly solid Bitcoiner back in, like, the twenty seventeen, twenty eighteen days. And he's looks to me like he might actually represent the poster child for what it is that you have to just how ultimately you have to debase your reputation on Twitter for clicks, likes, reposts, so that you can get the money that Elon Musk gives you.

Because you've got a following. Because you've got the blue check. Alright? And people will look at my following at at my latest Twitter account, which miraculously hasn't been, you know well, what what happened to me? I got I got booted off that platform, like, five times, Starting with COVID. Starting with COVID, I got, you know, I had, like, 14,000 followers on my first account that I had had from since 2011, and I got booted. And my second account had, like, 4,000 followers inside of twenty four hours because I put out the bat signal, and twenty four hours after that, it got booted.

So when you look at my fifth attempt, you're gonna go, oh, yeah. See, you're just jealous. Because right? That's that's that's always the fucking reason that somebody can't say anything about anybody, even when that somebody is basically a scumbag. And we'll get to why here in a second. Because you're jealous. Now I got I got the riot act read to me from fucking Rusty Russell one day because I dared mention to him when he was singing the praises of Peter McCormick, which I actually like. I actually like Peter McCormick. I don't like the fact that we were begging him to stop allowing BlockFi to be a sponsor, and he wouldn't do it. I I don't care if he had a contract.

Right? I don't care. Just give all the money back and stop getting people into trouble because that's what happened with BlockFi. BlockFi went tits up and everybody that had money in BlockFi lost all their money, and we told Peter that was gonna happen. He didn't listen to us. That doesn't mean that I hate Peter McCormick. But the fact that I brought it up and I get Rusty Russell, one of the OG fucking Bitcoin developers, giving me the shit heel because I'm I I could only wish to be as big as Peter McCormick. Maybe I don't wanna be that big. I don't want a football team.

I I don't. But, see, that's the thing. And that's one of the things that is so aggravating about this Dennis Porter business and this extreme breaking. Yes. It was not breaking news. It wasn't just breaking. No. It was extreme breaking. And, yeah, he's got like a quarter million followers. Just completely debased himself on this. And it's not the first time, but this is what has to be done. You have to do this. You cannot have any kind of integrity on any of these centralized platforms and get any kind of monetization at all.

You won't get any follower. Even if you're not trying to monetize, you won't get any followers. You won't get any traction. You won't get any responses. You will just be like this this this voice yelling, screaming into the wind because you ain't getting nothing out of these platforms, which is why Nostr. That's what this that's what this entire thing, the abject lesson of the Dennis Porter nothing burger announcement is noster. That's why I'm being passionate about it right now. This this Twitter, this YouTube shit, which oh, YouTube is now going to reinstate everybody that got booted off on COVID, and everybody thinks that this is the greatest thing since sliced bread. Until next time.

They did it once and you wanna run back into YouTube's arms and cozy up to a mama who basically put you in a basket and left you on the doorstep of a church down the street to be raised by wolves or somebody they didn't know because they didn't want you. And yet when you find when when mama comes back and go, you know what? Maybe I made a mistake and I shouldn't have left my baby on the doorstep to hell. And and the baby is like, oh, yay. Mama loves me. No. Mama doesn't love you because she if she did, she never would have put you on the doorsteps of hell.

She never would have abandoned you. She never would have pulled the plug on your monetization. All of this, these Twitter, X or whatever you call it, Facebook, TikTok, YouTube, Google, it doesn't matter. It doesn't matter what they say right now because all they're doing is licking their finger, holding it up, and seeing which way the fucking wind blows. And right now, the wind is blowing favorably for you. So you look at Google and YouTube and see this announcement and say, oh, see, everything is gonna be fine. No. It's not. The only way to build a real lasting presence from now until the end of freaking time digitally is with something like Nasr, something that can't be owned, something that a very small group of people can make almost no money from.

I know that sounds like I'm being a communist. I'm not. If you can make if you could figure out a way to make money off of a platform that leverages the Nostra Protocol, more power to you. But you don't control the protocol. Dennis Porter, who understands how Twitter and x works, did exactly what they wanted him to do. Literally debase himself in front of the masses so that he would be able to get a few bucks on the other side. Is it more than a few bucks? Oh, hell yeah. He's he might be very well just be be able to make a fairly decent living just on what he gets paid out of x, given what I've seen from other large accounts like his. But how far do you wanna go down that hole?

Do do you value your reputation? Do you do you understand what happened with the nothing burger announcement? Let's get into it with Braden Lindria from Cointelegraph. Here's the announcement. A pro Bitcoin Democrat named Ian Calderon is going to run for governor of California. That was the big political Bitcoin news. That was the news that other news outlets wanted to scoop, like you scoop out a cat box, a litter box. You scoop the shit out of it. That's what this was. For two days, people were running around with hair on fire trying to figure out what the hell was going on. And and this is what and I knew it was gonna be something that just didn't matter, and it doesn't matter one bit.

Because former California assembly member and Bitcoin advocate, Ian Calderon, has kicked off his campaign for cal California governor in 2026 entering a crowded and competitive race to replace Gavin Newsom. Pausing right here to tell you Calderon doesn't have a chance. He doesn't have a chance. It doesn't I'm I'm not saying that a Republican is gonna replace Gavin Newsom either. I'm not saying that's why he doesn't have a chance. He'd Ian Calderon, and I just got finished bitching about how low my numbers were on Twitter. Even somebody like Ian Calderon, who was an assemblyman or assembly person or whatever you wanna call them, In California, one of the largest state, actually, probably the most populated state in The United States, maybe outside of New York. It either he's got 15,000 Twitter followers.

Nobody knows who this cat is. The only reason we know his name today is because Dennis Porter, who's got 250,000 followers on Twitter. Right? So you see how this is working? Do you see how this is working yet? Calderon confirmed his bid for governor in a post on X on Tuesday, centering most of his promises around affordable homes, affordable groceries, and affordable gas while positioning himself as a Bitcoin proponent. My generation pays bills on our phones. We send money to each other with Venmo. Oh. And we save Bitcoin. But the people running our government, they're trying to use yesterday's ideas to solve today's problems, and it isn't working. Put a tie on your bullshit suit speed. It's just vapid.

