Topics for today:

- Quantum Jokes

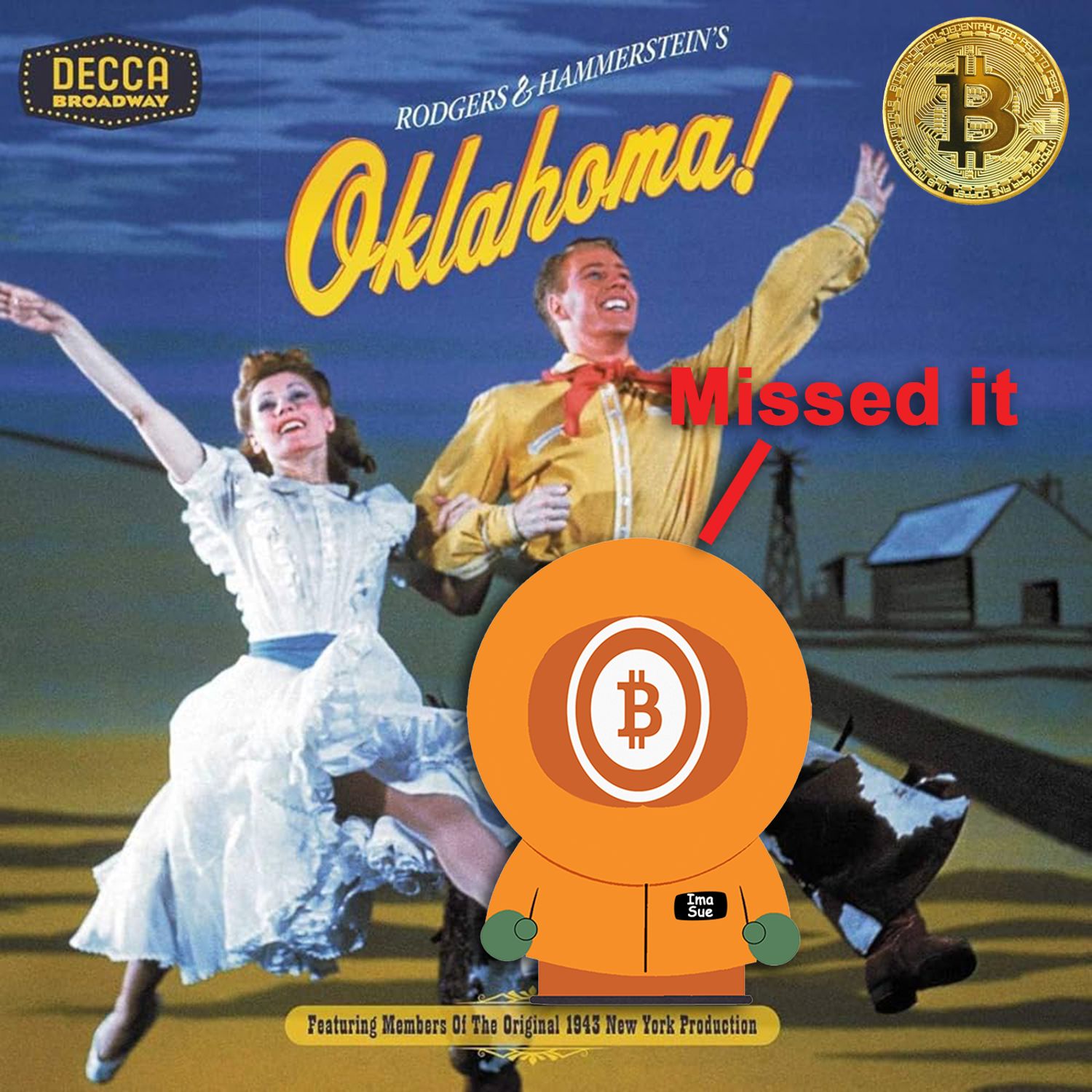

- Arizona Leads, Oklahoma Fails

- Panama City Accepts Bitcoin

- Tether Buys Bitdeer's Dip

Circle P:

Maple Syrup and Soapsnostr handle: https://primal.net/p/npub172mu27r5yny0nnmvgjqwhx055dmsesrrx7j0p5d3pxagfx6xgxfsv75p3q

Twitter: https://x.com/beisnerds

Articles:

https://cointelegraph.com/news/quantum-computers-likely-to-reveal-if-satoshi-is-alive-adam-backhttps://bitcoinmagazine.com/takes/how-do-we-protect-bitcoin-from-quantum-computers-not-with-a-joke

https://www.theblock.co/post/351240/arizona-leads-crypto-reserve-legislation-race-as-sb-1373-passes-house-committee

https://atlas21.com/oklahoma-rejects-strategic-bitcoin-reserve-bill-fails-in-senate-committee/

https://www.zerohedge.com/crypto/panama-city-approves-bitcoin-and-crypto-payments-taxes-fees-permits

- https://www.cnbc.com/futures-and-commodities/

- https://dashboard.clarkmoody.com/

- https://mempool.space/

- https://www.bitcoinandshow.com/

- https://fountain.fm/show/eK5XaSb3UaLRavU3lYrI

- https://geyser.fund/project/thebitcoinandpodcast

https://www.coindesk.com/policy/2025/04/18/leaders-of-usd190m-brazilian-crypto-ponzi-scheme-sentenced-to-over-170-years-in-prison

https://atlas21.com/south-korean-candidate-promises-cryptocurrencies-reforms/

https://www.nobsbitcoin.com/opensats-unveils-the-eleventh-wave-of-nostr-grants/

https://www.nobsbitcoin.com/coinswap-v0-1-1/

Find the Bitcoin And Podcast on every podcast app here:

https://episodes.fm/1438789088

Find the Bitcoin And Podcast on every podcast app here:

https://episodes.fm/1438789088

Find me on nostr

npub1vwymuey3u7mf860ndrkw3r7dz30s0srg6tqmhtjzg7umtm6rn5eq2qzugd (npub)

