Topics for today:

- Real World Assets Takes Weird Turn

- Hong Kong Salivates over Impending Stablecoin

- Ego Death Raises $100 Million For Bitcoin Development

- Coin Center's Tornado Cash Appeal Closed

Circle P:

Peony LaneWine

nostr: https://primal.net/BenJustman

Twitter: https://x.com/BenJustman

Website: https://www.peonylanewine.com/bitcoin

Articles:

https://decrypt.co/329005/evil-proposal-sell-gaza-land-via-crypto-tokens-backlashhttps://www.coindesk.com/policy/2025/07/08/over-40-firms-prepping-for-hong-kong-stablecoin-license-applications-report

https://bitcoinmagazine.com/news/u-s-court-brings-coin-centers-tornado-cash-appeal-to-a-close

https://atlas21.com/ego-death-capital-raises-100-million-to-fund-bitcoin-startups/

- https://www.cnbc.com/futures-and-commodities/

- https://dashboard.clarkmoody.com/

- https://mempool.space/

- https://www.bitcoinandshow.com/

- https://fountain.fm/show/eK5XaSb3UaLRavU3lYrI

https://atlas21.com/bbva-launches-bitcoin-and-ether-trading-for-retail-clients/

https://bitcoinmagazine.com/news/nakiki-se-to-become-first-german-public-company-with-pure-bitcoin-treasury-strategy

Find the Bitcoin And Podcast on every podcast app here

https://episodes.fm/1438789088

Find the Bitcoin And Podcast on every podcast app here:

https://episodes.fm/1438789088

Find me on nostr

npub1vwymuey3u7mf860ndrkw3r7dz30s0srg6tqmhtjzg7umtm6rn5eq2qzugd (npub)

6389be6491e7b693e9f368ece88fcd145f07c068d2c1bbae4247b9b5ef439d32 (Hex)

Twitter:

https://twitter.com/DavidB84567

StackerNews:

stacker.news/NunyaBidness

Podcasting 2.0:

fountain.fm/show/eK5XaSb3UaLRavU3lYrI

Apple Podcasts:

tinyurl.com/unm35bjh

Mastodon:

https://noauthority.social/@NunyaBidness

Support Bitcoin And . . . on Patreon:

patreon.com/BitcoinAndPodcast

Find Lightning Network Channel partners here:

https://t.me/+bj-7w_ePsANlOGEx (Nodestrich)

https://t.me/plebnet (Plebnet)

Music by:

Flutey Funk Kevin MacLeod (incompetech.com)

Licensed under Creative Commons: By Attribution 3.0 License

creativecommons.org/licenses/by/3.0/

It is 08:15AM Pacific Daylight Time. It is the July 2025. This is episode eleven twenty nine of Bitcoin and land for sale. It's on the blockchain, and then we're gonna talk a little bit about this. Asia is going apeshit for stablecoins because Hong Kong is about to open up for that, So we'll talk about it. And then the Tornado Cash appeal from Coin Center has been brought to a close. And if you think that's gonna be good news for our boys of Tornado Cash, well, you'd be wrong. Ego Death Capital has raised a boatload of money to do things and reach for stuff. Then we're gonna talk about Meta Planet. No. I'm not gonna talk about how they bought more Bitcoin.

They're doing something else. I believe that we're entering phase two of Bitcoin treasury companies. I'm specifically talking about the evolution of a company that has already become a treasury company starting to morph into a maybe a final form. Think of a butterfly. You know, it starts out as an ugly little caterpillar and then it metamorphizes into something beautiful and swan like. Right? Well, maybe, maybe not. But Spanish bank BBVA is launching some trading for its retail clients, and Nakiki is gonna be a German company. They're they wanna go pure.

They're gonna do it purely. We'll we'll we'll get into that one. Okay. So land on the blockchain. We've talked about it for a long time on this show. It's stupid. It's very stupid. But I never thought I'd hear anything more stupid than what I'm about to read. Let's just do it. Oh, and by the way, some of you guys out there might get triggered. Remember, I am not passing judgment. I am the weather guy. It it's either raining or it's not. It there's either a tornado or there isn't. There's either a hurricane or there's not. Right? I'm not saying any of this is good. I'm not saying any of it's bad.

