Join me today for Episode 890 of Bitcoin And . . .

Topics for today:

- Gensler Thinks Ether is a Security

- Samurai Breakdown

- Warren is at it Again, This Time it's CSAM

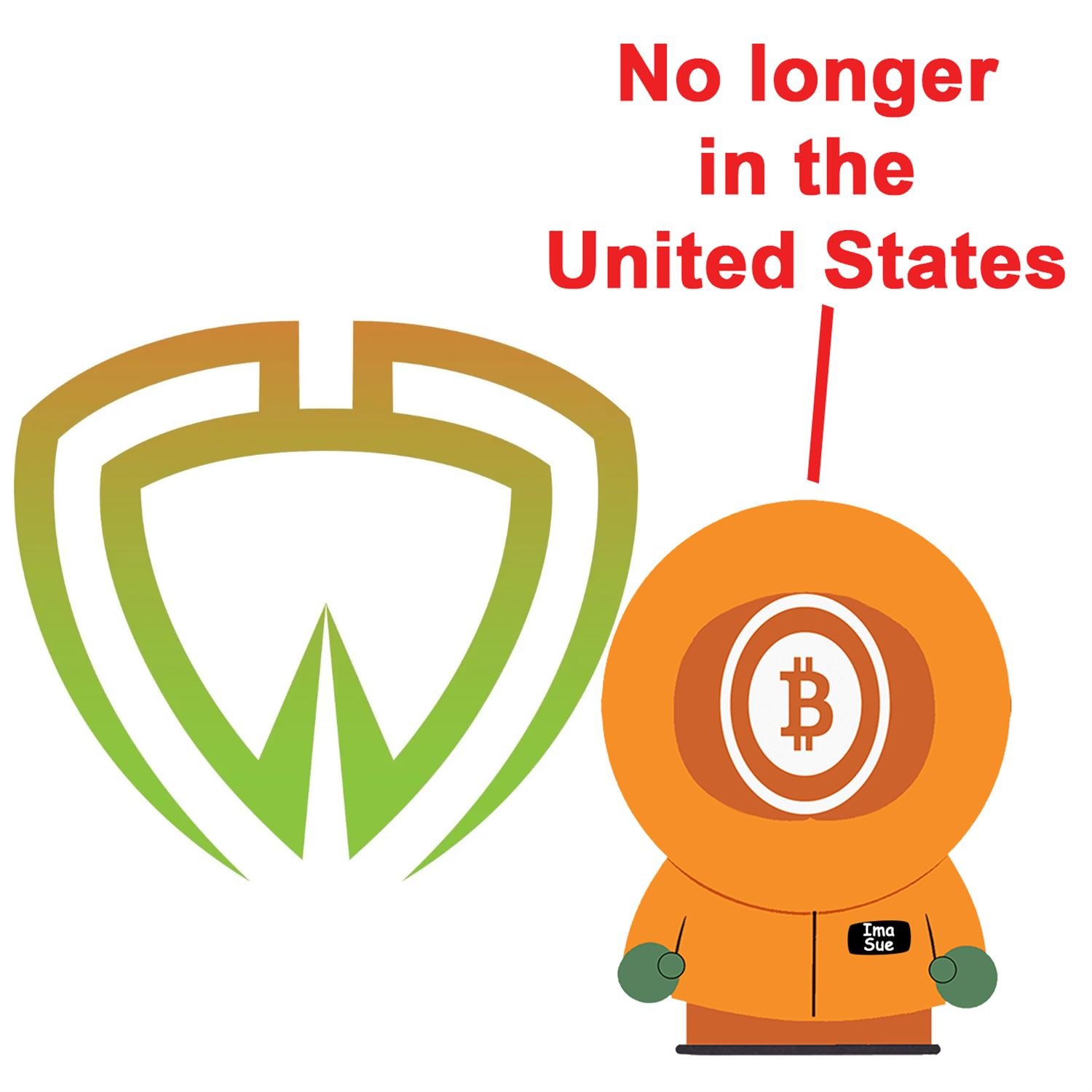

- zkSnacks Blocks all US Citizens

- Teather Gets into Neuroscience?

#Bitcoin #BitcoinAnd

Circle P:

Sovereignty in style

https://theleathermint.com/

Nostr: @LeatherMint

Twitter: @TheLeatherMint

Coupon code is BitcoinAnd for 10% off.

Articles:

https://primal.net/e/note1skyc4dm9hk5p2y04zkcpq0kxymeae98graja56fx2rpqw56lkjuqumzr8d

https://cointelegraph.com/news/sec-chair-gensler-ether-security-year

https://bitcoinmagazine.com/legal/samourai-wallet-breaking-down-dangerous-precedents

https://decrypt.co/228317/elizabeth-warren-claims-crypto-is-the-payment-of-choice-for-child-abuse-material

https://www.coindesk.com/business/2024/04/29/tether-buys-200m-majority-stake-in-brain-computer-interface-company-blackrock-neurotech/

- https://www.cnbc.com/futures-and-commodities/

- https://www.cnbc.com/bonds/

- https://dashboard.clarkmoody.com/

- https://mempool.space/

- https://fountain.fm/show/eK5XaSb3UaLRavU3lYrI

https://www.nobsbitcoin.com/zksnacks-is-now-blocking-u-s-residents-and-citizens/

https://www.nobsbitcoin.com/doj-challenges-roman-storms-motion-to-dismiss-indictment/

https://www.nobsbitcoin.com/simplex-chat-v5-7-0/

https://primal.net/e/note10q9rgteufq60waz2c2t07dlg9pak9qxxagxurpshklcn6xk5slxsr35chq

https://www.nobsbitcoin.com/custodia-bank-files-court-appeal/

Find the Bitcoin And Podcast on every podcast app here:

https://episodes.fm/1438789088

Find me on nostr

npub1vwymuey3u7mf860ndrkw3r7dz30s0srg6tqmhtjzg7umtm6rn5eq2qzugd (npub)

