Topics for today:

- New Hampshire Wins BTC Derby

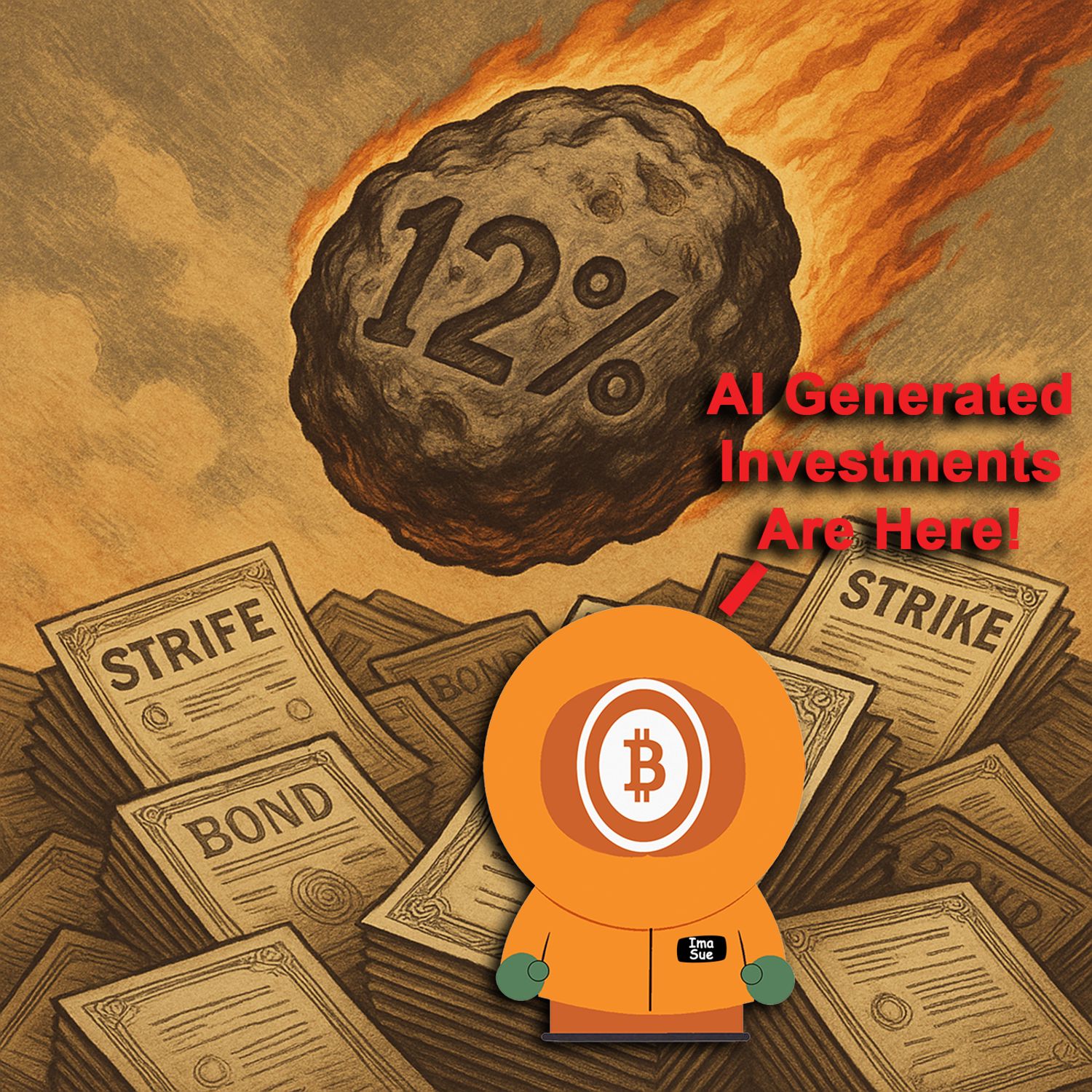

- Strike Loans at 12-13% APRs

- Strategy Used AI to Create Debt Instruments

- Trump Stable up 1500% in 48 Hours

Circle P:

https://ditto.pub/@shishi@nostrplebs.com (faster)email: shishi21m@protonmail.com (slower)

Product: Comfrey

One full root for 20$

Or root cutting for 1$ each

Buyer pays shipping

All about comfrey: https://fountain.fm/episode/15491737864

Articles:

https://cointelegraph.com/news/new-hampshire-bitcoin-reserve-lawhttps://cointelegraph.com/news/diversified-energy-crypto-mine-abandonment-pennsylvania

https://bitcoinmagazine.com/news/jack-mallers-strike-launches-bitcoin-backed-loans-for-eligible-u-s-customers

https://decrypt.co/318186/strategy-ai-michael-saylor-bitcoin-empire-chatbot

- https://www.cnbc.com/futures-and-commodities/

- https://dashboard.clarkmoody.com/

- https://mempool.space/

- https://www.bitcoinandshow.com/

- https://fountain.fm/show/eK5XaSb3UaLRavU3lYrI

https://cointelegraph.com/news/trump-backed-usd1-is-now-the-seventh-largest-stablecoin-worldwide

https://www.coindesk.com/business/2025/05/07/revolut-to-roll-out-bitcoin-lightning-payments-for-europe-users-through-lightspark

https://decrypt.co/318289/metaplanet-buys-bitcoin-easing-us-china-trade-tensions

https://bitcoinmagazine.com/news/thumzup-media-ups-shelf-to-500m-to-fuel-bitcoin-treasury-push

Find the Bitcoin And Podcast on every podcast app here

https://episodes.fm/1438789088

Find the Bitcoin And Podcast on every podcast app here:

https://episodes.fm/1438789088

Find me on nostr

npub1vwymuey3u7mf860ndrkw3r7dz30s0srg6tqmhtjzg7umtm6rn5eq2qzugd (npub)

6389be6491e7b693e9f368ece88fcd145f07c068d2c1bbae4247b9b5ef439d32 (Hex)

Twitter:

https://twitter.com/DavidB84567

StackerNews:

stacker.news/NunyaBidness

Podcasting 2.0:

fountain.fm/show/eK5XaSb3UaLRavU3lYrI

Apple Podcasts:

tinyurl.com/unm35bjh

Mastodon:

https://noauthority.social/@NunyaBidness

Support Bitcoin And . . . on Patreon:

patreon.com/BitcoinAndPodcast

Find Lightning Network Channel partners here:

https://t.me/+bj-7w_ePsANlOGEx (Nodestrich)

https://t.me/plebnet (Plebnet)

Music by:

Flutey Funk Kevin MacLeod (incompetech.com)

Licensed under Creative Commons: By Attribution 3.0 License

creativecommons.org/licenses/by/3.0/

It is 08:49AM Pacific Daylight Time. It is the May already 2025 and this is episode ten ninety of Bitcoin, and you're here to get all the news you can use about what's going on in Bitcoin. And we've got several news stories today, some of them happy, some of them neutral, some of them stupid, and we'll get into all of them. But we're gonna begin with one of the happier pieces of news, which actually occurred yesterday. And in yesterday's show, I told you about stupid when the Arizona governor decided that she was going to veto the, strategic Bitcoin reserve bill for her state.

