Join me today for Episode 945 of Bitcoin And . . .

Topics for today:

- Hashrate ATH!

- Riot Straight Up Threatening Bitfarms Now

- BOJ Gov Hints at Rate Increase

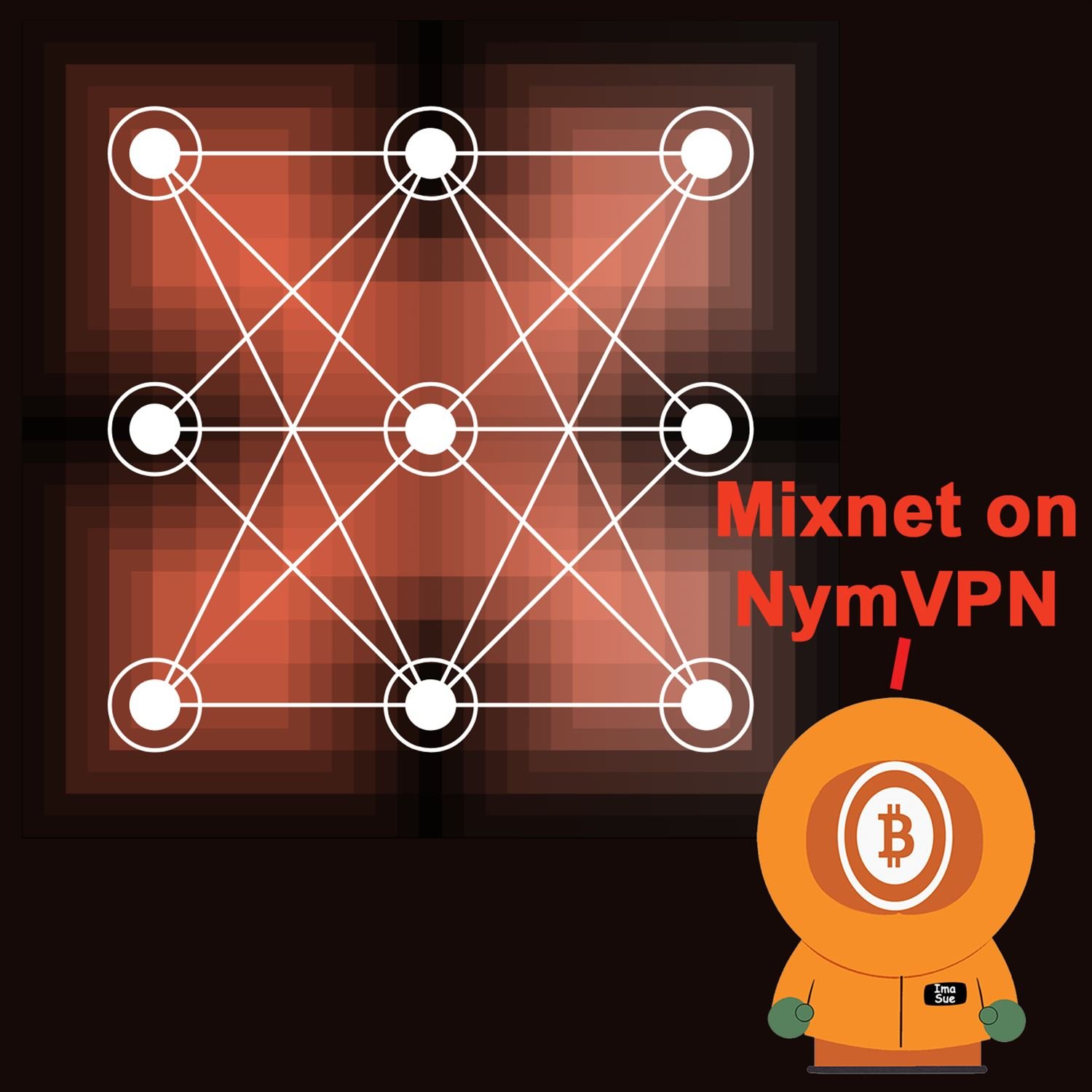

- NymVPN Beta Announced

- Nostrudel, Core Lightning, and Bull Bitcoin News

#Bitcoin #BitcoinAnd

Circle P:

Rev.hodl: https://primal.net/p/npub1f5pre6wl6ad87vr4hr5wppqq30sh58m4p33mthnjreh03qadcajs7gwt3z

Rev. Hodl's Applied Permaculture Class: https://primal.net/e/note1t6p47jytn4wg9ft5a4t4unm787y3jyz3drsrfgz072jjsuszpgsq2u370f

The King Ranch Donation Pages:

https://www.ruralamericainaction.com/fundraising/save-king-ranch-and-agriculture-in-washington

https://www.givesendgo.com/Kingranch

Articles:

https://bitcoinmagazine.com/business/bitcoin-hashrate-records-new-ath-surpassing-740-eh-s

https://cointelegraph.com/news/riot-open-letter-bitfarms-board-changes

https://www.coindesk.com/markets/2024/09/03/bank-of-japan-governor-hints-at-more-rate-hikes-btc-drops-04/

https://decrypt.co/247547/this-is-fucked-up-detained-binance-exec-protests-treatment-by-nigerian-court

- https://www.cnbc.com/futures-and-commodities/

- https://dashboard.clarkmoody.com/

- https://mempool.space/

- https://fountain.fm/show/eK5XaSb3UaLRavU3lYrI

- https://geyser.fund/project/thebitcoinandpodcast

https://www.nobsbitcoin.com/nostrudel-v0-40-0/

https://www.nobsbitcoin.com/nymvpn-available-for-beta-testing/

https://www.nobsbitcoin.com/core-lightning-v24-08/

https://www.nobsbitcoin.com/bull-bitcoin-announces-launch-in-france-mobile-wallet-v0-3-0-released/

https://www.nobsbitcoin.com/soft-fork-covenant-dependent-layer-2-review-report/

Find the Bitcoin And Podcast on every podcast app here:

https://episodes.fm/1438789088

Find me on nostr

npub1vwymuey3u7mf860ndrkw3r7dz30s0srg6tqmhtjzg7umtm6rn5eq2qzugd (npub)