6389be6491e7b693e9f368ece88fcd145f07c068d2c1bbae4247b9b5ef439d32 (Hex)

Twitter:

https://twitter.com/DavidB84567

StackerNews:

stacker.news/NunyaBidness

Podcasting 2.0:

fountain.fm/show/eK5XaSb3UaLRavU3lYrI

Apple Podcasts:

tinyurl.com/unm35bjh

Mastodon:

https://noauthority.social/@NunyaBidness

Support Bitcoin And . . . on Patreon:

patreon.com/BitcoinAndPodcast

Find Lightning Network Channel partners here:

https://t.me/+bj-7w_ePsANlOGEx (Nodestrich)

https://t.me/plebnet (Plebnet)

Music by:

Flutey Funk Kevin MacLeod (incompetech.com)

Licensed under Creative Commons: By Attribution 3.0 License

creativecommons.org/licenses/by/3.0/

Good morning. This is David Bennett, and this is Bitcoin and, a podcast where I try to find the edge effect between the worlds of Bitcoin, gaming, permaculture, podcasting, and education to gain a better understanding of all. Edge effect is a concept from ecology describing a greater diversity of life where the edges of 2 systems overlap. While species from either system can be found at the edge, it is important to note there are species in the overlap that exist in neither system, and that is what I seek to uncover. Uncover. So join me in discovering the variety of things being created as Bitcoin rubs up against other systems. It is 10:30 AM Pacific Daylight Time. It's the 29th day of god, April 2024.

This is episode 890 of Bitcoin, and the circle p is open for business. It is. And the circle p is where plebs like you that have goods and services for sale in Bitcoin are presented on this show. All I ask is that if they make any sales from these advertisements that I am giving them, that they will send some of these sats my way. Because that's the only way value for value actually is going to work. All advertising models are broken. They're all done. This is the only way forward, at least in the short to medium term. I have no idea what the hell long term is gonna look like. But today we have, who do we have? We have the Leathermint. That's right, sovereignty in style.

And I'm putting up an auction that is starting tomorrow from the Leathermint. Actually, is it tomorrow? Let's see here. Yep, it's starting tomorrow, I do believe. Anyway, the Leathermint at Leathermint on Noster and at the Leathermint, all one word, on dead birdsight. They've got wallets. They've got belts. They've got passport holders. They've got all kinds of stuff, but the issue is is that they use high quality leather. But what gets my goat about this is that clearly, and you can just tell by the pictures, the stitching.

And the stitching is what makes the wallet. I mean, honestly, I you could if you had like a couple of pieces of decent vinyl and they were well stitched that wallet would probably last you a lifetime. It's all about the stitching. You know, you get a nice shirt, button falls off, you don't know how to sew. Nobody knows how to sew anymore. Grandmas are all dead and shit like that. There's no sewing. Except for these guys over at the Leather Mitt. These guys know exactly what the hell they're doing, man. You can just tell. And the people that I've talked to that said that they got one, they're like, Yeah, when I got it I figured it out. It's a good high quality wallet. They take Bitcoin for it because if you're not taking Bitcoin for a good and services, then you're not in the Circle P. Because not only is it value for value going forward, ladies and gentlemen, it is a circular Bitcoin economy.

Go to the leathermint.com. That is the leathermint, m I n t, all one word, dotcom and throw them the coupon code and get 10% off. Bitcoin and that's the coupon code. Like, yeah. That makes total sense. Anyway, they got this auction going on. Leatherman, and I've got it up here in the, in the zap.stream so that people that are there can see it. They are auctioning off what appears to be a wallet. It says, the most honest and valuable work I could provide for the having bull bitcoin themed true block height signature blah blah blah blah blah. The, Kjell Cordovan and Pueblo. Now I think that may be the colors that they're talking about. It's fully lined.

8+2Pockets. I'm not exactly sure exactly what that means. I think it means a total of 10 pockets or I think. I'm getting the feeling that this wallet might very well have an NFC chip inside of it, as well as RFID shielding inside the wallet. This thing looks like it's gonna be freaking badass.

[00:04:34] Unknown:

I mean, Wow an NFC chip behind the bull so

[00:04:41] Unknown:

you can just pay literally with your wallet and it just is able to read the the RFID chip while the shielding protects all of your actual credit cards inside. I hope they actually have this whole thing as as something you can buy every day. This is an awesome looking wallet. Anyway, I'm sorry. I got all kinds of distracted with that. Now on to the news. The SEC and Gary Gensler believed ether was a security for at least a year. Helen Partz, Cointelegraph. Consensus' lawsuit against the United States Securities and Exchange Commission has uncovered more information about the SEC's stance on ether.

The SEC and its chair, Gary Gensler, believed ether was a security for at least some time, according to a report by Fox Business producer, Eleonore Tarrant, Citing court documents filed by the Ethereum software firm, Consensus, on April 29th, Tarrant wrote that the SEC and Gensler, quote, appear to have believed, at least for a year, that ether was an unregistered security trading out of compliance with current federal regulations. The new information comes a few days after consensus filed an unprecedented complaint against the SEC in a Texas federal court on April 25th.

The filing came in response to a Wells notice from the securities regulator detailing its plans to sue the firm for failing to comply with federal securities laws. According to a new filing, on March 28, 2023, the head of the SEC's division of enforcement, Gubir Grewal, approved a formal order of investigation into Ether's status as a security. The investigation, known as Ethereum 2.0 investigation, reportedly authorized enforcement staff to investigate and subpoena individuals and entities involved in the buying and selling of the cryptocurrency. Citing anonymous sources with direct knowledge of the matter, Terret noted that subpoena recipients were instructed by the SEC to keep the investigation strictly under wraps if they wanted further details regarding the investigation.