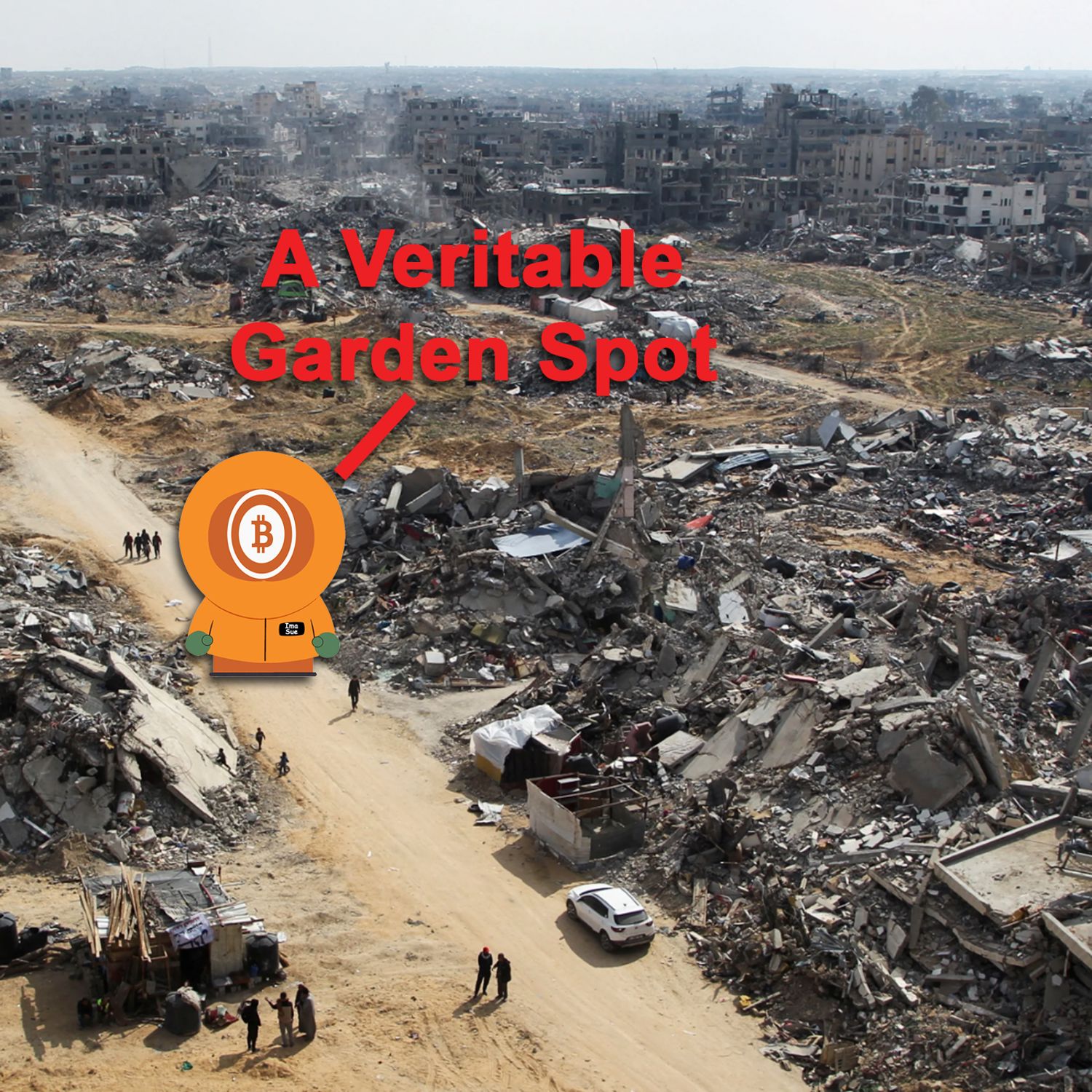

Personally, I think this whole thing is is stupid simply because of the mechanism, but the underlying morals and ethics of what I'm about to get into could possibly trigger the living AF out of you. So just be prepared and and remember, don't stone the messenger. Evil proposal to sell Gaza land via crypto tokens has been met with backlash. Ryan Gladwin from Decrypt starts us out this morning. The Tony Blair Institute helped form a plan that proposed selling land in Gaza via blockchain tokens according to the Financial Times after paying Palestinians to leave their land.

The tokenization project would have also seen the region rebuilt with Dubai style artificial islands and blockchain trade initiatives complete with Elon Musk and Donald Trump themed areas. I'm I'm telling you this is just even I mean, I don't hate either of these guys. I'm I'm not a hater of Tony Blair, Elon Musk, or Donald Trump. I don't trust them, but it doesn't mean I hate them. But this sounds like a theme park. Donald Trump land, the the Musk of the future land. I'm just like it's like fucking Disneyland, guys. The report was met with major uproar from Palestinian activists, one of whom described the proposed plan to decrypt as not just grotesque, but evil.

A slide deck titled The Great Trust was developed by the Boston Consulting Group. The Financial Times reported on Sunday with participation from two staff members from the Tony Blair Institute, an organization founded by the former UK prime minister. It was shared with the Trump administration according to the Financial Times, which echoed similar sentiments back in February. The deck, the slide deck, suggested paying half a million Palestinians to leave Gaza to attract private investors to redevelop the area following Israel's or sorry. Israel's bombings.