6389be6491e7b693e9f368ece88fcd145f07c068d2c1bbae4247b9b5ef439d32 (Hex)

Twitter:

https://twitter.com/DavidB84567

StackerNews:

stacker.news/NunyaBidness

Podcasting 2.0:

fountain.fm/show/eK5XaSb3UaLRavU3lYrI

Apple Podcasts:

tinyurl.com/unm35bjh

Mastodon:

https://noauthority.social/@NunyaBidness

Support Bitcoin And . . . on Patreon:

patreon.com/BitcoinAndPodcast

Find Lightning Network Channel partners here:

https://t.me/+bj-7w_ePsANlOGEx (Nodestrich)

https://t.me/plebnet (Plebnet)

Music by:

Flutey Funk Kevin MacLeod (incompetech.com)

Licensed under Creative Commons: By Attribution 3.0 License

creativecommons.org/licenses/by/3.0/

It is 09:00AM Pacific Daylight Time. It is Good Friday. This is Good Friday. This Sunday is Easter day, so the Friday before is Good Friday. That is the day that, Jesus was crucified. And I still always struggle with the Good Friday part because I'll tell you one thing, man. If you go to, like, a church service, like, I'm an Episcopalian, which is, got its roots so far into into Catholicism. It's like the oldest Protestant religion at this point, but it very, very, very close to what you would find in the Catholic church. And a service on Good Friday, at an Episcopal church, has this one little part in it that always pretty much chokes me up pretty hardcore, and that's when they snuff the candle that always burns in the church out. And it's a it symbolizes the the death of of Jesus Christ. And I'm sitting here and I'm always going, it's Good Friday, and yet I feel like crap. It's just, I know that's probably not the way that I should be feeling about it, but I cannot help but to tell the truth.

I do hope that everybody has a wonderful Easter weekend. That is for damn sure. But it is the April 2025, and this is episode ten seventy seven of Bitcoin. And we've got all kinds of stuff to touch on today. We're gonna talk about the Coinbase debacle because, apparently, they've rugged a whole bunch of people. We've got a couple of bits of quantum, news as it pertains to, is it going to affect Bitcoin? And honestly, man, I it's not that we shouldn't be thinking about quantum computing, but I I think we're putting the cart before the horse here. There's a lot of stuff that has to go on with quantum computing before it becomes even remotely viable.

Right now, it is it is not a viable compute system, but there's a couple of articles that I wanna get into with that. Then we've got oops. I hit the wrong button. Arizona is in the news. They've, decided to put the gun to their head and pull the trigger, and then we've got, what else? Oh, Oklahoma is going to put well, no. It's Oklahoma that put their gun to their head. Arizona seems to be doing okay when it comes to their Bitcoin strategic reserve, but Oklahoma has decided to, I don't know, jump off of a cliff. Panama City is going to be talked about as well as, well, Tether seems to be loading up on mining companies.

So what do we got here? We got we got Tether. They're buying US treasuries, hand over fist, seventh largest buyer, the largest stablecoin in the world. They are neck deep into agriculture and at least one other industry in El Salvador and Central America, and they directed all of their hashing power over to Ocean, and now they're loading up on a Bitcoin mining company. They're buying their stock. If you're not watching Tether, then you're also probably not watching Central America, South America, Africa, and Eastern Europe as well as Southeast Asia. And if you're not watching all of that, you're probably gonna miss the fireworks because they're coming, and I'll explain more about that later.

We've got Brazilian crypto Ponzi scheme guys got their ass handed to them in court, And South Korea seems, or at least there's a guy who's a presidential candidate, who seems to be following in the footsteps of Trump and the way that Trump has been touting, quote, unquote, crypto. Alright. So before I get into any of that, I released an episode of Bitcoin and late yesterday, like, in the afternoon, because I was interviewing, Andy Schoonover versus Schoonover, I think is how you pronounce his last name, from crowd health yesterday. And if you if you did not think that I released an episode yesterday, I did. It just it just got late because I had to interview the guy first, and then I had to do some post production. But it is out. And if you have been wondering about what crowd health is, what crowd health does, because I've I've talked about them before and you've probably seen their name buzzing around the Bitcoin circles, then that interview is a must listen to. And it was yesterday's episode number ten seventy six of Bitcoin, and I had a really good time talking to Andy.

And his crew over there at CrowdHealth do a lot more than just crowdfund for people's health care. In fact, they do well, go listen to the episode, and you'll find out where it is that I really wanted to pull apart what crowd health actually does versus what people, I think, think they do. Now let's get into the news. Coinbase has distanced themselves from base in the highly criticized meme coin that dumped $15,000,000, which, you know, we've seen bigger dumps before. But come on, guys. I mean, are we just are we doomed to repeat this pattern over and over and over again? Jesse Coughlin, please tell us more from Cointelegraph.

Crypto exchange Coinbase has distanced its blockchain network base from a meme coin it shared that saw massive backlash after the token rapidly gained and then, Base posted on Twitter on April with an image promoting the network with its marketing tagline, quote, base is for everyone. It also shared a link to a token of the same name on Zuora, a social network where users can make posts into tokens for others to speculate on. Let me read that to you again because this is this is the base case of what's going on with the base thing. It shared a link to a token of the same name, base on something called Zora, a social network where users can make posts like think tweet or Instas or whatever, a post on a social network that you can make into tokens.

So I make a post, and then all of a sudden, it's got a it becomes a token. This is how bad it's become. Alright? Do you remember when that idiot bought the first Twitter post ever from Jack Dorsey? Actually, it was it was the first Twitter post, much less the first Twitter or the first tweet from Jack Dorsey himself. Just happens to be one and the same. Sold for millions of dollars. It's worth snot rag now. That's just a complete loss. Millions of dollars of value just evaporated for this poor gentleman or whoever the hell it was that bought this tweet. And we're right back again, only we're going wholesale.

