Join me today for Episode 1013 of Bitcoin And . . .

Topics for today:

- PM Pierre?

- Czech Central Bank to Buy Bitcoin?

- CFTC Chair is Stepping Down

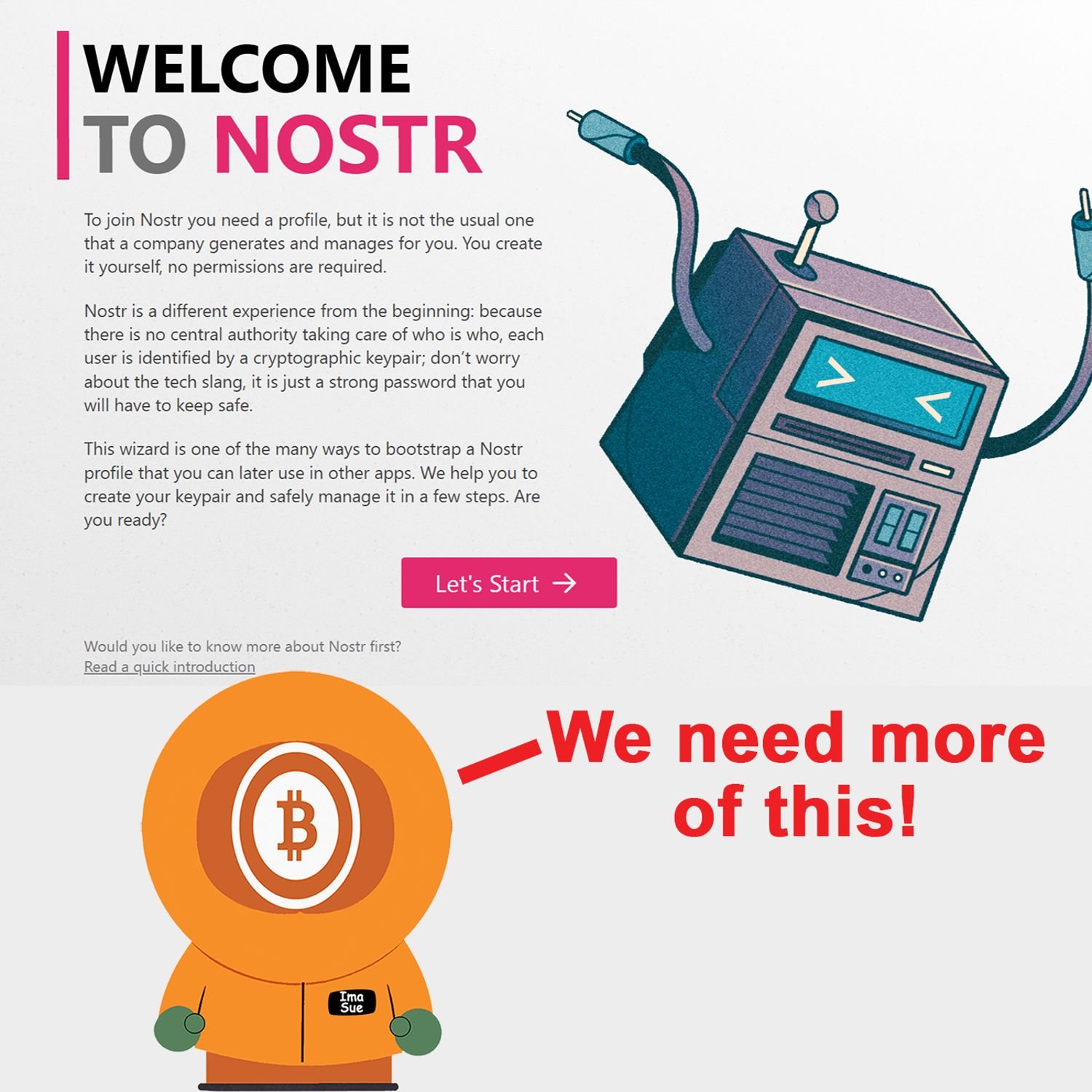

- nostr On-boarding Made Easy

#Bitcoin #BitcoinAnd

Circle P:

The King Ranch Donation Pages:

https://www.ruralamericainaction.com/fundraising/save-king-ranch-and-agriculture-in-washington

https://www.givesendgo.com/Kingranch

Articles:

https://bitcoinmagazine.com/takes/canada-can-elect-the-next-bitcoin-world-leader

https://www.theblock.co/post/333408/czech-national-bank-weighs-bitcoin-purchases-for-potential-reserve-asset-diversification

https://www.coindesk.com/business/2025/01/07/how-ethiopia-s-low-energy-costs-allow-bit-mining-to-recycle-its-bitcoin-machines

https://cointelegraph.com/news/cftc-chair-rostin-behnam-steps-down-crypto-regulation

- https://www.cnbc.com/futures-and-commodities/

- https://dashboard.clarkmoody.com/

- https://mempool.space/

- https://value4value.info/

- https://fountain.fm/show/eK5XaSb3UaLRavU3lYrI

- https://geyser.fund/project/thebitcoinandpodcast

https://www.coindesk.com/markets/2025/01/07/bitcoin-dips-below-98-k-as-strong-u-s-economic-data-leads-to-300-m-of-crypto-liquidations

https://primal.net/e/note1qqqrulwlqd8rh7866pkyeg0gkt6rjlfgufy4eckqpp5p25yy6s3sc4y0lm

https://start.njump.me/

https://decrypt.co/299717/bitcoin-price-102k-trump-team-weighs-narrower-tariffs

https://atlas21.com/attempted-bitcoin-kidnapping-in-canada-crypto-forum-moderator-forced-into-hiding/

Find the Bitcoin And Podcast on every podcast app here:

https://episodes.fm/1438789088

Find the Bitcoin And Podcast on every podcast app here:

https://episodes.fm/1438789088

Find me on nostr

npub1vwymuey3u7mf860ndrkw3r7dz30s0srg6tqmhtjzg7umtm6rn5eq2qzugd (npub)

6389be6491e7b693e9f368ece88fcd145f07c068d2c1bbae4247b9b5ef439d32 (Hex)

Twitter:

https://twitter.com/DavidB84567

StackerNews:

stacker.news/NunyaBidness

Podcasting 2.0:

fountain.fm/show/eK5XaSb3UaLRavU3lYrI

Apple Podcasts:

tinyurl.com/unm35bjh

Mastodon:

https://noauthority.social/@NunyaBidness

Support Bitcoin And . . . on Patreon:

patreon.com/BitcoinAndPodcast

Find Lightning Network Channel partners here:

https://t.me/+bj-7w_ePsANlOGEx (Nodestrich)

https://t.me/plebnet (Plebnet)

Music by:

Flutey Funk Kevin MacLeod (incompetech.com)

Licensed under Creative Commons: By Attribution 3.0 License

creativecommons.org/licenses/by/3.0/

It is 9:21 AM Pacific Standard Time. It is the 7th day of January 2025. This is episode 1013 of Bitcoin. And yeah. Yesterday, I said it was, like, 2012, episode number 2012 on a, I I I don't know why I did that yesterday when I sent out the, you know, the stuff that I normally send out after I do a show. So I had to correct it because, no, I haven't done 2,000 episodes, man. I was I was doing good to get to a 1,000, so, apologies for all of that. We're gonna get back into Canada a little bit, and then the Czech Republic a little bit. We're gonna run over to Africa, and we're gonna talk about the, CFTC chairman, might be, saying goodbye.