It proposed, excuse me, that the public land in Gaza be put into a trust and then sold via digital tokens traded on the blockchain. Gazans could add their private land into the trust in return for a token that would give them the right to a housing unit. Quote, the process referenced is a common one in real world assets, Chris Yin, cofounder and CEO of RWA project Plume Network explained to Decrypt, quote, the title for the land is put into a special vehicle that only does one thing. In this case, a trust that holds the title. Then the shares that represent ownership in that trust are tokenized and minted on a blockchain.

As a result, Sam Muti, cofounder and CEO of tokenization project Savia, said to decrypt that land in Gaza would become an international investment opportunity with tokens possibly traded on centralized exchanges. But while the plan showcases a type of real world asset tokenization that is increasingly being adopted by other projects, the proposal has been met with severe backlash by Palestinian advocates who see it as disturbing and opportunistic amid the recent violence. Quote, those fucking monsters want to steal all Palestinian land and sell it back to them, said Paul Bigger, founder of Tech for Palestine.

One source told the Feet that the people of Gaza will be incentivized to leave, predicting via a BCG, that's that Boston group, the Boston Consulting Group, via a BCG financial model that 25% of Palestinians would vacate the region. BCG calculated that relocating Palestinians outside of Gaza would be cheaper than providing support to them while reconstructing the area. Palestinians want to live in their home. That is the simple truth at the heart of this, doctor Ashok Kumar, associate professor of political economy at the Birkbeck Business School, told Decrypt, he suggested that Israel's siege on Gaza has been designed to make life so unbearable for the survivors that they are forced to choose exile.

The Tony Blair Institute and the Boston Consulting Group did not respond to request for comment. Both have distanced themselves from the proposal and comments to the Feet, Financial Times, with the Tony Blair Institute claiming limited participation and BCG saying its leadership was misled about the scope of the project. The deck also includes the construction of world class resorts called the, quote, Gaza, Trump, Riviera, and Islands, end quote, as well as an industrial area called the Elon Musk Smart Manufacturing Zone.

I'm telling you, man, this just smells like Disneyland. In February, president Trump proposed that Gaza could be reconstructed under United States rules as the, quote, Riviera Of The Middle East, a claim that now echoes the plans outlined in the now leaked deck. The deck also proposes a man made coastline similar to Dubai with blockchain based trade initiatives, whatever the fuck that means. Moody explained that this could mean a Gaza stablecoin or processing the region's trade on the blockchain to reduce paperwork. Yin suggested this could mean a crypto friendly environment akin to Dubai to stimulate blockchain activity in the region. But Palestinian supporters aren't buying the pitch, you think? Quote, like vultures circling a dying body, men like Tony Blair, multimillionaire, war criminal, profiteer, prepare to swoop in and make millions from the rubble buying up the land from which its people were driven. This is not just grotesque, it is evil, said doctor Kumar.

Quote, the lives of the people in their homes are worth less than dollars to them. Loopify, pseudonymous game developer and founder of charity Crypto Gaza, told Decrypt. Morals aside, experts believe that the DEX tokenization goals are too lofty even for the most simplistic of cases, let alone one of the most complex regions in the world. Quote, frankly, the gap between the deck briefly alludes to two and what is technically illegally possible is so vast, Moondy finished, quote, implementing commercial scale real estate land tokenization is probably still two to three years away, and that would be for small, straight forward use cases, not massive war ridden plots of land in a politically and geographically contested country, end quote.

I I honestly I have It's very rare that I run into a news story that just makes my skin crawl. And, again, you'd what whatever side any of you guys are on out there, I'm trying to be as neutral as I can. Right? But there there are facts on the ground, and then there is what people think should have happened and a whole other group of people that think something else should have happened. I'm I'm not getting into that. What I what I am just saying is that The United States and Western Europe, generally speaking, kinda has a history of what's known as rubbleization, where we either pound something into the sand so hard or, through inaction or even possible help, allowed to cause the complete destruction of land so that it can be built back up by people like Halliburton.

This is it's not tinfoil hat theory. This shit happens. The minute Trump started talking about this stuff, I was, like, going, oh my god. It's probably gonna happen. Now it will be tokenized. That that's a different story. Let's just let's just center on the the problem at hand. Gaza's completely destroyed. It's completely destroyed. From one end of it to the other, it's completely destroyed. It's been almost completely functionally rubbleized. It's got all the rubble's gotta be moved out, and then everything gets rebuilt. And who do you think is gonna rebuild it? It's gonna be people like Halliburton.

