Topics for today:

- Tiny Island Wants a Stablecoin

- Now Japanese Bonds Are Freaking Out

- Tariffs to Fund Bitcoin Buys?

- Refining BTC Like Crude

Circle P:

SoapMinerProduct: Tallow Soap

Website: https://soapminer.com/

nostr Profile: https://nostrudel.ninja/#/u/npub1zzmxvr9sw49lhzfx236aweurt8h5tmzjw7x3gfsazlgd8j64ql0sexw5wy

Twitter Profile: https://x.com/soapminer1

Articles:

https://cointelegraph.com/news/northern-marianas-veto-bill-allowing-stablecoin-launchhttps://bitcoinmagazine.com/news/unchained-launches-multi-million-dollar-bitcoin-legacy-project

https://www.coindesk.com/markets/2025/04/15/japanese-bonds-stir-unease-as-bitcoin-recovers-from-last-week-s-tariff-panic

https://decrypt.co/314816/tariffs-fund-us-bitcoin-reserve-buildup-white-house-advisor-bo-hines

- https://www.cnbc.com/futures-and-commodities/

- https://dashboard.clarkmoody.com/

- https://mempool.space/

- https://value4value.info/

- https://fountain.fm/show/eK5XaSb3UaLRavU3lYrI

- https://geyser.fund/project/thebitcoinandpodcast

https://www.theblock.co/post/350823/sweden-bitcoin-policy-pitch

https://atlas21.com/bhutan-mining-as-a-strategic-choice-to-revive-the-national-economy/

https://www.theblock.co/post/350772/sec-delays-crypto-etf-staking-in-kind-redemption

Find the Bitcoin And Podcast on every podcast app here:

https://episodes.fm/1438789088

Find the Bitcoin And Podcast on every podcast app here:

https://episodes.fm/1438789088

Find me on nostr

npub1vwymuey3u7mf860ndrkw3r7dz30s0srg6tqmhtjzg7umtm6rn5eq2qzugd (npub)

6389be6491e7b693e9f368ece88fcd145f07c068d2c1bbae4247b9b5ef439d32 (Hex)

Twitter:

https://twitter.com/DavidB84567

StackerNews:

stacker.news/NunyaBidness

Podcasting 2.0:

fountain.fm/show/eK5XaSb3UaLRavU3lYrI

Apple Podcasts:

tinyurl.com/unm35bjh

Mastodon:

https://noauthority.social/@NunyaBidness

Support Bitcoin And . . . on Patreon:

patreon.com/BitcoinAndPodcast

Find Lightning Network Channel partners here:

https://t.me/+bj-7w_ePsANlOGEx (Nodestrich)

https://t.me/plebnet (Plebnet)

Music by:

Flutey Funk Kevin MacLeod (incompetech.com)

Licensed under Creative Commons: By Attribution 3.0 License

creativecommons.org/licenses/by/3.0/

It is 08:58AM Pacific Daylight Time. It's tax day. It's slave day. It's been slave season. Have you noticed that? People keep talking about it's tax season like it's, like it's football season, or it's baseball season, or it's basketball season, it's skiing season, or snowboarding season, or freaking barbecue season. It's not a season. We're not celebrating some function of of humanity that is great. What we're doing is somehow or another infantilizing absolute theft. We're codifying it. But when when people say tax season around you, do the following. Say stop. Stop. Stop.

It's not a season. This is not tax season. If it's a season of anything, it's a season of theft. Please stop calling it tax season. You know? Just just say I had to do my taxes. Right? Yeah. Yeah. Yeah. I mean, I'm not, you know, all that happy about paying taxes, but don't don't get me don't get me wrong. I'm not, like, all that pissed off. It's just it is freaking annoying. When did we start doing this? I I literally just started noticing this about five years ago. Tax season. I call bullshit. And, well, so did somebody from four Chan. We're gonna talk about something that happened to four Chan. If you don't know what four Chan is, you're not really gonna be interested, but I get the feeling most people on the planet kinda kinda know of well, at least in The United States know knows what 4 Chan is, and something something bad happened to them. And then we're gonna talk about, well, stablecoins again because I'm being I'm being proven right. I am being proven right. Stablecoins are going to just be unrelenting, Unchained, has a new project going on that seems very, very cool, and the Japanese bonds, as usual, are out of control.

And then there's, well, there's some tariff stuff that we're gonna talk about. We're gonna talk about some stuff going on in in in the Swedish country of, you know, Sweden, and then the SEC. We got some mining stuff, and we're gonna get into it all. But what the hell is going on with four chan? Do you do you remember the the the days of yore when four chan was, like, really, really fun? And I really never got on four chan. But when I fir when I got totally basked in what 4chan was was the twenty sixteen election of Donald j Trump for his first term, and everybody lost their ever loving mind, including a gentleman actor by the name of Shia Labeouf or Boof or Boofy or whatever you wanna call him. He's batshit crazy. He's one of my favorite people, but my god does this guy hate Trump.

And it was just this relentless battle between him trying to do art projects that were protesting Trump and four chan basically just destroying it. Every project. Like, he he tried to do this thing where he hid this they well, okay. He kept hanging this flag up in different places. And within, you know, within like twenty four hours, 4chan, you know, crew somehow or another would know exactly where it was. Right? So and they go steal the flag. It was literally captured the flag. And then this happened, like, twice. And he had put it into, you know, in cities. And then then Shai goes, you know what?