6389be6491e7b693e9f368ece88fcd145f07c068d2c1bbae4247b9b5ef439d32 (Hex)

Twitter:

https://twitter.com/DavidB84567

StackerNews:

stacker.news/NunyaBidness

Podcasting 2.0:

fountain.fm/show/eK5XaSb3UaLRavU3lYrI

Apple Podcasts:

tinyurl.com/unm35bjh

Mastodon:

https://noauthority.social/@NunyaBidness

Support Bitcoin And . . . on Patreon:

patreon.com/BitcoinAndPodcast

Find Lightning Network Channel partners here:

https://t.me/+bj-7w_ePsANlOGEx (Nodestrich)

https://t.me/plebnet (Plebnet)

Music by:

Flutey Funk Kevin MacLeod (incompetech.com)

Licensed under Creative Commons: By Attribution 3.0 License

creativecommons.org/licenses/by/3.0/

Good morning. This is David Bennett, and this is Bitcoin and, a podcast where I try to find the edge effect between the worlds of Bitcoin, gaming, permaculture, podcasting, and education to gain a better understanding of all. Edge effect is a concept from ecology describing a greater diversity of life where the edges of 2 systems overlap. While species from either system can be found at the edge, it is important to note there are species in the overlap that exist in neither system, and that is what I seek to uncover. So join me in discovering the variety of things being created as Bitcoin rubs up against other systems. It is 9:0:9 AM Pacific Daylight Time. It's the 3rd day of September 2024 and whoop dee doodie have we started September out with just kind of a fizzle. It's just kind of a kind of a we got some PMI numbers that came out. If you're wondering why all the markets are swimming in, generally speaking, a gigantic bloodbath, and that kind of includes Bitcoin.

If I remember to rub my 12 brain cells that I have left together during the market update, I'll get into the rest of the numbers that you can expect this week. But first, the circle p, it's open for business today as it has been for the last couple, like week and a half, it's Rev Hoddle's applied permaculture class. That's right. It's rev.hodl. It's rev hoddle. He has his second, I believe this is the second time he's done it, his applied permaculture class is gonna be Saturday, October 12th. Alright? So we're a little bit over a month away from this taking place in Baroda, Michigan. It's gonna cost you exactly a 100,000 satoshis where you will learn how to apply permaculture to any lifestyle to build sovereignty, resilience, and wealth in this half day class. He's gonna detail how he applies permaculture ethics and principles to homesteading. He'll share how he to homesteading. He'll share how he builds resilience into his wealth with the eight forms of capital.

And illuminate the connections between Bitcoin and permaculture. So, on Saturday, October 12th, that's Saturday, October 12th at roughly around 10 am in Baroda, Michigan, you will get hold on, hold on. Let me get down to it. The applied permaculture presentation, which starts at 10 am Saturday, October 12th. 12 pm is the homestead lunch. She's gonna feed you food grown on the farm. 1 PM is Permaculture in Action tour. And then 3 PM is the wrap up and networking. And I presume that that might go a little bit longer than, you know, everybody actually thinks. But the day before, if you don't wanna buy a ticket and you just wanna go hang out with some Bitcoiners at the same place in Burroda, Michigan on Rev. Rev. Hoddle's Permaculture Place, Friday, October 11th, the day before, you can check-in at 3 pm and just hang out 7 pm for Fireside Bitcoin meetup, you will need to bring your own beer. I presume you're probably gonna need to bring your own beer for the, lunch and the wrap up and networking thing for Saturday, October 12th.

But, it's whoop dee doo. I mean, you know, he can't provide everything for you. So it's a 100,000 sats. There's only 21 tickets available. You need to DM him on Nostr. And, as always, his in pub will be in the show notes. And you can just click the link and it will take you directly to it. I don't make it to where you've got to put in his inpub. I give you a whole link. So you just click the link and you'll get over to Rev HODL. Give him a DM, tell him that you want to buy a ticket, but also tell him that you heard it on the circle p. Otherwise, he will not be able to know that I was successfully able to sell one of his tickets and he will not give me any of those sweet sweet satoshis.

On to the news. Bitcoin Hash Rate records a new all time high by surpassing 740 exahashes per second. Bitcoin Magazine, the VVXN. The network hash rate reached new all time high on September 3rd, surpassing 740 exahashes per second. This comes even as Bitcoin price trades below $60,000 Yeah. Back into the, 57 k territory. I never thought I would find myself trying to defend 58 k. It's ridiculous. A higher hash rate reflects more computational resources spent processing transactions and mining new Bitcoin. Leading mining companies such as What'sMiner and Microbt are launching advanced machines that take advantage of the surge in hash rate. WhatsMiner has introduced 4, count them, 1, 2, 3, 4 new mining rigs in a forthcoming solar powered mining container system.

Meanwhile, microbt has rolled out its m6xsplusminer capable of processing between a 190450 terahashes I'm not sure if that's actually correct yeah I guess I guess it is terahashed okay okay I'll take them I'll take their word for it riot platforms also purchased Block Mining for $92,500,000 to enhance its hash rate and broaden its market presence. And additionally, miners are looking into AI integration and potential acquisition opportunities to address persistent identity challenges in the industry. Bitcoin's rising hash rate indicates a strong confidence in its long term sustainability.

But while the hash rate doesn't directly influence Bitcoin's price, it does reinforce the underlying network security. Hash rate milestones also tend to precede bullish market moves and Bitcoin's halving events Okay, so look guys the amount of times over the last month and a half that I'm just reading like a note on Noster or even on Twitter out in the wild that just says this like a single bullish statement about Bitcoin. And I mean, American HODL did it yes it was either yesterday or the day before said, like, it was some something like something's in the wind. Can you smell it? Something big is about to happen. I'm begging you to stop doing that shit because it's not working. It never works. It it's just not working. We're having to find ourselves finding or finding ourselves having to defend the 58 k gang.

