Join me today for Episode 982 of Bitcoin And . . .

Topics for today:

- Bitmain DENIES!

- Consensys Lays Off 20% of Workforce

- Trump Stable Coin is ON THE WAY!

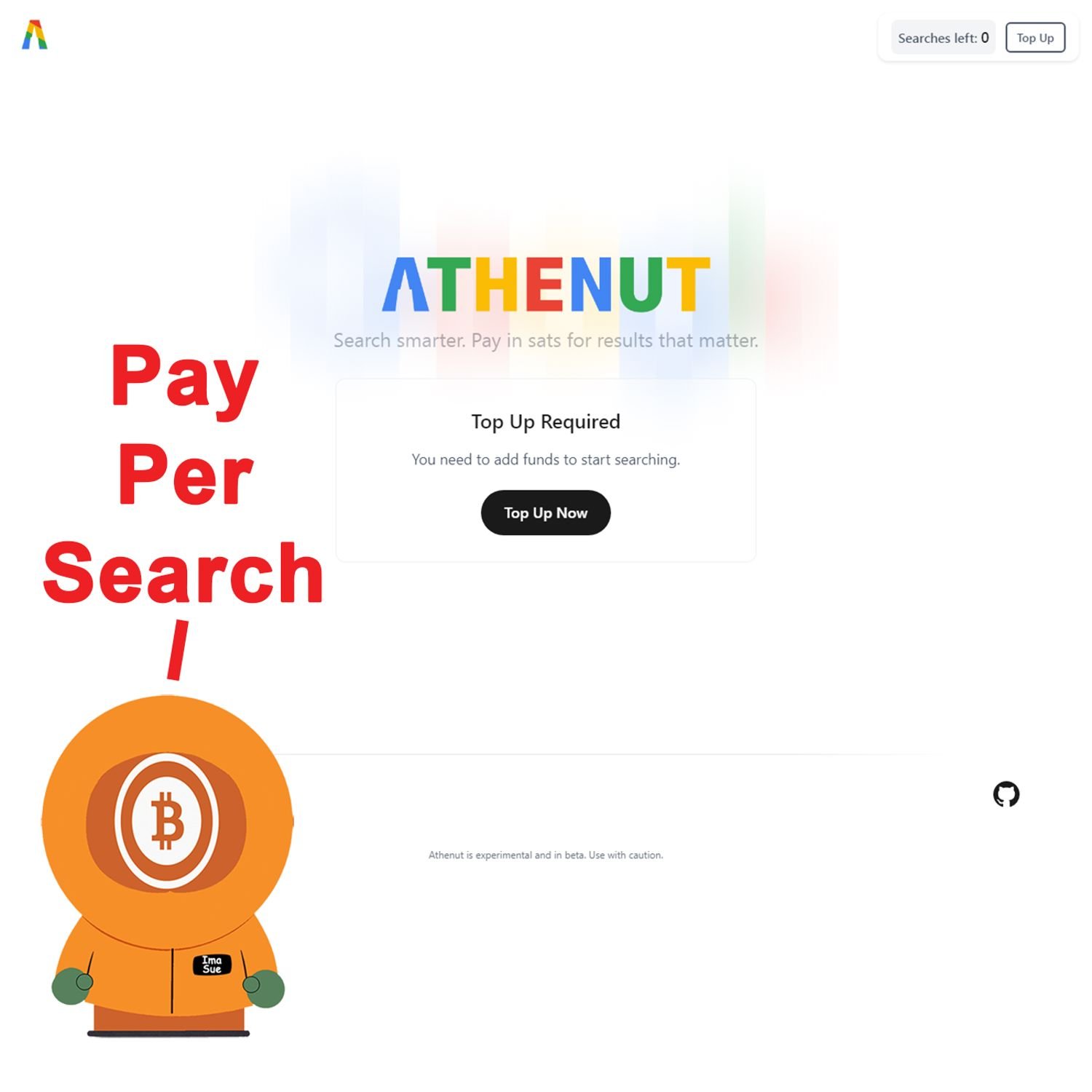

- Calle's Athenut: Pay as you Search

- Bhutan Moves Some Corn

#Bitcoin #BitcoinAnd

The King Ranch Donation Pages:

https://www.ruralamericainaction.com/fundraising/save-king-ranch-and-agriculture-in-washington

https://www.givesendgo.com/Kingranch

Articles:

https://decrypt.co/288788/bitmain-denies-ties-huawei-supply-chain-investigation

https://cointelegraph.com/news/consensys-cuts-workforce-20-percent-ceo-outlines-decentralization-plans

https://decrypt.co/288636/trump-crypto-world-liberty-financial-stablecoin

https://www.coindesk.com/business/2024/10/29/binance-unveils-binance-wealth-for-elite-customers/

- https://www.cnbc.com/futures-and-commodities/

- https://dashboard.clarkmoody.com/

- https://mempool.space/

- https://fountain.fm/show/eK5XaSb3UaLRavU3lYrI

- https://geyser.fund/project/thebitcoinandpodcast

https://primal.net/e/note1em36yafj3tcunrwl3n640chx6a7m7864tattzkrnzupq3fmyq63sshrwjq

https://athenut.com/

https://www.theblock.co/post/323479/bhutan-government-bitcoin-binance

https://decrypt.co/288635/robinhood-us-presidential-election-prediction-market

https://www.coindesk.com/business/2024/10/28/emory-university-joins-bitcoin-etf-rush-reporting-16m-holding-in-grayscale-vehicle/

Find the Bitcoin And Podcast on every podcast app here:

https://episodes.fm/1438789088

Find the Bitcoin And Podcast on every podcast app here:

https://episodes.fm/1438789088

Find me on nostr

npub1vwymuey3u7mf860ndrkw3r7dz30s0srg6tqmhtjzg7umtm6rn5eq2qzugd (npub)

6389be6491e7b693e9f368ece88fcd145f07c068d2c1bbae4247b9b5ef439d32 (Hex)

Twitter:

https://twitter.com/DavidB84567

StackerNews:

stacker.news/NunyaBidness

Podcasting 2.0:

fountain.fm/show/eK5XaSb3UaLRavU3lYrI

Apple Podcasts:

tinyurl.com/unm35bjh

Mastodon:

https://noauthority.social/@NunyaBidness

Support Bitcoin And . . . on Patreon:

patreon.com/BitcoinAndPodcast

Find Lightning Network Channel partners here:

https://t.me/+bj-7w_ePsANlOGEx (Nodestrich)

https://t.me/plebnet (Plebnet)

Music by:

Flutey Funk Kevin MacLeod (incompetech.com)

Licensed under Creative Commons: By Attribution 3.0 License

creativecommons.org/licenses/by/3.0/

Good morning. This is David Bennett, and this is Bitcoin and, a podcast where I try to find the edge effect between the worlds of Bitcoin, gaming, permaculture, podcasting, and education to gain a better understanding of all. Edge effect is a concept from ecology describing a greater diversity of life where the edges of 2 systems overlap. While species from either system can be found at the edge, it is important to note there are species in the overlap that exist in neither system, and that is what I seek to uncover. So join me in discovering the variety of things being created as Bitcoin rubs up against other systems. It is 11:28 AM Pacific Daylight Time. It's damn near the last day of October 2024. It's the 29th and this is episode 982 of Bitcoin and I know I screwed it up yesterday.