I think they're just easily able to identify what city and what block. I I think these guys are a little too smart. So what I'm gonna do is I'm gonna put this flag on a flagpole out in the middle of a field, out in the middle of nowhere where you can't see anything. There's no buildings. There's nothing. There's no street signs. It was just a field. And in twenty four hours, the guys out of four Chan was able to go capture that flag. Why? Because they were identifying flight patterns of the planes in the background of the live feed of the flag because it was a twenty four seven live feed of this flag on this pole. That was that was the installation that Shia Labeouf did. Right? So while they're just sitting there watching it or, you know, recorded it and then sped it up, and they looked at all of the planes flying over. And then given the shadows of the trees, they figured out what directions these planes were going, and they knew what time these planes were going. And it did not take long for them to cross pollinate what they had discovered with publicly available data about listed flight plans and paths, and they figured out what airlines they were and where they were. And then all of a sudden, they were able to find exactly where that flag was. They did it in a day. It was great. It was it was hilarious. Right? It was really, really fun. Well, it turns out that four Chan, like, as many have suspected over the years, might have been populated by a bunch of government spooks. Because, a, four Chan has been taken down. I got this tweet over here. It says, about four hours ago, four chan got taken down by a rival image board hacking group. The database was dumped. The mods were doxxed, proving some were federal agents, and all the servers are now offline.

This may be the last post ever, and then they give a screenshot of this post containing Jack Black as Steve in Minecraft, which if you haven't seen is honestly, it's not a good movie, but it is highly entertaining and it's kind of gorgeous and I took my kids to it and we had a lot of fun. It was it was absolutely a lot of fun. Anyway, so getting back to getting back to this whole 4chan thing. Where was it? Yeah. Here's here's another, here's another, tweet. The fact Janis on four Chan had private reasons to ban people is hilarious and shows how much of a power tripping idiot that they were. Hero, after taking ownership, literally did nothing to improve the site.

Moot should have thought twice about who would succeed him. And I guess she's talking about the 15 year old that started four Chan way back in the day. But there's a lot of other tweets about jannies or janitors, and that's, I guess, what they called, like, the people that would help kinda keep the site up and clean. You know, like, you know, janitors. And it turns out there's a lot of people saying that they were actually government spooks. So that's what's going on this morning. And the reason I think it's important is that four Chan has kind of been an indelible mark of American Internet culture for well over a decade, y'all. I mean, it's four chan has been around for a very, very long time, and it looks like it may be gone forever.

But there are larger fish to fry on this episode ten seventy four of Bitcoin and Northern Marianas veto's bill for Tinian to launch its own its very own USD pegged stablecoin. Jesse Coughlin from Cointelegraph tells us about the onslaught of the stablecoin. The governor of the Northern Mariana Islands, a small Pacific US territory just north of Guam, has killed the legislation that would have allowed one of the territory's local governments to launch a fully backed US dollar pegged stablecoin. In an April 11 letter seen by Cointelegraph, Northern Mariana Islands governor, Arnold Palacios, said he vetoed the bill as it, quote, presents several legal issues and may be unconstitutional, end quote.

His letter said that the bill, which largely dealt with issuing licenses to Internet casinos, would regulate an activity that could not be clearly restricted it to to Tinian, a small island forming part of the territory, that was hoping to launch the stablecoin. Tinian, which has just over 2,000 residents. Let that sink in. This is an this is a little island with 2,000 residents and they, what, want a a stablecoin? Anyway, it's largely a tourism based economy. It's governed by the local government, the municipality of Tinian and I I Aguaquin, One of the four municipalities in the Commonwealth of the Northern Mariana Islands.

In February, Republican Northern Mariana senator Jude Hochschneider led the introduction of the bill to amend a local Tinian law to allow Internet only casino licenses, which tracked on a provision allowing the Tinian treasure to issue, manage, and redeem a Tinian stable token. The four member Tinian delegation to the Marianas legislature passed the bill in a unanimous vote on March. In vetoing the bill, Plasios did not commit on or comment on the proposed stablecoin, instead taking issue with its aim to police an industry that can cross jurisdictional boundaries and said the measure lacked robust enforcement measures to prevent illegal gaming activities. That's, honestly, that's all we really need to know about this because two things happened here. One, he didn't veto the stable coin bill. He just doesn't wanna get into this licensing of in of of Internet only casinos because you you get on the wrong side of the United States government on that one, and it's not going to play well. But the other thing was is that, clearly, attached to this bill was this creation of a stablecoin.

Now what have I been saying? Everybody and their dog is going to want to print up a stablecoin. We are about to enter altcoin season, except it's not gonna be for altcoins. It's going to be for people spinning up stablecoins, but it's the exact same thing. Just because you say it's a stablecoin and that it's quote, unquote pegged to, oh, I don't know, u US dollar, gold, silver, coconuts, it doesn't really matter. It's bullshit. It stay away from these things. And Tether is going to end up being in Tinian and the these islands. It's not gonna matter. They're not they're not going to need their own stablecoin. Right?

And, again, not really advocating for Tether either. I'm just telling you what which way the wind's gonna blow, and the wind's gonna blow out of the Tether group. It's not gonna blow from every country spinning up their own stupid ass stablecoin. I I can guarantee it. But our friends over at Unchained, which I think used to be Unchained Capital, and they shortened their name to just Unchained. They've launched a multimillion dollar Bitcoin legacy project, Vivex and Bitcoin, Bitcoin magazine, Bitcoin financial services company Unchained, has announced the launch of the Bitcoin legacy project, a multiyear, multimillion dollar initiative to support the long term development, education, and advocacy of the Bitcoin ecosystem.

The project begins with an initial 1,000,000 commitment with additional funding planned in the years ahead. The initiative will financially support Bitcoin developers, educators, core infrastructure projects, and advocacy organizations. Key components of the program include funding for Bitcoin community hubs, a think tank, a university endowment, and direct support for Bitcoin core development. As part of the initiative, Unchained is introducing what it describes what it describes as the first Bitcoin native donor advised fund platform or DAF.

