Topics for today:

- The Specter of MtGOX Ending

- Regional Banks Etc. Drives Everything Down

- NewsMax To Add BTC

- Only Cash-Flow and Bitcoin Matter: Cardone

Circle P:

GreatGheeProduct: 100% Pasture-Raised, Grass-Fed, Jersey Cow Ghee sourced and produced in SW Virginia

Put BitcoinAnd in the order comments section

https://greatghee.com/

nostr Profile: https://ditto.pub/@GreatGhee@greatghee.com

Today's Articles:

https://cointelegraph.com/news/ghost-mt-gox-stop-haunting-bitcoin-halloweenhttps://www.tftc.io/repo-madness-and-bitcoin-dumps/?ref=martys-bent-newsletter

https://decrypt.co/344707/newsmax-reveals-bitcoin-trump-meme-coin-treasury

https://cointelegraph.com/news/florida-lawmaker-files-new-crypto-reserve-bill

https://atlas21.com/lightning2049-bitcoin-layer-2-comparison-in-singapore/

https://www.coindesk.com/business/2025/10/17/japan-s-top-banks-plan-joint-stablecoin-launch-nikkei

https://bitcoinmagazine.com/business/real-estate-mogul-grant-cardone-doubles-down-on-bitcoin-purchases-during-market-sell-off

https://www.theblock.co/post/375048/bitfarms-upsize-offering-500-million

Get You're Free Comfrey Owner's Manual Here:

https://www.bitcoinandshow.com/the-comfrey-owners-manual-is-here/

Find the Bitcoin And Podcast on every podcast app here:

https://episodes.fm/1438789088

Find me on nostr

npub1vwymuey3u7mf860ndrkw3r7dz30s0srg6tqmhtjzg7umtm6rn5eq2qzugd (npub)

6389be6491e7b693e9f368ece88fcd145f07c068d2c1bbae4247b9b5ef439d32 (Hex)

Twitter:

https://twitter.com/DavidB84567

StackerNews:

stacker.news/NunyaBidness

Podcasting 2.0:

fountain.fm/show/eK5XaSb3UaLRavU3lYrI

Apple Podcasts:

tinyurl.com/unm35bjh

Mastodon:

https://noauthority.social/@NunyaBidness

Support Bitcoin And . . . on Patreon:

patreon.com/BitcoinAndPodcast

Find Lightning Network Channel partners here:

https://t.me/+bj-7w_ePsANlOGEx (Nodestrich)

https://t.me/plebnet (Plebnet)

Music by:

Flutey Funk Kevin MacLeod (incompetech.com)

Licensed under Creative Commons: By Attribution 3.0 License

creativecommons.org/licenses/by/3.0/

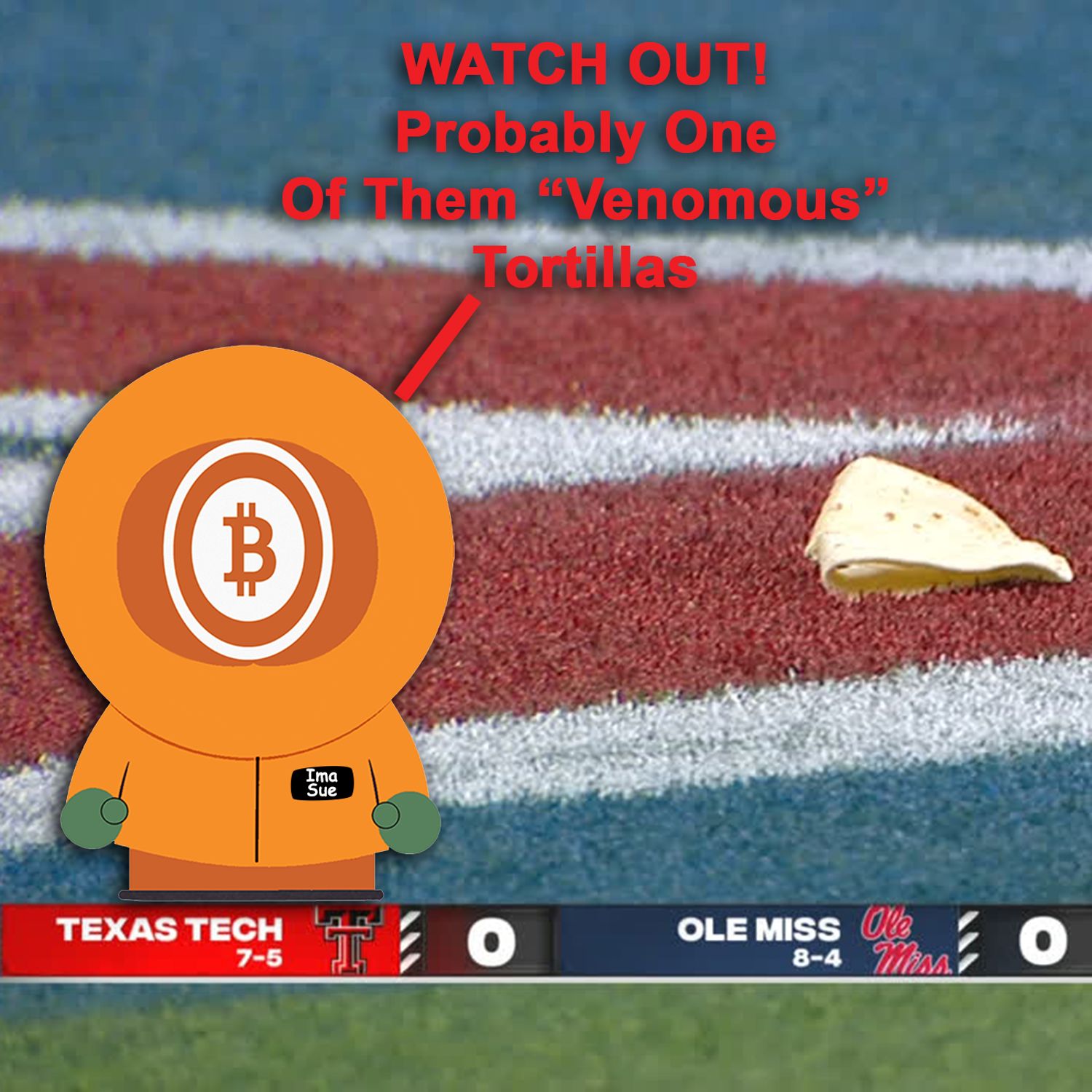

It is 10:16AM Pacific Daylight Time. It's October 2025, and this is episode eleven ninety two, Bitcoin. And today, I'm gonna start off just a little bit different talking about sports ball because I just can't seem to let it go. So it's like a tune that gets stuck in your head. Right? It it it it just is. The only way through it to get that little worm out of your head is to go ahead and talk about it. So, I'm not gonna talk about it too long, but it seems that during the Kansas and Texas Tech University game last Saturday, we got into trouble.