Right? I don't think the bullish comments are actually helping. Right? So, you know, it's it's a little at this point, it's a little silly. September is gonna be a kind of a rough month. It always is for Bitcoin. Right? And I guess a lot of people I guess we always forget that because by the time September runs around again, it's been damn near a whole year and we forgot that September has a tendency to suck. But let's keep Riot platforms in the crosshairs here because they are urging Bitform board that changes ahead of a crucial October meeting are, well, they want to discourage this. Let's talk about this. Josh O'Sullivan and Cointelegraph. Riot Platforms, the largest shareholder of Bitfarms, has issued an open letter to Bitfarms shareholders calling for additional changes to the company's board of directors.

The upcoming meeting is scheduled for October 29th. And during that meeting, Wright is expected to push for reforms to improve governance and value for all shareholders. Yay. We're the saviors. Bitfarms is a publicly traded company based primarily in Canada that specializes in cryptocurrency mining industry with a particular focus on Bitcoin mining. Riot holds 19.9 percent of a stake in the BTC mining focused firm and has acknowledged recent changes to the board including the resignation of co founders Emiliano, Grodsky, and Nicholas Bontha.

In the open letter, Riot argues that these changes are insufficient and simply reactionary to public pressure and proposes the election of 2 independent directors, Amy Friedman and John Delaney or Delaney, however you wanna pronounce it. And the 2 independent directors proposed would replace Bitfarms board members, Andreas Finkelstein and Frannie Philip. I just sorry, Andreas. I just your name is impossible to pronounce. In its letter, Riot also warns Bitfarms against taking further action. Read that again. Riot is warning Bitfarms against taking any further actions that could entrench the existing board before the October 29th meeting.

They stated that it sincerely hopes that Bitfarms will ensure shareholders have their say and not seek to take any steps that could adversely affect investors or gain unfair advantage in the director election. Quote, Bitfarms board should not enter into any financing transaction prior to the completion of the special meeting. Riot is deeply concerned that any transaction that the current Bitfarms board would pursue would be punitively dilutive of all Bitfarms shareholders when there are other more attractive financing options available. End quote. Telling them how to run their business.

Riot warned that if the Bitfarms board insisted on taking any such action to further entrench itself at the expense of shareholders, incumbent directors would be held personally accountable. Did you not hear what I said? I mean, Riot is like, they're just flat threatening action. And I'm not sure how you hold, you know, any incumbent directors as personally accountable. I mean, it's not like they have arrest powers. They can't send them to prison. Or could they? This is where my knowledge of corporate structure kind of falls a little short, But honestly, to me, this is a huge this is there. They are just threatening. They're not warning.

No, the Cointelegraph article says that they're warning. No, they're not warning. They are threatening these guys that they have to do exactly what Riot says. And if they don't, their directors are going to be held personally accountable. Anyway, on August 13th, Bitfarms announced the appointment of CEO Ben Gagnon as a new board member amid Riot Platform's attempt to take over. Bonta, who worked as Bitfarms' interim president and CEO, stepped into the role in May and decided to step down from the board upon Gagnon's entry. A Bitfarms spokesperson told Cointelegraph at the time that the appointment of a CEO to a board was standards across public company. I guess standard action across public company?

Anyway, that's the end of the article. But, you know, let's let's not get off of this without at least making sure that we all understand what's going on here. Riot holds exactly 0.1% less than a 20% stake. 19.9 percent. That's a lot of votes, right? And they're straight up threatening these guys with personally accountable actions. If they do anything that could be construed I guess in the eyes of Riot to be wrongthink or that you've diluted your shareholders value. But there's no definition that I've been able to or at least it wasn't in this particular story. I'd like to see what the definition of that actually means. Is it simply that your share price goes down in value as a company if you commit action XY or Z like buy a company or get another round of financing or something like that. If if your share price goes down, I can see it. Also, if you have to print new shares to be able to get said financing or whatever it is that you want to do, then I can see that as being dilutive as well. But there does not seem to be one inkling of an actual definition of what dilutive means in this particular context.

I kind of think at this point Riot is starting to play dirty. That that's my thought. But we gotta move over we gotta go over to the land of the rising sun. Bank of Japan governor is hinting at more rate hikes, and then BTC drops 0.4%. I'm not sure how they're connected, but let's find out. This is out of CoinDesk. It's written by Amkar Godbold. Bank of Japan governor Kazuo Ueda reiterated that the central bank will raise rates further if if if the economy and inflation develop as expected according to Bloomberg. In a document filed with a government panel led by prime minister Fumio Kishida on Tuesday, Ueda said that the economic environment remains accommodative with inflation adjusted interest rates negative even after a late July increase in the benchmark borrowing cost.

That was the first in decades and and triggered an unwinding of yen carry trades destabilizing risk assets including cryptocurrencies. Ueda's comments drew bids for the yen pushing the USDJPY pair from, or to 145.85 which is down from 147 according to charting platform trading view the boj's plan to tighten monetary policy poses a challenge for risk assets because the US Federal Reserve is likely to start cutting rates in September and other central banks are expected to do the same in the months ahead. That means the yen could be solidly bid against most currencies, including the dollar, potentially forcing traders to sell riskier investments to pay back their yen denominated loans.

The unwinding of the so called yen carry trade rocked the global markets earlier last month and was partly responsible for BTC's slide from 70,000 down to $50,000. Quote, the initial positive market reaction to the Fed's impending rate cuts is justified because investors believe that if money is cheaper, assets priced in fiat dollars of fixed supply should rise, Arthur Hayes, a co founder and former CEO of crypto exchange BitMex and the chief investment officer at Maelstrom, wrote in a recent blog post. Quote, I agree. However, we are forgetting that these future anticipated rate cuts by the Fed, boe, and the ECB reduce the interest rate differentials between these currencies and the yen.