And apparently, one of those bills is still alive. I made a mistake on that. I I said both of them are dead, but one of them is has yet to be acted upon, I guess, by the governor because as far as I knew, both of those, bills had passed all committees, house and senate at the state level. And one of them, the actual one that was specifically set up to start a Bitcoin strategic reserve was vetoed. But New Hampshire seems to have gotten it right because the New Hampshire governor has signed their crypto reserve bill into law, and Turner Wright from Cointelegraph is gonna kick off the day for us with New Hampshire becoming the first US state to allow its government to invest in cryptocurrencies, including Bitcoin, after governor Kelly Ayotte signed a bill passed by the legislature into law.

In a May 6 notice, Ayotte announced on social media that New Hampshire would be permitted to invest in cryptocurrency and precious metals through a bill passed in the state senate and house of representatives. House bill three zero two introduced in New Hampshire in January will allow the state's treasury to use funds to invest in cryptocurrencies with a market capitalization of more than $500,000,000,000, eliminating most tokens and almost all meme coins. Quote, the live free or die state is leading the way in forging the future of commerce and digital assets, said New Hampshire Republicans in a May 6 Twitter post.

With the signing of the bill into law, New Hampshire has become become the first United States state to pass legislation establishing a strategic Bitcoin reserve, including an initiative with the federal government. A similar bill in Arizona passed the state's house in April but was vetoed by governor Katie Hobbs on May. And Florida's government withdrew two crypto reserve bills from consideration on May. The efforts to create crypto reserves in different United States states comes as president Donald Trump and Republican lawmakers propose similar policies at the federal level.

Senator sent the alumnus who sponsored the boosting innovation technology and competitiveness through optimized invested investment nationwide, god, called the Bitcoin Act. It just please stop. Please stop. Please stop with the bullshit marketing at the federal level and state level. I don't need cheap one off crappy ass fiber based marketing schemes from my governments because y'all don't do it well. There's only there's only and I I'm I'm I'm probably gonna get in trouble for saying this, but there was only one government that was ever very, really, really good at propagandizing the living shit out of its population. You wanna know what that government was? Yeah. It was the German government right around before World War two.

It was the only propagandizing campaign that has ever really looked likes coming out of Madison Avenue in New York, which is where all the advertising gurus live. And you know why Madison Avenue is so good at what they do? Because a lot of the propagandist that was captured and or surrendered in the German government came over to The United States. We always talk about Operation Paperclip. And it was a scientist, and that's how we got NASA, and that's how we got our space program and rocketry and and and all kinds of nice airplanes because German engineers had their shit together, and we got a bunch of them. But what's never really talked about is that we also got a bunch of their propagandizing stuff.

Now Goebbels did not make it, but some of his underlings actually did. And a lot of them ended up in Madison Avenue and became advertising guys. And advertising is just another word for propaganda in in a very real way. But it's propaganda when it comes to a government ideal being spread. It's advertising when it's a product and or a service offered by a private company, but the structure is essentially the same. Right? So when I see things like the Bitcoin act and it's like this huge acronym, you know, or it's like Bitcoin is an acronym for this like, let's boosting innovation, technology, and competitiveness through optimized investment nationwide.

What you're you're forcing words in an order that begin with a certain letter to fit a word that your that that everybody already knew knows, and that's that's Bitcoin. Right? This is is I just wish they'd stop. It's not done well. Please, for the love of God, stop doing that stuff. But it's good news that it's going to be New Hampshire that has won the horse race. No other state in The United States is going to be first anymore. At this point, it's a race to be second. And, honestly, what a crappy position to be in for states like Texas. Y'all should have been first.

Y'all should have been first. But, yep, whatever. Crypto miner deserts a Pennsylvania site and fails to plug the wells according to a report. Before I even begin this, I want to make sure that we all understand the timing of this particular report coming out. What was I telling you about yesterday? A series of mainstream media rags, magazines, and television people have picked up on this story about Bitcoin mining causing black lung. Not exactly what it said, but kinda. Because the essentially, there was this report that came out, and it said that Bitcoin miners in Texas somehow or another force other power plants to kick on in in another state.

And when that happens, downwind particulate matter go to another state and get people sick over there. Alright? The through the particulate matter, that's why I picked on black lung. And it's a it's it's a crappy report. It's it's filled with inaccuracies, and it doesn't really actually work. And it's part of a FUD campaign that is seems to me to be very well coordinated as I was talking about with Daniel Batten yesterday because he's been on Twitter trying to combat all this. And I just saw him combating news outlet after news outlet after news outlet that was essentially saying the exact same thing, picking on the exact same thing. And yet, here we have this report, and this is actually if you take it at face value, which I do not and I highly recommend that none of you do as well, is kind of damning. So I have to question the timing considering that we're combating this other FUD piece that's being picked up by every media outlet. But Ahmed Haschonis has this one from Cointelegraph, and it begins.

Cryptocurrency miner Diversified Energy quietly vacated a natural gas powered crypto mining site in Elk County, Pennsylvania, reportedly leaving behind unplugged wells and regulatory violations. The site, known as Longhorn Pad A, was revived in 02/2022 after sitting dormant for nearly a decade when Diversified began using it to fuel on-site generators powering cryptocurrency mining computers according to a report by the Erie Times News. Okay. So the report is from a a quote, unquote news media outlet. Again, I question the timing. Per the report, the operation was launched without obtaining an air quality permit from the Pennsylvania Department of Environmental Protection.

