Join me today for Episode 1014 of Bitcoin And . . .

Topics for today:

- BTC Declines on Treasury Volatility

- Bitfinex Arm Moves to El Salvador

- Federal Court Demands Private Keys

- Fidelity Really Does "Get It"

- Canaan Introduces "Heating" Miners for Retail

#Bitcoin #BitcoinAnd

The King Ranch Donation Pages:

https://www.ruralamericainaction.com/fundraising/save-king-ranch-and-agriculture-in-washington

https://www.givesendgo.com/Kingranch

Articles:

https://cointelegraph.com/news/bitfinex-derivatives-el-salvador-crypto-license-will-relocate

https://www.coindesk.com/markets/2025/01/08/key-market-dynamic-that-greased-bitcoin-and-spx-rally-after-u-s-election-is-shifting

https://bitcoinmagazine.com/takes/democrats-should-reverse-their-stance-on-bitcoin

https://primal.net/e/note1sftnuj4f6mgg0nrt4scgshzv95ezrvlnxt7wpk8y8cvgnzedx4qqr0qu6e

https://decrypt.co/299978/texas-court-orders-bitcoin-investor-to-surrender-keys-to-124-million-stash

- https://www.cnbc.com/futures-and-commodities/

- https://dashboard.clarkmoody.com/

- https://mempool.space/

- https://value4value.info/

- https://fountain.fm/show/eK5XaSb3UaLRavU3lYrI

- https://geyser.fund/project/thebitcoinandpodcast

https://atlas21.com/bitcoin-in-national-reserves-fidelitys-prediction-for-2025/

https://www.nobsbitcoin.com/nstart-nostr-onboarding-wizard/

https://www.nobsbitcoin.com/anchorwatch-launches-in-the-u-s-for-customers-holding-between-250k-100m-in-bitcoin/

https://www.nobsbitcoin.com/canaan-introduces-avalon-mini-3-nano-3s-bitcoin-home-miners-and-heaters/

https://decrypt.co/299993/pakistani-trader-kidnapped-340000-crypto

Find the Bitcoin And Podcast on every podcast app here:

https://episodes.fm/1438789088

Find the Bitcoin And Podcast on every podcast app here:

https://episodes.fm/1438789088

Find me on nostr

npub1vwymuey3u7mf860ndrkw3r7dz30s0srg6tqmhtjzg7umtm6rn5eq2qzugd (npub)

6389be6491e7b693e9f368ece88fcd145f07c068d2c1bbae4247b9b5ef439d32 (Hex)

Twitter:

https://twitter.com/DavidB84567

StackerNews:

stacker.news/NunyaBidness

Podcasting 2.0:

fountain.fm/show/eK5XaSb3UaLRavU3lYrI

Apple Podcasts:

tinyurl.com/unm35bjh

Mastodon:

https://noauthority.social/@NunyaBidness

Support Bitcoin And . . . on Patreon:

patreon.com/BitcoinAndPodcast

Find Lightning Network Channel partners here:

https://t.me/+bj-7w_ePsANlOGEx (Nodestrich)

https://t.me/plebnet (Plebnet)

Music by:

Flutey Funk Kevin MacLeod (incompetech.com)

Licensed under Creative Commons: By Attribution 3.0 License

creativecommons.org/licenses/by/3.0/

It is 9:28 AM Pacific Standard Time. It is the 8th day of January 2025, and this is episode 1014 of of Bitcoin. And we've got stuff on the docket for this morning. We got Bitfinex in the news. Seems to be moving down south. There's some, key market dynamics that may suggest what Bitcoin is doing and why. We'll get into that, and it has something to do with, you know, volatility. And then, should Democrats reverse their stance on Bitcoin? We're gonna find out. And then we've got a fairly ugly piece of news coming out of low elites and the United Nations. We've also got some Texas, stuff in the news.

Bhutan is back in the news. We've got it all, ladies and gentlemen, and we're gonna get to it starting right now with Bitfinex Derivatives Moving TO El Salvador After Securing the Local Crypto License That They Needed. Tom Mitchell Hill from Cointelegraph is going to tell us all about it the derivatives arm of crypto exchange bitfinex has secured a digital asset service provider license to operate in El Salvador everybody's moving to El Salvador and moving down there fast, I guess. In a January 7th statement shared with Cointelegraph, Bitfinex Derivatives said, with the approval of the DASP license, it will relocate from the Seychelles to the Central American nation. So if anybody has been following the whole saga of Bitfinex, the fact that they have been basically running around the world saying that their headquarters isn't really anywhere and then they finally end up in the Seychelles, well the crypto the derivatives arm of the crypto exchange is physically up just just uprooting themselves from their home in the Seychelles which has been their home for a couple of years now and moving their happy butts all the way down to El Salvador.

This critical transition represents a defining moment for Bitfinex Derivatives and highlights El Salvador's rise as a global financial hub, said Bitfinex Derivatives chief technology officer, Paulo Adorno. The firm lauded El Salvador's continued efforts in developing new crypto frameworks saying that the move aligned with its broader goals to deliver financial services in the region. Well, El Salvador has been rapidly pushing through new digital asset regulations in a bid to transform that nation into a crypto hub. After the country passed its digital assets securities law in 2023, Bitfinex Securities secured a local DASP license in April.

El Salvador's licensing regime allows companies to tokenize funds, debt, equity, and real estate, simplifying the process of raising capital for companies to issue tokens, fund investments and projects, and offer returns to investors. On November 19th, the firm debuted a tokenized public offering of United States Treasury bills under El Salvador's legal framework. In July of 2024, Bitfinex Securities had to refund investors who participated in a Hilton Hotel tokenization effort after failing to raise the minimum $500,000 required to continue that venture the project which marked the very first public offering of digital debt assets in the country of El Salvador, only mustered a measly $342,000 from investors before the first deadline, barely 5% of the 6,250,000 that it was looking to raise. The funds were intended to finance the construction of the Hampton by Hilton Hotel, sized at 4,500 square meters across five levels with 80 rooms, a restaurant, a work area, a swimming pool, gym, and a garden.