The danger of the yen carry trade unwind well, hold on. Let me do that again. The danger of the yen carry trade unwind will reappear and could derail the party unless real food in the form of central bank balance sheet expansion, aka money printing money printer go brrr raises the quantity of money, Hayes continued to write. Interest rates in Japan were stuck at 0 for over 2 decades, leading investors to borrow yen and invest in high yielding assets according to Deutsche Bank the Japanese government accounted for $20,000,000,000,000 in carry trade as of October last year The bank, the Japanese government, accounted for $20,000,000,000,000.

That's $1,000,000,000,000 with a t, not million with an m, not billion with a b, but $20,000,000,000,000,000 with a t dollars. That's a lot of cash for this little itty bitty island country. It's gonna get weird. If they raise rates and the United States drops ours and we're going to drop ours in September, They can't keep this shit up. The money printer must go brr because the math that they've worked theirselves into demands it. It's not opinion. It's not sentiment. It's not sciatica. It's fucking math. There's no way there's no way you can keep this shit up. Everything is falling to pieces, and the only way to make it stop falling to pieces in the very short term to possibly short medium term is to print another boatload of money which is actually going to make things worse thank God for Bitcoin Alright. Last up before the market, this is fucked up.

Literally, that's the quote. This is fucked up. Detained Binance executive protest treatment by Nigerian court. And I'm kinda blown away by this. I had no idea this was going on, and it's weird, so strap in. Decrypt Ryan s Gladwin writing. Detained Binance executive Tigran Gambarian protested his treatment by Nigerian authorities in a newly released video posted on Twitter. In the video, Gambarian can be seen caring sorry, crying, physically crying out in pain, pleading with the Nigerian Guard for support as he struggles to walk using a single crutch. The guard was told not to help me, Gamberrion asserted to cameras filming him, adding, This is fucked up. Why can't I use a goddamn wheelchair? End quote.

Binance CEO Richard Tang retweeted the video stating that quote, this inhumane treatment of Tigran must end. He must be allowed to go home for medical treatment and to be with his family. A Binance spokesperson told Decrypt that we are extremely distressed by the video of Tigran in court yesterday, adding that the executive's health is rapidly declining amid concerns over the long term consequences of this unjust detention. Nigeria does not need to keep Tigran in order for us to settle any alleged past issues. And we continue to implore the government of Nigeria to let Tigran return home and let us continue in our engagements.

Gambarian, finance's head of financial crime compliance, has been detained in Nigeria since last February where he and the exchange have been accused of money laundering to the tune of $35,000,000 and manipulating the forex market. And during this time, Gambarion's team says that his health has deteriorated with the executive having collapsed in court, suffered from a herniated disc which has left him immobile, and experienced several bouts of malaria. Despite this, a Nigerian court denied his request for bail in May, citing flight risk concerns. According to local media, the altercation came amid a hearing in the Federal High Court in Abuja where the Economic and Financial Crimes Commission contested the severity of Gambian's health concerns.

And oh, sorry. Ichinay Ichio, there's no way I can pronounce that, lead counsel for the EFCC reportedly told the court that he had seen the Binance executive walking within the detention facility, contradicting his claims that he was unable to move. And this came after the wife of Gambrian issued a plea to the US government to intervene in what she considered to be an unlawful detention of her husband, a US citizen, and a former IRS agent. Quote, I am deeply concerned about recent statements from Nigerian authorities denying Tigran's health issues, Yuki Gambrian, the Binance executive's wife, said in a statement, he is in so much pain and he can barely walk, end quote.

She said that the prison withheld the executive's medical records for months and that partial records it has released suggest that he requires a surgery. In July of, in July, US representatives French Hill and representative Rich McCormack submitted a resolution to congress urging the government to consider Gambrian a hostage and calling on the US to do everything in his power to secure his release. So I don't know. This my gut feeling is that it's possible that Gambrian is kind of, you know, maybe he's got a little bit of health issues, but it sounds to me like he might be overplaying it a little bit. You know, oh my stomach hurts, but you turn it into, like, oh my God, I'm dying to get out of school. And who can blame him? Nobody wants to be in prison in Nigeria. I mean, I get it.

But something about this doesn't feel right. And I'm not saying I mean, I still think he needs to get the hell out of Nigeria. You can go keep him in like some prison like it Rikers Island or something like that over in New York. Right? He honestly doesn't really need to be in Nigeria. Right? We we can work this shit out but this entire it's like it's like a genre at this point of being of you being anything to do with crypto or God forbid X and or sorry I should have called it Twitter or like Telegram or and at one point or another, I'm I'm waiting for the 1st Nostra developer to be, like, sent up the river. That if you're in some other country, you know, a a country that is not your own country, that you weren't born in and you don't have citizenship in, then you can just get hosed.

Right? Because nobody's rights anywhere in the world is being respected at all. And it's really sad. And it definitely demonstrates to me a generalized direction that this planet is going. And it ain't going well. Right? Anonymity needs to be key. Centralized platforms if sure. You if you you want to go to prison for 25 years, by all means, start up a Bitcoin centralized exchange. That's your quickest way to get into trouble and get thrown in the fucking WhoScout. So stop doing that shit. So thank God for Bitcoin and at this point thank God for noster. But if you're working on noster, don't tell anybody you're working on Nostr.

And and start doing that now. I mean, tell only I mean, you're gonna need to tell people, like, if you're if you're writing a grant for Open Sats, they're going to allow for a hell of a lot of anonymity on that shit. But they're I mean at one point or another they're not just going to give money over to somebody they don't know. So there's going to be some way that some place like open sats knows who the hell you are. But if you're on Nostr and you're like, you know, like under your own name and your own picture of your own face and working on Nostr, please at least reconsider and take a good hard long look at where we are in the world.

And understand that these people are reaching for straws, not not the Nostra guys. Although, well, I think all the developers in this space are reaching for straws because, you know, they gotta pay rent. I'm talking about governments. They look to me like they're a wild animal that's been backed into a corner. You never want to tangle with an animal that's backed into a corner. I wouldn't even jack with a tree squirrel if it was backed into a corner much less something like a honey badger. That's where we seem to be. So all I'm asking is that please reconsider how you go about releasing what ever aspects of your identity that you want to release given your affiliation with Bitcoin, Lightning, eCash, Noster any of these things.