Though the company was later granted the permit in December of twenty twenty three, a March 2025 inspection revealed that Diversified had already removed the mining infrastructure. Empty metallic metallic sheds and missing production equipment led the DEP to issue a formal violation notice for well abandonment. Diversified reportedly denied that the site was abandoned, saying that it may resume gas production. However, the DEP and environmental advocates say the company has failed to meet its obligations. Under a 2021 agreement, Diversified had committed to plugging Longhorn A And 13 other wells at the end of their operational life, an obligation that it has reportedly not fulfilled.

Environmentalists have long raised concerns about Diversified's business model, which involves acquiring aging, low producing wells and extracting remaining value without sufficient plans for decommissioning. Plugging a single well can cost over a hundred thousand dollars, and Pennsylvania already has over 300 excuse me. 350,000 orphaned and abandoned wells, making the stakes particularly high. I gotta pause right there. Yes. Plugging a single well can cost well over a hundred thousand dollars. I get that. But 350,000 orphaned and abandoned wells in Pennsylvania seems like a little high of a number to me.

I I was raised in the oil and gas industry. I mean, it's like that's what my daddy did. I was out on oil fields when I was eight years old. Alright? And 350,000 orphaned and abandoned wells, it that number seems a little high for something like Pennsylvania. And then it says making the stakes particularly high. Well, what the stakes for what? The stakes for the Pennsylvania Department of Environmental Protection or the fact that it costs a hundred thousand dollars to plug a single well, and that's makes the stakes particularly high for diversified. See, the it's it's not clear.

And this is one of the one of the clues, the little pieces of bread the little breadcrumbs of evidence that's left behind that leads me to believe that this just may be a bullshit report that goes along to attach with all the other FUD that's coming out because we see this as a we see this cyclically. Right? Remember the whole Greenpeace USA thing and their green skull of death with the whole, you know, nuclear power plant cooling towers coming out of its head? There was a whole raft of FUD that we had to combat, and then it just went away. And then it comes back, and then it goes away, and then it comes back. And here we are today.

Right? It is a it is a rinse and repeat cycle that is never going to end. So I I have a high suspicion that this particular report is a well timed addition to what's going on with this Guardian report that came out a few days ago that Daniel Batten was talking about. Anyway, a 02/2022 report labeled the company's approach a business model to fail Appalachia, warning that taxpayers could be left footing the bill for thousands of unplugged wells. Okay. Again, did how many well there's 13 wells that Diversified is apparently responsible for according to this particular agreement.

So who's the thousands of unplugged wells? Who who who's responsible for that? Are they are there are there thousands of unplugged wells that have been abandoned by Bitcoin miners or cryptocurrency miners? See, again, another breadcrumb. Diversified recently agreed to plug, oh, here, 3,000 wells by 02/1934 in a separate legal settlement, but continues to face regulatory scrutiny, including a probe by the US House Committee on Energy and Commerce. Well, three thousand doesn't I don't know. Yes. Technically, it's thousands of wells. But when you say thousands of wells, people automatically think 9,000, nine thousand five hundred, eight thousand. But, again, I'm not certain that diversified, if diversified is only a Bitcoin mining structure, I'm not sure that they were going to actually ever use 3,000 separate wellheads, Especially if they had already been abandoned or were in such low production capacity, there's just it just nothing about this actually makes a whole lot of sense.

Again, another another breadcrumb here. Horton Township Officials, where the Longhorn site is located, say they've received no updates from the company. Local supervisor PJ Picarillo told the Erie Times News that generators and tanks were removed without notice. Quote, all we know is that the property seems to have been abandoned. On April, the planning commission of Villanoya hold on. Villanoya, Arkansas unanimously rejected a proposal to establish a cryptocurrency mining facility within the city limits following opposition from residents. And in January, Arkansas lawmakers introduced a bill that would ban crypto mining operations within 30 miles from any US military facility in the state.

The opposition to crypto miners in Arkansas follows a broader trend across US municipalities where crypto mining initiatives have faced increasing scrutiny. And in October of twenty twenty four, a group of residents in Granbury, Texas filed lawsuits against Marathon Digital alleging that its mining facility generated too much noise. Yeah. I I remember that one. Look, guys. That's the end of the article, but there's there's something about what's going on here with Diversified that in this particular media story that it kinda just doesn't make a lot of sense. There's a lot of loose ends here, and it just doesn't make any sense. But timing, the timing of the release of this particular report has me, you know, a little not on edge, but, I I find this dubious. The timing is dubious at best.

Now we're gonna get into the stupid. The yeah. Here. Like, that was stoop that was stupid. No. No. That was neutral. And I hate to say it, but this is stupid. And the reason I hate to say it is because it's strike. Jack Mallers' strike launches Bitcoin backed loans for eligible United States customers. Yeah. I know. I told you about it yesterday. But I also said that I didn't know anything about the loan parameters. Well, now we do, and they kinda freaking suck. Oscar Perez from Bitcoin Magazine. Strike has unveiled one of its most powerful and innovative features to date, Bitcoin backed loans.

For the first time, eligible users in select United States states can borrow cash against their Bitcoin holdings without having to sell their cryptocurrency. This option allows individuals to access liquidity without losing long term exposure to Bitcoin's price appreciation. Okay. So here it is. Buckle up. Here's the here's the parameters. The loans range from a low of $75,000 to a high of $2,000,000, offering flexible terms of up to twelve months. So let's stop right there and talk about this. Do you need a loan for $25,000 and have enough Bitcoin to cover it? Too freaking bad. You're not getting one from strike.

Do you need 35,000, 40 5 thousand? How about $50,000 to do a full renovation on not only your kitchen and your mudroom, but to build a nice outdoor kitchen and porch sitting area outside of your house. The $50,000 would go a long way to do that, wouldn't it? Well, too bad you're not getting it from strike. Unless you are prepared to borrow a minimum of $75,000 you can kiss strike goodbye. And who would want this? Interest rates start at 12% annual percentage rate, APR. 12%. Twelve %. Double digit interest on your $75,000 loan against the most pristine backing you will ever have as collateral.

12%. Strike proudly offers these loans with no origination fees, oh, joy, making the service more attractive compared to many traditional lending options. This launch reflects a growing trend among long term Bitcoin holders. According to blockchain data from April 2025, '60 '3 percent of Bitcoin supply hasn't moved in over a year signaling strong conviction amongst holders. On strike, more than 90% of bitcoin purchases withdrawn to cold storage showing that users tend to view bitcoin as long term investments rather than a short term trade and many of these holders are unwilling to sell their bitcoin due to its strong performance history and now with Stripe's new loan offering, they won't need to. No. They just need to pony up a $75,000 loan at 12% interest.