The platform is designed to allow individuals and institutions to donate Bitcoin or other assets in a tax efficient manner with the ability to direct grants to US based nonprofit organizations. Contributions can be held in bitcoin within the fund, and recipients can also choose to receive grants in said bitcoin. To incentivize participation, Unchained will match donations made through the d a f platform to select partner organizations including the MIT Media Labs Digital Currency Initiative, Human Rights Foundation, OpenSats, and Brink, all the way up to 1 full bitcoin.

In addition to philanthropic giving, the bitcoin legacy project will support physical spaces for bitcoin collaboration and innovation. In its first year, the project will direct funding to three Bitcoin hubs, Bitcoin Park Nashville, Bitcoin Commons in Austin, and The Space in Denver, Colorado. These hubs aim to foster development, education, and community engagement within the bitcoin sector. Unchained is also allocating resources to broader research and policy efforts, and this includes a $50,000 contribution to the Bitcoin Policy Institute, a $150,000 to launch the first bitcoin focused university endowment at the University of Austin, a new bitcoin scholars program will distribute up to $250,000 in research grants to support original work and thought leadership in the Bitcoin space.

Quote, Bitcoin's strength comes from the people who build, educate, and advocate for its future. Yet, many of the most critical initiatives struggle with long term funding, said Joe Kelly, CEO at Unchained. And we believe in not just using bitcoin but strengthening it for future generations. The Bitcoin legacy project is our commitment to ensuring that Bitcoin remains strong, sovereign, and unbreakable. The Bitcoin legacy project reflects Unchained's broader strategy to support Bitcoin's growth while reinforcing its commitment to financial services centered on collaborative custody and long term asset security. So here's what I'd like to see. I noticed that all these places like Bitcoin Park and I'm don't don't don't misunderstand me. I'm not getting on these guys' case.

Right? But a lot of these places like Bitcoin Park, the Bitcoin Commons in the space, What I don't see, and it doesn't mean that they don't do this, but what I need to really see is I need to see more kids. I need to see more more children friendly projects going on at these places where they can fill up a room instead of with nerdy, geeky ass coders like a bunch of seven year olds. Not just to explain Bitcoin, but how do how do we go about teaching the importance of running a node after your parents have passed away? I asked this shit to, like, a whole bunch of people.

You know? And it's like I I can't really get a good answer as how do we per perpetuate this. And I know that's what Unchained is trying to do here, but talking to ourselves is not really the way to do this. Right? I mean, it's one way. It it it it it like I said, it it doesn't mean that I'm I'm poo pooing on this entire thing. But somehow, we need to figure out how to engage children. Does it need to be a science fair? I mean, how do you engage when I mean engage children, I don't mean just shove them in a room and say, hey. We got 40 kids under the age of 10, and they're playing with a raspberry pi and Bitcoin. That's not enough. How are you sparking their imaginations?

How are you getting them excited about running a node? Because it's kinda boring to run a node. Believe me, I've run one for years, and it's kinda boring. It's like it's it's it's necessary, and it excites me because I'm doing it and I know that it's necessary. How do we impart that that that feeling? How how do we manufacture more people to continue what we've started here? Because at one point or another, ladies and gentlemen, we're all worm food. We're all gonna die. I know that sounds really depressing, but it's reality. We're all gonna die.

How am I gonna get my kids, your kids, our kids to say running a node is one of the most important things that we can do for our parents' legacy, our present, and our children and their children's children's future. And I don't see that many initiatives going on at any of these places where I see a room full of kids. Maybe they are doing it. But if y'all are doing it, please take pictures and post the living ever loving crap out of them online so that we can see that, yes, you are in fact engaging kids. Because if we don't do that, it's not gonna matter how much you loved running a node.

If they turn it off after you dead, I guess it did it it didn't really matter, did it? That that's what I'm saying. But onto Japan, land of sushi and sake, Japanese bonds stir unease as Bitcoin recovers from last week's tariff panic. My god. It's the thirty year yield. Oh, by the way, this is, CoinDesk. And who's writing it? None other than Amkar Godbold. Trading in financial markets feels like dodging a barrage of stones, each demanding constant vigilance and agility. Just as Bitcoin and traditional risk assets stabilize after last week's Trump tariff led panic, unsettling movements in Japanese bonds emerge, throwing a spanner into the mix, also known as wrench for us Americans.

Apparently, in in UK, it's a spanner. In Europe, it's a spanner. But over here, it's it's it's a wrench. Anyway, the yield on the thirty year Japanese government bond rose to 2.88 early Tuesday, the highest since 02/2004. It's a long time ago. It registering a nearly 60 basis point increase in one single week according to data source from TradingView. The yield differential between the thirty year and the five year bonds representing the premium investors demand to hold ultra long bonds over five year bonds has widened to a nearly two decade high. Good lord.

The ten year basis or the ten year yield has bounced roughly 30 basis points to 1.37% in one week, but stays well below the recent high of 1.59%. These moves in the ultra long bonds have raised yet another alarm in the investor community and rightfully so as Japan has long been an international creditor and the top holder of the United States treasury notes. As of January, Japan held 1,790,000,000,000.00, that's trillion with a t, dollars in treasuries. Besides, for almost two decades, Japan has been an anchor for low bond yields, especially across the advanced world, supporting increased risk taking in financial markets. So the ongoing increase in the ultra long Japanese government bonds could incentivize Japanese funds to sell international bond holdings and yen funded risk on carry trades and move capital back home to Japan.

The resulting volatility in the US Treasury market and the strengthening yen could add the risk or add to risk aversion. Quote, Japanese have the largest international investment position in the world, and they have a lot of money in various different markets. If that money starts to get repatriated back to Japan, that would clearly be a negative according to Gary Evans, chief strategist for global asset allocation at BCA Research. Bitcoin too could come under pressure as it did in August of last year when the first round of the yen carry trade unwind supposedly happened.