And then we'll do the market update, and then we'll get back into something that I think is really kinda cool. There's a note on Noster from Danielle, d a n I e l e, about creating a welcome to Nostr website that basically does all the things that a new Nostr user would need. We'll look into that because, honestly, that's kind of a pretty cool deal. It looks good. It functions well. I kind of tested it out. We're gonna go through that one, and then we'll, talk a little bit about well, clearly, we're gonna talk a little bit about why, Bitcoin price decided to, do what it does, turn south like a duck in winter, and start bulldozing into the fucking ground like it just has the this tendency to do.

Just so happens that economic numbers came out and we'll get into all of that and more but first let's go up north to our friends in the frozen white tundra up in Canada where Bitcoin Magazine's Nicholas Hoffman has written this one, Canada can elect the next Bitcoin world leader. Woo hoo. Let's see what they're talking about. We know what happened with Justin Trudeau yesterday, which I still think is kind of fishy. I'm sorry. I'm calling it. I think it's fishy. I mean, just because he's resigning from the party, does and and said, well, he's gonna stay on as prime minister.

No. No. No. You resign from everything, Justin. You get out of your party. You resign the prime minister. You have special elections. And I guess the only reason that Justin was able to do this is because he lost his second in command before Christmas. She said, you know, I'm done. I'm gone. I'm out. You know? And that was not that was not good. So I guess he just doesn't have anybody like a vice president like we have in the United States to take over the reign like like Nixon, like the whole issue in, 1970 whatever it was after Watergate, president Richard Nixon, he resigned.

Well, he had a second in command, and that would be Gerald Ford. And Gerald Ford then became installed as president of the United States and finished out, Richard Nixon's term. Well, so I guess, anyway, I guess Justin Trudeau doesn't he doesn't have his, assistant prime minister anymore. So and I and I'm not a specialist on Canadian politics, so I don't know. But it just there's something about him not stepping down as prime minister that seems a little fishy to me. But regardless, Nick Hoffman, Bitcoin Magazine says, Canada's prime minister Justin Trudeau has announced he is officially resigning from his position in office and as the leader of the Liberal Party of Canada effective when the party chooses his successor.

So I guess there's a caveat that says that, well, he will resign the prime ministership when they, when the party chooses his successor. I don't know, man. The whole thing seems freaking confusing to me, but Trudeau has faced massive, massive criticism over the last few years due to his inability to solve the housing shortages, inflation, and other economic struggles that the country is facing. Oh, gee. Plus the fact that he stripped Canadian citizens of their banking rights because they honked the horn, he continuously destroyed he continuously destroyed the Canadian economy throughout the entire COVID pandemic.

So people have become more and more fed up with this guy, but apparently, this all boils down to him not being able to solve these problems, and I call BS. People hate this guy. Anyway, he has also stated that he is fighting internal battles and therefore cannot be the best option for the country in the upcoming 2025 Canadian federal elections. Trudeau, known for his anti Bitcoin stance alongside his other poor economic policies, said in early 2023 that his political opponent and leader of the Conservative Party of Canada, Pierre Polivier, I can't pronounce his name, will not was not fit for leadership because he correctly told Canadian citizens to opt out of inflation by holding Bitcoin.

Trudeau cherry picked data from when Pierre said that and used it as an attempt to make holding Bitcoin seem like a bad decision, stating that Canadians would have lost half of their life savings if they had bought Bitcoin. If Trudeau had been intellectually honest and able to see the bigger picture, he would have also encouraged his citizens to accumulate Bitcoin as well because Bitcoin's price has increased about 375 percent percent since Trudeau tried to make a mockery of saving in Bitcoin. Canada has their federal election coming up later this year, and they have the potential to elect the next Bitcoin world leader, Pierre Palom.

I'm sorry. I just can't pronounce his name. I can't do it. I don't I I make I mean, all I can do is make apologies and move on. Pierre is a staunch Bitcoin advocate and has done the work to understand what money is. Here below is a great 10 minute speech by Pierre on money really showcasing his deep understanding of it. And here is another speech in which Pierre says that the bottom line is we're growing the money supply which causes inflation. We're printing money to fund irresponsible government spending. And, of course, the links are below in this particular article. And all these articles are linked in the show notes if you want to go see them for yourself. Similar to how Trump visited Pub Key in New York City to purchase burgers and drinks using the Bitcoin Lightning Network, Pierre has also visited a local Bitcoin business to purchase food with Bitcoin.

In 2023, he visited a Canadian restaurant accepting Bitcoin as payment and paid in Bitcoin for food, further showcasing his openness to embracing the asset and promoting the use of it as a medium of exchange and not just a store of value. And by the way, he went to tahini's restaurant. They don't actually say that in this particular article, but it's the restaurant's name is Tahini's. And a long time ago, like, when I was still living in Canyon, Texas, I interviewed one of the brothers that is behind the restaurant, Tahini's, and what they think about Bitcoin and how they're accepting it and how they're growing their, their business with it. It's it's it's an amazing story.

I don't have the number of that particular interview, but it was so long ago that it's probably not exactly evergreen at this point. However, let's continue. Bitcoiners in Canada now have a chance to vote for a prime minister who would have sound economic policies and promote the use of Bitcoin. And if this happens, they would join the ranks of the United States, El Salvador, and other countries who do have leaders embracing Bitcoin and the benefits of it. Canada's election is slated to take place on or before October 20, 2025. That's a long way away, ladies and gentlemen. I personally think that Pierre is the best choice for Canada this election not not only because of his pro Bitcoin stance, but because of his economic policies, his freedom oriented mindset, and rational thinking. I hope to see Canada embrace Bitcoin and solve their economic problems caused by Trudeau and the Liberal Party of Canada's poor mismanagement of their economy by choosing new conservative leadership and encouraging further use of Bitcoin in the country.

So Canadians, get out and vote for Pierre this election. This is your shot to make history and embrace the future of finance with Bitcoin. And my question is, as we end that article, is can we trust Pierre? Is he just paying lip service? This is this is my normal refrain. Just because somebody says a thing does not necessarily mean they believe that thing. It's possible ladies and gentlemen that Pierre is just lying through his teeth. Now do I believe that? Not really. But I'm I'm just tired of being swept up in the, oh, this guy likes bitcoin so therefore he's gonna be good for Bitcoin and therefore we're all gonna get Lambos and girlfriends. I think honestly that that's a very naive and juvenile way of moving around the political spectrum if you were somebody who's thinks that voting is actually going to change shit.