12% interest. Do the math. Think of a hundred thousand dollar loan. 12%. In a year, I'm going to owe $12,000 on that. No. Actually, yeah. 12 yeah. Year yeah. $12,000. That that that's that's not good. That's not a good that these are not good. This is no good. It's a it's it's a shitty product. Strike is also introducing Bitcoin backed loans for businesses with amounts ranging from, oh, here you go, $10,000 to $2,000,000. That's probably a typo. It's probably a hundred thousand dollars, but let's say it's 10. Business owners will benefit from the same competitive rates, flexible terms, and straightforward application process. This move opens up new opportunities for small and medium sized enterprises to obtain working capital without needing to liquidate Bitcoin held on their balance sheet.

In addition, Stripe offers flexible repayment options. Borrowers can repay monthly or make a lump sum payment at maturity. Users can also adjust their loan to value ratio by adding more collateral if needed, reducing the risk of liquidation during volatile market conditions. The process is both simple and secure. Borrowers post Bitcoin as collateral, receive cash in their accounts, and manage the loan entirely through the Strike app. And once the full loan amount along with any accrued interest is repaid, the Bitcoin is safely returned to the user. There are no credit checks, no long approval processes, and no taxable events triggered by selling assets.

By offering this new loan service, Striker is attempting to help expand the financial utility of Bitcoin. It brings modern financial tools, typically reserved for traditional assets like real estate or stocks, into the world of Bitcoin. The company has partnered with vetted third party capital providers to ensure secure custody and smooth loan execution. And that's the rub at the very end. It seems let me make sure that this is yeah. It seems that what's going on here is that the Bitcoin, once you send it to strike, is immediately sent on to a third party custodian. And as far as I can tell, that custodian does not allow you to hold one of the keys to that Bitcoin.

This is one of the reasons why you should be looking at Unchained Capital. Unchained Capital offers loans. Okay? So I don't know where they're getting in this news story that this is the first time United States citizens can borrow against their Bitcoin. That's not true. Unchained Capital is a Texas company. It's an Austin, Texas company. It's was started by oh god. I can't even remember the guy's name right now. It is killing me because everybody knows who this dude is. It It was started by him and a few other, like, hardcore Bitcoiners, and they started offering loans. But in their realm, they hold a key.

They have a trusted third party hold a a second key, and you hold a key, and it's two of those three. Yes. I know. Unchained can collude with their with their third party and take that Bitcoin. But I'm just saying, in this particular case, once you turn your Bitcoin over to strike, that's it, pals. You're out of the game on that one, and you have to trust Jack Mallers and strike. Again, I still like Jack Mallers. I I always have, and I hope he does things well. But 12% interest rate, I'm sorry. No. That's what you give people that are offering you equities, especially in this environment, as collateral, not the most pristine collateral that mankind has ever seen. That should get a much better rate. But they're acting they're acting the people at strike are acting like this is a dangerous collateral to hold, especially when you're not ever gonna collateralize any of these loans at a full 100%.

You're not gonna collateralize 1 Bitcoin to be worth 97,500 or wherever the hell we're at today. Right? It's never going to happen. You might you you'll you'll be lucky to do 70%, especially after the debacle of BlockFi. If you're really smart, you will opt to take only 50% of the value or 40% of the value of the Bitcoin. That way, in volatile times, you won't get liquidated. But 12% and a $75,000 minimum buy in and I'm like, again, I highly I I don't know about this $10,000 number for businesses. That seems a little weird. Seems like it'd be, like, a hundred thousand for business and $75,000 for non business. But, hey, you do you.

Just be aware of the risks here. Even if it is Strike, even if it is Jack Mallers, even if he is a Bitcoiner. Right? Be freaking careful loaning your Bitcoin or collateralizing your Bitcoin to take a fiat loan. Please, please, please don't do that. Okay. Circle p is open for business. I got Comfrey. Actually, it's not me that's got Comfrey. It's she she 21, and you can go and find him on Noster. I have not I I think he's completely off of Twitter now, but he also has an email, which is the only other way you're gonna order comfrey and you want to order comfrey. His email is shishi,thenumbers21m@protonmail.com.

It's sheshe21m@proprotonmail.com, guys. And you can get one full root for $20. You can get root cuttings for a buck a piece. All you gotta do is plug these things. You just dibble a hole in the ground wherever you want this thing. You throw in the root cutting or the full root thing. The plant grows and it's never going to stop growing. It comes back year after year. It mines minerals from deep in the earth, and it pulls it up into its leaves. It's rich in phosphorus and nitrogen and all kinds of good stuff. In fact, I got a whole episode of Bitcoin and it will be linked in the show notes under the circle p and all of the URLs that you need to get to XiXi20 1 m to order this magic plant. And it is a magic plant because once you have it, it will always produce for you and it produces copious amounts of biomass.

High in nitrogen, high in phosphorus, high in potassium. This thing is a freaking miracle. And if you wanna learn all about it, go to the circle p heading in the show notes. All about comfrey is at the very last of the information that I put for the circle p. It's got a link to a fountain.fm episode of mine, and I think it's, like, I think it's episode seven thirty six where I do a full show of all about this plant, its history, what it is, what it does, and why you want it in your yard. And it's springtime. This is the best time to start thinking about planting a whole bunch of comfrey for all of your fertilization program needs.

On to strategy's AI embrace. Yes. MicroStrategy, now known as strategy, is getting into AI. Michael Saylor says that he built his Bitcoin empire with chatbot help. Okay. I I almost don't wanna read this, but let's let's see how close to the lunatic fire we really are with this whole strategy thing. This is from Jose Antonio lands out of decrypt dot c o. We already know strategy is going all in Bitcoin, and now it's giving space to Wall Street's favorite new buzzword, AI. And during the company's strategy world event, founder and executive chairman, Michael Saylor, explained how AI helped engineer innovative financial products that powered its Bitcoin treasury, which now holds a staggering $52,000,000,000 worth, a more than 200 x increase from its $250,000,000 starting stake five years ago.

The AI workflow evolved from basic text editing to sophisticated financial modeling. When developing novel financial products, Saylor said that he would use AI to analyze sources and make decisions. Quote, I would put this chat in deep research mode and I would grind it. And it would grind through 50 sources and work for fifteen minutes and come back, Saylor said during a conversation with strategy CEO, Fong Li. Quote, it doesn't necessarily give me the answer that I can immediately act on, but it gives me somewhere between 8095% of what I need.

