Topics for today:

- Nobel Peace Prize Awarded to Bitcoiner

- $2 Trillion Wiped Out in Hours

- Insider Trade?

- Core V30 is Here

Circle P:

SoapMinerProduct: Tallow Soap

Website: https://soapminer.com/

nostr Profile: https://nostrudel.ninja/#/u/npub1zzmxvr9sw49lhzfx236aweurt8h5tmzjw7x3gfsazlgd8j64ql0sexw5wy

Twitter Profile: https://x.com/soapminer1

Discount code: Use "BITCOINAND" in the Cart's Coupon Code box for 10% off total purchase

Today's Articles:

https://bitcoinmagazine.com/news/maria-corina-machado-wins-nobel-peace-prize-could-she-become-the-first-bitcoin-nobel-winnerhttps://cointelegraph.com/news/centralized-crypto-exchanges-undrerreport-liquidadations-even-100x-hyperliquid-ceo

https://www.theblock.co/post/374324/crypto-investment-products-log-3-17-billion-in-weekly-inflows-despite-historic-liquidation-event-coinshares

https://x.com/unusual_whales/status/1976973805999603795

https://www.coindesk.com/markets/2025/10/13/trader-who-made-usd192m-shorting-the-crypto-crash-is-betting-against-bitcoin-again

https://www.theblock.co/post/374306/hyperliquid-activate-hip-3-upgrade

https://atlas21.com/bitcoin-core-v30-is-here-the-op_return-issue-splits-the-community/

https://decrypt.co/343896/presidential-pardon-binance-founder-cz-report

https://atlas21.com/india-over-400-traders-investigated-for-tax-evasion-through-binance/

https://cointelegraph.com/news/steak-n-shake-u-turns-eth-payments

https://cointelegraph.com/news/strategy-acquires-220-bitcoin-27-2-million-crash-week

Get You're Free Comfrey Owner's Manual Here:

https://www.bitcoinandshow.com/the-comfrey-owners-manual-is-here/

Find the Bitcoin And Podcast on every podcast app here:

https://episodes.fm/1438789088

Find me on nostr

npub1vwymuey3u7mf860ndrkw3r7dz30s0srg6tqmhtjzg7umtm6rn5eq2qzugd (npub)

6389be6491e7b693e9f368ece88fcd145f07c068d2c1bbae4247b9b5ef439d32 (Hex)

Twitter:

https://twitter.com/DavidB84567

StackerNews:

stacker.news/NunyaBidness

Podcasting 2.0:

fountain.fm/show/eK5XaSb3UaLRavU3lYrI

Apple Podcasts:

tinyurl.com/unm35bjh

Mastodon:

https://noauthority.social/@NunyaBidness

Support Bitcoin And . . . on Patreon:

patreon.com/BitcoinAndPodcast

Find Lightning Network Channel partners here:

https://t.me/+bj-7w_ePsANlOGEx (Nodestrich)

https://t.me/plebnet (Plebnet)

Music by:

Flutey Funk Kevin MacLeod (incompetech.com)

Licensed under Creative Commons: By Attribution 3.0 License

creativecommons.org/licenses/by/3.0/

It is 09:20AM Pacific Daylight Time. It's the October 2025, and this is episode eleven eighty eight of Bitcoin. And it's not quite a palindrome, but that'll do, pig. That'll do. Okay. So what's what's going on for today? Because this is where you come for all the news that you can use about Bitcoin and more. Gonna talk about the Nobel Peace Prize. It seems that a Bitcoiner may have won it. We're I don't know. There's there's some confusion on this headline, but, we'll we'll we'll we'll suss it out. Don't worry. And then we're gonna do a relatively deep dive into the massive liquidations that occurred over Friday and Saturday.

It was ugly. Everybody got hurt. Trillions were wiped out across all markets. So every everything was affected except for gold. Gold apparently did okay. But everything else was affected. I mean, energy, equities, everything just just tanked. And it seems to have all been due to possibly there's a rumor that this is possibly all due to a misinterpretation of language between both Trump and president Xi in China. But I'm more interested in the wipe out that occurred clearly in Bitcoin. And there's some unusual there was something very unusual about that. And I I didn't say it Friday when I was doing the show because I didn't realize the extent that we were gonna dive down. I think I I foolishly said that we'd see $17.05.

We did on its way down to $1.00 2. I think somebody has actually said that one of the exchanges saw a price of $1.00 2. I know somebody got a order filled at a 104,000, so I know at least it got there on an exchange. But, that's what I wanna focus on is what happened and this unusual activity that occurred right before Trump made his truth social post, which started the cascade failure across equities and all legacy markets, and then took Bitcoin and the rest of it with it. And let's see here. What else is going on today? Oh, v 30. Bitcoin Core v 30 was released on Friday as well.

And so we're gonna get it dig into that. No. It was not the release of Bitcoin v 30 that caused liquidation. This was all about Trump and the tariffs. And honestly, honestly, I I actually think that that was that it was kinda good. Well, okay. Let's I'm being relative here. In a relative way, I'm glad that the release of v 30 was completely overshadowed by the carnage going on in the markets. I'm not excited about v 30. I'm running 29. That that's gonna be the last core update that I do to my Bitcoin core node until all these people settle down and figure out a better path forward.

And I don't really need to run 30. I don't need to run the new Bitcoin core software. And even if even if there was nothing in v 30 that was questionable, I still would wait six months, if not even a whole year, to upgrade. Hell, it's taken me a year to upgrade from '28 to '29. Well, somewhere around I don't know. Somewhere around a year, I guess. Whatever year '28 was released in, I upgraded, like, after that, and then now I've upgraded to '29. That's it. I'm I'm I'm done for a good long while, and that's the beauty of the Bitcoin network. I literally would be able to run 25 if I wanted to. Sure. I wouldn't have some lights, whistles, and bells, but I can run it and I would be able to execute valid transactions on the network with 25. And I'd honestly, I'd be able to execute value valid transactions on the Bitcoin network from a long time ago because that's the way that this stuff is built. Right? So, for all the people that are pulling their hair hair out over version 30, it's not worth your time.

It I mean, stop worrying about it. It is not worth you worrying about. And then is there a pardon in the works for Changpeng Zhao, founder of Binance? I don't know exactly why he would need one because I from what I understand, he's not in jail. I don't know. Maybe they'll maybe I got that wrong, and we'll figure it out later. India is getting some people into trouble through tax evasion, charges and calls. Stake and Shake does something stupid, and strategy buys more Bitcoin, but they did so at a price that they probably wish that they hadn't have done. They should've waited, I guess. Alright. So Peace Prize. Nobel Peace Prize has been awarded to Maria Carino Machado.