And even if Pierre was elected, unless you sweep out all the bits of trash, just like here in the United States it's not like you Canadians are, like, alone in this thing. We've got our problems down south here too, pal. But unless we sweep away the last vestiges of all the remaining bullshit, it doesn't matter who we elect. Whether you guys elect Pierre or we elect Trump or whatever, whoever it is, because that's that's not the that's not the end all be all of the machine that is has been at work destroying our wealth, destroying our psyche, destroying our health, destroying everything because somehow or another we've just let evil infiltrate just about every little nook and cranny that we can find.

And I still have absolutely no answer as to why we would do that. I don't know, maybe Czechoslovakia or or the Czech Republic has an answer. Let's see what they're doing over there in Eastern Europe. This is from the block. Brian MacLean and he's writing it. Czech National Bank weighs Bitcoin purchases for potential reserve asset diversification. Well, isn't that interesting? It seems everybody is, this is what bugs me. Is this a fad? I mean, just because something is a good idea and I think national banks and and and and governments and whatnot like that, having at least some Bitcoin I mean, honestly, you might as well buy some in case it takes off. Remember that? I don't think he was saying I don't think that that Satoshi Nakamoto, when he said that back in, what, 2011 or 2010 or whatever it was he had a like a a mail on the on the mailing list for the cypherpunks or the bitcoin mailing list he said hey you know you might want to buy some bitcoin just in case it takes off there wasn't he made no mention that well unless you're a central bank then go pound sand he didn't say that he said you as in anybody any institution any government any retail guy any Joe Schmo on the street you should probably get some in case it takes off okay well looks like the Czech National Bank might be following suit but again the question becomes is this a simple fad Is this just a simple fad at this point?

Again, just because something is a good idea doesn't mean that it doesn't become a fad and fads have a tendency to be dangerous especially when you're talking about something like, oh, I don't know, countrywide worldwide economies? Just saying, let's be careful here, but the Czech National Bank governor, Ales Michal, discussed the possibility of bitcoin as part the bank's reserve diversification strategy in an interview on Monday. Speaking with CNN Prima News is it Prima? CNN Prima News? I've never heard of that before, but whatever. A local media company, Michael, revealed that he had suggested that the Czech Central Bank purchase Bitcoin to diversify its asset holdings but clarified that there are no plans to acquire any cryptocurrency.

Sure, I consider bitcoin but there are 7 of us on the board Michael stated adding that discussions would continue Bitcoin is an interesting option for diversification against other assets. I was thinking of acquiring just a few Bitcoin, but I never intended to make a significant investment, Michael added. The Czech Republic is not the only country apparently considering cryptocurrency purchases. And then they talk about El Salvador and blah blah blah blah blah. I'm just gonna skip all that. Let's get back to the check part. As the CNB continues to explore diversification strategies, Michael said that the bank is also focused on increasing its gold holdings.

The bank plans to increase its gold reserves by approximately 5% of total assets by 2028, continuing the trend of adding more traditional assets to its portfolio. Yeah. Everybody's punching out a fiat, dude. The news follows the Czech government's approval of capital gains tax exemptions for long term Bitcoin holdings in early December. Last month, the Czech Republic passed the law that exempts Bitcoin holdings of over 3 years from capital gains tax. This legislation, which was unanimously approved by the Czech parliament on December 6th, took effect on January 1st. According to the Czech news site, there's no way I can pronounce this so I apologize, but maybe the new tax exemption law sets clear criteria for excluding cryptocurrency transactions from personal tax payments quote. Individuals can benefit from these exemptions if their total gross annual income from crypto asset transactions does not exceed 100,000 CZK or about $4,000 US, the Czech media outlet said. Additionally, digital assets held for more than 3 years before being sold are also eligible for tax exemption encouraging long term holding strategies, end quote.

Prime minister of the Czech Republic, Petr Fiala, also explained in a Twitter post that cryptocurrencies sold after more than 3 years will not be taxed. Quote, we push for better conditions for cryptocurrencies and to make life easier for people and support modern technologies, Fiala said. To further qualify for the tax exemption, digital assets must not have been part of business assets for at least 3 years after ceasing self employment. The new framework also applies retroactively in certain cases digital assets acquired before 2025 can still qualify for tax exemptions if they are sold under the specified conditions in subsequent tax years. So Czech Republic talking about it, maybe getting a couple of Bitcoin.

Who knows what they actually mean to do? I mean, honestly, if I was actually considering okay. If I was like the Czech Republic and the Czech National Bank and one of the guys at the Board of Governors, the Czech National Bank, which is their central bank, and I was saying, hey, look, we could be thinking about buying Bitcoin. We're gonna buy a lot of Bitcoin. You don't telegraph that. You just don't do that. So it's possible that they might be considering buying more than just a couple of Bitcoin, but they don't want to, you know, I don't know, inflate the market. Not, as of right now, I don't think they're gonna be inflating much of a market because Bitcoin is still doing its little nosedive thing, and as far as I know, China has yet to actually wake from their slumber to see the charts, so we'll probably have a little bit of, more downside action. I expect to plumb the depths of 95,000 by the end of the day. And I don't mean to, like, rain on anybody's parade, but I also don't want to lie to your ass either. So, anyway, let's go over to Africa and figure out how Ethiopia's low energy costs allow bit mining to recycle its bitcoin machines?

Now I talked about Ethiopia yesterday. We were talking about the dam and it looks like CoinDesk, has decided with Tom Carreras to dig a little bit deeper into what's going on in Ethiopia, so let's find out. Landlocked between 6 different neighbors in the Horn of Africa, Ethiopia has approximately 120,000,000 inhabitants making it the 2nd most populous nation in on the continent and a GDP of $163,000,000,000 which puts it in the same economic league as Ukraine, Morocco, Slovakia, and Kuwait. However, the country also has suffered from a bloody civil war with several regions still under the control of anti government forces like the ethnonationalist Amhara militafano, but that hasn't prevented Chinese Bitcoin mining company BitMining from expanding its operations until now confined to Akron, Ohio.

No. Seriously, a Chinese company in Akron, Ohio into Ethiopia by signing a $14,000,000 deal to acquire facilities worth 51 megawatts worth of power and almost 18,000 Bitcoin mining rigs in the country. Excuse me. In fact, for doctor Yue Yang, chief economist at Bit Mining, Ethiopia's ultra low electricity costs provide the firm a unique opportunity to extend the shelf life of its bitcoin mining rigs, which, due to the industry's extreme competitiveness, tend to become obsolete in the United States after only 2 or two and a half years of activity. Quote, the price of electricity is maybe 75% higher in Ohio than in Ethiopia, sometimes almost double.