Yes. I know they're an oil services company, but they've been so knee deep in The Middle East for so long. They are probably the pinnacle of construction companies at this point in The Middle East. I it's it's weird to say that because I remember when I was a kid in the oil patch in Midland, Texas, and I would I was on Halliburton trucks with my dad in in the logging trucks, looking at the logs as they were sending tools down the hole to do X-ray diffraction and all the stuff that you did at for oil wells. That's where I got introduced to people like Schlumberger and Halliburton and Western and all those companies. Right? And Halliburton was right I mean, they did fracking. They did, they did downhole log tool logging. They did all kinds of all kinds of stuff. And then all of a sudden, we start meddling really hard core in The Middle East, in debt I believe it all began with Desert Shield under George Bush the first.

Since that time, Halliburton has basically been serving lunches and building buildings in The Middle East everywhere we go because there's always rubble to be moved and buildings to be built, and we always have basically the US army kind of backing everything up. It's it's sad. And, again, there are there are arguments on both sides of the fence. You know? I mean, breaking through the wall and attack you know, putting boots on the ground inside of Israel was not the best move that Hamas could have made, and it definitely screwed up the Palestinians. A continued and and sustained bombing campaign like what Israel has done to Palestine is probably not a good move either.

I don't think there's any winners or any losers in this. Right? I mean, as far as who's right and who's wrong. But the fact remains. Gaza is destroyed. It's probably going to be rebuilt at the hands of The United States and Western Europe. The Palestinians will probably be moved or the great guts and feathers of them will probably be moved somewhere else, and nobody's ever even talked about where, where are you gonna relocate these people? Their land I'm sorry, but their their land is gone. Now the tokenization aspect of all this is fucking stupid.

You cannot tokenize real world assets. It's impossible. Let's but but well, I could put my I could put my, oh, oh, My title of my land on the blockchain. So what? Your tie right now, the title to your land or the title to your house or the deed or whatever you wanna call it, it's already at the county courthouse on paper in a filing cabinet. Do you think that stops men with guns from taking your land if they want your land? No. It doesn't. Look what happened to the look what happened to the Palestinians. Their land is gone. It's not coming back.

Gaza's done. It's now it's functionally gonna be Israel. I mean, again, I'm not making a moral judgment, and I'm just call I'm just calling balls and strikes here. Their land was probably technically owned, like the homeowners in Gaza probably had pieces of paper at various courthouses or places that you file important paperwork. And it did not matter. It did not stop bombers coming over and rebelizing shit. It did not stop missiles coming in and rebelizing shit. It's not going to stop all the rubble being taken away and brand new buildings being built. It's the whole thing is a mess, but the whole fact that there's this group of people that want to tokenize this should show you one of the reasons why hardcore maximalist Bitcoiners absolutely cannot fucking stand tokenizing real world assets.

It causes the worst of people to come out. Again, no matter what you think about what happened on either side of the Palestinian or the Israel side, the tokenization of land that's being taken from a people by a group of people that do not even live there is it's just this goes on and on and on. The imperialism has never left us, and is just causing all manner of problems. Don't get fooled into believing that your shit's safe because it's on a blockchain. You cannot tokenize real world assets. Onto Hong Kong, who whose land was also taken by China. Okay. They had a lease. I get it. Whatever. But over 40, count them, four zero firms are prepping for the Hong Kong stablecoin license applications when they come out. Sam Reynolds out of CoinDesk. Hong Kong's stablecoin licensing regime is set to begin soon, August, and it's drawing significant interest from the region's financial and tech heavyweights with local media in China reporting that over 40 applications have already been received, but expectations are being tempered by the reality that the Hong Kong Monetary Authority is likely to approve only a single digit number of licenses according to reports.

Despite the rush of interest, only three firms have been admitted to the HKMA's stablecoin sandbox so far including a joint venture between Standard Chartered and Animoca Brands. According to an HKMI MA fact sheet, the sandbox was created to allow companies with a genuine and well developed plan for issuing fiat referenced stablecoins to engage with regulators, refine compliance models, and offer feedback on proposed rules. Admission is not an endorsement or guarantee of licensing, and Sandbox participants will still need to apply formally once the full regime is live. However, the limited number of firms accepted into the testing phase offers an early look at how narrow the approval funnel may be.

Most of the firms preparing to apply are among China's largest banks, payment processors, and Internet companies according to reports. Standard Charters Chartereds joint venture, jd.com, which I talked about a couple of shows ago, Blockchain division, and Ant Group's digital finance units are all expected to be contenders with Standard Chartered and JD already sandbox participants. And the HKMA's cautious approach seems to be consistent with how the Securities and Futures Commission has handled virtual asset platforms granting only 11 licenses so far.