The Ethereum 2.0 investigation was reportedly based on the SEC's belief that potential unregistered offerings and sales of ether occurred since at least 2018. If the Gensler SEC finds ether to be a security it will contradict prior SEC guidance under former chair Jay Clayton. In June 2018, then director of corporation finance, Bill Hinman, stated in a speech that the SEC's position is that ether, alongside bitcoin, was not a security. The new filings disclosed that the 5 member commission approved the division of enforcement's Ethereum 2.0 investigation on April 13, 2023, just 5 days before Gensler appeared before the House Financial Services Committee where he refused to answer repeated questions on whether the SEC believed ether to be a security.

The news comes a few days after the applicants and firms involved in a potential spot ether exchange traded fund in the US claim that the SEC will likely delay its decision on whether to approve such a product in May. Bloomberg ETF analyst Eric Balchunis believes that Gensler's stance on ether could impact the decision process as Gensler refused to clarify whether ether was a security last year. Well, that's the story, but as we all know, ether is a security. It is. It just is. How it is that the that Hinman made that speech where he said that ether and Bitcoin wasn't a security. He was right about Bitcoin, but he was obviously wrong about ether.

That whole thing is a security. It's an unregistered security. Now, I I don't know. I I I don't see how it is that if they were to regard ether as not a security, considering that it completely passes every single part of the Howey test, which is a test that's been used in, I don't know, a 100 for a 100 years or so as to how to figure out if something's a security or not. If they lit ether not pass the Howey test, then the amount of garbage that is also going to be argued that doesn't pass the Howey test and therefore is not a security is going to overwhelm the courts the financial court system, the SEC, Treasury Department, FBI, you name it. Whoever is involved in investigating this kind of crap is gonna be overwhelmed because it's going to be a floodgate.

Ether is a security. It is. It just is. Now, Bitcoin Magazine. Now that we've had some time to digest the whole samurai wallet thing, let's get into this one written by Lola Leitz Samurai Wallet, breaking down dangerous precedents. On Wednesday, the founders of the Bitcoin privacy wallet, samurai wallet, were arrested and charged on behalf of the US government. The indictment could set dangerous president precedents beyond Bitcoin privacy services. Last Wednesday, samurai wallet founders, Keyon Rodriguez, and William Hill were arrested and charged with conspiracy to money laundering and conspiracy to operate unlicensed money laundering service businesses in the Southern Court of New York.

The indictment alleges that samurai wallet, quote, facilitated more than $100,000,000 in money laundering transactions from illegal dark web markets. So let's get into it. Can a non custodial wallet be a money service business? FinCEN's 2019 guidance on persons administering, exchanging, or using virtual currencies define a money transmitter as a person that provides money transmission services or any other person engaged in the transfer of funds. As the guidance states, a transmitter initiates a transaction that the money transmitter actually executes. The guidance further states that the term money transmission services is defined to mean the acceptance of cryptocurrency, funds, or other value that substitutes for currency from 1 person and the transmission of currency, funds, or other value that substitutes for currency to another location or person by any means.

As a non custodial Bitcoin wallet, Samurais Wallet's operators do not take custody of user funds and therefore are technically incapable of accepting or depositing or executing the transmission of funds contrarily to what is alleged by prosecutors stating that, quote, samurai engaged in the unlicensed receipt and transmission of funds, including funds deposited into a samurai wallet by an undercover law enforcement agent located in the Southern District of New York. However, technically speaking, the agent deposited funds into an application running his own device, with no engagement from samurai operators a circumstance correctly noted by prosecutors throughout the indictment stating that the private keys for these cryptocurrency addresses are stored in each user's individual cell phone that these private keys were not shared with samurai employees, and that, quote, the samurai software on the user's cell phone will broadcast a transaction to the blockchain.

The indictment yet alleges that SAMURAI Wallet facilitates transactions between SAMURAI users, a claim that seems blatantly incorrect in the face of the fact that coinjoin transactions do not facilitate transactions between users at all, but rather create a shared transaction in which every user spends their own funds to themselves. The indictment further repeatedly alleges that SAMURAI creates new addresses used during the transaction and that the SAMURAI server is responsible for broadcasting transactions. Broadcasting transactions claims which too are technically incorrect as transactions are created solely on the user's device and Samurai only broadcasts transactions on behalf of users if users choose to broadcast their transactions via Samurai's node.

For anyone running their own node with Samurais wallet known as dojo, transactions are broadcast by users themselves. Numbers provided by the node provider Ronin Dojo suggest that up to 85% of Whirlpool users run their own Dojo. It is questionable whether organized criminals would rely on nodes provided by Samurais Wallet as its operators would effectively be enabled to de anonymize transactions by gaining knowledge of users' extended public keys, a design choice often criticized in SAMURAI Wallet's architecture. Notably, the indictment makes no mention of dojo at all.

The indictment against samurai appears to suggest that the Department of Justice does not believe Finsen guidelines apply as reflected in the language used to describe samurai's services, in which prosecutors note the broadcasting of transactions, the operation of a centralized server, and the subsequent collection of fees from the services offered, quote The SAMURAI server is responsible for broadcasting the Ricochet transactions to the BTC network. From Whirlpool and Ricochet, Rodriguez and Hill earned at least $4,000,000 in fees.

The DOJ's argument appears more in line with recent recommendations issued by the Financial Action Task Force, FADF, an intergovernmental body established by the g 7 in 1989 to combat money laundering and terrorist financing risks, is not a regulatory body, but the task force recommendations are known to form the basis of informing AMLCFT regulations around the world. In recommendations issued in 2021, FATF expands the definition of virtual asset service providers as decentralized exchanges or platforms, which have a central party with some measure of involvement or control, such as developing user interfaces for accounts holding an administrative key, or collecting fees.

By the logic put forward by FADF, it appears that the development of any individual, organization or technology interfacing with financial transactions last week aimed at updating current AML regulations in accordance with FATF recommendations, specifically exempted self custodial services. Similar attempts to circumvent FinCEN guidelines are currently being made on the tornado cash case. In an opposition issued on April 26, prosecutors argued that the definition of money transmitting does not require the money transmitter to have control of the funds being transferred highlighting that section 1960 of the US code, a codification of permanent federal laws, extends the definition of money transmitting to transferring funds on behalf of the public by any and all means.