BTC is an asset with several appeals ranging from emerging technology to a haven to a store of value. The narrative strengthened last week as the escalating tariff war between the Trump administration and China led to broad based risk aversion. BTC, however, fell less than the Nasdaq and the S and P five hundred. This relative resistance has been hailed as a sign of Bitcoin's evolution as low beta play by some while they hedge by others while effectively ignoring the fact that the cryptocurrency has been trending lower since early February, likely pricing a trade war that triggered sharp losses in The United States stock market last week. So stay alert. I agree. Probably should stay alert because god only knows what this all means.

See and this is where it gets really hairy because I can talk about the ten year yield on the on The United States bond, but you know what what where it gets really hairy is when you start connecting two governments together like The United States and Japan. And how do their how do their government bonds interact with each other? See that that's that's where where some real math is going to occur, and I'm not going to sit here and pretend I'm an expert at that. But the two are related. So what does that mean? If I've got ten year yields popping up, you know, to four and a half percent, and now the thirty year and ten year and five year yields in Japan are also starting to pop up, you know, does that necessarily mean that bad shit's gonna happen? Well, no.

But it is putting pressure where pressure was not present, you know, two or three years ago. It's all a very dirty business. And if you're dirty, why not get clean with some soap miner, handmade tallow soap? The Circle p is open for business. The Circle p is where I bring plebs like you with goods and services to plebs like you who might want to partake in those goods and services. And today, it's soapminer.com. Soap miner Com. That's soapminer.com. Get your handmade 100% beef tallow soap. I use it. I love it. So does my wife. And now my daughter is starting to actually go, this is really nice soap, man. He sent me, like, four bars of it to try it out because I had been kinda shielding his product, and yet I hadn't used it. Well, I've been using it lately, and it's beautiful soap. You can get cedarwood, you can get peppermint, you can get lavender, and you can get pine tar, or you can have just rough cut tallow soap, which has all of three ingredients, beef tallow, lye, and distilled water.

This soap is badass soap. You need to get the soap. Are you dirty? Are are the markets making you feel dirty and nasty? Well, get clean with SoapMiner Soaps at soapminer.com. That's soapminer.com. He sells his soap for Bitcoin. If you're not selling it for Bitcoin, you're not in the circle p, but you gotta tell SoapMiner you gotta tell SoapMiner that you heard about it here on the circle p. Otherwise, SoapMiner won't know that I made a sale for him. And why do I do it? Because I wanna see Plebs succeed. I'm tired of massive corporations sucking the wind out of everybody. And it's not that I hate corporations. I just want to see the little guy have a life too.

Nothing wrong with that. And if we survive the tariff wars, maybe we can get that. Because tariffs may help fund The United States Bitcoin reserve buildup according to White House adviser, Beau Hines, who honestly looks like he's still in college. But Vince D'Aquino from Decrypt.c0 has the story. No offense to Beau Hines, but, honestly, you you do look you do look like you're on the on the broad side of 25 there, pal. I mean, how much shit have you gone through so far? Anyway, the Trump administration sweeping tariff, which have roiled global markets over the past few weeks, may just become the instrument in funding The United States strategic Bitcoin reserve without using any taxpayer money While the extensive tariffs threatened and implemented over the past month have escalated and jolted markets as the Trump administration pursues an America First trade policy, a key White House adviser thinks the revenues from it could be used to add to the country's Bitcoin stash.

Beau Hines, executive director of the presidential council of advisors on digital assets, said in a White House interview with professional capital management's Anthony Pompliano that the Trump administration is exploring several budget neutral methods to get more Bitcoin. Well, we're looking at many creative ways, whether it be from tariffs or, you know, something else, Boehind said. Boehind said. Boeh's idea comes after president Donald Trump signed an executive order that established the creation of the strategic Bitcoin reserve last month. And data from Arkham intelligence tracking The US stash shows it currently sitting at a 92,012. Following Trump's executive order, a separate document circulated from the federal register detailing a presidential directive requiring federal agencies to disclose all Bitcoin and digital asset holdings to the treasury secretary. That order and digital asset holdings to the treasury secretary.

That order's deadline was last Saturday. Pines adds that there is a one hundred and eighty day landmark that's on the horizon as the federal agencies go through recommendations for acquiring more corn. Quote, we'll comb through all the reports and then we'll produce a comprehensive piece of work, which basically means a larger report. Aside from the creative strategy of using tariff revenues for buying Bitcoin, Heinz cites senator Cynthia Lummis' Bitcoin act of 2025, which would revalue the United States Treasury's gold certificates from their outdated valuation of approximately $43 per ounce to reflect the current market prices that exceed $3,000 per ounce. And such an adjustment would free up billions of dollars in value for Bitcoin acquisition without requiring congressional appropriations of money.

Treasury secretary Besson and commerce secretary Lutnick joined, quote, many great actors working through an interagency digital assets working group to develop acquisition strategies aligned with the administration's goal of making The United States the Bitcoin superpower of the globe, Boeheim said. We will come together and flesh out some of these ideas and really get to the best solution. I don't know. Honestly, that works. The bit bonds, idea from Bitcoin Policy Institute also works. It's about buying, you know, like selling United States treasury bonds, but 10% of it of the proceeds of those bonds on sale to the whoever buys them goes to direct purchase of Bitcoin, which is also, in a way, a budget neutral way to acquire new Bitcoin. So you've already you've already got two things out of the gate that essentially demonstrate how you can be budget neutral and buy an ever loving shit ton of corn. Let's run the numbers.

CNBC Futures and Commodities. Earl is down two thirds of a point. West Texas Intermediate trading at $61.17. Brenton North Sea is also down two thirds of a point to $64.47. Natural gas is down almost a full point to $3.29 per thousand cubic feet, while gasoline moving the other direction up point 05% to $2.02 a gallon. Gold, wow. The third of a point to the upside brings it back up to $3,236 per ounce. Silver's up point one three. Platinum up 1.37. Copper is up well, it's not really up. It's just moving sideways. It just happens to be green. Palladium is up, however, 1.68%. And over in ag, mostly in the red, the only real winner today is coffee, 2.23% to the upside.