Yesterday was actually episode 981, not 982. That's my bad. But, I don't know. You know, it is what it is. Anyway, so I'm coming late to you today because, you know, I had to take my daughter to the doctor's office because she's got like a bump on the back of her neck. Right? I could I was thinking it was an ingrown hair, but no. My wife was right yet again. Lymph node. So it was a lymph node. She's fighting off some kind of infection, I guess. I don't know. She's actually okay, but, that's why I'm late because I had to drive her happy ass over to the doctor and do all the things and touch all the stuff and get the letter so she could go back to school without pissing the public school system off. Yes, I know. She's in the public school system, but she's got a lot of friends there. So friends are important, aren't they?

The education probably sucks ass, but you know, hey, friends. We all need friends. And you and I both know how important friends are because it's not about $72,793 per Bitcoin. It's about the shit posting we did of bucks, along the way. And our shit posting friends, and our meme lords, and our edge lords, and our side edge lords, and the other lords, and the ladies that, you know, it's community. It's about community. It's not about $72,906 per coin, because that's just how it changed over in that few seconds. It's about you and me. It's about it's about all of us. It's not just about my dream of doing this podcast all day. It's about all of us. Right? So let's get into it with Bitmain denying the allegations, tying it to the Huawei supply chain investigation, or Huawei, or Huawei, or however the hell you pronounce this Chinese firm's name. I don't give a shit, but Vesmaevy from Decrypt apparently does. Because she wrote about it starting off with Bitmain, a leading cryptocurrency mining hardware manufacturer has refuted claims linking it to a supply chain investigation involving Huawei or Huawei or whatever way, following multiple media reports. And the company, had issued a formal statement, probably wearing a tie, on Twitter yesterday denying any involvement in the ongoing probe, calling the reports false and baseless.

Bitmain also warned it may pursue legal action against media outlets for spreading false information. The controversy resurfaced after a recent Reuters report stating how Taiwan Semiconductor Manufacturing Company, also known as TSMC, halted chip shipments to Sophego, I s o p h g o, a Chinese chip manufacturer affiliated with Bitmain. Gonna shake up some mining things, I guess. The investigation began when a TSMC makeshift was found embedded in Huawei's Ascend 9 10BAI Processor as per 2 people familiar with the matter according to the report. Now the report raised concerns about a potential breach of US export regulations as Huawei has been under restriction since 2020 prohibiting it to access or rather prohibiting its access to United States derived technologies due to national security concerns.

TSMC immediately notified US and Taiwanese authorities of the situation and suspended its shipments to soft go while the investigation continues. The United States Department of Commerce, which enforces export control, stated that it is aware of the situation but did not confirm whether an official investigation into the matter is underway as per the report. Huawei has denied sourcing chips from TSMC following the 2020 US export restrictions, which aim to limit Huawei's access to foreign technologies made using US components. The restrictions fall under the foreign direct product rule, a measure implemented by the United States Department of Commerce to prevent companies like TSMC from supplying advanced chips to Huawei without a US government license.

I'll get to why I'm breathing out on that one in a minute. Softco, cofounded by McCree Zahn, the ousted CEO of Bitmain, also denied any direct involvement in supply chain dealings related to Huawei. Softco issued a similar statement as Bitmain, clarifying that it has never ever conducted business with Huawei and remains fully compliant with all export laws. As per the statement, the chipmaker provided TSMC with a detailed report to clear its name and hinted at legal action if inaccurate reports continue to harm its reputation. Zhan was removed from the leadership position at Bitmain in 2019 following the power struggle with co founder Zhehan Wu.

Wu's strategic removal of Zahn involved reducing his voting rights through internal maneuvers, triggering legal battles that eventually allowed Zahn to regain partial control over Bitmain through lit litigation in 2020. Huawei's troubles with US regulators have persisted due to concerns that its technology poses a maggot in national security risk. In August of 2020, the United States Commerce Department announced sanctions that restrict any foreign semiconductor company from selling chips developed or produced using US software or technology to Huawei.

These restrictions have disrupted Huawei supply chains, forcing the tech giant to explore alternative channels to maintain operations. And, of course, no comments from Bitmain or Huawei. So okay. So here's here's my thing. Let's get back up here, to it. Do do do see if I can find it here. Yep. The restrictions fall under the foreign direct product rule. A measure implemented by the United States Department of Commerce to prevent companies like TSMC from its supplying advanced chips to Huawei without a US government license. Last I heard, TSMC was not a United States company. It was in fact Taiwanese.

Now, I am reserving every right possible under the sun to be just wrong as shit about that, but I don't think I am. And one one of the one is one of the thing oh, wait. Wait. Hold on. Hold on. I got shit's flashing at me. I'm like a bird. Something shiny is happening. Hold up. Okay. Okay. I'm back. Had to text with my wife. She was asking about how things went at the doctor, blah blah blah. So just doing that. And while I was texting her, I did look up TSMC. And according to every source that I can tell, TSMC, Taiwan Semiconductor, whatever manufacturing company, is a Taiwanese company, but it's also multinational.

However, the majority of the ownership is Taiwanese or and a lot of it is also foreign, you know, investment. But it's not, you know, balanced like I don't it's not like anybody can make an argument that says, like, the majority of TSMC is owned by United States shareholders, so therefore, United States law would apply, which I think would be bullshit anyway. But let's say that that was the case. Okay. Well, it's not. Because the majority of the shareholders of TSMC are foreign nationals, and most of it's actually owned by Taiwanese. It's it is a Taiwan company.

It has nothing at all to do with the United States. And yet, we are forcing them to get a US government license to be able to sell their product to whoever they want to sell their product to. Sure, I get that it's national security, but do you think that, I don't know, Costa Rica would be able to make the same deal? No. Why? Because we will bomb the fuck out of you. That's United States policy at this point for everything. We will just kill you. You don't do what we like, we'll kill you. You don't, say what we like, we'll figure out a way to put sanctions on your ass. It we've put ourselves into this leader of the world thing, and it is a bad place to be.