To own a slice of the hotel, investors had to make a minimum $1,000 investment to purchase the h I l s v token on the bitcoin layer 2 liquid network. Okay. So that's the end of the article. I'm not I'm not a big fan of this tokenization issue however I got exactly jack shit to say about it they're going to do this bitfinex is going to be at the forefront The guys over at Tether are going to be at the forefront. This is not going to end. In my view, what they're doing is somehow or another, they're trying to legitimize the shit coinery that we've seen over the past years, the constant issuance of airdrops and tokens and all that kind of stuff, and there seem to be wrapping it up into a package that fiat legacy investors can easily understand.

It's hey. It's a share. It's a security. It's just digital. Honestly, this after all these years, after all this fighting, this is what these people are doing. Is just the same thing it's just the same thing there's there these guys have almost no imagination so it's going to be up to the actual Bitcoiners that understand what we've been fighting for and what we've been fighting against to step into the fray and fix this little red wagon. But again, I'm not gonna be able to do anything about it. You're not gonna be able to do anything about it. Just don't invest in it. Okay? Figure out something else to do with the money. Just buy bitcoin and hold it. Okay. I mentioned key market dynamics about bitcoin.

This is what I was talking about. Key market dynamic that greased the bitcoin and SPX rally after the US election is shifting. Bitcoin and the s and p 500 seem to be tracking rates volatility, and that volatility rate is rising. This is out of CoinDesk. Amkar Godbold is riding it. The crypto market is known for its rapid pace. And if you have any doubts about that, just look at how sentiment has flipped to bearish in just 24 hours. This sudden shift is not without reason. Bitcoin and the S and P 500 are both forming a head and shoulders topping pattern coinciding with a change in the market dynamic that fueled the post election surge in both assets.

We're specifically referring to the move index or the Merrill Lynch Option Volatility Estimate Index, which measures expected 30 day volatility in, you guessed it, the United States Treasury Bond Market. As the 2nd largest financial market globally, after currencies, volatility in the fixed income market, especially in treasury notes, often leads to tighter financial conditions. It can trigger risk aversion across all corners of financial markets. Unfortunately for crypto bulls, the move index is rising, having bottomed out in mid December near 82 according to charting platform trading view anyway. On Tuesday, the index climbed to 102.78 after hotter than expected manufacturing data indicated a robust economy and persistent inflation, resulting in higher Treasury yields.

Specifically, the yield on the 30 year note rose to 4.92%, the highest since November 23rd, and the 10 year yield jumped to 4.68%, the highest since May, and I brought you that news yesterday. Interestingly, bitcoin fell 5% to 96,900 on Tuesday, while the s and p 500 declined by over 1%. The post US election uptrend in both assets lost momentum in mid December coinciding with the bottom in the move index as shown below, and they give a graph, and it it shows the bottom of the move index. The move index collapsed following Donald Trump's victory in the United States election held on November 5th, which helped ease financial conditions for riskier assets, leading to impressive gains into the year end.

However, both Bitcoin and the S and P 500 faced challenges when the move index began to shift in mid December. The key takeaway is that bonds are driving the broader market narrative. A bullish turnaround in risk assets likely requires the Treasury market to stabilize. Currently, with the move index trending upwards, the likelihood of Bitcoin and the S and P 500 completing their respective head and shoulders bearish reversal patterns appears high. Okay. Well, let's see. So that's that's sort of what's playing, and I had had hinted at that yesterday when we were talking about the Treasury bond market. The the fact that no matter what the the Federal Reserve seems to try to do, the bonds themselves are not reflecting the yield.

They they they what you would expect and I said this yesterday. What you would expect is that as the Federal Reserve decreases interest rates or the the fed funding rate, that the yield, the percentage yield on treasury bonds would also fall. And as far as the 10 year is concerned, and now it appears that the 30 year is following suit, both of those yields are actually trending higher. The market is not buying what the Fed is doing. That's all that means. So what we have here is a huge rise in the volatility index of Treasury markets, and therefore, people are just not wanting to get into riskier assets. They just wanna sit in cash.

That's what we're seeing, and that's why we've bought why we're plunging the depths again today on the Bitcoin price. Clearly, right now, at 93,000 and 250, and it's plunging to 93,000 and it's finding support right there right now. But if it continues, that support will break and just understand that we've been here before and we will be here again. I mean, not exactly at the same price in the future. We will eventually go up again, but there will always be these downtrends because people have the itchiest of trigger fingers right now simply because nobody really knows what the hell's going on. And do now now the question becomes from Frank Korva out of Bitcoin Magazine, do democrats know what's going on?

More specifically, democrats should reverse their stance on Bitcoin. Let's see what Frank has to say about it. Last month at the New York Times Deal Book Summit, political analyst and media personality Van Jones admitted that the democrats has made a fatal mistake in not only largely disregarding the crypto voter, but in acting against them during the last election cycle and more broadly during president Biden's time in office. Quote, 50,000,000 people bought some crypto. That's a bet on the future, said Jones. They're trying to get to a better future. Joe Biden, Kamala Harris, Elizabeth Warren, beating the hell out of crypto was not smart, he added.

Jones is one of the first and prominent Democrats to publicly admit post election that the Democrats should have invited those who hold Bitcoin and crypto into the party instead of pushing them away. The questions now are, will other well known democrats follow Jones' lead, and what would their policy proposals look like if they did? The latter question is particularly important because while democrats may begin to say they're procrypto, the devil is in the details. For example, when I interviewed former congressman Wiley Nicholl, a democrat out of North Carolina, one of the few outspoken bitcoin and crypto proponents in the democratic party last year, I asked him if he'd support the right for bitcoin and crypto owners to hold their private keys.