The company, formerly known as MicroStrategy, has seen its stock price skyrocket since adopting what what Sailor calls the Bitcoin standard era beginning August 2020. This performance has outpaced all S and P 500 companies. Repeat, outpaced all S and P 500 companies even topping NVIDIA during the exact same period. This, Saylor explains, could not have been possible without the help of AI. Strategy's AI powered approach wasn't just for information gathering. Saylor revealed that his company's financing structures, specifically its convertible preferred stock products named Strife and Strike, were designed with artificial intelligence.

Quote, a lot of our innovative capital markets, things like Strike and Strife, we had to fight through all sorts of complicated legal issues, complicated financial issues. We did a convertible preferred stock. It had never been done before. We listed it on Nasdaq. It had never been done before, Saylor said. Strategies Perpetual Strike preferred stock and Perpetual Strife preferred stock are stock offerings launched early this year to raise capital primarily for Bitcoin acquisitions. Strike offers a 8% dividend payable in cash or MSTR stock and is convertible into Strategy's common stock, whereas Strife is non convertible and prioritizes stability for fixed income.

This approach allowed STRATEGY to imagine financial innovations that traditional thinking couldn't produce. Quote, those two preferred stocks, Strife and Strike, are the first artificial intelligence design securities that I know of, certainly in our industry. Saylor said his larger philosophy connects digital intelligence, digital property, and what he calls digital capital, AKA Bitcoin. Companies are going to create extraordinary products, extraordinary services. There's going to be a hundred x increase in productivity. If you're a corporation, if you're a private sector, if you're a capitalist, what are you going to do with that capital?

You're gonna roll it into Bitcoin. End quote he sketched a vision where AI and Bitcoin naturally complement each other quote the explosion of productivity with digital property and digital intelligence and digital labor will create an explosion in demand for digital capital that's a lot of explosions there, Mike. But Strategy CEO Lee, Fong Li, also announced a new data analytics product called Mosaic, which he said was the first ever within strategy gen AI created product. Strategy gen AI created product. Within strategy gen AI. It sounds like they're announcing a new service to me.

This hopefully, I'll remember to come back to that thought. Anyway, it's designed to change the way companies handle their data, solving problems with generative AI. He framed Mosaic as doing for data what Bitcoin does for capital, freeing it from middlemen and giving control back to the creators. The product promises to eliminate lengthy data warehouse implementations and allow companies to access their information in real time without transferring control to third parties. Quote, what you own should be yours. It's your data. Don't give AI companies the right to go train an AI with your data. And if you want them to do so, sell your data. In fact, that's a great way to make money. Oh, boy.

The message to other companies considering similar transformations? Think outside the box. Quote, consensus thinking won't result in success in a world of 400,000,000 competitive companies. Talk about burying the lead. Okay. Well, they didn't really bury the lead, but it's okay. Here's two there's two major points in this thing that we need to really talk about here. And one is the fact that Sailor and Crew says, they haven't proven it, but they say, so we'll just I'll just go ahead and trust them just to get through this, that they produced the products, Strife and Strike, the preferred stock offerings, with AI.

Okay. It's not that it's mind boggling as much as did you really need AI to do that? You you really didn't come up with 8% stock offering. You you've already been selling you've been selling debt for five years. I mean, it's just like, holy shit, dude. It's not it doesn't seem like you need AI to say, hey. I think it'd be a good idea to create shit out of thin air, sell sell it as debt, and we use the money to buy this other thing that makes more money than the debt is actually worth and what the interest rate on that debt is actually going to be. This does not seem like a stretch that I need AI for. That's not what I'm concerned about here.

It's this announcement of where what what was the name of it? Hold on. It's back up here. The first okay. Strategies CEO Fong Li, announced a new data analytics product called Mosaic, the first ever within strategy gen AI created product. That's a terrible sentence. But so now what they're announcing is this product called Mosaic. Now remember what strategy was before they did all this. They were a business analytics company. They wrote software to analyze data for businesses. I don't know what kind of businesses. Maybe it's Morton Thickell. Maybe it's, I don't know, Wendy's Hamburgers.

I don't care. It's business day. And what's your revenue? What's your your outflow? You know, how many employees do you have? What's their benefit package? And you crunch all those numbers together and maybe it gives you some kind of, like, business intelligence about maybe what you can add or what you can subtract or what you might wanna change. It was business analytics. And they basically followed exactly what I said was gonna happen after they started getting into this whole Bitcoin thing is that they were going to dump out of that business altogether. And then they did.

They basically abandoned all of their business analytics stuff, and we can tell by their revenue numbers that are coming out of strategy, which are dismal. If it wasn't for Bitcoin, this company would just it would just implode. Their revenue numbers for the last, like, quarters are just terrible compared to what they've always done, yet their stock prices is in inversely proportional to what their revenue numbers are showing. Right? And it's all because of Bitcoin. So it didn't really matter that they were abandoning their business analytics. But apparently, throughout all this time, they've been developing this new product, business analytics coupled with artificial intelligence.

So here's my new prediction. They roll this out. It works. It's wildly successful. Their revenue numbers skyrocket. They don't sell their Bitcoin, and strategy becomes one of the most important companies on the planet whether you like it or not. Let's run the numbers. Oh, lordy. West Texas Intermediate taking it on the chin, oil down one and a quarter, but still chilling out at $58.38, probably because there's war between India and Pakistan, which nobody seems I I I would have thought very much that I would see a lot more about this whole India, Pakistan fracas than I'm actually seeing, but it took hours for it to trend on Twitter.

It took hours for me to actually see, like, news stories that I didn't specifically search for India or Pakistan on to actually show me, oh my god. And I talked to my daughter, like, an hour after she was out of school. You know? She she has a cell phone. She she knew nothing about it. But oil did have a spike yesterday but has decreased. And Brittanorsee is also down by one in the third. Natural gas, however, is up four and a half points to $3.61 per thousand, and gasoline is down almost two points, still just a hair above $2 a gallon. Gold is down a point to $33.88 in a dime.

Silver down 1.73. Platinum is down almost a point. Copper is down two and three quarters of a point, and palladium is down a quarter of a point. Most of agriculture is in the red. The biggest winner is chocolate, two and a third to the upside. Biggest loser is coffee, 1.68% to the downside. Live cattle is down almost a full point. Lean hogs are down a tenth. Feeder cattle are down seven tenths of a point. Dow is up point 7%. S and P is up a quarter of a percent. Nasdaq is down point one six. S and P Mini is up a half. What's Bitcoin doing? $96,590.