As interpreted by the Department of Justice, AT and T would require a money service business license to allow customers to access their PayPal. An ISP would need a money service business license to allow users to access online banking services. A postman would require a money services business license to deliver cash in mail. A grocery would need one to hand out change. And Telegram, WhatsApp, Signal and Twitter would require a money service business license if users utilize the platform to share PSBTs or lightning invoices subsequently deeming all such services to require full know your customer verification.

The indictment has sent ripples through the Bitcoin ecosystem leaving anyone involved in the broadcasting of Bitcoin transactions in uncertainty, including Bitcoin miners and node operators. The non custodial lightning wallet Phoenix has since announced the suspension of operations in the United States. The privacy first Bitcoin wallet Wasabi Wallet was banned or has banned United States users from accessing its services and software. Reading the indictment it appears as though everything we knew about the regulatory aspects of money transmission may have been misapplied, as the indictment appears to go as far as to attempt the criminalization of self spending.

As the indictment reads, self spends, as evident in Coinjoins and Samurais Ricochet, they further blockchain surveillance mechanisms and censorship, further muddying regulatory waters. The foundations to introduce KYC to the Bitcoin network have been researched as early as 2016 with the MIT Chain Anchor Project which explores the introduction of identities and permission groups to blockchains preventing non registered users from having transactions mined in blocks. With increasing miner centralization with around 47 percent of Hashrate's mining rewards custodied by a single custodian, including the pools of Antpool, F2Pool, Binance Pool, Brains, Btcom, Secpool and Poolin, plans to KYC the Bitcoin network may not seem too far fetched.

In 2023, F2 Pool already began censoring transactions in line with OFAC sanctions lists. Since the indictment of the samurai founders, the FBI has issued a PSA concerning cryptocurrency money service businesses alerting the public to avoid services that do not require KYC info. If the non custodial operation of services is ruled telecommunication providers. If spun ad absurdum, it could even be argued to require the registration of KYC for the use of highways or the purchase of briefcases. Plans to KYC the Internet have been around as early as 2014 when the US government attempted to introduce a driver's license for the Internet, similar to the planned introduction of digital identities around the world. It should be noted that the treatment of samurai founders who are currently serving pretrial detention stands in no comparison to the handling of financial crime allegations around the world.

Since 2000, traditional financial institutions such as UBS, JPMorgan, and Bank of America have been fined over 380 $1,000,000,000 The argument that traditional banks are primarily used for legal transactions can also be applied to samurai wallet as the indictment reportedly only alleges the transmission of illicit funds of 3.6 percent of SAMURAI's total transaction volume, leaving 96.4% to legitimate usage. The Samurai case has been assigned to judge Richard M. Berman who previously presided over the Jeffrey Epstein case. Oh my god. In 2005, Berman ruled that random police searches of rider's bags on the New York City subway did not violate the United States Constitution.

Which is total bullshit. Because that is a direct violation of the 4th Amendment of the United States Constitution Bill of Rights. It's a direct violation. Direct. It doesn't matter if it was better for the subway system, worse for the subway system in New York, or neutral, It was a direct violation of the 4th amendment of the United States constitution, specifically the bill of rights, which is the first ten amendments to the constitution of the United States. And without those first ten amendments, the constitution was never going to be ratified by the signers of the constitution, which mean it wouldn't even exist if it wasn't for amendments 1 through 10 of which number 4 is clearly in the bill of rights.

It would be a breach of contractual duty on the part of the constitution of the United States if this continues. Actually, if this occurs. So there's already breach there's already contractual breach. But since nobody seems to actually give a shit about the constitution of the United States, we find ourselves in this situation. And if we don't fight this situation, we're gonna find ourselves in more and more bullshit situations. Now, let's go back up here to the top and see if I can find it again. I had it highlighted, but no, it doesn't look like I've got it highlighted.

[00:23:04] Unknown:

Hold on. Well, I guess one thing that I can say is

[00:23:10] Unknown:

the notion that a postman becomes a money transmitter when they drop off a check, like your Social Security check if you're retired or or like, you know, of Social Security age, and they put a check-in your mailbox that all of a sudden the the postman becomes a money transmitter. Or when the grocery store gives you change back,

[00:23:33] Unknown:

they might be a money transmitter. Let me let me just say this. Here's the real issue. We're all money transmitters, and we were before Bitcoin We were before egold before any of this stuff was even

[00:23:53] Unknown:

a sparkle in the eyes of our our parents, Right? If any of your parents are still alive We were all money transmitters all of us postman grocery clerks you know, like, UPS guys. Everybody's a money transmitter. You know, I mean, am I worried that my lightning node and my Bitcoin full node are going to be regarded as money transmission services? No, I'm not. Because this is where we get into guerrilla warfare. How easy is it to deploy a Bitcoin full node? And and I have been thinking about this for a long time. The the thought of just dumping something like a fist sized unit that has Wi Fi or at least, you know, some kind of, you know, the ability to get into some like a college, like university, go go pick a university.

Their Wi Fi network. Or if you can get it if you can even get it even, you know, a little bit more in into like a closet and tape that son of a bitch to a corner and put like an old chair over it and hook it into the, you know, into the Internet port there. Now, good schools, IT schools will notice that there's something out of port. I get I don't know I I don't know how this works. All I know is that for as small as a Bitcoin full node is, would it not be possible for that to be ammunition in a guerrilla warfare on this kind of bullshit where nobody even knows it's yours? You just left it over at IBM. You just left it over at Texas Tech. You just accidentally hooked it into the computing system or it's like strapped to the Wi Fi at college station.

Yep. It it is probably a stupid idea, but I'm just gonna go ahead and allow myself the naivete to suggest that if they want to actually perpetrate this continual stream of bullshit, that we're gonna have to fight back somehow. We this is just leads to tyranny. It's just not going to stop. It either stops now or the future is really grim indeed. Just absolutely shockingly grim. And it will probably be led by this person. This is out of decrypt written by Jason Nelson. Elizabeth Warren claims crypto is the payment of choice for child abuse material.