This was his response, quote, in congress, we're really focused on doing a few things before we get into the next level of stuff. It's about regulating the industry. BIT 20 1, the digital assets market structure bill and stablecoins. We've gotten sidetracked with SAB 121 for custodial banking. Those are the things that I think we need to tackle first and then we get into the next layer of stuff and I'm really hopeful we're going to get those things done this congress end quote I'm pausing to say stuff? This really? This is an elected official, ladies and gentlemen. Continuing on, the right to hold one's private keys is the first level of stuff in my book, and his lack of a direct response to my question worried me, especially when juxtaposed with what Trump said on the matter at the Libertarian National Convention in May of 2024, quote, I will support the right to self custody for the nation's 50,000,000 crypto holders.

That's what Donald Trump said. That he just he just plain said it. So if the Democrats are to start shifting their rhetoric when it comes to Bitcoin and crypto, they're also going to need to come, they're also going to need to come correct when it comes to policy proposals if they plan to win over the voters that they lost in this previous election cycle come midterm elections. Okay. I disagree with with Frank here. I like Frank. Believe me. I I really do. Frank, if you're listening, I love your writing and stuff like that. And it's not that I'm necessarily saying that Frank is wrong here.

I'm saying that that is a single voter issue. And even if here here's what I'm saying, that is that even if that party had told me directly in multiple speeches from multiple different representatives of the party that I can custody my coins and that Bitcoin's okay and that blah blah blah. I still I still know. Uh-uh. There's too much bullshit on that boat for me to even think about walk it's like walking onto a trash barge to get across a river. No. I will wait for the nice clean ferry or I will take a rowboat and I will row myself across the freaking Timbs. I it doesn't matter. I'm not getting on a garbage scowl simply because the captain comes to greet me at the gangplank.

There's too much other garbage going on, and I'm just I'm not going to do it. And that's why I think Frank is is not, again, not wrong, but I I don't think that this is the entire picture. And you know what I'm talking about. You know the chicanery that has been committed by this party at this point. And both parties are are in fact kind of well not kind of they're they both suck but the one I you know I just can't wrap my head around even thinking about shifting alliances simply because somebody says, oh, hey. Bitcoin's okay. It's it that's not all there is in life. And for those of for those people that are listening to me that think that the only way that that the only answer that there is is simply Bitcoin, I'm going to suggest that you may be wrong.

Other things exist in life. I do think that the money is the major problem, but I don't think it's the only problem, and there was no way that it was going to solve that party's issue. Now, on to Lola Leitz. Lola is the author of the, magazine The Rage and she's bringing us some kind of disconcerting news out of the UN General Assembly. Okay. So here's what her note on Noster is, and it says, last week, the United Nations General Assembly adopted the UN Cybercrime Convention, a global treaty to formalize the cooperation of law enforcement agencies between UN member states. That officially voids bank secrecy laws.

I'm going to pause there for a little bit of effect because if you're anything like me, you may be you may have gotten distracted by a dog running across the street while you were driving the car. So let's read this again. The UN General Assembly last week adopted the United Nations Cybercrime Convention. That convention is a global treaty to formalize the cooperation of law enforcement agencies between all United Nation member states, and that officially voids bank secrecy laws. As if bank secrecy laws weren't bad enough, now they're superseded by an entire building full of unelected officials making handshake agreements with each other that they will tattle on their citizenry to each other.

Lola Leitz goes on. She says, here's what this means to you. When other countries want to access your financial information for law enforcement investigations, they currently have two primary methods to rely on. 1st, there's information sharing via the EGGmont Group, a global consortium of financial intelligence units which allow countries to request financial data for anti money laundering and counter terrorist financing investigations from other FIUs. That's the Financial Intelligence Units. A similar program exists within the UN called Go AML, a database to share financial information.

Data shared via the Egmont Group is highly confidential and for investigative purposes only. For example, the data is not allowed to be used in court. To legally act on the information obtained, countries have mutual legal assistance treaties which require law enforcement agencies to cooperate with each other, for example, in the seizure of assets. Under the UKUSMLAT, if the United Kingdom receives a request by the United States to freeze or seize a person's assets due to a money laundering investigation, the United Kingdom is required to oblige by the United States' request and vice versa.

In contrast, for example, the UK currently does not have an MLAT with China. While both are parties of the UN and some cooperation agreements for UN member states already exist, the UK may currently tell China to fuck off if it requests the seizures of assets held in the UK. The United Nations Cybercrime Convention essentially functions as a United Nations wide MLAT. The only re prerequisite to the convention is that the crime a country requests assistance in is also a crime in the country it requests assistance from.

With the UN Cybercrime Convention, China and any other UN member state may now request other countries to freeze, seize, and forfeit assets on behalf of the requesting country, MLAT or not. The convention is now expected expected. The convention is now expected to be ratified. It's going to be ratified. Right now, it's just kind of they're looking at it, but everybody expects this thing to actually be ratified by UN member states, and it's an absolute nightmare for the security of your funds, putting you at risk of asset seizures through authoritarian regimes no matter what country you are in.

Now, that's the end of what she says, and she links she definitely links to her art of to an entire article about it, and this is from the rage.c0, not com, just the rage, therage dotc0, and the title of the article is UN Cybercrime Convention to Overrule Bank Secrecy. And she wrote this back in August 11, 2024, but what she's what she's saying is that this is at the final stage. Since August and I've brought I've I've talked about this before, and I wanna talk about it again because they're going to ratify this thing, which means that if for some ever for whatever reason, you piss off, China, well, they can request to freeze your bank assets in the United States even though you're not a Chinese citizen.

