Join me today for Episode 1051 of Bitcoin And . . .

Topics for today:

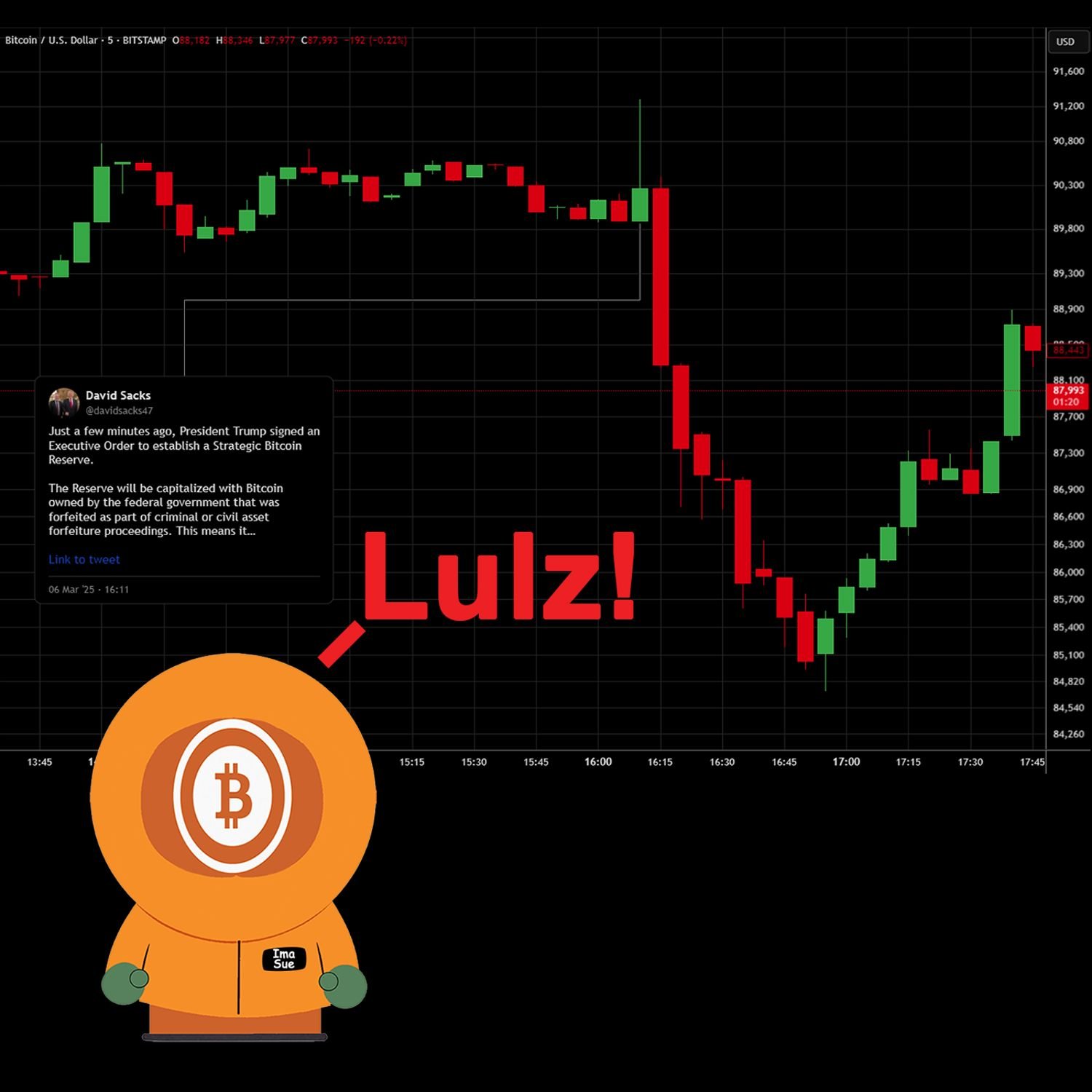

- Federal SBR Signed; BTC Plunges

- Texas SBR Passes Senate, Next Stop: House

- Senator Warren on the Warpath Again

- Bhutan Funds Country Ops Via Bitcoin

#Bitcoin #BitcoinAnd

The King Ranch Donation Pages:

https://www.ruralamericainaction.com/fundraising/save-king-ranch-and-agriculture-in-washington

https://www.givesendgo.com/Kingranch

Articles:

https://bitcoinmagazine.com/news/the-united-states-officially-establishes-a-strategic-bitcoin-reserve

https://x.com/DavidBennettNB/status/1897812637838115159

https://www.kvue.com/article/news/politics/texas-legislature/texas-senate-bill-creating-bitcoin-reserve/269-1cf581e6-964e-4ff8-81d5-6faf2e389029

https://cointelegraph.com/news/blockchain-industry-braces-for-white-house-crypto-summit-what-to-expect

https://www.theblock.co/post/345185/standard-chartered-says-funding-of-us-strategic-bitcoin-reserve-could-involve-selling-gold-as-a-budget-neutral-option

https://cointelegraph.com/news/trump-crypto-summit-bitcoin-tax-crypto

- https://www.cnbc.com/futures-and-commodities/

- https://dashboard.clarkmoody.com/

- https://mempool.space/

- https://value4value.info/

- https://fountain.fm/show/eK5XaSb3UaLRavU3lYrI

- https://geyser.fund/project/thebitcoinandpodcast

https://decrypt.co/309060/elizabeth-warren-david-sacks-trump-crypto-policies

https://atlas21.com/bhutan-the-billion-dollars-in-bitcoin-supporting-the-national-economy/

https://bitcoinnews.com/markets/bitwise-bitcoin-gold-etp-btcg/

https://lightning.news/flash-non-custodial-wallet/

Find the Bitcoin And Podcast on every podcast app here:

https://episodes.fm/1438789088

Find the Bitcoin And Podcast on every podcast app here:

https://episodes.fm/1438789088

Find me on nostr

npub1vwymuey3u7mf860ndrkw3r7dz30s0srg6tqmhtjzg7umtm6rn5eq2qzugd (npub)

6389be6491e7b693e9f368ece88fcd145f07c068d2c1bbae4247b9b5ef439d32 (Hex)

Twitter:

https://twitter.com/DavidB84567

StackerNews:

stacker.news/NunyaBidness

Podcasting 2.0:

fountain.fm/show/eK5XaSb3UaLRavU3lYrI

Apple Podcasts:

tinyurl.com/unm35bjh

Mastodon:

https://noauthority.social/@NunyaBidness

Support Bitcoin And . . . on Patreon:

patreon.com/BitcoinAndPodcast

Find Lightning Network Channel partners here:

https://t.me/+bj-7w_ePsANlOGEx (Nodestrich)

https://t.me/plebnet (Plebnet)