So it can take only run so it can only run very advanced asics like the newest or second newest generations. Now we can just move older generation machines into Ethiopia, Yang told CoinDesk. It's a big deal because aside from mining Litecoin, oh god, and Dogecoin, bit mining is mainly in the hosting business, meaning that it operates mining facilities for the sake of various clients. State of the art mining rigs don't come cheap, like, you know, a single machine fetching anywhere between $510,000 at retail. Yeah? And investors are naturally reluctant to send such expensive pieces of machinery to, you know, war torn jurisdictions.

The pitch then is to install the newer rigs in the United States and send the aging ones out to Ethiopia. That creates a positive feedback loop because now investors can extract greater returns from their machines than if bit mining restricted itself to operating in solely the United States. That in turn attracts more capital according to Yang. We can get at least 2 extra years by moving these rigs to Ethiopia and then maybe after that they're completely done Yang said but why Ethiopia specifically Well, for one thing, the country's electric standards is similar to China's, which allows bit mining to leverage the expertise of its engineering team and redeploy some of the electrical equipment it previously used in the middle kingdom before the Bitcoin mining ban in China. Ethiopia also enjoys an abundance of hydroelectric power, some of it thanks to Chinese investments, which have totaled $8,500,000,000 across more than 3,000 separate projects in recent years. For example, China helped fund the construction of the Grand Ethiopian Renaissance Dam or the GERD.

Once completed, it will be the largest dam in Africa and generate over 5,000 megawatts. Holy smokes. Not all of Ethiopia's electrical output has been put to use yet, however, and that has created a window of opportunity for Bitcoin miners especially since the Ethiopian government has been supportive of the mining industry. In fact, the country is home to 1.5 percent of Bitcoin's total hash rate according to hash rate index, meaning that it contributes about as much to the network as Norway does. That's despite the fact that the Ethiopian federal government has a shaky control over the country's overall territory.

100 of thousands of Ethiopians were killed in the government's war against the Tigray People's Liberation Front between the years 2020 and 2022, and the state only just signed a peace treaty in December with the Oromo Liberation Army, which it had been fighting in some form or fashion since 19 seventies. When asked whether Bit Mining had concerns about the social unrest in the country, Yang replied that the firm had been, quote, studying, researching, and also visiting Ethiopia several times, just that it's a stable place, end quote.

The decision was made to purchase a facility instead of building it from scratch to avoid any unforeseen trouble. Even so, it was a challenge convincing bit mining employees to move to Ethiopia from their previous domiciles in the US or China. Quote, people obviously like to live and work in richer and safer countries. While a third of the facility's operating team are foreign right now, the team will be composed of mostly locals down the line, he said, well, according to Yang. In the meantime, the company is on the lookout for new investments in the country, be them energy infrastructure projects, data centers for artificial intelligence purposes, or other Bitcoin mining facilities. Quote, there's plenty of opportunities in Ethiopia, Yang said.

The AI thing we've been studying it for at least 6 to 9 months. We have the power. We have the people. We have the ability to do it, but the whole process is capital intensive. Construction in the United States is a lot more expensive, so it's very hard to do pilot experiments, but it's a hell of a lot easier to try one of those in Ethiopia, end quote. And I kind of embellished that quote just a little bit. Hey, you know, gotta do something to to keep it all fresh. So the whole issue of sending old mining rigs to different parts of the world depending on the age of the mining rigs and the cost of electricity is going to be an arbitrage opportunity from now on.

It's good. This is gonna be great because now you can just say, okay, look, we we we got the newest, latest, greatest machines. They have, like, efficiencies of, I don't know, 14 joules per terawatt. They, you know, it it it they're insanely light, and and they cost $15,000 a unit, let's say. Alright. Just really expensive. Alright. We'll put those over in the United States. Let's let's use that efficiency against the price of electricity in the safest place that we can find, and that would be western countries, like the United States, Canada, Europe, Norway, things like, you know, things like, you know, that nature.

Right? Then as those age out, you can start sending them to less than stable areas because the electricity is going to be cheaper, and that way you can replace these machines with yet the newest machines, like, let's say, 12 joules per terrahas or however kilojoule however, whatever the efficiency is. Okay? Just really high even more efficient machines come in, you re rack them into United States or Western Europe, and then you send those out. And that way you end up with, like, you might be able to get 2, maybe even 3 separate uses out of the same machine simply by shipping it. And of course, you'll be saying, well, yeah. Well, what's the shipping cost in all that weight?

I don't know. And that's that's where there's gonna be some some, you know, you're you'll you'd have to work the actual numbers. But, honestly, this sounds good, especially when you consider what we were talking about yesterday. The ability for mining companies to come into 3rd world countries like Ethiopia, and they're not exactly 3rd world at this point, by the way, but let's just say 3rd world countries you mine bitcoin on their cheapest electricity sources like hydroelectric power in Ethiopia they use that money to build out the infrastructure to get all of the electrons to their capital cities, their, you know, rural towns, basically, you know, build out their grid.

And then at that point, there's a choice as to whether or not it's a good idea for the Bitcoin miners to stay. And that's a decision made by the government and the Bitcoin miners themselves. They may not want to stay. Maybe the electricity prices start to rise. Anyway, it it seems apparent that we've got this entire ecosystem of mining that just builds electrical infrastructure everywhere it goes and we still we still have fingers pointed at us for destroying the world. Whatever. Now let's get back over here to the United States where the US Commodities Futures and Trading Commission chair is going to step down and flags an urgent need for crypto regulation. Cointelegraph Josh o'Sullivan is writing, Rosten Benham, chair of the United States Commodities Futures Trading Commission, will step down on January 20th after a 4 year tenure marked by significant enforcement actions in the crypto sector.

Benham or yeah. Benham saw oversaw high profile cases including a $4,300,000,000 settlement with Binance, but has expressed concerns about the lack of regulatory oversight in the digital asset space. Benham told the Financial Times that he was concerned about digital asset regulation, describing it as insufficient due to large swaths of digital asset space being unregulated in the United States. And as he prepares to leave office, Benham emphasized the need for robust oversight to address growing adoption demands and ensure market integrity.

During his tenure, he led the CFTC to finalize federal guidelines for carbon offset trading and expand oversight into digital assets. The agency pursued Binance for operating illegally in the United States as an unlicensed crypto derivatives trading platform and failing to comply with regulations. Benham reportedly highlighted the regulatory gap in crypto markets, arguing that many digital tokens qualify as commodities and should fall under the CFTC's jurisdiction. Benham stressed the importance of international regulation calling for a very disciplined approach to how rules are written that is driven by the law. He called for his replacement to deliver renewed focus to the crypto market so that clearer lines are in place to determine what is permissible and impermissible.