How's that for you? And and Spain can do the same thing. Oh, and Norway can do I guess Norway. I I guess Norway is in the EU, but France. Or or if you're a French citizen and you piss off, somebody and that has a high enough ranking that can, you know, pick up the phone and do shit, if you're if you're a French citizen and you piss off the United States, guess what? Your French money is at risk of being seized and you left penniless, and you're not even a United States citizen. See, this this this can't happen. At one point or another, humanity has to stand up because you can't just have French, you know, the French people tell me that I can't use my money to go buy, I don't know, McDonald's, and that's what this means and if you if you think I'm getting a little outlandish with it this is exactly what this means now does that mean that that we have the power to piss off the right people that can pick up a phone and make shit happen and and get out of terrorize your funds not not exactly I mean you kinda gotta be a heavy hitter to the point to get on these people's radar in the first place but that doesn't mean that they don't start looking in a more granular fashion with the technology that's coming online, with the surveillance that's already here.

Who's to say that it's not just Joe Blow on the street who said something on social media about a parliamentary member in Spain that gets their assets frozen. Remember what happened in Canada? That was Canada doing it to its own citizens. What happens when you piss off I don't know. Let's say Trudeau stays in power and you piss him off on social media and you're an American citizen and Trudeau calls up and uses the MLAT at the that the UN is is is is is is hammering out and says, you know what? I don't like that guy. Freeze all their money. Never before in the history of humanity is has bitcoin been more important just to exist.

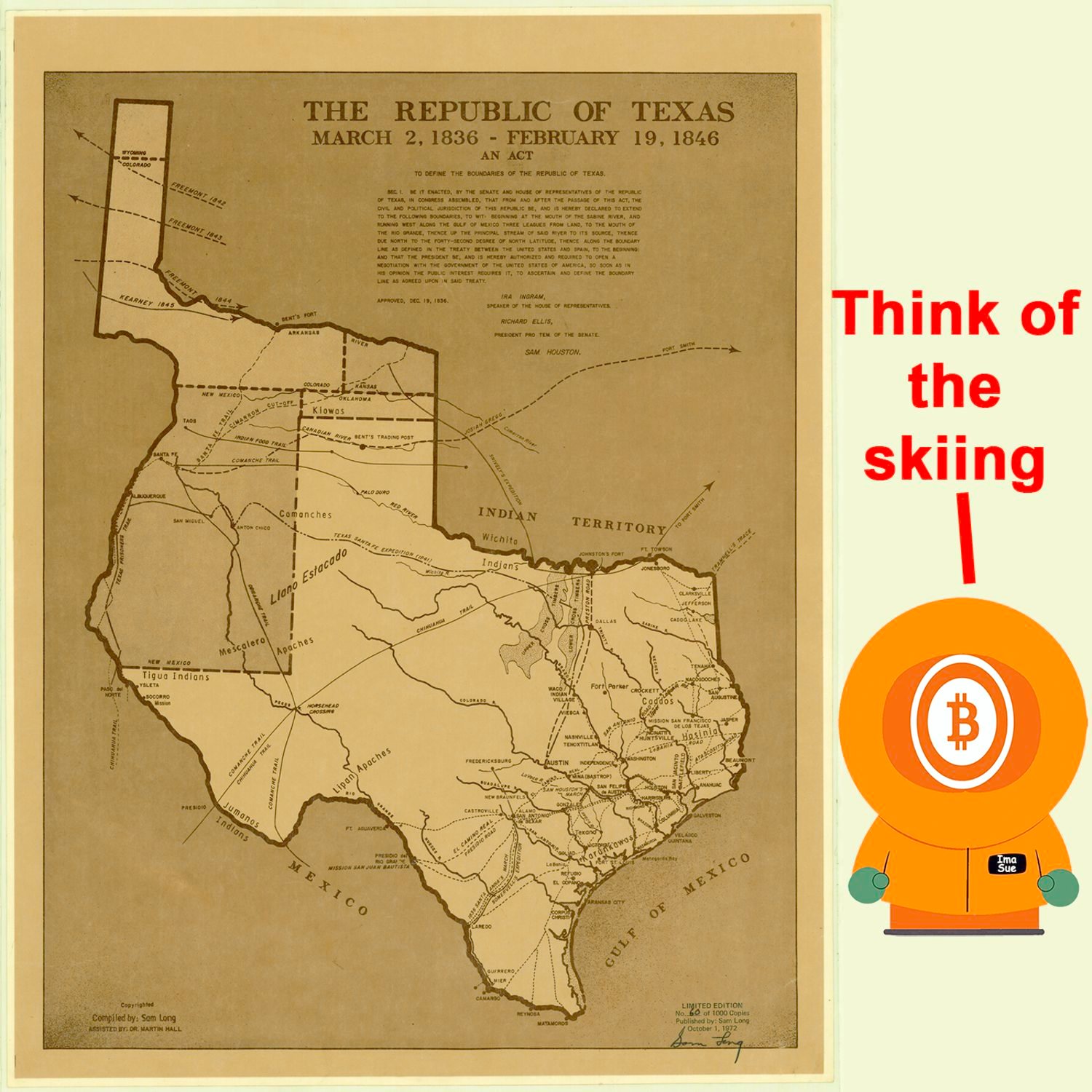

At this point it's kind of not even about the price. It's just having something that cannot be seized by somebody because you got them pissed off and their friends are in control of your bank account and them and their friends all have dinner and lunches and go to fancy parties together and, I don't know, eat children. I this is the thing. Anybody who thinks that this is just a big nothing burger is fooling themselves and it's going to get worse. So buy Bitcoin and self custody it. Do not. Do not. And if you have coins anywhere, I don't I don't care if you're a Solana head. I don't care. Get it off. If if you value your Solana, then you need to get it off of exchanges because that shit that what I was just saying, that's coming to to cryptocurrency exchanges as well. Your shit will be frozen. You piss off the wrong person on the wrong day at the wrong time in the right country, and you can't ever get that shit again. So this is the time to drain well, actually, the the the best time to drain all of your funds off of exchanges was yesterday. The next best time is today. Okay. Let's go to Texas, which is not making me happy right now even though it is my birth state and Texas will always live in my heart.