This is just vapid marketing political copy. Actually, I say vapid political marketing copy. That's what that shit is. Whenever you hear a politician say anything fucking remotely like this, you know they're full of shit. I don't care who they are. If when Trump says shit like this, I'm like, you're full of shit. Why? Because you just said a bunch of words that ends up making sentences that forms a paragraph that ends up only saying one thing. Political marketing bullshit suit speak. Calderon placed extra emphasis on Bitcoin in a separate expo stating, quote, California has always been a leader on technology.

It's time for us to get back to our roots and make California the undisputed leader on Bitcoin, end quote. Lawmakers at the federal and state levels have more widely promised crypto friendly policies in their campaigns after the crypto lobby emerged as a top donor during the twenty twenty four election, spending millions in successful bids from Donald Trump and multiple lawmakers. Calderon entered California's legislature at in 2012 at twenty seven years old, making him the youngest member at the time. He served until 2020, leading California's blockchain working group and laying the foundation for the state's blockchain roadmap.

California is the most populated state with a $4,300,000,000,000 economy, and state lawmakers recently moved forward with a bill that would allow state agencies to accept crypto for payments. But that bill hasn't seen the same level of support and progress for a Bitcoin reserve as in other states, you know, like Texas. During a livestream on x, Calderon said he believed that California should be holding Bitcoin on its balance sheet. Quote, once I'm governor, I'm going to make sure that we hold Bitcoin on our balance sheet, he added. Calderon also said he'd push for California to use Bitcoin as a way to pay for state programs.

I don't know. Why don't you go in and look at some of those programs and see what you might not wanna pay for going into the future? I'm just saying, you probably got state programs that don't do dick and cost a lot of money. Just a thought. California will go to the polls for its gubernatorial election on 11/03/2026, and Calderon is a long shot. A long shot, except it was extreme breaking news, but, you know, long shot to win as several more established candidates are vying to succeed Newsom who cannot and will not seek reelection at the end of his second term. The race opened up late July when former vice president Kamala Harris confirmed that she wouldn't run for the position.

Polling shows former Democratic congresswoman Katie Porter is the current front runner followed by sheriff Chad Bianco, who is, in fact, running as a Republican and former Republican political adviser and Fox News contributor, Steve Hilton, is running. Oh, well, Stevie. While out of politics for the past five years, Calderon worked with Satoshi Action Fund CEO, your friend and mine, Dennis Porter, to introduce a bill exploring Bitcoin as legal tender in 2022. So that's where the connection is. Calderon and Dennis Porter worked together at the Satoshi Action Fund. So I don't know about you, but at this point, anything that comes out of Satoshi Action Fund for me is a 100% suspect because of the way these people have handled themselves, the way these people have basically said, you know, I really don't give a shit about my reputation in this space because people are gonna follow me anyway because, you know, hey, it's the algorithm.

And and he's and they're absolutely right, which means that there's a second algorithm that's at work here that that I think most people forget about. That would be you. That would be your own processing centers in your own brain. You gotta stop giving people like this your attention. Because they are attention whores. This was a bullshit announcement from a bullshit candidate who's gonna be forgotten about in the first round, even four of the first primaries, even start to to to dawn on California, this Ian Calderon, no.

Not gonna be anywhere. That that ship sailed in the twenty twenty four elections. If if you're a Bitcoiner right now and youth and and and that works on you, me saying I'm a candidate for for the government in any position, and because I like Bitcoin, you should donate to my, fund and you should vote for me. Yeah. That shit sailed. Why? Because we still have yet to see promises delivered from fucking orange man about the strategic Bitcoin reserve, which is why we elected him in the first place. And get don't get me wrong. We were the ones that pushed him over the top. That was the Bitcoin lobby that pushed him over the top and nobody else. If it hadn't have been for him coming to fucking Las Vegas or what wherever it was oh, no. I guess it was the Tennessee show where he said, we're gonna we're gonna put Bitcoin on the balance sheet. And then then as he's leaving the stage, he says, have fun playing with your Bitcoin.

It's like it's like talking to children and everybody glossed over that and just glommed on to the strategic Bitcoin Reserve, which I think is a great idea and yet nothing nothing has happened. So this nobody that wants to head up a psychotic lunatic bin like California with almost no name recognition at all save somebody who's got 20 times the amount of followers that he's got just because he worked with them at a place called Satoshi Action Fund. Now he's he's able to get his name recognized. And I helped. I I will totally admit that. I helped because otherwise, you probably wouldn't have known who Ian Calderon was either.

This is the state of affairs over on Twitter. Get the fuck off of Twitter, Get your ass over to Noster and start having conversations with real people who actually, I don't know, respect their own reputation and respect their reputation as it's presented to people that they don't know, but also respect themselves. They don't know them because they've never met them in real life. This attitude of I will whore myself out for anybody, anywhere, anytime because I need so much money. Is this is ridiculous? It's no way to live, man. It's just not. But we see it everywhere, don't we?

Because Tether, the company Tether, you know, USDT, they are in talks to raise $20,000,000,000. But, oh my god, what does that mean for Bitcoin? Micah Zimmerman out of Bitcoin Magazine got the scoop for us, bro. Tether Holdings SA, the issuer of the world's largest stablecoin, is reportedly in talks with investors, unnamed for right now, to raise as much as $20,000,000,000 in new capital, a deal that could propel the firm into the ranks of the world's most valuable private companies. And according to people familiar with the discussions, Tether is seeking between 15 and $20,000,000,000 in exchange for roughly a 3% stake through a private place. But what was just said?

What was just said? They wanna raise $20,000,000,000 and whoever gives them $20,000,000,000 gets all of 3% of Tether, which means that we get to value that company at a pretty high price tag. Right? That would imply a valuation near $500,000,000,000. Let me say it again. $500,000,000,000 putting the company in the same league as SpaceX and OpenAI. Talks remain in the early stages and details may shift before the any deal closes according to Bloomberg. Cantor Fitzgerald is said to be advising on the transaction, which would involve new equity rather than existing shareholders selling their stakes. The fundraising effort comes as Tether has steadily expanded beyond stable coin issuance, building itself into a broader reserve backed financial powerhouse.