During the SFC licensing process for virtual asset platforms, a number of high profile contenders withdrew their applications, and reports at the time indicated that the regulator discovered, quote, unsatisfactory practices at some exchanges. Eye watering amount of interest in stablecoins in China at this point. I don't think the digital yuan is going to last very long. Stablecoins, you love them or you hate them, or you're completely neutral on them. Either way, they're here, and there's nothing anybody's gonna do about it. What we're looking at is a new arms race when it comes to debt instrumentation monetization technology because, honestly, that's all stablecoins are going to end up being. It is a stopgap between the fiat system that we are moving away from and the Bitcoin future that we can see just on the horizon.

But instead of transitioning directly from fiat to Bitcoin, there's gonna be an entire epoch of stablecoin. And it's going to be abused. It's going to be used to print and then monetize immediately debt instrumentation from not only The United States, but every developed country in the world. We are going to flood the rest of the world with paper money in the form of stablecoin, and everybody's gonna go, thank you. Thank you for giving me that stablecoin. It's not a good deal. Okay? It's it's not gonna be a good deal. It's it's going to have long lasting and deleterious effects on the world's poorest nations, And there's not a damn thing we can do about it.

Moving over to The United States, a US court has brought CoinCenter's tornado cash appeal to a close. Frank Korva writing this one for Bitcoin Magazine. On 07/03/2025, the United States Court of Appeals for the Eleventh Circuit agreed to end an appeal that crypto advocacy group, Coin Center, made to OFAC regarding the Ethereum based mixing service, Tornado Cash. This decision by the court occurred approximately two and one half months after the United States Treasury Department removed Tornado Cash from its OFAC sanctions list after having kept it on the list for over three years. The dismissal of this case officially ends Coin Center's challenging OFAC's decision to include Tornado Cash on its sanctions list.

Peter Van Valkenburg, executive director at Coin Center, commented on X earlier today that the government did not want to continue to defend an interpretation of sanctions laws that seemed too broad. This appeal being dropped comes in the wake of a memo from The United States Deputy Attorney General Todd Blanch in which he stated that the U. S. Department of Justice will no longer target crypto technologies like mixers. Despite the fact that this appeal has been dropped and that Tornado Cash is no longer on the OFAC sanctions list, The creators of the technology are still facing criminal charges.

Tornado Cash cofounder and developer Roman Storm is scheduled to appear in federal court in the Southern District Of New York on Monday, July 2025. Storm is currently facing money laundering and sanctions violations charges, though he has affirmed that he did not profit from illicit transactions that were made through tornado cash. In September of this year, Storm's lawyer submitted a motion to dismiss the charges stating that Tornado Cash did not meet the definition of a money transmitter under the Bank Secrecy Act because the technology does not take control of user funds. The court denied the motion, though, stating that the BSA's scope does not require that the technology take control of users' funds.

Jesus. Alex Pertsev, another Tornado Cash cofounder, was found guilty of money laundering in The Netherlands in May of twenty twenty four and was sentenced to five years in prison. Remember that we also have Roman Semenov, the third Tornado Cash cofounder. He's been at large and wanted by the FBI since August of twenty twenty three. The US Department of Justice plans to bring Semenov up on the same charges as Storm. So there you go. It doesn't matter at this point. This this is like the rebelization of Gaza. It's the we just the United States Department of Justice and SEC and everybody that anything connected to the Biden administration just fucking carpet bombed crypto land into a rebelized state. Of course, the only thing that really came out was, you know, was Bitcoin.

But the collateral damage here is these three developers of tornado cash. This is ridiculous. It doesn't matter that we that the same people that rubbleize the crypto landscape is sitting there going, you know what? Tornado cash doesn't really have anything to do with any of this. Still, the Southern District Of New York is refusing to give up. They're like a dog with a bone. After all that, you might want to kick back with a glass of red wine. Go to peonylainewine.com. That's right. Peony Lane Wine. My good friend, Ben Justman at Peony Lane Vineyards. I love the way that he goes about doing his wine. It's high altitude wine.

He's at five 5,680 feet in altitude. It's the highest elevation natural wine in North America. He emphasizes minimal intervention, sustainable practices, organic farming. It all results in unique flavors, a healthier, more authentic product. He's a second generation family owned vineyard for God's sakes. They really do care about things like soil and root health of their vineyard. All of this works together. Ben Ben gets it. I think Ben is more of a soil nerd than he actually is a wine nerd, but that's one of these days we'll all talk be able to talk to Ben face to face and find out if he really is a soil nerd. Anyway, the the whole point is is that with a healthy ecosystem that he's growing his wines in, you get a lot of biodiversity, and that includes the actual yeast that's ambient that helps ferment the actual wine. It doesn't seem to me like he's reaching out to, you know, w yeast labs or some other liquid culture labs that that will provide a pure strain of whatever yeast you're trying to do. It's like sort of like beer, you know, brewing beer. I can get all kinds of different beer beer yeast.