Texas court orders Bitcoin investor to surrender the keys to a $124,000,000 stash. This is Vince De Aquino writing for decrypt. Okay. Well, at least it's a federal judge. But a federal judge has ordered an early Bitcoin investor to surrender encryption keys that could unlock approximately $124,000,000 in crypto, marking an unprecedented move in the United States government's efforts to seize digital assets and tax evasion cases. According to the order issued by US district judge, Dickhead Pittman oh, I'm sorry. Robert Pittman on Monday, Algren must disclose all private keys and identify any devices that he used to store cryptos such as hardware wallets.

Yeah. We'll we'll we'll get to the boating accident here at the end of this. The order extends beyond just wallet access. Algren and any associates are prohibited from transferring or hiding any digital assets without court approval, though they can use funds to or for normal monthly living expenses. The order aims to help recover about a $100,000,000 in restitution following Algren's December conviction. Initial coverage of the first of the order first appeared on Bloomberg. In February of last year, federal prosecutors released a 7 count indictment against Richard Algren the third, also known as Paco, marking the 1st US criminal tax evasion case centered solely on crypto trading.

The Austin, Texas resident faced 3 counts of filing false tax returns and 4 counts of illegal structuring of cash deposits. By December of last year, Algren was sentenced to 2 years in prison for falsely reporting capital gains he earned from selling $3,700,000 worth of Bitcoin. You dick. That's why you hold your Bitcoin. Quote, instead of paying the taxes that he knew were due, he lied to his accountant about the extent of a large portion of his gains, stating stating acting deputy assistant attorney general Stuart M. Goldberg of the Justice Department's tax division in a DOJ press release at the time. Algren, quote, sought to conceal another chunk of his profits by using sophisticated techniques designed to obscure his transactions on the Bitcoin blockchain, Goldberg stated.

The indictment meticulously outlines how Bitcoin transactions work, explaining that while the blockchain is public, Algren allegedly attempted to obscure his activities through multiple techniques. What makes Algorand's case groundbreaking is its focus on the deliberate manipulation of crypto cost basis calculations and sophisticated attempts to obscure blockchain transactions effectively creating a playbook for future crypto tax enforcement. Oh, good job, pal. US regulators are taking a more enforcement heavy approach while congress struggles to establish clear regulatory frameworks for crypto assets, a 2024 industry review from blockchain forensics firm Elliptic suggests.

At least, before major changes in crypto legislation are laid down, the United States remains a challenging regulatory environment for crypto market participants due to the lack of progress in passing legislation related to crypto compounded by a, quote, regulatory posture that relies heavily upon enforcement action, the report reads. So they're gonna force him to to hand over his private keys. That that's what this boils down to. So they have enough evidence to know that this guy's got Bitcoin. They've got enough evidence to know probably how much Bitcoin he has.

The only thing the only thing that they have left to do is to turn his private key to unlock the vault and they want that bitcoin now it is a Texas court but this is a federal court So this is this is all at the federal level. So I'm going to kind of back off on my stance on the fact that that that it's all Texas's fault and just say, no. This is United States government territory. They're the ones that are doing it. They're the thieves. I don't really give a shit if he evaded taxes. At this point, tax is theft. Good for him for Biden fighting back. Even though he got caught, it's probably gonna go to prison. You know? You you pick your battles, ladies and gentlemen. Just pick them for yourself. I can't pick them for you.

However, we have to we we now need to talk a little bit about the the meme in Bitcoin that has been around for at least a decade, and that is the boating accident. Lost my private keys in a boating accident. Oh, my hardware wallet's at the bottom of the ocean. Blah blah blah blah blah. At this point, we probably need to start asking ourselves how well does that work? How well prepared are you to actually say that sentence? If for whatever reason you find yourself in some kind of situation where you need to say that sentence as far as legal or or judicial authorities are concerned?

Now you can say that to a kidnapper. You can we'll get into kidnapping later. You can say that to people that that don't have these quote unquote authorities. That I just I don't even wanna talk about that. I'm talking about looking at a judge square in the face and saying, I lost my keys in a boating accident. Not not that you would say it that way I'm just saying that that that's the sentiment is that I don't have my keys I've lost my keys I cannot give you my keys let's talk about that just for a little bit Are you prepared to say it? That's the the question.

Are you prepared to defend that stance? Are you prepared to just say, you know what? I don't have the keys, and then the judge says, well, you know what? You're gonna go go to prison for 40 years because you don't have the keys. Is that is that possible? Well, clearly, it is possible, but is it defensible on both the part of the federal government or even a state government or even even a a county government, I suppose? Or or rather not or but and is it defensible from your standpoint saying look you can't you can't just put me in jail because I lost the keys to this thing of which there is no recovery So do they torture you to find out if you really did lose the keys?

They can't do that, not not not at to a United States citizen, not on United States soil, at least according to law. Doesn't mean that they wouldn't do it. I'm just saying that, technically, they can't do that, so they gotta figure out something else. So the real question here becomes, when you have private keys, all all anybody can prove if you're like if you bought bitcoin from using your bank account transferred money over to coinbase use that money to buy to to buy Bitcoin, they can see that. There you can't hide that. They know what bank account it came from. They know what time the transfer was done. They know what account it what, you know, came out of, and they know where it went. They and then at that point, it's just a simple matter of calling up Coinbase saying, who is this guy? And they will finger you because they don't give a shit. All they're doing is they're going to always comply so they don't get in trouble. So they know how much Bitcoin you bought, at least at Coinbase, and any other exchange that you did this the same way. If you earned it, like, you know, like value for value, that's a different story. I don't wanna get into that. I'm just saying that they know how much you have, but they only know how much you had at the time you actually bought it they don't really know like if I have one hardware wallet and I use that hardware wallet that the my twin 12 or 24, seed word phrase to generate multiple wallets from the same seed from the same private key I can do that they don't need they can't connect each one of those wallets to the same private key that's not the way asymmetric cryptography works right they they just know that there's these wallet addresses okay so each one of them is is actually separate well all they would ever know is that at one point or another, this bitcoin went into this wallet, and then they can if it goes out of that wallet, they can track it around. But they don't know the private keys to that wallet.