Could she become the first Bitcoin Nobel winner? And there's where I'm having some confusion. I don't really know what this headline is trying to say, but it's written by Micah Zimmerman as is the rest of the piece found in Bitcoin magazine. Venezuelan opposition leader, Maria Corino Machado, has been awarded the twenty twenty five Nobel Peace Prize recognized for what the Norwegian Nobel Committee called her, quote, tireless work promoting democratic rights for the people of Venezuela. But for many in the Bitcoin community, the wind carries another layer of meaning because Machado isn't just a democracy activist. She's also one of the few but growing global political figures who has openly embraced Bitcoin as a tool of resistance against authoritarianism.

The Nobel Committee described Machado, who is 58 years old, as a woman who keeps the flame of democracy growing going against a growing darkness, end quote. It's a description that fits not just her fight against the current regime, but her larger vision of how technology and decentralized money can empower citizens when governments fail them. And she does not look like she's 58 years old. If she's 58 years old, then she is taking marvelous care of herself. I'm just saying. I'm in shock, Machado said after the announcement. I am just one person. I certainly do not deserve this. I dedicate this prize to the suffering people of Venezuela and to president Trump for his decisive support of our cause, she wrote on x.

That's an interesting shout out. I was not expecting that one. Machado's political story is one of persistence under threat. Barred from running in last year's presidential election, which international observers widely dismissed as rigged, she was forced into hiding but refused to leave Venezuela. The Nobel Committee praised her as a key unifying figure in a brutal authoritarian state that is now suffering a humanitarian and economic crisis. That crisis is something Machado has long tried to explain in global forums. Venezuela's economic collapse, she argues, was not an accident, but a predictable outcome of financial repression and the state control of money.

And it's here that her views intersect directly with Bitcoin. In an interview first aired by Bitcoin Magazine last year, Machado spoke at length about Venezuela's economic collapse and the role Bitcoin has played in helping citizens survive it. Quote, the Venezuelan Boulevard has lost 14 zeros, she said, recalling how inflation once hit 1700000.0%. Quote, this financial repression rooted in state sponsored looting, theft, and unchecked money printing has destroyed our economy despite our vast oil wealth, end quote. For many Venezuelans, Bitcoin became the only alternative.

It has allowed families to store value outside the collapsing boulevard, receive remittances without confiscation, and even fund their escapes from the country. Machado called Bitcoin a lifeline for Venezuelans, a way to bypass government controlled exchange rate. She proposed including Bitcoin in Venezuela's future national reserves as the country seeks to recover its stolen wealth and rebuild from the dictatorship. Machado also proposed including Bitcoin in Venezuela's future national reserves as part of the country's post dictatorship recovery. Quote, we envision Bitcoin as part of our national reserves, helping rebuild what the dictatorship stole, she told Bitcoin magazine.

Machado's emphasis on transparency echoes one of Bitcoin's core principles, a public ledger that is incorruptible by design. It's an idea that resonates with freedom and justice.

[00:09:30] Unknown:

Okay. Well, so

[00:09:34] David Bennett:

it so happens that she talks about Bitcoin in a positive light. It so happens that she's suggesting that the country of Venezuela include Bitcoin in a strategic national reserve of of some sort or another, But she was not and this is just me trying to to be clear. She was not given the Nobel Prize because she's a Bitcoiner. She was given a Nobel Prize for her work as an activist defending the citizenry of Venezuela and trying to promote the ideals that's going to make that country great. This had nothing to do with her being a Bitcoiner. So for anybody who's who's promulgating that idea out there, please don't listen to them. And for God's sakes, don't don't take it any further. Alright? She was given a Nobel Peace Prize for something completely unrelated to Bitcoin.

It so happens, and this is the good part, that her ideals completely resonate with Bitcoin, which is why she is also gravitating towards that. She sees it as the freedom tool that it is. But, again, that was not why she was given the Nobel Prize, so she didn't get the Nobel Prize because she is a Bitcoiner. Just I just wanna be clear about that. But it's good news. I I mean, it's it's honestly, it's good news because that story is now going to resonate across the world considering that, well, I mean, it's a Nobel Peace Prize. And you can say what you want about the Nobel Foundation and all that and and, you know, maybe it's a little captive, maybe not. I I don't know. But, you know, they've made some questionable calls. I'll I'll say it. But sometimes they make the right call, and, honestly, I think they probably gave the peace prize to the right person this time.

So

[00:11:32] Unknown:

now now it's time to talk about the massive liquidations.

[00:11:39] David Bennett:

And it seems as if they may have been underreported. So Adrian Zmunsky from Cointelegraph is writing this, Centralized exchanges face claims of massive liquidation undercounts. Uh-oh. Hyperliquid. And keep Hyperliquid in mind because we're gonna talk about them a couple more times. Hyperliquid cofounder and CEO, Jeff Yahn, claimed that the way centralized crypto exchanges and Binance, specifically, report liquidation data likely underrepresents the true scale of losses during major market sell offs. Bitcoin fell to a $102,000 on Friday after United States president Donald Trump announced sweeping tariffs on China, and then they give the prices of a couple of shit coins.

According to data from Coin Glass, 16,700,000,000.0, that's with a b, billion dollars worth of long positions and 2,460,000,000.00 in short positions were liquidated on Friday, marking the largest liquidation event in crypto history. If you didn't if you were not aware, Friday marked the largest liquidation event in cryptocurrency ever. In a Monday ex post, Jan pointed to a documentation page on the world's top crypto exchange, Binance, explaining the platform will only include the latest liquidation happening in each second interval in the order snapshot stream. The stream provides real time updates on forced liquidations, while batching liquidations this way helps performance. Jan said that the system likely results in major under reporting during periods of heavy volatility when there can be more than 100 liquidations per pair per second.

Quote, because liquidations happen in bursts, this could easily be 100 x under reporting under some conditions, Jan wrote. Jan's statement echoed a Saturday expo from crypto from CoinDesk. The platform said that, quote, the actual liquidated amount was likely much higher since Binance only reports one liquidation order per second. Jan's comments follows or follow over 1,000 hyperliquid wallets being completely wiped out in the market crash on Friday. According to Look On Chain data, over 6,300 wallets are in the red with combined losses exceeding $1,230,000,000. Centralized crypto trading platforms run into numerous issues during the flash crash or ran into numerous issues. The world's top crypto exchange, Binance, in particular, has attracted considerable criticism over multiple reported issues.