This dude uses the ambient yeast, and when you have a healthy ecosystem, the yeast in your ecosystem is healthy as well. And that's what he uses. And if you've got problem with sulfites, dude, all grapes have a little bit of sulfite in it. And Ben only adds the the minimal amount of sulfites just to stabilize the wine. There's nothing else in there but grapes and water. That's it, man. Actually, I don't even think it puts water in it. I think it's just all pure grape juice. I'm not a vendor, so I don't I don't really know. I don't I'm actually pretty sure they don't add any water whatsoever. It's just pressed grape juice fermented from the natural healthy yeast on his healthy ecosystem of a second generation vineyard. If you want to buy his wine, you can buy it in Bitcoin because if you're not selling into Bitcoin, you're not in the circle p. That's where I bring plebs just like you with goods and services to plebs just like you who might want to actually purchase those goods and services, and you can purchase it with Bitcoin at peonylanewine.com.

That's pe0nylanewine.com. Pandelanewine.com. Make sure that you in your if when you buy wine using Bitcoin may or even if you don't use Bitcoin, make sure that you tell them in the notes section of the invoice, I heard about it on Bitcoin and Bitcoin and all one word. No. You don't get a discount, but it does let Ben know that I made a sale for him, and then he can assess whether or not it was a good sale and it was worth something. And if it is, he gets me back on the other end via Satoshi's. It's a value for value advertising model, and you're not gonna find it in any other Bitcoin podcast. In fact, you're not gonna find it anywhere. I invented it.

Now to Ego Death because my ego was getting a little ahead of me. Ego Death Capital raises a $100,000,000 to fund Bitcoin startups. This is out of Atlas twenty one. And according to Axios, Ego Death Capital has announced a $100,000,000 raise for its second fund, and this one is dedicated exclusively to supporting software startups building on the Bitcoin protocol. The fund will focus on startups generating actual revenue and actual cash flow often directly in Bitcoin, founding partner, Niko Lechuaga, stated that the goal is to invest in real businesses solving real world problems.

The fund targets companies earning between 1,000,000 and $3,000,000 in revenue where growth is limited more by available capital than by market demand. While the primary focus will be on series a rounds, a small allocation is reserved for high potential early stage seed investments. Reportedly, the fund's investors are primarily family offices already exposed to Bitcoin and eager to see the economy surrounding the asset expand. Ego Death Capital has outlined a clear strategy for investments. The firm will deliberately avoid hardware startups, Bitcoin mining companies, or infrastructure ventures, choosing instead to focus exclusively on scalable software businesses.

Among the fund's recent investment are Roxom, a native Bitcoin exchange, Relay, a Bitcoin trading app, and Breeze, a lightning network based payment wallet. Lechuaga commented, quote, we see Bitcoin as the only decentralized and secure base to be able to build on. So there you go. Ego death firmly planted in the development of Bitcoin software. There you go. Alright. Let's run the numbers Futures and commodities. West Texas Intermediate is up point 4% to $68.21. Brent North Sea Oil is up point 62% to just over $70 a barrel. Natural gas down one and a third, $3.36 per thousand cubic feet, and gasoline is up 1.6% to $2.18 a gallon. Shiny metal rocks having a bad day, and gold leads the pack 1.12% of the downside.

Oh, 33.05 and 2 dimes. Man, it's Peter Schiff is probably not happy today. Silver is down point 8%. Platinum is down a half. Copper is down point 44%. Palladium is in the green, but crab walking sideways. Ag, mostly in the red today. Biggest winner is coffee. 1.58% to the upside. Biggest loser today looks to be chocolate. Point 9% of the downside. Meanwhile, live cattle up one and a half percent. Whoop de doo. Lean hogs down a quarter and feeder cattle are up just over one point. The Dow is down a quarter of a point. S and P is crab walking sideways in the red, and the Nasdaq is as well. However, the S and P Mini finding some gains point 5% to the upside.

Bitcoin chilling out. $108,380 per coin. That is a $2,160,000,000,000 market cap, and we can purchase 32.8 ounces of shiny metal rocks with our one Bitcoin of which there are 19,889,194.58 of, and average fees per block are at 0.04 BTC. So that's sort of mid range and has been for more than a few months. There's six blocks carrying 12,800 unconfirmed transactions waiting to clear. High priority rates get you in at four as does low priority. Now, what are we looking at in mining? It looks like mining is coming back up. We are now we're after the dip due to heavy heat and the floods in Texas, 898.8 exahashes per second. So we are seem to be coming back up.

I don't know. We'll we'll we'll have to see if it lasts. From Musk's Bitcoin redo, it was episode eleven twenty eight of Bitcoin, and I got man, dude, I got, like, nothing in the way of donations on this one. Must have been a bad show. Psyduck with seven twenty eight says Psyduck. Yodel with five eleven says screw Musk. Pies with a hundred says thank you sir, bit chat sounds interesting. Yeah. Apparently there's okay. So somehow a meme was born out of bit chat and it's turned into at bitch or bitch at. I don't ask how. Maybe because bit chat sounds a lot like bitch at. I I guess that's how it formed, but even even Jack Dorsey himself is the creator of bit chat is, well, he's promulgating and propagating that meme, and it's kinda funny.