So again, the question becomes can you really trust being able to say I lost my private keys and there's no recovery of those keys will they believe you What what's the next step after that? We need to start really thinking about the I lost my private keys argument because in my view it's actually a substantial argument It's like, look, I cannot give you the keys I've let's say you really did lose them. What then? You you take a polygraph test. You pass. I really did lose the keys. They torture you in Guantanamo Bay. They I really did lose the keys. I and then they actually believe you. They go, yeah. He really lost his keys. What then? Yeah. How do we proceed?

Because here's the nature of this beast. You can prove that I bought something. You can prove that I sold something, most likely, but you can't prove that I'm in possession of a thing unless there's a document that proves it. You can prove that I own a house because you can go to the county courthouse of which the house that you suspect that I own and then pull the files from it and and look at the deed and say, yep, your name's on the deed. There's proof that you own this thing. There's a title to a car. Right? You see how this works. However, there's there's no title to Bitcoin it's just private keys there's an and and one point or another I guarantee you there will be a registration process that they will want you to do where you register your private keys at the county courthouse and only an idiot would fucking do that don't do that I'm just saying that as of right now today, there's no way to prove that I own the Bitcoin that I have unless I decide to prove it to them by signing a message with those private keys.

So think to yourself as we move forward into the future, just how solid is the argument I lost my private keys? Let's run the numbers. CNBC Futures and Commodities West Texas Intermediate Oil is down 1.17%. Apparently, the United States dollar has strengthened again, and that is reflecting in oil prices because Britney is also down 1.1%. It's at $76.2 a barrel, but natural gas going in the opposite direction because it's apparently cold everywhere and they need the natural gas to do the heating, it's up 4.35 percent to 3.60 per 1,000 cubic feet. Gasoline is down 0.73% to just over a penny over $2 a gallon.

Gold and the rest of its brethren are doing okay. Gold is up a 5th of a point to 26.71. Silver is down a quarter of a point, but platinum is up 0.6%. Copper is up 1.45%, and palladium is unchanged. Ag, mostly in the red today, biggest winner is rough rice up 0.36%, and the biggest loser is chocolate, down well over 7 full percentage points. Live cattle is down as well, 0.72% in the red. Lean hogs, however, up a quarter. Feeder cattle are down almost 1 and a half, and the Dow is down a quarter of a point. The S and P is down a 3rd. NASDAQ is down damn near a half, and the S and P mini is down a 3rd as well. And Bitcoin is down too. We're all the way down to $94,340.

That takes us well off of a $2,000,000,000,000 market cap. We're looking at 1.87 trillion of market cap, and we can only get 35.5 ounces of shiny metal rocks with our 1 Bitcoin of which there are. 19,807,207.63 of. Average fees per block are relatively low, 0.06 BTC taken in fees on a per block basis. And there are 55 blocks carrying a 185,000 unconfirmed transactions waiting to clear at the exorbitant price of 6 satoshis per vbyte for high priorities, low priority gonna get you in at 4. Hash rate chilling out at 794.7xahashes per second on a 1 week rolling average. And from Nostra boarding, yesterday's episode of bitcoin, and I've got Graham with a 1,000 sat says thank you, sir, no thank you. Joey DD with a 1,000 sats says Pierre Poliev.

He actually spells it out. He says Pierre and then he spells his last name and then after that he says, Paul hyphen Lee hyphen e v. So is it Paul Lee e v or is it Poliev? I'm going with Poliev. Thank you, sir. I appreciate that. God's death with 537 says thank you, sir. No. Thank you. And Mark with absolutely nothing says time to catch up with none of your business. Oh, he's in my he's in my fountain, stack because he actually linked to the fountain dot f m URL that goes right to this episode, and that's why it's in here. Wartime with 333 says, your highly identifiable swag is OTW.

That means on the way. No. I'm not gonna wear it. Mark with 210 says, the new insect bunker seems pretty cool. Yeah. It does. And we'll get into a little bit more of a noster onboarding later in the show. Pieds with a 100. Thank you, sir. No. Thank you. And that's the weather report. Welcome to part 2 of the news you could use. Fidelity has a prediction, a prediction for 2025. It says Bitcoin in national reserves by 20 in 2025, according to Atlas 21. Let's find out a little bit more, see what exactly Fidelity Investments is saying. In 2025, several states could begin including Bitcoin in their national strategic reserves.

This emerges from the latest Fidelity digital assets report, which outlines a scenario of strong growth for the crypto market in the very near future. According to Matt Hogan, a research analyst at Fidelity Digital Assets, central bankers, sovereign funds, and government treasuries could soon follow the example of countries like Bhutan and El Salvador, which have already obtained substantial returns in a relatively short period of time from their Bitcoin investment. The ant the analysis highlights how the decision not to invest in Bitcoin could paradoxically represent a greater risk than the investment itself.

This scenario is determined by growing challenges such as inflation, a fiat currency devaluation, which honestly is the exact same thing, and increasingly heavy financial deficits or fiscal deficits. Hogan also suggested that if the United States were to Hogan also suggested that if the United States were to proceed with their plan for a strategic Bitcoin reserve, other states would likely begin accumulating in secret. The analyst explained, quote, no nation has an incentive to announce these plans as in doing so could influence more buyers and drive up the price, end quote. Oh, gee. Wow. I'm glad that was explained to me. Anyway, the report doesn't limit itself to National Reserve prospects.

Fidelity also predicts greater diffusion of structured financial products linked to digital assets, emphasizing the success already seen with spot ETFs for Bitcoin and Ether. For 2025, tokenization is also predicted to emerge as a killer application with on chain value growing from 14 to $30,000,000,000 by the end of the year. The report also mentioned some technical aspects related to Bitcoin. Fidelity highlights how the ecosystem continues to develop various layer 2 solutions to improve network scalability. In particular, bitvm2, an evolution of the previous bitvm and ARC, a protocol that introduces a shared UTXO system, are noted.