Biggest loser is chocolate, 3% to the downside. Live cattle, however, is up a fifth of a point. Lean hogs are moving sideways. Feeder cattle are up point 6%. Equities are all in the green, point 25% increase in the Dow. S and P is up point four one. S and P or I'm sorry. Nasdaq is up point 74%, and the S and P Mini is up point five. Now on to Bitcoin, which is looking at a $85,000, price. We did see 80, like, a 86,200 earlier today, but that seems to have calmed down. We are right at a $1,700,000,000,000 market cap, and we can purchase 26.1 ounces of shiny metal rocks with our one Bitcoin of which there are 19,851,547.77 of. And average fees per block are low, 0.03 BTC taken in fees on a per block basis, And there are six blocks carrying 21,000 unconfirmed transactions waiting to clear at high priority rates of 5 Satoshis per v byte. Low priority is gonna get you in at four.

And hash rate is now back above 900. We're at 902.5 exahashes per second. So still not a single miner is capitulating, or at least it doesn't look like that to me. From Bitcoin mining fire, yesterday's episode of Bitcoin and I got digital panhandler with a thousand sats. He says nothing. Jubjub with a thousand sats says, the clean cloud act bill is some Atlas shrugged looter BS. I agree. Pleb of Pleb with 500 says Bitcoin doesn't need America. America needs Bitcoin. Pass it on. Yes. Yes. Yes. I totally totally agree. Total agreement here, man. Yodl with, $4.44 says, Aruba, Aruba.

You're just making me say stupid shit now, brother. James with $4.20 says, Legend. And Perma Nerd with 256 says, When it comes to Mantra, it's all sour grapes. However, if you're looking for some sweet, sweet grapes, check out Peony Lane wine. Yeah. Telling you, man. I hear good things. I really do. Have Ben has not or mister Justman, I should say, give give him a little bit of an honorific there, has not sent me any wine, but that's okay because he is still in the circle p. If you're going to buy some wine, you might consider P and E Lane wine. That's P and E Lane wine, and tell Ben you heard about it here on the Bitcoin and podcast. That's it for the weather report. Welcome to part two of the news you can use, the digital shekel.

I have always loved that word, shekel. You got a shekel on you? Yeah. It's this Israel's money is called the shekel, And they've been talking about their own CBDC for a while. And, well, there was a new study that said that 51% of Israelis are interested in adopting a CBDC known as the digital shekel. And, well, it's all bullshit. And here's why. There were five problems with that report, and one was the sampling bias. Check it out. The study utilized an online panel, potentially skewing results towards tech savvy individuals that are already familiar with digital platforms, thereby not accurately representing the general population's views.

That's a that's a real thing. That I mean, there you have to be careful when you do these studies. Ask me how I know. I mean, I was I was in academia for a long, long time. I saw how the sausage was made. You gotta watch out for all kinds of shit. And the sampling bias is, like, number one. That's what, like, one of the one and it's also one of the easiest ones to clear out. But seems there was some sampling bias. There was also underrepresentation of certain demographics. Like, Arab citizens were notably underrepresented in the sample To adjust, responses from some participants were doubled, which may compromise the authenticity and reliability of the findings. Well, that's just data creep, man.

And that's not good. This study is bogus, dude. Lack of digital access among participants was another problem. Participant dropout rate was a fourth problem because a significant number of the participants dropped out between the first and second questionnaires indicating a potential selection bias where only those more interested in the topic actually continued on, possibly affecting the study's outcomes. No. It didn't possibly affect. It did affect the study's outcomes. And then there's the omission of potential risks. Because the presentation of the digital shekel to study participants focused on its advantages without adequately addressing potential risks such as privacy concerns, government overreach, and impacts on cash economies, leading to an incomplete understanding among the respondents.

So if you're looking at this saying, oh my god. The Israelis, they they want a digital shekel where it's like and and for and for those that carry that forward into Israel controls The United States because that is a that is a real thought process. I don't know. I'm I'm gonna stay neutral about that. Alright? Because I just I can't wade into that shit. But, again, this is a thing. There are and I'm talking many, many, many people, not a little, not a few, lots of people believe that Israel is actually the dog wagging the tail that is The United States. And if that's true, and you see a report that says the the all the is Israelis want want to have a digital shekel in CBDC, that that could mean bad news for The United States. It doesn't. This study is bullshit.