I approve. That's the weather report. Welcome to part two of the news. You can use Meta Planet Eye's digital bank acquisition in phase two of its Bitcoin strategy. I'm telling you, you're gonna start seeing the metamorphosis of these companies into approaching at least they're going to approach what will ultimately be their final form. Amen. Hakshanis has this one for Cointelegraph. Japanese firm, Meta Planet, plans to eventually use its Bitcoin reserves to acquire cash generating businesses, possibly including a digital bank in Japan. In a recent interview with the Financial Times, CEO Simon Gurovich said that the company is racing to accumulate as much Bitcoin as possible before turning its holdings into leverage for expansion.

Quote, we think of it as a Bitcoin gold rush, Gurovich said. We need we need to accumulate as much Bitcoin as we can to get to a point where we've reached escape velocity and it just makes it very difficult for others to catch up, end quote. The Tokyo listed firm, originally a hotel operator, in case you forgot, started accumulating Bitcoin as a hedge against inflation back in 2024. It currently holds 15,555 Bitcoin and aims to boost that figure to over 20 I'm sorry, 210,000 by 2027, which is 1% of all the Bitcoin that will ever exist. Phase two of Meta Planet's plan involves using Bitcoin as collateral to access financing similar to securities or government bonds. Quote, we'll get cash that we can use to buy profitable businesses, Gurevich said. It's what happens when your own business isn't profitable. You luck into making a fuck ton of money and all of a sudden you go, maybe we should get into something that actually has a revenue stream. I'm just saying it's probably a good idea. Gurevich said Metaplan its future acquisitions would ideally align with its strategy.

So, quote, maybe it is acquiring a digital bank in Japan and providing digital banking services that are superior to the services that retail is now getting, end quote. While crypto backed lending remains rare in traditional banking, Some institutions are beginning to explore it. In April, Standard Chartered and OKX launched a pilot program allowing institutions to use crypto and tokenize money market funds as collateral. Gurvich ruled out issuing convertible debt. Interesting, but is open to preferred shares to fund growth. Quote, I don't wanna have to pay back the money in three, four years' time and have repayments linked to an arbitrary share price.

Hey. He he's actually demonstrating a little bit of common sense here. Again, I'm not a billionaire, so this is probably my thinking is probably what is causing me to not be a billionaire. I I but honestly, this sounds like common sense. On Monday, Meta Planet added 2,204 BTC to its reserves. The latest acquisition brings its total holdings to 15,555. Average purchase price at this point is $99,985 per coin, and Meta Planet stock has climbed over 345% this year. So they wanna buy a bank, and they want to use their Bitcoin, as leverage or rather as collateral to start accessing money to fund purchases of companies.

If you put this together, what happens if they buy a bank first? In my view, what this would allow them to do, if they if they are able to go secure financing through outside banking sources and they are able to get enough money and they buy their own bank, what does that enable them to do? They can collateralize their own Bitcoin at their own bank against whatever fundage is there and then they don't have to actually ask permission. Honestly, if they if it works and they get a bank and that bank actually has a bunch of deposits in it, it's a brilliant move because at that point nobody can tell them no. They won't have to grovel. They'll just self fund.

Now it'll be on the backs of their depositors. That is for that is absolutely for certain, and that means that their depositors, or actually, when you think about it, their creditors could be could be at risk depending on the fluctuations of price in the market. Still though, kind of brilliant. I mean, your own bank, it makes a lot of sense, especially when you're you might actually end up with the bank that, at least in the country of Japan, specializes in allowing people to collateralize their Bitcoin to access financing for purchases of, I don't know, houses, car, investments, building a business, whatever.

They you never know, man. Meta planet may actually transition into the butterfly I was talking about it. At this point, they are at the critical phase, like, because they're going right in between phase one and phase two. This is where a company becomes the most vulnerable. They're just like the caterpillar that turns into the chrysalis. Right? I hope they hide themselves well. I hope they found themselves some good cover against rainstorms and windstorms and predators because the chrysalis stage is a very vulnerable stage going between caterpillar or phase one and butterfly phase two.

Spain. I hear they have good food in Spain. BBVA launches Bitcoin and Shitcoin number one trading for retail clients. This is out of Atlas twenty one. Spanish bank BBVA has officially launched trading and custody services for Bitcoin for retail customers in Spain. They say another another shitcoin, but I'm not going to say its name because I'm just sick of seeing this thing still alive and people taking it seriously. The new initiative allows all adult clients put I mean, what are we at a strip club? Okay. Allows all adult clients to access these services through the bank's mobile app. The banking group has chosen to maintain full control over the custody of digital assets, opting not to rely on third party providers to manage customer funds. BBVA is one of the very first people to do this, ladies and gentlemen.