In just over an hour after it was created, the base for everyone token hit a peak market capitalization of $17,100,000, and then it dropped 90% over twenty minutes to a market value of 1,900,000.0 according to Dexscreener. The token has since made a slight recovery and was trading around $7,700,000 at the time of publication. A Coinbase spokesperson distanced base from the token, telling Cointelegraph that, quote, base did not launch a token. This is not an official base token, and base did not sell this token. Base posted on Zora, which automatically tokenizes content, the spokeswoman said, or person or whatever you wanna say.

They keep saying spokeswoman, so we'll go with it. The spokeswoman pointed to a legal disclaimer on the token's Zora page that states, bases post on the token making platform are similar to those already shared on Twitter. Do not expect profits nor returns, and no ongoing development nor efforts will be made to increase their value. That is a cover your ass statement if I've ever heard one. The post adds that Base will receive 10,000,000 tokens out of a supply of 1,000,000,000 tokens that it pledged never to sell, and money made from fees will support grants for the network's developers. Zorua shows Base has earned over $61,000 from the token, which has seen its total trading volume surpass $26,000,000 Now hundreds of Twitter posts have criticized Base over the token with one Twitter user saying that, quote, any credibility this chain had is now gone, end quote.

Former Riot Platform's researcher Pierre Rochard called the token terrible for the industry, very short term transactional extraction, end quote. AP collective founder Abhishek Pawa said on Twitter that base, quote, tried redefining meme coins as and here's the here's the word to this is the catchphrase or the catchword that you need to know going forward. They tried redefining meme coins as content coins and completely botched the execution. The core innovation actually has potential, but base utterly fumbled execution optics and trader expectations resulting in justified backlash, end quote. Meanwhile, base creator, Jesse Pollock, who has posted to Zuora to create dozens of tokens in the past two months, defended base creating the token saying on Twitter that, quote, someone has to normalize putting all of our content on chain.

I'm not afraid for it to be us, end quote. He added that creating a token for Internet content is the end game for how we can build a new economy where creators earn from their creativity, which he said would, quote, require overhauling our mental models and product experiences. Well, okay. Well, Harrison Legio, the cofounder of crypto startup Gatekeep, said that base is for everyone token was horrifically sniped. Legio, who goes by pop punk on Twitter, said he found two addresses that bought 21% of the token supply for 2 ether currently worth around $3,200 before both wallets transferred the tokens to other addresses and sold them for a total profit of around $300,000.

Just over seventy five minutes after the creation of the base is for everyone token, Base, again, posted to Zuora to promote its presence at an event in New York next month, which also generated a related token. Dex greener shows that that token called base at FarCon twenty twenty five reached a peak value of only $987,570 in the minute, not minutes, in the minute after its launch before quickly dropping nearly 77% to settle at a value of around $230,000. Okay. You're you're probably if you're like me, you're still kind of, like, in a in a a haze as to what's going on.

We've gone in in in crypto land. Okay. Think if you've been here as long as me, think back to 2015. Right? Litecoin was already created. Dogecoin was already a thing. Right? There was a couple other ones. And then, of course, ether came out in 2015. And that was yeah. There was, like, yeah, a couple of other ones, but it was mild in comparison. And then we had this, what what what's it called? The Cambrian explosion. Right? Like the Cambrian explosion, except it's a bunch of scams. Altcoin after altcoin after altcoin after altcoin, they just kept coming, and they kept coming and kept coming and kept coming. And then and then people started trying to, like, figure out NFTs, nonfungible tokens, where they were putting art on the blockchain.

And then we had an even further explosion of just absolute garbage hitting the market in between altcoins and forked altcoins and forked Bitcoin. And I'm there was 17 forks of Bitcoin. And Litecoin was the first one. Right? But, I mean, there was Bitcash or Bitcoin Cash. There was Satoshi's vision, the, s BSV or whatever it's called from that idiot from Australia. And we went through all of this, and all of us kept thinking, at one point, this is gonna stop. People are gonna get their fill of being scammed, of having their money robbed. But, no. Now we've got Base, which is, by the way, it it doesn't matter what this spokeshole says.

Coinbase is responsible for this token named Base and all of the bullshit that falls out of it. What's going on here is that every single piece of content is now tokenizable, whether it's a simple post on this thing called Zora or or and let me get to this x post here from base, and this is at b a s e on Twitter. That's their handle. And this Jesse guy that I was talking about earlier in this the leader of this basis for everyone group, which is directly connected to Coinbase no matter what spokeswoman says. He's on the Bankless podcast, and those guys have been just ruthless in taking people's money away from them by promoting every scam coin under the sun.

Technically, they're an Ethereum kind of podcast, but, honestly, it's just a shitcoin podcast. One of the guys from Bankless, and I can't it's the dude with the beard, is interviewing this Jesse guy. And they Base, in in this particular tweet, base has taken a snapshot that shows Jesse on the headshot on the left hand side and this bearded guy from Bankless on the right hand side, and there's a sentence down at the bottom that says, coin this livestream. Alright. So that picture is embedded into a tweet, and base says in that tweet, coined it.

So what again, let's be clear what's going on. They've invented a way to try to smuggle value out of every single piece of content that anybody can actually create. This goes well beyond nonfungible tokens, ladies and gentlemen. This is this is like at this point, if I was live streaming this podcast, it would not be outside the realm of possibility that I could coin or create a coin for every single minute of me live streaming. Remember how we were all talking about, you know, streaming Satoshis? And I I get Satoshis streamed to me every single minute on Fountain.