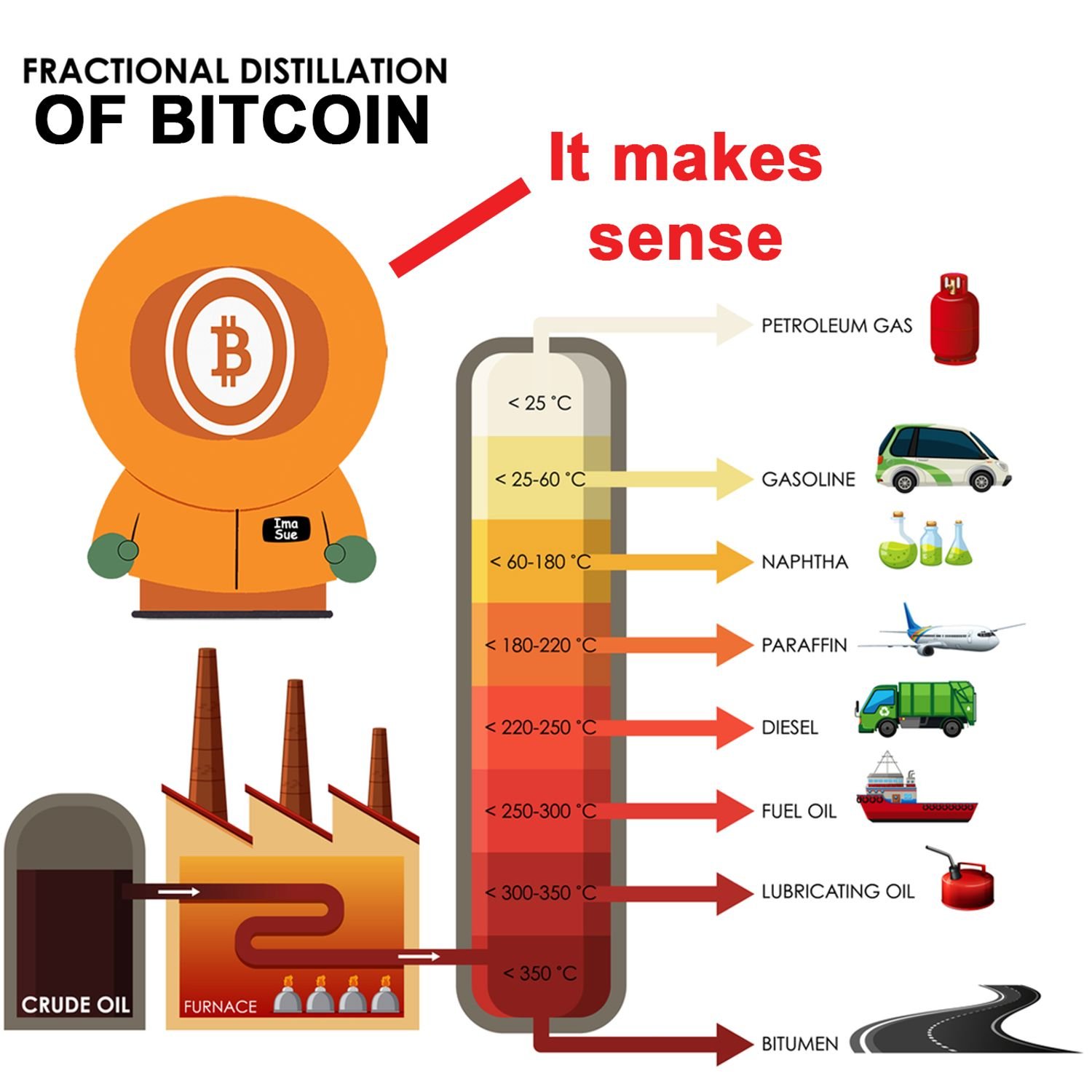

Israel is probably never going to get a CBDC, and they sure as shit aren't going to get it before the firestorm that is Tether completely envelops them like a dust storm of biblical proportions because that will happen. I guarantee it. Now how a Bitcoin treasury converts idle reserves into strategic capital. This is Nick Ward writing for Bitcoin Magazine. In the oil industry, reserves are only the beginning. What powers the world isn't raw crude oil. It's the refined products, jet fuel, diesel, gasoline, heating oil. Each serves a different market, a different use case, and a different risk profile. Public companies that hold Bitcoin are now discovering something similar.

Bitcoin held on the balance sheet is not just a passive reserve. It is a raw monetary resource, just like crude oil. One that can be refined, just like crude oil, into multiple financial instruments designed to meet the specific needs of different market participants. From structured debt to yield bearing assets to equity tied to Bitcoin appreciation, the treasury is no longer just a place to store value. It becomes a refinery capable of producing diverse capital market outputs from a single scarce input. The shift is subtle but transformative, and it represents a new paradigm for capital formation, investor access, and corporate treasury strategy.

Traditional treasury strategy is long centered around simple capital preservations. Corporations hold cash, short term bonds, and liquid equivalents as a defensive buffer. While this conservatism may preserve optionality, it often erodes shareholder value in real terms, especially in inflationary or low yield environments. But Bitcoin changes the equation. Bitcoin is liquid, globally fungible, and transparently auditable. More importantly, it is programmable capital, a bearer asset with no counterparty risk and a fixed supply. When placed on the balance sheet, it enables new forms of financial expression. Just as oil companies refine crude into differentiated energy products, corporations can now refine their Bitcoin reserves into structured financial products that meet demand across the capital stack.

This turns the treasury from a static safety net into a strategic source of capital access. There are four outputs of a Bitcoin refinery. One, convertible debt instruments. Bitcoin backed convertibles offer exposure to BTC upside, often with capped downside. They appeal to institutional investors who want long term optionality but are constrained from direct Bitcoin exposure. These structures can be calibrated for volatility, duration, and dilution profiles. Number two is yield bearing instruments. These are the ones that always scare me because where does the yield come from? But corporations can structure instruments that generate predictable yield collateralized by Bitcoin reserves.

This opens access to fixed income markets while retraining retaining treasury flexibility. These are especially attractive to allocators seeking returns without navigating custody or BTC volatility. Number three, BTC linked equity. When equity performance is visibly tied to the growth of BTC reserves, public shareholders gain a clear directional thesis. Investors seeking asymmetric upside can participate via equity that tracks Bitcoin exposure combining macro conviction with liquidity and governance. Number four, future BTC backed income streams.

Products like MSTY and Bitwise's new covered call ETFs are paving the way. These generate income from Bitcoin linked equities offering downside protection, monthly yield, and mandate friendly exposure for pensions, insurers, and endowments. Each product is a refined output, a market facing instrument designed to deliver value from the very same underlying reserve. A major often overlooked dynamic in capital markets is the regulatory constraint on asset mandates. Large institutional allocators like pension funds, endowments, insurance companies are often prohibited from directly owning Bitcoin due to internal policies or custodial limitations.

