Join me today for Episode 1033 of Bitcoin And . . .

Topics for today:

- Blackrock to 5% of MSTR

- 16 US States Looking at SBR

- The Importance of nostr is Unbounded

- Vertex Web of Trust as a Service

#Bitcoin #BitcoinAnd

Circle P:

Peony Lane

Wine

nostr: https://primal.net/BenJustman

Twitter: https://x.com/BenJustman

Website: https://www.peonylanewine.com/bitcoin

The King Ranch Donation Pages:

https://www.ruralamericainaction.com/fundraising/save-king-ranch-and-agriculture-in-washington

https://www.givesendgo.com/Kingranch

Articles:

https://cointelegraph.com/news/black-rock-increases-strategy-stake-to-5-after-micro-strategy-s-rebranding

https://decrypt.co/304890/third-of-us-states-bitcoin-crypto-public-funds

https://bitcoinreservemonitor.com/

https://decrypt.co/304833/hawk-tuah-girl-podcast-crypto-influencers

https://www.coindesk.com/markets/2025/02/06/u-s-added-143k-jobs-in-january-fewer-than-forecast

- https://www.cnbc.com/futures-and-commodities/

- https://dashboard.clarkmoody.com/

- https://mempool.space/

- https://value4value.info/

- https://fountain.fm/show/eK5XaSb3UaLRavU3lYrI

- https://geyser.fund/project/thebitcoinandpodcast

https://bitcoinmagazine.com/culture/nostr-the-importance-of-censorship-resistant-communication-for-innovation-and-human-progress-

https://www.nobsbitcoin.com/vertex-web-of-trust-as-a-service/

https://www.nobsbitcoin.com/tails-v6-12/

https://www.nobsbitcoin.com/bitcoin-keeper-v2-0-1-keeper-desktop-v0-2-0/

Find the Bitcoin And Podcast on every podcast app here:

https://episodes.fm/1438789088

Find the Bitcoin And Podcast on every podcast app here:

https://episodes.fm/1438789088

Find me on nostr

npub1vwymuey3u7mf860ndrkw3r7dz30s0srg6tqmhtjzg7umtm6rn5eq2qzugd (npub)

6389be6491e7b693e9f368ece88fcd145f07c068d2c1bbae4247b9b5ef439d32 (Hex)

Twitter:

https://twitter.com/DavidB84567

StackerNews:

stacker.news/NunyaBidness

Podcasting 2.0:

fountain.fm/show/eK5XaSb3UaLRavU3lYrI

Apple Podcasts:

tinyurl.com/unm35bjh

Mastodon:

https://noauthority.social/@NunyaBidness

Support Bitcoin And . . . on Patreon:

patreon.com/BitcoinAndPodcast

Find Lightning Network Channel partners here:

https://t.me/+bj-7w_ePsANlOGEx (Nodestrich)

https://t.me/plebnet (Plebnet)

Music by:

Flutey Funk Kevin MacLeod (incompetech.com)

Licensed under Creative Commons: By Attribution 3.0 License

creativecommons.org/licenses/by/3.0/

It is 08:57AM Pacific Standard Time. It is the seventh day of the second month of twenty twenty '5. This is episode 1,033 of Bitcoin and BlackRock back in the news. Even though we talked about BlackRock yesterday, they're they're doing other stuff. And then then we're gonna examine just how many states in The United States are now looking at a Bitcoin strategic reserve or some type of asset strategic reserve because the number has increased yet again. And then we've got, Hocktoa girl. Something, something has occurred and we are not going to be hearing anywhere close to the last from Hawk to a girl. I guarantee it. She's going to be in the news for a while.

If my prediction holds out. And then, well, we've got the jobs report came in, and we and we got a bump out of it. And, of course, the bears were ready and willing and able to, I don't know, have fun staying poor or something like that. We got tornado cash. That case is in the news again. And then we're gonna have a rather long discussion about Nostr. We've got a really good article in here from Leon Wenkam, from Bitcoin Magazine. That will be the second part of the show along with Vertex as a web of trust service coming out. There's, some important security fixes with Tails if you are using Tails OS, and Bitcoin Keeper is in the news. But first, let's go all the way to the top and talk about BlackRock yet one more freaking time.

Zoltan Vardai from Cointelegraph. BlackRock has increased its stake in Michael Saylor's strategy to 5%. Now I'm gonna pause here because notice how Zoltan Vardai made damn sure you know what you're talking about when he says the word strategy. Because the rebranding from micro strategy to strategy is such a terrible rebrand, Writers are having to actually put yet one more name into headlines so that you know what the hell they're talking about. Nobody knows what the hell strategy is. Everybody knew what MicroStrategy was. They I mean, we've been hearing the name MicroStrategy since 2021.

And before that time, nobody knew what MicroStrategy was. Yet here we are only, like, you know, four short years later, and they've rebranded to strategy. This, in my opinion, is bad, and this headline is evidence that the rebranding is bad because he had to actually throw in Michael Saylor's name. But, nonetheless, this story is about BlackRock and the fact that they have bought more, well, what used to be MicroStrategy. BlackRock has increased its stake in Michael Saylor's strategy, reinforcing its growing institutional interest in Bitcoin. And BlackRock, the world's largest asset manager with over $11,600,000,000,000 in assets under management, has increased its stake in strategy to 5% according to a February 6 filing with the SEC.

Following the investment, MicroStrategy stock rose by more than 2.8% in premarket trading to change hands at $325, as of February. Strategy is the world's largest corporate Bitcoin holder with 471,107 BTC worth around $48,000,000,000. Now that's all we really need to know. They get into some some history, or Zoltan or whatever gets into some history about BlackRock and whatnot like that and some numbers. And we're really we don't need that. What we really just need to understand here is that, BlackRock has increased their holdings of strategy to 5%. But here's the thing is that as of this morning, let me get bring it up here. As of this morning let me see if these news stories are still here.

Let me read you some of the headlines about MicroStrategy. We get over here. They are up. Actually, strategy is now up or MSTR is up 3.61%. And if I go over here to the news, I've got a couple of stories here. Keith, Brewiette, and Woods has initiated MicroStrategy at an outperform with a $560 price target. And then we have Maxim Group. MicroStrategy is maintained at a buy by this thing called Maxim Group, and they have a $500 per share target price, and that is up from $480. So it's not just BlackRock that is, you know, getting into MicroStrategy. It's a lot of these other agencies that they're not ratings agencies, guys that say, hey. This is a buy. It's a hold. This is a sell.

And this is an outperform. This is a, you know, get over leveraged on this. And they're calling for 5 hundreds anywhere between 500 to $580 per share, and you're looking at MicroStrategy at $3.60. So, you know, take it for what it's worth, and and I'm not suggesting that you go buy MicroStrategy stock or or anything like that. I'm just saying that this is what's going on. And remember that their next earnings report comes out in May, May the sixth, by the way. And they're going to be able to put their gains from their Bitcoin holdings for the first time ever on their balance sheet, and they may be looking at a 12 I think it was like a $12,600,000,000 increase in what their valuation that they are going to be able to report because of the fair value.