In a Sunday x post, Binance CEO Yee Hee said Binance's core contract and spot matching engines, as well as API trading, remain stable throughout the event. She admitted, however, that, quote, some individual functional modules of the platform did experience brief flags and certain wealth management products experienced some depegging, end quote. Yeah. Still, she claimed that depegging events did not cause the market crash and that the peg happened because of and after the downturn itself. She also said that Binance initiated and completed compensation for users affected by the depegging, which amounted to over $280,000,000.

Widespread reports indicate that the price of some major altcoins reached $0 on Binance at the time of the mass liquidation event. Pseudonymous crypto influencer, Hanzo, shared his experience during the damn time, quote, on Binance, buttons stopped working, stop orders froze, limit orders hung, only liquidations were executed perfectly. Binance later said that the anomaly was a display issue caused by changes to minimum price decimals for pairs such as IOTX USDT and not actual market data. Quote, certain trading pairs, such as the two aforementioned, recently reduced the number of decimal places allowed for minimum price movement causing the displayed prices in the user interface to be zero, which is a display issue and not due to an actual price of $0, end quote.

The the Athena USD stablecoin maintained its pay on the decentralized finance protocol curve, but it went severely off peg on Binance and competing exchange Bybit. In a Saturday ex post, Hasib Quarshie, a managing partner at crypto venture capital fund Dragonfly, pointed out that the USDE hit 95¢ on Bybit and well under 70¢ on Binance, but did not lose its peg on curve. Oh, well, Guy Young, the founder of Athena Labs, said that USDE minting and redeeming worked perfectly during Friday's flash crash. Data he shared showed that $2,000,000,000 in USDE was redeemed during twenty four hours across crypto exchanging, including Curve, Fluid, and Uniswap.

Tom Cohen, head of investment and trading at quantitative crypto asset management firm, Algos, told Cointelegraph that, quote, the start can be traced to roughly 60 to $90,000,000,000 of USDE simultaneously dumped onto Binance to exploit a mispricing, and this triggered a series of large sell offs. This sell off, he said, moved thinly traded marks markets very quickly. Hyperliquid also pat itself on the back following the reported centralized exchange outages. The platform wrote in a Saturday x post that, quote, during the recent market volatility, the Hyperliquid blockchain had zero downtime or latency issues despite record traffic and volumes.

This was an important stress test proving that Hyper Liquid's decentralized and fully on chain financial system can be robust and scalable. So the the extent of the liquidations may actually not be as,

[00:18:29] Unknown:

well, our maybe worse.

[00:18:33] David Bennett:

Maybe worse. And, will will we know? Oh, I'm sure eventually some sleuths out there will will figure it all out. I I still haven't seen an updated number, but it still is. Even if it's underreported, Friday was the largest liquidation event in the history of this entire industry. So just be careful out there. You know what to do, man. Just buy Bitcoin and hold Bitcoin. But despite all this, despite the Friday crash, crypto investment products logged a $3,170,000,000 of weekly inflows despite historic liquidation event according to CoinShares, and this is from James Hunt writing for The Block.

Global crypto investment products managed by asset managers such as BlackRock, Bitwise, Fidelity, Grayscale, ProShares, and twenty one shares generated net inflows of $3,170,000,000 last week according to CoinShares. And as a result, year to date inflows have now surpassed last year's record tally, totaling 48,700,000,000.0 so far in 2025, notwithstanding the chaotic end to last week when cascading liquidations wiped billions of dollars in value from the crypto sector. Quote, despite the significant price correction caused by the China tariff threat by The US, Friday actually saw little reaction with a paltry $159,000,000 of outflows, Coinshares head of research James Butterfield wrote.

Weekly trading volumes in digital asset exchange traded fund products or rather just exchange traded products also surged to a record 53,000,000,000, while Friday alone saw an all time high of 15,300,000,000.0 in daily turnover. However, following president Trump's tariff announcement, total assets under management slipped only 7% from last week's peak of $242,000,000,000, though James Butterfield's comments were later walked back to, well, some extent. At least $20,000,000,000 of positions were wiped out on Friday as some cryptocurrencies briefly fell literally to zero, the largest crypto liquidation event in the history in history in US dollar terms.

However, as liquidation data is imperfect with Bybit publishing in full, but Binance and OKX still under reporting in incomplete burst, for example, the true figure is likely far higher. But the real point about this story is is that even though Friday was a bloodbath across markets, somehow, crypto investment products ended the week $3,170,000,000 in the black. So this is a very confusing time for everybody. Right? So don't, you know, it if you were somebody who doesn't trade because because it's confusing, that's fine. Stay that way.

Don't trade, man. There is no reason to go to this casino. The girls aren't that pretty. The drinks are watered down. There's the the carpet's got stains on it. You don't want anything to do with this casino. Just please, because you're betting against people like this. Unusual whales on Twitter threw up a Twitter post that says, breaking. Look at this. A new crypto account was opened yesterday morning. Thirty minutes before Trump's announcement of 100% tariffs on China, it added a huge multimillion dollar leveraged Bitcoin short position. The market dumped.

The trader made a profit of a $192,000,000 in two hours. Unusual. No. It's not. It's not unusual at all. And I'm going to let Sharra Malwa tell you more about it from CoinDesk. Trader who made a $192,000,000 short in crypto cash is betting against Bitcoin again. So there's another short that's been open, so just be aware. A trader who pocketed a $192,000,000 shorting Bitcoin ahead of last week's crypto wipeout has reloaded with a large bearish position as markets attempt to recover from the Trump tariff shock. The wallet identified as OXB317 on the decentralized derivatives platform, Hyper Liquid, remember we're just talking about that, opened a new $163,000,000 short position on Bitcoin late Sunday, data from Hyperscan shows.

The position is 10 x leveraged and already $3,500,000 in profit in Asian afternoon hours with a liquidation level of a 125,500. So the only way this dude gets wiped out is if the price of Bitcoin goes to a $125,500. That's kinda what that means. Anyway, the same trader now here, listen up. The same trader first drew attention on Friday when it opened a massive short roughly thirty minutes before former president Donald Trump's surprise announcement. They call him former president Trump. He's the actual president. He was also the former that's weird language. I don't know, man. Smelling some bias there, but let's let's try it again.