Yeah. We we did. We got into trouble. And I'm not gonna go through it. It's like, you know, one of the traditions of Texas Tech University, and it's been this way for decades, is throwing tortillas. And where that came from is because for the longest time, the team was not good. It is not a good team, Texas Tech University football. And somebody some radio commentator or somebody wrote a newspaper article said that the only bowl game Texas Tech University will ever get into is the tortilla bowl. And there was no such thing as a tortilla bowl. He was literally making a derogatory remark about several classes of people all at the same time. Honestly, hats off, brother. I mean, it was actually kinda elegant.

But it enraged Texas Tech students so much that we started throwing tortillas. And this this happened before I even went to school there. Okay? So this has been going on for, like, I don't know, thirty years or forty years or something like that. It's it's kind of ridiculous. But, I mean, they're soft tortillas. They're not edged in razor blades or anything like that, and they don't hurt anybody. I mean, my God Almighty, it's not not that big of a deal. Well, Kansas seems to have also, during that game, dropped a pocket knife on the sidelines and said that one of the fans threw it at the Kansas football team. Turns out it was one of the Kansas staffers that did that. So both teams got fined $25,000 by the Big twelve Conference.

But then later, a couple of days later, the commissioner of the Big twelve Conference decided that if any anything at a tech game, if any tortillas fly into the gameplay area, Texas Tech will be fined a $100,000. Per like, the first time we get a freebie. We get a warning, you know, on the first time. We get to do it during the kickoff and and we'll get a warning and a yay. But if anybody throws if any tech fan throws a tortilla out on the field and, you know, probably a bottle of water or something like that, 15 yard penalty, a $100,000 fine. Oh, by the way, for the tortilla toss during the Kansas game and the knife incident, Texas Tech were got both penalties at 15 yards, so we lost 30 yards and still won that game. It doesn't really matter, though. I because I know most of y'all don't really care about sports ball. But here's the point that I'm making.

The reaction that I'm seeing from Texas Tech fans is that, you know what? Yeah. We should just shelve the the tradition of throwing tortillas. And a lot of you might say, well, stupid. You're throwing food. Dude, they're tortillas. Yes. They are also food, but we're not throwing cans of baby jar you know, baby food. We're not throwing hot dogs. We're not throwing hamburgers. It's it's a tortilla. Why? Because they have a great flight pattern. It's off they're actually awesome. They're like little little delicious Frisbees. Right? So the reaction is that I'm seeing from some rabid Red Raider fans is, okay. We'll stop.

We'll just stop. And where this ties back into Bitcoin is that I find myself in a situation where I cannot have a discussion with people anymore who just get told what to do and accept it without any battle back. No fights, nothing. It's silence across the board. There are there are fans like me, yeah, that that are saying things about it, but it just reminds me of of well, it doesn't remind me. It it's a different way of looking at the same thing that we look at in Bitcoin. Are we really just gonna lay down and take it? Are we really just gonna say, okay, you know what? Take you know, we'll stop using Bitcoin.

We'll stop. No. That's okay. We the powers that be don't like it. So we're we're just not gonna put up a fight. We're just gonna say, you know what? Fine. Your fiat currency is just the best. You know, the way you're handling global economy, national economy, state level economy, city economy, you know, you you guys are always right, and we're we're always wrong. This this is why I can't have discussions with normal people anymore, which makes it difficult to operate in the wider world. So enough of the of the Texas Tech Bitcoin analogy. I just I I'll finish off by saying this.

If you think that it's just Bitcoiners that look out at the world and say, all of this is wrong, and you guys are just being entirely too weak by not trying to at least fight back, and then you cry about prices being high, about this being wrong, about that being wrong, whatever, without a fight, without anything. We have the same problem with this general attitude of malaise and apathy because that's what it boils down to. Most a lot of people have said the greatest risk to Bitcoin isn't government. It's general apathy. And what I've witnessed from this entire Kansas Texas Tech University debacle is nothing but apathy.

Just let them let them dictate what your tradition will be. Let them point the finger at you and laugh until you feel like you're just a fool. You know? And Bitcoiners have never put up with that. And I got nothing but respect for all of you because you don't. So you're here, not for football, but for all the news you can use about Bitcoin and more. The ghost of Mt. Gox will stop haunting Bitcoin this Halloween. Yohan Yoon kicks it all off. See what I did there? With a Cointelegraph story about this, and he says, Mt. Gox, the defunct Tokyo based cryptocurrency exchange, still holds around 34,689 Bitcoin, ahead of its October 31 repayment deadline.

What what what else happened on October 31? Oh, yeah. The dropping of the white paper in 2008 that defined the entire system of Bitcoin before the 01/03/2009 inaugural block minting of the Genesis block. But the exchange lost around 650,000 BTC in thefts that went undetected from 2011 until its 2014 collapse, while about 200,000 Bitcoin was later found in an old format wallet. Well, those coins became the foundation for creditor repayments overseen by court appointed trustee Nobayaki Kobayashi. In twenty seventeen and twenty eighteen, Kobayashi earned the nickname Tokyo whale for selling Mt. Gox Bitcoin to fund fiat repayments.

In mid twenty twenty four, so just last year, wallet activity surged again as roughly a 100,000 BTC was moved between Mt. Gox addresses for distribution, though not all represented actual sales. The repayment deadline was extended by one year to give creditors more time to complete claim procedures with about $3,900,000,000 in Bitcoin still in Mt. Gox linked wallets. This Halloween may again spark concerns about possible sell pressure. Yay. Like, we needed any more bullshit. Here's how Mt. Gox's Bitcoin movements have moved markets throughout its bankruptcy and civil rehabilitation proceedings.