Yeah. Fair fair value accounting rule set from the FASB is going to they're going to use it for the first time in May unless they don't, but they would be able to. So just be prepared for that. Now let's get into the states. Because remember when there was just two or three states that were talking about a strategic Bitcoin reserve and then it went to, like, eight and now it's like well, then it went to, like, 12. Well, now it's a full one third of all the states of The United States are now exploring Bitcoin and crypto for public funds. Vince D'Aquino from Decrypt.

A growing wave of US states are pursuing legislation to establish a strategic Bitcoin reserve or enable some type of crypto investments for public funds, opening a shift in state level fiscal policies. Out of the 50 US states, 16 have ongoing legislative considerations and varying statuses. Utah stands out as the state closest to potential implementation. The state's Blockchain and Digital Innovation Amendments Bill was passed and recommended on third reading by the Economic Development and Workforce Services Committee through the house with a majority vote of eight to one on January.

Utah's bill would authorize the state treasurer to allocate up to 5% of certain public funds to qualifying digital assets as long as they meet the main requirement of having over $500,000,000,000 in market cap averaged over the past twelve months and pretty much only Bitcoin fits that bill. Though a total of 17 states have filed similar proposals, North Dakota's proposal was notably rejected on February according to data visualized by the Bitcoin Reserve Monitor. Several other states are considering similar moves to allow Bitcoin or crypto for use in public funds. State level momentum continues to build with New Mexico becoming the latest entrant. Senator Anthony L Thornton introduced the Strategic Bitcoin Reserve Act on February proposing yet another 5% allocation.

This number five percent comes up quite a bit. Remember? We just got finished with BlackRock, five percent allocation. Anyway, Arizona's senate finance committee has advanced similar legislation passing SB ten twenty five, which would permit up to 10% of public funds, including public pension systems, to invest in cryptocurrency. Wyoming and Massachusetts have also joined the race with the latter opening its rainy day fund to be invested in Bitcoin or any digital asset for up to 10% of its stabilization fund.

Texas, meanwhile, has taken a different approach with two proposals. The state has a senate bill in the works that would allow up to 1% allocation from its general revenue fund balance, but it has a separate house bill focused on Bitcoin donations with provisions for crypto payment conversions to Bitcoin. So far, neither has advanced to law. From Oklahoma and Missouri to New Hampshire, Pennsylvania, and Ohio, various states in The United States have either proposed or pending bills with the legislative status of these bills across 16 participating states actively being tracked by Bitcoin Reserve Monitor. And they keep mentioning Bitcoin Reserve Monitor, which you can go look at at bitcoinreservemonitor.com, and it shows you a map of The United States and all the states that are proposing anything that even remotely looks like this are in various colors.

Blue is pending. Okay. So these are the states that are pending. Wyoming, South Dakota, Kansas, Oklahoma, New Mexico, Texas, Alabama, Florida, Missouri, Illinois, Ohio, Pennsylvania, New Hampshire, and Massachusetts. North Dakota is in red because they had one, but it got rejected. Now there's an orange one, and there's two states that are considering, which means that they've gotten it, you know, they've gotten it through. They're they're they're out of committee, and that's Utah and Arizona. Now of all of those states, we have one, two, three, four that are Bitcoin only, That only mentioned Bitcoin, and that is Arizona, New Mexico, Texas, and Illinois.

Oklahoma, that is a partial. So it's they've mentioned Bitcoin, but they're looking at other particular cryptocurrencies also known as shitcoins. So we have 16 states right now that are vying to be the first to have some type of either Bitcoin reserve or crypto asset reserve. Now going back to this North Dakota thing, it yes. It got rejected. I guarantee you they were they are going to revisit this. The the the people that wanted this to happen, they're not gonna let it go so easily. So just be aware that just because North Dakota got their shit handed to them on a silver platter, well, that it's gonna come back. I I guarantee that they're gonna try that one more time. Now let's get over here. Why is my thing not working? There we go. The Circle P is open for business, and Peony Lane wine keeps it real.

Their vineyard isn't about fancy talk. It's built on hard work, real grit. The nature of their vines come about through honest effort, crafting wines that hit hard with bold, unapologetic flavor. Each bottle tells a story of down to earth dedication and raw passion. If you're tired of the fluff and want wine that's as tough as it is tasty, give Peony Lane wine a try. No pretenses, just pure, unfiltered taste in every drop. That's right. Peony Lane Wines is back in the Circle p today. And I'm going to describe to you their 2022 Estate Pinot Noir.

It's vibrant and untamed from the highest elevation AVA in North America. I don't know what AVA means. Maybe it means available. Anyway, ripened by intense sunshine and crisp mountain air, our sustainably grown Estate Pinot Noir produces vibrant and untamed natural wines. Expressed through tart cherry and strawberry notes, this wine balances a lively acidity with a spiced bright finish, reflecting the unique terroir of North America's highest elevation wine region. Now when when they describe that and says intense sunshine, Ben Jessman is not kidding.

If you've ever been to the higher elevations in Colorado in the summertime, then you know what I'm talking about. If you haven't, then you have absolutely no clue just how baked in the sun you can get. And that's what you want for grapes. You want intense sunshine. And in fact, you you kind of want a little bit every once in a while, especially towards the end of the season, you kind of want a little bit of drought conditions to concentrate those sugars into the grape. And that is one of the hallmarks of high altitude wine because it is bathed in sunlight. And if you would like to buy this wine from Ben Jessman, you will have to actually email him if you want to use Bitcoin to buy it. Because while he does take Bitcoin, there's only a few a couple of sets of wine that you can actually just purchase without actually, you know, talking to him.

That is the lightning pack and the whale pack. If you want to buy some of his other wines for Bitcoin that's not in the list, then you need to email him directly. Okay? So that would be benjustman@peonylanewine.com. This whole thing, his his website is going to be in the, show notes under the circle p. You go to peonylanewine.com/bitcoin, and at the right hand side bottom, it says email us directly. Hit that thing, and you will be able to work a deal out with Ben. I'm not sure exactly what kind of deal you'll be able to work out with Ben, but whatever deal you do work out, make damn certain that you tell him that you heard about him and his wine and his vineyard P And E Lane here on the Circle P on the Bitcoin and podcast. Now on to the hock to a girl.

She posts and then deletes a podcast with crypto influencers. What's going on? And this is from decrypt.co. Who's writing it, by the way? Andrew Hayward is writing it. Hayley Welch, the Hocktoa girl who went viral last year, has awoken from her long slumber following the disastrous launch of her Solana meme coin early December. Things are as chaotic and confusing as ever because Welch appears to have posted a new episode of her Talk to It podcast. Get it? Talk To It? Anyway, on Thursday, more than two months after the last episode was released shortly before her meme coin catastrophe. Strangely, though, the episode no longer appears on her YouTube channel, seemingly deleted as abruptly as it went up. But if the idea was to scrub it before the Internet could get its eyes on it, then it wasn't fast enough as leaks of the episode are now circulating on social media.