That's my podcast app, and it it it it uses the Lightning Network to transfer value. Now that's been bastardized into this idea that we can almost coin every single instant of content. This is a very dangerous situation. The backlash on this is is credible. And thank god people are just saying enough enough of this crap. If you see anything come out of Coinbase, if you see anything from base, if you see people trying to tokenize their content, understand that they are engaged in a scam and be relentless on your backlash or just ignore it completely. And if you have anything on Coinbase, get it off now, get it off now, get it off now before quantum computers come because quantum computers are likely to reveal if Satoshi is alive.

And god forbid this is according to Adam Back himself, Cointelegraph, Adrian Zemonski is writing it. Early cypherpunk Adam Back cited by Satoshi Nakamoto in the Bitcoin white paper suggested that quantum computing pressure may reveal whether the blockchain's pseudonymous creator is still alive. During an interview after a q and a session at the Satoshi Spritz event in Turin on April, Bak suggested that quantum computing may force Satoshi Nakamoto to move their Bitcoin. That's because according to Bak, Bitcoin holders will be forced to move their assets to newer quantum resistant signature based addresses.

Bak said that current quantum computers do not pose a credible threat to Bitcoin's cryptography but will likely threaten it in the future. Bak estimated that quantum computers may evolve to that extent in maybe the next twenty years. When the threat becomes real, Bak said that the Bitcoin community will have to choose between deprecating old vulnerable addresses or letting those funds be stolen. Quote, if the quantum computers are here and people at universities and research labs have access, the network has a choice to either let people steal them or to freeze them to deprecate the signature, end quote.

Bak expects the community to go with a former option, forcing Bitcoin's pseudonymous creator to move their funds if they wish to avoid losing them. Still, Bak said that whether such a situation will reveal if Satoshi Nakamoto is alive also depends on Bitcoin's future privacy features, quote, it depends. A bit on the technology, there are some research ideas that could add privacy to Bitcoin, so possibly there might be a way to fix quantum issues while keeping privacy, Adam Bakk said. Still, not everyone is convinced that privacy enhancements or not, such a scenario would reveal whether Nakamoto was alive. An anonymous early Bitcoin miner and member of the Bitcoin community told Cointelegraph that he does not expect Nakamoto's coins to be moved, quote, even if he is alive and still holds the private keys, I do not think he'd move them.

Based on how he acted so far, I would rather expect him to let the community to decide, end quote. He added that since this is a controversial choice, it makes sense to let the community decide. He said that he'd be surprised if Nakamoto came out of the woodwork to move the assets. Back, Adam Back, explained that most quantum resistant signature implementations are either unproven in terms of security or very expensive from a data perspective. He cited Lamport signatures as an old and proven design but pointed out that they weigh tens of kilobytes.

Consequently, he suggested that Bitcoin should be prepared to switch to quantum resistant signatures but only do so when necessary. He also suggested a Bitcoin taproot based implementation allowing addresses to switch to quantum resistant signatures when needed. I am a little I kinda wish that Adam Back wouldn't have weighed into the quantum, argument right now because here's the situation with quantum. We don't know anything about it. We don't know how quick quick it's coming on. And even as a layman at this point, I know much more about Bitcoin and how it works than quantum computing does. I know a lot about how a bunch of stuff works, but I don't know how quantum computing works, and I'm not gonna lie about that.

I but what I do know is that it's so far out that I and I think it's it's good to engage in conversations in this way, but what I fear is that it's going to take on a fear perspective. And it already seems to be doing that. Instead of looking at it from a different perspective, it's like, oh my god. All of our addresses are in peril. Well, honey, that ain't the only shit that's in peril. And I've said it before, but all nuclear weaponry codes are in peril. Your bank account, in peril. Anybody else's bank account, also in peril.

Anything that has any kind of security on it where you need credentials to log in, it's all in peril. That means every university, every institution, the IRS, the CIA, the FSA, the NSA, you name it. It's all in danger. And if all of that shit gets compromised at once, then we've got other problems. We we we're not gonna be worried that much about who has gold and who has Bitcoin. You're gonna be worried about who's got bullets, who's got beams, who's got Bibles, and who's got fuel. And, you know, that that's where the that's the that's gonna be the base case. And I just I just don't see it happening, not because I don't see quantum computing happening.

I just don't see the human species not being able to catch up in a nice, measured, non fearful way. Yet you know what's going to happen in the media. They're going to scare the living piss out of you. So Shinobi wants to weigh in on the quantum computer and Bitcoin address thing, and he's doing so by writing for Bitcoin magazine in an article entitled, how do we protect Bitcoin from quantum computers? Not with a joke. Recently, and I've talked about this like on the show before last, recently, project eleven, a quantum computing research group, announced a 1 Bitcoin reward for the first team able to complete a challenge to demonstrate breaking an a clip an elliptic curve cryptograph key using Shor's algorithm on a quantum computer.

The deadline for this challenge is April 2026. Meaning, in order to qualify for the prize, a team must demonstrate breaking a key pair. It must be done before that deadline. This is frankly a completely absurd and meaningless prize for a number of reasons. The first of which is the deadline of just under a year from today. Even highly optimistic projections about the progress of quantum computing put the timeline of practically achieving such a goal at more like five to ten years. Expecting a workable proof of concept demonstration that actually breaks a key pair in a single year is pretty laughable at face value even if you do view quantum computing as the material threat in the short term. Next is the factor of economic incentives. A single Bitcoin is currently worth approximately $80,000 That is frankly not a lot of money in the grand scheme of things.

Especially when it comes to the application of a cutting edge technology like quantum computing that can perform an entire class of computation exponentially faster than a classical computer. Imagine how much more valuable things could be done with a working quantum computer. You could eavesdrop on internet connections regardless of TLS, breaking secure connections to banks, equity brokerages, private corporate networks not using post quantum cryptography. You could break every private messenger application on the planet. You could decrypt any PGP encrypted message sent over email that you knew the public key for, you could break the entire DNS system's certificate authority hierarchy, allowing you to impersonate any server in the world a user tries to connect to.