And then they give a they honestly, they all it is is just a graph of how much Bitcoin they used to have versus how much they have now over a period of time. It's just a step down function. They just it just goes from, you know, 2014 all the way now to 2025. They started out with 200,000, and now they're down to, I don't know, 33,000, something like that. Anyway, Kobayashi's first major round of Bitcoin sales took place between September and March with blockchain data indicating that the largest offloading occurred on February 6. By mid March, Mt. Gox's Bitcoin holdings had fallen to a 166,000 after Kobayashi disclosed the sale of 35,800 Bitcoin for 38,000,000,000 Japanese yen, which was about $360,000,000 at the time.

That may not seem like a significant supply shock in today's Bitcoin economy. On Wednesday, Bitcoin had a $2,240,000,000,000 market cap. But back in 2018, well, that number stood at roughly a 140,000,000,000. Say that again. We had we don't have it right now, but we had a $2,240,000,000,000 market cap at that time, February 2018, 140,000,000,000. How soon we forget, and how easily does recency bias come in to shape our thoughts and our emotions? For all of you guys out there that are freaking out, take a deep breath, man. And for the class of 2025, take an even deeper breath.

Calm down. Just there's not anything anybody can do about it. But let's continue. Kobayashi's February 6 sale also coincided with Bitcoin's slide to around $6,000, which was the lowest point of that year's first quarter. And Bitcoin was already falling from its December 2017 peak of nearly 20,000 during the height of the initial coin offering boom. While Bitcoin was already struggling after the collapse of the ICO bubble, its sharp drop on February 6 closed closely coincided with Kobayashi's major sell off. Kobayashi then denied that his Mt. Gox liquidations deepened the decline, but his actions drew criticism from market observers.

Then following the ICO crash of early twenty eighteen, bitcoin and the cryptocurrency industry entered what's now known as the first crypto winter. As liquidity dried up and funding slowed down, many crypto firms had to downsize or shut down completely. Kobayashi didn't help either by continuing to sell off Mt. Gox's Bitcoin. About 24,600 BTC was sold between April 27 to May 11, decreasing the exchange's holdings to a mere 141,680. The first major sale on April 27 was for about 15,000 BTC. Bitcoin had a sharp drop on April 25 to the twenty sixth, but rebounded on April 27 before having a small rally to second quarter's 2018, top of nearly $10,000.

The second major sale by Kobayashi on May 11 coincided again with its fall from the top. This was the last time Kobayashi sold Mt. Gox's Bitcoin. In June, after a creditor petition, the Tokyo District Court halted the bankruptcy and opened civil rehabilitation, appointing Kobayashi as rehabilitation trustee. In bankruptcy, nonmonetary claims are converted to cash. In civil rehabilitation, Bitcoin claims are not liquidated with repayment set by a court approved plan that allows for distributions in BTC or, god forbid, Bitcoin cash rather than cash. With Mt. Gox sales off the table, Bitcoin held above 6,000 for most of the year until November's Bitcoin Cash hard fork rattled the market. Mt. Gox's holdings remained steady at around a 142,000 during that period.

In mid twenty twenty four, Bitcoin was in a far stronger position than during the Tokyo whale era, still riding the momentum of the first batch of spot Bitcoin exchange traded funds. It was the middle of a bull rally that would eventually send Bitcoin past a $100,000 in December 2024. In early June, Mt. Gox wallets began moving Bitcoin as the exchange prepared for credit or repayments under the civil rehabilitation plan, markets initially feared that recipients would immediately sell. Bitcoin dipped again after Kraken, one of the exchanges handling the distributions distributions, announced on July 24 that it had finally completed the process.

Some analysts speculated that up to 99 of creditors might sell once they receive their share. But when repayments actually began, there was no significant spike in trading volume according to CryptoQuant. By August 1, Arkham data showed Mt. Gox's holdings had fallen by nearly a 100,000 BTC, leaving around 46,000 Bitcoin still under the trustee's control. On 10/10/2024, Kobayashi announced that most repayments to verified creditors had been completed, though many were still pending due to incomplete procedures or processing issues. With court approval, the repayment deadline was extended from October 31 to October 31, and the trustee urged remaining creditors to finalize their submissions through the Mt. Gox claims portal.

At the time of writing, Mt. Gox wallets hold 34,689 BTC worth $3,900,000,000 awaiting distribution. In March 2025, the exchange began moving assets between its wallets, a likely step in preparing for further repayments ahead of the Halloween deadline. It's been a long, long zombie ridden road for those of us traveling with Bitcoin through all this time. Mt. Gox pretty much collapsed right before I got into Bitcoin, but, I mean, the the it was pretty much all you heard about on the earlier, Bitcoin podcast around that time. We're almost done.

We're almost done with Mt. Gox. But does that does that mean that we won't have other kinds of chicanery? Of course, we're gonna have other kinds of chicanery. Because I've I've I've come to the conclusion a long time ago that most people on this planet are just kinda dumb. It doesn't mean that I hate humanity. It's not that. I'm just saying that most people are dumb. And I should also probably say either dumb or easily guided by their own emotions. Either way, either one of those gets people into trouble. Right? Just being allowing your emotions to dictate, oh my god. I'm scared. Therefore, I'm going to sell everything.

Oh my god. Fear of missing out. I've gotta buy MSTR at the top. You you get what I'm saying? Emotions are the worst thing in the world when it comes to making decisions. It doesn't mean that the feelings of love and happiness, sadness, boredom, any well, pick whatever emotion you want. Fear is is the worst one. They're good to have, but they are expressly not the thing that you need to be listening to when you're going to be making massive decisions. Like, I'm so lonely and sad that I will marry the first thing that I see. I'm terrified of being left alone on this planet if anything happens, so therefore, I'm going to have children. If that's the only reason you're having children, that's not the good reason to have children.