We got up all the way to, like, like, $97,500. So it looks like we are down well off those highs. But still, chilling at a $1,920,000,000,000 market cap, that's 28.3 ounces of shiny metal rocks that we can purchase with our one Bitcoin of which there are 19,861,700. Nope. 278.99 of. And average fees per block are still low, 0.04 BTC taking in fees on a per block basis. Looks like there's 10 blocks carrying 2,061 unconfirmed transactions waiting to clear at high priority rates of 3 Satoshis per vbyte. Low priority is also 3 Satoshis per vbyte. And hash rate is still chilling out. 909.2 exahashes per second. We're looking at a 5% difficulty adjustment on April, which is coming up.

Go to the Bitcoin and Show website. That's bitcoinandshow.com. Bitcoin and show Com. Sign up. The only emails that you're gonna get from me when you sign up with your email is a show announcement. That's it. I mean, well, I mean, well, anything that I publish to the to the website. But I'm not gonna sell your stuff, and I'm I'm not gonna just, like, inundate you with advertisements or anything like that. Just help support the the website, get it some traffic. New websites are a bitch to get off the ground. I need your help for it. That's bitcoinandshow.com. Bitcoin and show. Bitcoin and show Com. I'd appreciate your patronage over there. And from Southern Discomfort, not the whiskey you wanna drink, yesterday's show from Bitcoin. And I got Yodel with 888.

Some extra lightning in this boost just because. Psyduck with $5.96 six says Psyduck. Pies is back with a hundred, says the minimum strike loan amount is 75,000 with around one to one and a half or one with around 1 and a half Bitcoin as collateral. I really don't care because I'm not using Bitcoin as collateral. I learned my lesson last cycle and am poorer for it. However, I am a bit disappointed in this minimum amount. Yeah. So am I. God's death. $2.37. Thank you, sir. No. Thank you. Herring gone a 20. The interest rate is 12% on a hundred thousand if you pay every month and 13% on the same if you pay annually on strike lending as laid out in the app. Thank you, Harangone. I appreciate that. He also comes back with another one. 20 says, didn't know if you've seen it before the show.

New Hampshire's governor signs off on the nation's first, crypto reserve bill. Yeah. Live free or die. I hear that, brother. And that is the weather report. Welcome to part two of the news you can use. Okay. So op return in the news. So I noticed a trend yesterday, and a little bit on on the day before. Nostra has a bot called op return bot. And if somebody had put an op return in any of the transactions that got mined in a block, the op return is actually able to see that. And then the op return, bot yes. It sees it, and it puts it into an Oster note. There's also one for Twitter, and it tells you what's in the op return line.

I started seeing a whole bunch of them. I mean, a whole bunch of them. And, I mean, when I mean a whole bunch of them, I had to turn opportune bought off on Nostr because it was just spamming my feed. That's what we're talking about. And they have not the the guys at core have not released the new update to Bitcoin core, which will have the op return, limit lifted, completely. Like, there's not gonna be a limit on it at all apparently. So what was in those return op returns? BC 1 Bitcoin wallet addresses, all of them different, and some other information. I still not exactly sure what they were, but it seems like each one of these, was somehow putting a thousand Satoshis.

Not putting. Saying something about a thousand SATs into, like, a b c one address. And we're talking hundreds of these notes. Hundreds. That's why I turned off op return bot. Right? So I'd this I know this has something to do with what's going on with the op return debacle, And I'm not exactly sure what, but Ben the Carmen has got this note on Noster or on Twitter that says opportune bought in the last twelve hours. This is not including the 100 plus op return transactions that are waiting for a Mara or f two pool block so I can get past ancestor limits. Your filters work.

And then he shows a screenshot, and it says the total amount of op returns are 226. Non standard op returns are 221, which I take to mean those are those are transactions that are going to have to go out of band because they're they're beyond the op return limit. And let's see. Hold on. I wanna make sure. Total chain fees in this in this there's a couple other pieces of information in the screenshot, but it says at the bottom, total chain fees, 555,000 Satoshis. Now Supertestnet picked up on Ben de Carmen's tweet and basically retweeted it by saying, they are paying 555,000 sats to add 58,000 bytes and data bytes to the chain.

That is a fee rate of 9.5 Satoshis per byte, which is three times the going rate for a transaction. Yet they say the filters are not working. Ben the Carmen comes back and replies to that and says, op return bought by default just increases the fees a bunch to try to ensure it gets into the next block. And here's the rub. Supertest net replies. That is good. The point of the filters is to raise the cost of spamming. So there's what I'm talking about here is another way to think about the limits and filters and the raising of limits, all that have to do with this op return debacle that's going on between core and the rest of Bitcoin. Alright? Alright. So Bitcoin knots is a version of Bitcoin core that does all the things that Bitcoin core does, but has a bunch of filters enabled and enacted on it. So if I wanted to, I could completely not have anything to do with ordinals and inscriptions simply by running Bitcoin nots instead of Bitcoin Core.

I am still running Bitcoin Core, just so you know. But knots is already going to put in a filter that does not allow anything above 80 kilobytes in the opportune line on a transaction. So if I'm making a transaction, I have the choice to put some kind of arbitrary data in the transaction under the flag opportune. I could put your mother was a hamster and your father smelt of eldenberries. I could literally type that out, and if it was under 80 kilobytes, and it probably is, or 80 bytes of data, and it very well may be because, you know, text and ASCII doesn't cost a lot in data, then everybody that ever saw that transaction in the opportune line, your mother was a hamster and your father smelt of Eldenberries, would always be there. That's what opportune does.

I don't I'd I'm not even sure I'm like, I'd I'd there's all kinds of stuff that you can put in there. Okay? Let's just say that. You can put, like, secret messages in there, let's say. Right? The limits are 80 bytes, and core is going to lift that. So now it becomes arbitrary. But all this time, you could always put more data into Operaturn and then call up a miner and say, hey. Will you mine this transaction for me? I'll pay you x amount of Satoshis to do it. And if the terms are acceptable, the miner will say, sure. I'll do it. That's called an out of band transaction. It doesn't go through the mempools.