The new episode features a conversation primarily with Richard Banks, Bankston, the crypto native founder and CEO of gaming organization, Faz Clan, who brought along a pair of industry pals, DeGods creator and meme coin trader, Frank, and content creator and influencer thread guy in it. I know. You you're you're you're I you're doubling over in pain because you wanna throw up. I'm I've got a point, but I've gotta let you have the information first. Welch recounts her experience of agreeing to launch a meme coin. Keep that in mind. She agreed to launch a meme coin and how things went wrong with the deployer holding 80% of the supply and the token price immediately plunging to near zero and the immense backlash that mostly forced her offline in recent months, quote, I'm still a little shook up about it, Welch admitted at the top of the show.

Broadly, it's a friendly conversation about missteps around the meme coin situation, which resulted in a lawsuit against Welch's business partners, and Welch is playing ball with lawmakers taking aim at her one time allies. Welch suggests in the interview that she didn't really understand what she was getting into, which her guest agrees sounds accurate following the leak. Banks wrote on Twitter that he agreed to do the podcast under heavy stipulations, including that the episode not be leaked to manipulate markets and that her crypto team find, quote, a real solution regarding the money that she made, where that should go, and what to do with the hawk project moving forward.

Or maybe she should flush it down the toilet. Banks claims that Welch's team assured them that the episode wouldn't be released until his side approved it, but chatter around the upcoming episodes started circulating in recent days as Banks notes indeed, decrypt received a head received a heads up days ago about the recording from a source. Oh, this is ridiculous. Banks said that they called the episode off right then and there. He further alleges some shenanigans around the now nearly worthless hawk token on the back of the episode leak fueling hype. Quote, now today, the episode randomly gets leaked, the price of hawk is pumping, and they completely fucking fumbled the bag yet again.

What a fucking mess. Poor girl. It's a wonder how she found herself in this position in the first place, end quote. And that's bay what Banks was writing on Twitter. Indeed, the HAWK token more than doubled in price on Thursday afternoon, but has since cooled off up just 9% on the day to a current price of $0.00078 per coin. Decrypt reached out to Welch's spokesperson. Oh, for fuck's sake. This is ridiculous. Okay. So here's why here's why we're talking about it in the first damn place. Remember what I told you about pump.fun, And pump.fund is the website that makes most of these meme tokens, and they always use Solana.

My conjecture back in, you know, back in the day, what, late last year, when this thing happened in December, my conjecture was is that put that she had no idea how to do this. And it was like and it was like, it's her coin. She's launched a coin. She didn't launch shit. And I said it then, and I'm saying it now because it looks like I've been proven right. Pump dot fund, I believe, reached out to her because she was an Internet sensation for, like, that day and a half, and meme coins were going crazy. So pump dot fund did everything they could to get a hold of this poor girl and said, look. We're gonna make millions of dollars together. We're gonna make a meme token out of you, and we're gonna list it. We're gonna do all the back end shit. You all you gotta do is be the face of the project, and she said yes without any understanding of what that meant to say yes.

Because this is an unregistered security, and that's just that's probably the most of her war worries, but it's not the least problematic of what she's found herself into. Right? I mean, this now she could be, like, tagged for market manipulation after the fact with what happened here. She's completely blown her reputation. Not that that's gonna matter because every you know, everybody's still gonna wanna get her on on, you know, on her their podcast because it's Hawk two a Girl, and that's gonna lend some kind of credibility to whatever. I'm just saying that the guy that did the that had the squirrel and the raccoon suicided, you know, at his house, and then he made meme tokens, guarantee you the exact same thing happened.

Pump.fun reached out to him and said, you're an Internet sensation. Let's get rich together. We'll do the meme coin. We'll do the back end. We'll do the launch. You're the face of the project. If for whatever reason you find yourself in a situation where you're getting a lot of traction on social media because, I don't know, you ran into a tree on a tricycle, don't let pump.fun take you down this hole. You don't wanna be in this hole. This is going to take forever for these people to get out of. And if they don't see jail time, I will consider them lucky. That's what I'm taught that's why I'm bringing you this story. It's not because I think Haaktu is a good thing. It's not. It's it was an awful thing to to witness.

But, man, this girl just she just doesn't know when to clam up. It's it there's a fifty fifty chance that after this late latest experience that we never hear from her again. But there's also the same fifty fifty chance that we do, and god only knows what the hell that'll bring. So Bitcoin topped a hundred k after The United States added fewer than forecast jobs in January. The jobs report came out, and CoinDesk's James Van Stratten is gonna give us some particulars. The largest cryptocurrency rose above a hundred grand for the first time since February. We've become exceedingly efficient at crossing the hundred k mark.

Anyway, that was after the Bureau of Labor Statistics said that the economy added a 43,000 jobs in January, which was below the forecast for a 70,000 and definitely down from the 256,000 added in December, and I am still waiting on those numbers to be adjusted down because I guarantee you they will be. Still, the unemployment rate dropped to 4% compared with the expected 4.1% and December's '4 point '1 percent as well as growth in average hourly earnings blowing past the estimates coming in at 0.5% compared with the expected 0.3. Quote, relatively high wage inflation and a low unemployment rate means that the Federal Reserve isn't likely to cut rates anytime soon, but markets already knew that, said Zach Pandell, Grayscale's head of research.

As long as equity markets remain broadly stable, Bitcoin could make new highs later this quarter, end quote. The chance of a Federal Reserve lowering the bench rate interest rate or sorry. The benchmark interest rate at its March meeting fell to 8% from 15% according to CME FedWatch data. The Fed cut the Fed funds rate by a hundred basis point over the last four months of 2024. And, several weeks ago, investors were expecting more of the same in 2025, but a string of strong economic and inflation data since then, however, has had the Fed quickly backtracking on its dovishness and traders pricing out the odds of any further policy easing.

So and we are now back down to 97,400 according to my sources, which is my little m five block that's got the Bitcoin price on it. Alright. Let's run the rest of the numbers. Futures and commodities and most of the markets are bleeding out, but oil is actually up a quarter of a point for West Texas Intermediate, $70.8 a barrel. Brent Norsey, likewise, up a quarter to $74.50. Natural gas is down, however, one and two thirds point. Gasoline is up just over a point to $2.09 a gallon. Gold is up, but most other things are down. Gold is actually up a quarter of a point, and it looks like a brand new all time high for gold. Congratulations, mister Schiff. Two thousand eight hundred and eighty three dollars and twenty cents. Silver is down a third. Platinum is down a quarter, but copper is up 2.63%, while palladium is down two thirds of a point.