Right? Emotions make us do weird and very stupid things. If you can take a breath and meditate and spend that time instead of reacting to what's going on, try to figure out what is going on, then you will at least gain something, more knowledge than you used to have. And it's gonna be kinda critical, you know, especially where we are right now, because repo madness and Bitcoin dumps are all over the place. And this is one of the few times that I read Marty's bent from Marty Bent over at the, TFTC podcast, one of my favorite podcasts, by the way, along with Rabbit Hole Recap. I'm sure most of you already know what I'm talking about. But he's he does a good job trying to pull apart what's going on in this wider picture because it's not just about Bitcoin.

Everything's getting slammed, man. I mean, gold's gone down. We'll get to that. Live cattle prices gone down. We'll get to that. I mean, everybody keeps thinking this is just about Bitcoin. It's not. This is much bigger. So from tftc.io, I bring you Marty's bent from October 16. That was the most active day in markets since the tariff tantrum earlier this year. The spread between SOFR, or SOFR, and the Fed funds rate blew out to its highest point since the COVID crisis, leaving many to speculate that there is an emerging liquidity crisis in the banking sector.

Keep that in mind. That's I'm pausing here to say we're gonna come back to that. Many are speculating that it's coming out of regional banks after looking at their stock performance today in relation to the too big to fail banks. It seems that there are also knock on effects of the tricolor auto lending implosion that happened last month, it's beginning to emerge. Apparently, Tricolor was not the only lender exhibiting extremely relaxed underwriting practices and handing out loans to anyone with a pulse. To make matters worse, it seems that many banks lapsed on the due diligence of their counterparts who were giving out these loans, leading to a domino effect that has forced a number of banks, including JPMorgan, to write off 9 figure loans.

I'm not sure if this is directly related to the budding credit crisis, but the standing repo facility is being tapped for the first time in many years, which and this signals a desperate dash for liquidity for at least some of these banks. To get a better understanding of the repo markets, I highly recommend that you check out this explainer from Nick Bhatia from the Bitcoin layer, and he's got a link to that YouTube video. Continuing. Lastly, gold is still the hottest chick in the room. It is currently sitting at $43.31 per ounce, and the chart is awe inspiring.

It looks like a Bitcoin chart, but over the course of a hundred years. Something is definitely happening happening with gold. This price action is extremely abnormal, and it signals to me that it is very geopolitical in nature. I'll reiterate what I said earlier this week while summarizing my conversation with Vince Lansey on TFTC. I would not be surprised if China is making the big move to make an alternative settlement network backed by gold and is forcing central banks and governments into the market to bid for as much of the pet rock as they can get their hands on. With this in mind, there are many out there who are disappointed that Bitcoin isn't moving in lockstep with gold right now. To these people, I'd say zoom out.

Bitcoin has performed exceptionally well so far this decade and will continue to do so. Gold is having its day because governments are falling back to what they know as the dollar reserve system comes into question. China is setting up a parallel settlement network using gold, and it's using gold because it's been reliable for millennia and, more importantly, has the liquidity profile to settle the size they need to settle if they're going to compete with treasuries. This does not change the fact that Bitcoin is superior in every way to gold. It's a harder money that's more easily divisible, easier to send, easier to verify, and easier to custody.

Bitcoin still has many trillions of dollars of market cap to add before it can compete with gold from a liquidity perspective. I am more optimistic than ever that gold will reach this point because more people are learning these facts every day, and the infrastructure around the protocol is advancing at a faster pace than I've ever seen. Square's release this week is the latest example of this. 4,000,000 merchants across The United States are currently being forced to ask the question, quote, should I accept and hold Bitcoin? How many do you think will take the plunge?

How many more products will come to market that make it easier to use Bitcoin? How many more TradFi spasms will there be? How many more inflationary bouts will there be? How many more authoritarian crackdowns on financial rails will there be? If the answer to any of the above questions is greater than one, then you can guarantee that more people are coming to Bitcoin over time. It's absolute chaos out there. Take advantage of the cheap sats while the sale lasts. And on that note, look for the Fed and the Treasury to step in as soon as things look like they're getting dire. They will plug the holes with so much liquidity, you'll feel like you're at a water park while looking at your Robinhood account.

Yeah. He's not lying. Things are really bad out there. But one of the things that happened that he's talking about with these banks, because he there's not a time stamp as to when he released it. It just says October 16. But I just got I literally got this email this morning along with other news about, quote, unquote, regional banks. It looks like there is a banking crisis brewing. Now don't, you know, don't freak out. We've been through banking crises before crises is the correct pronunciation. Crises. We've been through this before. Silvergate. Remember all that?

These banks are getting freaking hammered. And it just I mean, it's all due to just bad decision making all the way around, whether Tricolor is making auto loans to people who have no way of making those auto payments and letting them drive off with a freaking car, all the way up to banks holding absolute shit on their balance sheet and then getting blown out to the point that all of a sudden they need liquidity. The repo markets are tapped. These are the banks are going to repo going, I need money. There's no money. It's chaos.

So that's one of the reasons why it's not just Bitcoin that's suffering today. All the metal rocks are suffering. Cattle prices are suffering. Hog prices may still be suffering. They they were earlier. Maybe they've recovered. But last I saw, cattle prices, no. They're not they're not escaping the carnage. Everything has a major problem right now. So just, again, take a deep breath, ladies and gentlemen. Meanwhile, Newsmax decides that they're gonna be a Bitcoin treasury company, and they're adding Trump coin. This is from Decrypt. Logan Hitchcock is writing this one.

Publicly traded media company Newsmax is creating a digital asset treasury centered on Bitcoin and president Donald Trump's meme coin, which trades as Trump on Solana. The company's board of directors approved the plan, which will see it acquire up to $5,000,000 of the two assets in total over the next year, according to a company announcement on Thursday. Bitcoin oh, this is a quote. Bitcoin is fast becoming the gold standard of cryptocurrency, and we believe it would be an important company marker? That's an odd thing to say. An important car company marker to add this asset to our company reserves. Newmax CEO Newmax CEO, Christopher Ruddy, said in a statement, quote, we are also excited to add Trump coin to our cryptocurrency plan as we believe the coin's value should track the success of the Trump presidency, which so far has been impressive, end quote.