Music by:

Flutey Funk Kevin MacLeod (incompetech.com)

Licensed under Creative Commons: By Attribution 3.0 License

creativecommons.org/licenses/by/3.0/

Good morning. It is 09:09AM Pacific Standard Time, but not for long. Remember, Sunday, 02:00 in the morning, you're gonna roll your clocks forward for one hour. I don't know why we still do this, but apparently we do. It is the March 2025, and this is episode ten fifty one of Bitcoin and The United States officially established a strategic Bitcoin reserve. And the price immediately dropped. We're gonna talk about it. The Texas Senate is in the news about, the state great state of Texas's own strategic Bitcoin reserve. There's some good news on that front. And then, yes, today is the day of this crappy White House crypto summit where we were expecting the executive order on the strategic Bitcoin reserve to be signed, and I have absolutely no idea why it came a full day early.

But we still have this crypto summit at the White House to get through. We do not know what effect that will have, although I presume that we will see a price drop again just because, wow, people are just so twitchy out there. Now Standard Chartered is gonna make some comments about some of the comments that were inside Trump's executive order about the strategic Bitcoin reserve. And then what will the Trump crypto summit actually say about taxes? Maybe not much. Maybe not much. Elizabeth Warren is on the warpath about David Sachs. We'll get into that one and Bhutan because apparently they got a billion dollars in Bitcoin and we'll we're gonna see how that's helping or hurting or hindering or basically making Bhutan, you know, a great place to live, maybe not. I don't know. We're we're gonna find out all about it. And then Bitwise has introduced some Bitcoin and gold products into Europe. And then a company named Flash has launched non custodial Bitcoin payment solutions for merchants.

We'll find out more. I guarantee it. But first, the United States officially establishes a strategic Bitcoin reserve. This is written by Nick. Bitcoin magazine, United States President Donald Trump has officially made The United States the largest nation state holder of Bitcoin by signing an executive order this evening to create a strategic Bitcoin reserve. The reserve will hold an estimated 200,000 BTC, marking a significant shift in United States' financial strategy and reinforcing Bitcoin's role in the global economy. David Sacks, president Trump's cryptosar, provided further clarification on the newly established reserve stating that the reserve will be funded by the Bitcoin that's already owned by the federal government, specifically those assets that were stolen oh, I mean, forfeited in criminal and civil asset forfeiture proceedings. Quote, this means it will not cost taxpayers a dime, he emphasized, pausing just to comment. Unless you're one of the people that gets a civil asset forfeiture put upon your ass and you've got to give up your Bitcoin because for whatever reason, you don't tell them to go screw.

I mean, if you're gonna go through civil asset forfeiture, you may very well be looking at prison time anyway. I just say no. Just you you can't have it and exercise that right. Yes. I I get it. Nobody wants to go to prison. You know? I'm sure nobody wanted to die in the American revolutionary war either, but they did. You know? What point do we gut up? And you'll say, yeah. We'll wait till they come to your door. Yeah. You may be right. You may be right. I mean, you know, little dogs and medium dogs bark a lot. But when, you know, when when the two dogs that are barking across the, you know, across the way from each other through a fence and all of a sudden somebody opens that fence and all of a sudden they're all lovey dovey to each other. Yeah. Yeah. Yeah. I get it. But, honestly, I I think we may be at a world turning point on just how angry people are about just a continual stream or avalanche of BS coming and falling upon their heads and always causing them to lose wealth. And at one point or another, you're like, well, shit. If this continues, I'm not gonna have anything left.

And Lola Lietz has a lot to say about civil asset forfeiture, and she predicted that this particular executive order was actually going to use the stolen Bitcoin, and it's not forfeited. It wasn't confiscated. Use the proper word. This Bitcoin was stolen. As long as we can be honest about where the Bitcoin came from, we're not lying to ourselves and each other, then we can have a credible conversation about it. It doesn't necessarily mean that I think that the the executive order is just bad. I'm just saying we we should we would behoove ourselves to think critically about where this Bitcoin came from.

Continuing, the executive order also mandates a comprehensive audit of the federal government's Bitcoin holdings as the exact quantity of Bitcoin under US control has never been fully accounted for. Well, Sachs noted, quote, it is estimated that the United States government owns about 200,000 Bitcoin. However, there's never been a complete audit. The executive order directs a full accounting of the federal government's digital asset holdings, end, quote. The key provision of the executive order ensures that the government will not sell any Bitcoin deposited into the reserve. Instead, it will serve as a long term store of value with Sachs likening it to a digital Fort Knox for the cryptocurrency often called digital gold, end quote.

Highlighting past financial missteps, Sachs explained how premature sales of Bitcoin by the government have cost taxpayers over $17,000,000,000 in lost value. Well, with the new reserve, the administration seeks to avoid such losses while strategically maximizing Bitcoin's long term value. Additionally, the executive order grants the Secretaries of Treasury and Commerce the authority to develop budget neutral strategies. Budget neutral strategies for acquiring more Bitcoin, provided that such acquisitions come at no incremental cost to taxpayers.

There's two parts. I'm pausing again. There's two parts in that sentence that are highly, highly confusing because they're not well defined. Let's continue. The executive order also establishes a United States digital asset stockpile, which will include non Bitcoin digital assets seized in forfeiture proceedings. However, no additional assets will be acquired for this stockpile beyond those obtained through such means. Again, theft. Even if they're shitcoins, it's still theft. Sachs concluded by praising the administration's commitment to digital assets, quote, president Trump promised to create a strategic Bitcoin reserve and digital asset stockpile.

Those promises have been kept. He credited key officials, including treasury secretary Scott Dissent, commerce secretary Howard Lutnick, and executive director Beau Hines for their role in executing this initiative. This landmark decision positions The United States at the forefront of the global Bitcoin economy. With this move, president Trump's administration is signaling a bold, bold embrace of Bitcoin as a core component of national financial strategy. Ladies and gentlemen, there are two sides to this story. Actually, there's probably more than that, but there's at least two.