Ag not being saved, everything's in the red. Biggest winner, however, is lumber, and it is a full point to the upside. But the biggest loser today looks to be corn. Yeah. Of course. One and a half percent to the downside. Live cattle moving sideways, but lean hogs are up three quarters of a point. Feeder cattle also moving sideways. Now here's where the real bleed is happening. Legacy markets are having one hell of a morning. Dow is down a half point. S and P is down two thirds of a point. Nasdaq is down almost a full point, and the S and P Mini is well over a point down to the downside, 1.14%, in fact. And we are still hanging at $97,340 for Bitcoin.

That is a $1,930,000,000,000 market cap, and yet we can purchase less shiny metal rock with our one Bitcoin, of which there are 19,820,851.2 of. Average fees per block are incredibly low right now, 0.03 BTC taken on average on a per block basis. It looks to be there are eight blocks carrying a measly 12,000 unconfirmed transactions. High priority rates, you're gonna get cleared at 3 satoshis per vbyte, and low priority is the same. Hash rate, however, is continuing to increase 836.6 exahashes per second. We are looking at a 5% difficulty adjustment coming in, wow, like, what, forty two hours, a couple of days, five percent to the upside for the difficulty adjustment. So, yep, do with that what you want. From Check Check, and that was yesterday's episode of Bitcoin, and I got glimmering. Yes. Glimmering at a thousand sats, but he says nothing.

God's death with $5.37 says thank you, sir. No thank you. Paul Serene or Surnine says, thanks again, sir. Always a pleasure to listen to your episodes. Love your Obsidian notes on Nostr. Are you publishing them manually or using the available plug in? Any further recommendations on using Obsidian? Yes. I can I have answers for that? But first, let's do the rest of these. 444, is from I don't know who. It's like there's somehow or another, I don't know who this is. Says thank you, sir. So thank you, whoever the hell you are, sir. Pies with four twenty with value for value. Thank you, sir. No. Thank you. Wartime with three thirty three says cheers and cheers back. Anonymous with a 47 says thank you, sir. No. Thank you. Justin with a hundred says I appreciate you. Yanno with a hundred says, ah, this is how it works. So I guess he found the boost button. Justin with a hundred says, I appreciate you again, and I cannot thank you enough. Now let's get back up here.

Sir, for Paul Cernine. He wants to know about Obsidian. Okay. So, Paul, I am not using the plug in available on Obsidian to publish notes directly from, and there's a reason for that. I have the plug in, and I have used it, and, honestly, it works fine. But what I found is that when I've built a template for my notes. So here's what I do. I'm, you know, I'm running through and I'm looking for I'm looking at what I've written down in in books or, you know, what I've highlighted in my Kindle, and I've got my Kindle notes that that come directly into Obsidian. So I'll sit there and I'm like going, okay. Well, this is no. I don't wanna do that one. Oh, well, I'll I'll spend some time on on this particular highlight, and then I'll read and think about what it is that I'm trying to write, you know, what how it is that I'm going to say it in my own words so that it sticks.

And then I give the new I build a new note and I just give it a name and then I hit enter and then I go over to my templates and I select the template I have set up for it. I've named that particular template Corozetto note And it comes in with, a few items of information, in fact. And let me get let me get over here and I'm just gonna get one because this is kind of important. I'm just gonna say, untitled and I'm gonna say, of course, it'll note. Okay. So it'll give me the time that I write it and it will automatically put up the date. And then if I wanna add tags to it, I've got tags and a colon. And then I've got references like where did this come from? Like, if I'm doing the Sheldrake book, I'll put in the Sheldrake reference, and then I'll put in, like, any other core notes that it's related to, and then I'll give the locate the Kindle location.

And that's you know, most of these are, like, basically hyperlinks. And those don't really translate all that well. And, honestly, they kinda confuse people when if if I publish it directly because all this information will go directly to Nostr. But all I really need to go to over to Nostr is just the text that I write, and that's why I stopped using the Obsidian plug in. Okay. So the second question is, do I have any, further recommendations on using Obsidian? I recommend that, you go find oh, is it Milo? Hold on. I've got a I got an email from him earlier today. Nick Milo.

Nick Milo is at linking your thinking dot com. He has a YouTube channel, and it's and he's one of the guys that that I started listening to a lot as to what how does he use it? What is he using it for? What plugins, you know, and and stuff like that? I kinda recommend linkingyourthinking,uh,.com to people that are getting into this whole Zettlekasten thing. The other, recommendation that I would have is that just because you're using a note taking app like Obsidian does not mean that you're limited to just using it like Zettelkasten. There's a whole bunch of stuff you can do with this thing.

It doesn't have to be just the Zettelkasten thing. So if you're like, oh, man. Well, I I don't I don't care about doing that stuff. Dude, there's, like, Kanban notes you can put up, like, there's whole, like, mind map plugins you can get, and the internal structure of Obsidian is such that it's really easy to use. It's damn near intuitive. It has a massive community that are building really high quality plugins. It's free. And if you wanna donate to the developers, they have a place where you can do that. And if you wanna donate, most of the community plugins are also free. And if you wanna donate to those developers, they have, like, most of them have a little button says, you know, buy me a coffee down at the bottom of of their thing. But go I would go start with with linking your thinking and look at Nick Milo's, YouTube channel, which is also by the same name, Linking Your Thinking.

So, if you have any more questions about Obsidian, please feel free to give me a boost. And that's the weather report. Welcome to part two of the news that you can use, Nostr, the importance of censorship resistant communication for innovation and human progress. Leon Wencomb writing this for Bitcoin Magazine. In an economic landscape increasingly characterized by monopolization and the dominance of institutionalized credit, innovative technologies and protocols are emerging that have the potential to change the foundations of our economy and society.

At the forefront of this are Bitcoin and Nostr, 2 groundbreaking protocols that together can usher in a new era of innovation. Free you from the financial constraints of the fiat system, this article is going to examine the history and mechanisms that enable Bitcoin and Master to act as catalysts for innovation and human progress. In the days of hard metal currencies, especially during the gold standard, innovation was primarily driven by individuals and private companies who were independent of the state apparatus and institutional lenders.

Some of the greatest breakthroughs in science, philosophy, and economics were made by private entrepreneurs. In 600 BC, a Greek named Thales observed that amber, when rubbed with silk, attracted feathers and other light objects. He had discovered static electricity. The Greek word for amber is electron, from which the words electricity and electron are derived. The Greek philosopher Plato is widely considered to be the first person to develop the concept of an atom, the idea that matter is made up of an indivisible component of the smallest scale.