All of these things have immeasurable value beyond a mere $84,000. Why on earth would someone with a working quantum computer publicly reveal that fact to claim one single Bitcoin when they could take advantage of all these other things they would be capable of doing. Okay. So let's sweep all of those other possibilities aside and pretend the entire world magically migrates to post quantum cryptography aside from Bitcoin. It still makes no sense to try to publicly claim this prize if you have a functional quantum computer. Let's assume you have a barely performant enough quantum computer that it takes a decent amount of time to crack one single key.

How many bare public keys are there securing 50 Bitcoin outputs from the first mining epoch? Thousands of them. Why on earth would you crack one and then go tell everyone publicly to claim a single Bitcoin. You could just try to crack as many of those early coin based rewards as possible before people could detect you. And finally, the timetable on its own is just absurd. Quantum computers currently are not even capable of factoring prime numbers that people can do themselves in their head mentally. In a single year, the technology is going to jump from that to cracking Bitcoin keys? That's absurd.

So what the hell is the point of this prize except some publicity stunt? It's utterly meaningless as a serious bounty to function as a canary in the coal mine for us no matter how concerned or unconcerned you are with the time frames of quantum computers being a threat. This bounty is a joke. This is what I was saying. Would you really would you really just go after the Bitcoin first? Or would you go after something else? Would you go after nuclear launch codes for, let's say, India? Right? India's got quite a few, and they are basically centrally located to where they can reach all of China, all of Russia, all of Europe, and most of Africa.

Although, they can actually reach a lot more than that, but let's just keep it on on on the Eastern Hemisphere. Right? What would it be worth? What would it be worth for that person to demonstrate with the release of one small tactical nuclear warhead to prove that they've been able to crack those keys and say in the next four hours, if I do not have $1,000,000,000,000, think of, like, mister evil, you know, doctor evil, want $1,000,000,000,000, wouldn't you do that first? Or just completely abscond with the worldwide banking system and be done with taxes and be done with the fiat system? What if a Bitcoiner was actually the person that actually got a hold of a feasible functional quantum compute that was able to do this? We don't know who's going to be in control of it. We don't know when it's coming.

We're sitting here basically just kinda scared to death over something that we don't know if it's ever even gonna happen. We and and I posit that we have time. Yes. We should be looking at this. No. We should not be afraid of this. What we should also be doing is watching what are the banks gonna do about it. Are they releasing any materials? Are they releasing anything that suggests that they might want to move to post quantum compute cryptography for their customers, themselves? What about governments? Are they going to breathe anything about the possibility that even even at just institutional levels, like the in a like National Institutes of Health credentialing system. Not even we don't even have to go to nuclear warhead. We don't have to go to national security.

But we can just say the IRS. Are are is there gonna be any news releases about them changing to a post quantum situation where they can do their credentialing and be relatively secure that quantum compute is not gonna be able to break that particular style of cryptography? That's what we really need to be watching. We don't really need to be just thinking about Bitcoin at this point because everything everything is at risk. Think of it this way. There's a way that I've heard it described. You're looking for a single coin, a penny, not not a Bitcoin. Let's say you're looking for a single penny, and somebody said that they buried it in the Sahara Desert. They don't tell you where. They don't tell you even when. They don't tell you anything about it other than you're looking for a penny, and it's somewhere in the sands of the Sahara Desert.

What would be the easiest way to find that penny? You're not gonna go look for it. You're going to figure out a way to turn all of the sand in the desert into a sheet of glass. And then finding that penny from space is gonna be real easy because you can see right through everything. And Bitcoin is not the only thing in existence right now. And even Arizona even Arizona for for, you know, understanding that Bitcoin isn't the only thing that exists right now is still very much interested in Bitcoin because they are leading crypto reserve legislation races as SB thirteen seventy three has passed the house committee. Yeehaw. This is out of the block written by Timmy Shen.

Arizona's strategic digital asset reserve bill or SB thirteen seventy three has passed the house committee on Thursday. It now awaits a third reading and a full floor vote before reaching the governor's desk for final approval. This is its final phase, y'all. The SB thirteen seventy three bill proposes the creation of a digital asset strategic reserve fund, which would consist of funds appropriated by the legislature and crypto assets seized by authorities. I don't like the second part, but there it is. The bill notes that the state treasurer would be allowed to deposit seized crypto into the fund via a qualified custody solution or a state registered exchange traded product and that the treasurer may loan digital assets from the fund for additional returns. Quote, the state treasurer may not invest more than 10 of the total amount of monies deposited in the fund in any given fiscal year. According to SB thirteen seventy three, the term digital assets includes virtual currency, virtual coin, and cryptocurrencies, which encompass Bitcoin, stablecoins, nonfungible tokens, and other blockchain based assets that carry economic or access rights.

So, again, Arizona's strategic digital assets reserve bill has to go to a final vote. Right? That's it. It's it's passed everything. It's completely let's see. It's it's passed out of the senate. It's passed out of the house. All it's gotta do is go to the floor vote before reaching the governor's desk for final approval. They do not actually say when that's going to be. But sweet, sweet it is. Maple syrup. If you want good homemade maple syrup, and I mean made the old fashioned way, the way that our forefathers used to make it, then you wanna talk to Maple Trade, otherwise known as Biesnerds. On Twitter, you can find them at b e I s n e r d s. He's got maple syrup that he makes by hand for sale. He's already out of his half gallon jugs.

This is going fast. You need to contact him on Noster or Twitter. Both of the URLs to get directly to Maple Trade on either Nostra or Twitter will be in the show notes. Just click it and go give him a DM or tag him in a note. Do whatever it is you gotta do and say, I want your maple syrup, and make sure that you tell him that you heard about it here on the circle p in the Bitcoin and podcast. He's already been dumping thousands of Satoshis on me, so I can only presume that I have been successful in actually selling his product. And nobody has contacted me to say, why did you make me buy this product? It's awful. It's not awful. I've had it myself. This is handmade maple syrup, and he's running out fast. Make sure you mention the circle p when you buy some.