She has no proof, but let's get into it. US senator Elizabeth Warren is again attacking cryptocurrency, this time linking the digital asset market to child sexual abuse material or CSAM, c s a m. In a bipartisan open letter to the Department of Justice and Department of Homeland Security cosigned by Louisiana US Senator Bill Cassidy, Warren called crypto the payment of choice for child abuse material, quote, we are writing to express our concern regarding the use of cryptocurrency in the illegal trade of child sexual abuse material and to obtain information about the tools needed by the Department of Justice and Department of Homeland Security to end this illicit trade, the senators wrote. In the letter, Warren and Cassidy said cryptocurrency and the anonymity it provides facilitates trade in images and videos depicting the sexual abuse of children, pointing to a 2021 report by the International Center For Missing and Exploited Children.

The letter also cited a February report by the Treasury Department's Financial Crimes Enforcement Network that called Bitcoin the convertible virtual currency of choice for child exploitation and human trafficking. Out of 2,311 reports received, 2,157 specifically referenced Bitcoin as the primary CVC used for purported online child sexual exploitation and human trafficking related activity. From this dataset, FinCEN identified over 1800 unique bitcoin wallet addresses related to suspected ocse and human trafficking offenses. The senators also mentioned a recent crypto crime report by blockchain analyst firm Chainalysis.

Of course, our good friends over there, Chainalysis. That noted, privacy coins like Monero being adopted for CSAM vendors. Quote, many CSAM vendors have adopted Monero in recent years, though bitcoin is by far the most widely used cryptocurrency for c Sam purchasing, Chainalysis wrote. Thank you Chainanalysis for helping everybody. Fucking assholes. The data suggests Monero's role is more prevalent in c Sam vendors' efforts to launder their on chain earnings rather than to obscure the purchases themselves. Chainalysis acknowledged that it was difficult to verify Monero's role directly on chain using standard blockchain analysis techniques but could report on c Sam vendors' use of Monero friendly instant exchanges as a proxy.

The office of senator Warren didn't immediately comment. Warren and Cassidy set a May 10th deadline for the Department of Justice and Homeland Security to respond saying that it would help ensure congress and the Biden administration are doing their part to address challenges related to CSAM and cryptocurrency. Quote, existing anti money laundering rules and law enforcement methods face challenges in effectively detecting and preventing these crimes, the letter said. Quote, we are committed to ensuring that Congress and the administration have the full suite of tools needed to end CSAM and punish the sellers of this material, end quote. In addition to asking the agencies to outline their most pressing needs, the letter asked for a current assessment of the role that cryptocurrency plays in facilitating CSAM, whether the use of cryptocurrency poses any unique challenges to efforts in identifying and prosecuting illicit use of cryptocurrency, Warren introduced the Digital Asset Anti Money Laundering Act in December of 2022 and extend regulatory framework that applies to traditional financial institutions to include cryptocurrency firms.

Digital asset wallet providers, miners and validators would have to comply with know your customer and anti money laundering requirements. Last summer, Warren sounded the alarm on cryptocurrencies use in the fentanyl trade. Again, calling for stronger regulations. Do you see a pattern, folks?

[00:30:56] Unknown:

Do you see a pattern? It has nothing to do with fentanyl.

[00:31:02] Unknown:

It has nothing to do with CSAM. It It has nothing to do with human trafficking. It has nothing to do with border violations. It has nothing to do with any of it. It's pure and simple control of everything. Because half of all transactions that are committed on the face of the planet at any given time are money transactions. Control that shit. It's like control the spice, control the universe. The spice here is the transaction. You know, after that if they get since we're not gonna fight since we're not, you know, clearly, I don't think we're gonna fight back. We're just gonna take it as you know, take it on the chin and turn the other cheek, and we're gonna be good little good girls and boys and just lay down and take this shit.

What's next? What's the other side of the transactions? We've got 50% b and money transactions. What's the other transactions? Me being able to talk to you. This show. Me being on Nostr or on Telegram, or Signal, or Simplex, or pick your poison, Keith. Any of them. The ability to trade files on blossom or using blossom as as as an end to a means for file storage and the ability to transmit it somewhere if somebody wants to pay for that file. All of it. You can just kiss all of it goodbye. At one point or another, if somebody overhears me talking to somebody else physically in meat space on the street, that's a transaction. It's an it's a transaction of information.

[00:32:47] Unknown:

This only goes one way.

[00:32:50] Unknown:

There's no light at the end of this tunnel. It just gets darker and darker and darker, And it's a black hole, not a tunnel. There is no other side. There's no light at the end of that tunnel because this isn't a tunnel. It's a bottomless pit of bullshit. When do we fight? How do we fight? I mean, you know, there's there's only so many pro bono lawyers that are willing to just remain freaking poor for the rest of their lives so they can continuously fight this crap because they've got all the money, not the lawyers. I'm talking about the people that are doing this. Warren, for the amount of money she owns and the amount of assets she has on her personal books that she has gladly given over to Congress because that's what they have to do. They have to do financial disclosure. There's no way, given any of the jobs that she's ever had and any of the salaries that she's gotten as senator, there's no way she could put together that kind of asset list.

The criminals have taken over, and they are using our own system to fight us,

[00:34:04] Unknown:

and they are fortifying that system against us right now and I don't really know how to fight that. I'm not going to stop running my node. I'm just not going to stop running my node.

[00:34:20] Unknown:

But before we get into the numbers, I want to read you this one headline. And you can go think about it, however you wanna go think about it. This is out of CoinDesk.