The same trader first drew attention on Friday when it opened a massive short roughly thirty minutes before former president Donald Trump's surprise announcement of a 100% tariffs on Chinese imports, a move that erased over $19,000,000,000 in crypto market value and triggered the largest ever day of liquidations in the market. The again, listen carefully. The perfectly timed bet led to a gain of nearly $200,000,000, sparking speculation that the entity may have had advanced knowledge of the policy shift. No. I'm shocked that there's gambling going on in here. On chain analysts and traders have since dubbed the address an insider whale. Some even argue that the position itself could have accelerated the crash.

This hyper liquid whale opened shorts just thirty minutes before Trump announced the tariffs on China. He closed the trades for a $192,000,000 in profit. These accounts were open today, and he has already withdrawn most of the money. Lucky whale or insider, and that was a tweet from, I I don't know, Marty Party Music? And it's it's hard to tell. Anyway, continuing, Hyper Liquid is the biggest decentralized perpetuals exchange that lets traders open high leverage futures positions directly on chain without relying on centralized intermediaries like Binance or OKX.

It has become a favorite among high frequency traders in Wales because of its deep liquidity, transparent order book, and lightning fast execution, making it one of the few DeFi platforms capable of handling institutional size flow. The platform also features auto deleveraging or a built in safety mechanism that prevents bad debt during extreme volatility. When insurance funds are drained, ADL forcibly closes profitable positions to cover losses from bankrupt accounts. It ensures solvency, but it can also worsen sell offs as profitable traders get liquidated to balance the system. Over 6,000 wallets were hit during the weekend's ADL triggered flush according to the hypertracker data, wiping out more than $1,200,000,000 in trader capital on hyper liquid alone.

The new short adds intrigue to the market already on edge as participants continue to assess contagion effects following the weekend slide. Look, man. At a 125,500, this cat really doesn't have much to worry about, at least in the short term. Right? And even if we continuously build to the position of a like, maybe a 122, a 123, something like that. He at this point, this guy's got almost nothing to lose unless we hit a hundred and twenty five five because he's got 10 x leverage on this, what, $163,000,000 short.

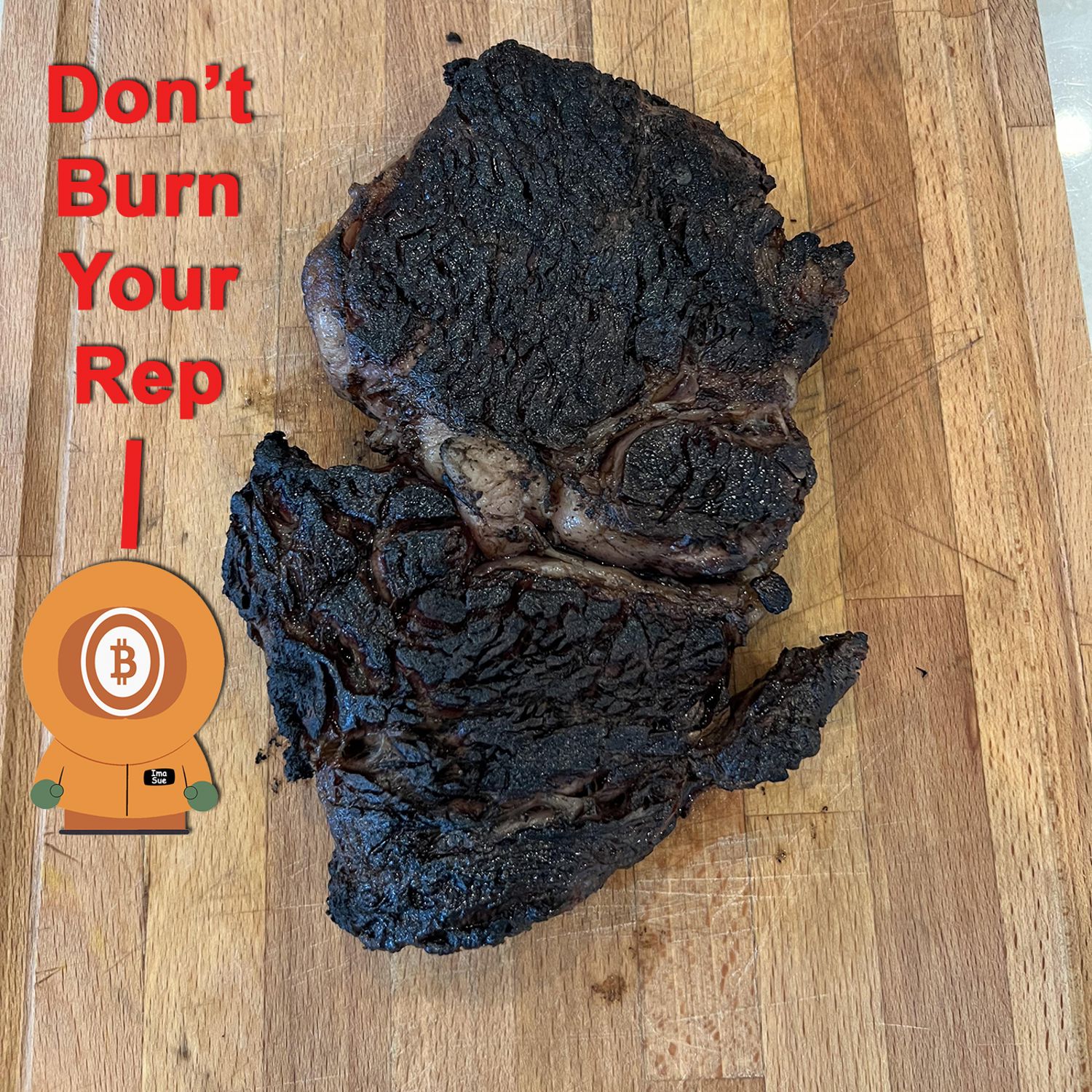

And if if he's 10 x, then he's you know, it's gonna be painful, but he already made $200,000,000. I didn't think this would just be I you know, this is just him, like, going, I don't know, man. Maybe I can get some icing on my cake for this one. But, honestly, if the this particular trader plays it right, it's not gonna be all that painful unless a hundred and twenty five five hits. And like I said, I don't see that coming in the short term. But it makes me feel dirty, which is why I'm glad I'm buddies with SoapMiner at soapminer.com. Are your hands dirty? Is your soul dirty? Is your mind dirty? You you you are are are you, like, nose deep into things that smell bad, like crypto trading, well, SoapMiner's gonna help you out. Handmade tallow soap with 100% beef tallow.