Earlier this year, CEO Paolo Ardoino revealed that Tether now holds a 100,000 Bitcoin worth more than $11,000,000,000 alongside 50 tons of gold as part of its reserves. It's like a fucking nation state, people. Those holdings make Tether one of the largest corporate owners of Bitcoin globally, a fact that further ties the fate of its business to the world's leading digital asset. And earlier this year, the company also began minting its stablecoin on the Bitcoin Lightning Network, in case you forgot. Tether announced it will launch its stablecoin on RGB, a next generation protocol that enables native stablecoin issuance directly on top of Bitcoin.

This move made Tether more Bitcoin native, underscoring its bet on Bitcoin as the base for everyday global money. The company has reaped massive profits by investing its reserves into US treasuries and other cash like instruments, booking $4,900,000,000 in profit. Say it again. 4,900,000,000.0 with a b in profit. Not gross, but net during the second quarter alone. Oh. Oh. Second quarter. So there's four quarters in a year, and they made $5,000,000,000 in one of those quarters in net profit. With what? 20 people? 50 people? It's insane.

This whole world is on fire. It's it's all a dumpster fire and it always was. Ardoino has claimed Tether operates with a 99% profit margin, figures that while unaudited by public market standards, it highlights the firm's cash generation engine. Tether already holds over a 100,000 BTC and is moving into or moving to issue stablecoins directly on Bitcoin. A successful raise would tie its future even closer to Bitcoin, making Bitcoin the backbone of one of the world's most valuable private companies. Who who for who? Are we for Bitcoin or is Bitcoin for us?

Ask not what you can do for yourself. Ask what you can do for Bitcoin. No. Actually, I got that wrong. Ask not what Bitcoin can do for you. Ask what you can do for Bitcoin, and we are forgetting all of it. Either through cheesy ass, nothing burger announcements with unknown politicians because of graft, or, hey, I'll give you a sliver of my company if you give me a really massive metric ton of cash. And that way, I'll be able to tell people that my company is worth half a trillion dollars. Where where are we going? What are we doing?

Maybe Morgan Stanley will have some sanity for us. Right? Because they're going to enable Bitcoin, Ethereum, and Solana trading via e trade. Okay. So no no help here, but James Rubin from Decrypt lined it out for us. Morgan Stanley is joining with crypto and stable coin infrastructure firm, Zerohash, to enable customers of the Wall Street Giants E Trade online brokerage platform to trade Bitcoin and a couple of shitcoins. The company confirmed to decrypt. And New York based Morgan Stanley may expand to other digital assets because 2 shit coins isn't enough, people, and is planning to offer wallet services.

Yes. Because we need a wallet to keep all those shitty coins in. And the bank referred decrypt to an article by Bloomberg, which first reported the news. Crypto trading services are expected to begin in the 2026, quote, the underlying technology has been proven, and blockchain based infrastructure is obviously here to stay. Jed Jed Finn, Morgan Stanley's head of wealth management, told Bloomberg, quote, clients, clients, our clients should have access to digitized assets, traditional assets, and cryptocurrencies all in the same ecosystem that they're used to. And that would be EJrade.

Morgan Stanley has been among a number of traditional finance firms aiming to bolster their crypto offerings in recent years. In January, the firm CEO and chairman, Ted Pick, told CNBC that the bank would work with regulators to see how they could offer crypto services safely. Last year, Morgan Stanley green green lit financial advisors promoting the then fledgling spot Bitcoin ETFs to client and in clients. And in 2021, offered wealthy clients access to Bitcoin investment funds. And then they go on to talk about the history of Morgan Stanley with the whole with all this crap. And we don't we don't need any of the history. We don't need to go back through the fact that Morgan Stanley, yes, indeed, was actually one of the first people that stepped up to the plate and said, okay. We're we're we're not sold, but we're also not completely against this, like, you know, I don't know, Goldman Sachs or something, you know, something like that.

That said, I'm telling you, for the for the people that think that one day they're gonna wake up and shitcoins aren't going to be here. I I hate to be the person that tells you this, but you're wrong. Shitcoins are always going to be here with us. Alright? And all you can do is go to oshigood.us and pick yourself up. Well, some hollow butter. Got two in stock. And then there's, oh, Satoshi coffee. He's, selling crunchy coffee hollow butter. He's got a new product. Oh, that's what this is. So here we are, we're over here at oshagood.us and osha good is my circle p vendor of the day. The circle p is where I bring plebs with goods and services that are just like you to plebs just like you that might want to buy said goods and services. And you have to buy it in Bitcoin because if you're not selling it in Bitcoin, you ain't in the Circle p. And today, it's oshigood.us.

Go to oshigood.us and check out their crunchy coffee huddle butter. It's let's see. What does he say? What does he say about it? Go full stack on flavor with this collaboration between Oshi and Satoshi Coffee Company. We took our signature small batch huddle butter and turbocharged it with premium roasted arabica grounds coffee grounds for a texture and taste experience more complex than explaining lightning network to your normie friends. More layers than the Bitcoin white paper. This caffeinated creation works as your morning fuel or late night coating companion. Stack two jars.

Keep one in cold storage, you know, the fridge, and one ready for immediate liquidity because running out of crunchy coffee goodness is not an option. So recommended usage, well, you do should probably keep this stuff, you know, refrigerated. And best pairing is, well, you and a spoon. Ingredients, pecans, ground pecans, by the way, because it's like peanut butter, but it's made out of pecans and maple sugar and roasted arabica coffee grounds and sea salt flakes and cinnamon and black pepper. Get a jar for well, this is yeah. 21,000 satoshis.