Any of the stuff that governments around the world cannot ever have a hope of controlling and have discovered that fact all of them are backed into a corner. Some of them know they're backed into a corner. Others have a gut feeling that they will be backed into a corner. But then there's others that have no conception that they are already in the corner and already fighting for their life and the second that they discover that shit watch out let's run the numbers CNBC Futures and Commodities Oil getting taking a bloodbath today.

West Texas Intermediate is down 3.82 percent to $70.74. Brent Norsey is down 4.3%, down to $74.9. Natural gas is up 2 and a half points as you would expect because it always goes in reverse for whatever reason. But gasoline is down damn near 5 full points to under $2 a gallon. $1.99. This is because, as usual, every single day, news comes out that China is seeing less demand for oil. And it's bizarre because, yes, we know they're seeing less demand for oil, but it's like a new news article comes out every single day about how they see less demand for oil. And, also, OPEC or OPEC plus is going to relax their restrictions on the flow of oil out of the Middle East, so they're gonna be putting more more oil on the market. And I can't remember. I think that's at the end of the year.

But then Libya has no export function because I guess they closed down their their oil ports. So I can't remember exactly what the hell happened in Libya. But at first, everybody in the market was going oil is going to stay the same and or arise because the Libyan output is going or the the no oil out of Libya is actually going to offset the more oil out of the Middle East in general because of OPEC plus. As of this morning, that sentiment has changed. How the hell can anybody in legacy financial markets make head or tails of this shit? It's just noise. It's sad. Thank God for Bitcoin.

But not for shiny metal rocks because they're all getting hammered as hell too. Gold down a 3rd. But still at $25.17.90, silver is down 3 points. Platinum is down 2 a quarter. Copper is down 3 points. Platinum is down, you guessed it, 3 points. Biggest winner in ag today is wheat. Three points to the upside, biggest loser. Chocolate, 5 points to the downside. Live cattle is up 0.76%. Lean hogs are up 0.4. Feeder cattle up 0.83%. And the legacy equity markets are, you guessed it, taking a bloodbath. The Dow is down over a point. The S and P is down 1a half. The Nasdaq is down 2a 3rd.

And the S and P mini is down damn near 2 full points. It's just, see, that's why I hate when numbers come out because it just screws everything up. But it's also screwed up the price of Bitcoin which is sitting at 57,720. That takes us to a $1,14,000,000,000 market cap and we can only get 32.2 ounces of shiny metal rocks with our 1 Bitcoin of which there are 19,748,899 in 1 quarter of and the average fees per block has fallen again. Now, we are at 0.05 BTC on average for fees on a per block basis. And there are in fact how many blocks? 128 blocks carrying 257,000 unconfirmed transactions waiting to clear at high priority rates of 4 satoshis per vbyte. Low priorities are 4 satoshis per vbyte. And mining looks like it is at 684.7 exahashes per second. So we've fallen from that 740 exahashes per second, that we talked about earlier today. But every time I see every time we see these peaks in hash rate, by the time I've read the story and go look at at, the mining pool, or rather the hash rate over on mempool.spaceforward/mining, it's already fallen. You know? So it's kinda like where it was last week as of right now. But still, kudos for 740 x ashes per second. That's pretty good, man. Alright. From Han Solo Miner, which was episode 944 of Bitcoin and I got God's death with 237 says we should all run a bitaxe.

I never played the lottery until I set mine up. I agree. The bird the bird 500 says, come on 28 k. No. Stop it. Stop. I don't need another gang name. That's ridiculous. Wartime with 333 says, boozed. God's death with 237 says, thank you, sir. No. Thank you. Yeager with 121 says, NWS, sounds crazy exciting. Thanks for reporting on it. Yeah. You're welcome. Matt f r l a 100. Keep it up. I will, sir. I will. And that will do it for that. Let's see. Is there anything else that I'm missing? Nope. That's gonna do it for the weather report. Welcome to part 2 of the news that you can use Nostrudl version 0.40.0, encrypted insect, Blossom uploads, WOSM relay, blind spot feeds, and more.

It's been announced. Version 0.40.0 has been announced. And if you haven't checked out Nostrudel, I gotta recommend that you do because it's it's just it's another cool Nostril client. It's got a lot of lights and whistles and bells. Remember last week I was talking about Ditto, which has almost no lights, whistles, and bells? Nostradle's got them. It's got a lot of them. On my machine, performance does get impacted. Your mileage may vary, but it doesn't matter. I still love this particular client just like I love Coracle, just like I love Primal. There's a satellite dot earth. These are all top notch top notch Nostra clients and you should try not only ones that I mentioned, but everyone that you can get your hand on. Except for the ones that require you to put your insect directly into into their website, use a different identity to test it out. Don't use your the insect that you're relying on right now for your majority of your nostril communications, don't you don't don't put that insect in. If you don't have another, identity on nostril, go get one. They're free. They're easy to get.

Use that insect and see what happens. But keep your insect that's the most important insect to you is how you should treat that insect. If it if it doesn't matter to you, then it doesn't matter. Right? But if it's really important to you like mine is to me, I do not put my insect into browsers. I don't mind using a browser extension. I use Alby's extension, but don't put it in directly. Anyway, so quote, after 7 months of work I've decided to release another version of Nostrudel. I fixed a few bugs and it's probably got a few new ones. But most importantly, it's got a ton of new features announced, hazard 149 or h r oh, sorry. Hzrd 149.

As always, if you wanna check it out, you can use nostrudel.ninja or run it locally using Docker, added to developer. So what's new? Well, there's support NIP 49 encrypted insect quote now when logging into the app it will prompt you to set a password to encrypt your insect so that it can be stored securely if that's even possible for a web client end quote. And I'm not sure about that last part but it's in the announcement so I'm keeping it in there. There is also a new account setting, view that lets you export your NSEC as an encrypt sec so you can copy it into other apps. Oh, interesting.