He also wrote a number of important books on science, philosophy, economics, politics, and mathematics. Wei Boi Yang was a Chinese writer and Taoist alchemist of the Eastern Han Dynasty. He is the author of The Kinship of the Three, also known as Kantong Ki, which is considered the earliest book on alchemy in China and is noted as one of the first individuals to document the chemical composition of gunpowder in January. The car was invented in 1886 by German engineer and automobile manufacturer, Karl Benz, who was inspired by Nicholas Otto who invented the first gas engine in in 1861. The Wright brothers are considered the innovators and the first to fly a powered m airplane on December '3 in Kitty Hawk, North Carolina.

The creativity and ingenuity of the Wright brothers has been well documented. The funds for the brothers venture included equipment, travel, and their testing site in Kitty Hawk came from the bicycle shop that they operated. They apparently spent just $1,000 over four years during the years of 1899 to nineteen o three to develop three flying machines, two of which had no engines. The Wright brothers lived during a time when The United States was on a gold standard, and saving allowed these entrepreneurs to accumulate enough capital to finance innovations, giving them the time and resources needed to pursue their pioneering work in aviation.

The ancient Greeks such as Thales and Plato also operated under hard metal currencies contributing to a stable economic environment that fostered philosophical and scientific advancements. Similarly, Wei Weiying exemplified the pursuit of knowledge during the Eastern Han Dynasty in China, which experienced fluctuating monetary conditions, including periods of stability that contributed to intellectual growth in various fields. Just as the Wright brothers benefited from a time when saving money, in sound money allowed individuals to focus on their innovations, today's private entrepreneurs, startups, and bicycle shop owners find it increasingly difficult to earn enough to take the time to think about innovations and finance those implementations.

Inflation has significantly driven up labor and material costs, particularly in industries like aviation and automotive where advanced technology and greater material requirements demand extensive research and development. As a result, entrepreneurs and freelancers often rely on third party loans. The average cost of developing a new Mercedes car today, for example, is more than €2,000,000,000. The fiat based monetary system has made it increasingly difficult for innovation to emerge without institutional funding. Monetary inflation erodes purchasing power, limits financing options, and creates obstacles for new ideas to flourish.

This is problematic because the institutions that typically fund innovation, including large venture capital firms, banks, and universities, are mostly dependent on the state in one way or another, either because they are regulated by law or because they receive government funding, and therefore have an incentive to support projects that, quote, follow the current political climate. The result is a banal misallocation of capital and social stagnation as can be observed in most countries around the world. Credit has become part of a system of control that nation states use in conjunction with fiat money to maintain their monopoly position.

Historically, technologies and social movements that undermine the monopoly power of the state and its affiliated institutions were typically banned. At the very least, there was usually an attempt to do so. A good example is the way bitcoin is treated by most states, how poorly it is spoken of in most universities, and how most banks used to consider it speculation at best. Because bitcoin threatens the existence of these institutions, this behavior is generally observed among monopolists and initially makes it difficult for entrepreneurs to enter new disruptive markets like bitcoin and shifts competition in favor of the monopolist or the state.

Money creation and the granting of credit are fundamental to maintaining the state's monopoly position. As a result, the reliance on the institutionalized credit system to finance innovation has led to a dependence on a central authority, again, the state. This disrupts the progress and prosperity of humanity that results from a free market in which capital and information can be freely exchanged and suppresses the collective creativity of humanity. With the introduction of Bitcoin in 02/2009, the state monopoly on money was broken. Due to its limited supply and excellent monetary properties, absolute scarcity, durability, fungibility, divisibility, mobility, resilience, and self custody, Bitcoin is the hardest money ever created.

This allows entrepreneurs to preserve the value of their efforts, giving them time and in the long term capital to focus on problems and find and fund appropriate solutions, which in turn create opportunities for innovation to emerge from the free market in a bottom up manner. Innovation, especially in the age of the Internet, requires more than capital and people with time. There is a need for efficient and secure real time communication and collaboration options for people around the world. Communication and collaboration are crucial for efficiently solving increasingly complex problems in a connected world.

Cunningham's law states that the best way to get the right answer on the Internet is not to ask a question. Instead, post the wrong answer because others will correct you. This underscores the importance of collective intelligence. The law is named after Ward Cunningham who invented the wiki software that allows users to create and collaboratively edit web pages or entries via a web browser. The most famous example is wikipedia.com. In late two thousand and nineteen, Lightning developer, Fiat Joffe, published his ideas on a censorship resistant social network he called Nostr, notes and other stuff transmitted by relays.

With the actual launch of Nostr shortly thereafter, a protocol that adds a layer of censorship resistant information sharing to the Bitcoin and Lightning Protocol suite, a brand new territory of freedom opened up in the same tech stack as Bitcoin and Lightning. Although there were a number of other decentralized communication networks besides Bitcoin before Nasr, like BitTorrent, LimeWire, Napster, etcetera, in my view, none of them had the potential to have a universal long term impact on collaboration to solve complex problems facing humanity.

Nostr has the potential to enable bottom up innovation and rapid problem solving that no one can keep a lid on. With Nostr, market participants can communicate, collaborate, and reward each other in real time globally more independently of nation state control. Even though individual applications that use Nostr can be switched off, the protocol itself cannot be effectively controlled or turned off by any central party. The first widely used application of Nostr is a censorship resistant social network that can be accessed through various clients. The most commonly used ones include Domus, Primal, Amethyst, and Iris, and I'm going to add Coreicle myself.

Hat tip to hodl bod. The usability of each client is largely optimized for desktop or mobile. The network structure is similar to the way one can access the IMAP email protocol through various clients such as Gmail, Yahoo Mail, etc. Applications connect to many Nostra relays that are run by network participants with technical know how. These relays distribute information. So, if one relay fails, there are others that continue to run. The relays operate largely independently of each other giving the network resilience because there is no central point of failure. Although Nostr is not based on the Bitcoin blockchain, it does utilize peer to peer Bitcoin payments via the Lightning Network.

With Zaps, users can pay each other or tip posts that they particularly like. People can now successfully save in Bitcoin, communicate via Nostr, and transact with each other using Lightning, potentially independent of any central authority. Even though, for a long time, I struggled to define the purpose of Nostra beyond its function as a decentralized Twitter, however, I eventually realized that the possibilities are nearly endless. Nostra is a protocol for a freer Internet in society poised to become the gateway to a truly free Internet. In this new landscape, we have the opportunity to innovate faster and reward ingenuity making way for a more empowered and interconnected world.

There are countless Nostra applications currently being built. Nostra Rocket, for example, is a client designed to coordinate decentralized Bitcoin based economies by rewarding contributors who work together to find solutions to global challenges. The application uses censorship resistant communication via Nostr and direct Bitcoin payments via the Lightning Network to help create economically sustainable organizations that solve problems on the critical path to a global Bitcoin standard. Nasr Rocket founder G sovereignty is a very active member of the Nasr community and worth following.