There's not a single country on the face of this planet that needs to be the leader of the world. You just need to lead your own country and stop meddling with everything. The only reason we have, quote unquote, problems with terrorism is because we keep pissing off all the people that want to commit terrorism. If they if if we stop doing that shit, do you realize how much terrorism would actually just evaporate? And I still have very serious doubts about just how much quote unquote terrorism is actually being inflicted upon various populations of the world for various political reasons.

It always seems to stem like it always seems to work like this. Oh, the terrorists, we've got to stop them. Yes. But if you hadn't have done what you did, there would the terrorists wouldn't be doing shit against you. Stop fucking with them. No. No. No. No. We've got to we've we've got to take care of this, and then there's even more terrorism. Oh, well, the terrorists. We've got to stop the terrorists. Well, if you'd stop messing with the terrorists, maybe the terrorists wouldn't actually be terrorists. And then there's the whole other section of my mind that says, just because we labeled something terrorism, does that actually mean that it's terrorism? This is all bullshit. It's going to it's going to ruin well, it's already ruined much of everything.

But whatever we have left, whatever semblance of a civilization or civilized behavior that we have left, whether it's the west or the east, is in danger of evaporating because of this kind of crap. Who the fuck is the United States? And believe me, I am an American citizen. I am a citizen of the United States. And even I'm saying, who in the fuck put us in a situation where we can tell a Taiwanese company what they can and cannot do, who they can and cannot sell to, and under what circumstances they can do any of that shit? It's none of our business.

Now, the staunch people out there in the audience that are like, you just sound un American. No, I am not un American. I just think that the United States Federal Government, which I do not consider to be American any longer, is doing things in our name without our permission and getting all of us in trouble. And it needs to stop. Will it? Probably not Which leads me to this next story Which has absolutely nothing to do with what I just talked about, but it's funny as shit. Gareth Jenkinson, Cointelegraph Consensus is going to cut their workforce by 20%.

The CEO outlines decentralization plans. For those of you who don't don't know, ConsenSys is the foundation essentially, the ConsenSys is the company behind Ethereum. It's founded by Joe Lubin. He's the CEO. And it was also founded by Vitalik Buterin and that other idiot that started this shit chain known as Ethereum. But Consensus is essentially the public company that is Ethereum. And now they're just talking about decentralization after they have to let go of 1 in 5 of their employees. Blockchain development firm, Consensus, has begun a major restructuring of its operations reducing its workforce by more than 20%. Pausing to make sure that at one point or another you guys need to go look at the ethereum divided ethereum price divided by the Bitcoin price and look at the chart over the last 3 to 4 years. And then you'll understand why they're having to restructure and cut 1 5th of their workforce.

It's burning down. Speaking exclusively to Cointelegraph, Ethereum co founder and Consensus CEO, Joe Lubin, confirmed that a 162 shitcoiners have been impacted by the move. The company is looking to go streamlining operations and expedite efforts to decentralize various parts of its core business offerings. Quote, it's motivated by a variety of factors. And to me, it feels like they're pretty equal. What the hell does that even mean? The first one, which is not necessarily more important than the others, is just the long term financial sustainability aspects in the face of potential economic volatility.

Oh, you mean because your shit coin is crashing and burning? I can't imagine why. It's not like we didn't warn you. Lubin stated that consensus is looking to become a smaller, much more agile organization that would be better equipped to capitalize on broad and deep capabilities that the organization has built over time. What the hell are what the hell does broad and deep capabilities mean? Nothing. My god. ConsenSys is best known for developing the browser based Ethereum wallet, MetaMask, a layer 2 protocol, Lineal, and a host of other Ethereum focused shitware products and services. The company currently employs 828 people or shitcoiners.

Lubin emphasized that consensus is committed to supporting its outgoing team members with generous severance packages, out placement services, and extended healthcare benefits. Display staff will also have an extension of stock option exercise windows from 12 months to 36 months. And this this is Ethereum. The stock options for Ethereum. Oh, healthcare benefits for Ethereum. Outplacement services for the people fired from Ethereum. This isn't consensus. This is Ethereum. And for those of you who are holding Ethereum and have not heeded my warnings about what a shit bag of shit coins that you hold, I I hope that this one may be the trigger for you. That you finally figure it out.

Ethereum has nothing to do with decentralized anything. They're just rebuilding the same bullshit that we've had for decades. But they have been actively engaged in a legal battle with the United States Securities and Exchange Commission. And as of 2024, the agency continues to target various companies and projects within the Ethereum ecosystem. In a previous interview with Cointelegraph, Lubin indicated that the costs incurred by consensus were necessary to combat what the industry views as a gross overreach by SEC chair Gary Gensler's administration.

Lubin played down any suggestion suggestion that consensus may have overextended its resources on legal costs when Cointelegraph asked whether its restructuring plans have been influenced by its efforts to take on the SEC, quote, we didn't overextend our resources at all. We didn't pick this fight. The SEC has been carpet bombing the ecosystem for years with investigations, wells notices, and lawsuits, end quote. Lubin added that the consensus had taken a thoughtful approach to going on the offensive against the SEC. Fellow Ethereum co founder Vitalik Buterin has urged Layer 2 projects to actively decentralize their operations and protocols in an effort to combat centralization concerns in 2024.

Lubin said that the consensus or, sorry, that consensus has been working to decentralize itself independently of any external pressures. Quote, anything that Vitalik says in that vein gets a cheer from me and from the company, but there's no extra pressure on us from Vitalik or from anybody outside of consensus. Lubin added that consensus has been preparing for a rapid shift to decentralized models with several of its projects. I thought they were already decentralized, Joe. Well, the restructuring act consensus is comprehensive with Lubin admitting that no specific departments, oh, you have departments, are facing more layoffs than any of the other ones. Quote, we are focusing more intensely on activities in MetaMask and activities in Linea. Infura has already been under transformation through DIN, the decentralized infrastructure network. It's all ridiculous.

He added that Infura remains critical to the functioning of MetaMask. A long term goal for MetaMask is to be able to expand to add to and address lots of different blockchains. Quote, this is both EVM, the Ethereum Virtual Machine blockchains, which we can handle pretty easily, but also non EVM blockchains, which we've been able to rely on through third parties on the DIN network. Getting her done, Lubin. Well, Lubin emphasized that consensus is looking to transform its suite of Ethereum products into protocols over the long term, including offerings like Metamask, Infura, Truffle, diligence, Besu, TeKu, G NARC, DIN, and Linea.