[00:34:32] Unknown:

Tether,

[00:34:33] Unknown:

the stablecoin company, you know, USDT, Tether, they have bought a $200,000,000 majority stake in brain computer interface company, BlackRock Neurotech So why does Tether have any interest in a buying stake in especially $200,000,000 stakes in companies, but neurotech? Brain computer interface neurotechnology. What what does a stable coin have to do? Why are you out of your lane, Tether? This is so far out of your lane, it's not even funny. And the argument will be said to me, but David, all they're doing is they're just this is how they're going to back their, you know, their their stable coin with with equities.

[00:35:27] Unknown:

I don't know, man.

[00:35:29] Unknown:

I don't know. I think what's happening is we're watching Tether take the amount of money, the massive amount of money that they've made and they're going to start divesting themselves of the stable coin market because they don't want to go to jail and they're going to use all of this money that if they get out of the market, if Tether says, you know what? We're fucking done. Nobody's ever gonna come after that money, because it's all gonna be in these US companies. So our so let's take it let's assume that that actually happens. That Tether is declared, you know, one point or another right before Tether is declared an illicit money transmitter and that they're all gonna go to jail and here comes the DOJ the day before, they divest themselves and close down Tether and rocks the entire cryptocurrency world, blah blah blah, and all the prices crash and everything's bad. And they've got all of their money in these US companies.

How is it the US companies are not acting as a money laundering endpoint for Tether? Now I don't know if Tether is actually doing this because they're money launderers. I don't care. Everybody apparently is a money launderer, and we're all gonna go to jail. There's not enough jail cells to fill or that I mean, well, there's not enough jail cells. We'll we'll fill them all 100 and thousands of times over. But in either event, we're all criminals. That's becoming very evident. But, I mean, would would any of the US companies be held liable for being an endpoint for money for money laundering? No. Would they be forced to sell those shares en masse? No.

Because that's not going to help the United States stock market. It's this is all a black game. It's a very dark game that we're in and we're at the very end stages of this entire thing and either it burns to the ground and the sun comes out and we start acting like humans again or we go into a dark age. Hate to be so somber on a Monday, but I don't know where else this goes. Let's run the numbers. Maybe that'll help. CNBC Futures and Commodities, they got oil. West Texas Intermediate is down 1.66 percent to $82.46. Brenton, North Sea is down 1 and a half. Natural gas is up 4.84.

Yes. Because it always goes in reverse of oil even though it comes out of the same hole in the ground, but whatever. Gasoline is down 0.67 percent to $2.74. All of your shiny metal rocks are having a good day, including gold, up a quarter point to $2,353.20. Silver is up a quarter of a point. Platinum is up 4.2. Copper is up 2.17. Palladium is up 2 and a third points. Ag, fully mixed today. Our biggest winner is sugar. 3.46 percent of the upside. Biggest loser today is going to be woah, holy shit. Chocolate. Dude guys chocolate is down 13.7 percent.

I rarely see a double digit number in agricultural futures. I rarely see that. What the hell happened to chocolate? Somebody find that out and tell me. Live cattle is down 0.85. Lean hogs are unchanged. Feeder cattle down 0.43%. The Dow is up a third of a point as is the S and P. The Nasdaq is up almost a half point, and the S and P Mini is up over a half point. Ken Warp, thank you for 2,100 satoshis. Wartime psychopath, thank you for 2.1 1,000 satoshis. They are much appreciated. Especially when the price is at $62,910, that is a 1.24 percent or try it again, $1,240,000,000,000 market cap. You can get 26.7 ounces of shiny metal rocks with your 1 bitcoin of which there are 19,691,669.87 of.

Average fees per block, 1 third of a Bitcoin. So fees, thankfully, have gone down. Unspent capacity seems to be holding still 10,006.63 BTC in unspent capacity in the Whirlpool. I I kind of expect that that's gonna drop. I really do, and I don't think anybody should freak out about it either because of the whole samurai thing. In either event blocks, there are 239 of them carrying 184,000 unconfirmed transactions at high priority fees of 25 satoshis per vbyte, low priority 24 satoshis per vbyte, and anything under 6 satoshis per vbyte are being purred from impulse around the world. I got a hash rate flashing of 552.4 exahashes per second. So we've lost quite a bit from the network.

We'll have to see if we gain that back as time goes on. From episode 889, also known as Sunshine Enema, I got 20,000 satoshis from Loke. The fact that you continue to deliver episodes week after week is amazing. Keep doing what you're doing. Thank you, brother. Letter 6173 with 5 ks says, god is great. Bubba with 5 ks says, nice shout out, so I'll shout back. My main statement was to stop talking on the Internet. Once I retire, in a couple of years, the smartphone will be replaced with a dumb phone. And I may let the wife be the only user on the pewter. Call me Unabubba or Unabubba I guess. Oh, like Unabobber.

Unabomber. Unabubba. I love it. By the way, I'm on Nostra, but I haven't been there for a while, but I do still listen to you What do I need the internet for? I got David Bennett every fucking day. I'm good. Plus communications. Bubba, you're you're a trucker. You've been a trucker for a long time. What if somebody told you that you needed to take the CB radio out of your truck and ditch it? And you needed to call for help. That honestly, that's one of the greatest things that the citizen band radio gave all the truckers was the ability to, hey, I'm over here, or God I need help, or hey where are all the hookers? I'm sorry. Did I say that out loud? In either event Bubba, I view a communications protocol as much more than just whether or not it's on the Internet.

And that's where I'm coming from. This goes for ham radio, FM, AM, CBs, any kind of two way communication stack even though you don't do that on FM and AM. But you see what I'm saying. Any kind of two way communication stack is a good thing. Will it be used for stupid shit? Absolutely. Why? Because we're hairless, dumbass, treeless apes. We fell out of the tree probably a little too early. But Jastrow with a 1,000 says, I appreciate the chapters in fountain. The bird with a 1,000 says, so does this mean they acknowledge Bitcoin as money? Since they are popping people based on money transmission?