Yet, many of these same allocators seek indirect exposure to Bitcoin's long term upside. Refined Bitcoin Treasury products offered the bridge. They deliver tailored BTC exposure through familiar structures removing the operational risk of custody. These instruments allow allocators to participate in the thesis while remaining compliant with existing mandates. For the issuing company, this unlocks entirely new pools of capital and enhances investor reach without changing the underlying business. One of the most compelling aspects of this model is that it does not require a company to become something that it's not.

The refinery model is complementary to existing operations. A company's products, services, and business lines remain intact. What changes is how it manages and mobilizes its treasury. A Bitcoin treasury unlocks the balance sheet, new capital formation tools, broader investor reach, alternative valuation frameworks, and stronger capital market narrative. These I need to pause here because it before I forget this, remember how we're always saying that it's not fair that everybody in the world now has to be a financial expert because inflation and taxes and the rest of all the bullshit that we have to deal with is eating our ability to save the time we expended in the past and be able to carry it forward into the future.

So we have to actually do the thing that we're not do like, I'm I wanna be a welder. I don't want to do financial markets. I don't wanna watch fucking Kramer and his drunk ass on CNBC so I can figure out how not to lose the money I made by welding. Same goes for a doctor or a nurse or all these people that they just wanna do their thing, man. They want they don't wanna do their thing and something else. And now what are we what are we seeing happen? Companies are and, of course, this has been true for a while, but it's we don't really talk about it, do we? Companies themselves are having to get out of what it is that they do, and they have to manage the treasury. They just can't save money. No. No. They gotta have derivative products or they've gotta, you know. And and, honestly, I like this piece.

I like this idea. I certainly like the comparative models between oil refinery. It all everything we use from petroleum comes from crude, yet nobody uses actual crude oil. The same thing for Bitcoin. It makes sense. So I'm definitely not pooh poohing it, but I'm seeing that now not just people are having to be these financial experts, But companies and large companies have always done this. I get this, but smaller companies, probably not as much as you think, but now now they're gonna have to. Now the only way to hedge against the bullshit of the world is to have some Bitcoin on your balance sheet and have at least two or three products that you can refine from that Bitcoin, hopefully, in a way that produces some kind of yield that you can explain to the customer where the yield comes from and it doesn't break the bank.

I just wanted to make sure that we understood that that what was happening to the individual is also happening to corporations and companies both large and small. Hell, I run a corporation. It's an LLC. It's it's a corporate structure. It's a corporation, but it's tiny. It's not it doesn't have millions of dollars. It's just a legal structure, but I have to engage with it. And it seems to me that the only way that we're gonna be able to make headway in the future is somehow or another get well, and we do have Bitcoin on the balance sheet. I fought for that and was able to win, but we don't have, you know, enough to make capital products out of. But in conclusion, Bitcoin is the first digitally scarce monetary asset. It's like crude oil.

When held at the corporate level, it enables a form of capital refinement that was never possible with fiat or traditional reserves. This isn't just about holding Bitcoin. It's about unlocking its potential, refining a single reserve asset into multiple financial expressions of itself, each one calibrated for different investors and strategic outcomes. The corporate treasury is no longer static. It's now programmable, refinable, strategic. The refinery is open. The resource is scarce. The question is, what will you produce? Dude, that sounds too much like what's in your wallet.

I hate those commercials. But this is a great way to view Bitcoin. It doesn't mean that it's not without its potential problems. It is an awesome mental model. Why can't we do this with Fiat? Because Fiat is one of the refined expressions of what it used to be backed by. Gold. This is not a hard model to to wrap your mind around. We can refine gold into 14 karat, 24 karat. We can refine further that gold into jewelry, electronics, all kinds of other stuff, like the gold foil that they put on NASA's stuff to reflect the sunlight. I don't know if they still actually use gold, but they used to. It it was and and and you could produce fiat money from it. You could back paper with it.

That was a refined product from gold, but we've destroyed all of it. How will we move forward in the future and not destroy what is being presented here, which I think is one of the best mental models for Bitcoin that I've ever heard. And I applaud the author, by the way. Swedish MPs pitch Bitcoin policy as Trump's White House eyes national BTC adoption. According to The Block, Naga Avanamayo is writing this one. Denis Dzhakarev, I think is how you pronounce it, a long serving Swedish MP, has asked finance minister Elizabeth Svontensson about a potential national Bitcoin policy of growing trend among European nations and in The United States. Under Trump, the US plans to convert its seized Bitcoin stockpile into a strategic reserve. And on Monday, Dayakarev suggested a similar path for Sweden to strengthen its currency reserves with Bitcoin alongside fiat and gold without spending any public funds.

Woah. Is this something that the minister and the government are considering, he probed in a formal question. The conversation around Bitcoin as a reserve asset has garnered traction across Europe recently. And last week, Rickard Norden, another member of Sweden's Rakstag, also asked minister Svensson to reassess Bitcoin's role in the nation's finances. Alice Michael, the Czech National Bank governor, proposed diversifying the republic's foreign reserves by investing up to $7,000,000,000 in BTC. Meanwhile, Bitcoin skepticism within the European Union has not abated. Enter orange woman, also known as Christine Lagarde, European Central Bank president.

She said it was unlikely any Apex Predator bank. She literally says Apex Bank. And all, like, when I see Apex, I see Apex creditor. I think it was she needs to shut her mouth, man. Just stop talking, babe. Anyway, it was unlikely according to orange woman that any Apex banks in the block would add Bitcoin to the balance sheet. Where Europe remains divided on BTC policy, Washington forged ahead on nationwide adoption because in March, Trump signed the executive order. Yes. We know. He signed the executive order, and y'all ain't done dick with it except theorize and pontificate. You need to actually put at least one more Bitcoin into that pile using a a budget neutral way just to demonstrate that you're not blowing smoke.