In conclusion, the Bitcoin protocol was created as an alternative to the fiat system, a decentralized, permissionless, peer to peer electronic cash system outside the reach of the state. Satoshi Nakamoto created arguably one of the most important innovations by a private individual or group of people that humanity has ever produced because he or they laid the foundation for anyone to be able to trade and act independently of the state. As a solid foundation for a freer economy, the Bitcoin network enables other network layers to dock to the base, creating new ways to use Bitcoin and opportunities for users. The Lightning Network, as a second layer payment protocol for fast transactions and micropayments, partially addressed the problem of how to scale Bitcoin so that it can be used by all of humanity.

The introduction of Nostr creates a new territory of freedom within the same protocol suite as Bitcoin and Lightning, enhancing Bitcoin's usability for diverse applications. By facilitating seamless communications and collaboration, Nostr further aids in scaling Bitcoin, empowering us to innovate faster and reward ingenuity. With Nostr, innovation can potentially emerge from the free market again, and Ingenuity can be rewarded once again. Thus, Bitcoin, Lightning, and Nostr provide a protocol suite for a freer Internet and society with Nostr poised to become the gateway to a truly free Internet.

The use cases for Nostr seem endless. I invite you to explore the possibilities of the protocol, and you can go to nostr.how forward / english or forward slash en forward slash get - started. That link is where is the underline is I invite you to explore the possibilities of the protocol. So if you want to read this for yourself and get a hold of this particular link that goes to nostr.how, then just hit the hit the URL in the show notes and then scroll down to the very bottom of this article, and it it'll be right there. Now this entire thing brings me right back to the question we had in the weather report about, about Obsidian.

There is if anybody's listened to my interview with Hogglebod, which I mentioned earlier, you will know that I am, you know, that I've been thinking about how to take this entire idea of notes in Obsidian. And Obsidian has this ability to link notes to other notes. Now you gotta make those links. It doesn't do it automatically. Although although with the advent of AI, we it it may actually be able to do that for us. However, if you don't if we were to just apply AI and let it run wild through, like, all the notes that I've ever written in my particular Obsidian vault, it could make a mess of things. So it you'd have to keep a lid on it, so to speak. But if if I'm right, we're going to probably see some AI plugins that will start making connections given certain sentence structure and what words are being used and say, hey. This note that you wrote four years ago has a lot of potential to be linked to this note that you wrote five minutes ago.

And, you know, maybe make a little dotted line between them that you would be able to see in some type of graph view, and Obsidian has that. But the power in being able to link notes to other notes is, well, the it it it's pretty immense, especially when you have hundreds and hundreds of notes. And as you're taking them, you you're actually building your own mental capacity in your own mind and being able to remember more and more and more because you're doing the writing, and that helps your brain grow. And it also helps you not get your brain not get quote unquote inelastic. Right?

But while you do that, you're sitting there writing a note and go, you know that or or you're reading a book. And I've noticed this over the last couple of months that I've been really solidly writing notes in Obsidian every day is I'll be reading something going, I even remember the name of the note that I wrote four days ago, and it has some similarities similarities to this. So in Kindle, I've got a Kindle scribe that my dear wife bought me for Christmas and is one of the most amazing things that I have right now. I can use a pen and actually write a handwritten note in I'll underline something, and then I'll be able to actually say, hey. Make a note, and it brings up a screen, and I just write a handwritten note. Say, look at note, I don't know, nodes for noodles or something like that. You know, like another note that I've written. And then when I go back to transcribe the note that I wrote the night before, I've got that note there that says, hey. Go look at this name of this note. I'll go find it and go, yes.

That's a connection. Now that I've made that connection, I have two seemingly separate ideas that may actually share some kind of common ground. And that's the power of that's the real power of zettelkasten. But let's take that and what all the everything that I just said, lift it up and drop it into Nostr, and we already have that. Get Citadel. In any one of your Noster applications that you're using, if you've got a search bar, search at Git Citadel, g I t Citadel. That is the project that, Liminal Lasserin, and I I cannot pronounce her name, Lasserin?

I I I sorry if I'm mispronouncing it. She also goes, I think, by Cyber Angel or Sirber Angel or something like that. And then, Maleku is in there somehow, and there's a couple of other really well known Nostra guys. And they've been working on this Git Citadel and in in a way that also represents the thing called project Alexandria. So if you wanna look for the hashtag Alexandria, you will find a lot of the notes that I've written lately have that hashtag because I'm kinda like thinking that I'm doing that right now just to run an experiment later, and I don't know what the experiment looks like, but it could very well be something attached to to Alexandria. So I kinda just wanted to hashtag that there so I could keep them all together, but be that as it may.