In fact, let's just look at his basic soap. It's called rough cut tallow soap. It's a five ounce bar of the finest rough cut tallow soap you can get, and it's made with 100% pure grass fed beef tallow, lye, which is sodium hydroxide, and distilled water. That's what goes in to soap miner soap at the base. But then he'll put sense in like cedarwood, pine tar. He'll well, actually, this I pine tar actually has some pine tar in it, I believe. Let's see. Where is it? No. Let's see. Made with, 100% pure yeah. A 100% beef tallow, 100% pure pine tar, and lye and distilled water. This is the this is the most simple hand soap you're ever going to find. He's got goat's milk tallow. He's got lemongrass. He's got orange cloves. He's got lavender. He's got tea tree, peppermint, Earl Grey, which is one of my favorite ones, and redacted tallow because it's got carbon in it.

I love this soap. I I like, it is like literally one of my favorite soaps from him, and I have yet to try his comfrey soap. And if you're like digging in the garden, if you're a gardener, if you get like, cuts and scratches and, like, little bitty kind of wounds and stuff and bee stings, you're you're gonna want to have a bar of comp free tallow soap. Make sure that you use the code Bitcoin and for 10% off at soapminer.com. That's soapminer.com. Let them know Bitcoin and sent you. Now onto the last story of this half. We're going back to hyperliquid. I told you we were gonna be taking a little bit of a deep dive. Remember, we were just talking about what hyperliquid is. It's this defy exchange that that offers all these lights, whistles, and bells and is the only thing, apparently, according to the last story we we read, that is capable of institutional sized flow.

Well, I've found it interesting that I've got this out of the block. Timmy Shen is writing it. Hyper liquid to activate HIP three upgrade enabling permissionless perpetual market creation. Oh, joy. Now we can just create a market out of thin air. Hyper liquid is expected to activate HIP three, a major protocol upgrade that will enable the permissionless creation of perpetual futures markets later today. A hyperliquid administrator announced in the protocol's Discord channel that the network upgrade on October 13 will include enabling HIP three.

Quote, HIP three will be enabled during this network upgrade. There is no immediate change for users. Deployers meeting the on chain requirements will be able to deploy perpetuals for trading once they are ready, said the administrator, end quote. The project said in a previously disclosed document that HIP three will support builder deployed perpetuals, marking, quote, a key milestone toward fully decentralizing the perpetual listing process, end quote. With HIP three in place, the deployers will be able to permissionlessly launch a perpetual decentralized exchange on Hypercore by staking some shitcoin integrated with Hyper EVM for smart contracts and governance.

H I p three includes safeguards like validator slashing and open interest caps according to the document. So this just screams danger. Danger, Will Robinson. Danger. I'm serious, man. The it's this kind of crap that makes this casino the filthy, stinky, crappy mess that it is. You why people are so attracted to this kind of gambling has always eluded me. But then again, I don't even bet on games. I don't bet on I don't bet on football or baseball or basketball. I don't have a sports bookie. You know? I have I have zero interest in going to Vegas and and playing cards or rolling dice or getting on a roulette wheel.

It's just I'd I'd rather take that money and put it in a brown paper bag and burn it for warmth before I would go gamble it. This this kind of crap, it's almost as if I could have an AI agent spin up a perpetuals market, bet on it, and and and lose on it, and win on it, and have and and have liquidations across the board and cause cascading liquidations all in my sleep. And at that point, you gotta ask yourself, what's the point? It's it's all stupid. Let's run the numbers. CNBC Futures and Commodities, Brit North Sea Oil up a point to $63.40.

West Texas Intermediate up 1.19% to $59.60. So we're still below 60 on that one. Natural gas is up point one three. Gasoline is up one and a quarter, and Murbaughn crude is up one and a third. And, of course, all your shiny metal rocks are doing extremely well today. Palladium is up four and a quarter. Gold is up 3.12 to smash through $4,100 to end up right now at $4,125.70 per troy ounce. Yes. Peter Schiff is gonna take a victory lap. That's okay. It'll let him go. He's been waiting for a long time for this. Okay? Just let him have his thing. Platinum is up 4.13%. Silver is up 6.7, cruising through $50.43 per ounce.

Copper is up five and a quarter. And ag is fully mixed. Just as much green as there is red, biggest winner today. Coffee up three. Biggest loser is sugar, 3.23% to the downside. Live cattle is up, oh god, point 7%. Lean hogs are up 1.2%, and feeder cattle up 0.12%. S and P is up 1.5. Nasdaq is up two full points. Not a bad recovery for the, legacy markets. Dow is up 1.3. That is a 596, gain on that particular that particular board, and S and P Mini is up 1.99%. So the recovery is underway, y'all. It's gonna be fine. Meanwhile, Bitcoin at a $114,760 were clearly being left out of the fund.

We could only borrow purchase 27.8 ounces of shiny metal rocks with our one Bitcoin of which there are 19,933,816.79 of an average fees per block are low 0.02 BTC taken in fees on a per block basis. Looks to be about 20 blocks carrying 40,000 unconfirmed transactions waiting to clear at high priorities of four Satoshis per v byte. Low priority gets you in at one. We are still in Zeta Hash territory on the hash rate. 1.03 Zeta Hash's per second. It's all the security I need. And from oh, man. It never loaded up. Really? Let's see if I can get my get these, comments to load up from, fountain.fm.

It's being buggy today for some reason or another. And you know what? This may just not work. I'll give it one more shot here and see if it'll actually spin up. Come on. You can do it. You can do it. Alright. There is something very wrong with, fountain.fm, so I am unable to get to any of the, any of the boosts that you guys gave me. So I will hold those over until fountain gets their little red wagon fixed. That's the weather report. Welcome to part two of the news that you can use Bitcoin Core v 30 is here. The op return issue splits the community. And this is from atlas21.com.

The Bitcoin community finds itself divided again after the official launch of the Bitcoin Core v 30 update. The release, which introduces changes to node architecture, performance, and security has sparked mixed reactions among developers, miners, and users. The key updates. The Bitcoin Core development team has implemented several new features designed to enhance the user experience on the network. One notable addition is optional encrypted node to node connections aimed at ensuring greater privacy for users. The official announcement on October 12 also clarified that with the release of this new major version, all versions prior to '27 dot x have reached end of life and will no longer receive security or maintenance updates.