And everything that you just heard fall out of my mouth is 100% complete bullshit. A, Ethereum was always supposed to be decentralized. We were always told it was decentralized. It was decentralized this and and then when they moved to proof of stake and we were all screaming, you're going to you're centralizing. You're centralizing. They were like, no, man. This is all decentralized. This is going to be great. And here we have Joe Lubin, the CEO behind the company, behind Ethereum, is now just getting into the decentralization aspect of this entire shit show.

They've been lying to you ever since 2015 and the launch of Ethereum. It's a it is a mess. Don't believe them. Don't trust them. Everything that Joe Lubin and Vitalik Buterin says has nothing at all to do with your peace of mind or your safety. I used to think that maybe Vitalik really didn't give a shit about getting rich, but now I I don't know. I still give him I still give him kudos for standing up against that idiot Craig Wright in public. That took a lot of backbone. But there's really nothing else that he's actually done that I can say that I give anywhere close to a shit about. Let's move on to decrypt and Sander Lutz writing this one, Trump crypto project world liberty plans to issue a stable coin.

You heard that right. It's not bad enough that right before an election, this guy has gotten himself into, in my opinion, a fairly tight and very deep ethical or financially ethical conundrum. Honestly, he shouldn't be doing this at all. But it gets worse because now there's a stablecoin involved? Well, the controversial crypto project World Liberty Financial has plans to create and issue its own stablecoin. The World Liberty team is still determining how to make the financial product safe before bringing it to market. Meanwhile, the team is working concurrently on a on major project components for World Liberty Financial, including the stablecoin, to ensure such features are ready to launch at the right moment, another source said.

Recent moves by World Liberty foreshadowed a potential stablecoin venture earlier this month. The project announced that Rich Tayo, cofounder of stablecoin issuer Paxos, will serve as World Liberty's stablecoin and payment lead. Tayo did, you know, not respond to a request for comment. While World Liberty has already attracted attention and controversy for its plans to launch an Ethereum based borrowing and lending platform, Trump, don't do this. Anyway, directly associated with the former and potentially future president, the prospect of Trump and his business partners issuing their own stable coin would likely bring it bring with it both substantially heightened risks and the chance to reap even greater rewards.

Stablecoins are a crucial element in the crypto ecosystem. And they give a they I think you guys know what a stablecoin is. It's just something that's pegged to something else at a one to one ratio. And that's where it gets its stable, you know, moniker from. But to remain true to their name, stablecoins must be heavily collateralized. And the top US based stablecoin issuer, Circle, says it currently holds $34,590,000,000 worth of dollar denominated assets at regulated American Financial Institutions to back the $34,370,000,000 worth of its stablecoin, USDC.

Other stablecoin projects have tried to circumvent such methods of fiat collateralization, Most notably, crypto company Terra, not Tether, but Terra, attempted to peg its UST stablecoin to the US dollar with an algorithm tied to another in house crypto token. And the gambit worked for over a year. Well, until UST's price collapsed to 0 in May of 2022, wiping out some measly ass $60,000,000,000 worth of value and, of course, devastating the broader crypto markets. The legality of stablecoins remains contested in the United States. Several prominent federal lawmakers have signaled their intention to vote on legislation regarding stablecoins in the next year, potentially setting up the remarkable scenario in which Trump, if reelected, would control the White House as Congress determined the legality of a financial product his business partners intend to offer.

This is insane, man. For all that potential legal and regulatory strife, stablecoins could offer the World Liberty team immense profits similar to bank stablecoin issuers, rake in cash by reinvesting customer deposits and yield bearing products like, oh my god, the United States Treasury bill. Tether, the company behind the market's leading stablecoin USDT, reported a record $5,200,000,000 of profit in the first half of this year alone. The British Virgin Islands company currently holds nearly $81,000,000,000 of Treasury bills.

It's a staggering amount of risk. Staggering amounts of risk, ladies and gentlemen. Revenue generated from stablecoins could help boost World Liberty's future plans, but issuing a new stablecoin in an already crowded field is no easy task. Such a venture would require brokering deals with the industry's leading crypto exchanges such as Coinbase and Binance to make the asset available to a broad base of users. Mhmm. If Trump were re elected, however, he would gain a uniquely powerful negotiating position with those exchanges. Binance and Coinbase are both currently the targets of protracted SEC lawsuits threatening their ability to operate.

Trump also has connections to the world's top stablecoin issuer. Tether relies on Wall Street asset manager, Cantor Fitzgerald, to custody many, many of its assets in reserve according to Cantor CEO, Howard Lutnick. Lutnick Courtly currently co chairs Trump's transition team. You see where this is going, don't you? Getting a collateralized stablecoin off the ground would also require large amounts of capital. World Liberty Financial launched sales of a governance token earlier this month, but has so far managed to offload a measly $14,240,000 worth of the token, according to data from Dune.

That's a paltry 4.7 percent of the $300,000,000 worth of tokens the project had earmarked for public sale. But nevertheless, World Liberty Financial plans to leverage the Trump brand to emerge as the go to service for retail investors looking to enter the often opaque world of crypto trading and DeFi. The the project has previously framed its mission as one to make crypto in America great again by driving the mass adoption of stablecoins and DeFi, end quote. That was an actual quote. But but though Trump and his crypto allies have eagerly espoused the benefits of stablecoins in recent months, they've also railed against the dangers of an American central bank digital currency, effectively a stablecoin, but issued by the US US government.

The former president has repeatedly vowed to outlaw the creation of a CBDC if reelected. Yeah. Because that'd be competition. Quote, such a currency would give the federal government, our government, the absolute control over your money, Trump said during a campaign event in New Hampshire earlier this year. They could take your money. You wouldn't even know it was gone, he added. Mhmm. Okay. This I'm sorry. I I I know that a lot of you think that I hate Trump. I don't. I don't know why everybody hates Trump. I lit like, oh, well, he's a Nazi. I don't know what the hell this man has done to be a Nazi.

It's it's the whole the whole thing is the whole thing is weird. It's very very weird. But be that as it may, let's say that Trump was somebody that nobody gave a shit about. And I mean, like, they they he wasn't a let's say he wasn't polarizing. That the left wasn't calling him not calling him a Nazi and the right wasn't calling him a savior. He was just some guy, very and was still famous, but non polarizing. Like a nonthreatening candidate for for presidency, where where he doesn't piss off half of everybody that that that knows that says his name. Right? The Trump derangement syndrome. If you say Trump, you're you're if you say the word, if you say his name, you're apparently a Trumpster or something like that. It's all bullshit. But let's say he was completely neutral and he was running for president and he was like, you know, have the same kind of polling that he's got today And and then and then he did this.