Yes, it does. 0121 with 444 says, you demand God's death with 337. Thank you, sir. No. Thank you. Kick with a row of sticks. Hope my two brain cells were correct when I connected KC cattle company and yourself via beef initiative. Zaps work on fountain. Yes, they do. User with a bunch of numbers, a 100 says what platform can I listen to your show live? I like fountain, but I feel like it's not a livestream. No, sir. It is not a livestream when it hits fountain. That is after I've edited it and done a whole bunch of other stuff. If you want to listen to this live zapstream.com If you can get to me on Nostr, you will be able to follow my inpub on zap.stream.

That's zap.stream. I don't know. I think I said about dotcom. That's not true. It's just zap.stream. I'm also on twitch at nosterbusiness. Nosterbusiness. Nosterbusiness. Pies with a 100 says, free samurai. I concur. Pies with a 100 says, thank you, sir. No. Thank you. End user with a bunch of numbers, a different set of numbers boosted a 100. Spot on, sir. Thank you very much. That's the weather report. Welcome to part 2 of the news that you can use zk SNACK's coin join coordinator is now blocking United States residents and citizens. How embarrassing is it at this point that nobody in the civilized world wants to do business with you because you are a United States citizen?

I'd scream racist, but, you know, I think, all the, the liberal snowflakes have that locked down. I find it rather embarrassing at this point. Nobody wants to do business with me when they find out I'm a United States citizen. Zksnackscoinjointcoordinator, now they're blocking US residents. You can't even visit their website. Or downloading and using Wasabi Wallet and any related products and services, including their APIs and RPC interfaces, announced the developers of Wasabi Wallet. Quote, effective immediately, mother.

And other until further notice, zk Snacks is now blocking United States citizens and residents from visiting its websites and all the rest of the stuff that I just mentioned. In light of recent announcements by US authorities, ZK Snacks is now strictly prohibiting United users from using any of its services. An IP address blocking for US residents is effective on wasabi wallet dot io, api.wasabiwallet. Io, and zksnacks.com. And in fact, right now I am not using a VPN. Let's see what happens. I'm gonna go to zksnacks.com.

What happens? Unfairly pride no, I'm in. I guess blocking didn't work and no, I'm not on a VPN. I'm not using one at this moment, and it looks like I'm totally in. Let let me try one of the other ones. Let's see what the API website says here. Just for shits and giggles. So api.wasabiwallet. Io. Now it's it's it says zk snacks is now blocking US residents and citizens. And then it gives me a notice and I have yeah. So API dot wasabi wallet is definitely definitely blocked.

[00:46:53] Unknown:

And let me just let me just

[00:46:57] Unknown:

round that thing out here. Hold on for a sec. Wasabi wallet dot io gives me the exact same message. Zksnacks is now blocking US residents and citizens. And hold on, let me just just check out that first one zksnacks.com. Still seems rather functional. What happened? It's got a button here for try wasabi wallet. And then it takes me to wasabi wallet dot io, which is indeed blocked by or for United States citizens of which I am 1. Quote, US refers to United States and includes several states of the United States and related territories. If you are a US citizen or a United States resident, you are not allowed to visit any sites aforementioned, download Wasabi Wallet, or use the Wasabi Wallet CoinJoin feature.

This includes if you are a US permanent resident or if you are an individual that holds US passports, as explained in a blog post. ZK Snacks is the company behind the default coin joint coordinator of Wasabi Wallet. Since March 2022, the company has been proactively filtering certain UTXOs from registering to coin joins by partnership with the chain surveillance partner since March of 2022. Well, ain't that just the bee's knees, brothers and sisters? Pretty soon, United States citizens, you won't even be able to travel to somebody else's country. It's it's almost like the United States is becoming a prison, not only within, but from without.

Something weird. There's something weird going on with that. Because think about it. Less and less countries, less and less companies in other countries wanting to do business with the United States citizenry. And yet, it's like I I don't know, man. There's something something doesn't feel right. All of a sudden something doesn't feel right. I'm not sad and I'm I'm not like, you know, I'm not moaning about any of it, but I am being I am

[00:49:11] Unknown:

putting The it's the call. It's the alarm call. The fire alarm is going off. What the hell is going on?

[00:49:21] Unknown:

Is the I mean, is the United States regulatory authorities as a body aware that internationally nobody wants to do business with a United States citizen? Are they aware that what they're doing, their continuous actions since, I'm gonna say, since 2,001? Really coming on strong after 2,008, but definitely taken a turn for the worst during and after the pandemic. Something's weird. What's going on? Somebody out there have any idea? Let's move on. The DOJ Department of Justice has challenged Tornado Cash developers' motion to dismiss. The United States Department of Justice pushed back against Tornado Cash developer Roman Storm's motion to dismiss criminal indictment against him, claiming that Tornado Cash, in fact, acted as a money transmitting business.

See a theme developing. In a 111 page filing on Friday, the DOJ disputed how the defense characterized tornado cash, saying it was announced in 2019 as a mixer and the overall service includes a website interface, a combination of smart contracts, and a network of relayers. Quote, the indictment clearly alleges that the Tornado Cash Service was a commercial enterprise carried on for profit, for or financial gain and that the defendant himself profited from its operation through his control while others of key components of the integrated Tornado Cash Service was stated in the motion as terrible sentencing. My god. Quote, the very success of the tornado cash service in laundering enormous amounts of criminal proceeds shows the needs for restrictions, said the prosecutors.

The indictment lays out one picture of the success in the form of $2,700,000 in tornado profit that it says Storm transferred to cold wallets and have still not been identified. Storm also accessed Binance using a VPN and an account under a false identity to cash out other Tornado Cash proceeds reports to block. In the summer of 2023, the DOJ charged tornado cash developer Romanstorm and Roman Seminov with conspiring to commit money laundering, conspiring to operate an unlicensed money transmitter, and conspiring to violate sanctions laws. Quote, the government has not charged the defendant with a crime that involves solely writing code or maintaining a website.