If you will notice, both on Nostr, if you are over on Nostr, and if you're not, why are you not claiming your name space? That's ridiculous. It ain't gonna cost you nothing. Or on Twitter, what you're probably seeing is the bifurcation or the bifurcating arguments on whether or not this is a good executive order or a bad executive order. Now if you look at the side, and I'm just gonna use Lowell elites as as an example of the side of the argument that says this is bad. It is because it's stolen property. It's stolen property. Think about it this way. A lot of those coins that the of the of the maybe 200,000 Bitcoin that the United States federal government has, a lot of those coins came from the Bitfinex hack, and I believe there's 60,000 Bitcoin as part of that hack. Well, last I heard, the United States government has been in talks with Bitfinex. Is it Bitfinex?

I think, yeah, the Bitfinex Act has been in talk with Bitfinex to give back those coins because Bitfinex is not the criminal. But as Lola Elite suggests, if any particular piece of property was, quote, unquote, engaged in or part of or somehow related to illegal activity, then it is up for civil asset forfeiture. Yet, again, I've heard more than several stories talking about the fact that the United States government is considering giving those coins back. So now we're already down to a hundred and 40,000 Bitcoin if they give that back. The rest of this Bitcoin, not all of it, but a good guts and feathers of it came from the Silk Road hack or I mean, the the Silk Road debacle. Well, Ross got a got a pardon, a full pardon, a % pardon, which means he was not guilty of any of this. So does he get his coins back?

Well, probably not. See, the here's the thing is that this is all stolen property. But there's another side of the argument that everybody is just, this is great. This is this is awesome. This is good. I'm not sure how they see that because the absolute second that David Sacks put up on Twitter, his tweet that starts out this thusly, and it was at my time sixteen eleven, which would be four, 04:11PM in the afternoon Pacific Standard Time, March the sixth of this year. David Sacks said the following just a few minutes ago. President Trump signed an executive order to establish a strategic Bitcoin reserve.

And then he goes on with the rest of the tweet. So I copied the address of the URL of that particular tweet, and I just pasted it into TradingView. And if you didn't know, if you do that, TradingView will actually put, look at the time stamp and then connect with a line onto the graph of what whatever it wherever it is that you put it. I put it on my Bitcoin chart Bitcoin slash USD chart. And there was an immediate sell off, and I mean a precipitous sell off. It was a huge sell off. And a lot of the people in the camp are saying that that sell off was because that there's no way that the United States government is has been entreated to buy more Bitcoin. They're just going to sit on the stolen property, and therefore, it's a big nothing burger. Well, that's that's a very possible, correct consideration right there.

Or it was a precipitous drop off because we are just going to sit on stolen property, and that this means that the United States government will therefore affect even more civil asset forfeiture of those Bitcoin, well, that's going to destroy the price of Bitcoin, so I don't buy that. Okay? I I just don't. However, I reserve the right to be fully wrong, but I don't see how that works in the favor of anybody. But I wouldn't put it past him. Still though, this precipitous drop and I mean, it started exactly exact we were actually up to 91 above $91,200.

Saks David Saks drops this tweet, and we go down all the way to over the course of one, two, three, four, five, six, seven hours, we get all the way down to 85,200. That's a hell of a drop. So something happened. But it's not all bad news. Okay? It it really isn't because I I have been telling you guys that it's not really about the federal at the federal level having a Bitcoin strategic reserve. It's more about the states. And one state, my state in particular, Texas yes. I know. I live in Washington, but you can you can take the Texan out of Texas, but you will never take Texas out of the Texan. I it just it just works that way.

So let's get this one from KView. It's an ABC affiliate station out from, Austin. Texas Senate passes bill creating Bitcoin reserve in effort to move towards digital future. Yes. The senate Texas senate passed senate bill 21. So on Thursday, the Texas senate passed a bill to diversify the state's cash reserves into cryptocurrency. The bill, authored by state senator Charles Schwartner of Georgetown, creates the Texas Bitcoin Reserve. That's the name of it. It's not crypto reserve. It's not shitcoin reserve. It's Bitcoin reserve. The bill to make the state's cash reserves more digital passed the upper chamber by a, get this, 25 to five vote in the Texas senate.

It now heads to the Texas house. And if governor Greg Abbott signs it into law, Texas could become one of the first states in the country to have its own cryptocurrency reserve. Now I gotta pause because it took me forever to find out whether or not it had already passed the house. Because if it had passed the house and it was on the senate, then it goes directly to the governor's desk for signing. And if Abbott signs it and he said that he will, it's automatically law, goes into effect, and they can start doing stuff. That is not the case. It has only passed the senate in Texas.

It has one more hurdle to jump, and that is the house of representatives, which contains a lot more people, and chances of of us getting a lopsided vote in favor of this is less because the 25 to five, that's one hell of a of a majority in the Texas senate considering that they even had democrat I mean, like, like, all the Republicans voted for it, and then there was even a few Democrats who were, like, going, hell yeah, man. LFG, bro. Well, the house has a lot more people in it, so we'll we'll have to see. And I don't even know when they're gonna send that thing over there. But Schwartner said that the Bitcoin Reserve would serve as a hedge against inflation, quote, I want Texas to lead in the digital financial economy.

I think it's worthwhile that it expands its treasury options and financial options when it comes to stored value, in this case, expanding its digital assets such as Bitcoin, end quote. Senate bill 21 would create a special investment fund outside of the state treasury. Oh, good lord. I got an advertisement. Lost my place. Where am I at? No. No. No. No. No. No. No. No. No. Hold on. Okay. Finally picked it back up again. Senate bill 21 would create a special investment fund outside of the state treasury using Bitcoin as the primary currency. It recognizes Bitcoin as a valuable digital asset similar to gold. Quote, Bitcoin offers unique advantages to its limited supply and decentralized nature in the digital era.

This bill will allow Texas to diversify our investment approach, participate competitively in the evolving digital financial economy, and leverage the benefits of Bitcoin and other cryptocurrencies, Schwartner said. He also said it gives greater autonomy as well as flexibility in investment strategies with state funds. The Texas comptroller would be able to acquire, exchange, manage, and retain investments in Bitcoin and other cryptocurrencies. The bill would require the currency invested in with state funds to have a market capitalization of at least $500,000,000,000.

That's not million. It's half of a trillion dollars that we're talking about Texas by itself. Half a trillion dollars over a twelve month period, essentially the value of the mined coins. Currently, only Bitcoin has a market cap above that number. A five person advisory committee would offer advice on managing the reserve. State senator Tan Parker of Flower Mound said diversifying assets enhance the state's fiscal resilience and the financial security for its residents. What we're doing here is not adding strength to our balance sheet in Texas, Parker said.