This is not good. The if Kamala did this, it's not good. This is an ethical dumpster fire. There's nothing about if if I was if I was the RNC, I'd be like, you you've got to distance yourself. You've literally got to firewall yourself against your business partners. You've got to dissolve all ties that could even be, you know, considered legally binding in World Financial, whatever the hell that thing is called. He could have no bearing at all on on this on this thing, and yet even that wouldn't work because you're still friends with these people. Just because you say that you've cut ties with them and can prove it on a sheet of paper doesn't mean that you're not calling them on the phone directing actions and nobody would really ever know.

Everything about this is bad juju, man. It's bad bad bad juju. I can't I honestly don't understand why he's doing this. He knows that this is an ethical mire. He's not dumb. So my question is why? Is it possible that he's like, look, man, either I do it first or somebody else that's gonna be president is gonna do it first. He I guess the only thing that I can say is that he's looking at a risk reward scenario. The risk? Well, he doesn't get to be president because there is such an ethical conundrum behind this entire World Liberty Financial thing that he either doesn't get elected by popular vote or there's enough evidence that suggests that there's no way he could possibly be president and somehow or another is just I don't know.

That, like, the last minute just just can't stand in for president and and everybody has to vote for Jay or or it goes to the vice president. Like, if Trump wins, he can't be president, so we just say JD Vance is now president. It doesn't matter because that's the risk. He can't go to jail for this. So but he might not be able to sit as president for this. What's the reward if he's not elected president? The reward is is that he was able to use the United States presidential elections and the pandering to all the Bitcoiners and the crypto community.

Because I know the name, World Liberty Financial. I know the name. I recognize the brand. I know it's connected to Trump. Honestly, no matter what happens, this is kind of a win win scenario for Trump. So it's I I don't think that he's stupid, not not one single bit. But if he really wants to be president and it let's say he gets elected and sits down in that chair, this is going to haunt his ass for 4 years. He probably doesn't give a shit. Okay. What do we got going on here? What's this last thing before we start running the numbers? Oh, yeah. Yeah. Yeah. Binance has unveiled Binance Wealth, but only if you're an elite customer because, you know, plebs suck ass. Ian, Allison, CoinDesk, Binance, the largest cryptocurrency exchange by trading volume in the whole world has unveiled Binance Wealth, a white glove service that allows private client managers to easily onboard high net worth individuals and offer them a wide range of digital assets.

Because you, who's listening to me, probably suck. We ain't got the money to be able to do this shit, even if you are a Bitcoiner. Because you probably didn't get enough Bitcoin. But wealth managers will handle the onboarding of clients by submitting know your customer documentation and creating individual subaccounts on Binance for each client, allowing them to trade or stake a wide range of shit coins with the feel of traditional wealth management framework. Support for Vybe Binance VIP key account client managers, will also be available.

Crypto assets are widely accepted as portfolio diversification spice among institutional investors with the arrival of Bitcoin and Shitcoin number 1 exchange exchange traded funds earlier this year, which had probably meant further validation of the asset class among higher net worth individuals. Despite appearances, Finance Wealth is not a financial advisory service, but a technological solution designed to meet the needs of wealth managers with the necessary infrastructure allowing them to oversee and support their clients' exposure to crypto, explained Catherine Chen, head of Binance VIP and Institutional in an email.

Oh my god. This is ridiculous. Alright. But what does it say anything at all that that we is there a takeaway here? Yeah. Bitcoin's not going away. It's cementing itself in every layer between every layer of brick laid on the wall that we've been building since 2009, January 20 January 3rd, 2009, ever since that first brick was laid, we've been laying and cementing layers of mortar between these bricks. And the wall gets higher and higher and higher until you no longer can see over the wall and thereby be able to dismiss the walls existence. No no no no. Now you have to look directly at the wall. Bitcoin's not going away. Let's run numbers.

CNBC Futures and Commodities. Oil, not doing well again today. Down a third of a point to 67.17 for West Texas Intermediate. Brent Norsee down a full half point. Natural gas is up 2 points though. Gasoline is down 0.84 percent to a buck 95 a gallon. Shiny metal rocks are mixed, but gold is doing very, very well today. 1.07% to the upside, 27.85.40 pennies. Silver is up 1.81%. Platinum is up, just over a point. Copper is unchanged and palladium is down 0.85 of a percentage point. Chocolate is our biggest ag winner of the day. 4.64 percent to the upside, followed on its heels by wheat 2.33 to the upside.

Biggest loser is gonna be coffee, 1.7 percent to the downside. Live cattle down 3 quarters of a point. Lean hogs up 2 and a half. Feeder cattle down 1 and 1 third point. The Dow is down a quarter of a point, but the S and P is up a quarter of a point. The Nasdaq is up almost a full point, and the S and P mini is basically moving sideways. Wow. $73,560. I think that's an all time high. I think that's an all time high. 1.45 trillion dollars of market cap now allows us to purchase 26.6 ounces of shiny metal rocks with our 1 Bitcoin, of which there are 19,774,680 and a half of.

And fees remain low. 0.07 BTC in fees on average on a per block basis. And there are 104 blocks carrying 219,000 unconfirmed transactions waiting to clear at 7 satoshis per vbyte. Low priority is gonna get you in at 5. 736.4 exahashes per second is the hash rate as it stands right now. And from Etu Clippy, which was yesterday's episode of Bitcoin and Jay with 22 oh, I'm sorry. 2,222 Satoshis says, the wars in the Middle East have always been bullshit in action. Yeah. I agree. Anonymous 982 says, yeehaw. God's death, but 3 no. 537 says, thank you, sir. No. Thank you. Pies to pleb.

420. Thank you, sir. No, sir. Thank you. Chaka. Chaka Khan. 400 sets gives me a single period. Now literally the the period point. Wartime, 333 says cheers. I think that's what he's saying because it's the little 2 clinky glasses and the emoji thing. And Blazer says, yes. Thank you. I agree. I don't know how that got into my fountain, fountain app thing. But whatever. That's the weather report. Welcome to part 2 of the news you can use, and Calley is first up. Calley over on Nostra, k or sorry, c a l l e. He's one of the, preeminent developers. And preeminent doesn't mean better than everybody, he's just very very prolific.

If you don't know who the hell Kali is, I don't know what to do for you because he's done more for Nostr and e cash and all kinds of stuff. He's the guy behind Cashew, or at least I'm I'm pretty think. So he says this. It's a note on Nostr. Presenting athenut, a t h e n u t. Privacy preserving web searches provided by Kagi and Cashew. I always wanted to use Kagi but thought it's a joke that a privacy search engine, k, so we're talking like a search engine, requires you to create an account and pay with a credit card? Athanut wraps around the Kagi API and lets you pay for searches with Bitcoin.