It's worth it. And tell them that Bitcoin and sent you by using the coupon code Bitcoin and that lets Oshi know that I made a sale for him. Oshi can determine for himself how much that sale was worth, and he will send those sats to me. Because this is the circle p. It's no contracts. It's a handshake. Dude, if I make a sale, if I'm able to promote you and somebody says I like this product and and and you've made a customer for life, then I've done my job because plebs need help. Some of these people do not have money for advertising. They don't have the $500 a month to get on somebody's podcast. So like the idiot that I am, I'll just do it for him because everybody needs some help.

Trump may need help. Trump, the great great bluff, pro Bitcoin proclamations, but his agenda paves the way for stablecoins. Oh, it was a bait and switch? Is that what atlas21.com is telling me? I don't know. Let's find out. Quote, Bitcoin stands for freedom. If we don't embrace Bitcoin and cryptocurrency, China will. I want to be I want it to be mined, minted, and made in The USA. We want America to become the crypto capital of the planet and Bitcoin superpower of the world, proclaimed Donald Trump from the stage of the Bitcoin conference in Nashville on 07/27/2024, adding the promise to create a national strategic Bitcoin reserve in just over a year later.

That same promise has proven a disappointment for many Bitcoiners who hope for a change in American policy approach towards Bitcoin. In the months following his election, Trump has shown growing support towards stablecoin issuer, collaborating with regulated entities that configure themselves as private versions of a CBDC, That'd be a central bank digital currency. The approval of the Genius Act has given further legitimacy to its political line, creating a regulatory framework that favors the growth of dollar pegged stablecoins. Tools like USAT, designed specifically for The United States market, target a clientele that already possesses traditional bank accounts, PayPal, Cash App, Venmo, and other fintech solutions, which makes their added value for American citizenry rather questionable.

Simultaneously, the possibility or the possible application of the Patriot Act intensifies regulatory pressure on Bitcoin revealing a government strategy increasingly oriented towards control and surveillance. The guiding and establishing national innovation for US stablecoins act, also known as the genius act, signed by Donald Trump 07/18/2025, represents the first comprehensive federal framework for stablecoin regulation in The United States. Following the Genius Act's approval, Tether announced the launch of USAT, a new stablecoin specifically designed to be fully compliant with the new regulations.

CEO Paolo Ardoino explained that USAT is intended for United States residents. The initiative will allow Tether to legally access The US market. While USDT operates with an offshore infrastructure managed by Tether Holdings Limited and has a diversified reserve structure that includes not only dollars and US Treasury bonds, but also Bitcoin, gold, and land, the new stablecoin USAT will comply with the reserve requirements imposed by the Genius Act. USAT will be issued by Anchorage Digital Bank, while reserves in US Treasury bonds will be entrusted to the custody of Cantor Fitzgerald.

Furthermore, Tether announced hiring Beau Hines, the former White House official and member of Trump's digital asset advisory council, as CEO of its United States division. Stablecoins are effectively consolidating a private version of a digital dollar under US regulatory control. The current administration has chosen not to pursue development of a national CBDC, citing concerns related to privacy and banking stability. No. No. No. No. Instead, it has opted for a different path. Collaborating in a public private model with stablecoin issuers as highlighted by Alex Gladstein, chief strategy officer at the Human Rights Foundation. This strategy proves an ingenious way to project American dollar power globally without the costs or political implications of state infrastructure.

Yeah. And we also don't have to bundle that shit up into pallets of cash and fly to fucking Afghanistan, do we? No. Hell no. We can just give it to them over their phone. Oh, well, whatever. For The United States. A benefit that the Genius Act brings is the increase in demand for American treasury bonds, and that's important. With growing global adoption, stablecoin issuers become a new and powerful buyer of US debt. Global adoption. Global adoption. Global that's it's not the issuers being a powerful buyer of US debt. Sure, they directly buy it. But what they're actually doing is that they're buying it on behalf of the people that are buying Tether.

In in effect, the people that are buying Tether globally, as Tether global adoption and Stablecoin global adoption occurs, the poorest people on the planet are buying fake money. And I literally mean US treasuries at this point. Not Tether's actually more real than the US dollar. Treasure Tether's actually more real than the US Treasury bonds and bills. It is it's more substantial as digital numbers and electrons. At least there's something there. Treasury, US dollar. I've been saying it for months, people. All we're doing is printing debt and letting an entirely new market buy that debt.

Whereas before it was just pretty much solid in The United States and parts of the West, no, no, that's not enough. We gotta ship this shit to every fucking corner of the universe. The Weimar Republic, the graphs that you see of the Reichmark valued in gold, honey, you have yet to see anything in your life. There's going to be nothing like this. We will have to wait though because we it's gonna take time to eviscerate the rest of the population of the planet with the machinations of old freaking men who don't have enough yet. And old women, by the way, it's not this isn't this this isn't, like, gender specific at this point.

Nancy Pelosi is just as bad as Warren Buffett, and she's also a better trader. No. Seriously. She actually trades better than Warren Buffett. How the hell does that work? Give you guesses about how that shit works. Anyway, with over a $120,000,000,000 in treasury bonds, the company treasure, Tether, has become one of the largest US creditors becoming now a strategic partner of the Stars and Stripes government. Do you know what strategic partner actually means? Protected by national defense. Oh, that's a that's a national defense issue. That's a national security issue. We oh, no. We gotta protect Tether because, it's a national security issue that they Tether and Palor Doino in in probably the fastest time ever in the history of The United States, is now actually functionally protected as a company and as a people by The United States under national defense, national security.

The most alarming news comes directly from the Financial Crimes Enforcement Network. On September 9, director Andrea Gacki confirmed that the treasury is finalizing the so called mixer rule, which will apply Patriot Act provisions to Bitcoin and other cryptocurrencies. This rule is not limited to mixers but represents a generalized ban on any software or behavior that guarantees transactional privacy to public blockchain users just gets worse and worse and worse. I don't even need to finish this. This was a bait and switch. I'm not happy with orange man right now, at least about this one. Is there other stuff that he's doing that I'm kinda, like, okay with? Yeah. Is there other stuff that he's doing that I'm not okay with? Yes. Do you know what that tells me? Probably a rather healthy individual to have leading a country. I know. If for all the people that says, oh my god, you're a straight up psycho. No. No. No.