Almost everybody that you see that's taking custody of Bitcoin, at least in The United States and and the West, all rely on third party custodians. This is actually the first time I've heard of an institution, especially at this scale, holding their own keys. This is good. BBVA's implementation of trading and custody services complies with the European Union's marketing crypto assets or MICA regulations. The service launch was preceded by the submission of an application to the National Securities Market Commission in March. BBVA had already tested similar services in Switzerland and Turkey through its subsidiaries in both 2021 and 2023 respectively.

Spain now becomes the third market for these services, but the first where the offering is directly aimed at retail clients without any intermediaries. Gonzalo Rodriguez, head of retail banking at BBVA in Spain, stated, quote, we want to make it easier for our retail customers in Spain to invest in crypto assets through a simple and easy to access digital solution on their cell phone. Francisco Maroto, head of digital assets at BBVA, announced future expansion plans, including the addition of new cryptocurrencies, stable coins, and tokenized real world assets such as bonds and ETFs.

And you know what I'm going to say about tokenized real world assets. It's bullcrap. BBVA is not the only financial institution embracing Bitcoin and cryptocurrencies. Banks like JPMorgan Chase and Standard Chartered have already integrated digital asset services offering trading and custody solutions to their own clients. So, again, BBVA, biggest bank in Spain, I think. It's it's actually the I think it's the largest bank in Spain holding their own Bitcoin. I I I kinda can't iterate how important that is that we're starting to see the comfort level of self custody at the institutional scale start to raise its head. I I I think it's really important for us to note that again, we are passing a gate. We are going from phase one of everything.

We are starting to look at what's going on in phase two. We're starting to see it on the horizon. We this is a critical time for everybody that has anything to do with Bitcoin. We have now we are firmly in the middle of the most critical time. I'm just saying. Okay, to finish us off, I got Bitcoin Magazine's Oscar Zarraga Perez, Nakiki SE, to become first German public company with a pure Bitcoin Treasury strategy. Let's see what pure actually means. Today, Nakiki SE announced plans to fully adopt a Bitcoin Treasury strategy aiming to become Germany's first publicly listed company to pursue a Bitcoin only Treasury Reserve Asset business plan similar to Michael Saylor's strategy.

The company will propose a name change and a revised business purpose at its annual general meeting in the second half of twenty twenty five. Nakiki SE is also in discussions with key investors to raise capital through share issuances to fund its Bitcoin acquisition. Quote, the course for building a Bitcoin portfolio was set today following discussions with potential investors placing banks and Bitcoin experts, the announcement stated. Nakiki's SE's announcement follows a growing trend among German companies specifically embracing Bitcoin as a treasury asset. One notable example is Evertz Pharma, GmbH, a private company focused on premium natural cosmetics, which made headlines earlier this year by becoming the first private German company to announce that it had implemented a strategic Bitcoin reserve.

It is important to note that Bitcoin Group SE is also another publicly traded company in Germany that holds direct Bitcoin on its balance sheet, but is not actively running the same Bitcoin treasury strategy that Michael Saylor's strategy has made so popular. This is where Nikiki SE is attempting to differentiate itself by becoming the first publicly traded company in the country to solely focus on this new business strategy. Quote, our mission is to promote natural beauty on a scientific foundation, said the managing director of Evarts Pharma GmbH, Dominic Evarts.

Quote, the same future focused mindset shapes our financial strategy. Bitcoin, as a scarce and globally tradable asset, complements our reserves and strengthens the long term resilience of our company, end quote. The adoption of a Bitcoin treasury reserve asset has dramatically increased over the course of the last year, expanding globally. To date, there are 256 companies and other entities with Bitcoin on their balance sheets, and then they talk a lot about strategy, and I don't think we need to get into any more about strategy. We all know about Michael Saylor's strategy.

But this publicly public company that is just going all in on Bitcoin is interesting. However, it should be noted they have not bought any Bitcoin yet, or at least not according to anything that I have seen. They're talking about it. They're planning to do it. They're gonna have a meeting about it, but they haven't done it yet. I think that that's also just as important to note. So that is the end of the news for the day. I will not bend your air any longer. I will see you on the other side. This has been Bitcoin, and and I am your host, David Bennett. I hope you enjoyed today's episode and hope to see you again real soon. Have a great day.

Introduction and Episode Overview

Asia's Stablecoin Surge

Tornado Cash Appeal Update

Ego Death Capital's Ambitious Fundraising

The Evolution of Bitcoin Treasury Companies