Now this next piece is the whole reason I'm reading this to you. On December 12th, Brian Kitsnitz, a former CFTC commissioner and the current head of policy at, guess who? Andreessen Horowitz's crypto division a16z has reportedly emerged as the top pick to replace venom How would you like to see an a 16 z staffer go back to the CFTC? The doors? No. The gates. No, the floodgates. No, the black hole of shit coinery opens before us. That's what I'm that's what I'm seeing is just chicanery in toto. Having anybody who is connected with a 16z anywhere freaking close to this thing scares the piss out of me.

His background features overseeing key policy initiatives at the CFTC when when he was there between 2017 and 2021. And his appointment as chair could change the long debated jurisdictional lack of clarity over cryptocurrencies. Sure. He'll say none of them none of them are securities. That they're all above board. You can buy anything. It like, it's gonna be scam nation. Anyway, the former CFTC commissioner previously advocated for financial innovation in the digital asset industry and continues to push this narrative as head of policy at a 16 z. He is a shitcoiner, and it looks like he might actually get in as the next chair of the CFTC.

This, in my opinion, is really bad news, but let's run the numbers. CNBC Futures and Commodities West Texas Intermediate Oil doing well today. It's up just under a full point, $74.25 a barrel. Brent Norsee also up almost a point to $77.03. Natural gas down 5 and a third percent to $3.47 per 1,000 cubic feet, and gasoline is down 1 third of a point to $2.2 a gallon. All of the shiny metal rocks are having a very good day today. 0.7 percent upside for gold to send it to $26.65.80. Silver is up 0.17, platinum is up 3.6%, copper is up 3 quarters of a percent, and palladium is up 1 3 quarters of a percent.

Ag futures, what are we doing here? The biggest winner today looks to be coffee, about a point to the upside, and the biggest loser is chocolate, about a point to the downside. I got live cattle, and they're up point 23%. But lean hogs are down point 88% and feeder cattle are up point 7. The Dow is down a quarter of a point. S and P is down point 84%, Nasdaq falling on its ass 1.5%, and the S and P mini is down a half. Gee, I wonder why. But first, before we actually ask why, why is Bitcoin down to $97,140? A loss of over 5% on the day. And that shit happened within minutes, and it liquefied, like, $450,000,000 of longs within minutes.

Do any of these people ever learn? I keep thinking about the guys that keep losing 1, 2, 10 bitcoin because they're betting like degenerates. Are I mean, are they offsetting this with, like, gigantic wins and this is just a cost of doing business? Because all I ever see is shorts getting liquidated, longs getting liquidated. I never see the wins, you know? And I'm sure that they're out there somewhere, but I don't know, man. This just seems like a game you don't wanna play. And at $97,210 per bitcoin, we have a market cap of $1,930,000,000,000. Good job getting us under $2,000,000,000,000, you freaking degenerate jackasses.

Anyway, you can get 36.6 ounces of shiny metal rocks with your 1 Bitcoin, of which there are 19,806,813.89 of. Fees, for transactions have risen a little since yesterday. 0.06 BTC taken in fees on a per block basis. Now before we hit mempool, let's talk about what's going on with the price of the Dow, the S and P, Nasdaq, the legacy legacy financial is not looking good today. I wonder why. And, of course, we've lost 5% on the price of bitcoin. So what the hell happened? Well, let's ask Kristin Sandor out of CoinDesk who has this headline.

Bitcoin dips below $98,000 as strong United States economic data leads to $300,000,000 of crypto liquidations. Yeah. Well, it's a hell of a lot more than that now. This is why. This is what's going on if you're asking questions. Crypto market stumbled with bitcoin losing the $100,000 handle on Tuesday morning, as to stronger than expected United States economic data prints through cold water on the digital assets bright and early year momentum. No, dude. We've been we've been hammered between 95 a100 for the entirety of the Christmas and New Year season. Please don't freak out, guys. The Bureau of Labor Statistics jolts job openings for November unexpectedly rose to 8,100,000 from 7,800,000 the previous month, easily topping analyst estimates for a decline to 7,700,000 Now I'm going to pause right there before we get into the other stuff.

This Jolt's job openings is a bullshit number, and it has been for decades but it's gotten worse during and since the pandemic this number I guarantee you will be revised down next month this is not a real number it's like the CPI these are all fake numbers now doesn't mean that the markets don't react to them because that's the only indicators that they have is CMI, PMI the JOLTS job openings, non farm payrolls, all that kind of stuff. They're all lie numbers. There's no truth to anything anymore, whether it's on purpose or because they just don't know what the hell's going on anymore because we screwed the economy up so bad, it doesn't really matter. The the effect is the same. These are not true numbers as to what's going on in the economy, yet economists and traders and retail Joe Schmoes and, like, I don't know, you know, Charles Schwab guys, they that's the that's the only indicators they have.

Right? So when this number dropped and it was expected, you know, unexpected rise to 8,100,000 on the Joltz job openings and it rose to that number from 7.8, that meant the economy is doing better than ever or at least in well, not better than ever, but at least better than the last few months. And what does that mean? That means the Federal Reserve is now less likely to lower interest rates because it's to them, it's quote unquote working. You know, all their all this the the lever that they're pulling and they've only got one lever that works left and that's the interest rate that whatever it is that they're doing is working so they don't have to pull that lever down anymore.

Now that doesn't mean that they won't lower interest rates at their next meeting, but it is way less likely that they do. Why is that important? Because that means that money won't be cheaper and freer than it is right now. And when you have cheap free money, that means you can borrow at low interest rates and do all kinds of need investing with it and make that money back, service the loan, but when you have higher interest rates that doesn't happen and all the investors are looking for low interest rates so they can have cheap and free money to go buy whatever they want and that includes Bitcoin. That includes Bitcoin.

So that's why when this number hit the print that the red bar started going down in earnest and it's going to be a bloodbath all day long I'm expecting to hit 95,500, maybe 95,250. It may you never know. It may even touch the 95,000 mark because China is still yet to wake up. The sun is not shining over Beijing just yet or at least not that I think it is. Anyway, let let's continue on. Because released at the very same time, the ISM, services purchasing managers index, a monthly gauge of the level of economic activity in the services sector? Well, it came in at 54.1 for December, overshooting expectations for 53.3.

So they were thinking it was going to be 53.3 but no, it's higher, it's better, it's stronger, it's faster, it's 54.1! Woohoo! And nicely ahead of November's paltry ass 52.1 print. The prices paid sub index came in red hot at 64.4 compared to the expected 57.5 58.2 in the previous month. While neither report generally tends to be much of a market mover, combined, they further shook up an already jittery bond market sending the 10 year US Treasury yield higher by another 5 basis points to hit 4.68% and within a few ticks of multi year highs.