I'm not one of these people that can look at somebody and say everything they've done is bad because I don't like that person. They're not they're not the same color as me. I'm not a racist when it comes to politics about that. I I actually miss Barack Obama. I actually miss Bill Clinton. I miss Ronald Reagan. I mean, there were there were things about all these individuals. There were good parts about them. There were also bad parts about them. That's what I want. I want somebody who I don't agree with all the time, and I don't want somebody who I disagree with all the time. That's not functional. Right now, though, when it comes to Bitcoin, I'm 100% solidly believing right now that we were just straight up lied to.

I knew we were gonna be lied to, but, man, dude, I had no idea it was gonna take this format. Let's run the numbers. CNBC, Futures and Commodities, as promised, I got a theory. I got a theory about oil in Russia. West Texas Intermediate right now is up yet another two and a half points. It's back to almost $65. It's just a hair away. Right? Brent Norsey is up 2.41% to $69.26. Natural gas is down point 6%, but gasoline itself is up a full point back over $2 a gallon. And Murbin crude seeing a 2% bump to $71.52. So how the hell does this work with Russia? What's going on here? I wanna read you this one.

This is from Trading Economics. It's not long, but listen carefully. Why is oil going up? And what has occurred in the very recent past that has made oil go up? And who benefits the most from even the slightest bump in the oil price? West Texas crude futures rose to $64.60 a barrel on Wednesday, extending a 1.8% gain from the previous session as US crude inventories fell last week, amplifying concerns about tightening supply. EIA data showed crude oil inventories in The US decreased by point 6,000,000 barrels, defying market expectations for an increase. And here we go.

This comes after talks to restart oil exports from Iraq's Kurdistan stalled as two major producers demanded debt repayment guarantees, keeping pipeline shipments to Turkey suspended since March 2023. Geopolitical risks also remain supportive of prices with NATO pledging a robust response to Russian airspace incursions and Ukrainian drone strikes targeting Russian refineries and pipelines. I would that's all we need. NATO is pledging a robust response to the so called Russian airspace incursions that we've seen go into Poland, specifically Poland recently, but there's another there there I can't remember what other country, but there's there's been Russian drones, quote, un you know, found in other in a couple of other Eastern European countries. I don't know who they are, but definitely Poland.

At $62 a barrel, $61 a barrel, Russia loses money on their oil production. This is a fairly well known fact. You need to get up to $67 a barrel for Russia to make, you know, to to make happy money. You need 64 to 65 somewhere in that zone to break even. And all of a sudden, miraculously, as if out of this clear blue sky when we had 61, $62 oil, Russia's got drones going into Poland. Oh, my god. And the the robust NATO response to come is sending oil prices back up. Is it possible that Putin did this shit on purpose because he knew or rather got a deal worked out with Trump? Who knows? I don't know.

It's like Trump I could see it. Trump going, okay. Look, man. I, dude, I can't do anything about the oil prices. Look. We don't give a shit about Ukraine at this point. I'm gonna pay him lip service, but we really don't fucking care. They could go piss themselves all they want. They're almost out of men. They've got their their breeding population is basically cratered. They're basically cratered. They're they're they're literally, the the any new babies born out of Ukraine are gonna depend on immigration. I hate to say it, but they're drafting 60 year old men at this point into the Ukrainian army. And when they do that, it means they got nobody left.

And it ain't the 60 year olds that are having babies at this point. Right? So what if this discussion with Trump is like he's like, okay. Look. Yeah. I know your oil the oil prices are sucking. I can't do nothing about it because they'll blame me. They'll say, look. He want Trump see, Trump wants Russia to win because he's he told his traders or or he's made, like, like, these these statements that clearly are gonna send oil up to $67 a barrel, which is exactly what Rachel wants. And she's playing right into Putin's hands. He's a Putin puppy. I can see Trump going. Look, here what you do.

Once you accidentally lose a couple of drones over, you know, not once, not twice, not three times, maybe four or five times over at least Poland, maybe pick one other, I don't know, bullshit Eastern European country, And and then we'll promise a robust, NATO response because I can sell that shit, and then the oil traders will do all the rest of the work for us. Don't think for a second that that's not on the table. Let's get back to the rest of this. Shiny metal rocks are not having a good day. Gold is down one and a quarter percent. Silver is down 1.1%. Platinum is down two. Copper is up almost 4%.

Palladium down one and a quarter. Biggest loser in ag today is they got it. They're all like they're they all are just slightly sucking. Cotton. We'll pick on cotton. Point 7% to the downside. But the biggest winner is coffee today, 5.31% to the upside. We got live cattle down point seven, lean hogs down two and a half, and feeder cattle are down three quarters of a point. The Dow is down point 4% and the S and P is down point 4%. The Nasdaq is down point 5% and the S and P Mini is down point 7%. Yay. What's Bitcoin doing through all of this crap? Well, it's clawing back some of its losses.

We've crawled up to a $113,800. That is a $2,270,000,000,000 market cap. And we can finally get again, one more time, 30.4 ounces of shiny metal rocks with our one Bitcoin, of which there are 19,925,432.42 of. And average fees per block are low. Again, 0.02 Bitcoin on a per block basis. It taken in fees and there are, wow, over 50 blocks carrying a 129,000 unconfirmed transactions waiting to clear at high priority rates of 4 Satoshis per vByte. Low priority is gonna get you in at one Satoshis per v byte, and a new all time high on hash rate, 1.09 zeta hashes per second. 1.09 zeta hashes per second. It's a new world record from rip plastic money yesterday's episode of Bitcoin and I got god's death with two thirty seven says thank you sir, no thank you.

Wartime with a 133 says, I think in general, people are kinda struggling and are distracted with a lot of personal stuff lately. Retail seems to be non existent right now and a lot of the Bitcoiners I know are heads down building stuff. I think this has an effect on the Nostra activity as well as show donations. Wartime, you're a 100% correct. I I totally appreciate and absolutely respect as well as completely agree with that assessment of the situation. Still, donate to the show. I'm starving over here. I'm starving. Wartime, again, with another 133 sats says, David.