The debate within the Bitcoin community regarding the next soft fork is also emphasized with particular attention to those things we call covenants. The 2 proposals analyzed in the report are op, check template verify, and opcat. Finally, there's also space for mining. The birth of the ocean mining pool is mentioned along with the release of datum, a protocol aimed at decentralizing mining following a philosophy similar to that of stratumv2. So for for those that just don't get this, Fidelity investment actually gets it.

They understand what to look for and they understand what these things actually mean. And of all the investment houses that I could have picked, Fidelity Investments was not on my bingo list as a group of people who would actually understand. The thing about it is is that Fidelity Investments has been in this game for years. And that's they they got into they got into Bitcoin early. They started looking at it early. They stopped dismissing it a long time ago. And when when they're looking at stuff like op check template verify, opcat, arc, datum, stratumv2, bitvm2, and bitvm, that's deep in the weeds, ladies and gentlemen. This is Fidelity Investments.

This is retail level. This is Joe Schmo walking in off the street and getting an account with Fidelity Investments to, I don't know, relocate their 401 k in or invest in Tesla for their children. It's not hoity toity. It's not high end. It's just it's retail, and they get it. And that's honestly, for me, that's actually a really good sign. Now yesterday, I talked a lot about this thing called end start, and I'm going to talk about it again because apparently, I was one of the first people to actually start talking about it to the point that even I didn't know who made it. I don't know who I didn't know who built it I do now and it actually makes a lot of sense let's read this from nobsbitcoin.com NSTART Noster onboarding wizard NSTART aims to simplify onboarding for new users to the nostril protocol with an easy to use wizard that provides helpful hints about the protocol and exclusive features like the multi signer bunker quote, say hello to NSTART, Nostra's onboarding tool announced Danielle now that much you know because I brought that shit to you yesterday but let's continue NSTART includes some powerful features including easy local backup of your insect or your encrypted insect email yourself your encrypted insect as an additional backup location you can create a multi signer bunker URL for Nostra Connect auto follow the contacts list of some old and trusted Nostra users, customize of customization of contact suggestions useful for onboarding friends and family.

Nstart makes use of multi signature bunker that is managed by promenade. Quote, this is really cool stuff made by fiatjoff that uses frost to split your insect in 3 or more and distribute each shard to an independent trusted remote signer. This will give you a bunker code that you can use to log in to many web, mobile, desktop apps without exposing your insect. Disclaimer. This bunker implementation needs a small update from the classic implementation, so not all apps support it yet. Please beg your favorite developer to update the app. It also does not support encryption, so it cannot be used for DMs for DM apps.

Using end start is simple. You can just share start dot end jump dot me with anyone you'd like to invite to Nostr to allow them to follow you and your contacts list, personalize the URL with your in pub or profile. Now that's something that I did not realize from yesterday, and also I made a mistake. I thought that this was built by Fiat Joffe. It's after reading this again, it's clear that it he's not the one behind start dot n jump dot me. He's just behind the insect bunker part of this. So I guess it's Danielle. And let's see here.

Let me I want to look at something here. Go to to d t o n o n. I guess he's the I guess he is the sole developer of this particular website. So also so it's Danielle, also known as d t o n o n. Thank you for building this, because this I'm going to try this out on a couple of friends to see what happens. Because a simple step by step, but not preachy, not overly complicated. In fact, this is not complicated at all. You can just go if you don't even have honestly, you don't really even have to read much of of what's going on that I told you about yesterday. You can just go hit the buttons and go through the steps. When you boil this thing down to the the minimum viable product, it's like you click a button 4 or 5 times, you type in maybe an email address maybe you type in one word and everything's done for you and you get to follow some people and you get a list of places to go with your brand spanking new insect to sign in It's this is the type of you user experience that we need.

This is the type of user experience that that this is the one that I've been waiting for to to send to friends and family. Just email them a simple URL and say, hey. I want you to give Nostra a shot. If you don't understand it, just go go through these steps. Give it 5 minutes. That's all I'm asking. Give it 5 minutes. You will be on, and if you like it, you'll stay. If you don't, you you'll leave, and then but maybe you'll come back to it. And if you've saved everything that you needed to save, and you can remember where you saved it, you'll come right back here again. And if not, whoop dee doo. You didn't do anything with your in pub anyway, so you might as well just go through the steps again, and this time maybe it'll stick. But this is the type of onboarding user experience that I've been looking for. I think this is going to be effective, but it's only going to be effective if you help spread it around.

Danielle doesn't give me sat Satoshis for saying this. Right? He he's not advertising this on on the Bitcoin and podcast. Right? I I don't get advertising. I don't get any of that nice, shiny, clinky, you know, actual money that you can go out and spend. Right? You know, I mean, like or at least I mean, I do, but, you know, just not enough of it. I'm I'm saying that I I I believe in this. And when I believe in something, I'm going to bring it to you. So Danielle doesn't know me from Adam. We've never spoken. I looked at this yesterday, and I was like, that's the one.

I need you guys to spread it as well. So please, please, please start spreading around the url start dot njump dot me. And for those of you who are particular about this, it is an HTTPS. It is a secure URL. It's not HTTP and when somebody tries to open it up on their modern you know operating system it's not going to yell at them it's not going to scare them this has been done correctly so please please please start. Njump. Me. Spread it around. Anchor Watch launches in the United States for customers holding between a quarter of a $1,000,000 to $100,000,000 worth of Bitcoin.

Anchor Watch is a pioneering insurance provider specializing in collaborative Bitcoin custody. It combines the advanced security features of Trident Vault with insurance from Lloyd's of London Syndicates. The service is currently available for retail and commercial customers in the United States. Quote, we're thrilled to announce the grand opening of Anchor Watch and welcome you to Safer Bitcoin Storage. For the first time ever, you now have access to truly insured custody without giving up your keys, announced the company. Anchor Watch is a Lloyd's of London cover holder with binding authority for up to $100,000,000 per customer. For those of you who don't know what Lloyd's of London is, I think it's the oldest insurance company in the world.