The move took US stocks lower with the Nasdaq now off by more than 1% in late morning action and the s and p lower by 0.4. Okay. So let's talk about this 10 year US Treasury yield being higher and what that actually means. The yields on the 10 year United States Treasury bond should be lower. It's not playing ball with the Federal Reserve. When the Federal Reserve lowers their rates, there's a few there's a few bonds that people look at, the 2 year, the 5 year, the 10 year, and then the big 30 year. The 30 year is more like your house more what kind of guides the house mortgage, interest rates, but the 10 year is sort of like right in the middle of the road. It sort of averages out general market sentiment as to whether or not the market believes the bullshit out of the federal reserve lowering interest rates, and the market is is not buying it.

That's what's going on. As the federal reserve lowers its interest rates, the 10 year yield should also decline, which means that the principal on the bond should actually increase, the price of the bond. Like, if I want to go buy a 10 year treasury and I got a $100 bill and I go, hey, I want a $100 worth of I want a $100 treasury 10 year. Okay. Well, if I buy it and the yield on it goes down then I can sell that bond for more than I paid for it because the amount that I can sell it for actually goes up. If the interest rate goes up, then what I can sell the bond for goes down the principal.

Right? So I can maybe sell it for $98. But I'm making more interest on it, so I'm inclined to hold it to make the interest. But if the interest rate goes down, I'm not inclined to hold it as much for the interest because it's not much interest, so maybe I sell it and get the money back immediately because I could sell it to somebody else for a higher price. And that's that's just the way the bond market kinda works. In this case, when the Federal Reserve lowers interest rates, the 10 year bond should come along for the ride. Its yield should go down. It's not going down.

It's not going down. This is an issue and nobody, almost nobody's talking about it. Not in mainstream. The Bitcoin podcasters, we're talking about it. You know, other podcasters, they're talking about it, but they don't talk about this shit on CNBC because what it's telling them is that the market is not buying what the Fed is doing. So the market is has a completely different definition of what the economy is doing than all of these piddly ass numbers that are coming out, but this is what you're seeing in the markets today. These good numbers, the quote unquote good numbers, they're making people sell their shit because they're not going to get the cheap and easy money that they thought they were gonna get when they get it and they're going to wait.

So there you go. That's my half assed opinion as to what's going on in the market. Now there are 63 blocks in MNPLs around the world and they're carrying a 191,000 unconfirmed transactions waiting to clear at high priority rates of double digits. Yeah. Twelve satoshas per v byte. Low priority gonna get you in at 8. Hash rate looks like oh, it's risen up a little bit. 804.4 exahashes per second. Yesterday was a solid 800 0.4 exahashes per second. And then again, this is a 1 week rolling average. And now from will work for poutine, yesterday's episode of Bitcoin and I got Nick_dose with 5,000 sats. Thank you, Nick. I, really appreciate that. He says cheers and cheers right back to you. Joeydd with a1000 says, yes, David. Most of us Canadians are thoroughly choked at the Trudeau, quote, situation.

Does he say choke or does that chalked? It may be chalked, c h o k e d. I just wanna make sure that we all get what Joey Didi is saying there. God's death with 5:37 says, thank you, sir. No, thank you. And then he says, welcome back, brother. Yeah. I'm glad to be here, pal. Wartime with 333 says, fire cheers. Zplbzx with a 125 says, welcome back to the news desk, and thanks for coming back. I appreciate that, sir, and I will read whatever is put in front of me. PIES with a 100 says, thank you, sir, no thank you. And Nick_dose with a 101 sat says, cheers. I appreciate it. That's the weather report.

Welcome to part 2 of the news that you can use. There's an this is the note from Danielle on Nostr about something called nStart. Nostr's onboarding tool. He says, say hello to nstart, noster's onboarding tool. Nstart, then that's n s t a r t, like nostrstart. Nstart aims to guide new users to noster offering or offering an easy and no nonsense onboarding wizard. He's built a Nostr onboarding wizard with useful hints about the protocol and some really exclusive features like easy local backup of your insect or n cryptsec which is your insect, that's been what am I trying to say?

Cryptographalyzed. Been run through cryptography. It's been but there's a word I'm looking for and I can't find it, so I'm gonna move on. You can email yourself your encryptsec, which is the oh, encrypted. Your encrypted insect. Right? So this is trust me, man. This is actually really kinda cool. You can create a multi signer bunker URL for Nostra Connect, and there's more info about that below. Auto follow the contacts list of some old and trusted Nostra users, and I was not on the list. Customize customized contact suggestions are useful for onboarding friends and family. So try nstartlive@start.njump.me.

That's start dot njump dot me or watch the video below to understand how it works a note about the multi signer bunker this is really cool stuff made by fiatjoff that uses frost to split your insect into 3 or more and distribute each shard to an independent trusted remote signer this will give you a bunker code that you can use to log in to many web mobile and desktop apps without exposing your insect If you ever lose your bunker code, if the signers vanish from earth and it stops working, or if it gets stolen by a malware virus, you can use your insect to create a new one and invalidate the old one.

More info and the source code is at github.com/dt0n0n/endstart. Enjoy it and send back any feedback. Okay, well, here's my feedback. I love this thing. Now, that doesn't mean that I have pulled it completely apart and made sure that it's completely safe. I I don't know. That's a little bit beyond my paygrade. But I'm over here at start. Njump. Me and it's got a nice a very nice graphic with some text up here and it says, welcome to Nostr. To join Nostr, you need a profile, but it is not the usual one that a company generates and manages for you. You create it yourself. No permissions are required.

Nostr is a different experience from the beginning because there is no central authority taking care of who is who. Each user is identified by a cryptographic key pair. Don't worry about the text slang, it's just a strong password that you will have to keep safe. This wizard is one of the many ways to bootstrap a Nostra profile that you can later use in other applications. We help you to create your key pair and safely manage it in a few steps. Are you ready? And then there's a button a nice, big, obvious button that says, let's start. Okay. Well, I'll press the button to say, let's start.

Now, the screen changes and it says, present yourself, and the text here is, on Nostra, you decide to be whoever you want. A Nostra profile usually includes a name, a picture, and some additional information, but it's all optional. The name is not a unique username. We can have as many Jacks as we want. Feel free to use your real name or nickname. You can always change it later. But remember, online privacy matters. Don't share sensitive data. And yes, to join Nostr, you do not need to give your email address, your phone number, or anything like that. It is KYC free.

Now, that's on the left hand side. On the right hand side is a place for me to put my image, and I just would click it and then upload an image. There's a box for my name, so I'll put in David Bennett. And then it says, a brief presentation. I run a podcast. And that's in a separate box. And then it's got a 3rd and final box for my website, and I'll just I don't know. I'll put in wait wait.com. I don't know. Something. And then I'm just gonna hit continue now the the screen has changed and now it says your keys are ready and underneath that it says well done David Bennett your nostr profile is ready yes it was that easy On nostr your key pair is identified by a unique string that starts with n pub.