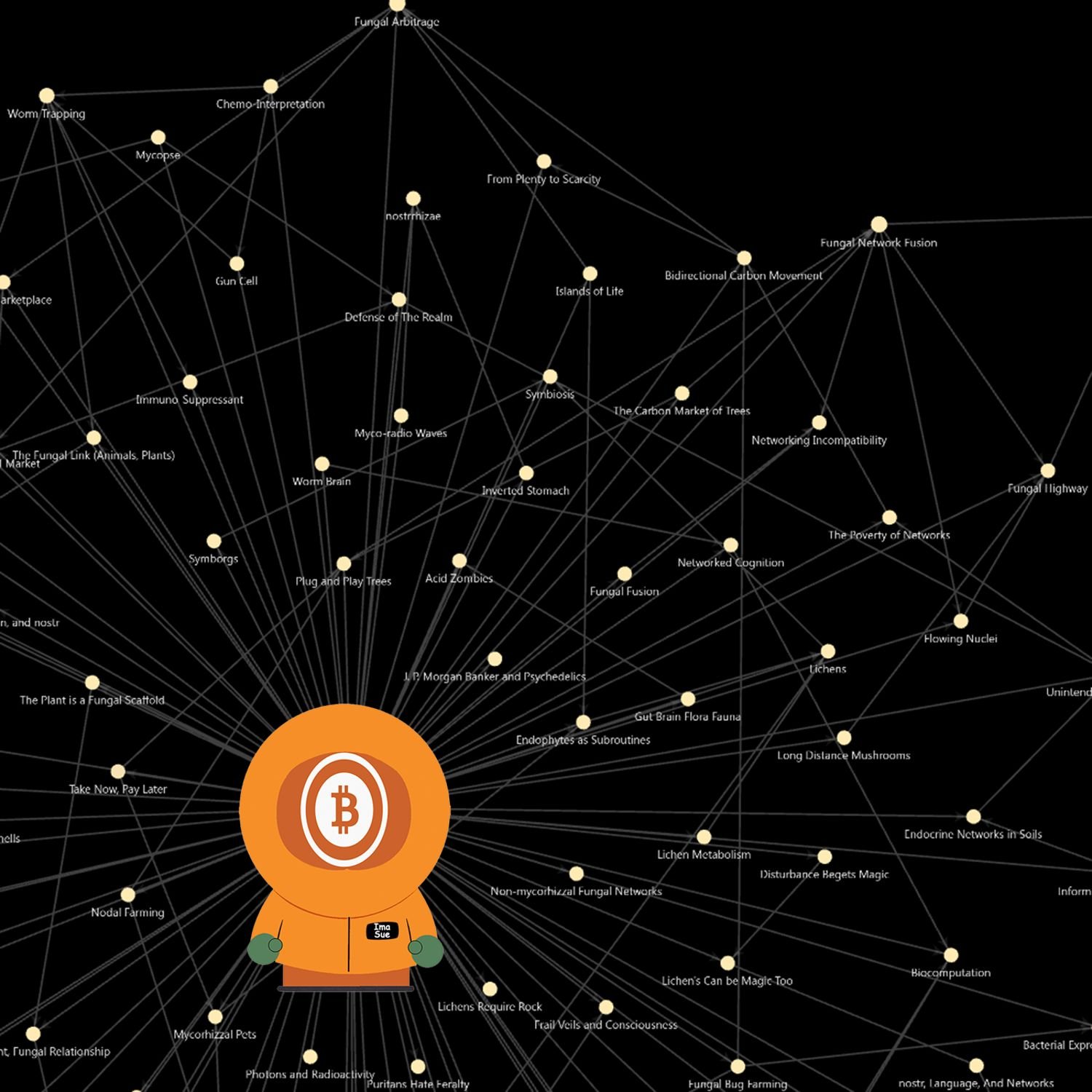

Now let's say that I've got all these notes that are floating around Nostril. How do I connect those notes to each other in the Nostril network? I can easily do it in Obsidian, and I do it all the time. I I'll do it later today, and I've did it a whole bunch yesterday, and I've got a huge web of all of these notes that somehow or another are drawing from other notes, and I can see it in a map because I have a graph view. And I can look at a node, and that is like one of my notes, and it will have, like, five lines that's drawn out to other notes, and I can grab them all together. And I can try to figure out why do I think these are similar, and boom, I've got enough writing to actually probably do a whole article on just that one subject. Okay. That's in Obsidian.

Now translate that over to Noster where I'm not just looking at my own notes. I'm looking at other people's notes and figuring out how do we make a graph view of all of our our ideas together? And what can other people formulate from something that even though I wrote it and and he and somebody else is like, oh, okay. You wrote this, but there's a connection to this other note over here. And those two together in my mind formulate this other thing that neither me nor the other person would have ever thought of on our own because we weren't a we weren't connected to each other. You would never be able to do this on Twitter. You will never be able to do this on Instagram, you Facebook, you name it. You're never going to be able to do what I just said on any platform but Nostra.

We talked about we just finished talking about in this Bitcoin magazine article the innovation that is possible through just plebs, just private individuals, not institutions, not the state, just us. But yet we've always been hampered by the fact that we're always sitting in somebody's walled garden, but not with Nostra. Anybody has the ability to scrape all of the relays all at once and make their own connections. The a p I mean, the the Nostra protocol is the API. You you can scrape anything you want. You can do whatever the hell you want. You can make all the graphs you want. You can run AI models on all those on all the notes that's ever been written or that that you can lay your hands on from any any of the relays that you can lay your hands on and collect them all together in one super massive database and run AI calculations on similarities and closeness and all the the stuff that graph theory does and start finding all these connections from hundreds and thousands of different people.

What would be able to what would be able to be born out of that? Think about that because that's really important. And that's what I'm when I look at Nostr, I see that potential. It's not here yet, but the guys over at Project Alexandria slash Get Citadel, that's what they're working on. Or that's one of the aspects that they're working on. We've I've talked to I've had I had an entire, interview with Liminal on this show, and it was like it was last year sometime. I think it was at the end of the summer or getting into the fall sometime, me and Liminal had a really great chat about exactly this. And at one point or another, I'll get Lassarin on and see if, you know, what she has to say about this. But this is where this type of project is not where Nostra is going, but it's where what Nostra actually allows to occur.

And the amount of innovation that could fall out of this is beyond my wildest imaginings, and hardly anybody's talking about it. Okay. So we got that as a web, and we're gonna move over to Vertex, which is a web of trust as a service. Vertex is a web of trust service for Nostra developers offering fast and reliable reputation scores to enhance personalized experiences and recommendations while protecting against in person impersonalization and DOS attacks. Quote, announcing Vertex, a fast, reliable, and open source web of trust, digital vending machine or DVM service based on the personalized pager rank or page rank algorithm announced the project.

Vertex is a web of trust computation service designed for Nostr developers. It helps deliver personalized and relevant experiences with minimal noise by providing reputation scores. Built on the Nostr social graph, which I was just talking about, Vertex aids in personalized discovery recommendations and protection against impersonations and DOS attacks. Developed by Pip Pipilia and Fran Zap, the project aims to deliver powerful and easy to use social graph tools. Oh, interesting. So you know bsbitcoin.com. I'm just looking at, at because that that is a link, and I was looking to see if social graph tools actually took me somewhere.

And hold on for a second. I wanna see what this no. It's just to another article. Okay. So the tools haven't been released yet, I guess. Quote, we are also open sourcing the code under the MIT license and started the conversation around DVM specs to encourage transparency and interoperability according to the developers. The project currently offers three data vending machines that can verify reputation, recommend follows, and sort authors. Learn more about the project by reading its FAQ here. Okay. Let's read that sentence again because this links directly up. This is this is exactly the kind of idea that I've got that I would be able to link up all these different notes in my local Obsidian vault, much less on something like the Nostra protocol or platform.

The project offers three data vending machines that can verify reputation, recommend follows, and sort authors. All of that is basically a gigantic search of a social graph. In this case, Noster, we're talking about a social graph, not a neural graph, not an airline travel schedule graph, none of that. No. No. This is like your your the social graph, but the social graph in this particular case is talking about just the author, just the in pub, just the person sitting behind the machine, not what they've written, but who they interact with. That's the social graph.

And this DVM is most likely an algorithm, if not full blown AI. I don't know. It doesn't really matter. It can just I mean, algorithms are just fine. That can sort through all of these people and find the connections. How many connections does one author have to these other connections? And what is the those people that they're the author is connected to, what who are they connected to? And when you do the math and you end up doing what's called graph theory and you run through the graph mathematics, and, like, you get closeness and edginess, and if you've ever looked at any of those, like, social graph tools or graphing tools, what you know, network graph tools whatsoever, you'll those words should be familiar to you. You. Then you can find connections that you wouldn't normally be able to see for yourself. Now that's just the INPUB.

What did the INPUB write each one of those notes and do the same thing to the notes. What does this note have in common with all these other notes? It's I'm what I'm suggesting is it's a fractal. I'm suggesting doing the exact same thing, except instead of examining the, reputation, the follows, and the sorting of the authors as in pubs, I'm talking about doing the same and more with the notes. Does the the is this person like like, for instance, I'll bet you that if Brandon Quidham was was present on Nostra a lot more than he is, and he's not even all that present on on Twitter as far as I can tell. I think he's pretty much just kinda doing his you know, where I think he's head of education or head of business development at a at a Bitcoin company. I think either Swan or Fold or something like that. And he may just not have time to get on social media anymore and doesn't care about it because I just haven't seen him around. But let's say he was, and he was writing a lot about mycorrhiza.