Interesting. Encrypt sec. So they put he put crypt like cryptography between the in and the sec. So your in sec becomes a encrypted insect and now is actually labeled, encryptsec and then your whole bunch of numbers and stuff like that after your after your, after the insect. Anyway, blind spot feeds, There are also new blind spot feeds that show what others are seeing in their timelines that you are missing. I have to admit, I haven't used blind spot feeds, but, it's it's hard to just really know a lot about the amount of Nostra clients that are out there because there's a ton of them. Thank god.

NIP 42 relay authentication, the app now supports NIP 42. It's opt in though. So if you wanna use popular authenticated relays like nostr. Wine or relay.snort.social, you will have to enable it in the settings. WOSEM relay and event verification is also new. The app now supports using atsnortforward/workerrelay as a local relay. It's at least 10 times faster than the internal browser cache and can hold at least 100x more events. Wow. It's not enabled by default though. So if you wanna use it, you have to switch it to in the re switch it on in the relays at cache relay view.

The app also supports using nostr hyphen WASM, w a s m, to speed up signature event verification. This is enabled by default. But if you want to still use the JavaScript verification or no verification, you can find that in the performance settings. Thread tabs, quote, threads now have a set of tabs that let you see the replies, quotes, zaps, and other stuff related to a note. Wiki articles it's not feature complete, but you can now view and edit Wiki FreeDIA articles in the app. Finish the Launchpad. Launchpad is now usable and shows the latest notifications, messages, streams, and tools. Blossom uploads.

The app now lets you upload images and video to Blossom server. This isn't enabled by default though, so you're going to have to enable it in your settings. So go to settings and look for Blossom stuff and you'll probably find it. Task manager, it lets you see what's going on under the hood in the app and there's a series of bug fixes. So I've been waiting for the the No Strudel update for a while, and I'm really happy that it's out. I have updated mine but I haven't really gotten a chance to play around with it yet. Now, on to this one. NEM VPN is the first commercially available VPN on a decentralized mix net.

NEM VPN is now publicly available for anyone to beta test for free and experience the 1st commercially available app to run on a decentralized mix net. It anonymizes your identity and payments and guards against metadata tracking and surveillance. Harry Halpin, CEO of NIM Technology, officially announced the launch of the public beta testing phase of NIMVPN at the web 3 summit last week. NIMVPN's anonymous mode uses the NIM mixnet, m I x n e t, to make traffic untraceable by routing it through 1, 2, 3, 4, 5 independent servers. And the key strategies include data fragmentation, cover traffic, packet mixing, timing delays.

So, like, let's look at those. Data fragmentation, it says fixed sized sized identically encrypted packets. Cover traffic is sending dummy packets alongside real data. Nice. Packet mixing for intermixing packets from different users. And timing delays which randomize packet handling times. These techniques create a network of noise, confusing data surveillance efforts and impeding AI tracking and net flow analysis by ISPs. Serious online anonymity sacrifices speed. So be aware. To unlink your online activities from your identity and combat advanced AI tracking, decentralized networks are essential.

More relay servers increase anonymity, but at a cost. What's the trade off? It slows down traffic. Hey, there's always a trade off, guys. You can't just have everything all at once. Sorry, I don't know what to tell you. But there is a fast mode. So this fast mode routes traffic through only 2 of the servers to obscure IP addresses ideal for messaging, crypto browsing, streaming. Upcoming WireGuard integration will boost security and efficiency. But then there's anonymous mode. And this mode surpasses traditional VPNs by routing traffic through 5 servers that adds the aforementioned noise that we talked about.

State of the art multi layer encryption, a decentralized network, added network noise to confuse nym, n y m v p n. We need to go check this one out. We really do need to go check this one out. In fact, I'm just gonna go ahead and click on the nimvpn.com. Privacy made simple. Sign up now for instant free beta credentials. And guess what the sign up is? It's not Nostr. It's my email address. Points taken away. I'm sorry, but I just can't deal with that right now. Core lightning version 24.08 steel backed up channels. Quote, we are pleased to announce the 24.08 release of Core Lightning named by Lagrange 3.

This release brings notable improvements to offers, pay, and the experimental Renepay? Renepay, Renepay plug in. I don't know what that is. Core Lightning is a lightweight, highly customizable, and standard compliant implementation of the Lightning Network protocol. What's new? Pay. Now checks for sufficient spendable capacity before computing a route and returns a clear error message if there isn't enough capacity. Oh, that's nice. Offers can now sell fetch and pay Bolt 12 offers and invoices. Offers automatically adds a blinded path from appear if we have no public channels and supports getting a blinded path for invoice request if we're an unannounced nodes. And there's Rent A Pay, what now prunes the network by disabling undesired channels, unreserves routes after use, and introduces a new exclude option for channels and nodes to be excluded from routing.

Wow. They've done a lot of work on this one. So again, Core Lightning version 24.08 has been released. You might want to go check that one out. But I caution everybody just because a brand new release of something has come out does not necessarily mean that you need to rush to go do that. My advice is what I do for myself, I wait. I do not install the newest shit upfront. I wait at least 3 weeks, if not 6 full weeks before I start even thinking about upgrading any of my services like like lightning, like l lnd, core bitcoin, that kind of stuff. I just don't until either either it's, like, so old and nothing has happened with it that I can pretty much trust that it's okay or something breaks and I have to upgrade, but whatever.

Bull Bitcoin has announced their launch in France, and the mobile wallet version 0.3.0 has been released. Bull Bitcoin recently acquired Bitcoin Lion, one of France's oldest brokers, to support Bitcoiners. Both experienced and new Bull Bitcoin is collaborating with its founding member, Jimmy Chambraad, the company announced in a blog post. Our mission is to equip you with the tools to reclaim your freedom and sovereignty. It started more than 10 years ago in Canada, continued in Costa Rica, and now we open a new chapter in our fight against central bankers alongside the French people, who will probably immediately surrender. I'm just saying. I know. I'm sorry. If you're French, I'm sorry. That that's a terrible thing for me to say. In related news, the company just released version 0.3.0 of bull Bitcoin mobile, an open source and trustless Bitcoin and liquid network wallet with integrated atomic swaps across Bitcoin, lightning, and liquid. Available on Android and an iOS version apparently is launching soon. TM. Bull Bitcoin wallet is available worldwide and you do not need a Bull Bitcoin account, said Francis Poulliot, founder of Bull Bitcoin.