I mean, it's in the transaction will be in the mempool, but it won't be validated as a valid transaction because its op return line has a lot more data than 80 bytes. The but you can still get that transaction in mind. You just gotta call a miner and say, hey, buddy. I'll pay you a hundred dollars if you mine this transaction for me. And they'll say, sure, buddy. I'll do that, you know, or whatever. Right? And that's I'm not exactly how sure how you well, there's something called slipstream, which is a way that a regular Joe like me can can, I guess, enter into an auction to have a nonstandard transaction mind. Slipstream's been there for a long time. It's it's old news. I I reported on it two, three years ago.

Right? But that's what we're talking about here. What Supertestnet and this Ben the Carbon, Twitter thread is getting at is that, essentially, what's going on is that there's a lot of of out of band transactions that are being done because they have stuff in the opportune line that is way larger than 80 bytes. And they're either going out of band or they're they're having these transactions mined another way, but they are getting mined. But they're paying three times the amount that they should be paying if they just wanted to do a transaction. So if you're of the mind that these because there's so much data in the opportune line that they're automatic spam, then the spammer in however you want to look at it, because maybe it's not spam. Maybe it's an important message in op return. I don't know. But they're paying three times as much for it, and SupertestNet is basically saying, these guys that we consider spammers are paying through the nose to have these transactions mined. And the only way that the only reason that they're able to have to do it, to have to pay three times more, is because the filters that everybody's using actually work and force people to go out of band.

But I don't think that that's actually going to start happening when a whole bunch of people aren't running filters and the op return limit is lifted. And those were those transactions will be in the mempool. And people who aren't running any filters whatsoever, and I'm not running any filters whatsoever right now, they'll be in my mempool. I mean, I might turn on a filter. I don't know yet. I'm I'm not exactly sure what I should do. I'm just gonna, like, lay back and let the dust settle. But what I want to what I want to really bring home here is that it's not going to matter either way.

These transactions are gonna get mined no matter what we do, no matter what Core does, no matter what you want, no matter what Core wants, no matter what the guy behind Bitcoin nots wants, and that's Luke Dasher. It doesn't matter what Ocean Pool wants. It doesn't matter what Marapool wants. It doesn't matter what f two Pool wants. Bitcoin is going to Bitcoin whether you like it or not, whether you like what's in the transaction or not. Wasting your energy, being mad about something that potentially we don't fully understand is a waste of your neural and metabolic energy.

You don't have to be mad. Just watch, wait, and see. What we really need to be looking at is shit like this. Trump backed USD 1, the stablecoin from the the the World Liberty Financial, is now the seventh largest stablecoin worldwide already. That this concerns me. Helen Parks, Cointelegraph. And even if it does concern me, it's not gonna matter. I can't do shit about it. But USD 1, the US dollar stablecoin launched by Trump backed World Liberty Financial has become the seventh largest stablecoin worldwide in just two months since its launch. Two months. Two months. Two months.

USD one has become the seventh largest stablecoin. WLFI snapshot vote for a USD 1 airdrop proposal is underway, and USD one's market capitalization has continued to climb. Launched in early May with a $3,500,000 supply. We're talking millions, like like, with 3,500,000.0. It's a drop in a bucket, a very large bucket. USD 1 has expanded into a market cap of $2,200,000,000 at the time of writing. So from $3,100,000 to $2,200,000,000 in two months leaving rival stablecoin, First Digital USD, PayPal USD, and Tether Gold behind according to data from CoinGecko.

In fact, at number seven, yeah, Tether Gold, PayPal USD, and First Digital USD, those come up numbers eight, nine, and 10 by market cap of how much value the their stablecoins have. I I cannot believe that we went from $3,500,000 to $2,200,000,000 in two months on a Trump backed stablecoin. I'm telling you, it's going to be a stablecoin free for all. It's going to be a stablecoin jubilee. Stablecoin, stablecoin, stablecoin, stablecoin. Everybody was all about ICOs. They were all about altcoins. They were all about meme coins and inscriptions and ordinals and NFTs and fucking Ethereum rocks, and now stablecoins.

Although rising fast, the USD 1 market cap is still far from the market value of majors like Tether's USDT and USDC. Trump backed USD 1 is almost exclusively issued on the Binance backed BNB chain. According to data from BSCscan, as much as $2,100,000,000 of all USD 1 supply is issued on BNB chain, accounting for more than 99% of its total circulating supply while an Ethereum based version accounts for a piddly ass 14 and a half million dollars according to Etherscan. USD one's latest market spike was sharp, jumping 1,540 from a hundred and 20 8 million dollars to $2,100,000,000 within two days in late April. Do I need to say that again?

Let's do it. A 1500% gain from a hundred and 28,000,000 to 2,100,000,000.0 within two days, forty eight hours according to CoinGecko. The spike came days before Eric Trump announced that Abu Dhabi based investment firm, MGX, would use the USD 1 to invest $2,000,000,000 into Binance. As USD one's market cap spiked, some centralized exchanges rushed to list the Trump backed stablecoin, HTX, a crypto exchange closely associated with Tron founder, Justin Sun, and formerly known as Huobi, announced the listing of USD 1 with permanent zero fee withdrawals on the BEP twenty network on May. According to websites like CoinGecko, HTX was one of the first centralized exchanges to list USD 1, and the token is primarily available on decentralized exchanges, including PancakeSwap and Uniswap.

Jesus Christ. We're going back to the summer of twenty twenty two when SushiSwap came around. My god. It's just this is this is gonna compromise Orange Man. I swear to god. While the WLFI community has been voting on the USD 1 airdrop, some reports suggested the WLFI investment is mainly coming from outside The United States. Oh my god. Oh my god. The spies. It's the spies. According to a poll by v one PS founder Notaz Sol, as much as 90% of WLFI investors are likely coming from non US jurisdictions, including Europe, Asia, and Latin America. May's a May 7 Bloomberg report also indicated that over half of the top holders of Trump branded meme coins reside abroad.

The USD 1 stablecoin's growth lines up with Trump's pro stablecoin agenda announced in his executive order on strengthening American leadership in digital financial technology in January. While WLFI has been closely associated with Binance, both Trump and Binance have repeatedly denied and criticized reports suggesting any links or deals between the parties. It's not gonna matter. This just looks bad. This, look, I'm gonna say it. It it it looks like total corruption. And at this point, I kinda don't care. I've been I my entire life has been deal has been lived under the guise or under the shadow of complete and total worldwide corruption in the highest echelons of power and wealth.