Okay. So Oklahoma, unlike Arizona, has decided to put a bullet in one of the chambers of a six shooter and put the gun to its own head because Oklahoma has rejected the strategic Bitcoin reserve. The bill has failed in committee. In particular, a senate committee, this is Atlas twenty one writing, with a six to five vote six to five vote, the Oklahoma senate committee on finance and tax struck down. House bill 12 o three, also known as the strategic Bitcoin reserve act. And, honestly, that's all we really need to know. So Oklahoma will have to try again later, but in the meantime, let's run the numbers.

CNBC futures and commodities. West Texas Intermediate is up over three full points, back to $64.45. Brent Norsee is up 3% to $67.85. Natural gas is crawling sideways at three dollars and twenty four cents per thousand. And gasoline is up 2.3% back up over $2.02 dollars and 9¢. Gold is down just a smidge point 15% to $33.41 and 30¢. So it has definitely been banging out new all time highs. Silver is down one and a third. Platinum is down one third. Copper is up almost a half, and palladium is down 1.75%. In agriculture, everything is mostly in the green. Cocoa is the biggest winner of the day. Three and a third to the upside. Biggest loser is soybeans, one third of a percent to the downside. Live cattle is up almost a full point. Lean hogs crawling sideways slightly in the red.

Feeder cattle are up a half point. The Dow is plunging today down 1.14. S and P is up, however, a third of a point, and the Nasdaq is up too. Wow. It's it's actually up a quarter of a point. And the S and P Mini is also in the green 1.1%. So everything but the Dow is sucking swamp water. And, yes, we have pressure on Bitcoin. 80 4 thousand 4 hundred and 80 dollars per coin gives us a $1,680,000,000,000 market cap, and we can only purchase 25 ounces of shiny metal rocks with our one Bitcoin, of which there are 19,852,916 and a half of, and average fees per block remain pretty much the same, 0.04 BTC.

Taking in fees on a per block basis, there are four blocks carrying 13,000 unconfirmed transactions waiting to clear at high priority rates of two Satoshis per vByte. Low priorities is the same, two Satoshis per vByte, and hash rate remains unaffected. Nine eleven. Jesus. I hate that number. 911 exahashes per second is pretty high. I am still not seeing any types of minor capitulation. By the way, the Bitcoin and podcast has its own website, finally, after, you know, almost seven years. It is bitcoin and show, all one word, bitcoinandshow.com. That's bitcoinandshow.com.

If you would, go over there, give me some traffic on that page a little bit, and tell me how, like, what I can do to, you know, have a decent website. I am not a web designer. Right? So if you guys kinda like help me out, like, hey, you know, don't do this or you might wanna add that or or even if you think it's good and you just say, I like it. You know, all of that data is indispensable for me, but you can get to each individual each individual episode that I've been doing plus some writings, that I've done in the past. It's I do not have my entire library on there. Alright? So be aware, I'm only putting up the shows that are just now coming out. I've had this thing for a couple of weeks, so there's not a whole lot of content on there. I'm trying to figure out a way to scrape my RSS feed and have it automatically populate into the website, but that that ain't as easy as it looks. So just wanted to say, again, that's bitcoin and show dot com, not io, not org, not net, not nothing. No. It's a .com website, bitcoin and dot bitcoinandshow.com.

Now from CrowdHealth's Andy Schoonover, which was yesterday's episode of Bitcoin. And I got Psyduck with 585 sets says Psyduck. Justin with a hundred says, I love hearing about people working to fix broken systems. I agree. This are these are all that came out of Quantum Conundrum, which was the show before yesterday's episode. Baked potato gives me 4,000 sats, brother. Thank you. But he doesn't say nothing. Deleted account gives me 1,291 and says fuck taxes. Matt f r l with 1,000 says your segue into the circle p Leatherman was spot on, sir. Well done. I try. Justin with another thousand says, the quantum threat is the biggest obstacle between my dad and the orange bill. I'm sadly not intelligent enough to ease his concerns.

What say you about the QC uncertainty? Well, I Justin, if you listen to the first half of the show, you kinda know where I stand on this. Matt f r l with another thousand. Oh, it's it's a copy of the earlier one. Perma nerd with two fifty six says, the only thing stitched together better than a Bitcoin and episode is a leather good made by the Leathermint. I hear you. 444 from chill now. Enhanced human error, supplication to theft. Italian finance minister grasps the ring. Stablecoin equals an EU threat, fumbles the math, corrupts the equation.

Centralized digital euro equals fuckery. He was never one of us. She didn't knock. The system let her in deliberately. Remain yourself, only more refined. Session closed. Psyduck with another 584 says Psyduck. Paul Cernine with 500. Thank you. Enjoyed listening to your take on current events and news. Keep up the good work. I will try, sir. Yodle or Yodle with 444 says nothing. Psyduck with 444 says Yodle. Perma nerd with 256 says, oh, it's a copy again. Justin with another hundred sat says nothing. And that's the weather report. Welcome to part two of the news you can use.

Panama City, Panama approves Bitcoin and crypto payments for taxes, fees, and permits. This is actually out of a zero hedge and, as usual, is written by Tyler Durden. In yet another milestone for Bitcoin adoption in LatAm, the Panama City Council has voted to approve the acceptance of Bitcoin and other digital currencies for municipal services. Yay. The news was announced by Panama City Mayor Mayor Mizrahi, on Twitter who stated, quote, Panama City Council has just voted in favor of becoming the first public institution of the government to accept payments in crypto. Citizens will now be able to pay taxes, fees, tickets, and permits entirely in crypto starting with Bitcoin, Shitcoin number one, USDC, and USDT.