We're providing the additional ability for Texas to be autonomous economically and that we're really providing a hedge against a bad monetary policy that has cost America and Texans so dearly with the horrible inflation. So there you go. Texas is on its way to establishing a strategic Bitcoin reserve. And, again, this goes back to reinforce what what it is that I really think about this. Because if the federal government said, no. We're not gonna use taxpayer money to buy a single more Bitcoin. We're only gonna sit on this pile, and we're never gonna sell it. Okay. The only good part about that is that it decreases sell side pressure on 200,000 Bitcoin.

So let's say a 40 if they give the 60,000 back to back to Bitfinex. But it's the states. It's the states. Each individual state is going to be able to say, well, do we sit on funds that we've somehow already captured, if there are any, or can we buy some? And if there's a way that we can buy some, how do we do it in a way that doesn't piss off our constituency? Well, you know, I don't know. But what I do know is that it's being left up to the states. There will be more than a few that say we're buying Bitcoin, and the constituency will say yes, or at least most of them will.

And Texas is one of those states. And they may not, you know, go break the bank buying Bitcoin. They'll probably just steadily accumulate Bitcoin because Texas is like the seventh largest economy on the planet. Its economy is as large as, like, Italy, and it's a state. Right? So this is why I'm not kinda I'm not really all that freaked out by what Trump said in the executive order about just sitting on stolen property and not buying anymore in a legitimate fashion, because I think that there will be more than a handful of states that will ultimately step up to that plate. And what can Bitcoin bring them?

Well, I know what it brought a friend of mine. I'd had a conversation with a, a dear friend that I used to work with back at Texas Tech, and, he said and I quote, he's like, you know, nobody had my back but you, and I haven't even been hanging out with you for seven years because you told me to buy Bitcoin. He was able to he was able to buy a house because I was just I mean, when I was at work, I was the crazy one. I was the dude next to the whiteboard with a whole bunch of pins and red strings and pictures of, I don't know, JFK assassination stuff going, look, man. You I got some shit you should read, brother. I was that guy.

And a couple of people actually listened to what I had to say, and I started being that guy in 2015. Do the math. So I'm happy that my existence upon this planet was able to affect positively that one person in such a way. God bless you, my friend. I will call you later on today if you're listening. Okay. Onto this one. Blockchain industry is bracing for what the White House crypto summit will bring. Oh my god. David, what what should we expect? I don't know. Aaron Wood might tell us. He's writing from Cointelegraph. Crypto business leaders and US government officials are set to meet at the White House crypto summit on March, a high profile event that follows president Trump's executive order to establish a strategic Bitcoin reserve and national digital asset stockpile.

The event, the agenda of which is not yet public, will feature prominent figures from the crypto industry, including people like Michael Saylor and some other people. The the other people I mentioned as other people is not because I'm a Michael Saylor fanboy, but all the other people, they're all shitcoiners. The only dude there that is even remotely close to Bitcoin only and has been is provably Bitcoin only at this point. He might have said some stupid things that I don't really appreciate, but he's never said I'm all in on XRP. You know, that's Michael Saylor. All the rest of them, they're all shitcoiners.

Anyway, the Trump administration has moved quickly on a number of pro crypto policies, vowing to position The US as a global leader in digital assets. So who is attending? This this is this is who this is what I'm really concerned about here. Here's the name of the confirmed, quote, unquote, industry leaders. Chris Dixon from Andreessen Horowitz, a whole company full of shitcoiners. Fred Teal, CEO of Marathon, which is now called Mara. They do Bitcoin miners and a great big one too. Mike Belshi of BitGo, hundred percent shitcoiner. See the CEO of Ripple, Brad Garlinghouse, is a % shitcoiner.

Chris Giancarlo with the former CFTC chairman and senior counsel at Wilkie Farr and Gallagher, I'm not so sure, but he's not exactly all 100% in on Bitcoin. I'll just I'll just say that. Okay? Raghu Yaguraduraduraduraduraduraduraduraduraduraduraduraduraduraduraduraduraduraduraduraduraduraduraduraduraduraduraduraduraduraduraduraduraduraduraduraduraduraduradurad, I can't pronounce the name, cofounder and CEO of FalconX, Nathan McCauley, CEO of Anchorage Digital, Chris Marszlik, CEO of Crypto.com, Cameron and Tyler Winklevoss are the founders of Gemini. They've been in the space for a long time, and they are shitcoiners. Vlad Tenev, the CEO of Robinhood, Arjun Sethi, CEO of Kraken, Michael Saylor, we know who he is, Brian Armstrong, King Mulrath of all Shitcoiners, Sergey Nazarov, cofounder of Chainlink, Shitcoiner, Kyle Simani, managing partner at Multicoin Capital, Shitcoiner, Zach Whitkoff, cofounder of Trump linked World Liberty Financial, proven Shitcoiners.

Kyle Simani, managing partner at Multicoin Capital. Didn't wait. Did they put him up twice? Where's the other guy from Multicoin? Oh, Kyle yeah. They put him up twice, Kyle Simani. Whatever. Good god, y'all. Mike Huang, cofounder of Paradigm, David Bailey, CEO of Bitcoin Magazine, Jonathan Steinberg, CEO of WisdomTree, Brian Brooks, the former acting US comptroller of the currency, and Shane Copeland, the CEO of Polymarket, Chickwinder. Unconfirmed are Paolo Arduino from Tether, Changpeng Zhao from Binance, Cathie Wood, Vitalik Buterin, Jeremy Allaire, Charles Hoskinson, Antalone sorry. Antole wait. Anatole Yakovenko is the founder of Solana. Shit. Corner.

Marc Andreessen, the actual guy behind a 16 and Andreessen Horowitz. They are not confirmed, but I fully expect, Charles Hoskinson to be there and probably Anatoly and Marc Andreessen. I fully expect those people to be there. I wish that Changpeng Zhao, Cathie Wood, and Paolo Ardoino would be there because say what you want about Tether or ARK Invest or even Binance, but, honestly, those guys are some those are some pretty solid guys. I'm just saying. Even though it's Tether, I know, Paulo Adorno, Tether. I at one point or another, I don't have the energy to not cut people a break when they always talk about Bitcoin and they don't really talk that much about shitcoins even if they do have, you know, created Tether.

Okay. So I mentioned that we're not gonna be buying any more any more Bitcoin as at the federal level. We're just shit it was sitting on a stolen property. Well, Standard Chartered says that it's possible to fund The United States strategic Bitcoin reserve by selling gold as a, quote, budget neutral option. Remember that sentence that I read where they was stating what the executive order said? It was David Sacks saying stuff like budget neutral. We we won't buy any Bitcoin unless we can figure out a way to do it in a budget neutral fashion. Well, here's an example of what that could mean, at least according to standard Chartered. This is written by by Brian McGleanan out of the block.