This is your public profile code you can share with anyone. Then there is a private key. It starts with insect and is used to control your profile and to publish notes. This must be kept absolutely secret. Now, please download your insect, it's a text file, and save it in a safe place, for example, your password manager. Okay, so that's the end of the text. So, on the right hand side, again, this is the this web page these web pages are always split on the left hand side and then the right hand side And, it says your end pub is blah blah blah blah, whatever it just generated for me. Now, there's a button, same color as the other button. It's an obvious button that says save my insect, but right below it, it gives you an option.

It's there's another little button, but it's not really a button. It's more like a hyperlink and it says, I want to download the encrypted version. And then underneath that it says, from your insect you can generate your NPUB, so it is the only information you really need to keep safe. So if I go and I say, I want to download the encrypted version, it forces it pops up a box automatically and it says pick a password. Now, if I type in a password, it's going to encrypt my insect that it's generating with the password. So, I'm going to have to keep that I'm gonna have to keep that password, so you have to write it down. Then, after I pick a password and I'll just put in, I don't know, gg blah blah blah, whatever, and then I say, now the button that previously said save my insec, now that same button says, save my encryptsec.

N c r y p t s e c. So if I do that, if I hit that button, it brings up a I'm on Windows, so it brings up my save as, you know, it brings up a oh, my my file manager and it says save as. And I've got a file here set up and it says it says, save as filename nostr private key dot txt. And I okay. Okay. Great. Great. So I do that and I say and then it says, once I've done that, it says now or or or on the left hand side that the the Windows changes, it says, your keys are ready. And it says, well done David Bennett, your nostril profile is ready. Yes, it was that easy. And then on the right hand side it says, now please open the file and check that the long string after your end pub matches these starting and finishing characters.

And then it's like, you know, and then it shows me like a little window with the characters in it and it says, encryptsec 1 qggf0 and then a whole bunch of other letters and numbers. And then, it says, finally, copy the file into another safe place as an additional backup and separately save the chosen password and then it gives me my password and then it gives me a checkbox that says I saved the file and the password in a couple of safe places and then it gives me another button at the bottom that says continue Now it gives me email backup and on the left hand side it says email backup.

We offer you the possibility to send your encrypted N SEC, so actually a N cryptSec number to your email address to have another convenient backup location. We will use the same password you picked up previously. You wrote it down, right? You will receive an an email from no reply at njump dot me. If you see nothing, check your spam folder. And then on the right hand side it says it gives me a checkbox that says, I want to send my encrypted Nsec to the same with the same password already entered previously to the following email address. And it allows you to do that. Or the button says, no thanks, continue.

So I have the choice as to whether or not I want to send it to my email address or not, and then I'm just gonna push, no thanks, continue. Now it says multi signer bunker and then it describes this multi signer bunker which we've kind of already read on the right hand side it gives me a checkbox that says I want to save my insects split in a pool of remote signers to be used as a bunker connection the key will be split and then shared with these 3 independent signers if I uncheck that box the button says no, thanks, continue, and let's just do that Now, at the very last, it says follow someone.

What do you think now of following some interesting profiles? We offer you the possibility to copy the full following list of some Nostra users so you can start your Nostra journey with a feed full of posts from already curated individuals. You can later follow more people or unfollow some as well. With Nostra, you control what you see. No obscure and deceptive algorithms. No impositions. Again, on the left hand side. On the right hand side, it says, see the same things these Nostra users are seeing in their feed and it gives me a choice I can I like like, it gives me 5 people? There's a Louwanger, Pablo f seven z, Michael Dilger, Alex, and Fiat Joffe. And on the on next to each one of those is a checkbox, and I can just check each one of them to select them and then I'll hit next, or rather, actually it'll say finish.

And then it gives me the final screen that says explore Nostr. And then it says, we're done David Bennett. Now, you can start exploring Nostr using web applications or by downloading an app. These are some suggestions for getting started immediately and it gives me 5 different things that I can choose. First up is corekle and tell and it tells me it's a web app. Then there's another button and these are all buttons that gives the symbol of Coracle and it says social and micro blogging and then it says web app. Then there's Chachi, which is group conversations.

It gives me Olas which is the new one from Pablo F7Z photo and video social there's wikister and then soon to be it's got a little soon thing over here it says habla. News which is articles and blogging This is only a quick selection of the 80 plus applications that have already been built on Nostr, and then discover them all is underlined as a hyperlink. This is your web profile. You can share it anywhere and with anyone, and then it gives me the njump. Me, forward slash, and then my end pub. So that's it. Sure.

I mean, you know, I'm reading all this to you and I'm taking you step by step through it, but what the the thing that I want to impart here is that this is a great example of user experience. This is an awesome example of somebody who's like, how do we take all the stuff that we know about Nostra? That we had to fight for. We you know, those of us that have been here for like the last 2 years or or longer, god only knows, I can't I I think I've been here since, October, like, 3 Octobers ago. I've been on Nostr. And it's kind of a slog.

It's kind of a slog. You kinda I mean, it's like there there's not a lot of places with descriptions of what Nostra is and what is an insect and how do you manage this stuff. And this experience, this start dot njump dot me is a great experience for somebody who doesn't know what an insec is, who doesn't know what an inpub is, who doesn't know what nostr is. This gives you an this gives these people a simple onboarding experience. Now I'm not saying this is the best onboarding experience. I'm not saying it's the worst onboarding experience. I'm saying that somebody took their time to build an onboarding experience, and in this case, I think it's well done.

I think it makes sense and I think we need more of this if you want to, you know, try it out yourself it's start.njumpnjump dot me. That's start.njump.me and send send send it to your friends and say, hey, this is how you get on Nostr and see if it works. God knows I'm gonna be doing it, but I wanted to bring that to you because I think this onboarding experience to things like Nostr, I think making it simple for people to get on, I think is critical. I think it's critical to Nostr. I think it's critical to us, and I think it's critical for the rest of the world to find out that they don't have to be on Twitter. They don't have to be on Instagram, they don't have to do any of this shit anymore, and they'll never ever ever be deplatformed.

Now, let's shift gears to decrypt. Now, remember how we we spent the day, we're still struggling with $97,156 per coin because of the economic data that I gave. Well, a couple of days ago, we jumped up above 102,000. So I answered the question why we've dropped down why did we go up in the first damn place? Well, decrypt and Andrei Begonsky might have the reasoning and it doesn't look like it had anything to do with Michael Saylor buying a whole shitload of bitcoin anyway he says bitcoin price jumps above 102,000 as Trump team weighs narrower tariffs according to a report Let's find out.

The price of Bitcoin reclaimed a $100,000 Monday. Oh, I'm sorry. I forgot. This was just yesterday. And continued climbing as the US dollar weakened following a report that president-elect Donald Trump's team is considering a pared back tariff plan. Already losing steam, are we? The Washington post reported that following Trump's calls for universal tariffs on the campaign trail, his team is still considering taxes on goods and services imported from every country, but the plan could be limited to covering only critical imports. The post, which cited 3 people familiar with the matter, stated that the plan remains in flux as Trump gears up to return to the White House in 2 weeks.