The wallet is considered to be completely safe, heavily tested. Please back up your seed. You will find a link to the Telegram group in settings. Bug reports and comments are highly welcome. So, yeah, Bull Bitcoin launching in France. This is good news. Soft Fork, covenant dependent layer 2 review report. Alright. This is just a report. What's it to report on? Well, it's kinda confusing, so bear with me. Bitcoin developer Peter Todd has compiled a comprehensive overview of soft fork and covenant dependent layer 2 proposals including Arc, LNsymmetry, validity rollups, bitvm, CTV, sighash underscore anyprevout, lenhance, optransactionhash, opcat, consensus cleanup, and others. Holy smokes, brother.

On chain wallets map each economic transaction to 1 blockchain transaction. Aggregations, coin join and cut through payments may alter this slightly, but it's mostly accurate, writes the developer. Our goal here is to do an overview of all of these proposals, figure out what technical patterns that they share, figure out what kinds of new opcodes and other software upgrades that they need to function, And then create a comparison table of how all the parts fit together. Lightning enables infinite economic transactions with a single channel link to one UTXO by collapsing the quote time dimension of transactions.

However, a single UTXO per user isn't sufficient for ultimate scaling. Proposals aim to let multiple users share one UTXO further collapsing the space dimension. Along the way, we'll also define what an L2 protocol actually is, what kind of scaling Lightning is already capable of, and get an understanding of what improvements we need to do for mempools to achieve all this. And then he gives thanks to Folger Ventures, Daniella Bronzi, and Sarah Cox. And there looks to be, this is the table. It shows lightning, channel factories, ln symmetry, arc, advanced arc, and validity roll ups in this little screen capture.

And it doesn't it's really not that well done in this, no bs bitcoin.com. But, hey, you you do what you you do what you can. So I can't really tell what you and are actually mean. It just it doesn't say. It doesn't give me a it doesn't give me a legend. So, anyway, there's anyway, there's several things that are going on in Bitcoin right now especially concerning Bitcoin's relation to lightning. And the the main argument is this, is that there's not there will never be enough UTXO's for everybody on earth to have their own UTXO. Right? That's been a concern for years. It's not new. Right? It's not a surprise. I'm just saying understand we've known about this shit forever. But it keeps coming the argument keeps coming back.

And every time it comes back, you get a whole bunch of FUD around it. Like, oh my god. What are we gonna do when nobody like, only half the people on the planet or even just quarter of the people on the planet can actually have a UTXO. Does that make me having my own UTXO better than somebody else? No. Seriously, it gets down to it into othering, like, in like, damn near racism. Like, I've got a UTXO and you don't. You suck. You're, you know, your mom is so fat she lays around in how she really lays it's all bullshit, right?

Because and the reason I say it's bullshit is because we are humans and we are purpose built to figure out problems. This is the Bitcoin is the best thing that we've seen to be able to get a handle on on widespread corruption and greed at the highest levels of power that there can be and yet it's not enough it's not enough so then we add lightning but even then opening a channel but you I mean at least you once you do open a channel with your one singular UTXO if you're quote unquote lucky enough to get 1 a 100 years from now that we will enable you to do back and forth payments in in infinitum. You can just keep on going, but then you'll have to close that channel which is another UTXO.

So I'm not exactly sure what the one UTXO thing because that well, there's 2 transactions and I guess you could actually say that that might encompass one UTXO. It doesn't matter and here's why Lightning, channel factories, LN symmetry, Arc, Advanced Arc, liquidity roll ups. These are just a few of these ideas that are on the table. This doesn't even and Peter Todd isn't in the e cash or Fedimint universe right now. He's just he's just talking about lightning's relationship with Bitcoin and the UTXO. He hasn't even included e cash. What if this what if I open up a channel with my privileged one UTXO that I have. I open up a lightning channel with that and somehow or another somebody figures out a way that e cash can leverage that channel without actually opening up its own UTXO.

So now I have like me and my in my, oh my loftiness my privilege of having a UTXO has deemed it mandatory that I open up a channel and provide the squires, and the little plebs, and the the, you know, the guys digging in the sod out in like, you know, Southern England in the fucking fog like in, you know, movie of one of my favorite movies. The peasants. The little people. This is why I get so upset about this whole fucking argument. Because it's just turning this whole goddamn thing into yet one more way that we can look at each other and talk about our privilege. Or talk about how someone's a racist. And it's all bullshit, and it doesn't do anybody any good, and it causes strife, and it makes people not want to work together. And when we stop working together, shit breaks.

And I don't know how else to put it. Stop with the othering. Stop with the the the racism shit. Stop with the fucking word privilege. It's beyond childish at this point. How do we fix it? How about we do that? How about we fix it? Is it possible that I can leverage one of my channels on, like, so using something like e cash that somebody I don't even know is using the liquidity. Maybe they're paying me a rate for using that liquidity, but they didn't have to open a channel. There somehow or another e cash or a Fedimin is just connected to that particular channel because I made that channel available on the open market for other people to leverage.

Is it because I'm magnanimous? No. It's because I know we're all going to need this shit. And if it happens to be the case that I am indeed this privileged noble class, then it kinda is impen you know, it kinda depends on me to open these channels, which is why I've never closed down my Lightning node. It doesn't make any money. If I were to get into the math, it probably actually loses me money, but it certainly doesn't make me any money. But so why do I do it? Support the Lightning Network, support Bitcoin, and have these things enabled already so that I don't have to rush to the exits or at least rush to the entrance to figure out how to do it later on when it becomes clear that we're going to need them.