Rather, the charged offenses require the government to prove that the defendant conspired to conduct financial transactions designed to conceal criminal proceeds. That's count 1. Operate a money transmitting business, which is count 2. And receive or provide goods or services to sanctioned entities or deal in blocked property, which is count 3, explains the filing. Lawyers representing Storm sought to dismiss the indictment at the end of March. They contended that tornado cash does not qualify as a custodial, mixing service, or a financial institution as defined by law. Additionally, they argued that Storm was unable to exercise control over the service or prevent its use by cybercriminal groups.

The trial of Roman storm is set to begin this September. So there you go with all that. Simplex chat version 5.7.0. Quantum resistant end to end encryption. Simplexchat is a free and open source messaging platform that has no user identifiers and is private by design available on Android, iOS, Linux, Windows, and Mac OS. Quote, This release is focusing on improving the app usability and preparing the foundation for version 5.8 that will provide an inbuilt protection of user IP addresses when connecting to unknown file and messaging servers reducing the need to use Tor, which would still remain supported via SOX proxy for additional privacy, stated the blog, quote, we are planning a third party security audit for the protocols in cryptography design in July of 2024 and also the security audit for an implementation in December of 2024 through January 2025.

And it would hugely help us if some part of this $50,000 expense is covered by donations. See this section for ways to donate. And that section, by the way, is github.com/simplexchat and, yeah. Go there's a donation page on their GitHub. So just just go go go help them out. Anyway, so what's new? Quantum resistant end to end encryption with all contacts. Forward and save messages without revealing the source? In call sounds and switching source sounds better network connection management customizable profile images and they added Lithuanian interface languages to the Android and desktop apps. So if you're Lithuanian, that's good news. But I want to get to the quantum resistant end to end encryption.

You might as well do it now. I mean, sure there's gonna be people that just go, you know quantum computing is just it's just it's dumb. It's it's a red herring. It's you know, it's not gonna happen. Well, maybe and and and even if it does happen, it's probably not gonna happen for a while And when it does happen, honestly, your chats are probably the least of your worries. Your fiat legacy financial bank account, if you still have one, should actually be your first concern. Because if they can crack the encryption on my Bitcoin wallet, they're not going to do that first.

They're going to go after the fiat money, if it's, well, if it's worth anything by that time. But some of it still will. Fiat's going to be around. We're not going to be able to get rid of it anytime soon. However, for something like a messaging app, there's no reason not to change the encryption. It makes sense in this context To change the proof of work, the hashing algorithm of Bitcoin, that doesn't make sense right now. However, I have no problem with people forward thinking, like Matt Corallo, who is has threatened the nuclear option and said we should change the proof of work, he's doing it not for you know the quantum issue. It's doing it for, you know, this this well, all the 47% of Bitcoin templates actually being provided by Ampull, and it's everybody's a proxy for Ampull.

I get that. But when there are other people that we're talking about, you know, fortifying Bitcoin against quantum attack, that's also a nuclear option because the only way to do that is to change the hashing algorithm, which basically is also the nuclear option. So I'm just gonna say it. If for whatever reason, and I don't think it's a good idea that we need to pull the plug on all the miners and destroy all of their infrastructure in one fell swoop by changing the hashing algorithm if we're going to do that, and I don't think we are, then we should change it to the quantum resistant version of shah 256 and I don't know what that is but I do know that there are things that are like that that are out there.

Now this one Custodia Bank appeals district court decision denying it a Fed master account. Wow. They've been fighting this shit for so fucking long. It's not even funny. Custodia, a full reserve crypto bank from Wyoming that has been actively seeking an account with the Federal Reserve System for several years, has filed an appeal against a court decision confirming the Federal Reserve's refusal of its application for what's known as a master account. The master accounts grant institutions direct entry to the federal payment system, offering the most immediate access to the United States money supply for financial institutions.

Quote, unless federal I'm sorry. Unless Federal Reserve Banks possess discretion to deny or reject a master account, state chartering laws would be the only layer of attract businesses by reducing state chartering bird burdens through tax legislation, allowing minimally regulated institutions to gain ready access to the central bank's balances and Federal Reserve Services ruled Scott Judge Skovado. I I cannot pronounce it. Custodia sued the Federal Reserve Board of Governors and the Federal Reserve Bank of Kansas City in 2022 for delaying a decision on its application following a statutory deadline of 12 months.

Custodia's request for a master account was denied by the Fed in January of 2023 based on quote fundamental concerns with custodia's approach The way you read that last statement is this. The Federal Reserve in January had a fundamental concern with a bank that had full reserves and was able to pay out 100% of all deposits to all of their depositors in in the event of a collapse or some kind of banking calamity on the part of custodia.

[00:59:28] Unknown:

How do you have a problem with being able

[00:59:31] Unknown:

provably able to pay back all of your creditors in the event of a financial catastrophe whether internal or external. What kind of psychotic sociopath do you have to be to with a straight face in a court of law as the presiding judge state that you got a problem with that. I The whole world has gone insane. It really has. Last up, it's time for lightning and it's time for bolt 12. This is a note from ocean. As of today, ocean miners can attach a bolt 12 offer to their bitcoin address and get paid out over lightning. Bolt 12 offer or offers allow us to request multiple invoices for any amount while only requiring the miner to set things up once.

Miners simply sign a message containing the offer using the private key associated with the Bitcoin address using bolt 12 also allows us to prove to the world that a payment was made. The size of the payment, the node to which it was paid, and that it was paid by us. This means that we can continue to offer a fully transparent and verifiable pooled mining while no longer being restricted at the base layer. Using the Bitcoin stack to its fullest is how we eliminate the need for trust and bring sovereignty to mining.

So that's Ocean now using Bolt 12 as their pay as a payout device for miners, which is really really good. Alright, so we are 1 hour and 1 minute in. I'm gonna go ahead and end it here, but I want to say thank you to Kidwarp. Glad to see you in the stream. You haven't been here in a while. I have literally missed you. Wartime psychopath, thank you also for being here. I will see you on the other side. This has been Bitcoin, and and I'm your host, David Bennett. I hope you enjoyed today's episode and hope to see you again real soon. Have a great day.