Well, I poor thank you, sir. I appreciate that. Perma nerd with 210 stats says, thank you, sir. By the way, Perma nerd, it's awesome. All the stuff you sent me is freaking awesome. He sent me freeze dried apples. He sent me a bag of freeze freeze dried bananas and freeze dried peaches and freeze freeze dried, cherry tomatoes that are cut in half like freaking candy, this stuff, man. Some conferee salve, which has already taken care of my daughter's chapped lips literally overnight, just like I say, conferee works. You should listen to me. I'm not stupid.

I know how this stuff works. He's got this comfrey salve that's badass. So it's very clear that Perma Nerd is gonna end up being in the circle p. I just gotta work out the details with him, but his freeze freeze dried stuff is freaking awesome. And dude, the oregano smells wonderful. I can't wait to start cooking with it. And then I've got let's see. Oh, I've got this is actually from political nothing burger, but Aaron Joel came in late with a 172 sat says, nothing burger, extra mayo, hold the relish, please. Yeah. No shit. And pies with a 121 says thank you, sir. No. Thank you. That's the weather report.

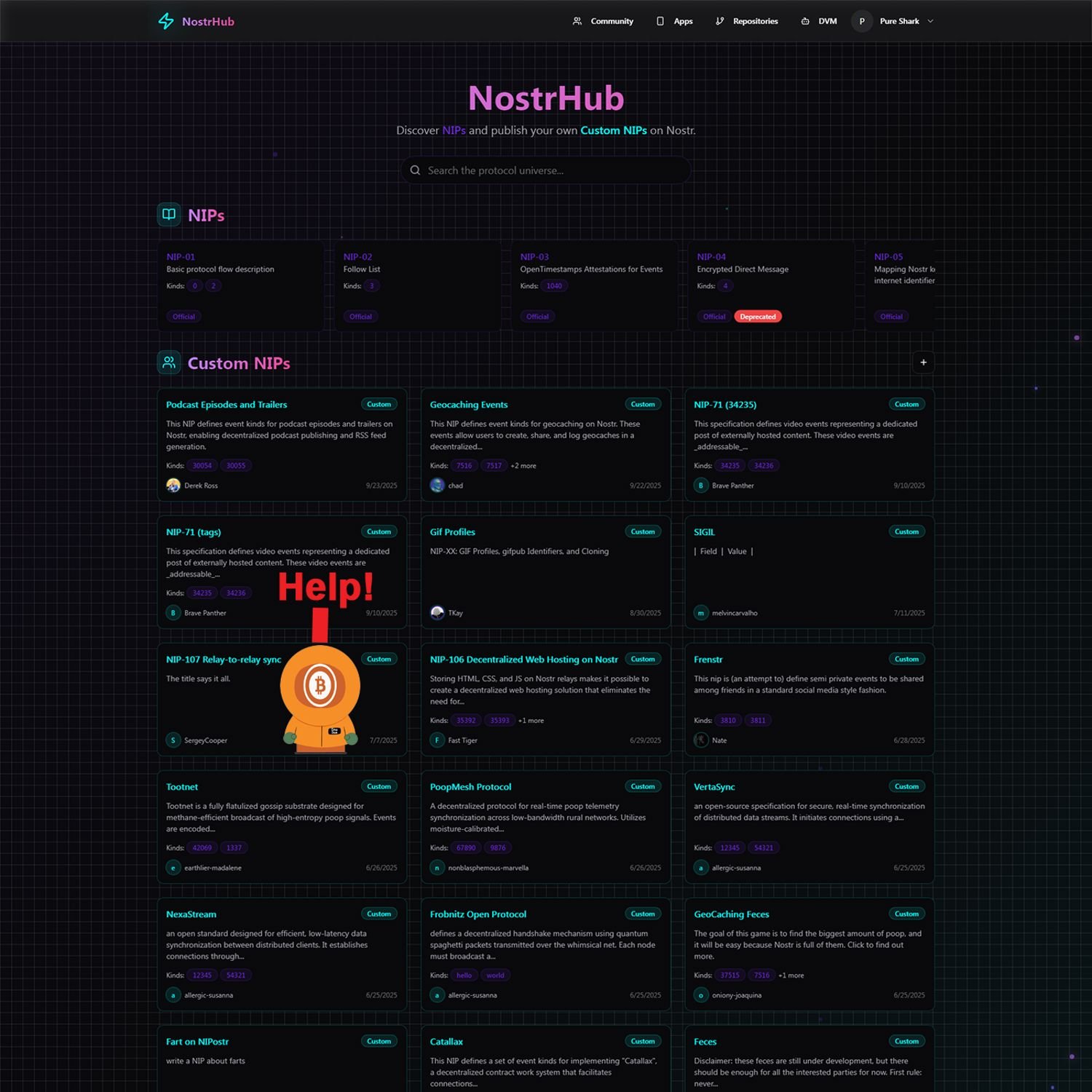

Welcome to part two of the news that you can use. Derek Ross over on Nostr has this to say about, what what is it? Oh, Nostr Hub. Sorry. Nostrhub.io. We'll get to all this. Just bear with me. He says the year is 2025. You discover a nostr app that you like, but you wish that it had a special feature. You head on over to nostrhub.io, open that app's repo link, and click the quote edit with Shakespeare button. You describe the feature that you want, and Shakespeare builds it in. You test it. It works perfectly. And with one click, you submit a merge request back to that repo.

The developer reviews and merges your changes. Life is good. So what just happened? What what what the hell was that? Derek was kind of introducing this thing called nostrhub.io. That's nostr, n0strhub.io. Nostrhub.io. And it's a nostr app repository. I I think I'm probably gonna use the the the landing page as the background for today's show art. So you'll you know, if you see a grid with a bunch of purple and, you know, complimentary blue in in it, you know, and a whole bunch of nips and custom nips and all kinds of little description boxes. Yeah. That's what that's what this is.