I know I'm going to need these channels. I don't need them right now. Actually, I kind of do because I this value for value in podcasting 2.0 kinda depends on kinda depends on it. But I don't have to do it that way. I can rent a node from like Bolts or something like that. I don't have to run my own node. I do it because it's cheaper for me to run my own node than it is to rent a lightning channel from bolts or whoever is gonna provide me the liquidity. That's really the only reason that I keep my lightning node open right now. But I don't have to. But I know that I'm going to I'm going to pat my younger self on the back for having the foresight to make sure that I always have at least like 5 lightning channels open, if not way more than that.

I can feel it in my from balls to bones I know I'm going to need those lightning channels sometime in the future. Maybe not now, maybe not soon, but sometime, and it's going to really matter. How can I help and it's not even that I want to help how can I have it have utility while I'm waiting for the whole reason that I put this shit into play 3 years ago in the first place? How can I leverage that? I mean, it's okay, I don't mind saying it. How do I make a little money out of that? And if I can make a little money out of that with and provide the ability for somebody to have incoming and outgoing liquidity and they are never going to be able to have their own UTXO, why wouldn't I?

Especially if I have no idea who this person is. And and if all these like this NIM VPN, if somehow or another this fabulous technology of introduction of noise can be used in the Lightning Network and e cash network and not jack everything up, then I don't give a shit. Nobody's gonna know who the hell's doing what with who on what channel and who owns that channel. It's gonna be impossible for anybody to figure this out. That's why we continue to work together and not have a noble class versus a peasant class all under the auspices of there's not enough UTXOs.

This entire argument needs to die. And if anybody makes this argument it always needs to be made in connection with how do we get over ourselves and continue to work together to do things like NIMVPN. That's my question, and I'm gonna leave it there. But one more thing before I let you go. We've got we've got numbers coming out in September. Remember I told you I was gonna try to figure out a way to, you know, have my brain cells work, you know, work together, to let you know what's going on. Here's what's going on but I gotta bring up trading view first. So bear with me. I'll be here in a second while I watch this sad ass red candle on my right hand side of the screen.

Let me get this. Okay. So today, we had let's see if, it's not gonna do it. Okay. Today, we had the ISM, manufacturing PMI come out and it missed by 0.3, by 0.3 points. Now, on September 4th, which is tomorrow, we've got another report. And this is the Joltz job openings report, and it's supposed to be released at 7 AM, I I guess, eastern time. Or no. No. 7 AM my time. So what? 10? 27, 9, 10. Yeah. 10 AM Eastern Standard Time most likely. But it's the Joltz job openings. Well, it's not over guys because on 5th, the day after that, we have the ISM services PMI.

The numbers that dropped today were for manufacturing. But the service sector, that PMI comes out September 5th at 10 o'clock AM Eastern Daylight Time or whatever at 7 o'clock my time. And we're not done because we'll have unemployment rate dropping on the 6th September, so the day after. See how they're see how they stack this shit up? So the unemployment rate number and and remember how we can't trust this shit because they had to revise the unemployment rate down or up or what the employment rate down 818,000 jobs. That was like last month we got that news. That they lied about there being a 1000000 jobs. They just straight up lied. And then they waited 6 months. That was the March report. They waited 6 months or so, and then they revised all that shit down by 818,000 jobs so I have no no respect whatsoever for whatever this unemployment report is going to actually say because whatever it is they say it's going to be a fucking lie And if you don't believe me, I can't help you.

Also, on that same day, non farm payrolls is going to drop. So that is also in connection with that 818,000 jobs that they those two reports sort of work together. So back back to back to back to back bad news is probably what's what we're gonna see. And the markets are going to suck all week long. And it's not gonna be just Bitcoin. It's gonna be your legacy markets. It's gonna be the energy markets. It's going to be gold is probably not going to do all that well. Silver, platinum, as we saw today, all the shiny metal rocks are not doing well. Everybody's running to cash. And they always do this because they want to find out what the hell these reports say before they redeploy that cash.

That's the way that the rich people work. It's I don't make the rules. I just I I I'm trying to figure out what the rules are because I don't wanna be poor either, but I also don't wanna do it in the legacy markets because, honestly, it's just a fucking casino and I don't like casinos. I'm just saying. I think we're gonna have we have bad news today. We're gonna have bad news tomorrow. We're gonna have bad news the day after that. We're gonna have bad news the day after that. So Tuesday, Wednesday, Thursday, Friday, a full the full 1st week of September is gonna be just a string of terrible economic news. And you know what'll probably happen after all that news drops? The Bank of Japan will announce a rate hike. And that gin carry trade is gonna get bent over the the the bleachers again and done dirty.

And that's going to affect everything including the Bitcoin price again. I'm not telling you to sell. And I'm not telling you not to buy. DCA is always a good option. What I am saying is that you're gonna have to have patience to let the dust of this week settle out before you should really be making long term decisions about your wealth. In other words, if you think you're just gonna sell all your Bitcoin and come out golden on the other end, you might be right but you might be so horribly wrong that you're never able to get back into your entry point, which is why I ain't selling nothing.

I might have to sell $1,000 worth to cover a bill, like a medical bill or something like that. But this is why I have I keep my Bitcoin in savings. Right? So that I I mean, at one point or another, I'm going to use it, but I am not going to make a trade with it. And there's a difference between using your Bitcoin because you gotta pay rent or something like that and using your Bitcoin because you think it's it's a safer play to sell everything, go to USD, wait for dust settle, and figure out that you're not going to be able to get back in at your sell point and you're gonna end up with less Bitcoin. Be patient and let the stupidity of the markets clear itself out, let the dust settle, and then start making your long term decisions as to what you wanna do. I still recommend do not sell your Bitcoin, and I will see you on the other side.

This has been Bitcoin and and I'm your host, David Bennett. I hope you enjoyed today's episode and hope to see you again real soon. Have a great day.

Market Numbers and Analysis

Upcoming Economic Reports and Market Impact