Details about how the firm will fund the initiative were not revealed, but it expects to make the first strategic purchase, quote, in the near future. Shares of Newsmax, which trade on the NYSE with ticker NMax, dropped around 4% today to $10.83 as broader market slid amid increased macro volatility. However, shares are up more than 4% in after hours trading. Both Bitcoin and Trump dipped further on Thursday with BTC falling 3% to a 107,709 as the president's official meme coin dropped 2.1. The latter coin fell outside of the top 100 cryptocurrencies by market cap according to CoinGecko.

Newsmax joins the Trump backed Trump media as media companies with digital asset reserve plans. And earlier this year, Trump media themselves bought $2,000,000,000 worth of Bitcoin in related securities, placing it inside the top 10 publicly our largest publicly traded Bitcoin holders. If Newsmax used all 5,000,000 of its approved funds to purchase BTC, it would only be able to obtain around 46 Bitcoin, ranking it outside the top 100. And they asked for a comment, which was not given by Newsmax. Newsmax is not a smaller media outlet.

I see Newsmax stuff all over the place, so that's why I'm telling you about this. You know, it if we gotta get into it, if we if we got if we've got to ask the question about treasury companies in general, is it possible that we're gonna see companies that were waiting to become Bitcoin treasury companies now make the decision and pull the trigger? Because a lot of stuff is sold off, which means there's a lot of cash floating around there waiting to find a home. And for for one, I'm gonna say this. If I see it, I'm I'm not going to be excited about it, like, at all. I'm I'm I'm just kinda tired of listening to people talk about treasury companies.

And, like, oh, it's a new preferred stock. It's a new perpetual. It's it's a new senior note. It's all debt. It's just it's just printing paper, being told that this paper is worth something because reasons, and then you giving your money to these companies so that they can buy actual assets, which is the promise of why this paper is worth something in in the first place. It is for me, it's just not a good business model. If you're not making something to sell or have a service to offer that people want, then why are you in business?

You know? And honestly, let's be fair. This is not just the West, but the world's problem for this at least the first part of this entire century, from 2001 to 02/2025, it's just fake money. It's really sad, but there's the amount of zombie companies that are walking around out there that somehow have value but don't actually provide any value and have been doing so for at least two decades. It's a phenomenally high number, and yet they're still alive. Their stock is still being traded. They offer absolutely nothing. So maybe things will calm down on that front, but according to that story from Newsmax, not yet.

Circle p is open for business. It's where I bring plebs with goods and services for actual sale to plebs just like you who want goods and services, and you're gonna be buying it in Bitcoin. Because if you're not selling it in Bitcoin, you ain't in the circle p. Today's vendor is Great Ghee at greatghee.com. That's great, ghee,all1word,.com. What the hell's ghee? Kinda? Butter? A little bit? Well, here. Here's the definition. Ghee or clarified butter is made by simmering butter, real butter, 100% butter, to remove all the water, milk solids, and impurities, leaving behind a golden lactose free oil with a nutty flavor and high smoking temperature. Unlike regular butter, ghee is shelf stable and versatile for cooking, baking, or even skin care.

Shelf stable is the whole point here. Well and and the flavor is phenomenal. But being able to keep a large amount of butter at room temperature in a jar without it spoiling for absolutely immense periods of time is a food preservation mechanism. It's like making sauerkraut. It's why we do pickles. It's I mean, there is all manner of food preservation techniques that most of us have forgotten about. This is why we have things like salami, cured meats. You know? That that humans were like, dude, if we don't eat this right now, it's gonna go, it's gonna go bad. How can we preserve this? And we were packing stuff in salt and all kinds of neat stuff. Well, over thousands of years, we've been figured out how to preserve just about everything, and ghee is a structural component of being able to preserve into the future large amounts of healthy animal fat, in this case, in the form of butter, and it's delicious.

So make sure that you mention Bitcoin and all one word in the coupon code so that Great Guy knows that I made a sale for him because this is value for value advertising. And if Great Guy knows I made a sale for him, he'll get me back on the other side with some sats. Let's go to Florida. Florida lawmaker has rebooted the crypto reserve bill after the first one flopped. So I asked the question a couple of days ago about I I I or at least, I think I might have asked it on this show, maybe not. But I heard about this, and I remember replying somehow because I've got four brain cells left, so you'll have to bear with me. I remember replying about this somehow that basically said, I thought Florida already tried this because it was being presented to me in a news story that, oh my god. Look. Florida's gonna put in a strategic Bitcoin reserve. And I'm like, wait a minute.

This this seems familiar. Well, it is. And Braden Lindria from Cointelegraph tells us about it. A Florida House Republican has filed a revised bill to allow the state to invest in digital assets such as Bitcoin and crypto ETFs after Florida's operations subcommittee withdrew his initial attempt in June. So that's why this seemed familiar. The Florida house bill one eight three would let the state and certain public entities invest up to 10% of their funds in digital assets like Bitcoin, crypto exchange traded products, crypto securities, non fungible tokens, and other blockchain based products according to the new bill introduced by Florida lawmaker Webster Barnaby on Wednesday. And, honestly, that's all we need to know. So Florida strategic Bitcoin reserve, well, kind of is on deck again. Let's run the numbers.

Energy is mostly in the green this morning. Brent North Sea is up point 05% to $61.00 9 a barrel. West Texas Intermediate, however, is the only one in the red. But, you know, 0.09% of the downside to $57.39. Natural gas doing its thing, 2.69% to the upside. Gasoline up 1.2%, and Merban crude is up point 19% to $63.13. All of your shiny metal rocks are sucking swamp water this morning. I tell you what, palladium down 8.8%. Gold getting off pretty easy. 1.52 to the downside. It's still chilling at $4,239 an ounce, ladies and gentlemen. Platinum is really bad, 6.77% to the downside. Silver is off by 5.62%, but still hovering 30¢ over $50 an ounce. Copper, last on the list, down a third.

Ag is fully mixed this morning. Got the biggest loser being sugar, 1.7% to the downside. Biggest winner is gonna be lumber over 1% to the upside. Meanwhile, oh, live cattle is down 2.41. Lean hogs are down, but only moving sideways, essentially. Feeder cattle are also down substantially 2.44% to the downside. The S and P, however, is moving sideways but in the green. Nasdaq is up a tenth. Dow is up point one six percent. The S and P Mini is the only thing in the red at point three to the downside. A $106,460 is still a $2,120,000,000,000 market cap for Bitcoin.