I'm pretty sure Lloyd's of London has been around. Well, I know it's been around for centuries, but I'm pretty sure that it's the oldest insurance company in the world. These are the people that would insure things like the World Trade Centers. These are the people that would insure things like the Titanic. Like, they would be the insure the insurance company for the entire White Star lines. And if you don't know what White Star is, they're the ones that owned and operate the Titanic as well as a couple of other great classic ships this is a heavy hitting insurance company and they're working with Anchor Watch to insure Bitcoin I'll let your imagination run wild with that one The company aims to transform Bitcoin custody with its Trident Vault software leveraging Bitcoin smart contracting language for features like time locks, multiple spending conditions, and multi sig quorums.

This ensures strong security and governance facilitated at the Bitcoin protocol level while embedded regulated insurance reduces risks from theft, kidnappings, and or fraud. Trident Vault goes beyond traditional collaborative custody products built on legacy multisig by utilizing mini script offering 2 key advantages. 1, time locked recovery paths. This feature allows Bitcoin to be recovered using different combinations of keys over a period of time. And then 2, multi sig of multi sigs, and this enables AnchorWatch to be required or sorry, AnchorWatch to be a required signer on transactions while you're insured ensuring that we can never unilaterally control a customer's Bitcoin quote. When you combine these two features, it means you get extra protection while insured, but after your policy ends, the vault seamlessly becomes pure self custody, where you don't need us at all. If you want to renew your policy, then we restart the clocks on the time locks and put you back at full protection.

End quote. The service is currently available for retail and commercial US customers who hold between a quarter of a 1000000 dollars and a $100,000,000 in Bitcoin. Stay tuned for expansions to additional countries, and in the meantime, we can ensure American LLCs that hold Bitcoin. There are Bitcoin attorneys that can help you quickly set up an LLC in the United States, that you wholly own, blah blah blah. And it goes on and on and on. So the biggest part about this is that their reinsurance is through Lloyds of London. It's not this is not unless they're lying about it, and they're not going to lie about it, you're not gonna lie that you that you're working with Lloyds of London. You will get sued into the ground.

You will go you might even go to jail for, like, outright financial fraud by saying shit like that. You're not messing around with Lloyds of London. So if you are in the market for having Bitcoin insurance, you might consider checking out Anchor Watch. I am not a customer of Anchor Watch nor do they advertise on the show. I'm just bringing you the news. Now on to mining, Kanan introduced the introduces the Avalon mini 3 and the nano three s bitcoin home miners and heaters. Yeah. They they know where the they they know about heat recovery. They know that heat is a very useful high entropy energy. I won't get into that. Let's just get into this. Canaan announced the launch of the, Avalon mini 3 and nano three s at CES in Las Vegas aiming to democratize bitcoin mining and convert home heating systems into mining devices.

Kanan unveiled the Avalon mini 3 in Las Vegas and the device is a 37.5 terahashes per second bitcoin miner that also functions as a home heater. The company also introduced the nano 3 s which is an upgraded version of the well received Avalon Nano 3 featuring a hash rate of a mere 6 terahashes per second, but this device is designed as an affordable beginner friendly bitcoin mining option competing with the Avalon mini 3. Quote we are committed to making bitcoin mining accessible to everyone the Avalon mini 3 and Avalon 3 s represents our vision of user friendly practical mining solutions for the modern individual We're reimagining how technology can create value while minimizing environmental waste, and they're talking about heat waste.

The Avalon mini three's ability to generate cryptocurrency while heating your home is a perfect example of our vision for sustainable multipurpose technology, said Ing Zhang, CEO and founder of Canon. Preorders are available here, and there is a link to www.cananca naan.io. During the preorder period, which runs until the end of February, the price of the Avalon Nano 3 s is a mere $249, and the Avalon Mini 3 is priced at 8.99. That's $899, but only while supplies last. Alright. So it's clear at this point to me that bitaxe has made a permanent indelible mark on Bitcoin mining at the retail level.

I don't think Canaan would have done this had it not been for the success of BitX. And that's important because when I was when and I and I'm looking at my Bit ax miner right now, fans spinning and everything. I wanted to learn about mining. Now these guys have taken it one step further. They're saying, hey, look. This heat that these things generate, pretty important stuff. You can heat your homes with it, and they're designing it directly around home heating. Then that's important. However, I think they made a mistake. It's like January 8th, y'all.

You should have had this shit available before, I don't know, sometime mid November. If not, actually, honestly, you should have had this announcement prepped and ready to go and all the machines ready to ship by mid October at the latest. Kanan is late to this party. It doesn't mean that I mean, they'll be okay, but I mean, honestly, you should have get you should have hyped this shit. Hey, winter's coming. You should have done the whole Game of Thrones meme. Right? You could have done an entire meme based marketing push for this entire thing, but no. It's damn near mid January, so it's a little late. Alright. So here's the end of today's show. Pakistani trader has been kidnapped and then forced to hand over $340,000 in crypto.

I'm not going to read the article because I want to make sure that as I ended the show yesterday, I want to end this the show the same day same way today. Don't wear swag. Don't talk to strangers about your Bitcoin. Don't moderate Bitcoin websites and then somehow or another leak where you live. If you're going to tell somebody where you live, you don't want them to know that you even know anything about Bitcoin. This guy got tapped for $340,000. I don't know if that's all of what he had, but that's enough. I mean, you could have bought a house, a really nice house in West Texas for that. I mean, really nice, like 5 bedrooms, 4 bathrooms, a 3 car garage, and a yard. Just bought it and he lost it.

We cannot act like like bumbling idiots about this stuff anymore. Don't tell people about your Bitcoin. And if you already have, don't ever mention it again, and I will see you on the other side. This has been Bitcoin and and I'm your host, David Bennett. I hope you enjoyed today's episode and hope to see you again real soon. Have a great day.

Introduction and Episode Overview