Every individual search is paid for with e cash, which means that you have no account and your payments can't be correlated to your searches. In the background, Athanet has an entire Casu wallet built in that is almost completely hidden from the user. All the user does is to pay a lightning invoice and see how many searches they have left. It's made for grub brains who want to be free. You pay, you search, that's it. This is simply amazing. I've been dreaming about this for so long. It's only the beginning. We're going to make error 4 0 2 great again.

Alright, so, it's athenut.com. That's athenut.com. Athanut.com. And I've got it up here on my screen. It says, Athanut, search smarter, pay in sats for results that matter. And it's telling me that I am required to do a top up. And it gives me a little button that says top up now. Okay. It says I have 0 searches left. Zap your account with SATS to unlock more premium searches. Okay. First up that I notice, I am not logged in with my, InPub or my Insec. Okay? It has not asked me if I want to use a browser extension to log in. In fact, there's no login.

There I there's no there I don't see anything that says login. So it bugs me that I've it says zap your account. I wish that terminology was a little different considering what Cali said is that you don't have an account. That this has and I don't know how this works, but I've got 6 buttons here. I got a button says 1 searches, 5 searches, 10 searches, 20, 35, and 50 searches. So I'm going to hit the button that says one searches. And by the way, Cali, that would be one search. 2 searches. 1 search. Okay. So it says I am it says that I am purchasing one search for 41 sats and then it gives me a, looks like gives me a lightning network address.

So I've copied it and I'm going over here to my GetAlb and I'm typing in or I'm pasting in this, this invoice and it says that the amount is 0 sats to approve payment. Now I'm I'm sitting here looking at my Get Albie extension, and it says that I only owe, 0 SATs. I'm just gonna pay that now to see what the hell it does. Because it should say 41 SATs, but it's but when I paste that into get Alby, it's Alby is reading it as 0 sats. So there may be an issue here. And it's just spinning and spinning and spinning. So I'm going to just I'm just gonna get out of that. And I'm gonna copy that invoice one more time. I wanna take it over to, let's see. I'm gonna take it over to my ride the lightning. Oh, shit. Hold on for a sec. Because this is important, guys. This is important. I wanna make sure that I'm presenting you something that can actually be done.

I'm gonna go over my trend. I'm now I am now actually directly in my lightning node, directly attached through Ride the Lightning. I'm going to send a payment. I'm gonna copy that invoice again. Now, ride the lightning is actually decoding this LNBC invoice and saying that it's 40 sats. So I'm going to send that payment. Payment is in transition. I'm getting I'm getting a type of error. So I'm going to clear the fields and kill this and I'm going to see if I was actually able to send anything by refreshing my screen and seeing if it's even registering and it's not. There seems to be a problem with Athanet.

I'll let Cali know that I'm unable to actually, do it. But the point is is that I mean, all of this this we're trying to fix a plane in flight. Right? There's bound to be problems. But let's say that it worked. What what would I would I be able to do? Well, I'd just be able to go to Athnut. I'd be able to top up a wallet that is not connected with my Insec, my InPub, my, Gmail account, a ProtonMail account, or any kind of identification at all. So I assume this is all cookie based in my browser, but that still means or it still makes me wonder, could these searches be connected to my IP address?

Well, fuck it. I use Google. I everything that I do on Google is like, you know, everybody knows what I'm searching for at the NSA and the CIA and the FBI. So I'm not all that concerned about it. But if this had worked oh, wait a minute. Oh, I got it. It worked. Holy shit. It just took a long time. So I okay. Now my browser for a Athanut, which is athanut.com, says that I have one search left and now it's opened up the search bar where I can actually type in something because before I had a search available to me it was blurred out. I'm going to ask, let's see.

Why does Kamala drink so much alcohol? Let's see what it says. For the 2nd time in a day, Trump resorts to false personal attacks. That's one of the headlines from NBC News that came up. Let's see. Sky News has Kamala Harris obviously drunk while speaking Internet claims. Wow. So it's a full search and it's like and I get a lot of search results. So I'm gonna scroll all the way down to the bottom and there is no place at the bottom of where okay. So I own whatever results that I get, it's only one page of results. I'm sure if I were to do the exact same search on Google, I would get multiple pages of results.

I only get one page here, but it looks like there's like, I don't know, 20? Like a page full of 20 returns and I have no more searches left. So I blew my searches. Oh my god. I feel so bad that I wasted it on Kamala. The point is, it doesn't it looks like this is the ability to have a search. And DuckDuckGo used to be good. I don't like it anymore because it just returns complete and utter garbage. But this is the first instance that I know of where I can pay for a single search. It only cost me 41 Satoshis or 40 somewhere somewhere around there. Honestly, not bad. Next time I do it, I certainly am not going to waste it on Kamala Harris.

Now, Bhutan is back in the news, and maybe maybe not in a good way. The Bhutan government has moved $66,000,000 in Bitcoin to Binance deposit address according to ARCEM Intelligence. This is from the block written by James Hunt. The Royal Government of Bhutan has transferred 929 Bitcoin, which is worth $66,100,000 to a deposit address of crypto exchange Binance on Tuesday morning. So this was today. Bhutan initially transferred a 100 to Binance at 9:0:9 AM UTC followed by another 839 BTC at 900 or at 9 56 AM UTC, according to on chain analytics platform, Arkham.

It's the first time that the kingdom of Bhutan has sent Bitcoin to a crypto exchange since it deposited 381 BTC worth 24,100,000 at the time, to Kraken on July 1st, per Arcob's data. The reason for the latest transfer is unknown. Though such deposits to crypto exchanges are often made to sell the asset. Oh, let's scare everybody, the block. The move was initially, initially noted by the blockchain analytics platform Lookon Chain, which also highlighted that Bhutan still holds some 12,456 BTC, which is worth around $886,000,000. Bhutan also sent, 228.8 shitcoin number 1 to a Binance hot wallet address on October 18th, but I honestly don't give a shit.

The Bitcoin in question is held in custody for Bhutan by the Bhutan State Investment Wing known as Druck Holdings and Investments. Bhutan's balance makes it the 5th largest known nation state hodler of Bitcoin behind the United States, 203,000 BTC. China's 190, and UK's 61,000. And Ukraine's 46,000 BTC. And, of course, China was a 190,000 BTC. Whatever. However, while many countries tend to acquire their Bitcoin via criminal seizures, which is in my opinion criminal itself, Bhutan has been mining Bitcoin to build up its reserves, leveraging the country's abundant hydroelectric power to drive eco friendly mining operations. Oh, yay. So Bhutan has moved an appreciable amount of Bitcoin to Binance.