We can only purchase 25 ounces of shiny metal rocks with our one Bitcoin of which there are doing the audit on the fly as normal. 19,935,832.41 of average fees per block are low, 0.02 BTC taken in fees on a per block basis. There's, like, 25 blocks carrying 54,000 unconfirmed transactions waiting to clear at high priority rates of 2 Satoshis per v byte. Low priority is gonna get you in at one. And, oh my god, another record. Hash rate is going through the freaking roof. 1.16 Zeta hashes per second. Yesterday, it was a row of sticks. 1.11.

We've added point zero five Zeta hashes per second to the security of Bitcoin at the time that Bitcoin is, like, off by 18% from its all time high. So figure figure it out. Okay. From Fat Goldfinger, yesterday's episode of Bitcoin and I got Jubjub with 5,000. Thank you, sir, for supporting the show. He says, my Bitcoin wallet, it does now lack those Satoshi sent giving value back. I appreciate the, little haiku thingy. KT with 2,300 sats. Again, thank you for your well, for supporting the show. It really means a lot to me, by the way. He says or she says, I don't know which, lots of value. Here's a small boost. Also, it wasn't intentional.

Fountain let you down on reading boost from Argentina's fire sale episode, but I don't think they ever got read on air. No worries. But hope you got the memo that that Lake Satoshi is a Bitcoin retreat in Central Michigan late, July to early August that should be on your radar. It's the small vibe, high signal content you said you were looking to attend. Yeah. I I know I know about this, and it's still too far away. I need a conference that I can drive to within, like, four hours. Otherwise, I can't go. I'm not I'm not gonna pay $5,000 for the for the the the you know, to go sit on a plane, to go through the American skies right now. Just air travel has been absolutely destroyed. When I was a kid, it was an adventure.

And now it's not because I grew up, it's because they made air travel suck so bad after 02/2001. I'm just not I'm not gonna pay those prices to be treated like that. I'm just I can't. I can't. I can't. He continues. KT does. Also, have you seen expos from Zach BTC claiming that the Cambodian pig slaughter scam is a cover story for hacked and stolen funds? No. I have not. His post says that the wallets listed match wallets from another report two years ago about vulnerable keys. Curious on your take. Well, KT, I did try to go find Zach on Twitter. I I I'm I'm not seeing anything about that pig butchering scam, but I I grant you, I didn't have that much time to look.

I will say this, it wouldn't surprise me. And I will say this as well. It also won't surprise me if absolutely nothing is done. As long as you can tie something negative to Bitcoin, then by all means, just like Kansas football, do it. You know, just just lie about it. Throw a knife on the field. You know what? I'm just gonna stop right there. Turkey with 500 says nothing. And then I got eternal student with 200 also says nothing. Now, I just wanna make sure that I honor KT. I did go back to the episode Argentina's Fire Sale on Fountain so that I could read you KT's, boost that came along with 2,300 sats. Again, thank you for your support. He says or she says. So Malay shows up like an Austrian economic savage and slaughters his government spending, bringing triple digit inflation down to double digits.

Then he rug pulls a $99,000,000 crypto scam and loses all trust, and now we're bailing them out for $20,000,000,000? Off the cuff here, but kinda seems to parallel our president coming in with Doge, then rug pulling his own shitcoin and looking to get a massive dollar decline bailout from stablecoins just when I think my faith in the system can't get any lower. Oh, Ben, dude, I I I hear you. I hear you. And besides, it's that number, by the way, KT, and you probably already know this, since that episode, that number is increasing to $40,000,000,000, but I'm gonna assume you already know that. But that's the weather report.

Welcome to part two of the news that you can use. Lightning $20.49, Bitcoin layer two comparison in Singapore. This is out of Atlas 21. So what this is is we're gonna look at some some various things that were presented at the Lightning twenty forty nine conference over there in Singapore, and some of them are quite interesting. During the October, Lightning twenty forty nine was held in Singapore, a side event of token twenty forty nine dedicated to the Bitcoin layer two ecosystem organized by LNFi Network and RGB Protocol Association with support from Bitfinex.

The event reviewed the implementations currently operational on the Lightning RGB and Taproot asset protocols. The RGB Protocol Association confirmed that RGB version zero point eleven point one is active on mainnet. The protocol enables the issuance of assets, including stablecoins and tokens, through smart contracts that operate with a privacy oriented approach. Integration with the Lightning Network represents one of the ongoing technical developments. Darius, cofounder of LNFi Network, presented l n node, a self custodial Lightning node with support for Bitcoin, Taproot assets, and RGB.

This solution allows operators to open channels, generate yields in BTC, and manage assets through a web interface or natural language commands. On the front of native yield in Bitcoin, Frederico Tanga, r and d strategist at Bitfinex, discussed the use of lightning to generate yields through liquidity routing without resorting to centralized staking or lending. Then there was the presentation by Walter Mafioni, cofounder and CTO of Kaleidoswap. Yeah. Yeah. Kaleidoswap. They showcased or he showcased the first atomic swap of RGB assets executed on the Lightning Network.

The operation was performed using the DEX infrastructure developed by KaleidioSwap, enabling trustless exchanges between RGB assets on mainnet. Then we have Bobby Schell, VP of marketing at Voltage. He illustrated some new use cases and developments for the Lightning Network, micropayments for AI services, stablecoin invoicing, and pay per use APIs. During the panels, the transitional phase that the ecosystem is going through emerged. While on one hand, various layer two components, including trading protocols or rather, trading protocols, programmable applications, and self custodial yield mechanisms are already operational on main net.

On the other hand, the need to improve user experience and accessibility for developers and end users remains a priority. There's a lot more stuff happening on lightning than we think. And a lot of you will say, god, RGB, stable coins. Hey, look. Dude, I would much rather I would much rather NFTs, ordinals, stable coins. I'd rather that all go to the Lightning Network than be on mainnet BTC. Why? It's it just seems like the proper place for it. Does it and then the next question is, well, won't that make Lightning Network a a shit chain? No. It doesn't work that way.