So, what he's describing is I've got nostrilhub.io. It looks to be a complete repository of all of the nips and I can go to the actual code base of each individual nip. Or or I can look at custom nips. Or I can go to nostrhub.i0/apps, and I can look at like the all these apps like Syncster and Shosho and Time Capsules and there's Podster, there's NostrPass, there's Nosstutter, there's There's e Hagaki, There's what else is there? There's Bloom. Bloom is like I'll go to Bloom here. Bloom is a simple to use and intuitive file manager utilizing Blossom and NIP 96 servers to store files.

And I can go and I can I can open the app directly from this bloom box and or I can view its details? And if I view its details, I can go I can view the developer. I can open the app. I can let's see. Let's see. I can I I don't know if I can go directly to the repository from here, but if I if I can't, then I can probably go find it if I go to nostrhub.i0/repositories? Now, I have what looks like a GitHub. So I can go let me just go to, AlienHub, and I don't know what it does, but it's got a view button over here. And I'll go over here to Nostra Hub or to its to its repository, and it loads in and lo and behold, it is a GitHub like repository that's Nostra native or it seems to be, and it's over here on nostrahub.io.

Now, here's what I haven't seen. When when Derek Ross said, you you head on you find the app that you like, you wish it had something, so you go to that app, you go to that app's repository, and you hit edit with Shakespeare, I do not see that button. So I do not know if Derek Ross is conjecturing or or if this is real and and my browser is just so old that I'm not seeing the button. But let's say there was. Let's say I've I've gotten like, I use an app and I go, man, I'm gonna go find that app on on nostrhub.io. And then I go there and I find the app and then I go to its repository and lo and behold, let's say there's a button that says edit with Shakespeare.

That's Alex Gleeson. That's Shakespeare is his artificial intelligence sort of, you know, like, build a program or build a web page from the ground up sort of thing, which works very, very well. And it's if it's embedded in the repository, then I can use the repository code and hit edit with a with Shakespeare. Shakespeare looks at this says, oh, you're talking about this code that because we're right here in this repository, and then I start working on it and I find something that works, and then I'd say publish, and then all of a sudden, it just puts a pull request over to the original developer, and it's already has a testable functional addition to the code base that the developer can look at and say, wow.

That's a shitty terrible idea. I don't wanna have anything to do with it. Or I like this idea. I'm going to dig into the code. I'm going to find the problems with this code, and I'm going to fix those problems with the code, and I'm going to make it work with my code base so that there's no technical debt. So it's a relationship between somebody who uses the app, somebody who's got enough intelligence and enough, you know, wherewithal to figure out how to change this app using the tools that Derek Ross is conjecturing about or that that are there that I can't see, and then spend the time to build something that actually works that represents the idea that I have in my head, and then notify the guy that built the app in the first fucking place. And then that app developer is essentially working with me and I'm working with the app developer even though we've never met and I'm able to give him something concrete, something that works, something that's not on the back of a stained napkin from a bar that's next door to a strip club that's in a strip mall bar.

You know you know what I'm you know what I'm saying? You know, like a strip mall like a strip club. If you've ever seen a strip club that's in a strip mall, don't go there. It's probably a terrible strip club. Why? Because it's in a strip mall. And strip mall bars are no better. But sometimes you do come up with good ideas. And if all you've got is a dirty napkin from one of these places with, like, a a really shitty sketch on it because you were half lit the fuck up when you were doing it and you try to get it to the developer, when the developer looks at it, they're gonna look at you and go, why are you wasting my time? Wouldn't it be better if you gave him an actual functional button to push on his own creation that says, this is sort of what I see happening? That's what Derek Ross is talking about. And, yes, it is could be a game changer.

Nostra hub dot I o. Go over to nostrahub.i0 and check it out. And, also, please, somebody that's got a newer operating system, let me know if I'm just not seeing the damn Shakespeare button. FTX files a $1,150,000,000 lawsuit against Bitcoin miner Genesis Digital as if the zombie hasn't had enough brains to eat. Micah Zimmerman from Bitcoin magazine tells us about this bullshit. The FTX Bankruptcy Trust has filed a lawsuit against Bitcoin mining firm Genesis Digital Assets, marking one of the largest clawback actions yet in the ongoing efforts to recover assets lost in the collapse. The complaint alleges that Genesis Digital and its cofounders received more than $1,000,000,000, billion with a b, in fraudulent transfers from Sam Bankman Fried's Alameda Research between 2021 and 2022.

The investments, the trust argues, were made at, quote, outrageously inflated prices and provided little to no value to FTX's business, which was already insolvent at the time. Quote, between August 2021 and April 2022, the bank fraud caused Alameda to purchase several tranches of shares of GDA, a Bitcoin mining firm, at outrageously in freight inflated prices. While FTX group funds were used to purchase the shares, only Alameda and in turn, Bankman Fried, Alameda's 90% owner, was to receive any benefit whatsoever to the great detriment of customers and other creditors of ftx.com.

So it's just it goes on into some of the particulars here, but we are running long and there's no need to to to really hash that out. But yeah. I mean, this is and Sam Bankman Fry tweeted apparently from his jail cell either this morning or or yesterday, but his Twitter account came alive with the letters g m, which generally means good morning or generally means either way. Whatever. So the does he get his phone? This is a guy who ripped people off left and right, up one side and down the other. He literally walked up and down the ass of retail, not caring about all of the hopes and dreams he destroyed along the way.

And he gets his phone? Fuck that, dude. When I ground my kids for something way less than that shit, like not washing the dishes, I don't give them their phone. This in this this is just extreme coddling, and it's got to end. It's got to got to got to got to end. And it didn't end with shuttered shape shift. The crypto exchange has settled sanctions violations for another $750,000, Matt DeSalvo. Decrypt says, defunct crypto exchange shape shift has agreed to pay 750,000 to settle violations of the Office of Foreign Assets Control. The government department said that the exchange took money from users based in sanctioned countries, Cuba, Iran, Sudan, and Syria.