Dude. Gotta pause right there to say bad move.

[00:38:14] Unknown:

That's that's

[00:38:17] David Bennett:

that's not depressing. It's unfortunate is what this is. Because it's like it's yeah. The the more that core makes moves like this, the more I'm not gonna run look. I I'm not gonna run knots, and I don't really wanna engage in in in this kind of chicanery here or or talking well, not chicanery. Talking bad behind, you know, core's back because core that's why that's why Bitcoin is what it is. So when I read stuff like this, it makes it all the harder because I'm becoming a little bit more and more disappointed with with Bitcoin Core as a group of developers.

It I feel that they may have lost their way. And yet I am still unaffected emotionally by, like, well, is this does that mean it's the end of Bitcoin? No, of course not.

[00:39:10] Unknown:

I mean, that

[00:39:13] David Bennett:

that's not the way Bitcoin actually works. Alright? I feel absolutely nothing about this. Absolutely nothing. But continuing on, one of the other main changes is the reduction of default transaction fees. Nodes can relay transactions with fees as low as 0.1 sat per vbyte while miners will be able to include them in the next block with a minimum fee of 0.001 sats per vbyte. The most hotly debated chain, however, concerns the expansion of the op return limit, which is increased from about 80 bytes to a 100,000 bytes. Holy shit. This adjustment allows for much larger amounts of non financial data to be stored within Bitcoin transactions.

Although the update also includes bug fixes and performance improvements, it is the opportune limit increase that has captured most of the attention and divided the community. What are the reactions? Well, Alex Bergeron, ecosystem lead at Arc Labs, expressed excitement about Bitcoin Core v 30 on x stating his intention to use all of the additional op return space and will use it to make Bitcoin more like Ethereum, except better. Oh, joy. Pavel Rusnak, cofounder of Satoshi Labs, said he chose Bitcoin Core v 30 for its great development team, peer reviewed code, and sane engineering decisions, end quote.

Critics of the update argue that this change violates Bitcoin's core principles as a peer to peer electronic cash system. Concerns include the potential growth of the blockchain size, higher operational cost for nodes, and legal risks. Last week, Nick Szabo, a well known cypherpunk, recommended on x, quote, as a hopefully temporary temporary measure, run knots. I strongly recommend not upgrading to core v 30. Dude, you can upgrade to v 28. If you're on if you're on, like, below 27, right, which they've they've said they're not your core said we're not gonna we're not gonna do security updates for any of that crap anymore. Then go to 28 or go to 29 or go to 29.1.

You don't have to do 30. Right? So everybody should be a little bit more careful about this. Anyway, earlier in October, Szabo had already raised concerns about the legal implications of increasing the op return limit. According to him, node operators risk hosting illegal data for which they could be held criminally liable. In recent months, in response to Bitcoin Core's decisions, a significant number of node operators have adopted the alternative implementation Bitcoin knots, which allows for strict data size limits to be applied. Data from Clark Moody Bitcoin shows that there are currently nearly 5,000 active knots nodes representing about 20% of all nodes. So if the argument here is that increasing the byte size of op return from 80 bytes, which is very low indeed, not a whole lot of information can be stored in 80 bytes of data, to a 100,000 bytes of data. And at that point, you can store data. I mean, that's that's I mean, it's not massive, but still yeah. You can put a picture in there. And the argument is is that immediately picture, pictures of child porn are going to be put on the blockchain.

That that's the general argument. And because my node will be hosting that CSAM, then I'm criminally liable for it, except I can't ever really see that because my notes software doesn't allow me to look at pictures. It will tell me things about the the the blocks. It'll tell me things about transactions. It will tell me other things, but it doesn't have a a picture viewer as part of its its onboard complement. I would have to do some first of all, I'd have to know the block number, and I would have to know the transaction ID. Right? Actually, I I I really wouldn't have to know the block number, but I would have to know the transaction ID to be able to identify which of the hundreds of millions of transactions that I wanna go decode a picture from. And then I gotta scrape that data and then I gotta send it to a view. I'm not I don't care.

I don't care. Okay. So here's the here's the other thing is like we're getting to a point where and this has always been kind of always been an argument where many people have said a long time ago that for node runners like me that just have a, like, a very small server, you know, with, like, minimal compute power. Although my start nine is actually pretty beefy when when when you get right down to it. But they're talking about, like, later on, this block size grows and that compute power is enough and the memory storage isn't enough that maybe we can just go to looking at block header data, which is perfectly viable.

Right? You will it will not actually it would not actually represent a full accounting of every single transaction because you would need all the transaction data for every transaction, and all we would have would be the headers that said, yes. At at the time, this was a valid and you can already do that. It's called a pruned node. Right? Where and from that standpoint, it just doesn't include a whole bunch of transactions from way, way, way back in time. Mine is a full archive. Right? I've got I've got the Genesis block and all the well, the all the transaction that was included in the genesis block and every transaction since. I've got it on my note. I've got every piece of data that's ever been generated by the Bitcoin network since 01/03/2009.

That's the way that it works. But there's another way to do this where you can just hold the headers because we already know that these transactions were valid. They've been revalidated millions of times. There's always a full audit. Every ten minutes, the whole blockchain gets audited. And for everybody that does an initial, blockchain download, the computer that's running or the the the processing unit that's running that node has to actually revalidate all of the transactions. It doesn't remind them. It just revalidates them to make sure that, yes, this this transaction comes after this transaction, and they tell you can tell all that just through the header data.

You don't need to to rifle through every single bit and byte of every transaction. So if that were to occur, if that was a a switch that I could throw right now, I might consider doing it because that means that this evil child porn shit that everybody is is thinking that is going to automatically be stuffed into the Bitcoin blockchain, it wouldn't be present on my node. Guys, there's there's fixes. There's so many ways to skin a particular cat that everybody that's losing their mind about all this right now, you're just wasting your your energy.

It's not worth it. It really is not worth it. So let's move on. Is a presidential pardon in the works for Binance founder, CZ, Josh Quitner, has this one for decrypt? Is the Trump administration seriously weighing a pardon for Binance's Shengpeng Zhao? Crypto Twitter is all a flutter after Fox business reporter Charles Garaspino tweeted a scoop, claiming White House insiders say discussions are heating up and Trump is leaning toward a pardon. Gasparino is a veteran financial and political journalist. His tweet lands atop a complex backdrop in May. CZ confirmed that his legal team formally applied for clemency.