And honestly, I think it would now I may be wrong about this, but I think that it would be a hell of a lot easier to scale crap that people clearly want just because we're we're looking at it going, why would you want any of this? It's all garbage. I agree. And yet, there are people that would allow forty years of football tradition to go down the toilet without a freaking fight. Oh, I'm sorry. Wrong wrong argument. There are people out there that want garbage. They're and they're always gonna want garbage. And there's nothing that you can do or I can do to tell them, hey, this is garbage. You should stop buying it. They're not going to stop buying it. I would much rather them have their own little playpen.

You know, we've got ARC coming up. We got Spark coming up. We've got FEDAMENT. We've got Cashew. We have all manner of places for the garbage to live rather than on the main chain. So I'm fine with it, and I'm always going to be fine with it. What if it but, David, what if it kills Lightning Network? Then something else will happen. But, no, it's not going to kill Lightning Network. If you don't I mean, I'm I'm sure at one point or another, we will have different kinds of payment channels. Some payment channels will only handle Satoshis. Other payment channels will handle all handle all manner of crap.

You you can have a a a crap channel and a couple of actual Bitcoin payment channels. Why not? It's no skin off my nose. It takes me barely any energy whatsoever to run a full lightning node, which I've been doing for years now. It'll be fine. Promise you. Okay. Let's see. Let's get past that one because it's not worth it. Real estate mogul Grant Cardone has doubled down on Bitcoin purchases during the market sell off. Bitcoin magazine, Micah Zimmerman, has this one. It's been a turbulent stretch for the crypto market with many investors stressing as Bitcoin continues to slide day by day.

But Grant Cardone's investment firm, Cardone Capital, doesn't seem to be phased, reportedly adding adding another 200 Bitcoin to its holdings following a 300 Bitcoin purchase just last week. Cardone is doubling down, seeing opportunity where others see risk. In a recent interview with Bitcoin Magazine, Cardone elaborated on his perspective, framing money and attention as nearly identical formulas. Quote, I got to keep my money stored someplace. Saving it doesn't keep it because it's going down in value, he said, basically saying that traditional savings erodes wealth over time. For him, a good Bitcoin strategy isn't simply buying Bitcoin outright.

It's about multiplying it through thoughtful structures. Cardone has pioneered a model that merges institutional quality real estate with Bitcoin acquisition. Instead of purchasing crypto directly, he uses cash flow from carefully selected properties to buy Bitcoin over time. I I gotta pause right there. He still is purchasing crypto directly. I know. I don't wanna I know I should say Bitcoin, but you get what I'm saying? The sentence saying instead of purchasing crypto directly, he uses cash flow to buy Bitcoin over time is still purchasing Bitcoin directly.

Right? And I'm I'm not getting in I'm not I'm not trying to make trouble for for this guy because he has the right idea. Cash flow before all else. This is my same argument about zombie companies and Bitcoin treasury companies who have no product or service to sell. Instead, they create debt instrumentation, sell it to a bunch of yahoos who give their hard earned money to for a promise, for a description. If that's the product, then that's not a business. This guy actually generates revenue and then uses that revenue to buy Bitcoin. This is the way to go. I'm sorry. It just is.

I don't care what anybody else said, but you're gonna miss out on 100 x gains. Yeah. Well, I'm also gonna miss out on 50 x drops too, bitches. Because this is this is insane. Goods and services that generate revenue and then use revenue to buy Bitcoin so that you don't are not saddled with a melting ice cube. Quote, basically, our renters are buying the investors in a building Bitcoin. The structure starts conversationally with about, or rather conservatively, with about 15% of the funds allocated to Bitcoin. But over several years, the goal is a roughly fifty fifty balance between real estate and Bitcoin, both assets appreciating over time.

This approach reflects a pragmatic philosophy. Bitcoin is an exciting store of value, but cash flow remains essential. Cardone warned in his interview that while some enthusiasts want to convert all assets to Bitcoin, liquidity is necessary for everyday life. He his method bridges that gap, giving investors exposure to digital assets without sacrificing income stability. Beyond the mechanics of investment, Cardone sees Bitcoin as part of a broader cultural shift. He celebrates wealth creation and financial literacy, noting that comfort in the middle class offers little protection against inflation or economic upheaval. Quote, the moment you become comfortable, you're probably at risk of having everything taken away, he said. Bitcoin, with its limited supply and censorship resistant design, fits into a vision of long term financial sovereignty.

Cardone also emphasizes accessibility to Bitcoin. Most people entering his funds have had no prior exposure to Bitcoin and little interest in mastering its technical complexities. By pairing it with something tangible like real estate, investors gain exposure passively learning as they go. Quote, I'm going to onboard people into Bitcoin that don't know anything about Bitcoin, he said, underscoring his belief in intuitive real world adoption over ideological purity. And then they go into Bitcoin's recent price action for whatever reason. The point is, if your company is not generating a revenue stream, then it's not a company.

If if your company's claim to fame is Bitcoin on the balance sheet, I'm sorry, that's not enough. You need to be selling something. And while and we can poo poo what's going to happen with, real estate here probably in the near future. Cardone may get squeezed financially to a point that none of us want to see because I house prices just went way, way, way above average price per house in The United States when you look at the entirety of the continent well or sorry, the entirety of the of, you know, the 50 states, you end up with a number that is way freaking higher than 2,006, 2,007, which was the peak home price before the bubble got popped in 02/2008.

We're way above there. Way, way, way, way above there. Commercial real estate is it's oh my god. It is a dead dog with fleas and maggots, by the way. Nobody's renting commercial. Whole buildings are sitting empty. So I hope that Cardone because he seems to be more in multi multifamily dwellings like apartment buildings rather than housing. And I I maybe he has some commercial exposure. I don't know. But given what we're reading right here, we can pretty much assume that he is at least in, multifamily residential complexes like apartments. So if he gets squeezed, will the amount of Bitcoin that he's already been able to stack see him through to the other end while he figures out what to do with the assets on the other side of that?

This guy, I like this guy so far. I don't know much about him. But, I mean, I've seen him, like, I've seen him tweet. Some of a lot of his stuff makes sense. This particular story, his attitude here, it actually makes sense. He's got to manage two things at at this point. It's not just how much rent can he get, how much, occupancy rate can he maintain versus what is the principal value of the buildings that he's into. Those three remain the same. Now he's added a fourth one and a fifth one and a sixth one or maybe even 27 with the addition of Bitcoin.