Standard Charter's Joff or Jeff Kendrick has highlighted a potential strategy for funding the newly established US Strategic Reserve in a budget neutral manner, selling a portion of the country's vast gold reserves to buy Bitcoin, pausing to ask anybody, have we done the audit on Fort Knox yet, or did we already forget about that? Fair question. Right? Okay. And and vast well, we I don't know. We nobody knows how much gold The United States has. Hell, we can't even count up Bitcoin, and that's on a digital ledger. Come on, man. Anyway, quote, the next question is, what could constitute budget neutral strategies?

And in theory, the following could be done, to sell gold and buy Bitcoin. Kendrick said in an email, he added that the United States government holds approximately $760,000,000,000 worth of gold. How do you know that, Kendrick? Have we don't have an audit yet. Anyway, this follows president Donald Trump's overnight signing of an executive order, officially establishing the Bitcoin strategic reserve in a digital asset stockpile, marking a historic shift in the federal government's approach to digital assets. The order mandates that any future government acquisitions of Bitcoin for the Reserve must follow the quote, unquote budget neutral strategies, ensuring that no incremental cost to American taxpayers are realized.

Under the new directive, all Bitcoin currently held by the United States government will be transferred to the strategic Bitcoin reserve with a clear stipulation that none of it will be sold. Kendrick also suggested additional budget neutral strategies that could be explored. One option, he said, is using the exchange stabilization fund, which holds $39,000,000,000 in net assets. While the ESF is traditionally used to stabilize liquidity during financial crises, Kendrick noted that repurposing it for Bitcoin purchases would be a clear change of direction.

Another possibility is the Bitcoin act of 2024 introduced by senator Cynthia Lummis, which proposes buying 200,000 Bitcoin per year for five years. Kendrick suggested that if structured appropriately, the Bitcoin Act could be passed and worked into a budget neutral way. I call complete bullshit on that last one. Anyway, president Trump is expected to expand on the strategic Bitcoin reserve during his remarks at the White House Digital Asset Summit on Friday. However, Kendrick cautioned that immediate policy implementations are unlikely, noting that secretary of the treasury Scott Bessent will play a critical role in shaping and executing the acquisition strategy.

Quote, in reality, I cannot see any of these three solutions being delivered today. Rather, they would all require secretary Besant to propose something given the importance placed on Besant in the executive order. Kendrick suggested that The United States and institutional investors, including long term pension funds, could be encouraged to allocate to Bitcoin following the federal government's lead. The standard chartered head of digital assets research also emphasized that the formalization of a US strategic Bitcoin reserve could spur other sovereign nations to follow suit. Quote, I have written previously about how a United States strategic reserve, whatever it looks like, can embolden other sovereigns, Kendrick said.

At the December, Abu Dhabi held 4,700.0 BTC equivalent of iBit. Other sovereigns will now sure surely join in the buying. Well, yeah. I mean, I have yet to see it. So, you know, I'm not trying to poo poo on everybody's parade. I'm just saying we we don't need to be like cheerleaders all the time and everything is great. We we have to keep a critical eye. Right? Because there's a lot of people that are saying that that the strategic Bitcoin reserve basically and the way that Bitcoiners are acting towards it is basically a bunch of bootlicking. John Carvallo, in particular, put out a meme like that to have a little piece of art of a boot on a table and this happy face clown looking guy just happily looking at the boot and then above it, it says strategic Bitcoin reserve.

It's this thing is is a this is a polarizing time for Bitcoiners right now. And I think it's important for those of the for those Bitcoiners that are in love with the strategic Bitcoin reserve, take a step back and take a breath and look at their brethren on the other side of the argument and say, what is it that they're looking at that they don't like about this? Conversely, the people that hate this, that absolutely hate this thing, needs to take a step back, take a deep breath, and look at the people that love it and say, why do they love it? What is it about that this that's making these people really excited about this?

And it doesn't mean that I'm not suggesting that that means that we have to, you know, I don't know, hold each other's thoughts as truth in our minds at the exact same time. But this is a polarizing issue. And every time I've seen polarizing issues of this nature, and by this nature, I mean heavy, very powerful, pull like the twenty seventeen blockchain wars or block the block size wars. Right? That was a massive polarizing event in Bitcoin. This has every bit of the potential to become that, and we don't need one more of these things. We don't. We don't need any more polarization between what we've got left.

We lost a lot of people to the Bitcoin cash debacle, and half of those guys went over to Satoshi's vision when that shit happened. And if you don't know what I mean, you gotta go read the block size wars. It's a book, and I can't remember the name of the author, but the title of the book is the block block size wars. So go get it. I lived through it. I I watched it all happen, so I kinda really haven't haven't really gotten the book yet to read it because I was there. I watched it happen. I don't wanna see this shit happen again. If if for no other reason that we look at each other's arguments than to just tie us together, It doesn't mean that I need to believe the other side. It doesn't mean that I need to think that I'm wrong because the other side is right. It just means that I'm throwing a rope over the chasm, and hopefully it's being caught by somebody on the other side of the chasm. And if we have thousands of people doing that, then we have sutures between the two groups across the chasm.

It doesn't mean that we need to agree with each other. And in fact, the only way to pull the rift back together is for us to actually be applying force in the opposite direction on the rope. And if you really think about how tug of war works, and if we if both teams actually work together at the exact same time, they keep tension on the rope, and the land and earth and the the the structures beneath your feet kinda come along for the ride. Because I believe that this is a, this is a turning point, and we don't need any more bifurcations in Bitcoin. We just don't.

Now just to end up here, I wanna make sure that we it's it's apparent that in this crypto summit thing, taxes on Bitcoin and other cryptocurrencies are not going to be discussed. Now that was a apparently, I I I'm not even sure who the hell said it. Sam Borgie from Cointelegraph has a a bid on it. He oh, he he says it's a senior White House official has indeed confirmed that US president Donald Trump's crypto summit on March will not cover taxes. And almost immediately, the second this news hit the wires, Bitcoin price went from, like, $92,000 down to $87,000.

It's right now at just beneath 87 or just beneath 88, rather. It's at 87,788. That's how twitchy all the markets are. And let's in fact, all the markets are so twitchy, we're gonna run the numbers about it. Futures and commodities oil getting getting a breather today. It's actually up over a point to $67.08 a barrel. Brent Norcia is up one and a quarter, back above $70 with 32¢ to spare. Natural gas is down two and a half points to $4.19 per thousand cubic feet, and gasoline is up point 14% to $2.10 a gallon. All your metal rocks are doing poorly today except palladium. Gold is down a quarter of a point, but still holding at an impressive number of $22,918 and 40¢. Silver is down 1.72%.