This decision sets Panama City on a more progressive path enabling residents to interact with their local government using Bitcoin for everyday transactions. Mizrahi also explained how this was achieved without the need for any new legislation, a hurdle that has stalled previous efforts. Quote, prior administrations tried to push a bill in the senate to make this possible, but we found a simple way to do it without new legislation. Legally, public institutions must receive funds in dollars. So we partner with a bank who will take care of the transaction receiving in crypto and converting on the spot to dollars.

This allows for the free flow of crypto in the entire economy and entire government, end quote. The Panama City mayor's office further confirmed the news on its official social media channel saying, quote, we will soon become the very first public institution in the country to allow payment for municipal services in cryptocurrency through an authorized bank that will be responsible for converting the proceeds into dollars for the mayor's office, end quote. The mayor also revealed that the agreement with the banking partner will be finalized next week. Okay. Why is it final why isn't it not finalized now? Why are you announcing an announcement?

Because anything can happen at this point. Oh my god. Quote, deals being signed next week at the blockchain conference in Panama. Look out for signing of the deal next week. Oh, yay. Two weeks. If anybody remembers Butterfly Labs, two weeks. Anyway, let's talk about Tether. As Bitcoin mining companies slump, Tether loads up on BitDeer. Matt DeSalvo is riding for Decrypt. Bitcoin miners may be struggling as the price of the biggest cryptocurrency by market value trades sideways and investors sell off their equity, but stablecoin giant Tether is betting big on one of the sector's largest players purchasing $32,000,000 worth of equity in publicly traded BitDeer in April.

An SEC filing shows that Tether snapped up the shares as the price of BitDeer stock dropped. Of course, Tether did not respond to questions, but the company has increased its interest in the Bitcoin mining space. The company bought a stake in BitDeer last year, and in March, filing showed that it had increased its stake in BitDeer to 21%. The stablecoin company said on Monday that it would support Bitcoin mining pool ocean by providing it with hash rate to help mine blocks and reap the BTC rewards. Nasdaq listed BitDeer finished the day trading at $7.62 a share, which is down nearly 67% year to date and part of an industry wide swoon that's come as Bitcoin has lost momentum and mining difficulty has soared, making it difficult for miners to recover their cost. Well, if that's so, why is the hash rate still high?

Why am I not see seeing capitulation through a drop, a severe and precipitous drop in hash rate? Because I'm not seeing it. It's still high. The hash rate is 911 exahashes per second today. It's one of the highest numbers I've ever seen. It's not the highest number I've ever seen, but it's one of the highest. It's well above 900 exahashes per second. Where's the capitulation? If all these mining companies are sucking swamp water so bad, where's the capitulation? Something ain't right here. But the price of Mara Holdings, the largest miner by market cap, is off by 26% so far this year, while Riot Platforms is down nearly 38%.

And last week, miners quickly offloaded Bitcoin in frantic selling likely to raise funds according to CryptoQuant. Bitcoin was recently changing hands at about 85,000, up nearly 7% over the past week, but well off of its record high near a hundred and 9,000 set in January. Tether is the company behind USDT. Yes. And then they go into a history of Tether, and we don't need it because we know what Tether is. So the question becomes twofold. A, why is the hash rate not falling if all of these guys are basically on the ropes? And b, why would you be buying mining companies if all of these miners are on the ropes?

Now that one's ease the second one is easier to handle. Right? You got a 67% drop in BitDeer versus a 27 and a 38% drop in the other two companies. If you have a choice to buy low of any of these three companies, you're gonna go with BitDeer. And they might be buying low because they're like, hey. This is a hell of a deal. I'm buying the dip. K. So the second one is easier to explain, but hash rate, I can't explain it. I haven't found anybody to explain it. I haven't seen anybody really even talk about it. Why is the hash rate not falling over a cliff?

Well, I don't care because we're going to Brazil where leaders of a hundred and $90,000,000 crypto Ponzi scheme have been sentenced collectively to over one hundred and seventy years in prison. Francisco Rodriguez is writing, a Brazilian court has sentenced three executives behind the collapsed crypto scheme, Braze Company, to a combined one hundred and seventy one years in prison, concluding one of the country's largest crypto fraud cases to date. Federal judge Vidor found Joel Ferrari D'Souza, the scheme's alleged mastermind, guilty of operating an unlicensed financial institution and laundering millions through shell companies and unregulated crypto wallets according to local media.

D'Souza received the steepest sentence. He's gonna be cool in his heels well beyond his death. A hundred and twenty eight years behind bars, brothers and sisters. Two others, Gensana Rayyan Silva and Victor Verones received twenty seven and fifteen years respectively for their roles. The ruling comes after Brazil's Federal Prosecutor's Office accused five individuals of orchestrating a pyramid structure that raised 1,100,000,000. Oh, god. What oh, 1,100,000,000.0 rials or a hundred and $90,000,000 from 20,000 investors.

Bray's companies or company promised outsized returns through crypto trading, but allegedly ran a parallel financial system using informal transfers and high commission operations. The court ordered the seizure of 36,000,000 rials, though it's unclear how much victims will recover. According to Artemio Pincano, the lawyer representing several victims, those affected must file civil claims soon, soon, TM, before the funds are absorbed by the state. Two defendants were acquitted for lack of evidence, and the rest, the judge ruled, quote, acted to disguise the illicit origin of the money running operations that mimic legitimate investment practices but served to enrich ins insiders. And, well, okay. So they're going away for a long time. But a hundred and twenty eight years?

Yikes. What's this South Korean presidential candidate gonna do? Well, he promises Trump style crypto reforms according to Atlas twenty one. Hong Joon Pyeol, a member of the right wing People Power Party and a candidate in the South Korean presidential primaries, has vowed to implement favorable reforms for the blockchain and cryptocurrency sectors if he's elected president. He says, to foster blockchain and virtual assets as an industry, I will reform regulations as much as the Trump administration in The United States. Wow. So what does that actually mean?