Beds alleged that ShapeShift had no sanctions compliance program in place to screen users or transactions for a nexus to sanctioned jurisdictions and processed over $12,500,000 in crypto transactions by users from sanctioned countries between December 2016 and October 2018. Quote, only after ShapeShift received an administrative subpoena from OFRAC did it adopt a sanctions compliance program, this Treasury Department's announcement read. ShapeShift had no reason or rather had reason to know that such users were located in sanctioned jurisdictions, including on the basis of IP address data, the treasury department continued, adding that the exchange conveyed economic benefit to persons in several jurisdictions subject to OFAC sanctions and thereby harmed the integrity of multiple OFAC sanctions programs.

It said that the fine was small as, well, ShapeShift is, you know, shuttered. And it has limited assets. Yeah. It's been drained, dude. ShapeShift closed in 2021. We are four years out, people. And they are still settling their crap. Anyway, the exchange, founded in 2014, incorporated in Switzerland and run out of Denver, Colorado before it shut down, allowed users to swap digital coins and tokens without ever having to sign up with typical know your customer or KYC details. Clients could therefore trade cryptocurrencies like Bitcoin and Shitcoin number one with a high degree of anonymity.

ShapeShift received early funding from crypto bigwigs like Bitcoin Jesus Roger Ver and Barry Silbert, but the exchange ran into trouble when the Securities and Exchange Commission started an investigation. ShapeShift last year agreed to pay a completely different cease and desist order and a $275,000 fine to settle allegations from the SEC. By the way, ShapeShift was Eric Voorhees' outfit. And you could convert right inside the app some stupid ass token to some other stupid ass token until you finally got your shit straight and went into Bitcoin. Now, Eric Voorhees is behind venice.ai, which is actually pretty good. I act I use it. I've I spent some money on that one. I will probably start using maple.ai.

But for right now, I've still got a subscription to venice.ai, and it works pretty well. I'm I'm I'm actually very happy with it, but Eric Voorhees is is behind that, and he was behind ShapeShift. But it just goes to show that the zombies don't fall too far from the morgue. But getting back into something completely different, UK listed b hodl. B hodl, b h o d l with a space between the b and the h. B hodl buys a 100 Bitcoin for $11,300,000 to do what? Kick off its Bitcoin treasury. It's Bitcoin treasury. Ding ding ding ding ding ding ding ding. It's Bitcoin credit treasury corner over here at Circle Bay. UK listed b hodl plc announced the purchase of a 100 Bitcoin on Wednesday to kick off its treasury strategy.

The acquisition places b hodl squarely in the top 100 public Bitcoin treasury companies currently ranked ninety eighth according to Bitcoin treasuries data. Everything else about this story is just stupid. I mean, what okay. It's not stupid. We don't need to know it. Right? Again, getting to the end of the show, but there are what this story demonstrates is that there is still there are still people out there that think that the Hail Mary pass is going to work. It will work for some, but for most it will not work. It will not work.

And lastly, Dirty Coin has won the best national documentary at the Puerto Rico Film Festival. Bitcoin news has it. Dirty Coin, the documentary by Puerto Rican filmmaker, Helena Medevilla has been awarded best national documentary at the film festival festival held September 21. The film, which has been screened internationally with sold out theaters and multiple awards, continues to solidify its place as a powerful and timely story about data mining industry. It's an honor to receive the award, said Medevia. After fifteen years abroad, she left her corporate job at Google and moved back to Puerto Rico to launch Campo Libre, her independent production company whose first film is Dirty Coin. Campo Libre is the next incarnation of my career as a filmmaker, and Dirty Coin's success now honored with this prestigious award is a beautiful confirmation that I'm focusing on what I need to be doing right now. Oh, well, good for you.

No. I actually mean that good for her. The Puerto Rican film festival, one of the island's premier showcases for cinema, highlights the creativity and vision of, well, Puerto Rican filmmakers. Well, duh. Since its premiere, Dirty Coin has toured theaters across North America, Europe, Asia, Africa, and Latin America, winning audiences with its fearless exploration of one of the most misunderstood industries of our time. The documentary continues its global run with upcoming screenings and distribution plans that will bring the film to even wider audiences.

Dirty coin is not about bitcoin mining. I don't think so. It is a feature length documentary directed and produced by, well, Halana, and the film takes place across four continents, oh, at locations that are mining Bitcoin. Okay. So they said the the data mining, but that it's, I guess, Bitcoin mining. Because I was confused, but now I'm not. These are about this is about mining Bitcoin. It has already garnered international acclaim, including awards at film festivals in Europe and The United States and now, well, Puerto Rico. So you can add Latin America to that. I have not seen this film. I have heard about the film, but I have not seen it. I look forward to actually screening it when and if I can actually, you know, get get a copy of it. Okay.

That's all the news that you can use for today. I think we've covered everything under the sun. I'll see you on the other side. This has been Bitcoin and and I'm your host David Bennett. I hope you enjoyed today's episode and hope to see you again real soon. Have a great day.

Cold open: Episode setup, timeline, and "nothing burger" tease

Headlines rundown: Tether raise, Morgan Stanley, oil/Russia, Nostr, FTX, ShapeShift, BHodl, Dirty Coin

Dennis Porter’s “extreme breaking” hype and the incentives of centralized platforms

Why the creator goes Nostr-first: platform trust, censorship, and reputation

Monetization vs integrity on X: the cost of chasing algorithmic reach

Assessing Calderon’s odds, name recognition, and Bitcoin campaign pitches

Bitcoin-on-balance-sheet talk and California policy context

Satoshi Action Fund ties and why the host is skeptical

Call to action: leave Twitter, build and converse on Nostr

Tether’s reserves, Bitcoin holdings, Lightning/ RGB plans, and profit engine

Power dynamics: Is Bitcoin serving us—or are we serving corporate interests?

Circle P break: OshiGood’s crunchy coffee HODL butter highlight

National security angle: Tether as US creditor and privacy clampdowns

Markets check: skepticism on promises and a balanced view on leaders

Run the numbers: Oil theory on Russia, NATO risk, and price thresholds

Bitcoin stats: price, fees, mempool backlog, and record hash rate

Dream workflow: "Edit with Shakespeare" for community code contributions

Sign-off: Wrapping the news you can use