Platinum is down one and a fifth. Copper is down 2.11%, and palladium is actually the only one in the green. It's up point 14%. Ag is fully mixed today. Biggest winner, oh, man. That's pretty good to be close. Cotton, 1.06% to the upside. Biggest loser today is, well, coffee, point 39% to the downside. Live cattle is up. Wow. Wow. Wow. 2.20.15% to the upside. Hogs, lean hogs are up almost a half point, and feeder cattle are up one and one fifth point. But here's the bad news. Here's the twitchiness. Indices, legacy markets are bleeding out yet again with the Dow losing a quarter of a point.

S and P is lost a half a percent. Nasdaq is well over half a percent to the downside, and the S and P Mini is down three quarters of a point. That's gotta hurt. And we're chilling out with Bitcoin at $88,080. Market cap is $1,750,000,000,000. We can only purchase 29.9 ounces of shiny metal rocks with our one Bitcoin, of which there are 19,833,385.37 of. Average fees per block are low, 0.04 BTC taken in fees on a per block basis, and there are 28 blocks carrying 12,855 unconfirmed transactions waiting to clear at high priority rates of 4 Satoshis per v byte. Low priorities are also four Satoshis per v byte.

Hash rate remaining stable, 789.5 exahashes per second gives us plenty of security and from Pumpin' Trump. Yesterday's episode of Bitcoin and I got Bitcoin for president with a thousand sats says your show is fantastic. Dude, thanks. Please share the show with all your friends and family. And thank you, sir. I appreciate your time and effort to keep us all informed. Oh, thank you, sir. I appreciate it. Paul Surnine with 500 says, thanks again, sir. Enjoy the clown show, and have a great weekend. Looking forward to the episode next week.

Let's see here. Psyduck with 562 says Psyduck. Anonymous twice with 500 each and says nothing. Yodle with 300 says nothing. Perminerd with $2.34 says the media is a hate machine. Yeah. No shit. Yodle with nothing, but he does say spitting fire. That's the weather report. Welcome to part two of the news you can use. Elizabeth Warren on the warpath again and is demanding that David Sacks prove he isn't directly profiting from Trump's crypto policies. Stacey Elliott and Liz Napolitano is writing this one for Decrypt. Senator Elizabeth Warren has demanded that David Sacks, president Donald Trump's crypto czar, prove that he isn't, quote, directly profiting off of the Trump administration's efforts to selectively pump the value of certain crypto assets, end quote.

The Massachusetts senator laid out her concerns about a conflict of interest in a six page letter that she made public on Friday morning, just hours ahead of a planned crypto summit at the White House. Earlier this week, Sachs said that he sold all his crypto assets before beginning his role as crypto czar. He was appointed in early December, by the way. Quote, despite your public statements via x, it remains unclear exactly when you personally divested from Bitcoin, Ether, and Sol or Solana, when Kraft Ventures divested from Bitwise. Warren wrote, referring to venture firm that Sachs himself founded, quote, and whether people close to you may have held positions and sold into the recent price surge. So she's talking about insider trading, which I'm sure that Elizabeth Warren herself is guilty of because how the hell can you be valued at $67,000,000 of personal wealth when you get paid $209,000 a year?

Just asking. Because I I I I don't know anybody who's that good at trading stocks except, for maybe possibly Nancy Pelosi. Now come on, guys. If you actually think that this was that they got their wealth legally and above board and ethically and morally, you are fooling yourselves. Just last night, president Trump signed an executive order to establish a Bitcoin reserve. Sachs shared the announcement on x, formerly Twitter, promising that the efforts would not, quote, cost the taxpayers a dime. And at the time of writing, the Bitcoin price is just above $90,000. Oh, come on, man. You you never need to put the price in your in your news stories because god only knows what happens the second after you press press publish.

Anyway, the order authorizes the government. Yeah. Yeah. Yeah. Ethical questions, broadly sweep. Yeah. Yeah. Yeah. Several web three industries, blah blah blah. Because it's like the only reason the only reason I'm not reading the rest of it is that it is a basically, it's it's just rehashing a whole bunch of other stuff. So the only thing of of any noteworthy, or brain worthy, thing here is that Elizabeth Warren is demanding proof from David Sacks that he's not directly profiting, and I have not seen the letter that she sent. I'm I'm kinda hoping that it'll come out so that we know exactly what steps mister Sacks needs to take to to provide such proof, I would like a manifest of what proof she intends to get.

Because, honestly, I think she was just laying in wait on this. She could have done this at any time, but she waited till this morning because she knew it was gonna be picked up by the newswires. If she she is if she's anything, she is conniving when it comes to, you know, how to place her her media press releases. Alright. Let's go over to Bhutan where they don't where they don't get into this crap. The billion dollars in Bitcoin supporting Bhutan's national economy is written by Atlas twenty one. Bhutan's prime minister, Chiring Tabge, has stated that the country is actively using its Bitcoin reserves to fund essential national expenditures, including public salaries, health care, and environmental projects.

The strategy has proven particularly useful during a period of contraction in tourism revenue, a sector historically vital for Bhutan's economy. According to ARCEM intelligence data, the nation currently holds 10,635 Bitcoin worth nearly $1,000,000,000 In an interview with Al Jazeera, the prime minister said, quote, we have used Bitcoin to provide free health care and support environmental efforts, but the most important use has been to finance the salaries of our public servants. Tabghay then rhetorically asked, quote, hundreds of people have made significant profits from Bitcoin.

Why shouldn't governments adopt similar strategies? Oh, shit, dude. What sets Bhutan apart is its sustainable approach. Bitcoin is mining Bitcoin mining is done using only clean hydroelectric power, which the country has in abundance, thanks to its mountainous terrain. Okay. So that's that is a budget neutral way to attain Bitcoin, except for the fact that you'll, you know, you'll have to excuse the fact that it's clear that they had to buy, you know, buy the power. So who's providing the power? How are they getting the power? How much is it costing the Bhutan tax pay? Whatever. Okay. I I get it. But that is definitely a more neutral way of getting a hold of Bitcoin than just buying it on the open market at the behest of your citizenry of your country. I'm just saying.