Right? Because what happens with, you know, global economics? What happens when banks go to the repo and there's just no cash to get? What happens when these regional banks are looking at, you know, like, liquidity crunches? What happened? You know, all these macroeconomics are now in play on the other side of Cardone's fifty fifty split on his traditional business that he's used to and the Bitcoin treasury side. But it doesn't matter. Well, it does matter, but I think he's in a much better position. Yeah. I'll say it that say it that way. He's in a much better position than somebody like Meta Planet, which only has Bitcoin and not as much as strategy does.

Certainly in a better position than than Nakamoto, which is now trading at, like, $0.79, maybe $77. It's 77¢. Thing was I can't remember what its high was, and I don't care. I I I recommended nobody buy it. I hope nobody did. I sure as hell didn't. Some I I've seen some people that did, and they're not having a good day. Let's just let's just say it that way. They're not in a position to make any revenue at all. None whatsoever. Real estate, no matter what happens to it, people are always going to rent, and they're always going to pay money for that rent. That money is gonna go to people like Cardone, and that person is gonna be able to make a decision. Do I take this fiat and I save it when I know the United States government and the rest of the West is going to light it on fire, or do I buy something like Bitcoin? I think it's a better route to travel than Bitcoin treasury companies. I will give it that.

Finally, for the day and for the week, by the way, this is Friday. Bitcoin, a miner, bit farms, up sizes. Oh, here we go. Convertible notes offering to $500,000,000. Yes. I purposely ended off with a Bitcoin treasury company, although at least they mined Bitcoin. Let's see what what the hell's going going on here. This is from the block, by the way, written by Timmy Shen. Bitfarms Limited, a North American Bitcoin mining firm, announced Thursday it has priced an expanded offering of convertible senior notes, increasing the size to $500,000,000 from the $300,000,000 first proposed just one day earlier.

The Nasdaq and Toronto listed company said in a statement that it will issue 1.375% convertible senior notes due 2031 with an option for initial purchasers to buy an additional $88,000,000 within thirteen days. That means they're expecting they're they're expecting full subscription and then an over subscription to this offering. All they're expecting all $500,000,000 worth of this thing to be sold immediately, and they're getting giving themselves $88,000,000 of room for people that are, I don't know, latecomers who want more or whatever, but they're expecting oversubscription.

Do you think they'll get oversubscription today or whatever it is that they sell it? I don't know, man. But, the convertible notes will accrue interest semiannually starting 07/15/2026. Then they mature 01/15/2031. The notes carry an initial conversion price of approximately $6.86 per share, a 30% premium to Bitfarms' last closing price of $5.28 per share. What is that today? I don't even know, but it's probably not good. The offering is expected to close around 10/21/2025, so this is right around the corner. This is, like, next week. The offering is expected to close around October 21, pending approval from the Toronto Stock Exchange.

Yikes. Bitfarms plans to use the proceeds for general corporate purposes and financing capped call transactions designed to limit dilution according to the statement. The company operates crypto mining facilities and energy infrastructure for high performance compute across North America. It maintains a 1.3 gigawatt energy pipeline with over 80% of capacity US based oh, being US based. 80% of its capacity comes from The US according to the statement. Bitfarms stock trading under BIFT closed down 18.4% to $5.28 on Thursday, but then fell another 5.3% in extended hours according to Yahoo Finance.

While Thursday's decline offsets gains from recent sessions, the stock is still up 26.6% over the past five days. Wow. And 82.7% up over the past month. Interesting. And also interesting let's get back. I wanna see here. Because they're not saying they're gonna buy Bitcoin with it. They're going to use the proceeds for general corporate purposes and financing capped call transactions designed to limit dilution according to the statement. But there's no direct statement about buying Bitcoin. Now, so it it could be inferred that those two, bullet points there for what they wanna use is 588 eventually, $588,000,000, if they get oversubscribed, is gonna be used for. It could be inferred or implied that Bitcoin purchasing is part of that, but it's not directly stated.

So are we entering a different phase for some of these companies where they're like, dude, this whole buying Bitcoin with a debt is kinda played out, but but, you know what we could do? We could just fund our operations by selling debt. Yeah. Let's just go back to doing that shit. You know, again, at least Bitfarms, you know, mints Bitcoin. Well, they mine they mine Bitcoin. They don't really mint it, but they do mine it. So there is some revenue stream on the other end of it. So at least they got that going for them. Alright. So I will try desperately not to get into a Texas Tech University rant again, but it's still it is still kinda sad that it matches up with what I've seen or what I've learned to see over the last ten years in Bitcoin.

Is that I've I've gone from being completely blind to noticing just how much people will put up with because they don't wanna rock the boat or they want to get rich quick or they want to win the big game or you know, there's no defense. There's no defense of honor. You know, there's there's like no there's no energy left in humanity to say no. We're not gonna do that shit. The only thing that seems to be left is people scrolling TikTok and then saying they'll do whatever somebody they don't know tells them to do. And it's really sad.

I really wish it wasn't that way, but this is the mind field that we've been given to navigate. Be careful out there because any one of these people that look like they're gentle and docile, as a group of people, they literally represent the destruction of tradition, the destruction of what you came to know and love, the destruction of everything. Because as they lay down and just take it, then it emboldens the enemies to think that they'll just be able to do this to anybody, that everybody will just lay down. And if we're not careful, everybody will. And don't let that be you.

I'll see you on the other side. This has been Bitcoin, and and I'm your host, David Bennett. I hope you enjoyed today's episode and hope to see you again real soon. Have a great day.

Opening, show intro, and a Texas Tech tradition

Tortillas, penalties, and the apathy

From football to Bitcoin: apathy vs. resistance

Tokyo Whale sales, 2018 crash, and crypto winter context

2024: large transfers, repayments, and market impact

Emotions, decision making, and market psychology

Market carnage beyond Bitcoin: metals, cattle, and more

Circle P: pleb marketplace vendor 22Great Ghee22

Markets and commodities rundown, fees and hash rate surge

Boosts and listener notes: conferences and scam claims

Let garbage live off-chain: why Lightning can sandbox them

Closing reflections: defend traditions and say no to apathy