In earlier reports, the Trump family was said to have explored investment deals involving Binance's US arm linking business incentives to political favors. Zhao denied that speculation. CZ and Binance have previously denied that a pardon has been granted. Media reports of a pardon allegedly issued were retracted, and Binance's founder, Yi Hee, dismissed the rumors. DOJ records show no official clemency in his name. Still, the path from rumor to pardon isn't closed. If a clemency is issued, then it could ease regulatory constraints on Zhao's future involvement in crypto, rewire power dynamics of Binance, and reintroduce political entanglements in US crypto legislation.

And Zhao did not deny Gasparino's report. In fact, he welcomed the outcome, quote, thank you, Charles. Great news if true, Zhao wrote while correcting a detail from his post before thanking the journalist, quote, for the coverage. CZ resigned his position as Binance's CEO in 2023 as part of a plea bargain that sent him to jail for four months at a minimum security prison in Lompoc, California. As part of the deal, he was allowed to maintain his ownership stake in Binance, but could no longer hold an executive role at the exchange. He remains Binance's largest shareholder and one of crypto's most influential figures. And since his return from jail, he's focused on global crypto advocacy, advising governments on digital asset policy and investing in blockchain startups through private ventures.

He founded Binance in July 2017 following an initial coin offering that raised a paltry $15,000,000. God, he's been around for a long time. Is there gonna be a pardon? Who knows? I kinda don't care. But Indians will be caring about this in India. Over 400 traders are investigated for tax evasion through Binance continuing with the little Binance thread here, Atlas twenty one has this one India's tax authorities have opened a wide reaching probe into more than 400 wealthy individuals suspected of avoiding taxes on crypto transactions conducted through Binance. According to the Economic Times, the inquiry focuses on traders who operated on the platform between 2022 and 2025.

The Central Board of Direct Taxes has issued an internal notice to local tax departments across several cities requesting a detailed report on actions taken by October 17. The investigation covers the fiscal years from 2022 through 2023 and 2024 through 2025, during which the traders in question allegedly bypass tax regulations and the probe goes beyond standard exchange activity, also examining peer to peer transactions facilitated by the platform in India and settled through domestic bank accounts, Google Pay, or Cash. India's tax system for cryptocurrencies is among the most burdensome in the world.

Market participants face a 1% tax deducted at source on every transaction coupled with a 30% tax on on profits. And for top income taxpayers, the effective tax rate can reach 42.7%. It's just I just want half of your money. Just give me half. When including surcharges and the 4% cess. I I don't know what s e s s means. An additional levy used to fund targeted programs such as education and health care. CES. I've never seen that used before. Anyway, the government's stance toward digital assets remains focused on strict control and taxation. Union minister Goyal recently reiterated the administration's intention to intensify efforts on developing a CBDC while maintaining high tax rates on cryptocurrencies.

Yeah. That's not gonna work. I don't think India's ever going to be able to get a CBDC. I I I wouldn't hold my breath on that one, and thank God for the people of India. Although, it's not like it's not just as as terrible as it can be. I mean, I remember when they recalled the 100 rupee notes, and people were standing outside their banks forever to try to get the new the newly issued paper currency in India, and it was just it was an absolute fiasco. And I do believe people died because I think it was, like, in the middle of the hottest part of the year in India, and it was just it was brutal.

But but not not like this kind of brutality. Steak and Shake feels the ire of the Bitcoiner. Stake and Shake quickly u turns as ether poll angers Bitcoiners. Oh, we're so angry. Braden Lindria, Cointelegraph. Stake and Shake has reversed course on a potential plan to accept ether payments after several Bitcoiners balked at the idea of the fast food chain expanding beyond Bitcoin. Steak and Shake asked its 468,000 ex followers whether it should accept Ether on Saturday, promising to abide by the result of the poll. The poll saw 53% of voters say yes, but the fast food chain suspended it around four hours later due to backlash.

Quote, poll suspended. Our allegiance is with Bitcoiners. You have spoken. Who even allowed this? I'm back at my desk. Steak Toshi. Whatever. Okay. Fine. Steak and Shake started accepting Bitcoin as payments on May 16 in all of its locations where permitted by law, including The US, France, Monaco, and Spain. It's odd I'm just pausing to say that I find it very odd that Steak and Shake has restaurants in Monaco. France and Spain, I can almost see, but Monaco? Okay. In the third quarter, Steak and Shake announced its same store sales rose by 15% year on year, partially attributing the rise to Bitcoin or supporting the chain. So it made sense as several Bitcoiners criticized Steak and Shake for even considering expanding its crypto payment options beyond Bitcoin.

Quote, I promise if you accept ETH, I will never eat at your restaurant again, said Adam Simica, builder of Bitcoin self custody wallet, Mana. Quote, the fact that you even created the ETH poll is disappointing, added a user named Colleen, also known as the Bitcoin gal. While Bitcoin developer, Carmen, was one of the many who said the poll harms Steak and Shake's reputation. And then Ben Justman, our favorite circle pier, with Peony Lane wine or Peony Lane vineyard says, would you destroy your credibility and no one would even pay an ETH? Sad to see.

As a reminder that Bitcoin and crypto tribalism remains alive and well, many Bitcoiners view Bitcoin as the best form of money. Michael Saylor once famously said, there is no second best crypto asset. There's crypto assets, and it's there's only one crypto asset and it's called Bitcoin, end quote. While some criticized Stake and Shake's quick change of heart, interestingly, the decision was praised by one of the biggest names in the Ethereum community, Vitalik Buterin himself, who suggested that crypto adopting businesses should stick to a crypto tribe instead of trying to appeal to as many customers as possible, quote, we need the stubborn ones who believe in their cause and their tribe and see their work as a labor of love to it, end quote.

Last week, Steak and Shake also announced that it is launching the Bitcoin stake burger on October 16 to celebrate the company's adoption of Bitcoin. I I missed that announcement. I don't know what that's about, but it took mere months. It was just back just back in, like, what, in in May? Say, was it May 16? Yeah. May I march in for May? Yeah. Yeah. It was back in May that they started, taking Bitcoin and it took mere months for them to start considering a, alternative cryptocurrency. And this just goes to show why it's so difficult in this field.

There's so there's so much noise that's been introduced since the release of Bitcoin. Just a bunch of screaming, diaper wearing morons going, me too. Me too. We're better than Bitcoin. We're Bitcoin two point o. Remember how there was Betamax and VHS? Yeah. And all the other arguments. And it's all crap. It's just it's it's all crap. So steak and shake is no different than almost everybody else in this field. Maybe maybe we should consider an alternative cryptocurrency as well. No. Don't. Stop. Just I mean, honestly, the whole reason we're not where we should be is because of all the me too's out there.