And The United States, Texas specifically, is a huge Bitcoin mining reserve. So how would we be able to leverage Bitcoin miners without stealing from them? Because we gotta keep that shit in mind. How would we be able to lever how would The United State how would the federal government be able to use existing Bitcoin mining infrastructure and or the knowledge base to start mining Bitcoin for themselves in a, quote, unquote, budget neutral fashion. I don't know. Maybe they need to send some emissaries over there to baton and see exactly how they did it, because it sounds to me like they made out like bandits.

Just saying. Okay. So over to Europe where Bitwise has introduced Bitcoin and gold exchange traded products in Europe. Not not exchange traded funds or ETFs, but ETPs in Europe. Bitwise Asset Management has launched a new exchange traded product that combines the growth of Bitcoin with the defensive stability of gold. Well, that's kinda interesting. The Bitwise Diamond Bitcoin and Gold ETP started trading on Euronext Paris in Amsterdam, March The Sixth Twenty Twenty Five. That was yesterday. The product dynamically allocates between Bitcoin and gold, so investors get exposure to both assets while managing risk between the two. BTCG, that's the ticker symbol for it, follows the diamond Bitcoin and gold index, which reallocated funds between Bitcoin and gold based on market conditions.

When Bitcoin's risk adjusted performance improves, the ETP increases its exposure to Bitcoin. And during downturns, it shifts more to gold, which has historically been a safe haven in times of economic uncertainty. This dynamic approach aims to capture Bitcoin's long term potential while minimizing risk and volatile market conditions. The product is perfect for investors looking for a quote store value strategy that protects them during Bitcoin bear markets and allows them to benefit from the asset's growth. BTCG is a physically backed exchange traded product, meaning that it holds real Bitcoin and PAX Gold or PAXG, a digital asset tied to physical gold stored in London bull Bullion Market Association vaults.

The Bitcoin held in cold storage custody, so it is not connected to the Internet. The product has a total expense ratio of 1.49% per year and is domiciled in Germany. The ETP is rebalanced once a month using ULCER or ulcer indices, a measure of downside risk, first developed in the nineteen eighties, and backtesting has shown that that this strategy outperforms static allocation methods and helps investors achieve better returns while managing their risk. The launch of the BTCG is a big milestone for Bitwise, which has been expanding into Europe. Bradley Duke, Managing Director and head of Bitwise Europe said, quote, as crypto rapidly enters the mainstream, it is essential that we offer investors the full gamut of options available in traditional markets, including sophisticated hedges such as the ones that we have developed in cooperation with Diamond Partners, end quote.

BTCG is a product of the partnership between Bitwise and Diamond Partners, a digital asset focused UCITS fund manager backed by Azimut, a European asset manager. Danielle Bernardi, CEO of Diamond Partners, said, quote, the Bitwise Diamond Bitcoin and Gold ETP enables confident allocations to both physical Bitcoin and digital gold, this is weird, offering diversification and low correlation to strengthen portfolios in a risk managed framework. Bitcoin is called digital gold but often shows extreme volatility. Gold, on the other hand, is a proven hedge against inflation and economic instability and its price is more stable.

By combining these two assets in one investment vehicle, BTCG allows investors to benefit from their strengths while reducing exposure to wild market swings. For example, when geopolitical tensions or economic policies worries arise, investors tend to flock to safe haven assets like gold. Meanwhile, during bull cycles, Bitcoin has been one of the best performing assets. BTCG's dynamic rebalancing ensures investors are positioned for both. Not sure I buy this shit. With institutional interest in alternative safe haven assets on the rise, BTCG enters the market at the right time, Bradley Duke said, quote, we've looked at the performance of this index versus the S and P five hundred, the Nasdaq one hundred, and gold alone, and it has outperformed considerably.

Okay. So as you might sense, David's got a problem with this. Yes. I've got a problem with this. And it it doesn't it's not necessarily what they're generally saying. What they're generally saying is act kinda correct. Why would you not want a product that that that somehow or another switches from one asset to another asset in in in percentages and in ratios given certain market conditions so that you get the best of both worlds, an increasing price of your investment altogether and good balanced risk management? Hey. That sounds like a wonderful idea, doesn't it?

Except that we live in the universe that does not seem how does how to say this? If it's too good to be true, it probably is. That I think that that's where what I'm getting at here. And what does this sound like? Given certain market conditions, they reduce or sell the amount of of gold in the port or the amount of Bitcoin in the portfolio and buy gold. And then when there's a bull market, they reduce their exposure to gold, sell that on the open market, and use the the proceeds of that sale to buy more Bitcoin. And then it just goes back and forth and back and forth. And it would seem like it squelches the amount of, quote, unquote, noise in the markets.

I contend that it does not. That it, in fact, is one of the noise makers in the market because this sounds a lot like, remember the whole procedural stablecoins? Remember? If you don't remember that, just Google procedural stablecoins. It's right around the time that, oh, let's see. Oh, FTX blew up, Alameda blew up, BlockFi blew up. They all blew up. Remember that? Yeah. Look for procedural stable coins. Okay. This sounds like a procedural stable coin to me, except that it's in tied in tied inside of legacy markets, that being gold.

So there's a couple of things that I've I've I've I've got a problem with this product. I I don't think this product is a good product. It doesn't mean don't go buy it. Alright? It's not investment advice. Yes. That's a cover your ass statement because I don't I could be so wrong. It's just not even funny. This thing could be the bee's knees when it comes to, you know, if you're a gold bug and you like Bitcoin, hell, man. This this might be the thing for you. And if you don't invest in it, you're not gonna get the billion dollars. And then all of a sudden, I get a lawsuit slapped on me because I said don't buy this product. Let me say this. I'm not gonna buy this product, but not just because I'm in not a European.

If I was a European living in Europe, I still wouldn't buy this product because I'm looking at this going, something doesn't smell right. This smells like something that can introduce noise to the markets, and we've got enough noise already. And I don't think that this procedural way of of managing risk by selling one into the other and vice versa during certain market conditions, I don't view that as something that squelches noise in the market. I see it as a noise maker. That's all I'm gonna say on that one. Last up for today and for this week, Flash launches a non custodial Bitcoin payment solution for merchants.

Yay. This is out of lightning.news, and it is written by the editorial team. So maybe I'll take the editorial team out to lunch one day. Flash has introduced a noncustodial lightning wallet ready for payment automation and wallet connections. The wallet is targeting merchant payment challenges offering support for Nostra Wallet Connect. Together with Flash payment gateways, the new ecosystem addresses key friction points by eliminating KYC requirements and providing business, businesses intermediate transaction capabilities. Okay.