What what do I care if orange man gets in on the fucking deal? At this point, I'm so tired. It's not even funny. But if I was an adviser to the Trump camp, I'd be saying, what are you doing? Are you stupid? You do realize that they are going to come after you with pitchforks and torches and barrels of tar and pillows full of freaking down feathers, and they're gonna run your ass out on a rail. And it's just like it's it's either like he doesn't it's one to three things. He doesn't give a shit. He's stupid and he or two, he's stupid and he doesn't realize what he's doing, and I don't think that's true forever. Or he knows something. That he's he knows something he's not gonna get in trouble. It's one of those three because when you put your feet this close to that fire in the position that you're in, you're going to get host.

You have enemies. I mean, a lot of enemies. There's a lot of people that hate orange man. Right? And they they are not without power themselves. So what's the deal? A hundred and 28,000,000 to 2,100,000,000.0 in forty eight hours of market cap? Are you fucking shitting me? And there's nothing to see here? Sorry, man. There's something to see here. I don't know what it is, but there's something to see here. Let's move on. Sorry. I was having to drink some coffee there because I'm, like, I'm just kinda, like, flabbergasted that these guys, they just don't give a shit.

It's probably because they're gonna get so ridiculously wealthy on this crap that it's not even funny. But there it's they're already rich. I don't get it. Is it is it a disease where you just have to collect billions of dollars? And once you get your first billion, you just can't stop? It's like is it like Lay's potato chips? You can't eat just one? You can't get just $1,000,000? You gotta get, you know, the whole bag? I I don't know, man. It just amazes me. But Revolut is the good news is some of the good news for today. They are rolling out Bitcoin lightning payments for European users through LightSpark, And this is written by Christian Sandor.

Digital bank Revolut is working with LightSpark to roll out Bitcoin transactions on Lightning Network to customers in The UK and select countries in the European Economic Area. The feature aims to cut transaction fees and payment processing time for crypto users, LightSpark said in a post. The Lightning Network is a layer two system built on top of Bitcoin that allows near instant low fee transactions. And by connecting the network through LightSpark, Revolut users will be able to circumvent the congestion and high fees of the base blockchain to send BTC even faster.

And here the whole thing is Revolute is a massive digital bank. It's like 50,000,000 users. Right? 50,000,000 users are gonna now are being onboarded to the Lightning Network. It was just like last month that I was telling you about another company, and I can't remember who it was, that also has something like like I think it's a Latin American. They have, like, 46,000,000 users, and they're all being exposed to the lightning network. Nothing stops this train. Even Meta Planet bought more Bitcoin just yesterday, and it was Monday, I believe, that I told you about them buying Bitcoin on Friday, and they've bought some more. Visma v from Decrypt says that Meta Planet buys more Bitcoin amid easing United States China trade tensions. Yes. It looks like we've that that little thing might be warming up a little bit or cooling down depending, but it seems like some some people from Trump and China seems like they they might wanna actually talk this shit out because I think they're getting tired of this crap. But Japan's meta planet added yet another 555 Bitcoin to its treasury late Tuesday right as China confirmed that it would resume trade talks with The United States while laying out firm conditions for engagement and warning against coercive and blackmailing tactics.

Honestly, that's all we need to know is that Meta Planet bought more Bitcoin the minute that China kinda cooled their heels a little bit and said, okay. We'll tell you what, we'll we'll come talk. Honestly, I I really want this shit to be over. But we've got one more for the day. A company called Thumbs Up Media ups shelf to $500,000,000 to fuel its own Bitcoin treasury push. I've never heard of Thumbs Up Media. Please, Jenna Montgomery, tell me more about it from bitcoin magazine. Thumbs up media corporation has filed an amendment to its shelf registration on form s three with the securities and exchange commission, increasing the maximum offering amount from 200,000,000 to $500,000,000.

The move signals a significant ramp up of the company's dual mission, scaling its social media branding platform and growing its Bitcoin holdings. Again, never heard of this company. As of May, thumbs up holds 19.1 BTC. So they don't hold a whole lot. It's it's worth $1,800,000, but the company's board previously green lit a bold treasury strategy allowing up to 90% of its liquid assets to be held in Bitcoin. This expanded registration gives thumbs up the flexibility to raise capital through multiple avenues, including common stock, preferred stock, warrants, debt securities, and units over the next three years. According to the company's filing quote, we view Bitcoin as a reliable store of value and a compelling investment.

Oh, interesting. We believe it has unique characteristics as a scarce and finite asset that can serve as a reasonable inflation hedge and safe haven amid global instability. No securities are being sold at this time. However, any future offering under the registration will be detailed in a prospectus supplement filed with the SEC. The amended filing reaffirms thumbs up conviction in Bitcoin's long term potential drawing comparisons to gold, quote, given our belief that Bitcoin is a comparable and possibly better store value than gold, Bitcoin has the potential to approach or exceed the value of gold over time, the company stated.

This development follows a broader shift in Thumbs Up's operational strategy. Since its Nasdaq listing back in October of twenty twenty four, so they haven't been around that long on the Nasdaq, the company has adopted Bitcoin as its primary treasury reserve asset and announced plans to offer payments in Bitcoin through its account specialist program. As Thumbs Up positions itself at the crossroads of digital marketing and digital currency, this expanded registration marks a strong signal of its future intentions. For investors and analysts tracking corporate Bitcoin adoption, Thumbs Up's latest filing is another example of publicly traded companies doubling down on BTC as its core financial strategy.

But $1,800,000 does not seem like their like Thumbs Up is treating Bitcoin as its primary reserve asset, does it? So I don't know exactly what that means, but, you know, it is it is what it is. I need to look at something. Hold on. Thumbs Thumbs. Do I have thumbs up? What I'm doing is I'm looking in my I I keep a let's see. I keep all of the transcripts of this podcast in my Obsidian vault, and then I'm able to search that vault. And I wanted to see if I had yep. There it is. I have talked about it before. Bitcoin and podcast episode number ten fifteen. I said let's see here.

Two publicly traded companies announced great big Bitcoin buys this week. Los Angeles based social media marketing company, Thumbs Up Media, said on Tuesday that it purchased $1,000,000 in Bitcoin, and that's its first foray into the token. So that was what date was that? That was January. Yeah. 01/09/2025. So at the very beginning of this year is when, is when I talked about thumbs up. So my bad. I do know what thumbs up is. I just forgot all about it. That's probably because I've got, like, all of three brain cells left to rub together, and I'm going to go do that while I see you on the other side.

This has been Bitcoin, and and I'm your host, David Bennett. I hope you enjoyed today's episode and hope to see you again real soon. Have a great day.

Introduction and Episode Overview