It's it is what it is. Just ignore the noise if you can. And finally, for the day, strategy added 220 Bitcoin for $27,200,000 last week, right as Bitcoin was posting new highs. Michael Saylor's strategy, acquired 220 Bitcoin for 27,200,000.0 in its later latest purchase, Sailor announced on x on a post on Monday as the related filing had yet to appear on the US Securities and Exchange Commission website. The purchase was made at an average price of a $123,561 per coin as Bitcoin reached an all time high above a 126,200 October 6 before dipping to a 107,000 in Friday's flash crash according to Coinbase data.

God. Talk about ill timed. So, but sailors still bought Bitcoin, but although he should have done it last week, you know, or or the week before last. That was the week that he didn't buy Bitcoin, and he should have bought Bitcoin that week because he'd probably still be okay at this point, but he's down quite a bit on this particular purchase. It doesn't matter. His liquidation price is so low at this point. It's not even funny. I don't even I don't even worry about it anymore. The only thing that I worry about is, well, will Sailor pull a stake and shake and start talking about some shit coin? You never know. I doubt it, but you never know. He'd get hit in the head.

And, oh, oh my god. We should buy Solana. And, I mean, like I said, I doubt it, but you never know. So let's end this back on what happened on Friday.

[00:58:49] Unknown:

You got a guy

[00:58:53] David Bennett:

that opens a massive short thirty minutes before Trump made an announcement that was sure, 100% guaranteed to send the stock market and all the rest of everything spiraling downwards. Does that sound like it was a mere coincidence to you? No. And here here's the thing. Am I saying that it is clearly a Trump insider? I don't know. I mean, I I'm a, I'm not saying that. B, I'm not saying that because I don't know. I'm not there. I don't know any of these people personally. I don't hang out with them. I don't shake hands with them. I don't drink beer with them. I I don't live in Washington, DC, so I don't know any of these people. So, therefore, for me to conjecture on that is is would be wildly speculative as well as, well, unethical.

But this is what we know. The short that was opened on on Friday morning was $600,000,000. What does that preclude? Well, probably, it precludes somebody like a staffer overhearing Trump maybe talking to one of his people or one of Trump's people talking to another person saying, yeah, here in about here in about forty five minutes, Trump's gonna lower the boom on China. He's gonna announce another tariff. It's not likely that a staffer or some, you know, guy that's just kinda walking around within earshot or somehow or another gets that information second or third hand is gonna have the ability to leverage $600,000,000 on a short on freaking hyper liquid.

Okay. So there's that. So that that takes care of a lot of the underlings and and the the the possibility that somebody gathered this information out of earshot, which brings me to somebody who could open a $600,000,000 short on hyperliquid. And I'm not I mean, I I have I I was about to say I'm not gonna name names because I I I don't even know where to begin. Some people are posting pictures of Barron Trump. Doubtful, but okay. Maybe. What I'm getting at is that I I do believe that this is some kind of ins insider play.

Now was it on Trump's camp? Well, not necessarily, because people outside of Trump's camp may also somehow or another get information that Trump's about to make some kind of announcement that is going to send markets into a tailspin. But so we don't know. But the chances of this being completely organic is probably zero. Thirty minutes? Are you kidding me? So here's what will be very interesting in my opinion. Will somebody try to figure out who it was? And will they be successful in being able to prove it was that person? And if so, will we find out that that person is deeply connected into the inner chambers of Washington DC policymakers and economists and administrators, you know, the guys that are, like, you know, close to Trump or the upper echelons of the United States government. Because if we do, we have some may somebody should should end up in prison for that one.

[01:02:25] Unknown:

And

[01:02:28] David Bennett:

you gotta remember that it wasn't just the crypto markets and Bitcoin that was affected.

[01:02:34] Unknown:

Everything got wasted. Energy,

[01:02:37] David Bennett:

equities, I don't think the bonds had a very good day, everything sold off. Agriculture was in the toilet, everything was just it was a Black Friday. I mean, it was like somebody is saying that in total, some somewhere around $2,000,000,000,000 with a t, 2,000,000,000,000 of wealth was evaporated over the course of four hours

[01:03:08] Unknown:

because he made a post about putting tariffs back on China. Okay.

[01:03:15] David Bennett:

And somebody, thirty minutes before, opens up a $600,000,000 short on Bitcoin on hyper liquid. I'm I'm sorry, but I got a call bullshit. Somewhere, there is an insider. And this person that opened that short knew something was about to happen and probably knew more than, quote, something was about to happen. Probably knew a lot more. And it was a they made a $192,000,000 in that four hours as $2,000,000,000,000 were being liquidated across all markets around the world. That's this is the kind this also demonstrates the weakness of the markets and not not because there's it's not because the the markets are weak because, I don't know, trading goes down or there's not enough throughput on the Internet. That's not what I'm talking about. I'm not talking about infrastructure.

I'm talking about structurally weak. And it also does not help that people around the world have almost no clue where to put their money. And this is the kind of crap that demonstrates just how deeply the idea of I don't know where to put my money to keep it safe runs throughout the world. Everybody is affected by the government's printing money because it's done the same damage everywhere in the world. Nobody is safe. Oh, well, it's just The United States printing money. Yeah. That affects everybody. It affects Canada. It affects the countries that aren't printing their own money, which are few, if any.

But even if those countries aren't printing as much of their own currency as The United States is printing of ours and China's, you know, not exactly not printing their money, it demonstrates just how powerful our decision making over here is. And the fact that two or three sentences on a social media platform can evaporate $2,000,000,000,000 of wealth in four hours should demonstrate just how structurally weak everything is. And the question remains, where do you put your money? I put my money in Bitcoin. I'll see you on the other side.

[01:05:37] Unknown:

This has been Bitcoin, and and I'm your host, David Bennett. I hope you enjoyed today's episode and hope to see you again real soon. Have a

[01:05:50] David Bennett:

great

[01:05:53] Unknown:

day.

Opening, agenda, and market carnage preview

Bitcoin Core v30 released; host’s upgrade stance

Markets snapshot: commodities, metals, equities, Bitcoin metrics

Legal and node-ops concerns; pruned nodes as mitigation

Was the massive short insider-informed? Systemic fragility and closing