The Bitcoin community known for embracing new tech has quickly started to try out this new service. Twitter account, the Bitcoin Coffee Guy posted running, app pay with flash. What? Oh, oh, oh, Pay with Flash is their is their Twitter handle. The Bitcoin Coffee Guy posted running Pay with Flash, an homage to Hal Finney who famously posted running Bitcoin. Okay. Yeah. I get it. I get it. The wallet's core feature includes instant, low cost payment processing, complete financial sovereignty, and zero personal data requirements. Merchants can deploy the solution without traditional verification processes enabling rapid onboarding and flexibility.

Technical capabilities distinguish Flash Wallet from existing solutions. Full Lightning and Liquid network integration allows businesses to accept Bitcoin payments with minimal transaction cost and maximum efficiency. The non custodial architecture ensures that merchants and the users retain complete control over their funds, addressing a critical concern in cryptocurrency payment ecosystems. Upcoming feature developments include offline transaction processing, invoice generation, point of sale functionality, and automated recurring billing mechanisms.

These enhancements aim to transform the wallet from a simple payment tool to a comprehensive business financial platform. By removing intermediary bear intermediary barriers wow, that's a mouthful, and simplifying the setup process, Flash Wallet represents a strategic approach to expanding Bitcoin's commercial utility. The platform's zero k y c model aligns with principles of financial sovereignty, providing businesses an unencumbered path to accept Bitcoin payments. Quote, we're fundamentally reimagining how businesses interact with Bitcoin, says Flash cofounder Pierre Corbin.

Our goal is to make Bitcoin payments as straightforward as swiping a credit card, but with dramatically enhanced privacy, much lower cost, and more control for users. Okay. Well, this sounds great. I I I I do. I actually love this kind of thing. But my problem here, yes, Dave has a problem, is when are they gonna shut down their service because they can't service anybody in The United States or Europe. It's not about being able to provide KYC free tech. We've always been able to do that. It's about how able are you to stand in the face of Goliath while he's smashing you into the ground with a giant boulder?

Because that's the federal government of the United States. That's the federal government of Mexico. That's the federal government of Canada, and that's the whatever you wanna call the government of the European Union. And a whole bunch of other ones, by the way, New Zealand, Australia, I could go on and on and on. I won't. We've seen what happened to Walla de Santoshi. We've seen what happened to BitMex. All of these people are, like, going, hey, man. You do all this shit KYC free until you can't. So the fight isn't the fight isn't at the level of the tech. That's easy, dude.

The fight is at the level of these governments that have been allowed to grow so out of control and develop such a deep seated hatred of their citizenry that they regard all citizens as criminals, not even potential criminals, kinetic criminals. The federal government looks at me as a kinetic criminal, not a potential criminal, and it certainly doesn't look at me as a citizen that if I do commit a crime that I am innocent until proven guilty, that shit sailed. That is gone. You are now guilty. And it's all almost it's well, it's not always been that way in Europe, but it's been that way in Europe for a lot longer than it has in The United States. That's for sure.

So it's at that level that we have the problem. It's not the technical level. And that's one of the reasons why I'm having a problem with this particular, solution here is that we've seen this solution before. It's not really a solution. It's just another instantiation of that which at one point or another, a phone call or a knock on the door will occur and say, hey, mister no KYC guy, we're going to throw you in prison for the rest of your natural born life unless you either shut it down or prove to us through various regulatory ways that you're performing AML KYC.

It's happened again. It's or it's happened before. It's happened several times. It'll happen again, and it will happen several times again. Is Flash going to be the next wallet of Satoshi? I don't know. I hope not. I mean, I don't have a problem with the people behind it. I'm sure that their hearts are in a good place. You know, they're they're working with Bitcoin. Right there tells me that they're not in since they're not shit coining, that they're probably pretty decent people. Yes. All shitcoiners suck. I'm sorry. They just do. They don't understand anything that they're touching, and they're basically sucking the air out of what should be and using it for themselves. But I'm digressing here. I'm just saying it's not the technology that doesn't enable KYC or AML free situations.

It's the jurisdictions in with in which they operate. And until we fix that, this could just end up being another Wallet of Satoshi issue, but I certainly hope it's not. Okay. That's the end of the show. If you wanna support me and what I do, please use podcasting two point o enabled podcast players like Fountain, the Fountain app, and you can find that at fountain.fm because that's the way that you'll be able to give me boostagrams. So what is that? Write me a brief message and attach a certain amount of satoshis for it. Yes. You gotta have a lightning wallet. Those are easy nowadays. Come on. It's it's not that hard. And then you say, hey. Boost this guy 10,000 sats and make him say good morning on a show. Yes. I'm going to read it. You could boost me, like, you know, 5,000 sats and say, I'm gonna make him say, oh oh, uh-uh.

I'll probably read it, dude. I'm I'm sort of that way. If somebody is going to give me their value, I'm going to try to give the value back. It is value for value that what is that's how we do things here. So if you wanna support me, if you wanna support what I do, stream me Satoshis through podcasting two point o. Boost me through podcasting two point o. I will make your wedding announcement for you if you want. And then the third thing that you can do if you don't wanna do either one of those, go leave me drop me a five star review on Apple Podcasts because that actually still helps. It helps quite a bit because the more five star reviews a podcast has on Apple Podcasts, the the the easier the discovery of the podcast is.

And that's where I'm at right now. I mean, I've got a good solid listener base. I want to add more people to that listener base, and that's where you come in. I cannot market myself the way that professional marketers can. I don't make enough money on this podcast that I can spend into a marketing scheme. And even if I did, the chances are good. It would just make me look bad because most marketing, in my opinion, it's just awful. It makes people look bad. Oh, you I know what you need to do. You need to run a contest and give away something free. I'm sorry, but that makes me feel sick inside.

Maybe it shouldn't. If you know about marketing and how that how that works, then let me know why it is that my guttural response to doing a giveaway is the is wrong headed. I will listen. I promise. But other than that, if you guys can help me spread word of the show, whether it doesn't have to be just on Nostr, LinkedIn. Even if you I mean, there are still people on LinkedIn. There's, clearly, there's a shit ton of people on Twitter. If you can, if you have time, help me market the show in those places. Then see if we can get some more listeners, and I will see you on the other side.

This has been Bitcoin and and I'm your host, David Bennett. I hope you enjoyed today's episode and hope to see you again real soon. Have a great day.

Introduction and Time Change Reminder

Bitcoin Reserve Announcement

Crypto Summit at the White House

Debate on the Executive Order

Polarization in the Bitcoin Community

Conclusion and Call to Action