It means he's piggybacking off of what Trump did. Remember what happened with the election of Trump. He did not alienate the, god forbid, cryptocurrency industry. Right? He basically embraced it, and he got all those votes. He got that entire segment of voters. We're talking about South Korea. And this guy, he learned his lesson quick, very quickly. He's doing the exact same thing because Hong, who served as mayor of the city of Daegu until last week, outlined a vision that includes integrating blockchain technology into, of course, public services and administrative systems.

He also pledged to invest at least 50,000,000 no. I'm sorry. 50,000,000,000,000 South Korean won, which is a measly $35,100,000,000 US over the next five years in research and development for artificial intelligence, quantum technology, and room temperature superconductors. Wow. As part of his growth driven by disruptive technologies initiative, according to a local outlet, The Financial News, Hong had already criticized the South Korean government's decision to tax cryptocurrencies back in 2021, calling the move regressive and urging the creation of legal frameworks to institutionalize emerging technologies.

The country's twentieth president, Yoon Suk yeol, was removed from office on April after the constitutional court unanimously upheld the National Assembly's impeachment vote, which was triggered by his declaration of martial law back in December 2024. With presidential elections scheduled for June, so if that's coming up, June, less than two months away, neither of the two major political parties has officially nominated a candidate. Hong is among eight people vying for the People Power Party's nomination, while Yoon's impeachment has given the opposition Democratic Party of Korea an edge heading into the election.

Who will win? Will there be enough cryptocurrency and and advocates and and generalized Bitcoiners in South Korea to flip the tables? We shall see. It's coming June. Meanwhile, OpenSats has unveiled the eleventh wave of Nasr grants. Holy shit. They just OpenSats is just it's like they might as well just call it open wallet at this point. Holy crap. This is out of no b s bitcoin.com. OpenSats, a US based nonprofit organization dedicated to supporting Bitcoin open source projects and contributors, has announced the eleventh wave of grants to support the growing ecosystem of Nostr developers.

So the five projects receiving support in this wave are as follows. Sway, a mobile first live streaming app that leverages the Nostr protocol to enable decentralized video broadcast directly from smartphones. Wow. The current prototype supports nostril account creation, livestream viewing, and initiating streams via RTMP URLs. Then we have hamster. It facilitates nostril communications via ham radio, providing offline network access in areas lacking Internet, under censorship, or during infrastructure outages. It connects off grid clients with Internet connected relay gateways using packet radio, ensuring resilient messaging optimized for extremely low bandwidth conditions.

Vertex offers web of trust infrastructure for Nostr, assisting client developers in filtering spam, personalizing content, and maintaining decentralization. The project has released core tools including crawler and relay software and integrated its verify reputation digital vending machine or DVM into live applications. Next up is Nostra Double Ratchet, providing end to end encrypted private messaging for Nostra clients by offering a library that implements the double ratchet algorithm, and I don't know what that is. Nostra game engine. Oh, shit.

The Nostra game engine is developing a free, open source, royalty free game engine for developers utilizing the Nostr protocol. Based on JMonkey Engine, it replaces traditional centralized systems with Nostr native modules while maintaining compatibility. Holy shit. I gotta click that. I gotta look at that for a sec. Oh my god. This is this is amazing. I wonder if it's any good. See, you can say that you've got a game engine, but I don't I've seen really shitty game engines and I've seen really good game engines. I remember Unity when it first came out and it was totally free. And that, of course, that model has changed, but back in the day when Unity came out, it was a little kludgy, but it was a good damn game engine. And now, it's world class. It's a world class game engine. So Nostr game engine, this could be a lot of fun.

And how it's implemented and how you actually interact with it is gonna be something that I'm gonna have to dig into because game engines are game engines is something that I've always loved. Alright. So moving on, Coin Swap version zero point one point one protocol efficiency, security, and usability improvements. Coinswap is a functioning minimal viable binary and library to perform trustless peer to peer Maxwell Belcher Coinswap protocol with version 0.1. Coin Swap marketplace is now live on test net four. So if you are a Coin Swap user, you may want to consider looking at the upgrade, Coin Swap version zero point one point one. And down here is a what I I'm not gonna even I'm not even gonna try to describe it very much here, but they have a great diagram for how these coin swaps kind of work. Right?

And if if you are more visual of more of a visual learner than somebody who likes to read white papers, this one's for you. So this nobsbitcoin.com, this this article or this, announcement about coin swap zero point one point one. It's that URL is in the show notes. If you want to go see what it is that I'm talking about, go to the show notes, look for the for the nobsbitcoin.com forward /coinswap URL. Click it, and you'll go right here. Scroll down to about halfway, and you'll see exactly what I'm talking about, and it will make coin swaps will probably make a little bit more sense to you. Okay. That is the show for today. Hold on. I just saw something. Oh, it's Good Friday, so go out there and be good.

You know, don't don't be too terribly sad because, you know, Sunday's coming. And that should be sort of the end of the story for the year where we're all back together. So have a good weekend, and take the kids out. Let them go, Easter egg hunting on Sunday, and have fun with them. You don't have them for very long, and I'll see you on the other side. This has been Bitcoin, and and I'm your host, David Bennett. I hope you enjoyed today's episode and hope to see you again real soon. Have a great day.

Introduction and Good Friday Reflections

Episode Overview and Topics

Coinbase and the Meme Coin Controversy

Tether's Strategic Moves in Bitcoin Mining

Interview with Andy Schoonover from CrowdHealth

Quantum Computing and Bitcoin's Future

The Rise of Content Coins and Tokenization

The Evolution of Crypto Scams

Quantum Computing: Real Threat or Media Hype?

Closing Thoughts and Weekend Wishes