2 weeks. A targeted tariff plan could focus on imports from sectors deemed critical to US national security and economic security such as medical supplies or energy production, the paper reported. In a truth social post, Trump pushed back on the post's reporting arguing that it incorrectly states that my tariff policy will be pared back. In September, Trump proposed a tariff of up to 20% on U. S. Imports along side a whopping 60% tariff on goods and services from China. As an asset correlated with the US dollar's strength, higher tariffs could weigh on bitcoin's short term price, Grayscale Managing Director of Research Zach Pandell told the crypt quote higher tariffs all else equal will mean dollar strength, he said. The impact is indirect, but tariffs can have an effect on Bitcoin's valuation because it's correlated to the dollar, end quote.

The US dollar index, which or the Dixie, which measures shifts in the dollar's value relative to a basket of other currencies, fell 0.6% on Monday to a 108.29. Holy shit. That's high. According to TradingView, last week, the index reached a 109.43, its highest level since October of 2022. Bitcoin's price surged above a $102,000 early Monday, punching above the $100,000 mark for the first time in more than 2 weeks. Last month, the leading cryptocurrency climbed as high as a $108,000 setting a new all time high price record for the asset only to fall as a hawkish outlook on rate cuts dented Bitcoin's price. The Federal Reserve signaled that it would cut interest rates at a relatively cautious pace this year, slashing the United States Central Bank's forecast to 2 25 basis point rate cuts, which is down from 4.

We'll be lucky after today's numbers to get 1, ladies and gentlemen, but lower interest rates typically will support risk assets, as I was saying earlier as they reduce borrowing costs, increase consumer spending, and make traditionally safer investments like bond or cash less appealing While higher tariffs could weigh on Bitcoin's price in the short term, Pandell described their increased use as part of structural changes in international trade and financial norms that have guided the global economy for the past few decades. Quote, in the longer run, they are part of the larger trends that are fragmenting the dollar based international financial system driving investors to alternative stores of value like physical gold and Bitcoin, he said well, Pandell said rather. Okay. So that's why we went up in price, and so you now you know why we went down, and now you know why we went up.

Or at least I I I hope. Now, we're gonna end today with a huge word of caution to Bitcoiners. I've been preaching about this shit forever. Don't go outside wearing a Bitcoin shirt. Don't wear a Bitcoin hat. You know, if you're gonna wear swag, make it esoteric, like a Citadel dispatch hat. Hardly anybody knows that that's directly connected with Bitcoin. Right? Only the insiders, only the Bitcoiners really know about that kind of thing, okay? It's not but if you wear a like a huge yellow shirt with an orange bitcoin on it, yeah, chances are good somebody's gonna look at you and go, Target! Well, here's a target from Atlas 21.

Attempted Bitcoin kidnapping in Canada, a crypto forum moderator has been forced into hiding. A Canadian moderator. This guy's just a moderator, Right? A Canadian moderator of a crypto forum along with his family was forced to continue, continuously move from 1 Airbnb to another to escape criminals attempting to kidnap him and seize his alleged Bitcoin holdings. According to the newspaper La Presse, the criminals had planned brutal torture, even preparing specific equipment including a 2 foot by 2 foot tarpaulin with a hole in the middle and green hoses around it to cut a limb and stop the bleeding as stated by the victim himself.

The motive for the attempted kidnapping was tied to the moderator's online activity. The criminals, after seeing his post in a Facebook group dedicated to cryptocurrencies, believed he owned 2,500,000 bitcoin. However, the victim clarified, quote, that is far from being the case. I'm an ordinary guy. I may have $10,000, end quote. The ordeal began November 4th when 2 masked men threatened the victim outside his home. Then on November 8th, while he was driving with his daughter, he was followed by an unlicensed vehicle and threatened with a firearm. 4 individuals have been arrested, 2 of whom are charged with conspiracy to kidnap and illegal possession of firearms.

The suspects have been released on bail under house arrest awaiting trial in March. This case adds to a long list of threats to to the safety of cryptocurrency holders. According to monitoring by developer, Jamieson Lop, at least 181 separate incidents of robberies, kidnappings, and murders linked to the crypto world have been recorded since 2014 with several cases occurring during the recent holiday season. Lop advises greater discretion on social media regarding cryptocurrency holdings and avoiding peer to peer transactions with strangers to reduce the risk of becoming a potential target.

Ladies and gentlemen, I cannot iterate the importance of not telling people that you have Bitcoin. Don't wear swag outside. If you go if you go to a Bitcoin meetup, or if you go to a Bitcoin conference, don't wear swag. I mean, you're already with a group of people, all of which are potential targets. It doesn't mean don't go, it just means don't do stupid shit, like get hammered in a bar all by yourself while wearing a Bitcoin shirt one block away from my you know, Bitcoin Miami. That's not a smart thing to do, right?

If you're going to hang out with people you should at least know them, and I'm talking again about going to a Bitcoin conference. You should know who these people are. It's just it's just please, it's it's not we don't exist in the same world that the rest of the world exists in. If it if anybody even knows or or or suspects that you might have Bitcoin, then you might be a target. And I don't want to see this kind of shit happen to you. I don't wanna see the kind of stuff that happened to Jameson Lop happen to you. He got swatted at least once.

I don't wanna see somebody have their limbs cut off in some kind of torture routine to, you know, to 5, you know, $5 wrench attack your mind to get your Bitcoin. I don't want to see family members of people abducted and held for ransom. This we live in a world of shitbags. I hate to say it, but I I think that that over 50% of all the people on the face of this planet have the potential to be shitbags, and if but if only 6 to 5 percent of those people are actual shitbags, we've got problems. That's a lot of people. 5% is 1 in 20.

5% is 1 in 20 people being a shitbag. Somebody who doesn't care about human life. Somebody who doesn't care about your freedom, your health, your family, anything. They just don't care. Those people do exist. When when my children were very small I would tell them the monsters that you think exist do not exist. And those monsters, if they did, would run and hide from the real monsters. The 1 in 20 human beings on this planet that are actual shitbags. Because those people can do some of the most ugly damage and be the most ugly people. The most ugly monsters ever.

I never ever once lied to my kids about that bullshit. There's not a monster under your bed. They're usually in a suit, in a chair, or somebody who's gonna whack you on the back of the head because they think you've got money. It hasn't changed since ever. It's just if anything, it's just given these people a new target. So while I appreciate the people that build Bitcoin swag, and I don't want them to lose money, please consider building other types of swag. Something that's very esoteric. Something that you'd really have to know what the hell you're doing to understand that it's related to Bitcoin. Please consider it. I'll see you on the other side.

Introduction and Episode Correction

Global Bitcoin Discussions: Canada, Czech Republic, and Africa