I'm I'm sick of the pontification. Do it or get off the pot. Still though, you know, it all may not be lost for Europe. And if they don't have at least a little bit of Bitcoin that they refuse to spend, like Germany spent all of theirs, like, last year, and they really screwed the German people over on that one, Then Europe is lost, just the way that they're going. I don't know what's going on in Europe, but none of it is good. And the European people are just caught in the crossfire. I don't think they really know what to do at this point. My heart goes out to all of you guys across the pond. From Atlas twenty one, Bhutan, mining as a strategic choice to revive the national economy.

Prime minister Sheeran Tabgay, I think is how you pronounce it, recently stated that Bitcoin mining represents a simple strategic choice that could generate billions of dollars in profit for governments that chose to invest in the sector. In an interview with Al Jazeera, Tab Gay explained that using excess hydroelectric power during the summer months for mining makes perfect sense from an economic perspective. It's simply a strategic choice that many people have made earning billions of dollars, and I believe government should do the same, said the prime minister.

The report highlights how mining is one of the few industries that allows Bhutan to grow its economy while remaining true to its environmental values. The country has a strong commitment to protecting natural resources with a constitution that mandates at least 60% of its total land area be maintained as a forest. Quote, we have been careful about foreign direct investment. We have ruled out companies that harm the environment, contaminate air, or threaten our culture, Tab Gay declared. A key aspect of Bhutan's approach is its use of Bitcoin to counter brain drain from the public sector. And according to the report, the government sold $100,000,000 worth of Bitcoin in 2023, which allowed it to double public sector salaries and reduce resignations in the following year.

Bhutan is among the world's largest sovereign huddlers of Bitcoin with reserves valued at over, wow, $656,000,000 or about 7,700 Bitcoin managed by the state owned investment firm, Druck Holdings, according to blockchain analytics firm, Arkham. So Bhutan Prime Minister just straight up saying y'all should be doing this. It works for us. It's been working for us. We've been able to do x, y, and z since it is working for us. And you guys that aren't having it work for you are just missing the boat, and this is the country of freaking Bhutan. It's like being slapped around by a six year old, man.

You know, countries need to take some note. Anyway, last up for the day, the Securities and Exchange Commission has delayed ETF staking and in kind redemption decisions as the agency mulls long term crypto regulatory strategy, and this is MK Manilov from the block dot c o. The US Security and Exchange Commission has delayed its decision regarding staking ETFs as well as in kind creations and redemptions for several cryptocurrency exchange traded funds to later on in the year when the regulator intends to give itself more time to assess these rule changes as its in house crypto task force considers just how to implement long term and comprehensive digital asset regulations.

The crypto task force was formed to accelerate the creation of sensible guidelines and policies for the crypto industry. And so far, the group has met with a number of players to gather their recommendations and has rolled back most of the previous administration's enforcement actions against cryptocurrency firms. In February, Jitou and Multicoin Capital executives met with the SEC to advocate for staking ETFs, which could pay yield generated by locking up assets to investors. Well, that's all that is going to basically be put on hold. And it's not the staking ETFs that I really give a shit about. It was the in kind creation and the in kind redemption of Bitcoin specifically out of BlackRock's iBit Spot Bitcoin ETF.

And what that means is that for whatever reason okay? And this is where it gets you know, this is probably more of avoiding regulatory hassle for some companies and institutions than anything else is that if they had Bitcoin, they could just send Bitcoin to BlackRock to buy shares of their iBit Bitcoin ETF, right, without having to sell the Bitcoin. Okay? So that they have like, I have Bitcoin, and I say, you know what? I'm not allowed to hold this Bitcoin because of these mandates that I discovered in my company's charter, let's say. I've gotta get this shit off my balance sheet, but I don't wanna sell it for cash. Hey. There's there's BlackRock's iShares. Will you hold this shit for me so that I can say that I don't hold it? But I don't want to sell it to take a capital gains hit. I just want you to take the Bitcoin I already have and just hold on to it in its original format. And BlackRock would be able to say yes.

That would be an in kind creation of BlackRock shares on the ETF that you would then receive and you would be legally allowed to hold without making anybody, you know, getting all their panties in a wad. Now let's say something changes, and you need you need that Bitcoin back because, I don't know, you're gonna do a deal with somebody in the country of Bhutan, and you need that Bitcoin back to go do that do do do that deal. So what you do is you go back to BlackRock and you say, I need an in kind redemption of the 10 BTC that I gave you guys. And they say, sure.

And they give the Bitcoin back. They adjust the amount of shares outstanding, and then you take the shares and you do your deal with Bhutan. And as long as it's not on your balance sheet, which is the first reason you put it into BlackRock in the first place, then everything's okay. So you've done the deal with Bhutan. That is an in kind redemption. That has been something we've been waiting for, and we're gonna have to wait some more because they just can't figure out, I guess, how to do it. I I don't really know. But, hey, it is it is what it is.

Okay. So that's the end of the show, and I hope you guys learned a lot today. It's what we do here on the Bitcoin and podcast. It is the Bitcoin news you can use. I do it it every day. I love bringing you this stuff. Please donate to the show. Use podcasting two point o to do that. You can send me huge, massive boostograms or you can stream me satoshis. I've even got a geyser fund. It's all on my website bitcoinandshow.com. That's bitcoinandshow.com. 1 last time bitcoin and show. It's theshow.com. Go there, and you'll figure it all out, and I will see you on the other side. This has been Bitcoin and, and I'm your host, David Bennett. I hope you enjoyed today's episode and hope to see you again real soon.

Have a great day.

Introduction and Tax Season Rant

4chan's Downfall and Government Infiltration

Stablecoin Legislation in Northern Mariana Islands

Israel's Digital Shekel and Survey Critique