And the block automatically suggests that this is often done to sell said assets. Not always. What if Binance is a qualified custodian for the Kingdom of Bhutan? I mean, of course, you know, I would be just as, like, guilty on the opposite end of the spectrum as the block is. I'm trying to give everybody hopium and the block is trying to scare the piss out of everybody. Meanwhile, Bitcoin is chilling out at $72,778 per coin. 2 minutes ago, it hit 73,000. A lot of volatility going on. So is Bhutan fixing to cut and run on some of this? I think that they'd be really stupid if they did. But not as stupid as this, Robinhood has launched a US presidential election predict prediction market, but but but for Americans only because that'll help decrypt. Andrei Beganski is riding this one with the US presidential race approaching a crescendo, and god knows it can't come soon enough. Robinhood has become the latest firm to offer event contracts for the White House's soon to be chosen winner.

The investing app announced Monday that Robinhood Derivatives will offer 2, not 1, but 2 contracts, letting traders speculate on whether former president Donald Trump or current vice president Kamala Harris will take the election. The move comes as Trump and Harris make their final pitches with 7 days left in the 2024 race. Again, this shit can end soon enough for me, ladies and gentlemen. But blockchain based predictions, platforms like Poly Market, have thrust election betting into the limelight and Robinhood wants to cash in on the shit. Traders can purchase contracts for a candidate that adjust in price, eventually paying out $1 per purchased contract if said candidate wins.

Unlike PolyMarkets platform, however, Robinhood is offering to purely US focused people. Robinhood said that the contracts are offered through forecast x, a Futures Commission merchant regulated under the CFTC. Polymarket has been off limits for users in the US since 2022 when the startup agreed to cease and desist following a letter from the CFTC, alongside settling a $1,400,000 fine for it. Wow. Even though Polymarket reportedly has a system in place for vetting users, Robinhood articulated its restrictions clearly in its announcement.

Anyone attached to the US presidential election or politics is forbidden from participating in the market, such as White House staff and presidential campaign members. How would you know? Additionally, each bidder must be approved by Robinhood derivatives in order to participate in the market. Cutting it a little close, aren't we guys? Jeez. Robinhood's embrace of event contracts for 2024 represents how political betting has increasingly gone mainstream. Rolled out in 20 24 races home stretch, it may also illustrate how shifts in the regulatory landscapes are are influencing how firms approach the space.

The prediction market platform, Calshi, noted a major legal victory over the CFTC last month. While the CFTC has tried to block Cal sorry, Calci's prediction markets for 2 years, a federal judge ruled that the platform could move forward with plans to launch US election markets starting with congressional bets. The ruling was quickly appealed, but Kalshi launched a US election betting pool not long after. And earlier this month, a multinational brokerage firm, Interactive Brokers, jumped into the election betting scene unveiling its own set of election based contracts.

While Trump and Harris could emerge victorious on election day as results for key battleground states trickle in, the market offered by Robinhood Derivatives will resolve 2 months later after the results are certified by Congress. The expected date? January 7th, based on congressional record filings per the terms of forecast x's US presidential market contract. And Robinhood didn't respond for a request for comment. No shit. Okay. So this is just bad as Polymarket. And while nothing was said in this particular, this particular news article that, you know, Robinhood was doing this because poly market sucks by allowing foreign nationals to bet on the race and therefore, you know, blah blah blah blah blah. It it it doesn't matter.

I can trick this shit with a VPN unless unless unless they're really serious about vetting my ass and saying, well, you've got to give us a copy of your, you know, you got to take a picture of your, driver's license front and back or your passport or something like that. Then I'm kind of host, unless I've got fake documents, which I may or may not have. Doesn't matter. I don't care. It doesn't help. This is still this has nothing to do with polling. Is what I was saying yeah. I was railing about this shit yesterday. This has nothing to do with who is going to actually win the United States election, and yet news story after news after news story keep pointing to the fact that Trump has, like, 67% of the polls. No. He's got 67% of the money given to this fucking betting platform by complete degenerates who can't afford to go to Vegas.

That's not a poll. I mean, if if I were to bet on on the Washington Redskins, which, of course, they don't aren't called the Washington Redskins anymore, but, you know, whatever. I'm always going to call them the Washington Redskins. Don't really care. Do you think that me betting on the Washington Redskins is going to somehow or another telegraph to the world that the Washington Redskins are better than, I don't know, whatever other NFL team is out there that could could literally crush the Washington Redskins? Does it give them any better chance?

Does it give the people out there any actual knowledge of the outcome of that game? I could have like 89% chances of the Washington Redskins winning that game against whoever is obviously going to crush the crap out of them, and it's not going to change the fact that the Washington Redskins are actually going to lose that game. This insanity. This insanity of looking at Polymarket to tell you that you have yeah. Well, you know, you're probably gonna get Trump for president if you believe Polymarket. It's it's it's it's infantile.

It's juvenile. This is ridiculous. Everything about this is just dumb. This is just degenerate gambling. So please please please please please don't believe betting markets for the outcome of presidential elections, congressional elections, who's gonna win a Washington Redskins game, who's gonna eat the hot dog the fastest. It's all bullshit because you don't know until the actual day. Now am I trying to throw shade on the fact that Trump is leading in some of the polls? No. I don't care about that. What I'm trying to say is that these are not polls. And yet, I have seen credible, large, mainstream media news outfits actually tell people that they're probably gonna get Trump as the president because poly market says so?

Am I just living 100% inside the circus tent that is clown world? Please don't believe this crap. It's all garbage. And finally, you've probably heard about it already, but I just I gotta do it. Emory University has joined the Bitcoin ETF rush. They are holding $16,000,000 worth in grayscale vehicle. Oh, wow. They went with grayscale, So we can add Atlanta based Emory University to the list of institutional investors taking a shine to Bitcoin. And by the way, this is written by Helene Braun out of CoinDesk. Yeah. I gotta give proper attribution here. The university disclosed the ownership of more than $15,000,000 worth of shares of the grayscale Bitcoin Minitrust, according to a Friday filing with the United States Securities and Exchange Commission.

According to a top ETF analyst, the announcement marks the very first time that an endowment to publicly report such exposure to Bitcoin. Emery also reported holding 4,312 shares of Coinbase valued at just under $1,000,000 as of press time. The university's total assets stood at $21,000,000,000 as of August of last year. Endowments are created to fund non profit institutions like hospitals and churches and universities. Up until now, it appears that no other endowment has previously publicly reported a Bitcoin ETF position according to Eric Balchunas, a senior ETF analyst for Bloomberg Intelligence.