I've been writing a lot about mycorrhiza too, but he's coming at it from his perspective. I'm coming at it from mine. And yet our notes, I guarantee you, if a DVM and an algorithm that was basically had its head up, its social graph, theory, mathematics, and all that kind of thing was run across the network. I'll bet you my ass that my latest notes would be reaching out to Brandon Quidham's notes, and therefore, that would tie me and Brandon together. It would tie our in pubs together. But I'm more worried about what not worried about, but I'm more interested in what does the graph of the connections between our notes that are related to each other, what does that look like? And further, I'm more interested in what can I write out of that? What can I learn from those connections? What can I say? Like, here's the note I wrote, but it's list it's it says that it's connected to these three Brandon Quiddum notes. Well, what do those notes say?

Does it give me an idea? Does it spark imagination? Does it say does it answer a question that I might have had when writing the original note that is now connected to these three notes? See what I'm getting at? Not you can only do this with Noster. Only Nixon could go to China is an old Klingon proverb, apparently. In either event, that's what I'm talking about. Only Noster has this capability. Nobody else is interested in doing this. It's not in their best interest. That's why they're not interested in it. They may even be interested in doing it, but they know that if they do, that's why Twitter closed down its API once Musk got a hold of it. Unless you wanna pay $500,000 a year, you're not getting access to the Twitter API, which means that what you're going to be doing with that Twitter API, you you're going to try to make money off of it because, otherwise, how are you gonna get that that money paid back to you? $500,000 is a lot of cash.

Right? Only Nasr allows this. And then when we expand that, we've got music through Wave Lake, Nasr enabled, Fountain, Nasr enabled, Zap enabled, Bitcoin. All these things that I'm about to tell you are Zap enabled, eCash enabled, Lightning enabled, either all three of them or just a couple of them at once, and they're all Nostra enabled as well. Wave Lake, Fountain, any number of podcast apps, which means run AI over what are what are we talk all these podcasts talking about on this particular day. Are there is there a theme? Because if there's a theme between 10 different Bitcoin podcasts on a particular day or during a particular week, then it's probably pretty important, and then you can write articles about it, see where I'm getting at. And that's just listening and transcribing through AI, like, 10 podcasts in a week.

Then you got video over at Zap.Stream. You've got any number of kind one through kind 5,000,000 note, Noster clients that are available. You got Corel, you got Domus, you got Amethyst. There's, like, 50 of them. Now you got Olas. So can a DVM be run over all the photographs that are coming out of, Pablo f seven z's Olas? On a pixel per pixel basis, is there a theme? Is there a color theme? Is there anything that can be gleaned? Because that's going to happen. And while that is just as, you know, exciting as it is terrifying, it's going to happen, and there's not a damn thing anybody can do about it. Why? Because Nostra is the only open protocol that we have for this cut this many and this kind of communication. It's going to be insane. Again, if you'd if you doubt what I'm talking about, go look at for GitCitadel and out in hashtag Alexandria or hashtag project Alexandria, and you'll start pulling it apart.

It's one of the most important projects on Nostra that almost nobody knows about, and it's sad. And they also can't get grant funding. So if you help them out, you know, get get in the ears of the people that are giving grants and and tell them that they need to look at at what's going on with Git Citadel and Project Alexandria. Tails version 6.12 has important security fixes because a recent external security audit was conducted by Radically Open Security and several vulnerabilities were uncovered in the Tails operating system. These findings were responsibly disclosed in the Tails development team or to the Tails development team for assessment and resolution. Quote, we are not we are not aware of these attacks being used against Tails users until now. These vulnerabilities can only be exploited exploited by a powerful attacker who has already exploited yet one more vulnerability to take control of this particular application in tails. So chances are good you're not gonna have to worry about this. But still, there is a, in this new release of of tails, there it prevents an attacker from monitoring Tor circuits.

It prevents an attacker from changing the persistent storage settings, and it does a whole bunch of other stuff, but we're not gonna get into those. So if you are a tails user, please, please, please update to the new version. And finally, Bitcoin Keeper version two point zero point one has new design, mini script integration with Bitbox o two, Coldcard, Jade, Ledger, and more. Bitcoin Keeper, if you did not know, is an open source multi sig mobile Bitcoin wallet with inheritance features. Keeper Desktop is a secure cross platform desktop app for using hardware wallets with the Bitcoin Keeper mobile app.

This version of the Bitcoin Keeper mobile app introduces a new app redesign for a simplified user experience, adds mini script integration with Bitbox o two, Coldcard, TapCider j, Ledger, and Keeper mobile key. It enables in app concierge ticket support for all users and implements cold card queue, QR support, and includes a variety of other improvements. And it is a slick using, looking user interface. The color scheme is great. I'm looking at it, like, a couple of their screens on their on this app on mobile right now, and this is a beautiful looking app. I have not used it myself, but if you are a Keeper user, you might want to think about moving up to the new version two point zero point one. That is version two point zero point one, and that is it for the show today, ladies and gentlemen.

If for whatever reason, you are a person that's more has more than a passing interest in using what you read to come up with new ideas, I cannot recommend Obsidian enough because not only is it free, it is almost fully functional. The only thing that they require you to pay for if you decide to to do it is they offer file sharing and syncing across multiple devices. So, you know, your laptop, your desktop, and your mobile phone would have access to the exact same vault and any change you made or new note that you write or anything that you do on any one of those three things is going to be reflected on the other two immediately because you're sharing the same shared vault.

But that's only, like, $5 a month. Maybe it's 8. I don't know if they've increased their prices or not, but it was it's it was it's pretty cheap. But everything else is free, and it is a gorgeous user interface. You can even get themes and different fonts, and you can customize it eight ways till Sunday. It has a massive community around development, and it is probably pound for pound the best note taking app I've ever seen in my life. So if you wanna take your game to the next level, go to Obsidian. If you have more questions about it, hit me up on Nostor. My end pub is always in the show notes.

You can or just, you know, if you already follow me, just send me a DM. Actually, don't send me a DM on Nostor. There's a reason why. Nostr DMs blow. They suck. Okay? And everybody knows it. It's okay. It's just one aspect of Nostr. Just just hit me up directly in a note. And if for whatever reason you really don't wanna say what you wanna say in public, then just say, hey. I really need you to read your DMs right now. And if your DM is there and I do see it, I will read it, and I will see you on the other side.

[01:09:43] Unknown:

This has been Bitcoin, and and I'm your host, David Bennett. I hope you enjoyed today's episode and hope to see you again real soon. Have a great day.

Introduction and Episode Overview

Exploring the Potential of Nostr