Similar to pension funds, endowment funds prefer a risk averse approach to their investments making Emory's allocation into a Bitcoin ETF notable. Pension funds, such as the state of Wisconsin have previously reported holdings of Bitcoin ETFs. Additionally, the municipal pension plan of Jersey City, New Jersey announced that it would allocate 2% of its assets into the ETFs. Grayscale's mini BTC fund launched much later than its counterparts after the asset manager's flagship Bitcoin Trust bled large amounts of assets largely due to its relatively high fee of 1.5%. Despite its late start, the newer product has quickly become one of the more successful Bitcoin funds currently standing in 6th place by assets under management with roughly $2,300,000,000 worth of Bitcoin according to Bloomberg data.

CoinDesk previously reported on universities in investing in Bitcoin with Harvard, Yale, and Brown all buying the cryptocurrency, but directly from Coinbase. Some of them have had accounts with the crypto exchange since 2019. Holy crap. I didn't realize that. So it's cool. Emory University has now got Bitcoin in their endowment fund. And there's a lot of things about an endowment fund, that is necessary for the survival of universities going forward. I've talked to you about this before, but you many universities that, you may have heard of are probably not going to survive the next 10 years. And the reason is because they really didn't allocate enough money to their endowment funds. So what does an endowment do? Well, it's just an investment fund. Except the way that it's structured is that the output of all of the interest is basically it depends on how the fund is structured but think of it like this.

Donor comes up and says, I want to donate a $100,000,000 to the Texas Tech University Endowment Fund. Okay. Great. Here's the way that we manage our fund. And I don't know this. I'm from Texas Tech, and I haven't looked at the particulars of their endowment fund, but it works something like this. They take that 100,000,000 and they drop it into their investment fund as part of a pool of a whole shit ton of money that other people have donated. And it's, you know, they're, like, you know, I don't know. It's probably US Treasury bills and, like, at 40%, and then there's, you know, like, a whole bunch of equities that earn interest or some kind of dividend or something like that. And whatever other instrumentation that you can think of. But generally speaking, it all kinda needs to produce a yield.

And it's that yield. And if it's done right, like for instance, this is the way that I think about it. 90% of the yield on an annual basis from any endowment fund needs to actually be spent outside of the investment fund. So that's where you put an endowed chair of, like, electrical engineering. So part of the interest payment goes to pay all of the ancillary benefits and salary and stuff every single year for this endowed chairman of, like, the electrical engineering department at Texas Tech. But 10% 10% is reinvested back in the fund along with other donors money that come along year after year so that the fund, even if it doesn't get fresh infusions of cash, is always actually growing because you have to outpace inflation.

But some percentage every year is split for like research, student services, endowed chairmanships, endowed professorships. And that way, you're not actually taking the student tuition and paying the teachers. The teachers or the professors that have these endowments or these endowed chairs, their salary is coming from the endowment fund, but that endowment fund, if done correctly, is constantly growing, constantly getting bigger, constantly like, and after decades decades decades, instead of just 1 endowed chairmanship, you've got 15 or 35 or 65.

It just it's designed to keep growing. Right? Some universities like Texas Tech and the University of Texas have done this well. Other schools have not done this well. And they're facing an enrollment cliff. They are not getting the amount of students in. And it's not because none of these new students wanna take out student loans. They're taking out the loans. There's just not enough of them to take out enough loans to keep this system afloat anymore. You're going to see a fucking disaster in secondary education. Or, well, actually, I guess it's technically called higher education.

Colleges and universities are going to burn to the ground. Not all of them. Many of them have done the right thing. They've they've they've invested for the future. But more often than not, they haven't. They've squandered their shit on massive athletic fields for a team that doesn't win anything. Believe me. I've I've seen I'm seeing it happen at Washington State University. Their team's not so good. They spent a $1,000,000,000 or so on this goddamn new stadium that they've got up here. They can't fill it. Right? They don't have the ticket sales to fill it. It's a nice stadium, but Washington State, the the team just is they're they're alright, but there's nothing to write home about.

You know? I mean, it's just I don't know. The whole thing is insane. But Emory University is the first one to put bitcoin in their endowment fund. Now these other things that you that they've talked about, these other institutions, they have Bitcoin, but they bought it, a, they bought it directly, and b, they don't have it in their endowment funds. They've got it in other kinds of funds, which is a completely structure for completely different purposes. We won't even get into that. But as far as a endowed public institution, this is the first time that Bitcoin has been part of that in the United States that we know of. I think that that's actually an important move. And it certainly is going to be important for those universities that don't wanna go under in the next 10 years and turn into old folks' homes because, ladies and gentlemen, I got a whole fucking plan for that.

Like, West Texas A&M University in Canyon, Texas. That piece of shit school, other than its veterinary school, the rest of that campus needs to be turned into an old folks home because it is worthless. It's absolutely worthless. It used to be a good, good university. But now, the only thing that it has going for it is good buildings with solid bones, good heating and cooling systems, very pretty in between spaces of these buildings. It's got cafeterias. It's got, like, a medical like, it's got, like, not a like a small, you know, clinic. But one of these buildings could definitely be turned into a full blown hospital. And you could stack thousands of older people in there that wanna go out and garden, wanna go out and take walks, and have a nice room to go to, and have, like, you know, 5 different cafeterias, and be able to walk all the across campus with these 100 year old trees. That's the only thing West Texas A&M University has going forward anymore, is to be turned into an assisted living center or elder care facility.

Fuck these people. And if you think that that's the only campus that's going to go that way, you were wrong. So many universities didn't watch out. They didn't think of what it was that they were doing. They were too busy paying their president a $1,000,000 and a half a year so that he could drive a fucking Audi to park it and rub it in the faces of all the students that were paying a salary. Or at least now well, actually, the students didn't pay a salary directly. No. No. No. They took out loans so that they could pay money every month for the rest of their life for the money that went to pay the salary of the president at $1,500,000.

Did you know that 30 years ago, those presidents and things of colleges the size of UT never got anywhere close to that money? It wasn't until student loans just ended up basically taking care of everything that you started seeing that bullshit. And now those chickens those chickens have come home to roost. Let's just hope they're not overhead and take a shit on you. I'll see you on the other side. This has been Bitcoin and and I'm your host, David Bennett. I hope you enjoyed today's episode and hope to see you again real soon. Have a great day.

Community and Bitcoin's Value Beyond Price

US Foreign Policy Critique